10 Best Low P/E Stock Picks for 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

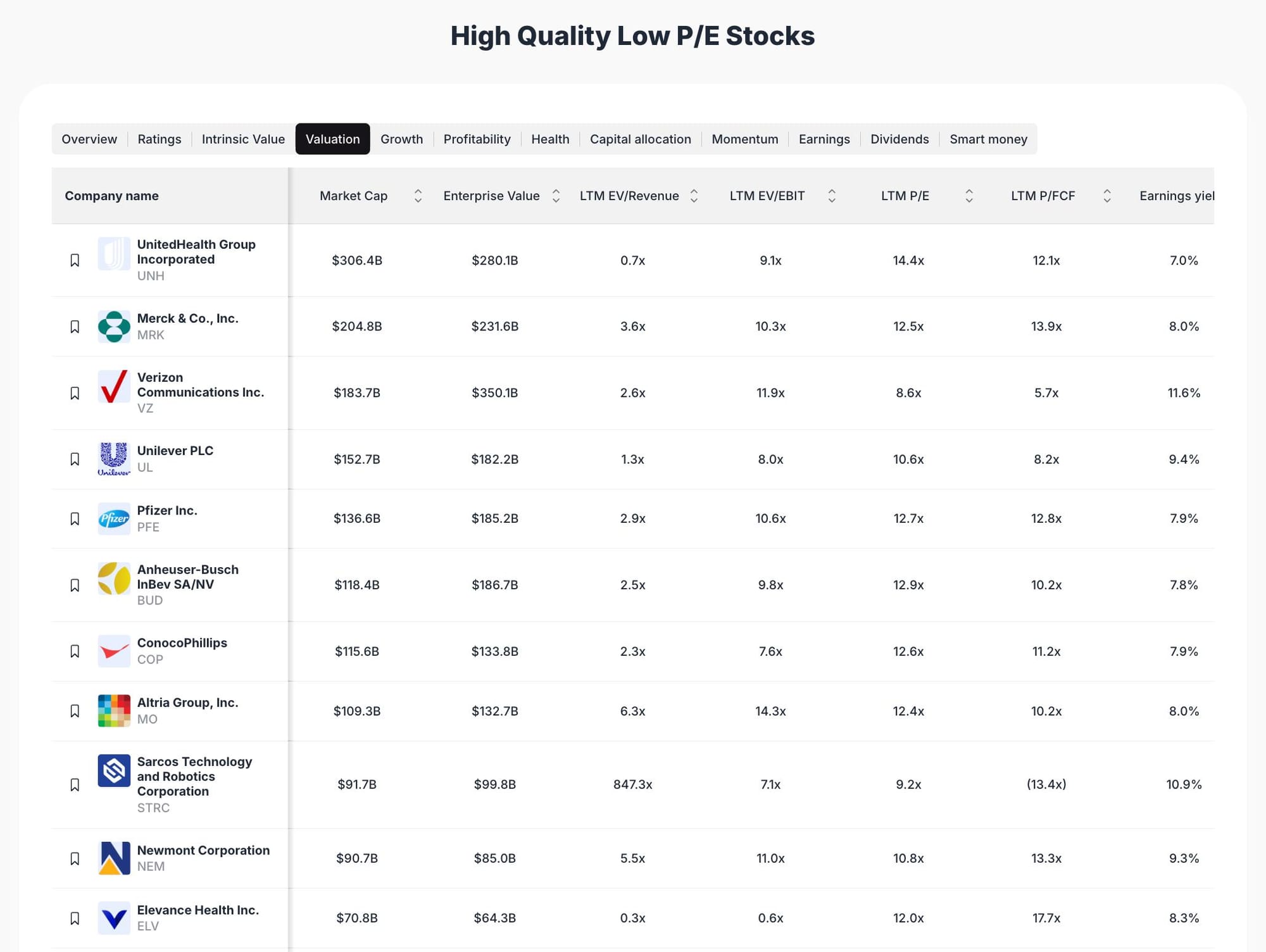

In 2025, market volatility and sector rotation have made valuation discipline essential for investors. This watchlist focuses on stocks with low price-to-earnings (P/E) ratios, which can indicate undervaluation relative to earnings power. Selection criteria include: - Market cap above $60B for stability - LTM (Last Twelve Months) P/E ratios significantly below sector averages - Strong earnings yield and free cash flow metrics - Sector diversification across healthcare, technology, consumer staples, and industrials

