10 Best Nuclear Energy Stock Picks for 2026

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

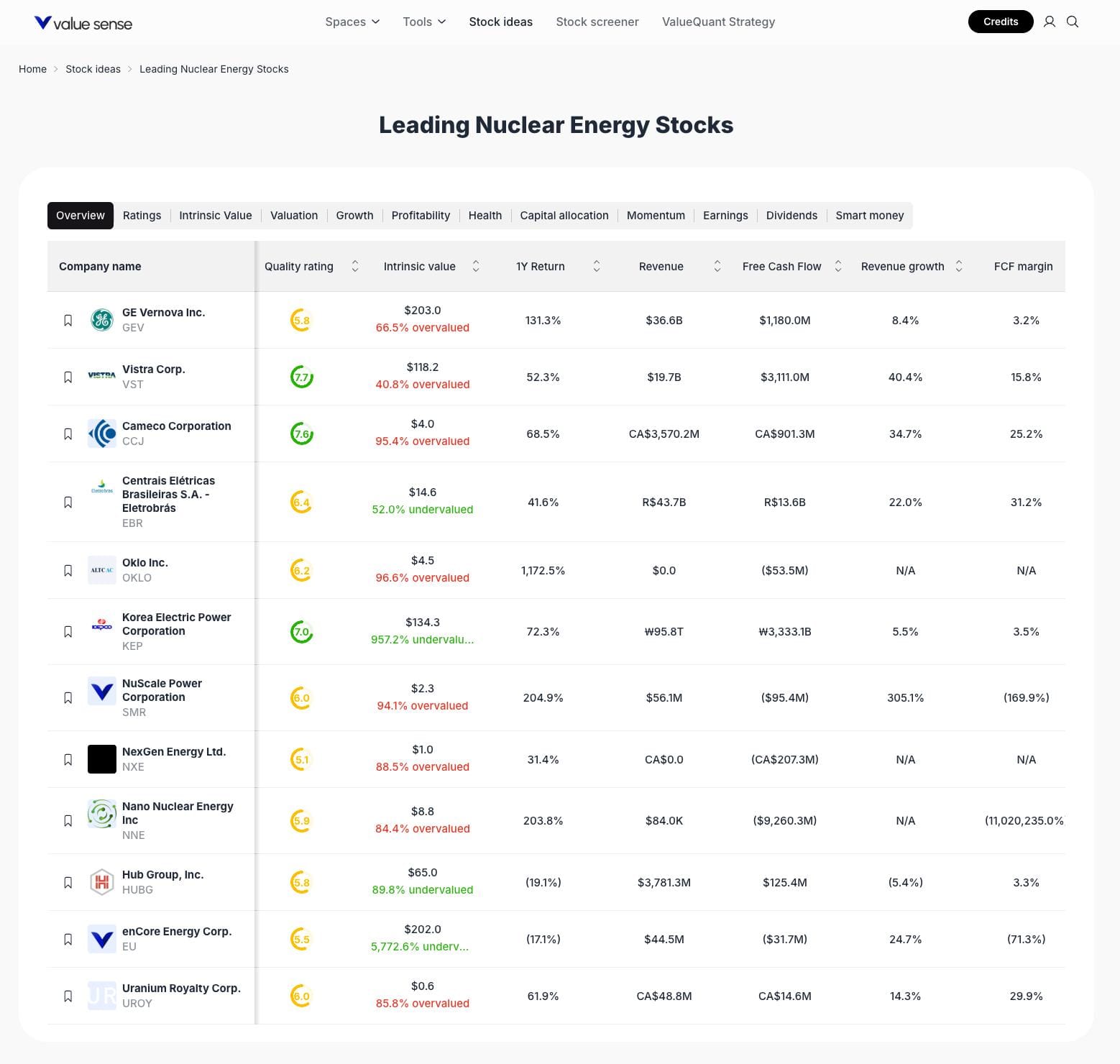

The nuclear energy sector is experiencing renewed interest as clean energy demand rises and governments invest in next-generation power infrastructure. Our selection methodology focuses on stocks with strong quality ratings, attractive intrinsic value, robust cash flow, and clear growth catalysts. We analyze a blend of established leaders and innovative disruptors, using ValueSense’s proprietary ratings and financial metrics to identify the most compelling opportunities for 2026.

