10 Best GARP Stock Picks for 2025: ValueSense Watchlist & Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

GARP stock idea --> https://valuesense.io/ideas/browse/growth-at-reasonable-price

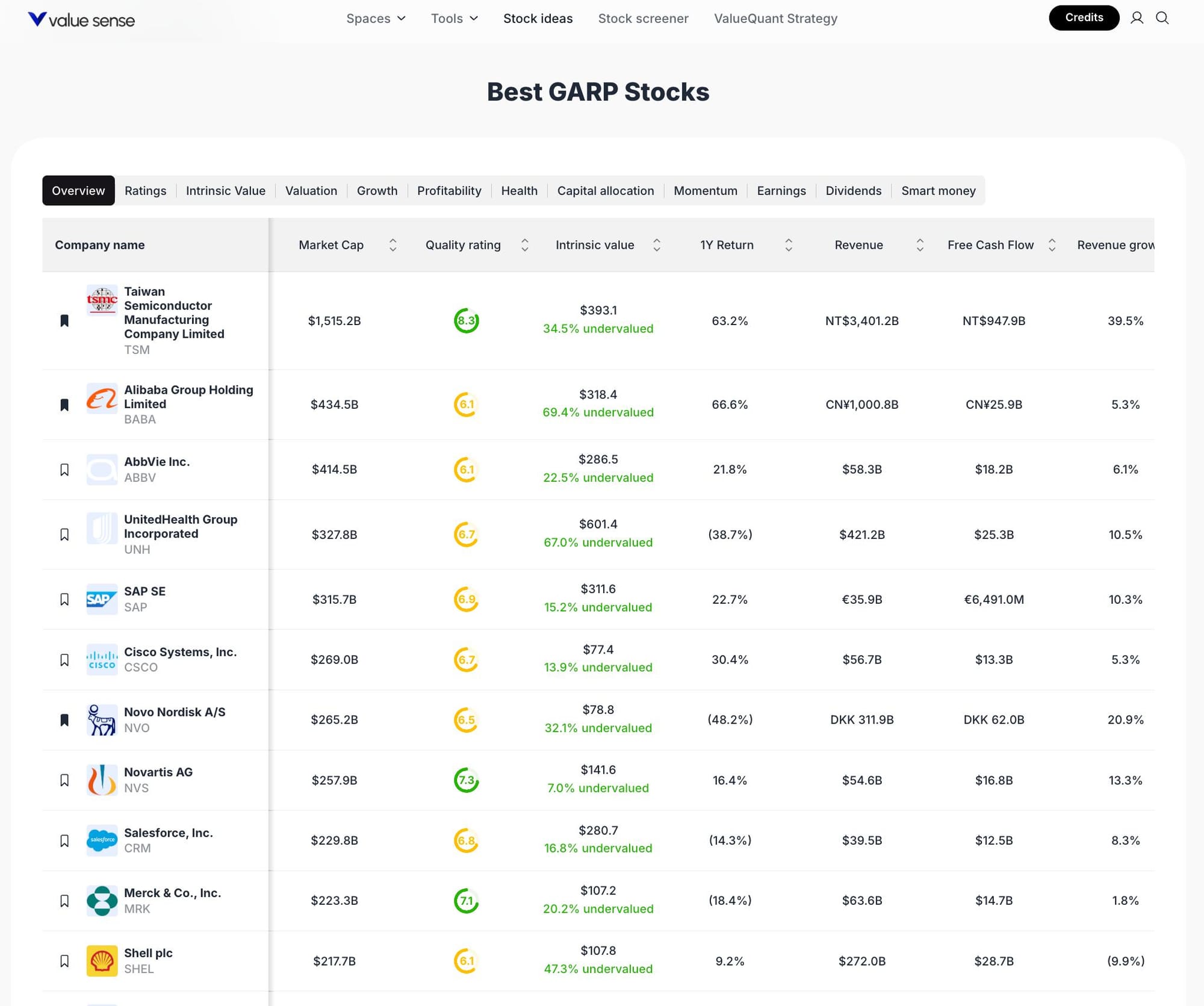

The current market landscape is marked by volatility and sector rotation, making Growth at a Reasonable Price (GARP) strategies especially relevant. GARP stocks blend the best of value and growth investing, focusing on companies with robust earnings growth, reasonable valuations, and solid financial health. Our selection methodology prioritizes: - Intrinsic value discounts (undervalued by ValueSense models) - Consistent revenue and free cash flow growth - Quality ratings above 6.0 (ValueSense proprietary metric) - Diversification across technology, healthcare, and global sectors

Featured Stock Analysis

Stock #1: Taiwan Semiconductor Manufacturing Company Limited (TSM)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $1,515.2B |

| Quality Rating | 6.3 |

| Intrinsic Value | $393.1 (34.5% undervalued) |

| 1Y Return | 63.2% |

| Revenue | NT$3,401.2B |

| Free Cash Flow | NT$947.9B |

| Revenue Growth | 39.5% |

Investment Thesis

Taiwan Semiconductor Manufacturing Company Limited (TSMC) stands as the global leader in advanced semiconductor manufacturing. With a massive market cap and a ValueSense quality rating of 6.3, TSMC is recognized for its technological edge and scale. The stock is currently trading at a 34.5% discount to its intrinsic value, highlighting significant upside potential. TSMC’s robust 1-year return of 63.2% and exceptional revenue growth of 39.5% underscore its dominant market position and continued demand for high-performance chips.

TSMC’s free cash flow generation (NT$947.9B) supports ongoing capital investments and shareholder returns. The company’s strategic importance in the global supply chain, especially for AI and high-performance computing, positions it as a core GARP holding.

Key Catalysts

- Global demand for AI, 5G, and high-performance computing chips

- Expansion of advanced manufacturing nodes (3nm, 2nm)