Featured Stock Analysis

Stock #1: UnitedHealth Group Incorporated (UNH)

| Metric | Value |

|---|---|

| Market Cap | $306.4B |

| Enterprise Value | $280.1B |

| LTM EV/Revenue | 0.7x |

| LTM EV/EBIT | 9.1x |

| LTM P/E | 14.4x |

| LTM P/FCF | 12.1x |

| Earnings Yield | 7.0% |

Investment Thesis:

UnitedHealth Group is a leading healthcare conglomerate with a robust market cap and efficient capital structure. Its LTM P/E of 14.4x is attractive for a sector leader, suggesting the stock is undervalued relative to its earnings power. The company’s diversified revenue streams and scale provide resilience against sector headwinds. Strong free cash flow and a healthy earnings yield further support its value proposition.

Key Catalysts:

- Expansion of healthcare services and insurance offerings

- Aging population driving demand for managed care

- Strategic acquisitions to enhance service portfolio

Risk Factors:

- Regulatory changes in U.S. healthcare policy

- Margin pressures from rising medical costs

- Competitive threats from emerging health tech firms

Stock #2: Merck & Co., Inc. (MRK)

| Metric | Value |

|---|---|

| Market Cap | $204.8B |

| Enterprise Value | $231.6B |

| LTM EV/Revenue | 3.6x |

| LTM EV/EBIT | 10.3x |

| LTM P/E | 12.5x |

| LTM P/FCF | 13.9x |

| Earnings Yield | 8.0% |

Investment Thesis:

Merck is a global pharmaceutical leader with a focus on oncology, vaccines, and animal health. Its LTM P/E of 12.5x is well below the industry average, highlighting its undervaluation. The company’s strong earnings yield and consistent free cash flow generation underpin its financial strength. Merck’s innovative drug pipeline and established brands position it for continued growth.

Key Catalysts:

- Blockbuster drugs and expanding oncology portfolio

- New product launches and regulatory approvals

- Global expansion in emerging markets

Risk Factors:

- Patent expirations and generic competition

- Regulatory hurdles for new drugs

- R&D pipeline execution risks

Stock #3: Verizon Communications Inc. (VZ)

| Metric | Value |

|---|---|

| Market Cap | $183.7B |

| Enterprise Value | $350.1B |

| LTM EV/Revenue | 2.6x |

| LTM EV/EBIT | 11.9x |

| LTM P/E | 8.6x |

| LTM P/FCF | 5.7x |

| Earnings Yield | 11.6% |

Investment Thesis:

Verizon stands out in the telecom sector with a notably low LTM P/E of 8.6x and a high earnings yield of 11.6%. Its strong free cash flow supports dividend sustainability and network investments. As 5G adoption accelerates, Verizon’s infrastructure and scale offer a competitive edge, making it a compelling value play in communications.

Key Catalysts:

- Nationwide 5G rollout and monetization

- Stable recurring revenue from wireless subscriptions

- Cost efficiencies from digital transformation

Risk Factors:

- Intense competition from AT&T and T-Mobile

- Capital-intensive network upgrades

- Regulatory and spectrum allocation risks

Stock #4: Unilever PLC (UL)

| Metric | Value |

|---|---|

| Market Cap | $152.7B |

| Enterprise Value | $182.2B |

| LTM EV/Revenue | 1.3x |

| LTM EV/EBIT | 8.0x |

| LTM P/E | 10.6x |

| LTM P/FCF | 8.2x |

| Earnings Yield | 9.4% |

Investment Thesis:

Unilever is a global consumer staples powerhouse, offering defensive qualities and steady cash flows. Its LTM P/E of 10.6x is attractive for a company with a diversified product portfolio and global reach. Unilever’s focus on emerging markets and sustainable brands positions it for long-term growth.

