10 Best AI Stock Picks for Q4 2025: In-Depth Analysis & Watchlist

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

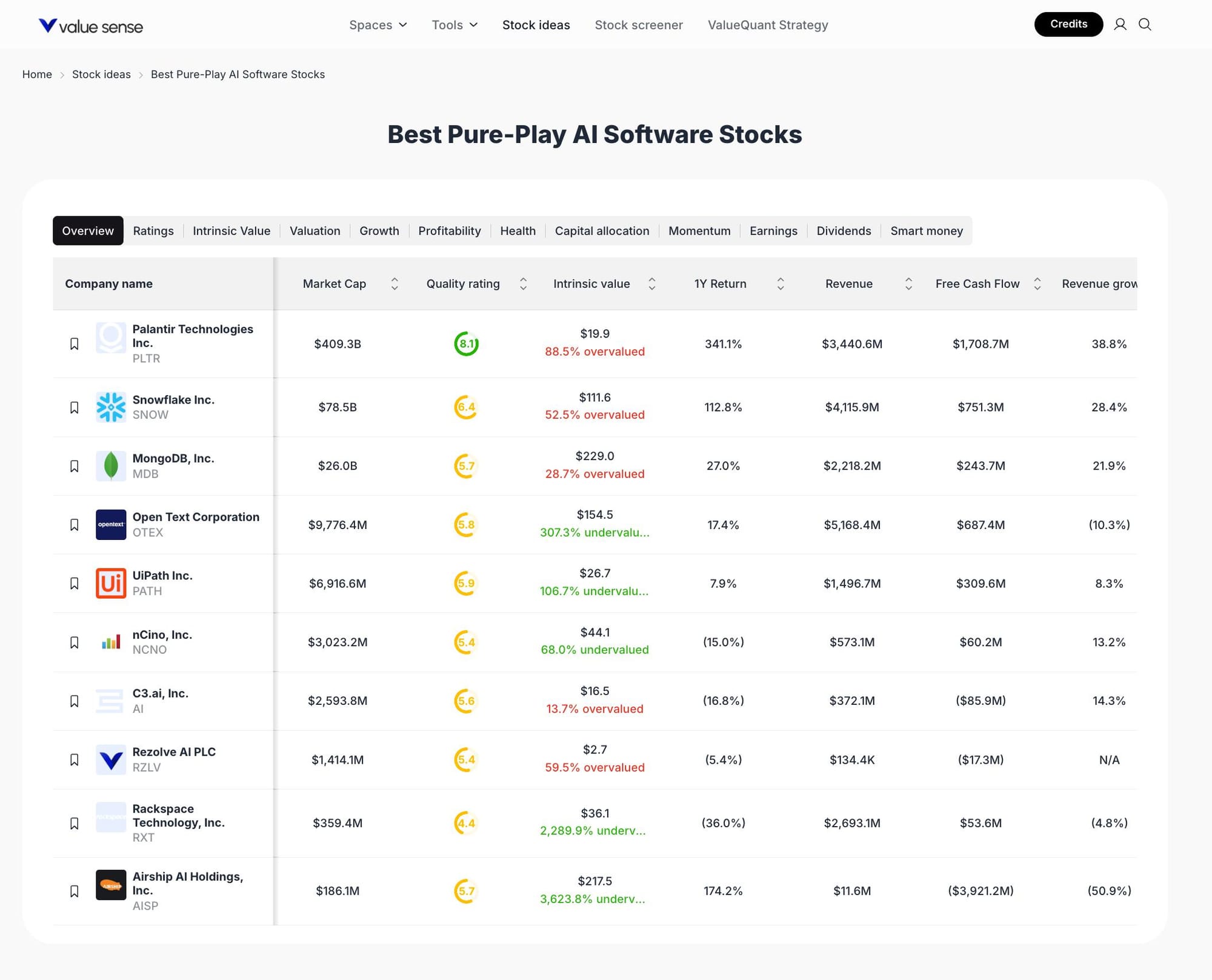

The AI sector continues to drive market innovation, with software companies at the forefront of digital transformation. For this watchlist, we focused on pure-play AI software stocks with strong market presence, robust revenue growth, and clear ValueSense quality ratings. Each stock was selected based on a combination of intrinsic value, recent returns, and sector relevance, ensuring a diversified and opportunity-rich collection for October 2025.

