10 Best Cannabis Stock Picks for 2025: Top Watchlist & Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

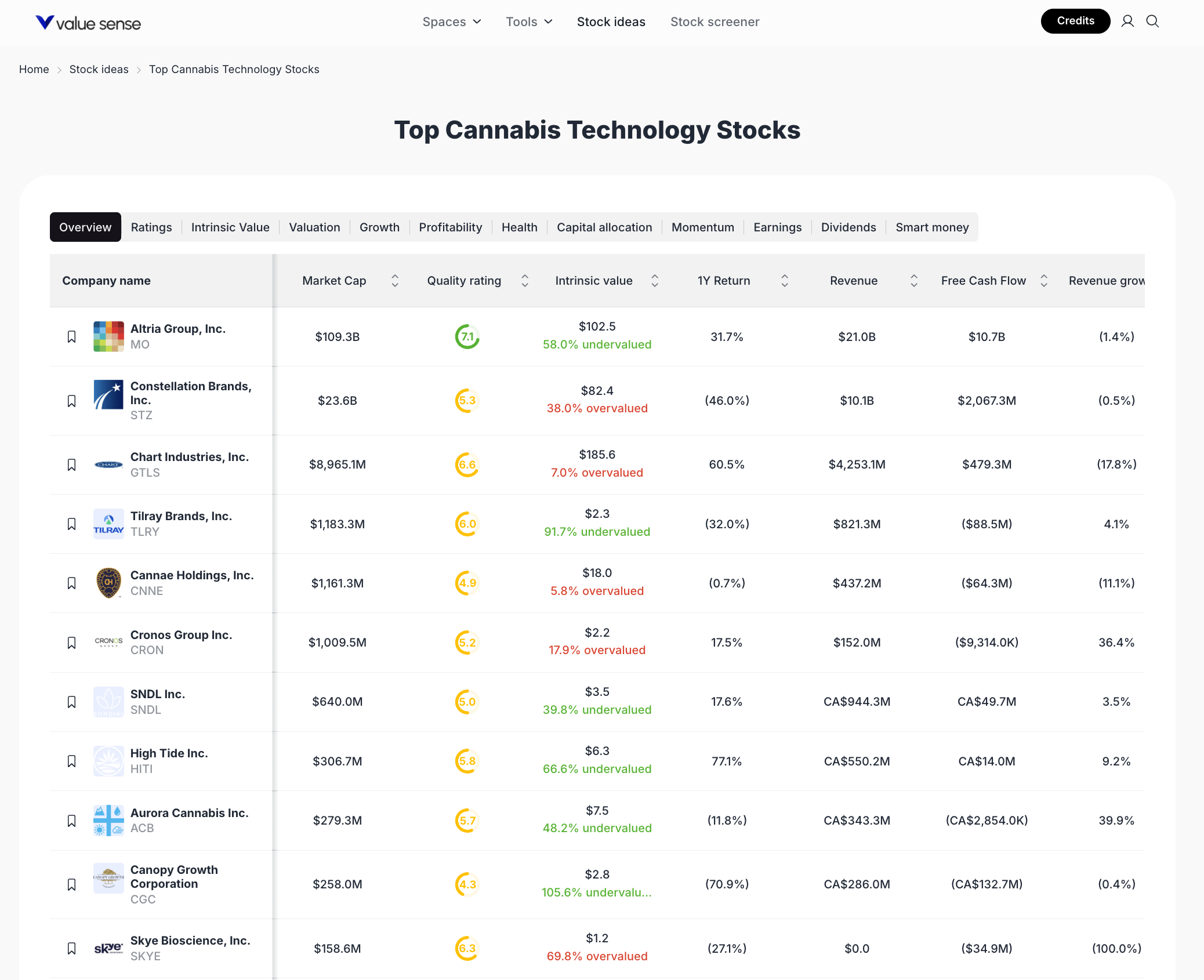

The cannabis sector continues to evolve rapidly, driven by regulatory changes, medical adoption, and innovation in cultivation and distribution. For this watchlist, stocks were selected based on a combination of market capitalization, ValueSense quality rating, intrinsic value discount/premium, and recent return metrics. The methodology emphasizes companies with strong fundamentals, clear undervaluation, and sector leadership, while also considering diversification across the cannabis value chain.