Key Catalysts:

- Expansion in high-growth emerging markets

- Portfolio optimization and premiumization

- Sustainability initiatives driving brand loyalty

Risk Factors:

- Currency volatility impacting international earnings

- Shifting consumer preferences

- Input cost inflation

Stock #5: Pfizer Inc. (PFE)

| Metric | Value |

|---|---|

| Market Cap | $136.6B |

| Enterprise Value | $185.2B |

| LTM EV/Revenue | 2.9x |

| LTM EV/EBIT | 10.6x |

| LTM P/E | 12.7x |

| LTM P/FCF | 12.8x |

| Earnings Yield | 7.9% |

Investment Thesis:

Pfizer is a leading pharmaceutical company with a strong balance sheet and global presence. Its LTM P/E of 12.7x reflects an attractive entry point, especially given its robust earnings yield and free cash flow. Pfizer’s diverse portfolio and R&D capabilities support its long-term outlook.

Key Catalysts:

- Continued innovation in vaccines and therapeutics

- Strategic partnerships and acquisitions

- Expansion into emerging healthcare markets

Risk Factors:

- Patent cliffs and biosimilar competition

- Regulatory and pricing pressures

- Dependence on blockbuster drugs

Stock #6: Anheuser-Busch InBev SA/NV (BUD)

| Metric | Value |

|---|---|

| Market Cap | $118.4B |

| Enterprise Value | $186.7B |

| LTM EV/Revenue | 2.5x |

| LTM EV/EBIT | 9.8x |

| LTM P/E | 12.9x |

| LTM P/FCF | 10.2x |

| Earnings Yield | 7.8% |

Investment Thesis:

Anheuser-Busch InBev is a global beverage leader with a diversified brand portfolio. Its LTM P/E of 12.9x and solid earnings yield highlight its value. The company’s scale and distribution network provide a competitive moat, while ongoing cost optimization supports margins.

Key Catalysts:

- Premiumization and innovation in beverage offerings

- Expansion in emerging markets

- Operational efficiency initiatives

Risk Factors:

- Shifting consumer preferences toward non-alcoholic beverages

- Currency and commodity price volatility

- Regulatory risks in key markets

Stock #7: ConocoPhillips (COP)

| Metric | Value |

|---|---|

| Market Cap | $115.6B |

| Enterprise Value | $133.8B |

| LTM EV/Revenue | 2.3x |

| LTM EV/EBIT | 7.6x |

| LTM P/E | 12.6x |

| LTM P/FCF | 11.2x |

| Earnings Yield | 7.9% |

Investment Thesis:

ConocoPhillips is a major integrated energy company with a focus on efficient capital allocation. Its LTM P/E of 12.6x and strong earnings yield make it a compelling value in the energy sector. The company’s disciplined approach to exploration and production supports long-term cash flow growth.

Key Catalysts:

- Rising global energy demand

- Strategic asset acquisitions and divestitures

- Technological advancements in exploration

Risk Factors:

- Commodity price volatility

- Regulatory and environmental risks

- Capital-intensive operations

Stock #8: Altria Group, Inc. (MO)

| Metric | Value |

|---|---|

| Market Cap | $109.3B |

| Enterprise Value | $132.7B |

| LTM EV/Revenue | 6.3x |

| LTM EV/EBIT | 14.3x |

| LTM P/E | 12.4x |

| LTM P/FCF | 10.2x |

| Earnings Yield | 8.0% |

Investment Thesis:

Altria Group is a leading tobacco company with a history of strong cash flows and shareholder returns. Its LTM P/E of 12.4x and high earnings yield suggest undervaluation. The company’s focus on reduced-risk products and dividend stability are key strengths.

Key Catalysts:

- Growth in non-combustible tobacco products

- Cost management and margin expansion

- Consistent dividend policy

Risk Factors:

- Regulatory pressures on tobacco products

- Declining cigarette volumes

- Litigation risks

Stock #9: Sarcos Technology and Robotics Corporation (STRC)

| Metric | Value |

|---|---|

| Market Cap | $91.7B |

| Enterprise Value | $99.8B |

| LTM EV/Revenue | 847.3x |

| LTM EV/EBIT | 7.1x |

| LTM P/E | 9.2x |

| LTM P/FCF | (13.4x) |

| Earnings Yield | 10.9% |

Investment Thesis:

Sarcos Technology and Robotics is an emerging player in robotics and automation. Its LTM P/E of 9.2x and high earnings yield highlight its value potential. The company’s focus on industrial automation and innovation positions it for growth as demand for robotics accelerates.

