10 Best High Quality Industrials Stocks to Buy Now

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

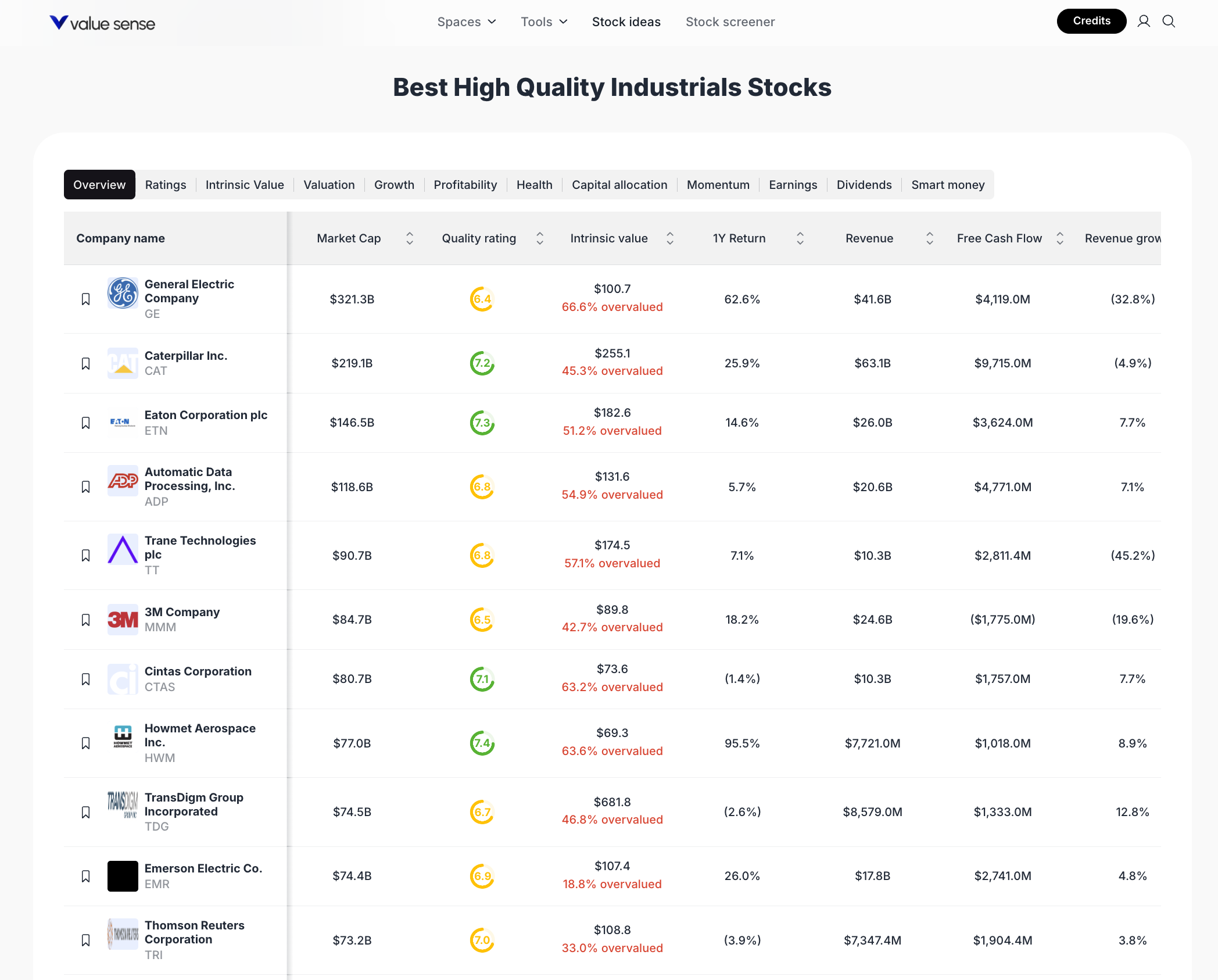

Market Overview & Selection Criteria

The industrials sector remains a backbone of economic growth, encompassing companies that drive manufacturing, automation, infrastructure, and essential services. In 2025, industrials are outperforming broader markets, fueled by innovation in automation, aerospace, and energy efficiency. Our stock selection methodology leverages ValueSense’s proprietary quality ratings, intrinsic value analysis, and financial health metrics to identify high-quality, resilient leaders. Each stock featured below is chosen for its robust fundamentals, sector leadership, and clear growth or value catalysts.