Featured Stock Analysis

Stock #1: Palantir Technologies Inc. (PLTR)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $409.3B |

| Quality Rating | 6.1 |

| Intrinsic Value | $19.9 (88.5% overvalued) |

| 1Y Return | 341.1% |

| Revenue | $3,440.6M |

| Free Cash Flow | $1,708.7M |

| Revenue Growth | 38.8% |

Investment Thesis:

Palantir Technologies stands out as a leader in AI-driven data analytics for government and enterprise clients. Its remarkable 341.1% one-year return highlights strong market momentum, while robust revenue growth of 38.8% and significant free cash flow generation underscore operational strength. However, the stock is currently trading at a substantial premium to its intrinsic value, suggesting heightened expectations and potential volatility.

Palantir’s platform is increasingly embedded in mission-critical workflows, driving recurring revenue and long-term contracts. The company’s ability to scale its AI solutions across sectors positions it as a core holding for exposure to the AI software boom.

Key Catalysts:

- Expanding government and commercial contracts

- Continued innovation in AI and data integration

- Strong free cash flow supporting reinvestment

Risk Factors:

- 88.5% overvaluation relative to intrinsic value

- Competitive pressures in enterprise AI

- Sensitivity to public sector budget cycles

Stock #2: Snowflake Inc. (SNOW)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $78.5B |

| Quality Rating | 6.4 |

| Intrinsic Value | $111.6 (52.5% overvalued) |

| 1Y Return | 112.8% |

| Revenue | $4,115.9M |

| Free Cash Flow | $751.3M |

| Revenue Growth | 28.4% |

Investment Thesis:

Snowflake is a cloud-native data platform enabling scalable AI and analytics solutions for enterprises. With a 112.8% one-year return and a strong quality rating, Snowflake continues to capture market share in the data warehousing and AI infrastructure space. Its revenue growth of 28.4% and substantial free cash flow reflect a healthy business model, though the stock remains overvalued by ValueSense metrics.

The company’s focus on AI-driven data solutions and ecosystem expansion positions it for continued growth as organizations accelerate digital transformation.

Key Catalysts:

- Growing enterprise adoption of cloud data platforms

- Expansion of AI and machine learning capabilities

- Strategic partnerships and ecosystem growth

Risk Factors:

- 52.5% overvaluation

- Intense competition from cloud hyperscalers

- Execution risk in scaling new AI offerings

Stock #3: MongoDB, Inc. (MDB)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $26.0B |

| Quality Rating | 5.7 |

| Intrinsic Value | $229.0 (28.7% overvalued) |

| 1Y Return | 27.0% |

| Revenue | $2,218.2M |

| Free Cash Flow | $243.7M |

| Revenue Growth | 21.9% |

Investment Thesis:

MongoDB is a leading provider of modern database solutions, essential for AI and big data applications. Its 27.0% annual return and solid revenue growth demonstrate resilience in a competitive market. While the stock is moderately overvalued, its strong developer adoption and expanding use cases in AI-driven workloads support a positive outlook.

MongoDB’s flexible, scalable architecture makes it a preferred choice for enterprises building next-generation AI applications, ensuring ongoing relevance in the evolving data landscape.

Key Catalysts:

- Rising demand for scalable, AI-ready databases

- Expansion into enterprise and cloud-native markets

- Continued product innovation

Risk Factors:

- 28.7% overvaluation

- Competition from open-source and cloud-native alternatives

- Slower growth in a maturing market

Stock #4: Open Text Corporation (OTEX)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $9,776.4M |

| Quality Rating | 5.8 |

| Intrinsic Value | $154.5 (307.3% undervalued) |

| 1Y Return | 17.4% |

| Revenue | $5,168.4M |

| Free Cash Flow | $687.4M |

| Revenue Growth | -10.3% |

Investment Thesis:

Open Text is a global leader in enterprise information management, offering AI-powered solutions for content and data integration. Despite a modest 17.4% return and negative revenue growth, the stock is deeply undervalued according to ValueSense, suggesting significant upside potential if fundamentals stabilize.

