10 Best Price Dislocation Value Stocks: Stock Watchlist & Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

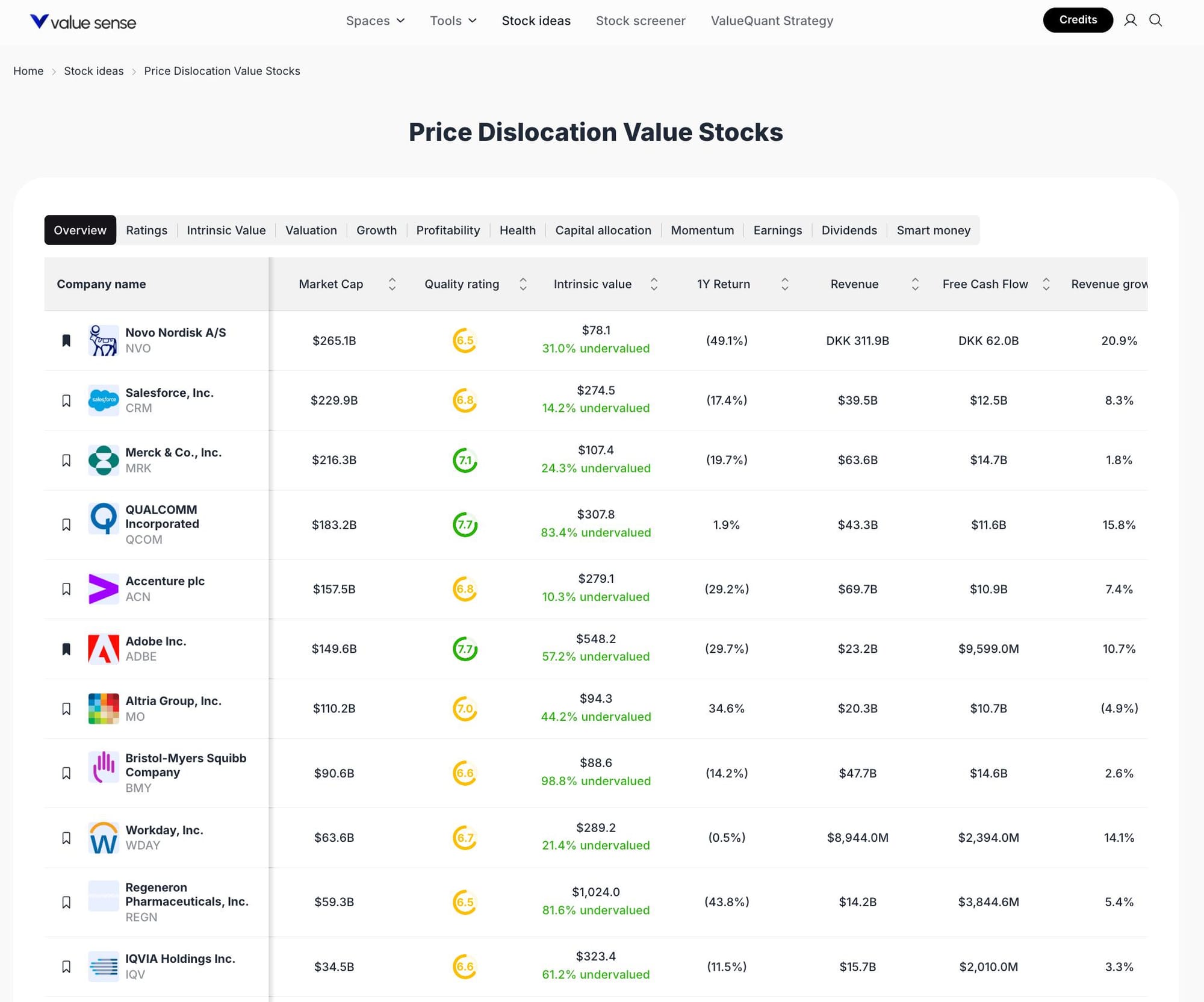

The 2025 equity landscape is marked by persistent valuation dislocations between value and growth stocks, creating unique opportunities for disciplined investors. ValueSense’s methodology prioritizes stocks with significant intrinsic value discounts, robust quality ratings, and positive free cash flow trends. Our selection process integrates sector diversification, focusing on companies with strong fundamentals, proven revenue growth, and clear undervaluation signals based on proprietary ValueSense models.