Featured Stock Analysis

Stock #1: General Electric Company (GE)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $321.3B |

| Quality Rating | 6.4 |

| Intrinsic Value | $100.7 (66.6% overvalued) |

| 1Y Return | 62.6% |

| Revenue | $41.6B |

| Free Cash Flow | $4,119.0M |

| Revenue Growth | -32.8% |

Investment Thesis:

General Electric (GE) stands as a diversified industrial leader, recently revitalized through strategic restructuring and a renewed focus on core businesses. Despite being significantly overvalued relative to its intrinsic value, GE’s strong one-year return of 62.6% highlights robust investor confidence. The company’s substantial free cash flow and large market cap underscore its financial resilience, though recent revenue contraction signals ongoing portfolio adjustments and divestitures.

GE’s transformation into a more focused industrial and aerospace powerhouse has improved operational efficiency. The company’s ability to generate strong cash flows, even amid declining revenues, reflects disciplined capital allocation and cost management. Its global presence and innovation in energy and aviation continue to drive long-term potential.

Key Catalysts:

- Ongoing portfolio simplification and focus on high-margin businesses

- Leadership in aerospace and energy technology

- Strong free cash flow supporting future investments

Risk Factors:

- Significant overvaluation relative to intrinsic value

- Negative revenue growth due to divestitures and restructuring

- Exposure to cyclical industrial demand

Stock #2: Caterpillar Inc. (CAT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $219.1B |

| Quality Rating | 7.2 |

| Intrinsic Value | $255.1 (45.3% overvalued) |

| 1Y Return | 25.9% |

| Revenue | $63.1B |

| Free Cash Flow | $9,715.0M |

| Revenue Growth | -4.9% |

Investment Thesis:

Caterpillar (CAT) is a global leader in construction and mining equipment, benefiting from infrastructure spending and industrial expansion. With a high quality rating and the largest free cash flow among peers, CAT demonstrates strong operational execution. Despite being overvalued, its steady one-year return and massive revenue base reflect enduring demand for its products.

CAT’s focus on innovation, digital services, and sustainable machinery positions it well for future growth. The company’s robust cash generation supports shareholder returns and ongoing investment in technology. While revenue growth is slightly negative, CAT’s scale and brand strength provide a durable competitive advantage.

Key Catalysts:

- Global infrastructure investment cycles

- Expansion into digital and autonomous equipment

- Strong free cash flow for reinvestment and dividends

Risk Factors:

- Overvaluation relative to intrinsic value

- Cyclical exposure to construction and mining sectors

- Modest revenue contraction

Stock #3: Eaton Corporation plc (ETN)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $146.5B |

| Quality Rating | 7.3 |

| Intrinsic Value | $182.6 (51.2% overvalued) |

| 1Y Return | 14.6% |

| Revenue | $26.0B |

| Free Cash Flow | $3,624.0M |

| Revenue Growth | 7.7% |

Investment Thesis:

Eaton Corporation (ETN) is a diversified power management company, excelling in electrical systems and industrial automation. With a strong quality rating and positive revenue growth, Eaton is well-positioned to benefit from trends in electrification and energy efficiency. The company’s solid free cash flow and moderate valuation premium reflect its stable growth profile.

Eaton’s focus on sustainable solutions and smart infrastructure aligns with global decarbonization initiatives. Its diversified portfolio and global reach provide resilience against sector volatility, while ongoing innovation supports long-term value creation.

