10 Best Stock Picks for Healthcare 2025: ValueSense Watchlist & Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

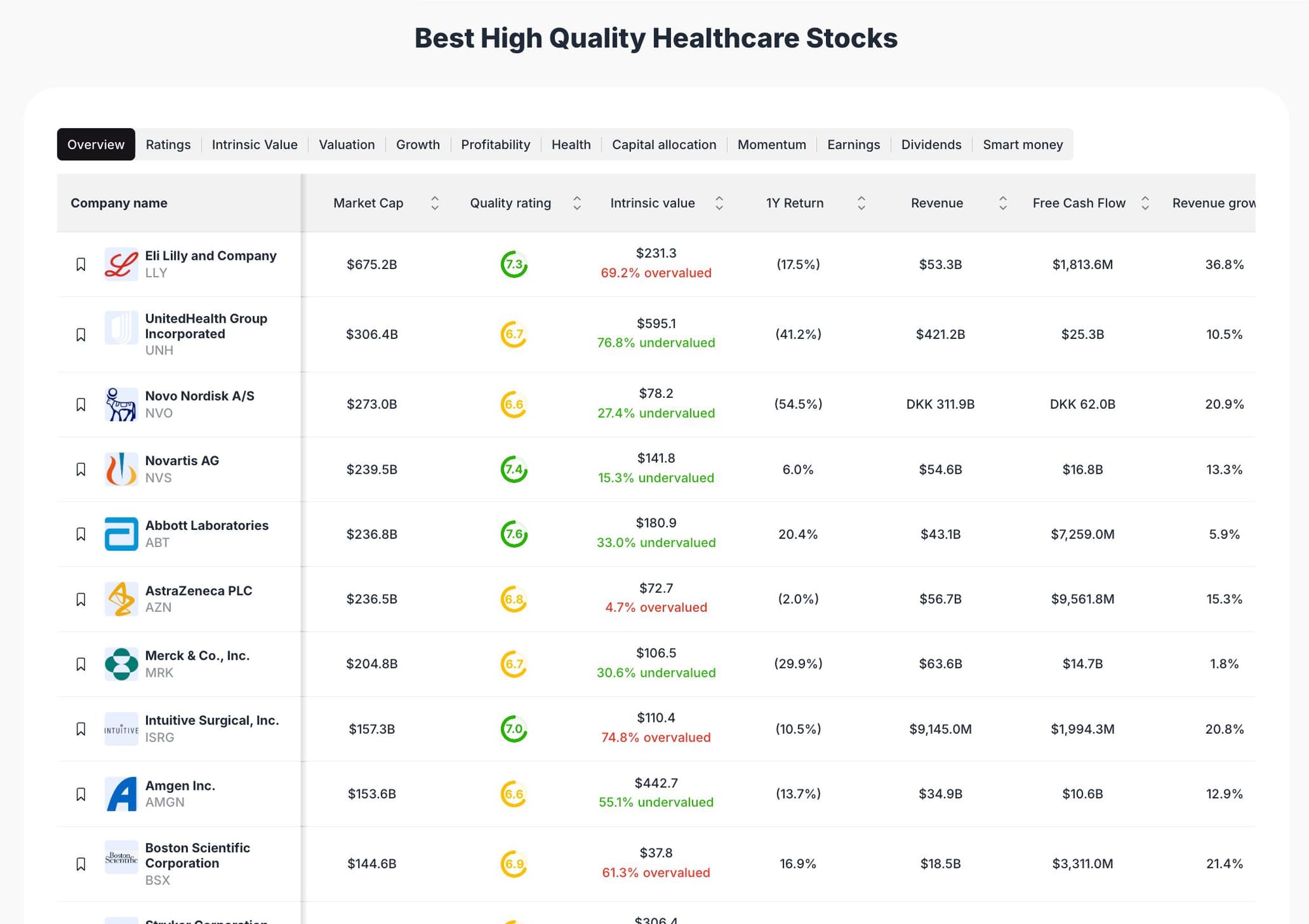

The healthcare sector in 2025 remains a focal point for investors seeking both defensive stability and growth potential. Our selection methodology emphasizes intrinsic value, quality rating, and undervaluation based on ValueSense’s proprietary metrics. Stocks are chosen for their strong fundamentals, sector leadership, and clear catalysts for future growth, while also considering risk factors and recent performance.