Featured Stock Analysis

Stock #1: Novo Nordisk A/S (NVO)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $265.1B |

| Quality Rating | 6.5 |

| Intrinsic Value | $78.1 (31.0% undervalued) |

| 1Y Return | (49.1%) |

| Revenue | DKK 311.9B |

| Free Cash Flow | DKK 62.0B |

| Revenue Growth | 20.9% |

Investment Thesis:

Novo Nordisk A/S stands out as a global leader in healthcare, particularly in diabetes and obesity care. Despite a challenging year with a (49.1%) return, the company’s fundamentals remain robust, as evidenced by a 20.9% revenue growth rate and substantial free cash flow. ValueSense’s intrinsic value model indicates the stock is 31.0% undervalued, suggesting a significant margin of safety for long-term investors. The company’s scale and innovation pipeline position it well for future growth, even as market sentiment has recently turned negative.

Key Catalysts:

- Continued leadership in diabetes and obesity therapeutics

- Expansion into new markets and product lines

- Strong free cash flow supporting R&D and shareholder returns

Risk Factors:

- Regulatory pressures in global healthcare markets

- Currency fluctuations impacting DKK-denominated results

- Competitive threats from emerging biotech firms

Stock #2: Salesforce, Inc. (CRM)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $229.9B |

| Quality Rating | 6.8 |

| Intrinsic Value | $274.5 (14.2% undervalued) |

| 1Y Return | (17.4%) |

| Revenue | $39.5B |

| Free Cash Flow | $12.5B |

| Revenue Growth | 8.3% |

Investment Thesis:

Salesforce remains a dominant force in cloud-based enterprise software, with a broad suite of CRM and business automation solutions. The stock is currently trading at a 14.2% discount to its intrinsic value, according to ValueSense. Despite a negative 1-year return, Salesforce’s recurring revenue model and strong free cash flow generation underpin its resilience. The company’s ongoing investments in AI and platform integration are expected to drive future growth.

Key Catalysts:

- Expansion of AI-driven CRM solutions

- Increased enterprise digital transformation spending

- Strategic acquisitions enhancing product ecosystem

Risk Factors:

- Slower enterprise IT spending in a cautious macro environment

- Integration risks from recent acquisitions

- Intensifying competition from other cloud providers

Stock #3: Merck & Co., Inc. (MRK)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $216.3B |

| Quality Rating | 7.7 |

| Intrinsic Value | $107.4 (24.3% undervalued) |

| 1Y Return | (19.7%) |

| Revenue | $63.6B |

| Free Cash Flow | $14.7B |

| Revenue Growth | 1.8% |

Investment Thesis:

Merck & Co. is a pharmaceutical giant with a diversified product portfolio and a strong pipeline. The stock is 24.3% undervalued, offering a compelling entry point for value-focused investors. While the 1-year return is negative, Merck’s consistent free cash flow and high-quality rating (7.7) reflect operational strength. The company’s focus on oncology and vaccines continues to drive long-term growth prospects.

Key Catalysts:

- Expansion of blockbuster oncology drugs

- New vaccine approvals and launches

- Strategic R&D partnerships

Risk Factors:

- Patent expirations impacting revenue streams

- Regulatory and pricing pressures in pharmaceuticals

- Modest revenue growth rate

Stock #4: QUALCOMM Incorporated (QCOM)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $183.2B |

| Quality Rating | 7.7 |

| Intrinsic Value | $307.8 (83.4% undervalued) |

| 1Y Return | 1.9% |

| Revenue | $43.3B |

| Free Cash Flow | $11.6B |

| Revenue Growth | 15.8% |

Investment Thesis:

QUALCOMM is a leading innovator in wireless technology and semiconductors, with a strong presence in 5G and IoT markets. The stock is trading at a remarkable 83.4% discount to intrinsic value, according to ValueSense, making it one of the most undervalued large-cap tech names. With a positive 1-year return and double-digit revenue growth, QUALCOMM’s fundamentals remain robust. The company’s licensing business and chip leadership provide a solid foundation for future expansion.