Key Catalysts:

- Rising demand for energy-efficient and smart infrastructure

- Expansion in electrification and automation markets

- Consistent revenue and cash flow growth

Risk Factors:

- Overvaluation relative to intrinsic value

- Competition in global power management markets

- Sensitivity to industrial capital spending

Stock #4: Automatic Data Processing, Inc. (ADP)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $118.6B |

| Quality Rating | 6.8 |

| Intrinsic Value | $131.6 (54.9% overvalued) |

| 1Y Return | 5.7% |

| Revenue | $20.6B |

| Free Cash Flow | $4,771.0M |

| Revenue Growth | 7.1% |

Investment Thesis:

ADP is a global leader in payroll and human capital management solutions. Its strong free cash flow and steady revenue growth highlight a resilient business model, even as the stock trades at a significant premium to intrinsic value. ADP’s recurring revenue streams and high client retention rates provide stability in uncertain markets.

The company’s ongoing investment in digital transformation and cloud-based services enhances its competitive edge. As businesses increasingly outsource HR functions, ADP’s scalable platform and global reach position it for continued growth.

Key Catalysts:

- Expansion of cloud-based HR solutions

- Increasing demand for outsourced payroll and compliance

- Strong free cash flow supporting innovation

Risk Factors:

- Overvaluation relative to intrinsic value

- Slower growth in mature markets

- Competitive pressures from fintech and HR tech disruptors

Stock #5: Trane Technologies plc (TT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $90.7B |

| Quality Rating | 6.8 |

| Intrinsic Value | $174.5 (57.1% overvalued) |

| 1Y Return | 7.1% |

| Revenue | $10.3B |

| Free Cash Flow | $2,811.4M |

| Revenue Growth | -45.2% |

Investment Thesis:

Trane Technologies (TT) specializes in climate control and HVAC solutions, serving commercial and residential markets. Despite a sharp revenue decline, Trane maintains a solid quality rating and healthy free cash flow. The company’s focus on energy-efficient systems and sustainability aligns with regulatory trends and customer demand.

Trane’s innovation in smart climate solutions and its global service network support long-term growth. However, the significant overvaluation and recent revenue contraction warrant close monitoring of execution and market conditions.

Key Catalysts:

- Rising demand for energy-efficient HVAC systems

- Regulatory support for sustainable building solutions

- Strong service and aftermarket business

Risk Factors:

- Significant overvaluation

- Large revenue decline year-over-year

- Cyclical exposure to construction and real estate

Stock #6: 3M Company (MMM)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $84.7B |

| Quality Rating | 6.5 |

| Intrinsic Value | $89.8 (42.7% overvalued) |

| 1Y Return | 18.2% |

| Revenue | $24.6B |

| Free Cash Flow | ($1,775.0M) |

| Revenue Growth | -19.6% |

Investment Thesis:

3M Company (MMM) is a diversified industrial conglomerate with a broad product portfolio spanning safety, healthcare, and consumer goods. While the company faces headwinds from declining revenues and negative free cash flow, its global brand and innovation pipeline remain strengths. The stock’s moderate overvaluation and positive one-year return reflect investor optimism for a turnaround.

3M’s ongoing restructuring and focus on core businesses aim to restore profitability. The company’s legacy of innovation and global distribution network provide a foundation for recovery, though near-term risks remain elevated.

Key Catalysts:

- Portfolio restructuring and cost optimization

- Innovation in healthcare and safety products

- Global brand recognition

Risk Factors:

- Negative free cash flow and revenue contraction

- Overvaluation relative to intrinsic value

- Legal and regulatory challenges

Stock #7: Cintas Corporation (CTAS)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $80.7B |

| Quality Rating | 7.1 |

| Intrinsic Value | $73.6 (63.2% overvalued) |

| 1Y Return | -1.4% |

| Revenue | $10.3B |

| Free Cash Flow | $1,757.0M |

| Revenue Growth | 7.7% |

Investment Thesis:

Cintas Corporation (CTAS) is a leader in uniform rental and workplace services, serving a diverse client base across North America. With a high quality rating and positive revenue growth, Cintas demonstrates operational excellence and resilience. The company’s recurring revenue model and strong free cash flow support long-term stability.