- Strategic partnerships with leading tech firms

Risk Factors

- Geopolitical tensions in East Asia

- Cyclical semiconductor demand

- Capital intensity and supply chain risks

Stock #2: Alibaba Group Holding Limited (BABA)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $434.5B |

| Quality Rating | 6.1 |

| Intrinsic Value | $318.4 (69.4% undervalued) |

| 1Y Return | 66.6% |

| Revenue | CN¥1,000.8B |

| Free Cash Flow | CN¥25.9B |

| Revenue Growth | 5.3% |

Investment Thesis

Alibaba Group (BABA) is a dominant force in e-commerce and cloud computing in China and globally. With a ValueSense quality rating of 6.1, Alibaba is currently trading at a substantial 69.4% discount to its intrinsic value, making it one of the most undervalued large-cap tech stocks. The company’s 1-year return of 66.6% reflects renewed investor confidence, while its massive revenue base (CN¥1,000.8B) underpins its market leadership.

Despite modest revenue growth of 5.3%, Alibaba’s diversified business model, including cloud, logistics, and digital media, offers multiple growth levers. The company’s free cash flow remains strong, supporting reinvestment and potential shareholder returns.

Key Catalysts

- Recovery in Chinese consumer demand

- Expansion of cloud and international commerce

- Regulatory stabilization in China

Risk Factors

- Regulatory risks in China

- Slower domestic growth

- Competitive pressures from local and global peers

Stock #3: AbbVie Inc. (ABBV)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $414.5B |

| Quality Rating | 6.1 |

| Intrinsic Value | $286.5 (22.5% undervalued) |

| 1Y Return | 21.8% |

| Revenue | $58.3B |

| Free Cash Flow | $18.2B |

| Revenue Growth | 6.1% |

Investment Thesis

AbbVie Inc. (ABBV) is a global biopharmaceutical leader with a diversified portfolio in immunology, oncology, and neuroscience. The stock is trading at a 22.5% discount to its intrinsic value, with a ValueSense quality rating of 6.1. AbbVie’s 1-year return of 21.8% and steady revenue growth of 6.1% reflect resilience amid patent cliffs and industry headwinds.

