10 Best DefenseTech Stock Picks for 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

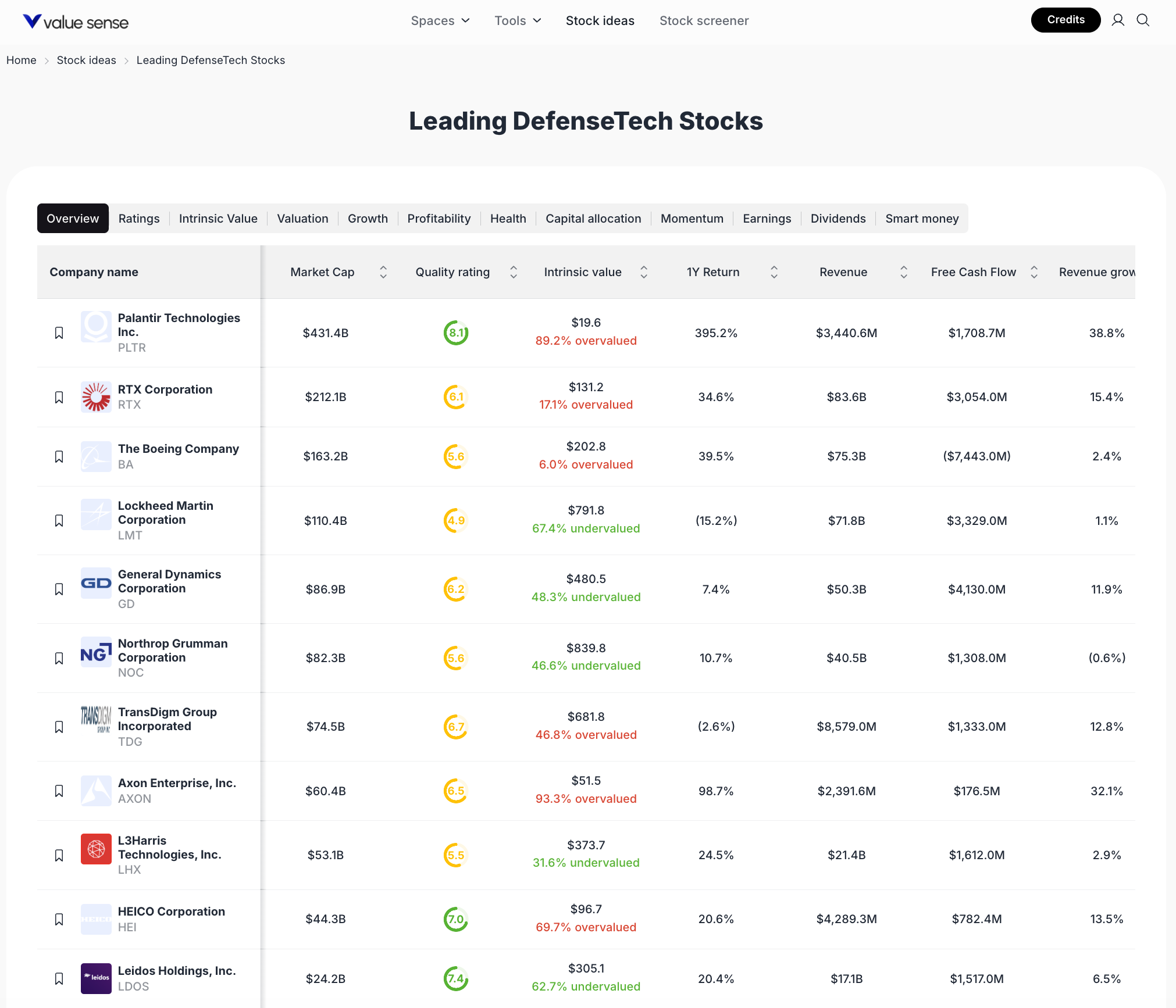

The defense technology sector is experiencing robust growth, driven by rising global security demands, increased government spending, and rapid innovation in aerospace, cybersecurity, and advanced weaponry. Our selection methodology leverages ValueSense’s proprietary quality ratings, intrinsic value assessments, and financial health metrics to identify stocks with strong fundamentals, attractive valuations, and compelling growth catalysts. Each stock featured below is systematically screened for market leadership, revenue growth, and risk-adjusted return potential.