Key Catalysts:

- Global 5G adoption and device upgrades

- Growth in automotive and IoT segments

- Strong patent portfolio supporting royalty streams

Risk Factors:

- Cyclical demand in consumer electronics

- Regulatory scrutiny on licensing practices

- Geopolitical risks in global supply chains

Stock #5: Accenture plc (ACN)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $157.5B |

| Quality Rating | 6.8 |

| Intrinsic Value | $279.1 (10.3% undervalued) |

| 1Y Return | (29.2%) |

| Revenue | $69.7B |

| Free Cash Flow | $10.9B |

| Revenue Growth | 7.4% |

Investment Thesis:

Accenture is a global consulting and professional services powerhouse, specializing in digital transformation and technology integration. The stock is 10.3% undervalued, per ValueSense, and offers exposure to secular trends in IT services. Despite a challenging year, Accenture’s diversified client base and strong free cash flow generation support its long-term outlook.

Key Catalysts:

- Rising demand for digital transformation services

- Expansion into cloud and cybersecurity offerings

- Strategic acquisitions broadening service capabilities

Risk Factors:

- Macroeconomic headwinds impacting client budgets

- Talent retention and wage inflation

- Currency volatility affecting global operations

Stock #6: Adobe Inc. (ADBE)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $149.6B |

| Quality Rating | 7.0 |

| Intrinsic Value | $548.2 (57.2% undervalued) |

| 1Y Return | (29.7%) |

| Revenue | $23.2B |

| Free Cash Flow | $9,599.0M |

| Revenue Growth | 10.7% |

Investment Thesis:

Adobe is a leader in creative software and digital media solutions, with a resilient subscription-based business model. The stock is trading at a 57.2% discount to intrinsic value, per ValueSense, making it an attractive candidate for value investors. Despite a negative 1-year return, Adobe’s double-digit revenue growth and strong free cash flow highlight its operational strength and innovation capacity.

Key Catalysts:

- Expansion of cloud-based creative solutions

- Growth in digital marketing and analytics platforms

- New product launches and AI integration

Risk Factors:

- Competitive pressures in creative software

- Slower enterprise IT spending

- Regulatory scrutiny on subscription pricing

Stock #7: Altria Group, Inc. (MO)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $110.2B |

| Quality Rating | 7.0 |

| Intrinsic Value | $94.3 (44.2% undervalued) |

| 1Y Return | 34.6% |

| Revenue | $20.3B |

| Free Cash Flow | $10.7B |

| Revenue Growth | (4.9%) |

Investment Thesis:

Altria Group is a leading tobacco company with a strong dividend track record and significant free cash flow. The stock is 44.2% undervalued, according to ValueSense, and has delivered a robust 34.6% 1-year return. While revenue growth is negative, Altria’s stable cash flows and shareholder-friendly policies make it a defensive play in uncertain markets.

Key Catalysts:

- Resilient demand for core tobacco products

- Expansion into reduced-risk and alternative nicotine products

- Strong dividend yield supporting total returns

Risk Factors:

- Regulatory and litigation risks in tobacco industry

- Declining cigarette volumes

- Shifts in consumer preferences

Stock #8: Bristol-Myers Squibb Company (BMY)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $90.6B |

| Quality Rating | 6.6 |

| Intrinsic Value | $88.6 (98.8% undervalued) |

| 1Y Return | (14.2%) |

| Revenue | $47.7B |

| Free Cash Flow | $14.6B |

| Revenue Growth | 2.6% |

Investment Thesis:

Bristol-Myers Squibb is a global biopharmaceutical leader with a diversified portfolio and strong cash generation. The stock is trading at a remarkable 98.8% discount to intrinsic value, per ValueSense, making it one of the most undervalued in the sector. Despite a negative 1-year return, the company’s stable revenue and free cash flow support ongoing R&D and shareholder returns.

Key Catalysts:

- New drug launches and approvals

- Expansion in oncology and immunology

- Strategic partnerships and acquisitions

Risk Factors:

- Patent cliffs and generic competition

- Regulatory and pricing pressures

- Modest revenue growth

Stock #9: Workday, Inc. (WDAY)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $63.6B |

| Quality Rating | 6.7 |

| Intrinsic Value | $289.2 (21.4% undervalued) |

| 1Y Return | (0.5%) |

| Revenue | $8,944.0M |

| Free Cash Flow | $2,394.0M |

| Revenue Growth | 14.1% |

Investment Thesis:

Workday is a leading provider of cloud-based enterprise software for HR and finance. The stock is 21.4% undervalued, according to ValueSense, and boasts a high revenue growth rate of 14.1%. Despite a flat 1-year return, Workday’s recurring revenue model and expanding customer base position it well for future growth.

