1-Month Market Movers: Best Undervalued High-Quality Stocks for October 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

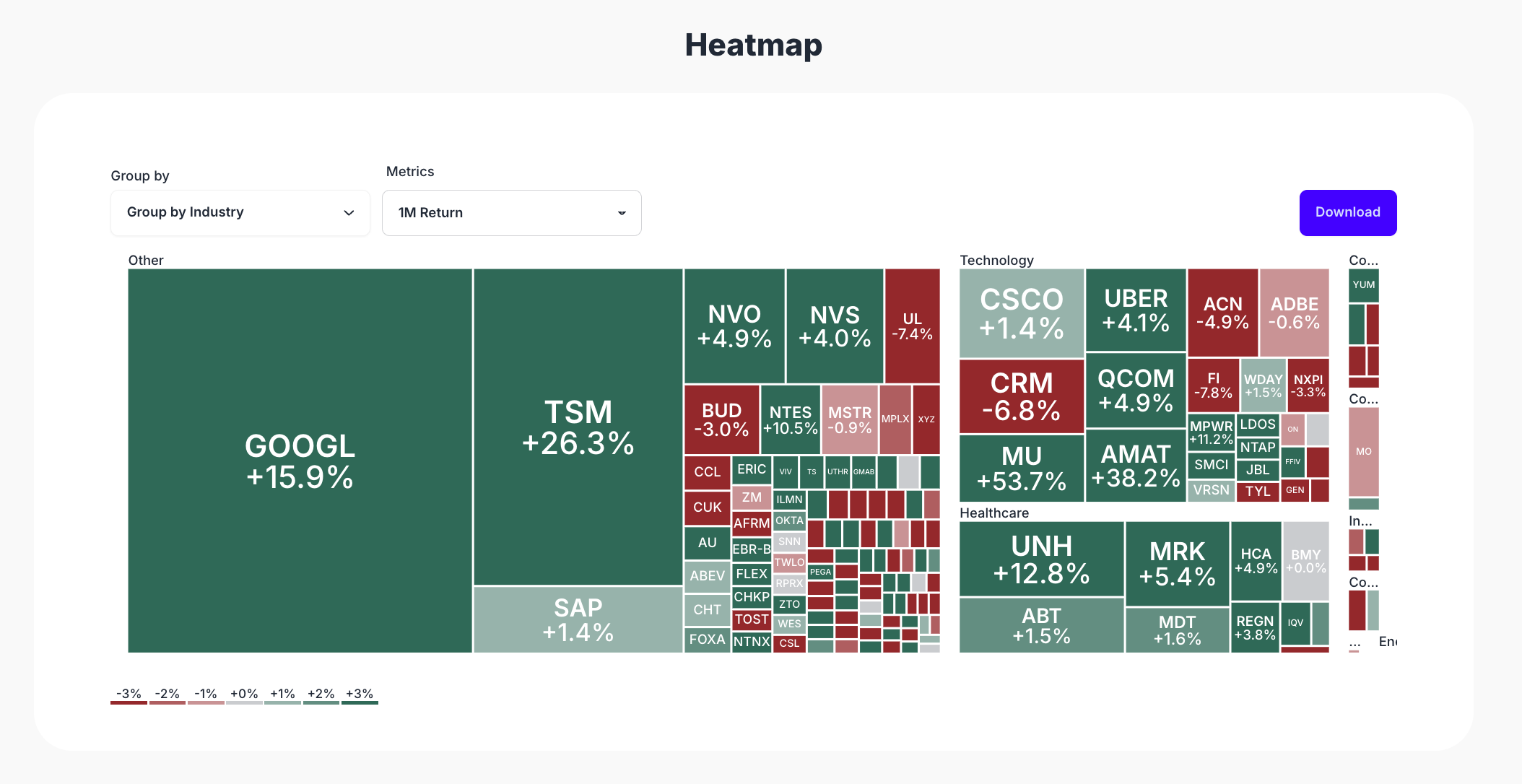

Keeping track of top-performing and lagging stocks provides investors with actionable insights for making smart investment decisions. Here’s an expert-curated look at the most notable gainers and losers among undervalued high-quality stocks during the past month.