Featured Stock Analysis

Stock #1: Palantir Technologies Inc. (PLTR)

| Metric | Value |

|---|---|

| Market Cap | $431.4B |

| Quality Rating | 8.1 |

| Intrinsic Value | $19.6 (89.2% overvalued) |

| 1Y Return | 395.2% |

| Revenue | $3,440.6M |

| Free Cash Flow | $1,708.7M |

| Revenue Growth | 38.8% |

Investment Thesis:

Palantir Technologies stands out as a leading data analytics and AI-driven defense contractor, leveraging its robust software platforms for government and commercial clients. The company’s explosive 395.2% one-year return highlights exceptional market momentum, underpinned by strong revenue growth of 38.8%. Despite being significantly overvalued relative to its intrinsic value, Palantir’s high quality rating (8.1) and substantial free cash flow generation position it as a premier growth story in the DefenseTech sector.

Palantir’s scalable platforms are increasingly embedded in critical defense and intelligence operations, driving recurring revenue streams and expanding its addressable market. The company’s ability to secure large government contracts and its growing commercial footprint further reinforce its long-term growth prospects.

Key Catalysts:

- Expansion of government and commercial contracts

- Continued innovation in AI and big data analytics

- Strong free cash flow supporting reinvestment

Risk Factors:

- High valuation risk (89.2% over intrinsic value)

- Dependence on government spending cycles

- Competitive pressures from emerging tech firms

Stock #2: RTX Corporation (RTX)

| Metric | Value |

|---|---|

| Market Cap | $212.1B |

| Quality Rating | 6.1 |

| Intrinsic Value | $131.2 (17.1% overvalued) |

| 1Y Return | 34.6% |

| Revenue | $83.6B |

| Free Cash Flow | $3,054.0M |

| Revenue Growth | 15.4% |

Investment Thesis:

RTX Corporation, formerly Raytheon Technologies, is a global leader in missile systems, integrated defense solutions, and advanced sensors. With a market cap exceeding $200B and a solid 34.6% annual return, RTX benefits from a diversified revenue base and strong free cash flow. The company’s moderate overvaluation is offset by its scale, technological leadership, and consistent contract wins in both domestic and international markets.

RTX’s focus on hypersonic weapons, air defense systems, and strategic divestitures positions it to capture future defense spending trends. Its robust balance sheet and ongoing innovation pipeline support sustainable growth and shareholder value.

Key Catalysts:

- Growth in hypersonic and advanced missile programs

- International defense contracts and partnerships

- Ongoing portfolio optimization

Risk Factors:

- Exposure to cyclical defense budgets

- Execution risk on large-scale projects

- Moderate overvaluation (17.1% above intrinsic value)

Stock #3: The Boeing Company (BA)

| Metric | Value |

|---|---|

| Market Cap | $163.2B |

| Quality Rating | 5.6 |

| Intrinsic Value | $202.8 (6.0% overvalued) |

| 1Y Return | 39.5% |

| Revenue | $75.3B |

| Free Cash Flow | ($7,443.0M) |

| Revenue Growth | 2.4% |

Investment Thesis:

Boeing remains a pivotal player in both commercial aerospace and defense, with a $163B market cap and a nearly 40% annual return. While the company’s intrinsic value suggests only a slight overvaluation, Boeing’s negative free cash flow and modest revenue growth reflect ongoing operational challenges. However, its diversified business model and global reach continue to underpin its strategic importance in the sector.

Boeing’s defense segment provides stability amid commercial aviation volatility, and the company’s focus on next-generation aircraft and defense systems offers long-term upside as supply chain issues resolve.

