10 Best Data Center Stock Picks for Q4 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

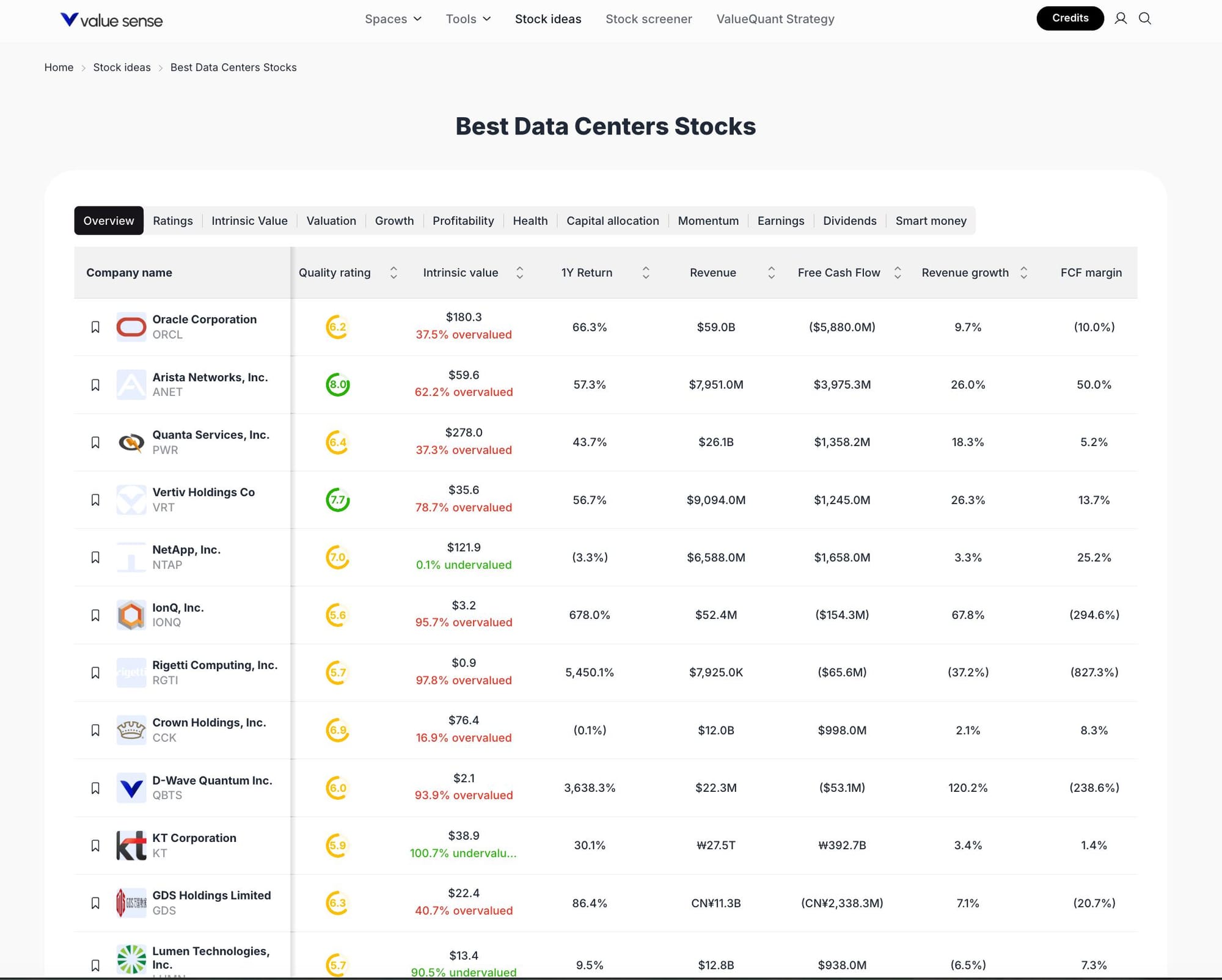

Market Overview & Selection Criteria

The data center sector is experiencing robust growth, driven by surging demand for cloud computing, AI workloads, and digital transformation across industries. Our selection methodology leverages ValueSense’s intrinsic value ratings, quality scores, and key financial metrics to identify stocks with strong growth potential, healthy cash flow, and sector leadership. Each featured stock is evaluated for its valuation, profitability, and momentum, ensuring a diversified and balanced watchlist for 2025.