Featured Stock Analysis

Stock #1: Eli Lilly and Company (LLY)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $675.2B |

| Quality Rating | 7.3/10 |

| Intrinsic Value | $231.3 |

| 1Y Return | -17.5% |

| Revenue | $53.3B |

| Free Cash Flow | $1,813.6M |

| Revenue Growth | 36.8% |

| ValueSense Rating | 7.3/10 |

Investment Thesis

Eli Lilly stands out as a global pharmaceutical leader with a robust pipeline and strong revenue growth of 36.8%. Despite a recent one-year return of -17.5%, the company’s fundamentals remain solid, as evidenced by a high market cap and consistent free cash flow generation. However, the stock is currently 69.2% overvalued relative to its intrinsic value, suggesting that much of its future growth may already be priced in.

The company’s high quality rating (7.3/10) reflects its innovation in drug development and its ability to capture market share in key therapeutic areas. Investors should note that while the growth trajectory is impressive, the premium valuation warrants caution.

Key Catalysts

- Strong pipeline of innovative drugs

- Leading positions in diabetes and oncology markets

- High revenue growth rate

Risk Factors

- Significant overvaluation (69.2% above intrinsic value)

- Recent negative price momentum

- Competitive pressures in core markets

Stock #2: UnitedHealth Group Incorporated (UNH)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $306.4B |

| Quality Rating | 6.7/10 |

| Intrinsic Value | $595.1 |

| 1Y Return | -41.2% |

| Revenue | $421.2B |

| Free Cash Flow | $25.3B |

| Revenue Growth | 10.5% |

| ValueSense Rating | 6.7/10 |

Investment Thesis

UnitedHealth Group is the largest health insurer in the U.S., commanding a dominant market position with $421.2B in annual revenue. The stock is 76.8% undervalued compared to its intrinsic value, making it a compelling candidate for value-oriented investors. Despite a steep one-year decline of 41.2%, the company’s fundamentals remain robust, supported by strong free cash flow and a diversified business model.

The quality rating of 6.7/10 reflects operational strength and resilience, even as the sector faces regulatory and competitive headwinds. UnitedHealth’s undervaluation and scale position it well for a potential rebound.

Key Catalysts

- Significant undervaluation (76.8% below intrinsic value)

- Market leadership in health insurance

- Consistent free cash flow generation

Risk Factors

- Recent sharp price decline

- Regulatory risks in U.S. healthcare policy

- Slower revenue growth compared to peers

Stock #3: Novo Nordisk A/S (NVO)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $273.0B |

| Quality Rating | 6.6/10 |

| Intrinsic Value | $78.2 |

| 1Y Return | -54.5% |

| Revenue | DKK 311.9B |

| Free Cash Flow | DKK 62.0B |

| Revenue Growth | 20.9% |

| ValueSense Rating | 6.6/10 |

Investment Thesis

Novo Nordisk is a global leader in diabetes care and obesity therapeutics. Despite a challenging year with a -54.5% return, the company’s fundamentals remain attractive, with a 27.4% undervaluation and strong revenue growth of 20.9%. The company’s high free cash flow and established market presence in GLP-1 drugs position it for long-term growth.

The quality rating (6.6/10) underscores solid operational performance, but investors should be mindful of recent volatility and sector competition.

Key Catalysts

- Undervaluation relative to intrinsic value

- Leadership in diabetes and obesity drug markets

- Strong free cash flow

Risk Factors

- High recent volatility and price decline

- Currency risk (reporting in DKK)

- Competitive pressure in core therapeutic areas

Stock #4: Novartis AG (NVS)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $239.5B |

| Quality Rating | 7.4/10 |

| Intrinsic Value | $141.8 |

| 1Y Return | 6.0% |

| Revenue | $54.6B |

| Free Cash Flow | $16.8B |

| Revenue Growth | 13.3% |

| ValueSense Rating | 7.4/10 |

Investment Thesis

Novartis AG is a diversified pharmaceutical company with a strong global footprint. The stock is 15.3% undervalued, offering a moderate margin of safety. With a positive one-year return and a high quality rating (7.4/10), Novartis demonstrates resilience and consistent growth, supported by a robust pipeline and strong free cash flow.

Key Catalysts

- Positive price momentum

- Undervaluation supports upside potential

- Broad product portfolio

Risk Factors

- Moderate revenue growth

- Exposure to global regulatory environments

Stock #5: Abbott Laboratories (ABT)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $236.8B |

| Quality Rating | 7.6/10 |

| Intrinsic Value | $180.9 |

| 1Y Return | 20.4% |

| Revenue | $43.1B |

| Free Cash Flow | $7,259.0M |

| Revenue Growth | 5.9% |

| ValueSense Rating | 7.6/10 |

Investment Thesis

Abbott Laboratories is a diversified healthcare company with a strong diagnostics and medical devices business. The stock is 33.0% undervalued, and the company boasts a high quality rating (7.6/10). With a solid one-year return and steady free cash flow, Abbott is well-positioned for continued growth.

