10 Best Stock Picks for 2025: E-commerce Watchlist & Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

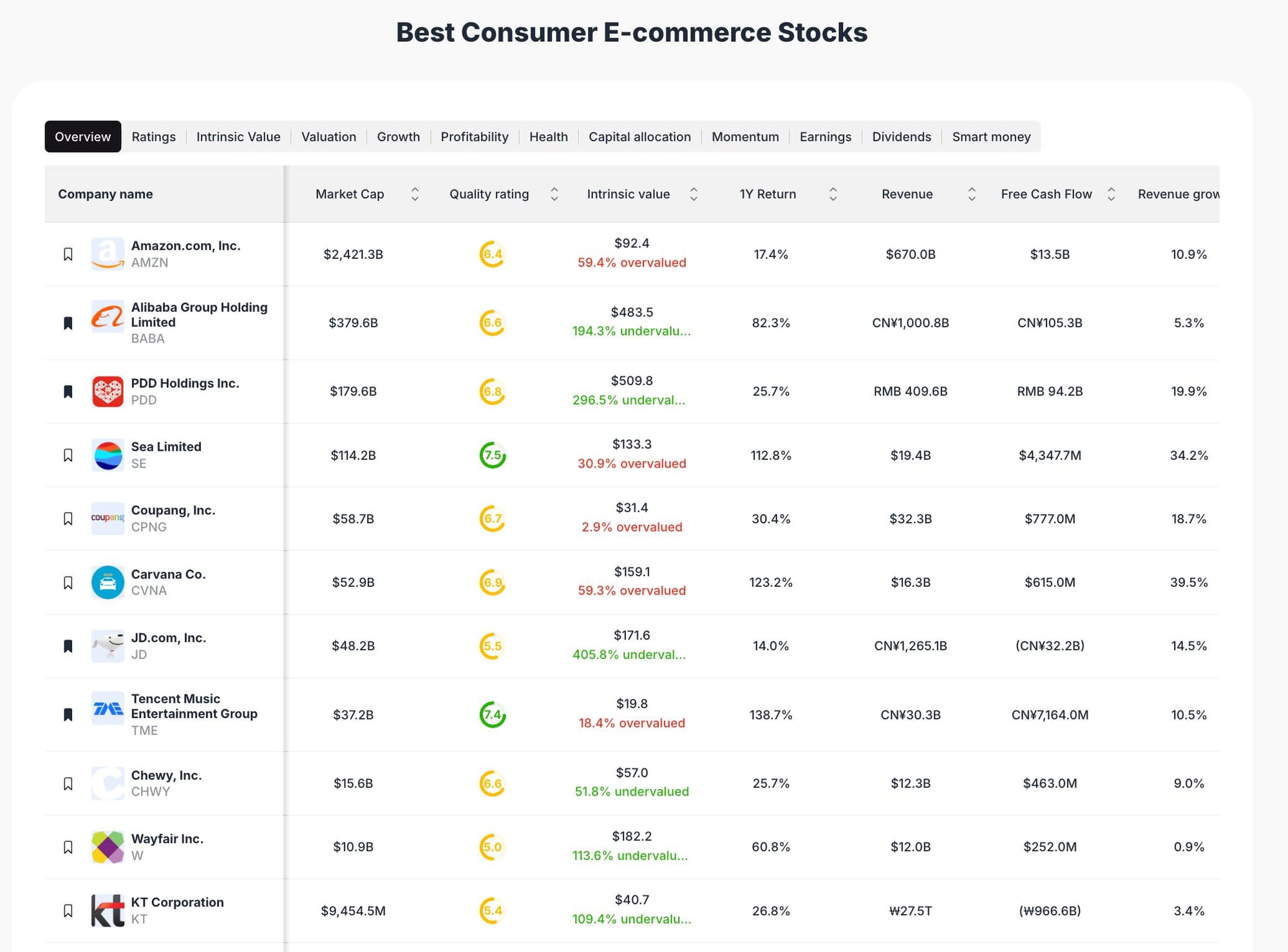

The e-commerce sector continues to outperform global benchmarks, driven by digital transformation, rising consumer adoption, and robust innovation. Our selection methodology leverages ValueSense’s proprietary intrinsic value models, quality ratings, and growth metrics to identify stocks with strong fundamentals, sector leadership, and favorable risk/reward profiles. Each stock is evaluated for market cap, revenue growth, free cash flow, and relative valuation, ensuring a balanced and diversified watchlist.