Featured Stock Analysis

Stock #1: Oracle Corporation (ORCL)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Intrinsic Value | $180.3 |

| 1Y Return | 66.3% |

| Revenue | $59.0B |

| Free Cash Flow | ($5,880.0M) |

| Revenue Growth | 9.7% |

| FCF Margin | -10.0% |

| ValueSense Rating | 6.2/10 |

| Valuation Status | 37.5% overvalued |

| Sector | Technology |

Investment Thesis:

Oracle remains a foundational player in enterprise software and cloud infrastructure. Despite being 37.5% overvalued relative to its intrinsic value, Oracle’s 66.3% 1-year return demonstrates strong market momentum. The company’s $59B revenue base and nearly 10% revenue growth reflect its ability to capture ongoing digital transformation trends. However, negative free cash flow and a -10% FCF margin highlight operational challenges, possibly due to heavy investment in cloud infrastructure and AI capabilities.

Oracle’s robust client base and transition to cloud services position it well for future growth, especially as enterprises modernize their IT stacks. The company’s scale and recurring revenue streams provide resilience, but investors should monitor cash flow trends closely.

Key Catalysts:

- Expansion of Oracle Cloud Infrastructure (OCI)

- Strategic partnerships in AI and data analytics

- Continued enterprise digital transformation

Risk Factors:

- Negative free cash flow and margin pressure

- High valuation relative to intrinsic value

- Intense competition from AWS, Microsoft Azure, and Google Cloud

Stock #2: Arista Networks, Inc. (ANET)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Intrinsic Value | $59.6 |

| 1Y Return | 57.3% |

| Revenue | $7,951.0M |

| Free Cash Flow | $3,975.3M |

| Revenue Growth | 26.0% |

| FCF Margin | 50.0% |

| ValueSense Rating | 6.9/10 |

| Valuation Status | 62.2% overvalued |

| Sector | Technology |

Investment Thesis:

Arista Networks is a leader in high-performance networking solutions, benefiting from the explosive growth in cloud data centers and AI workloads. With a 57.3% 1-year return and 26% revenue growth, Arista demonstrates strong operational momentum. The company’s free cash flow of nearly $4B and a 50% FCF margin highlight exceptional profitability and financial discipline.

Despite being 62.2% overvalued, Arista’s innovation in cloud networking and its entrenched relationships with hyperscale clients provide a durable competitive advantage. The company’s ability to scale with cloud and AI demand makes it a core holding for exposure to next-generation data center infrastructure.

Key Catalysts:

- Rising demand for AI and cloud networking

- Expansion into enterprise and edge markets

- Strong free cash flow generation

Risk Factors:

- High valuation premium

- Dependence on large cloud customers

- Competitive threats from Cisco and Juniper

Stock #3: Quanta Services, Inc. (PWR)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Intrinsic Value | $278.0 |

| 1Y Return | 43.7% |

| Revenue | $26.1B |

| Free Cash Flow | $1,358.2M |

| Revenue Growth | 18.3% |

| FCF Margin | 5.2% |

| ValueSense Rating | 6.4/10 |

| Valuation Status | 37.3% overvalued |

| Sector | Industrials |

Investment Thesis:

Quanta Services is a leading provider of infrastructure solutions for electric power, energy, and communications. With a 43.7% 1-year return and 18.3% revenue growth, Quanta is capitalizing on the modernization of utility and data center infrastructure. The company’s $1.36B free cash flow and 5.2% FCF margin reflect solid financial health.

Although 37.3% overvalued, Quanta’s diversified service offerings and exposure to secular trends in electrification and data center buildouts support its long-term growth outlook. The company’s ability to execute large-scale projects positions it as a key beneficiary of infrastructure investment.

Key Catalysts:

- Data center and grid modernization projects

- Expansion in renewable energy infrastructure

- Strong project pipeline

Risk Factors:

- Project execution risks

- Cyclical exposure to construction markets

- Valuation above intrinsic value

Stock #4: Vertiv Holdings Co (VRT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Intrinsic Value | $35.6 |

| 1Y Return | 56.7% |

| Revenue | $9,094.0M |

| Free Cash Flow | $1,245.0M |

| Revenue Growth | 26.3% |

| FCF Margin | 13.7% |

| ValueSense Rating | 7.7/10 |

| Valuation Status | 78.7% overvalued |

| Sector | Industrials |

Investment Thesis:

Vertiv is a global leader in critical digital infrastructure and continuity solutions. With a 56.7% 1-year return, 26.3% revenue growth, and a 13.7% FCF margin, Vertiv is firing on all cylinders as data center demand accelerates. The company’s $1.25B free cash flow supports ongoing investment in capacity and innovation.

Despite being 78.7% overvalued, Vertiv’s high ValueSense rating (7.7/10) reflects strong operational execution and sector leadership. The company’s partnerships with major AI and cloud providers position it as a core beneficiary of the ongoing data center buildout.