AbbVie’s strong free cash flow ($18.2B) supports R&D and dividend growth. The company’s pipeline and recent launches in immunology and oncology provide visibility into future growth, while its established brands continue to generate significant cash flows.

Key Catalysts

- New drug approvals and pipeline progress

- Expansion in immunology and oncology markets

- Strong dividend and capital return policy

Risk Factors

- Patent expirations (notably Humira)

- Competitive pressures in key therapeutic areas

- Regulatory and pricing risks

Stock #4: UnitedHealth Group Incorporated (UNH)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $327.8B |

| Quality Rating | 6.7 |

| Intrinsic Value | $601.4 (67.0% undervalued) |

| 1Y Return | (38.7%) |

| Revenue | $421.2B |

| Free Cash Flow | $25.3B |

| Revenue Growth | 10.5% |

Investment Thesis

UnitedHealth Group (UNH) is the largest U.S. health insurer, combining insurance and healthcare services. With a ValueSense quality rating of 6.7 and trading at a 67.0% discount to intrinsic value, UNH offers significant value. Despite a negative 1-year return of (38.7%), the company’s fundamentals remain strong, with $421.2B in revenue and 10.5% revenue growth.

UNH’s scale and integrated model drive efficiency and growth. Its strong free cash flow ($25.3B) supports ongoing investments in technology and care delivery.

Key Catalysts

- Growth in Medicare Advantage and Optum health services

- Expansion of value-based care models

- Healthcare digitization and analytics

Risk Factors

- Regulatory changes in U.S. healthcare

- Margin pressures from cost inflation

- Competitive dynamics

Stock #5: SAP SE (SAP)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $315.7B |

| Quality Rating | 6.1 |

| Intrinsic Value | $311.6 (15.2% undervalued) |

| 1Y Return | 22.7% |

| Revenue | €35.9B |

| Free Cash Flow | €6,491.0M |

| Revenue Growth | 10.3% |

Investment Thesis

SAP SE is a global leader in enterprise software and cloud solutions. With a ValueSense quality rating of 6.1 and trading at a 15.2% discount to intrinsic value, SAP offers a balanced GARP profile. The company’s 1-year return of 22.7% and revenue growth of 10.3% reflect strong demand for digital transformation solutions.

SAP’s robust free cash flow (€6,491.0M) enables ongoing innovation and shareholder returns. The company’s transition to cloud-based offerings is driving recurring revenue and margin expansion.

Key Catalysts

- Cloud adoption and digital transformation

- Expansion in enterprise AI and analytics

- Strategic partnerships and acquisitions

Risk Factors

- Competition from U.S. cloud giants

- Currency and macroeconomic risks

- Execution on cloud transition

Stock #6: Cisco Systems, Inc. (CSCO)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $269.0B |

| Quality Rating | 6.7 |

| Intrinsic Value | $77.4 (13.9% undervalued) |

| 1Y Return | 30.4% |

| Revenue | $56.7B |

| Free Cash Flow | $13.3B |

| Revenue Growth | 5.3% |

Investment Thesis

Cisco Systems (CSCO) is a global leader in networking hardware, software, and cybersecurity. With a ValueSense quality rating of 6.7 and trading at a 13.9% discount to intrinsic value, Cisco offers a stable GARP profile. The company’s 1-year return of 30.4% and steady revenue growth of 5.3% highlight its resilience and innovation.

Cisco’s strong free cash flow ($13.3B) supports R&D and shareholder returns. The company’s focus on recurring software revenue and cybersecurity positions it for long-term growth.