Key Catalysts:

- Growing adoption of cloud HR and finance solutions

- Expansion into new enterprise verticals

- Product innovation and ecosystem growth

Risk Factors:

- Competitive pressures from larger software vendors

- Slower enterprise IT spending

- Execution risks in scaling operations

Stock #10: Regeneron Pharmaceuticals, Inc. (REGN)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $59.3B |

| Quality Rating | 6.5 |

| Intrinsic Value | $1,024.0 (81.6% undervalued) |

| 1Y Return | (43.8%) |

| Revenue | $14.2B |

| Free Cash Flow | $3,844.6M |

| Revenue Growth | 5.4% |

Investment Thesis:

Regeneron is a biotechnology leader with a strong pipeline and innovative therapies. The stock is trading at an 81.6% discount to intrinsic value, per ValueSense, making it highly attractive for value-oriented investors. Despite a steep negative 1-year return, Regeneron’s healthy free cash flow and ongoing R&D investments support its long-term growth outlook.

Key Catalysts:

- New drug approvals and pipeline progress

- Expansion into new therapeutic areas

- Strategic collaborations and licensing deals

Risk Factors:

- Clinical trial and regulatory risks

- Patent expirations

- Competitive pressures in biotech

Stock #11: IQVIA Holdings Inc. (IQV)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $34.5B |

| Quality Rating | 6.6 |

| Intrinsic Value | $323.4 (61.2% undervalued) |

| 1Y Return | (11.5%) |

| Revenue | $15.7B |

| Free Cash Flow | $2,010.0M |

| Revenue Growth | 3.3% |

Investment Thesis:

IQVIA is a global leader in healthcare data analytics and clinical research services. The stock is 61.2% undervalued, according to ValueSense, and offers exposure to the growing demand for data-driven healthcare solutions. Despite a negative 1-year return, IQVIA’s stable revenue and free cash flow support ongoing innovation and expansion.

Key Catalysts:

- Rising demand for clinical research outsourcing

- Expansion in healthcare analytics and AI

- Strategic partnerships with pharma and biotech firms

Risk Factors:

- Regulatory changes in healthcare data usage

- Competitive pressures from other CROs

- Modest revenue growth

Portfolio Diversification Insights

This watchlist spans healthcare, technology, consulting, and consumer staples, offering a balanced sector allocation. Healthcare and pharmaceuticals are heavily represented, providing defensive characteristics, while technology and software names add growth potential. The inclusion of consumer staples (Altria) and diversified consulting (Accenture) further enhances portfolio resilience against sector-specific risks.

Market Timing & Entry Strategies

Given the current market dislocation, value stocks are trading at significant discounts to intrinsic value. Investors may consider phased entry strategies, such as dollar-cost averaging, to mitigate timing risk. Monitoring sector rotation and macroeconomic signals can help optimize entry points, especially for stocks with recent negative momentum but strong long-term fundamentals.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best Nuclear Energy Stock Picks for 2026

📖 Best Dividend Growth Stocks: 13 Quality Companies

📖 11 Best Undervalued Large Cap Moat Stocks for 2025

📖 12 Best Momentum Stock Picks for November 2025

📖 11 Best High Quality Stock Picks for November 2025

FAQ about Price Dislocation Stocks

Q1: How were these stocks selected?

Stocks were chosen based on ValueSense’s proprietary intrinsic value models, quality ratings, and sector diversification, focusing on companies trading at significant discounts to their estimated fair value.

Q2: What's the best stock from this list?

While several stocks are deeply undervalued, Bristol-Myers Squibb (BMY) and QUALCOMM (QCOM) stand out for their high undervaluation and strong fundamentals. However, the best choice depends on individual investment goals and risk tolerance.

Q3: Should I buy all these stocks or diversify?

Diversification across sectors and industries is recommended to manage risk. This watchlist is designed to provide a balanced mix of growth and defensive stocks for educational purposes.

Q4: What are the biggest risks with these picks?

Risks include sector-specific headwinds, regulatory changes, competitive pressures, and potential for continued market volatility. Each stock’s risk profile is detailed in its analysis above.

Q5: When is the best time to invest in these stocks?

Market timing is challenging; consider phased entry strategies and focus on long-term value. Monitoring valuation spreads and macro trends can help identify attractive entry points.

Summary & Investment Outlook

The 2025 ValueSense stock watchlist highlights opportunities in undervalued companies across healthcare, technology, and consumer sectors. Each stock is selected for its intrinsic value discount, quality fundamentals, and sector relevance. While risks remain, disciplined analysis and diversification can help investors navigate market dislocations and capitalize on long-term value opportunities.