Despite a modest one-year return and significant overvaluation, Cintas’s market leadership and focus on service innovation provide a durable competitive edge. Its ability to grow revenues in a challenging environment highlights strong execution.

Key Catalysts:

- Expansion of workplace safety and hygiene services

- Recurring revenue from long-term contracts

- Operational efficiency driving margin expansion

Risk Factors:

- Overvaluation relative to intrinsic value

- Slower growth in mature markets

- Sensitivity to labor market trends

Stock #8: Howmet Aerospace Inc. (HWM)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $77.0B |

| Quality Rating | 7.4 |

| Intrinsic Value | $69.3 (63.6% overvalued) |

| 1Y Return | 95.5% |

| Revenue | $7,721.0M |

| Free Cash Flow | $1,108.0M |

| Revenue Growth | 8.9% |

Investment Thesis:

Howmet Aerospace (HWM) is a leading supplier of advanced engineered solutions for the aerospace and transportation industries. With the highest one-year return among peers and strong revenue growth, Howmet is capitalizing on the recovery in global air travel and defense spending. Its high quality rating and solid free cash flow support ongoing investment in innovation.

Howmet’s focus on lightweight materials and precision components aligns with industry trends toward efficiency and sustainability. The company’s strong execution and market positioning drive robust growth prospects.

Key Catalysts:

- Recovery in commercial aerospace demand

- Expansion in defense and transportation markets

- Innovation in lightweight materials

Risk Factors:

- Overvaluation relative to intrinsic value

- Cyclical exposure to aerospace industry

- Supply chain and raw material risks

Stock #9: TransDigm Group Incorporated (TDG)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $74.5B |

| Quality Rating | 6.7 |

| Intrinsic Value | $681.8 (46.8% overvalued) |

| 1Y Return | -2.6% |

| Revenue | $8,579.0M |

| Free Cash Flow | $1,333.0M |

| Revenue Growth | 12.8% |

Investment Thesis:

TransDigm Group (TDG) is a specialized aerospace manufacturer, delivering proprietary components for commercial and military aircraft. With the highest intrinsic value among peers and double-digit revenue growth, TransDigm is well-positioned for long-term expansion. Despite a slight decline in one-year return, the company’s strong free cash flow and quality rating reflect solid fundamentals.

TransDigm’s focus on high-margin, engineered products and aftermarket services supports recurring revenue and profitability. The company’s disciplined acquisition strategy further enhances growth prospects.

Key Catalysts:

- Growth in global air travel and defense budgets

- Expansion of aftermarket services

- Strategic acquisitions driving scale

Risk Factors:

- Overvaluation relative to intrinsic value

- Cyclical exposure to aerospace sector

- Integration risks from acquisitions

Stock #10: Emerson Electric Co. (EMR)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $74.4B |

| Quality Rating | 6.9 |

| Intrinsic Value | $107.4 (18.8% overvalued) |

| 1Y Return | 26.0% |

| Revenue | $17.8B |

| Free Cash Flow | $2,741.0M |

| Revenue Growth | 4.8% |

Investment Thesis:

Emerson Electric (EMR) is a global leader in automation and process control solutions, serving diverse industrial end markets. With a balanced quality rating and moderate overvaluation, Emerson combines steady revenue growth with strong free cash flow. The company’s focus on digital transformation and industrial automation positions it for continued relevance in a rapidly evolving sector.

Emerson’s diversified portfolio and global footprint provide resilience against market volatility. Ongoing investment in innovation and strategic partnerships support long-term value creation.