Featured Stock Analysis

Stock #1: Altria Group, Inc. (MO)

| Metric | Value |

|---|---|

| Market Cap | $109.3B |

| Quality Rating | 7.1 |

| Intrinsic Value | $102.5 |

| Undervaluation | 58.0% undervalued |

| 1Y Return | 31.7% |

| Revenue | $21.0B |

Investment Thesis:

Altria Group stands out as the largest-cap company on this cannabis technology list, with a robust $109.3B market cap and a leading ValueSense quality rating of 7.1. The stock is currently trading at a significant discount to its intrinsic value, marked as 58.0% undervalued, suggesting substantial upside potential. Altria’s diversified revenue base and established presence in both traditional tobacco and emerging cannabis markets provide a stable foundation for growth. Its 31.7% one-year return demonstrates resilience and investor confidence, even as the broader sector faces volatility.

Key Catalysts:

- Expansion into cannabis and alternative products

- Strong cash flows supporting R&D and acquisitions

- Regulatory shifts favoring large, diversified players

Risk Factors:

- Regulatory uncertainty in both tobacco and cannabis

- Shifting consumer preferences away from traditional products

- Integration risks with new cannabis ventures

Stock #2: Constellation Brands, Inc. (STZ)

| Metric | Value |

|---|---|

| Market Cap | $23.6B |

| Quality Rating | 5.3 |

| Intrinsic Value | $82.4 |

| Overvaluation | 38.0% overvalued |

| 1Y Return | -46.0% |

| Revenue | $10.1B |

Investment Thesis:

Constellation Brands is a major beverage conglomerate with strategic investments in the cannabis sector. Despite a moderate quality rating of 5.3, the company’s scale and diversified portfolio offer defensive qualities. However, the stock is currently 38.0% overvalued relative to its intrinsic value, and its one-year return is deeply negative at -46.0%. This suggests caution, but also potential for a rebound if cannabis investments begin to pay off and market sentiment shifts.

Key Catalysts:

- Strategic cannabis partnerships and investments

- Brand strength in beverages and potential cannabis-infused products

- Ability to leverage distribution networks

Risk Factors:

- Overvaluation may limit near-term upside

- Execution risk in cannabis integration

- Competitive beverage and cannabis landscapes

Stock #3: Chart Industries, Inc. (GTLS)

| Metric | Value |

|---|---|

| Market Cap | $8,965.1M |

| Quality Rating | 6.6 |

| Intrinsic Value | $185.6 |

| Overvaluation | 7.0% overvalued |

| 1Y Return | 60.5% |

| Revenue | $4,253.1M |

Investment Thesis:

Chart Industries is a technology leader in cryogenic equipment, supporting the cannabis sector’s extraction and processing needs. With a solid quality rating of 6.6 and a strong 60.5% one-year return, Chart Industries is positioned as a growth enabler for cannabis processors. The stock is only slightly overvalued (7.0%), indicating it is near fair value. Its diversified industrial base and exposure to multiple growth sectors add resilience.

Key Catalysts:

- Rising demand for extraction and processing technology

- Expansion into new cannabis markets

- Cross-sector industrial applications

Risk Factors:

- Cyclical industrial demand

- Margin pressure from competition

- Regulatory headwinds in cannabis processing

Stock #4: Tilray Brands, Inc. (TLRY)

| Metric | Value |

|---|---|

| Market Cap | $1,183.3M |

| Quality Rating | 6.0 |

| Intrinsic Value | $2.3 |

| Undervaluation | 91.7% undervalued |

| 1Y Return | -32.0% |

| Revenue | $821.3M |

Investment Thesis:

Tilray Brands is a global cannabis leader with a strong presence in both medical and recreational markets. The stock is deeply undervalued at 91.7% below intrinsic value, which may appeal to value-focused investors. Despite a negative one-year return, Tilray’s international footprint and product innovation pipeline position it for long-term recovery and growth.