Key Catalysts:

- Surging AI and cloud infrastructure demand

- Expansion of global data center footprint

- Strong execution and capital allocation

Risk Factors:

- Elevated valuation risk

- Supply chain and tariff challenges

- Competitive landscape

Stock #5: NetApp, Inc. (NTAP)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Intrinsic Value | $121.9 |

| 1Y Return | -3.3% |

| Revenue | $6,588.0M |

| Free Cash Flow | $1,658.0M |

| Revenue Growth | 3.3% |

| FCF Margin | 25.2% |

| ValueSense Rating | 6.0/10 |

| Valuation Status | 0.1% undervalued |

| Sector | Technology |

Investment Thesis:

NetApp specializes in hybrid cloud data management and storage solutions. While the company posted a -3.3% 1-year return, its $1.66B free cash flow and 25.2% FCF margin underscore strong profitability. NetApp is currently trading near intrinsic value, offering a balanced risk-reward profile.

The company’s modest revenue growth (3.3%) suggests a mature business, but its leadership in enterprise storage and cloud integration remains relevant as organizations modernize IT infrastructure. NetApp’s focus on hybrid cloud and data services supports its long-term positioning.

Key Catalysts:

- Growth in hybrid cloud adoption

- Expansion of data management services

- Strong free cash flow generation

Risk Factors:

- Slower revenue growth

- Competitive pressures from cloud-native providers

- Market share erosion risk

Stock #6: IonQ, Inc. (IONQ)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Intrinsic Value | $3.2 |

| 1Y Return | 678.0% |

| Revenue | $52.4M |

| Free Cash Flow | ($154.3M) |

| Revenue Growth | 67.8% |

| FCF Margin | -294.6% |

| ValueSense Rating | 5.6/10 |

| Valuation Status | 95.7% overvalued |

| Sector | Technology |

Investment Thesis:

IonQ is a pioneer in quantum computing, with a remarkable 678% 1-year return and 67.8% revenue growth. However, the company’s negative free cash flow and extreme -294.6% FCF margin reflect early-stage operational challenges. IonQ is highly overvalued relative to intrinsic value, indicating speculative sentiment.

While quantum computing holds transformative potential, IonQ’s current fundamentals are characterized by high risk and volatility. The company’s rapid revenue growth and technological leadership make it a high-upside, high-risk play within the data center ecosystem.

Key Catalysts:

- Breakthroughs in quantum computing

- Strategic partnerships and research grants

- Expansion of commercial quantum services

Risk Factors:

- Substantial cash burn and negative margins

- Execution risk in scaling technology

- High valuation and speculative positioning

Stock #7: Rigetti Computing, Inc. (RGTI)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Intrinsic Value | $0.9 |

| 1Y Return | 5,450.1% |

| Revenue | $7,925.0K |

| Free Cash Flow | ($65.6M) |

| Revenue Growth | -37.2% |

| FCF Margin | -827.3% |

| ValueSense Rating | 5.0/10 |

| Valuation Status | 97.8% overvalued |

| Sector | Technology |

Investment Thesis:

Rigetti Computing is another quantum computing innovator, posting a staggering 5,450% 1-year return. Despite this, the company’s fundamentals are challenged by negative revenue growth and a deeply negative FCF margin. Rigetti is highly overvalued, reflecting speculative enthusiasm rather than operational strength.

The company’s focus on quantum hardware and software positions it for potential breakthroughs, but execution risk and financial sustainability are key concerns. Rigetti’s story is one of high risk and potentially high reward, suitable for investors seeking exposure to frontier technologies.

Key Catalysts:

- Advances in quantum computing technology

- Strategic collaborations and funding

- Expansion of quantum-as-a-service offerings

Risk Factors:

- Severe cash burn and negative growth

- High valuation risk

- Early-stage technology execution

Stock #8: Crown Holdings, Inc. (CCK)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Intrinsic Value | $76.4 |

| 1Y Return | 0.1% |

| Revenue | $12.0B |

| Free Cash Flow | $998.0M |

| Revenue Growth | 2.1% |

| FCF Margin | 8.3% |

| ValueSense Rating | 6.9/10 |

| Valuation Status | 16.9% overvalued |

| Sector | Industrials |

Investment Thesis:

Crown Holdings operates in the packaging sector, supporting data center and technology supply chains. With stable revenue and free cash flow, Crown offers a defensive profile within the broader data center ecosystem. The company’s modest 0.1% 1-year return and 2.1% revenue growth reflect a mature business.

Crown’s 8.3% FCF margin and near-intrinsic valuation provide a measure of stability, making it a potential diversifier in a tech-heavy portfolio. The company’s operational consistency and cash flow generation are key strengths.