Key Catalysts

- Growth in cloud networking and cybersecurity

- Expansion of subscription-based software

- 5G and edge computing adoption

Risk Factors

- Intense competition in networking

- Supply chain disruptions

- Technology shifts

Stock #7: Novo Nordisk A/S (NVO)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $265.2B |

| Quality Rating | 6.5 |

| Intrinsic Value | $78.8 (32.1% undervalued) |

| 1Y Return | (48.2%) |

| Revenue | DKK 311.9B |

| Free Cash Flow | DKK 62.0B |

| Revenue Growth | 20.9% |

Investment Thesis

Novo Nordisk (NVO) is a global leader in diabetes care and obesity treatments. With a ValueSense quality rating of 6.5 and trading at a 32.1% discount to intrinsic value, Novo Nordisk offers strong GARP characteristics. Despite a negative 1-year return of (48.2%), the company’s revenue growth of 20.9% is among the highest in the group.

Novo Nordisk’s free cash flow (DKK 62.0B) supports R&D and global expansion. The company’s leadership in GLP-1 therapies and obesity drugs positions it for sustained growth.

Key Catalysts

- Global diabetes and obesity epidemic

- New product launches in metabolic care

- Expansion in emerging markets

Risk Factors

- Pricing pressures in pharmaceuticals

- Regulatory and reimbursement risks

- Competition from biosimilars

Stock #8: Novartis AG (NVS)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $257.9B |

| Quality Rating | 6.4 |

| Intrinsic Value | $141.6 (7.0% undervalued) |

| 1Y Return | 16.4% |

| Revenue | $54.6B |

| Free Cash Flow | $16.8B |

| Revenue Growth | 13.3% |

Investment Thesis

Novartis AG (NVS) is a diversified global pharmaceutical company. With a ValueSense quality rating of 6.4 and trading at a 7.0% discount to intrinsic value, Novartis offers a balanced risk-reward profile. The company’s 1-year return of 16.4% and revenue growth of 13.3% reflect strong execution and a robust pipeline.

Novartis’s free cash flow ($16.8B) supports innovation and shareholder returns. The company’s focus on innovative medicines and biosimilars drives long-term growth.

Key Catalysts

- New drug launches and pipeline progress

- Expansion in biosimilars and generics

- Strategic acquisitions

Risk Factors

- Patent expirations and generic competition

- Regulatory and pricing risks

- Currency fluctuations

Stock #9: Salesforce, Inc. (CRM)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $229.8B |

| Quality Rating | 6.8 |

| Intrinsic Value | $280.7 (16.8% undervalued) |

| 1Y Return | (14.3%) |

| Revenue | $39.5B |

| Free Cash Flow | $12.5B |

| Revenue Growth | 8.3% |

Investment Thesis

Salesforce, Inc. (CRM) is the global leader in customer relationship management (CRM) software. With a ValueSense quality rating of 6.8 and trading at a 16.8% discount to intrinsic value, Salesforce combines growth and value. The company’s 1-year return of (14.3%) reflects recent volatility, but its revenue growth of 8.3% and strong free cash flow ($12.5B) support ongoing innovation.

Salesforce’s expanding suite of cloud-based solutions and AI integration drive recurring revenue and customer retention.

Key Catalysts

- AI-driven CRM and analytics

- Expansion into new verticals and geographies

- Strategic acquisitions

Risk Factors

- Intense competition in enterprise software

- Integration risks from acquisitions

- Macro headwinds impacting IT spending

Stock #10: Merck & Co., Inc. (MRK)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $223.3B |

| Quality Rating | 7.1 |

| Intrinsic Value | $107.2 (20.2% undervalued) |

| 1Y Return | (18.4%) |

| Revenue | $63.6B |

| Free Cash Flow | $14.7B |

| Revenue Growth | 1.8% |

Investment Thesis

Merck & Co., Inc. (MRK) is a leading global pharmaceutical company with a ValueSense quality rating of 7.1, the highest in this collection. Trading at a 20.2% discount to intrinsic value, Merck offers a compelling GARP profile. Despite a negative 1-year return of (18.4%), the company’s strong free cash flow ($14.7B) and leadership in oncology and vaccines support long-term growth.