Key Catalysts:

- Expansion into new international markets

- Product innovation in beverages and edibles

- Regulatory advancements in key regions

Risk Factors:

- Persistent sector volatility

- Integration risks from acquisitions

- Regulatory delays in major markets

Stock #5: Cannae Holdings, Inc. (CNNE)

| Metric | Value |

|---|---|

| Market Cap | $1,161.3M |

| Quality Rating | 4.9 |

| Intrinsic Value | $18.0 |

| Overvaluation | 5.8% overvalued |

| 1Y Return | -0.7% |

| Revenue | $437.2M |

Investment Thesis:

Cannae Holdings is a diversified holding company with exposure to cannabis technology. With a quality rating of 4.9 and near-fair valuation (5.8% overvalued), Cannae offers a balanced risk-reward profile. Its diversified approach may cushion volatility, but recent returns have been flat.

Key Catalysts:

- Portfolio diversification across cannabis and tech

- Strategic investments in emerging cannabis ventures

- Potential for value realization through asset sales

Risk Factors:

- Lower quality rating versus peers

- Flat recent performance

- Complexity of holding company structure

Stock #6: Cronos Group Inc. (CRON)

| Metric | Value |

|---|---|

| Market Cap | $1,009.5M |

| Quality Rating | 5.2 |

| Intrinsic Value | $2.2 |

| Overvaluation | 17.9% overvalued |

| 1Y Return | 17.5% |

| Revenue | $152.0M |

Investment Thesis:

Cronos Group is a Canadian cannabis innovator with global reach. While currently 17.9% overvalued, Cronos has delivered a 17.5% one-year return and maintains a moderate quality rating. Its focus on branded products and international expansion supports its long-term outlook.

Key Catalysts:

- Growth in international medical cannabis markets

- Strategic partnerships and product launches

- Expansion in high-margin product categories

Risk Factors:

- Overvaluation relative to intrinsic value

- Regulatory and competitive pressures

- Currency and international market risks

Stock #7: SNDL Inc. (SNDL)

| Metric | Value |

|---|---|

| Market Cap | $640.0M |

| Quality Rating | 5.0 |

| Intrinsic Value | $3.5 |

| Undervaluation | 39.8% undervalued |

| 1Y Return | 17.6% |

| Revenue | CA$944.3M |

Investment Thesis:

SNDL Inc. is a vertically integrated cannabis company with a strong retail footprint in Canada. The stock is 39.8% undervalued, and its 17.6% one-year return reflects operational improvements. SNDL’s focus on retail and branded products positions it well for continued growth in a consolidating market.

Key Catalysts:

- Retail expansion and brand development

- Operational efficiencies and cost controls

- Potential for M&A activity

Risk Factors:

- Canadian market saturation

- Execution risk in retail operations

- Regulatory changes impacting margins

Stock #8: High Tide Inc. (HITI)

| Metric | Value |

|---|---|

| Market Cap | $306.7M |

| Quality Rating | 5.8 |

| Intrinsic Value | $6.3 |

| Undervaluation | 66.6% undervalued |

| 1Y Return | 77.1% |

| Revenue | CA$550.2M |

Investment Thesis:

High Tide Inc. is a leading Canadian cannabis retailer and e-commerce operator. With a 66.6% undervaluation and an impressive 77.1% one-year return, High Tide is one of the top performers in the sector. Its omnichannel approach and focus on value-conscious consumers drive growth.

Key Catalysts:

- E-commerce and retail expansion

- Strong brand portfolio

- Growth in value and discount segments

Risk Factors:

- Intense competition in retail

- Regulatory headwinds in Canada

- Margin compression

Stock #9: Aurora Cannabis Inc. (ACB)

| Metric | Value |

|---|---|

| Market Cap | $279.3M |

| Quality Rating | 5.7 |

| Intrinsic Value | $7.5 |

| Undervaluation | 48.2% undervalued |

| 1Y Return | -11.8% |

| Revenue | CA$343.3M |

Investment Thesis:

Aurora Cannabis is a pioneer in Canadian cannabis, with a focus on medical and international markets. The stock is 48.2% undervalued, though recent returns have been negative. Aurora’s global reach and medical expertise offer long-term potential as regulatory frameworks evolve.