Top Gainers

MKS Instruments (MKSI): +28.8%

MKS Instruments delivers foundational technology solutions for the semiconductor, advanced electronics, and specialty industrial sectors. With standout innovations in processes like vacuum measurement and control, MKS reported record revenues across divisions in 2024-2025. MKS’s commitment to operational excellence and sustainability continues to attract long-term investors and industrial customers.

Onto Innovation (ONTO): +32.1%

Onto Innovation combines advanced wafer inspection, metrology, and process control with analytics to boost manufacturing precision in semiconductors and electronics. The company’s mission focuses on streamlining tech advances for chipmakers, and their products are central to improving yield, quality, and manufacturability of leading-edge microelectronic devices.

Applied Materials (AMAT): +38.2%

Applied Materials is a global leader in materials engineering solutions needed to produce virtually every advanced chip and display. By driving continuous chip innovation and scaling technology for clients, Applied has built a robust, diversified business and remains a critical supplier to major semiconductor manufacturers worldwide.

IAMGOLD (IAG): +38.4%

Based in Canada, IAMGOLD operates gold mines across North America and West Africa. Their robust portfolio of ongoing and exploratory mining projects and commitment to sustainable, responsible practices give them a unique advantage in the gold sector during periods of market volatility.

Micron Technology (MU): +53.7%

Micron Technology, a memory chip giant, is benefiting from rising demand in data centers and artificial intelligence. Their strategic focus on high-performance DRAM and NAND, combined with business unit reorganization, has boosted their competitive edge and powered investor interest in the ongoing AI boom.

Top Losers

Sportradar Group (SRAD): -14.0%

Sportradar is a leading provider of data and technology solutions for the sports, media, and betting industries. While experiencing tremendous long-term growth, the company faced short-term pressure, possibly connected to cost structure optimization or cyclical trends in sports betting data demand.

Instacart (CART): -14.6%

Instacart, North America’s top grocery delivery platform, continues to innovate with new offerings and runs at growing transaction volumes. Despite strong operational performance and rising gross margins, investor concerns over profitability and sector competition have weighed on share price momentum.

Deckers Outdoor (DECK): -17.7%

Deckers Outdoor stands behind famous footwear brands like UGG and Hoka. The company’s commitment to quality, product expansion, and strategic marketing has driven growth, though recent months have brought sector-specific market headwinds impacting its recent share price performance.

Toast (TOST): -18.7%

Toast provides end-to-end point-of-sale and restaurant management technology. The company has rapidly expanded its feature set and market presence, but a highly competitive hospitality tech environment coupled with recent earnings volatility has pressured short-term investor sentiment.

Brinker International (EAT): -19.8%

Brinker International operates popular restaurant chains including Chili’s and Maggiano’s. Despite enduring brands, the company faced margin and consumer demand challenges amid shifting economic conditions, impacting the share price over the last month.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Quality Large Cap Stock Picks for 2025

📖 10 Best Stock Picks for October 2025: High-Quality & Undervalued

📖 12 Best Robotics Stock Picks for 2025: In-Depth Analysis & Watchlist

📖 10 Best Stock Picks for 2025: E-commerce Watchlist & Analysis

📖 George Soros - Soros Fund Management LLC Q2 2025 Portfolio Analysis

Frequently Asked Questions - Market Movers: Best Undervalued High-Quality Stocks

What are undervalued high-quality stocks?

Undervalued high-quality stocks are companies with strong financial health, durable business models, and industry leadership that currently trade below their intrinsic value based on their earnings power and growth prospects.

Why did Micron (MU) see such large gains this month?

Micron surged due to robust demand for advanced memory used in data centers and AI, along with a major business reorganization and strong recovery in financials, capturing significant investor attention.

Are the recent losers good buying opportunities?

Stocks like Instacart (CART) and Deckers (DECK) may present long-term value given their strong brands and innovative models but require careful analysis as near-term headwinds may persist.

How often should investors review market movers?

It’s wise to review major gainers and decliners monthly to spot new trends, reassess portfolios, and identify both momentum and value investing opportunities.

Where can investors track updated stock picks and screeners?

Use reputable stock analytics tools or platforms like ValueSense for real-time screeners and actionable stock ideas focused on high-quality, undervalued equities.