The company’s established customer base and focus on AI-driven automation provide a foundation for recovery and renewed growth, especially as digital transformation accelerates across industries.

Key Catalysts:

- Deep undervaluation (307.3% below intrinsic value)

- Expansion of AI and automation offerings

- Strong free cash flow

Risk Factors:

- Negative revenue growth (-10.3%)

- Execution risk in business transformation

- Competitive pressures in enterprise software

Stock #5: UiPath Inc. (PATH)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $6,916.6M |

| Quality Rating | 5.9 |

| Intrinsic Value | $26.7 (106.7% undervalued) |

| 1Y Return | 7.9% |

| Revenue | $1,496.7M |

| Free Cash Flow | $309.6M |

| Revenue Growth | 8.3% |

Investment Thesis:

UiPath is a pioneer in robotic process automation (RPA), enabling organizations to automate repetitive tasks using AI. The stock is significantly undervalued and maintains a healthy free cash flow, though recent returns and revenue growth have moderated.

UiPath’s leadership in automation, combined with ongoing AI integration, positions it to benefit from the next wave of digital efficiency initiatives.

Key Catalysts:

- 106.7% undervaluation

- Growing adoption of AI-powered automation

- Expanding enterprise customer base

Risk Factors:

- Slower revenue growth (8.3%)

- Competitive landscape in RPA and AI

- Dependence on enterprise IT spending

Stock #6: nCino, Inc. (NCNO)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $3,023.2M |

| Quality Rating | 6.1 |

| Intrinsic Value | $44.1 (68.0% undervalued) |

| 1Y Return | -15.0% |

| Revenue | $573.1M |

| Free Cash Flow | $60.2M |

| Revenue Growth | 13.2% |

Investment Thesis:

nCino delivers cloud-based AI solutions for the financial sector, streamlining banking operations and compliance. Despite a negative one-year return, the stock is notably undervalued and continues to grow revenue at a double-digit pace.

The company’s focus on digital transformation in banking and expanding AI capabilities supports a constructive long-term outlook.

Key Catalysts:

- 68.0% undervaluation

- Increasing demand for digital banking solutions

- Expansion into new financial markets

Risk Factors:

- Recent negative returns

- Competitive fintech landscape

- Customer concentration risk

Stock #7: C3.ai, Inc. (AI)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $2,593.8M |

| Quality Rating | 5.6 |

| Intrinsic Value | $16.5 (13.7% overvalued) |

| 1Y Return | -16.8% |

| Revenue | $372.1M |

| Free Cash Flow | -$85.9M |

| Revenue Growth | 14.3% |

Investment Thesis:

C3.ai specializes in enterprise AI applications, targeting sectors like energy, manufacturing, and defense. While the company faces near-term challenges, including negative returns and free cash flow, its platform remains well-positioned for long-term AI adoption.

The moderate overvaluation and ongoing investments in product development suggest a watchful approach as the company seeks to return to growth.

Key Catalysts:

- Expanding enterprise AI use cases

- Strategic partnerships in key industries

- Product innovation

Risk Factors:

- Negative free cash flow

- 13.7% overvaluation

- Execution risk in scaling revenues

Stock #8: Rezolve AI PLC (RZLV)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $1,414.1M |

| Quality Rating | 5.4 |

| Intrinsic Value | $2.7 (59.5% overvalued) |

| 1Y Return | -5.4% |

| Revenue | $134.4K |

| Free Cash Flow | -$17.3M |

| Revenue Growth | N/A |

Investment Thesis:

Rezolve AI PLC is an emerging player in AI-driven business solutions. Despite limited revenue and negative free cash flow, the company’s platform has potential for rapid scaling if adoption accelerates. The stock is currently overvalued, reflecting speculative interest.

Investors should monitor execution and revenue traction as key indicators of future performance.