Featured Stock Analysis

Stock #1: GE Vernova Inc. (GEV)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | $203.0 |

| Intrinsic Value | 66.5% overvalued |

| 1Y Return | 131.3% |

| Revenue | $36.6B |

| Free Cash Flow | $1,180.0M |

| Revenue Growth | 8.4% |

| FCF Margin | 3.2% |

| ValueSense Rating | 6/10 |

Investment Thesis

GE Vernova Inc. stands out as a major player in the nuclear energy sector, leveraging its scale and diversified energy portfolio. The company’s robust revenue base and positive free cash flow signal operational strength, while its impressive 131.3% one-year return highlights strong market momentum. Despite being 66.5% overvalued relative to intrinsic value, GE Vernova’s established position and consistent growth make it a core holding for exposure to nuclear infrastructure.

Key Catalysts

- Expansion in global nuclear and renewable energy projects

- Strong cash flow supporting reinvestment and innovation

- Ongoing infrastructure upgrades and government contracts

Risk Factors

- Valuation risk due to significant overvaluation

- Moderate FCF margin may limit flexibility in downturns

- Regulatory and policy uncertainties in energy markets

Stock #2: Vistra Corp. (VST)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | $118.2 |

| Intrinsic Value | 40.8% overvalued |

| 1Y Return | 52.3% |

| Revenue | $19.7B |

| Free Cash Flow | $3,111.0M |

| Revenue Growth | 40.4% |

| FCF Margin | 15.8% |

| ValueSense Rating | 7/10 |

Investment Thesis

Vistra Corp. offers a compelling mix of growth and profitability, with a 52.3% annual return and a substantial free cash flow margin of 15.8%. The company’s 40.4% revenue growth underscores its ability to capitalize on rising energy demand. While currently 40.8% overvalued, Vistra’s operational efficiency and strong cash generation position it well for continued expansion in both nuclear and broader energy markets.

Key Catalysts

- Accelerated adoption of clean energy solutions

- High free cash flow enabling strategic investments

- Strong revenue growth trajectory

Risk Factors

- Overvaluation may limit near-term upside

- Exposure to commodity price volatility

- Competitive pressures in deregulated markets

Stock #3: Cameco Corporation (CCJ)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | $40.0 |

| Intrinsic Value | — |

| 1Y Return | 68.5% |

| Revenue | CA$3,570.2M |

| Free Cash Flow | CA$901.3M |

| Revenue Growth | 34.7% |

| FCF Margin | 25.2% |

| ValueSense Rating | 7/10 |

Investment Thesis

Cameco Corporation is a leading uranium producer, benefiting from rising global demand for nuclear fuel. Its 68.5% one-year return and 25.2% FCF margin reflect strong operational leverage. With 34.7% revenue growth and a solid cash position, Cameco is well-placed to capture upside from the nuclear renaissance, especially as governments seek secure, low-carbon energy sources.

Key Catalysts

- Global uranium supply constraints driving prices higher

- Long-term contracts with utilities

- Expansion of nuclear capacity worldwide

Risk Factors

- Commodity price swings impacting profitability

- Regulatory and geopolitical risks in uranium markets

- Currency exposure (Canadian dollar)

Stock #4: Centrais Eletricas Brasileiras S.A. - Eletrobras (EBR)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | $14.6 |

| Intrinsic Value | 2.0% undervalued |

| 1Y Return | 41.6% |

| Revenue | R$43.7B |

| Free Cash Flow | R$13.6B |

| Revenue Growth | 22.0% |

| FCF Margin | 31.2% |

| ValueSense Rating | 6/10 |

Investment Thesis

Eletrobras is the largest utility in Brazil, offering stable cash flows and a rare undervaluation (2.0% below intrinsic value). Its 31.2% FCF margin and 22% revenue growth highlight operational efficiency. Eletrobras provides geographic diversification and exposure to emerging market energy demand, making it a valuable addition to a global nuclear portfolio.