Key Catalysts:

- Expansion into international medical markets

- Product innovation and R&D

- Cost optimization initiatives

Risk Factors:

- Ongoing sector volatility

- Execution risk in international expansion

- Regulatory delays

Stock #10: Canopy Growth Corporation (CGC)

| Metric | Value |

|---|---|

| Market Cap | $258.0M |

| Quality Rating | 4.3 |

| Intrinsic Value | $2.8 |

| Undervaluation | 105.6% undervalued |

| 1Y Return | -70.9% |

| Revenue | CA$286.0M |

Investment Thesis:

Canopy Growth is a well-known cannabis brand with global ambitions. Despite a low quality rating and steep negative return, the stock is trading at a massive 105.6% discount to intrinsic value. This deep undervaluation may attract contrarian investors looking for turnaround potential.

Key Catalysts:

- Restructuring and cost-cutting initiatives

- New product launches and international expansion

- Strategic partnerships

Risk Factors:

- Weak recent performance and low quality rating

- High cash burn and restructuring risk

- Regulatory and competitive pressures

Stock #11: Skye Bioscience, Inc. (SKYE)

| Metric | Value |

|---|---|

| Market Cap | $158.6M |

| Quality Rating | 6.3 |

| Intrinsic Value | $1.2 |

| Overvaluation | 69.8% overvalued |

| 1Y Return | -271.1% |

| Revenue | $0.0 |

Investment Thesis:

Skye Bioscience is a biotech innovator focused on cannabinoid-based therapies. With a high quality rating but no current revenue and a steep overvaluation, Skye is a speculative play. Its pipeline and R&D focus could yield breakthroughs, but the risk profile is elevated.

Key Catalysts:

- Progress in clinical trials

- Potential licensing or partnership deals

- Expansion of cannabinoid therapeutic applications

Risk Factors:

- No current revenue

- High overvaluation and negative returns

- Clinical and regulatory risks

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Undervalued Retirement Portfolio Stocks for October 2025

📖 10 Holy Trinity Quality Growth Undervalued Stock Picks for 2025

📖 10 Best B2B SaaS Stock Picks for 2025

📖 52-Week High Stocks: Market Quality Leaders for Autumn 2025

📖 10 Best Undervalued Stocks for 2025

Portfolio Diversification Insights

This watchlist spans the cannabis value chain, including producers, technology providers, retailers, and biotech innovators. The portfolio is diversified across large-cap defensive names (Altria, Constellation), mid-cap growth plays (Tilray, Cronos, SNDL), and speculative biotech (Skye). Sector allocation covers traditional consumer, industrial technology, retail, and healthcare, reducing concentration risk and offering exposure to multiple growth drivers.

Market Timing & Entry Strategies

Given the sector’s volatility, staggered entry and dollar-cost averaging may help manage risk. Monitoring regulatory developments and earnings reports is crucial for timing. Investors may consider entering undervalued names on pullbacks and watching for technical breakouts in momentum stocks.

FAQ Section

Q1: How were these stocks selected?

Stocks were chosen based on ValueSense quality ratings, intrinsic value analysis, market capitalization, and sector representation, focusing on undervalued opportunities and growth potential.

Q2: What's the best stock from this list?

The "best" stock depends on individual goals, but Altria Group (MO) and High Tide Inc. (HITI) stand out for their strong quality ratings, undervaluation, and recent performance.

Q3: Should I buy all these stocks or diversify?

Diversification across multiple stocks and sectors can help manage risk, as the cannabis industry remains volatile and company performance varies widely.

Q4: What are the biggest risks with these picks?

Key risks include regulatory uncertainty, sector volatility, overvaluation in some names, and execution risks in expansion and integration.

Q5: When is the best time to invest in these stocks?

Market timing is challenging; consider phased entry, monitor sector news, and use valuation metrics to identify attractive entry points.

Summary & Investment Outlook

The cannabis sector offers a dynamic mix of undervalued growth stocks, established leaders, and innovative biotech plays. By focusing on intrinsic value and quality ratings, this watchlist highlights diverse opportunities for educational analysis. For deeper insights and real-time updates, visit ValueSense and leverage our research tools for smarter investing decisions.