Merck’s focus on innovative therapies and global expansion positions it for continued success.

Key Catalysts

- Growth in oncology (Keytruda) and vaccines

- Expansion in emerging markets

- Strong R&D pipeline

Risk Factors

- Patent expirations and biosimilar competition

- Regulatory and pricing pressures

- Slower revenue growth

Stock #11: Shell plc (SHEL)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $217.7B |

| Quality Rating | 6.1 |

| Intrinsic Value | $107.8 (47.3% undervalued) |

| 1Y Return | 9.2% |

| Revenue | $272.0B |

| Free Cash Flow | $28.7B |

| Revenue Growth | (9.9%) |

Investment Thesis

Shell plc (SHEL) is a global energy major with diversified operations across oil, gas, and renewables. With a ValueSense quality rating of 6.1 and trading at a 47.3% discount to intrinsic value, Shell offers significant value. The company’s 1-year return of 9.2% and strong free cash flow ($28.7B) support ongoing investments in energy transition.

Shell’s focus on renewables and low-carbon solutions positions it for long-term relevance amid the global energy transition.

Key Catalysts

- Energy transition and renewables investments

- Oil and gas price recovery

- Capital discipline and shareholder returns

Risk Factors

- Commodity price volatility

- Regulatory and environmental risks

- Transition execution

Portfolio Diversification Insights

This GARP stock collection spans technology, healthcare, and energy, providing sector diversification and risk mitigation. Technology names (TSM, SAP, CSCO, CRM) offer growth and innovation exposure, while healthcare (ABBV, UNH, NVO, NVS, MRK) provides defensive characteristics and steady cash flows. Shell adds commodity and energy diversification, balancing cyclical and secular growth trends.

Market Timing & Entry Strategies

GARP stocks are best considered during periods of market volatility or sector rotation, as their blend of growth and value can outperform in uncertain environments. Investors may consider dollar-cost averaging or staggered entry points to manage volatility and capture value over time. Monitoring intrinsic value discounts and sector trends can further refine entry timing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 1-Month Market Movers: Best Undervalued High-Quality Stocks

📖 12 Best High Quality Low EV/EBIT Stocks - October-November 2025

📖 12 Best Stock Picks for Profitable Growth

📖 12 Best Momentum Stock Picks for November 2025

📖 13 Best Wide Moat Stock Picks for 2025

FAQ about GARP stocks

Q1: How were these stocks selected?

A1: Stocks were chosen based on ValueSense’s GARP criteria, focusing on undervaluation, quality ratings above 6.0, and strong growth and cash flow metrics as shown in the platform’s data.

Q2: What's the best stock from this list?

A2: Each stock offers unique strengths; TSMC and Alibaba stand out for their high intrinsic value discounts and sector leadership, but the best choice depends on individual investment goals and risk tolerance.

Q3: Should I buy all these stocks or diversify?

A3: Diversification across sectors (technology, healthcare, energy) can help manage risk and capture different growth drivers, as reflected in this watchlist’s construction.

Q4: What are the biggest risks with these picks?

A4: Key risks include regulatory changes, sector-specific headwinds, geopolitical tensions, and company-specific execution risks, all highlighted in each stock’s analysis.

Q5: When is the best time to invest in these stocks?

A5: GARP stocks are often attractive during market corrections or sector rotations; monitoring valuation discounts and entering gradually can help optimize timing.

Summary & Investment Outlook

The 2025 ValueSense GARP watchlist features a diversified set of undervalued growth stocks across technology, healthcare, and energy. Each stock is selected for its blend of quality, growth, and reasonable valuation, as evidenced by ValueSense’s proprietary ratings and intrinsic value models. For more detailed analysis and real-time updates, visit ValueSense.