Key Catalysts:

- Growth in industrial automation and digitalization

- Expansion in process control and energy efficiency

- Strong free cash flow supporting R&D

Risk Factors:

- Overvaluation relative to intrinsic value

- Competitive pressures in automation markets

- Exposure to global industrial cycles

[BONUS] Stock #11: Thomson Reuters Corporation (TRI)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $73.2B |

| Quality Rating | 7.0 |

| Intrinsic Value | $108.8 (33.0% overvalued) |

| 1Y Return | -3.9% |

| Revenue | $7,347.4M |

| Free Cash Flow | $1,904.4M |

| Revenue Growth | 3.8% |

Investment Thesis:

Thomson Reuters (TRI) is a leading provider of information and technology solutions for legal, tax, and media professionals. With a strong quality rating and positive revenue growth, TRI offers a stable business model supported by recurring subscription revenues. The company’s moderate overvaluation and negative one-year return reflect market caution, but its robust free cash flow and diversified client base provide long-term stability.

TRI’s ongoing investment in digital platforms and data analytics enhances its value proposition. The company’s global reach and trusted brand support continued growth in professional services.

Key Catalysts:

- Expansion of digital and data-driven solutions

- Growth in legal and tax technology markets

- Strong recurring revenue base

Risk Factors:

- Overvaluation relative to intrinsic value

- Slower growth in mature markets

- Competitive pressures from new entrants

Portfolio Diversification Insights

This industrials stock watchlist spans a diverse range of subsectors, including aerospace, automation, construction, climate solutions, and information services. The portfolio balances exposure to cyclical growth (e.g., Caterpillar, Howmet Aerospace, TransDigm) with stable, recurring revenue businesses (e.g., ADP, Thomson Reuters, Cintas). Sector allocation ensures resilience against single-industry shocks and leverages both infrastructure expansion and digital transformation trends.

Market Timing & Entry Strategies

Given the current overvaluation across most featured stocks, investors may consider phased entry strategies, such as dollar-cost averaging or waiting for market pullbacks. Monitoring sector rotation and macroeconomic indicators can help identify optimal entry points. ValueSense’s intrinsic value tools provide ongoing guidance for timing and position sizing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 12 Best Dividend Growth Stocks to Buy Now

📖 12 Best Stock Picks with High ROIC for 2025

📖 10 Best DefenseTech Stock Picks for 2025

📖 10 Best Low P/E Stock Picks for 2025

📖 10 Best Stock Picks for Healthcare 2025

FAQ for Industrial Stocks

Q1: How were these stocks selected?

These stocks were chosen based on ValueSense’s proprietary quality ratings, intrinsic value analysis, and key financial metrics, focusing on sector leaders with strong fundamentals and growth potential.

Q2: What's the best stock from this list?

Each stock offers unique strengths; for example, Howmet Aerospace (HWM) leads in recent performance, while Eaton (ETN) and Caterpillar (CAT) provide stability and scale. The best stock depends on individual investment goals and risk tolerance.

Q3: Should I buy all these stocks or diversify?

Diversification across multiple industrial leaders can reduce risk and capture sector-wide growth. Consider balancing cyclical and stable businesses for a resilient portfolio.

Q4: What are the biggest risks with these picks?

Key risks include overvaluation, cyclical exposure, revenue contraction, and sector-specific challenges such as supply chain disruptions or regulatory changes.

Q5: When is the best time to invest in these stocks?

Market timing is challenging; consider phased entry or dollar-cost averaging, and use ValueSense’s intrinsic value analysis to identify attractive entry points.

Summary & Investment Outlook

The 10 best high quality industrials stocks highlighted here represent a diversified collection of sector leaders, each with distinct growth drivers and risk profiles. While many trade at premiums to intrinsic value, their strong fundamentals and market positioning offer compelling long-term potential. For ongoing analysis and personalized stock insights, explore ValueSense’s research tools and stay informed on evolving market opportunities.