Key Catalysts

- Privatization and restructuring initiatives

- Expansion of nuclear and hydroelectric assets

- Strong free cash flow supporting dividends

Risk Factors

- Political and regulatory risks in Brazil

- Currency fluctuations (Brazilian real)

- Execution risk on modernization projects

Stock #5: Oklo Inc. (OKLO)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | $4.5 |

| Intrinsic Value | 96.6% overvalued |

| 1Y Return | 1,172.5% |

| Revenue | $0.0 |

| Free Cash Flow | ($53.5M) |

| Revenue Growth | N/A |

| FCF Margin | N/A |

| ValueSense Rating | 6/10 |

Investment Thesis

Oklo Inc. is a high-growth, early-stage nuclear technology company focused on microreactors. Its extraordinary 1,172.5% one-year return reflects speculative enthusiasm for next-generation nuclear solutions. Despite no current revenue and negative free cash flow, Oklo’s innovative approach and potential for disruptive growth make it a speculative play on the future of clean energy.

Key Catalysts

- Development and deployment of microreactor technology

- Strategic partnerships and government support

- First-mover advantage in advanced nuclear solutions

Risk Factors

- No current revenue; high cash burn

- Execution and commercialization risks

- High valuation and volatility

Stock #6: Korea Electric Power Corporation (KEP)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | $13.4 |

| Intrinsic Value | 957.2% undervalued |

| 1Y Return | 72.3% |

| Revenue | ₩95.8T |

| Free Cash Flow | ₩3,333.1B |

| Revenue Growth | 5.5% |

| FCF Margin | 3.5% |

| ValueSense Rating | 7/10 |

Investment Thesis

Korea Electric Power Corporation is a global utility leader, trading at a deep discount to intrinsic value (957.2% undervalued). Its 72.3% one-year return and positive free cash flow highlight a turnaround story. KEP’s scale and government backing position it as a stable, value-oriented play in the nuclear sector.

Key Catalysts

- Government support for nuclear expansion

- Improving profitability and cash flow

- International project wins

Risk Factors

- Currency and geopolitical risks

- Modest revenue growth

- Regulatory changes in Korea

Stock #7: NuScale Power Corporation (SMR)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | $5.23 |

| Intrinsic Value | 94.1% overvalued |

| 1Y Return | 204.9% |

| Revenue | $56.1M |

| Free Cash Flow | ($95.4M) |

| Revenue Growth | 305.1% |

| FCF Margin | (169.9%) |

| ValueSense Rating | 6/10 |

Investment Thesis

NuScale Power is a pioneer in small modular reactor (SMR) technology, with a 204.9% one-year return and triple-digit revenue growth. Despite negative free cash flow and high overvaluation, NuScale’s innovative SMR solutions are gaining traction globally, positioning it as a leader in the next wave of nuclear deployment.

Key Catalysts

- Commercialization of SMR technology

- Strategic partnerships and licensing deals

- Regulatory approvals and project milestones

Risk Factors

- High cash burn and negative margins

- Execution risk on large-scale projects

- Competitive landscape in SMRs

Stock #8: NexGen Energy Ltd. (NXE)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | $1.0 |

| Intrinsic Value | 88.5% overvalued |

| 1Y Return | 31.4% |

| Revenue | CA$0.0 |

| Free Cash Flow | (CA$207.3M) |

| Revenue Growth | N/A |

| FCF Margin | N/A |

| ValueSense Rating | 6/10 |

Investment Thesis

NexGen Energy is an emerging uranium developer with significant resource potential. While currently pre-revenue and operating at a loss, its 31.4% one-year return reflects optimism about future production. NexGen offers high leverage to uranium price upside but carries substantial execution risk.