Featured Stock Analysis

Stock #1: Amazon.com, Inc. (AMZN)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $2,421.3B |

| Quality Rating | 6.4/10 |

| Intrinsic Value | $92.4 (59.4% overvalued) |

| 1Y Return | 17.4% |

| Revenue | $670.0B |

| Free Cash Flow | $13.5B |

| Revenue Growth | 10.9% |

Investment Thesis:

Amazon remains the dominant force in global e-commerce, supported by its vast logistics network, cloud computing leadership, and expanding digital ecosystem. Despite being flagged as 59.4% overvalued relative to ValueSense’s intrinsic value estimate, Amazon’s scale and operational efficiency continue to drive double-digit revenue growth and robust free cash flow. The company’s 17.4% annual return underscores its resilience and adaptability in a competitive landscape.

Key Catalysts:

- Continued expansion of AWS cloud services

- Growth in Prime membership and subscription revenue

- International market penetration and logistics optimization

Risk Factors:

- Valuation risk due to premium pricing

- Regulatory scrutiny in major markets

- Slower growth in core retail segments

Stock #2: Alibaba Group Holding Limited (BABA)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $379.6B |

| Quality Rating | 6.6/10 |

| Intrinsic Value | $483.5 (194.3% undervalued) |

| 1Y Return | 82.3% |

| Revenue | CN¥1,000.8B |

| Free Cash Flow | CN¥105.3B |

| Revenue Growth | 5.3% |

Investment Thesis:

Alibaba stands out as a deeply undervalued e-commerce and cloud giant, trading at a significant discount to its intrinsic value. The company’s 82.3% one-year return reflects renewed investor confidence, driven by stabilization in regulatory policy and a rebound in Chinese consumer demand. Alibaba’s robust free cash flow and diversified business model, spanning e-commerce, cloud, and fintech, position it as a core holding for exposure to Asia’s digital economy.

Key Catalysts:

- Recovery in Chinese consumer spending

- Cloud computing and international expansion

- Strategic investments in logistics and digital finance

Risk Factors:

- Regulatory and geopolitical risks in China

- Slower revenue growth compared to global peers

- Currency and macroeconomic volatility

Stock #3: PDD Holdings Inc. (PDD)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $179.6B |

| Quality Rating | 6.8/10 |

| Intrinsic Value | $509.8 (296.5% undervalued) |

| 1Y Return | 25.7% |

| Revenue | RMB 409.6B |

| Free Cash Flow | RMB 94.2B |

| Revenue Growth | 19.9% |

Investment Thesis:

PDD Holdings, the parent of Pinduoduo, is one of the fastest-growing e-commerce platforms in China, with a focus on value-driven social commerce. The stock is highlighted as significantly undervalued, with a strong balance sheet and nearly 20% revenue growth. PDD’s innovative group-buying model and rural market penetration continue to drive user acquisition and engagement.

Key Catalysts:

- Expansion into international markets (e.g., Temu)

- Growth in agricultural and rural e-commerce

- Technology-driven cost efficiencies

Risk Factors:

- Competitive pressures from Alibaba and JD.com

- Regulatory uncertainties in China

- Margin compression from aggressive expansion

Stock #4: Sea Limited (SE)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $114.2B |

| Quality Rating | 7.5/10 |

| Intrinsic Value | $133.3 (30.9% overvalued) |

| 1Y Return | 112.8% |

| Revenue | $19.4B |

| Free Cash Flow | $4,347.7M |

| Revenue Growth | 34.2% |

Investment Thesis:

Sea Limited is a leading Southeast Asian e-commerce and digital entertainment company, boasting the highest quality rating in this collection. Despite being 30.9% overvalued, its 112.8% annual return and 34.2% revenue growth highlight exceptional operational momentum. Sea’s Shopee platform dominates regional e-commerce, while Garena drives digital entertainment revenue.