Key Catalysts:

- Recovery in global aerospace demand

- New defense contracts and technology upgrades

- Operational turnaround initiatives

Risk Factors:

- Persistent free cash flow deficits

- Execution risk in commercial and defense segments

- Supply chain and regulatory headwinds

Stock #4: Lockheed Martin Corporation (LMT)

| Metric | Value |

|---|---|

| Market Cap | $110.4B |

| Quality Rating | 4.9 |

| Intrinsic Value | $791.8 (67.4% undervalued) |

| 1Y Return | -15.2% |

| Revenue | $71.8B |

| Free Cash Flow | $3,329.0M |

| Revenue Growth | 1.1% |

Investment Thesis:

Lockheed Martin is a cornerstone of U.S. defense, with a strong $110B market cap and a reputation for innovation in aerospace and advanced weaponry. Despite a negative one-year return, the stock is trading at a significant 67.4% discount to its intrinsic value, suggesting deep value potential for long-term investors. Lockheed’s robust free cash flow and stable revenue base provide a solid foundation for future growth.

The company’s leadership in programs like the F-35 and hypersonic weapons, combined with a healthy contract backlog, positions it well for a rebound as defense budgets rise.

Key Catalysts:

- Expansion of flagship defense programs

- Strong contract pipeline and backlog

- Undervaluation relative to intrinsic value

Risk Factors:

- Recent underperformance in share price

- Low revenue growth

- Budgetary and geopolitical uncertainties

Stock #5: General Dynamics Corporation (GD)

| Metric | Value |

|---|---|

| Market Cap | $86.9B |

| Quality Rating | 6.2 |

| Intrinsic Value | $480.5 (48.3% undervalued) |

| 1Y Return | 7.4% |

| Revenue | $50.3B |

| Free Cash Flow | $4,130.0M |

| Revenue Growth | 11.9% |

Investment Thesis:

General Dynamics offers a balanced mix of defense platforms, shipbuilding, and IT services. With a 48.3% undervaluation and strong free cash flow, GD is well-positioned for stable, long-term growth. The company’s diversified portfolio and steady revenue growth of 11.9% provide resilience against sector volatility.

General Dynamics’ recent contract wins and focus on margin improvement are expected to drive profitability, while its shipbuilding division remains a key differentiator.

Key Catalysts:

- New defense and shipbuilding contracts

- Margin expansion initiatives

- Undervaluation supports upside potential

Risk Factors:

- Moderate quality rating

- Exposure to government contract cycles

- Competition in core markets

Stock #6: Northrop Grumman Corporation (NOC)

| Metric | Value |

|---|---|

| Market Cap | $82.3B |

| Quality Rating | 5.6 |

| Intrinsic Value | $839.8 (46.6% undervalued) |

| 1Y Return | 10.7% |

| Revenue | $40.5B |

| Free Cash Flow | $1,308.0M |

| Revenue Growth | -0.6% |

Investment Thesis:

Northrop Grumman is a leader in advanced defense technologies, with a focus on nuclear modernization and space systems. The stock is trading at a 46.6% discount to intrinsic value, offering significant value for investors seeking exposure to next-generation defense platforms. While revenue growth is currently negative, Northrop’s innovation pipeline and strong contract wins support its long-term outlook.

The company’s expertise in missile systems and stealth technology positions it as a key beneficiary of rising defense budgets.

Key Catalysts:

- Growth in space and missile defense programs

- New government contracts

- Undervaluation provides margin of safety

Risk Factors:

- Negative revenue growth

- Execution risk on large-scale projects

- Moderate quality rating

Stock #7: TransDigm Group Incorporated (TDG)

| Metric | Value |

|---|---|

| Market Cap | $74.5B |

| Quality Rating | 6.7 |

| Intrinsic Value | $681.8 (46.8% overvalued) |

| 1Y Return | -2.6% |

| Revenue | $8,579.0M |

| Free Cash Flow | $1,333.0M |

| Revenue Growth | 12.8% |

Investment Thesis:

TransDigm Group specializes in proprietary aerospace components, with a focus on high-margin, mission-critical products. Despite being overvalued by 46.8%, TDG’s strong quality rating and double-digit revenue growth highlight its competitive advantages and pricing power. The company’s negative one-year return reflects recent market volatility, but its robust free cash flow and specialized portfolio support long-term resilience.