Key Catalysts

- Progress on flagship uranium projects

- Rising uranium prices

- Strategic partnerships and financing

Risk Factors

- No current revenue; high development costs

- Permitting and construction risks

- Market volatility

Stock #9: Nano Nuclear Energy Inc. (NNE)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | $58.8 |

| Intrinsic Value | 84.4% overvalued |

| 1Y Return | 203.8% |

| Revenue | $84.0K |

| Free Cash Flow | ($9,260.3M) |

| Revenue Growth | N/A |

| FCF Margin | (11,020,235.0%) |

| ValueSense Rating | 5/10 |

Investment Thesis

Nano Nuclear Energy is a cutting-edge microreactor developer, posting a 203.8% one-year return. Despite minimal revenue and deeply negative free cash flow, the company is at the forefront of next-generation nuclear technology. Nano Nuclear is a speculative bet on disruptive innovation in portable and stationary microreactors.

Key Catalysts

- Advancement of microreactor prototypes

- Strategic industry partnerships

- Regulatory progress and pilot deployments

Risk Factors

- High cash burn and limited revenue

- Commercialization and scaling challenges

- High valuation and volatility

Stock #10: Hub Group, Inc. (HUBG)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | $65.0 |

| Intrinsic Value | 88.9% undervalued |

| 1Y Return | (19.1%) |

| Revenue | $3,781.3M |

| Free Cash Flow | $125.4M |

| Revenue Growth | (5.4%) |

| FCF Margin | 3.3% |

| ValueSense Rating | 6/10 |

Investment Thesis

Hub Group is a logistics and supply chain company with exposure to nuclear fuel transportation. Trading at an 88.9% discount to intrinsic value, it offers value upside despite a recent decline in revenue and returns. Hub Group’s stable cash flow and strategic positioning in energy logistics make it a defensive play within the nuclear value chain.

Key Catalysts

- Expansion in nuclear fuel logistics

- Operational efficiencies and cost controls

- Industry partnerships

Risk Factors

- Revenue contraction and negative returns

- Competitive logistics sector

- Sensitivity to energy sector cycles

Portfolio Diversification Insights

This collection spans the nuclear value chain, from uranium mining (Cameco, NexGen) and power generation (GE Vernova, Vistra, Eletrobras, Korea Electric Power) to advanced technology (Oklo, NuScale, Nano Nuclear) and logistics (Hub Group). The portfolio balances established cash-generating utilities with high-growth innovators, offering exposure to both developed and emerging markets. Sector allocation is diversified across utilities, technology, and infrastructure, reducing single-stock and regional risk.

Market Timing & Entry Strategies

Given the sector’s volatility and varying valuation levels, staggered entry or dollar-cost averaging can help manage risk. Investors may consider entering undervalued names (Eletrobras, Korea Electric Power, Hub Group) immediately, while monitoring overvalued or speculative stocks for pullbacks. Tracking sector news, regulatory developments, and earnings reports can further refine entry points.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best GARP Stock Picks for 2025

📖 Best Dividend Growth Stocks: 13 Quality Companies

📖 11 Best Undervalued Large Cap Moat Stocks for 2025

📖 12 Best Momentum Stock Picks for November 2025

📖 11 Best High Quality Stock Picks for November 2025

FAQ about Nuclear Energy Stocks

Q1: How were these stocks selected?

A1: Stocks were chosen based on ValueSense’s quality ratings, intrinsic value analysis, financial strength, and sector relevance, focusing on companies with strong growth or value characteristics.

Q2: What's the best stock from this list?

A2: The “best” stock depends on individual goals; Korea Electric Power and Hub Group stand out for value, while Oklo and NuScale offer high-growth potential.

Q3: Should I buy all these stocks or diversify?

A3: Diversification across multiple stocks and sectors can help manage risk and capture different growth drivers within the nuclear energy theme.

Q4: What are the biggest risks with these picks?

A4: Key risks include overvaluation, regulatory changes, execution challenges for early-stage companies, and commodity price volatility.

Q5: When is the best time to invest in these stocks?

A5: Timing depends on valuation, sector momentum, and individual risk tolerance; consider phased entry and monitor for market catalysts.

Summary & Investment Outlook

The nuclear energy sector is poised for significant transformation, driven by clean energy demand and technological innovation. This watchlist offers a blend of value and growth opportunities, spanning the entire nuclear ecosystem. For further analysis and real-time updates, visit ValueSense for comprehensive research and tools.