Key Catalysts:

- Expansion of Shopee in new markets

- Growth in digital payments and fintech

- Monetization of gaming and entertainment assets

Risk Factors:

- High valuation relative to intrinsic value

- Competitive threats from regional and global players

- Regulatory risks in emerging markets

Stock #5: Coupang, Inc. (CPNG)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $58.7B |

| Quality Rating | 6.7/10 |

| Intrinsic Value | $31.4 (2.9% overvalued) |

| 1Y Return | 30.4% |

| Revenue | $32.3B |

| Free Cash Flow | $777.0M |

| Revenue Growth | 18.7% |

Investment Thesis:

Coupang is South Korea’s e-commerce leader, recognized for its logistics excellence and rapid delivery services. The stock’s valuation closely matches its intrinsic value, suggesting a balanced risk/reward profile. With a 30.4% annual return and strong revenue growth, Coupang continues to benefit from digital adoption and operational scale.

Key Catalysts:

- Expansion of Rocket Delivery and fulfillment services

- Growth in third-party marketplace offerings

- Increased penetration in adjacent Asian markets

Risk Factors:

- Thin margins in a competitive market

- Regulatory and labor challenges

- Currency fluctuations impacting profitability

Stock #6: Carvana Co. (CVNA)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $52.9B |

| Quality Rating | 6.9/10 |

| Intrinsic Value | $159.1 (59.3% overvalued) |

| 1Y Return | 123.2% |

| Revenue | $16.3B |

| Free Cash Flow | $615.0M |

| Revenue Growth | 39.5% |

Investment Thesis:

Carvana is revolutionizing used car e-commerce in the U.S., delivering triple-digit annual returns and nearly 40% revenue growth. While currently overvalued, Carvana’s innovative online platform and streamlined logistics have enabled rapid market share gains. Its quality rating reflects operational improvements and a scalable business model.

Key Catalysts:

- Expansion of inventory and delivery network

- Enhanced digital retail experience

- Improving unit economics and profitability

Risk Factors:

- High valuation risk

- Macroeconomic sensitivity to auto demand

- Execution risks in scaling operations

Stock #7: JD.com, Inc. (JD)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $48.2B |

| Quality Rating | 5.5/10 |

| Intrinsic Value | $171.6 (405.8% undervalued) |

| 1Y Return | 14.0% |

| Revenue | CN¥1,265.1B |

| Free Cash Flow | (CN¥32.2B) |

| Revenue Growth | 14.5% |

Investment Thesis:

JD.com is a major Chinese e-commerce platform, trading at a substantial discount to its intrinsic value. Despite a lower quality rating and negative free cash flow, JD’s scale and logistics infrastructure support steady revenue growth. The stock’s undervaluation may appeal to contrarian investors seeking turnaround potential.

Key Catalysts:

- Supply chain and logistics innovation

- Growth in third-party marketplace services

- Strategic partnerships and technology investments

Risk Factors:

- Negative free cash flow

- Intense competition in China

- Regulatory headwinds

Stock #8: Tencent Music Entertainment Group (TME)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $37.2B |

| Quality Rating | 7.4/10 |

| Intrinsic Value | $19.8 (18.4% overvalued) |

| 1Y Return | 138.7% |

| Revenue | CN¥30.3B |

| Free Cash Flow | CN¥7,164.0M |

| Revenue Growth | 10.5% |

Investment Thesis:

Tencent Music is China’s leading online music platform, with a high quality rating and exceptional annual return. Although slightly overvalued, TME’s strong free cash flow and diversified revenue streams from music subscriptions and social entertainment support its growth trajectory.