TransDigm’s ability to consistently generate high margins and its focus on aftermarket sales provide a stable revenue base.

Key Catalysts:

- Expansion of proprietary product lines

- Growth in aftermarket aerospace services

- Strong free cash flow generation

Risk Factors:

- Overvaluation relative to intrinsic value

- Market sensitivity to aerospace cycles

- Recent share price underperformance

Stock #8: Axon Enterprise, Inc. (AXON)

| Metric | Value |

|---|---|

| Market Cap | $60.4B |

| Quality Rating | 6.5 |

| Intrinsic Value | $51.5 (93.3% overvalued) |

| 1Y Return | 98.7% |

| Revenue | $2,391.6M |

| Free Cash Flow | $176.5M |

| Revenue Growth | 32.1% |

Investment Thesis:

Axon Enterprise is a leader in law enforcement technology, known for its TASER devices and digital evidence platforms. The company’s nearly 100% annual return and 32.1% revenue growth underscore its rapid expansion and market adoption. However, Axon is trading at a substantial 93.3% premium to intrinsic value, reflecting high growth expectations.

Axon’s integrated ecosystem and recurring SaaS revenues provide strong visibility, while ongoing innovation in public safety tech supports future growth.

Key Catalysts:

- Expansion of SaaS and cloud-based offerings

- Adoption of next-gen law enforcement solutions

- Strong brand and customer loyalty

Risk Factors:

- Significant overvaluation

- Dependence on public sector budgets

- Competitive pressures in tech-enabled policing

Stock #9: L3Harris Technologies, Inc. (LHX)

| Metric | Value |

|---|---|

| Market Cap | $53.1B |

| Quality Rating | 6.5 |

| Intrinsic Value | $373.7 (31.6% undervalued) |

| 1Y Return | 24.5% |

| Revenue | $21.4B |

| Free Cash Flow | $1,612.0M |

| Revenue Growth | 2.9% |

Investment Thesis:

L3Harris Technologies is a diversified defense electronics and communications provider. With a 31.6% undervaluation and solid free cash flow, LHX offers a compelling blend of value and stability. The company’s moderate revenue growth and strong quality rating reflect its leadership in mission-critical communications and sensor systems.

L3Harris’s focus on modernization and integration of advanced technologies positions it well for future defense spending trends.

Key Catalysts:

- Growth in defense electronics and communications

- Modernization of military platforms

- Attractive valuation

Risk Factors:

- Modest revenue growth

- Integration risks from acquisitions

- Exposure to defense budget cycles

Stock #10: HEICO Corporation (HEI)

| Metric | Value |

|---|---|

| Market Cap | $44.3B |

| Quality Rating | 7.0 |

| Intrinsic Value | $96.7 (69.7% overvalued) |

| 1Y Return | 20.6% |

| Revenue | $4,289.3M |

| Free Cash Flow | $782.4M |

| Revenue Growth | 13.5% |

Investment Thesis:

HEICO Corporation is a niche aerospace and electronics manufacturer with a strong quality rating and double-digit revenue growth. The company’s 20.6% annual return and robust free cash flow highlight its operational efficiency. However, HEICO is trading at a 69.7% premium to intrinsic value, indicating elevated expectations.

HEICO’s focus on high-value, proprietary components and its track record of successful acquisitions support continued growth.