Key Catalysts:

- Adoption of robotics in manufacturing and logistics

- Strategic partnerships and technology advancements

- Expansion into new industrial markets

Risk Factors:

- High capital requirements for R&D

- Competitive landscape in robotics

- Profitability challenges as a growth-stage company

Stock #10: Newmont Corporation (NEM)

| Metric | Value |

|---|---|

| Market Cap | $90.7B |

| Enterprise Value | $85.0B |

| LTM EV/Revenue | 5.5x |

| LTM EV/EBIT | 11.0x |

| LTM P/E | 10.8x |

| LTM P/FCF | 13.3x |

| Earnings Yield | 9.3% |

Investment Thesis:

Newmont is a leading gold mining company with global operations. Its LTM P/E of 10.8x and strong earnings yield make it attractive for investors seeking commodity exposure. Newmont’s scale, operational efficiency, and focus on sustainable mining practices support its long-term outlook.

Key Catalysts:

- Rising gold prices amid macro uncertainty

- Operational improvements and cost control

- Expansion of mining assets

Risk Factors:

- Commodity price fluctuations

- Environmental and regulatory risks

- Geopolitical exposure in mining regions

Stock #11: Elevance Health Inc. (ELV)

| Metric | Value |

|---|---|

| Market Cap | $70.8B |

| Enterprise Value | $64.3B |

| LTM EV/Revenue | 0.3x |

| LTM EV/EBIT | 0.6x |

| LTM P/E | 12.0x |

| LTM P/FCF | 17.7x |

| Earnings Yield | 8.3% |

Investment Thesis:

Elevance Health is a major health insurance provider with a strong market position. Its LTM P/E of 12.0x and solid earnings yield indicate value. The company’s focus on managed care and digital health solutions supports its growth trajectory.

Key Catalysts:

- Expansion of managed care offerings

- Digital transformation in healthcare delivery

- Strategic acquisitions

Risk Factors:

- Regulatory changes in health insurance

- Margin pressures from medical cost trends

- Competition from national and regional insurers

Portfolio Diversification Insights

This watchlist spans healthcare, technology, consumer staples, energy, and industrials, offering broad sector exposure. Healthcare and consumer staples provide defensive stability, while technology and energy add growth and cyclical upside. The inclusion of both U.S. and international companies further enhances diversification, reducing single-sector and geographic risk.

Market Timing & Entry Strategies

Investors may consider staggered entry or dollar-cost averaging to manage volatility. Monitoring sector rotation and macroeconomic trends can help identify optimal entry points. For value stocks, patience is key—allowing time for the market to recognize intrinsic value.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 12 Best Dividend Growth Stocks to Buy Now

📖 12 Best Stock Picks with High ROIC for 2025

📖 10 Best Stock Picks for 2025: High Quality, Low Price/FCF Stocks

📖 9 Best AgriTech Stock Picks for 2025

📖 10 Best Undervalued Stocks for 2025

FAQ for Low P/E quality stocks

Q1: How were these stocks selected?

A: Stocks were chosen based on low P/E ratios, strong earnings yield, and sector diversification, using ValueSense’s valuation tools and screening criteria.

Q2: What's the best stock from this list?

A: Each stock offers unique value; selection depends on sector preference and risk tolerance. Review individual analyses for details.

Q3: Should I buy all these stocks or diversify?

A: Diversification across sectors can reduce risk. Consider portfolio goals and sector allocation when constructing your watchlist.

Q4: What are the biggest risks with these picks?

A: Key risks include sector-specific headwinds, regulatory changes, and market volatility. Review risk factors for each stock above.

Q5: When is the best time to invest in these stocks?

A: Timing depends on market conditions and individual stock catalysts. Consider dollar-cost averaging and monitor for value signals.

Summary & Investment Outlook

This ValueSense watchlist highlights 10 best low P/E stock picks for 2025, offering a blend of value, stability, and growth potential. Each stock is analyzed for its unique strengths and risks, supporting informed, educational investment decisions. For more in-depth analysis and real-time updates, visit ValueSense.