Key Catalysts:

- Expansion of music and podcast content

- Growth in paid subscriptions

- Strategic partnerships and digital innovation

Risk Factors:

- Overvaluation risk

- Regulatory uncertainties in China

- Competition from global streaming platforms

Stock #9: Chewy, Inc. (CHWY)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $15.6B |

| Quality Rating | 6.6/10 |

| Intrinsic Value | $57.0 (51.8% undervalued) |

| 1Y Return | 25.7% |

| Revenue | $12.3B |

| Free Cash Flow | $463.0M |

| Revenue Growth | 9.0% |

Investment Thesis:

Chewy is a leading U.S. online pet retailer, trading at a notable discount to intrinsic value. The company’s recurring revenue model, customer loyalty, and expanding product offerings support steady growth. Chewy’s positive free cash flow and improving margins enhance its investment profile.

Key Catalysts:

- Growth in auto-ship and subscription services

- Expansion into pet health and pharmacy

- Increased penetration in pet food and supplies

Risk Factors:

- Competition from Amazon and Walmart

- Margin pressures from logistics costs

- Slower revenue growth

Stock #10: Wayfair, Inc. (W)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | — |

| Market Cap | $10.9B |

| Quality Rating | 5.0/10 |

| Intrinsic Value | $182.2 (113.6% undervalued) |

| 1Y Return | 60.8% |

| Revenue | $12.0B |

| Free Cash Flow | $252.0M |

| Revenue Growth | 0.9% |

Investment Thesis:

Wayfair is a major online home goods retailer, trading well below its intrinsic value. Despite modest revenue growth and a lower quality rating, Wayfair’s operational improvements and positive free cash flow support its turnaround potential. The company’s digital-first model and broad product selection remain competitive advantages.

Key Catalysts:

- Expansion of private label brands

- Improved logistics and delivery efficiency

- Growth in home renovation and décor markets

Risk Factors:

- Low revenue growth

- Competitive pressures from Amazon and traditional retailers

- Execution risk in cost management

Portfolio Diversification Insights

This watchlist spans U.S., Chinese, and Southeast Asian e-commerce, digital entertainment, and specialty retail. The portfolio includes large-cap leaders (Amazon, Alibaba), high-growth disruptors (Sea Limited, Carvana), and value opportunities (JD.com, Wayfair). Sector allocation is balanced between general merchandise, technology-enabled platforms, and niche verticals, reducing single-market risk and enhancing resilience against sector-specific headwinds.

Market Timing & Entry Strategies

Given the diversity in valuation and growth profiles, staggered entry strategies—such as dollar-cost averaging or sector rotation—can help manage volatility. Monitoring intrinsic value gaps and quality ratings may inform timing, with undervalued stocks offering potential entry points during market pullbacks. Investors should consider macroeconomic trends, earnings cycles, and regulatory developments when evaluating positions.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Quality Industrials Stocks to Buy Now

📖 5 Best Telecom Infrastructure Stock Picks for 2025

📖 10 Best DefenseTech Stock Picks for 2025

📖 10 Best Low P/E Stock Picks for 2025

📖 10 Best Stock Picks for Healthcare 2025

FAQ for E-commerce stocks

Q1: How were these stocks selected?

A: Stocks were chosen using ValueSense’s intrinsic value models, quality ratings, and growth metrics, focusing on sector leaders with strong fundamentals and diverse geographic exposure.

Q2: What's the best stock from this list?

A: The "best" stock depends on individual investment goals; Sea Limited and Tencent Music have the highest quality ratings, while Alibaba and JD.com appear most undervalued based on intrinsic value estimates.

Q3: Should I buy all these stocks or diversify?

A: This collection is designed for diversification across geographies and business models, which can help manage risk and capture growth from multiple trends.

Q4: What are the biggest risks with these picks?

A: Key risks include valuation premiums, regulatory changes (especially in China), competitive pressures, and macroeconomic volatility affecting consumer demand.

Q5: When is the best time to invest in these stocks?

A: Timing depends on market conditions, valuation gaps, and individual risk tolerance. Monitoring intrinsic value and sector trends can help identify attractive entry points.

Summary & Investment Outlook

The 2025 e-commerce stock watchlist features a blend of global leaders, high-growth disruptors, and value opportunities, each analyzed for quality, valuation, and growth potential. By leveraging ValueSense’s data-driven approach, investors can gain insights into sector trends and identify stocks aligned with their investment objectives. For more in-depth analysis and real-time updates, visit ValueSense.