Key Catalysts:

- New product launches

- Expansion into enterprise markets

- Potential for rapid revenue growth

Risk Factors:

- 59.5% overvaluation

- Limited current revenue

- High cash burn

Stock #9: Rackspace Technology, Inc. (RXT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $359.4M |

| Quality Rating | 4.4 |

| Intrinsic Value | $36.1 (2,289.9% undervalued) |

| 1Y Return | -36.0% |

| Revenue | $2,693.1M |

| Free Cash Flow | $53.6M |

| Revenue Growth | -4.8% |

Investment Thesis:

Rackspace Technology provides cloud and AI infrastructure services. Despite significant undervaluation and positive free cash flow, the company faces operational challenges, as reflected in negative returns and revenue contraction.

A turnaround in execution and renewed growth in AI services could unlock value, but risks remain elevated.

Key Catalysts:

- Deep undervaluation (2,289.9%)

- Expansion of AI and cloud offerings

- Cost optimization initiatives

Risk Factors:

- Negative revenue growth

- Execution risk in turnaround

- Competitive cloud services market

Stock #10: Airship AI Holdings, Inc. (AISP)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $186.1M |

| Quality Rating | 5.9 |

| Intrinsic Value | $217.5 (3,623.8% undervalued) |

| 1Y Return | 174.2% |

| Revenue | $11.6M |

| Free Cash Flow | -$3,921.2M |

| Revenue Growth | -50.9% |

Investment Thesis:

Airship AI Holdings is a niche AI software provider with a small market cap and volatile fundamentals. Despite a strong one-year return and extraordinary undervaluation, the company’s negative revenue growth and large free cash flow deficit highlight significant operational risks.

The stock may appeal to speculative investors seeking asymmetric upside, but caution is warranted given financial instability.

Key Catalysts:

- 3,623.8% undervaluation

- Potential for turnaround and new contracts

- AI innovation in specialized markets

Risk Factors:

- Severe negative free cash flow

- -50.9% revenue growth

- High volatility and execution risk

Portfolio Diversification Insights

This collection spans large-cap leaders (Palantir, Snowflake), mid-cap innovators (MongoDB, UiPath), and emerging AI disruptors (Airship AI, Rezolve AI). Sector allocation is concentrated in technology and software, with exposure to enterprise, cloud, and automation themes. The mix of undervalued and overvalued stocks offers a balance between growth potential and value opportunities, supporting diversified portfolio construction.

Market Timing & Entry Strategies

Given the current market volatility and varying valuation levels, consider staggered entry points and dollar-cost averaging for positions in overvalued stocks. Undervalued names may warrant closer monitoring for technical entry signals or positive business momentum. Always align entry timing with individual risk tolerance and broader market trends.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best GARP Stock Picks for 2025

📖 12 Best High Quality Low EV/EBIT Stocks - October-November 2025

📖 12 Best Stock Picks for Profitable Growth

📖 12 Best Momentum Stock Picks for November 2025

📖 11 Best High Quality Stock Picks for November 2025

FAQ about AI Software Stocks

Q1: How were these stocks selected?

A: Stocks were chosen based on ValueSense quality ratings, intrinsic value analysis, recent returns, and sector relevance, focusing on pure-play AI software companies.

Q2: What's the best stock from this list?

A: The "best" stock depends on individual investment goals; Palantir and Airship AI show strong returns, while Open Text and Rackspace offer deep value opportunities.

Q3: Should I buy all these stocks or diversify?

A: Diversification across multiple AI stocks can help manage risk, but allocation should reflect personal risk tolerance and sector exposure preferences.

Q4: What are the biggest risks with these picks?

A: Key risks include overvaluation, negative free cash flow, revenue contraction, and competitive pressures in the fast-evolving AI sector.

Q5: When is the best time to invest in these stocks?

A: Entry timing should consider valuation, technical trends, and market conditions; undervalued stocks may offer near-term opportunities, while overvalued names may require patience.

Summary & Investment Outlook

The AI software sector presents a dynamic mix of growth and value opportunities for October 2025. This watchlist highlights leaders and innovators across the spectrum, each with unique strengths and risks. For more in-depth analysis and real-time updates, visit ValueSense and leverage our research tools for smarter investment decisions.