Key Catalysts:

- Growth in packaging demand for tech and data center products

- Operational efficiency initiatives

- Expansion into new markets

Risk Factors:

- Low growth profile

- Sensitivity to commodity prices

- Competitive pressures

Stock #9: D-Wave Quantum Inc. (QBTS)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Intrinsic Value | $2.1 |

| 1Y Return | 3,638.3% |

| Revenue | $22.3M |

| Free Cash Flow | ($53.1M) |

| Revenue Growth | 120.2% |

| FCF Margin | -238.6% |

| ValueSense Rating | 6.0/10 |

| Valuation Status | 93.9% overvalued |

| Sector | Technology |

Investment Thesis:

D-Wave Quantum is a leader in quantum annealing technology, with a 3,638% 1-year return and 120% revenue growth. The company’s negative free cash flow and -238.6% FCF margin reflect the capital-intensive nature of quantum R&D. D-Wave is highly overvalued, but its rapid revenue growth and technological leadership make it a speculative play on quantum computing’s future.

The company’s partnerships and commercial deployments are early signs of traction, but sustainability and profitability remain key challenges.

Key Catalysts:

- Commercialization of quantum solutions

- Strategic partnerships and pilot projects

- Expansion of quantum cloud services

Risk Factors:

- High cash burn and negative margins

- Execution risk in scaling technology

- Speculative valuation

Stock #10: KT Corporation (KT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Intrinsic Value | $38.9 |

| 1Y Return | 30.1% |

| Revenue | ₩27.5T |

| Free Cash Flow | ₩392.7B |

| Revenue Growth | 3.4% |

| FCF Margin | 1.4% |

| ValueSense Rating | 6.9/10 |

| Valuation Status | 100.7% undervalued |

| Sector | Telecom |

Investment Thesis:

KT Corporation is a major South Korean telecom and data center operator. With a 30.1% 1-year return and 3.4% revenue growth, KT offers exposure to Asia’s expanding digital infrastructure. The company is currently 100.7% undervalued, making it a rare value opportunity in the sector.

KT’s stable cash flow and strategic investments in data centers and 5G infrastructure position it for continued growth. The company’s telecom backbone supports the region’s digital economy, offering both growth and defensive characteristics.

Key Catalysts:

- Expansion of data center and 5G infrastructure

- Growth in digital services and cloud adoption

- Attractive valuation

Risk Factors:

- Currency and geopolitical risks

- Competitive telecom landscape

- Regulatory uncertainties

Portfolio Diversification Insights

This collection spans technology, industrials, and telecom sectors, balancing high-growth quantum computing plays (IonQ, Rigetti, D-Wave) with established infrastructure providers (Oracle, Arista, NetApp, Vertiv, KT). The inclusion of Crown Holdings adds a defensive industrial component. Sector allocation is weighted toward technology, but the presence of telecom and industrials enhances diversification and reduces single-sector risk.

Market Timing & Entry Strategies

Given the sector’s recent momentum, consider phased entry strategies such as dollar-cost averaging to mitigate volatility. Monitor valuation levels, especially for stocks trading well above intrinsic value. For speculative quantum computing names, position sizing and risk management are critical. Established players may offer more stable entry points during market pullbacks.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best Nuclear Energy Stock Picks for 2026

📖 Best Dividend Growth Stocks: 13 Quality Companies

📖 11 Best Undervalued Large Cap Moat Stocks for 2025

📖 12 Best Momentum Stock Picks for November 2025

📖 10 Best Price Dislocation Value Stocks: Stock Watchlist & Analysis

FAQ about Data Center Stocks in 2025

Q1: How were these stocks selected?

Stocks were chosen based on ValueSense’s intrinsic value ratings, quality scores, and key financial metrics, focusing on growth, profitability, and sector leadership.

Q2: What's the best stock from this list?

There is no single “best” stock; each offers unique strengths. Vertiv (VRT) and Arista Networks (ANET) stand out for growth and operational execution, while KT Corporation (KT) is notably undervalued.

Q3: Should I buy all these stocks or diversify?

Diversification across sectors and risk profiles is recommended for balanced exposure. This list provides a mix of growth, value, and speculative opportunities.

Q4: What are the biggest risks with these picks?

Key risks include overvaluation, negative cash flow for early-stage companies, sector competition, and execution challenges in emerging technologies.

Q5: When is the best time to invest in these stocks?

Consider market conditions, valuation levels, and individual risk tolerance. Phased entry strategies can help manage volatility and timing risk.

Summary & Investment Outlook

The data center sector is poised for continued growth, fueled by cloud, AI, and digital transformation. This diversified watchlist offers exposure to established leaders, emerging innovators, and undervalued opportunities. Use ValueSense’s tools for ongoing analysis and portfolio monitoring.