Key Catalysts:

- Expansion of proprietary aerospace products

- Strategic acquisitions

- Strong free cash flow

Risk Factors:

- High valuation risk

- Dependence on aerospace cycles

- Competitive pressures

[BONUS] Stock #11: Leidos Holdings, Inc. (LDOS)

| Metric | Value |

|---|---|

| Market Cap | $24.2B |

| Quality Rating | 7.4 |

| Intrinsic Value | $305.1 (62.7% undervalued) |

| 1Y Return | 20.4% |

| Revenue | $17.1B |

| Free Cash Flow | $1,517.0M |

| Revenue Growth | 6.5% |

Investment Thesis:

Leidos Holdings is a leading provider of IT, engineering, and science solutions for defense, intelligence, and civil markets. With a 62.7% undervaluation and a high quality rating, LDOS offers attractive value and operational stability. The company’s steady revenue growth and strong free cash flow support ongoing investment in innovation and contract expansion.

Leidos’s diversified portfolio and focus on mission-critical solutions position it for continued growth in both government and commercial markets.

Key Catalysts:

- Growth in IT and engineering contracts

- Expansion into new defense markets

- Attractive valuation

Risk Factors:

- Moderate revenue growth

- Competitive federal contracting environment

- Execution risk on large projects

Portfolio Diversification Insights

This DefenseTech stock collection spans large-cap, mid-cap, and niche players across aerospace, cybersecurity, electronics, and IT services. The portfolio’s sector allocation balances high-growth disruptors (Palantir, Axon) with established industry leaders (Lockheed Martin, RTX, Boeing). Undervalued stocks like Lockheed Martin, General Dynamics, and Leidos provide downside protection, while overvalued growth names offer upside potential. This blend enhances diversification and risk-adjusted return prospects.

Market Timing & Entry Strategies

Given the sector’s cyclical nature and current valuation dispersion, staggered entry strategies—such as dollar-cost averaging—can help manage volatility. Monitoring defense budget announcements, contract awards, and earnings reports is crucial for timing entries. Investors may consider scaling into undervalued names during market pullbacks while maintaining exposure to high-momentum stocks for growth.

Portfolio Diversification Insights

This watchlist spans pharmaceuticals, biotechnology, medical devices, and health insurance, offering exposure to multiple healthcare sub-sectors. The portfolio includes both undervalued and overvalued stocks, balancing growth potential with defensive characteristics. Diversification across market caps and business models helps mitigate sector-specific risks and enhances overall stability.

Market Timing & Entry Strategies

Given the mix of overvalued and undervalued stocks, investors may consider staggered entry points and focus on accumulating positions in undervalued names. Monitoring sector trends, earnings releases, and regulatory developments can help refine timing. Dollar-cost averaging and sector rotation strategies may also be effective for managing volatility.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 12 Best Dividend Growth Stocks to Buy Now

📖 12 Best Stock Picks with High ROIC for 2025

📖 10 Best Stock Picks for 2025: High Quality, Low Price/FCF Stocks

📖 10 Best Low P/E Stock Picks for 2025

📖 10 Best Stock Picks for Healthcare 2025

FAQ for Defense Stocks

Q1: How were these stocks selected?

These stocks were chosen using ValueSense’s proprietary ratings, intrinsic value analysis, and financial health metrics, focusing on sector leaders with strong fundamentals and growth potential.

Q2: What's the best stock from this list?

The “best” stock depends on individual goals; Palantir leads in growth, while Lockheed Martin and Leidos offer deep value based on intrinsic value metrics.

Q3: Should I buy all these stocks or diversify?

Diversification across multiple DefenseTech stocks can help balance risk and capture sector-wide opportunities, as each company offers unique strengths and exposures.

Q4: What are the biggest risks with these picks?

Key risks include valuation premiums, dependence on government contracts, sector cyclicality, and execution challenges in large-scale projects.

Q5: When is the best time to invest in these stocks?

Optimal timing often aligns with sector pullbacks, contract announcements, or when stocks trade below intrinsic value; consider a phased entry approach for risk management.

Summary & Investment Outlook

The 2025 DefenseTech stock watchlist features a diverse mix of industry leaders and innovators, each offering distinct value, growth, and risk profiles. By leveraging ValueSense’s data-driven analysis, investors can identify opportunities in both undervalued and high-momentum stocks. Explore ValueSense for deeper insights and ongoing research to support your investment decisions.