Key Catalysts

- High quality rating and undervaluation

- Strong performance in diagnostics and devices

- Consistent free cash flow

Risk Factors

- Slower revenue growth compared to peers

- Potential margin pressures

Stock #6: AstraZeneca PLC (AZN)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $236.5B |

| Quality Rating | 6.8/10 |

| Intrinsic Value | $72.7 |

| 1Y Return | -2.0% |

| Revenue | $56.7B |

| Free Cash Flow | $9,561.8M |

| Revenue Growth | 15.3% |

| ValueSense Rating | 6.8/10 |

Investment Thesis

AstraZeneca is a global biopharmaceutical company with a diverse product portfolio. The stock is 4.7% overvalued, suggesting limited near-term upside. However, the company’s strong free cash flow and double-digit revenue growth highlight its operational strength.

Key Catalysts

- Strong free cash flow

- Broad therapeutic exposure

- Double-digit revenue growth

Risk Factors

- Slight overvaluation

- Recent negative price performance

Stock #7: Merck & Co., Inc. (MRK)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $204.8B |

| Quality Rating | 6.7/10 |

| Intrinsic Value | $106.5 |

| 1Y Return | -29.9% |

| Revenue | $63.6B |

| Free Cash Flow | $14.7B |

| Revenue Growth | 1.8% |

| ValueSense Rating | 6.7/10 |

Investment Thesis

Merck is a leading pharmaceutical company with a focus on oncology and vaccines. The stock is 30.6% undervalued, offering a margin of safety for value investors. Despite a challenging year, Merck’s fundamentals remain solid, supported by strong free cash flow.

Key Catalysts

- Undervaluation supports long-term upside

- Leadership in oncology

- Consistent cash generation

Risk Factors

- Minimal revenue growth

- Recent negative price momentum

Stock #8: Intuitive Surgical, Inc. (ISRG)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $157.3B |

| Quality Rating | 7.0/10 |

| Intrinsic Value | $110.4 |

| 1Y Return | -10.5% |

| Revenue | $9,145.0M |

| Free Cash Flow | $1,994.3M |

| Revenue Growth | 20.8% |

| ValueSense Rating | 7.0/10 |

Investment Thesis

Intuitive Surgical is a pioneer in robotic-assisted surgery, with a strong growth profile and high quality rating (7.0/10). The stock is 74.8% overvalued, indicating that investors should be cautious about current entry points despite robust revenue growth.

Key Catalysts

- Leadership in surgical robotics

- High revenue growth

- Strong free cash flow

Risk Factors

- Significant overvaluation

- Recent negative price performance

Stock #9: Amgen Inc. (AMGN)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $153.6B |

| Quality Rating | 6.6/10 |

| Intrinsic Value | $442.7 |

| 1Y Return | -13.7% |

| Revenue | $34.9B |

| Free Cash Flow | $10.6B |

| Revenue Growth | 12.9% |

| ValueSense Rating | 6.6/10 |

Investment Thesis

Amgen is a biotechnology leader with a strong portfolio of biologics and biosimilars. The stock is 55.1% undervalued, making it attractive for value-focused investors. Despite a negative one-year return, Amgen’s fundamentals and free cash flow remain solid.

Key Catalysts

- Substantial undervaluation

- Strong product pipeline

- Consistent cash generation

Risk Factors

- Recent price decline

- Competitive pressures in biosimilars

Stock #10: Boston Scientific Corporation (BSX)

Quick Stats Table

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $144.6B |

| Quality Rating | 6.9/10 |

| Intrinsic Value | $37.8 |

| 1Y Return | 16.9% |

| Revenue | $18.5B |

| Free Cash Flow | $3,311.0M |

| Revenue Growth | 21.4% |

| ValueSense Rating | 6.9/10 |

Investment Thesis

Boston Scientific is a leading medical device company with strong revenue growth (21.4%) and a positive one-year return. The stock is 61.3% overvalued, suggesting caution for new positions, but the company’s innovation and market leadership remain attractive.

Key Catalysts

- Strong revenue growth

- Market leadership in medical devices

- Positive price momentum

Risk Factors

- Significant overvaluation

- Competitive pressures

Portfolio Diversification Insights

This watchlist spans pharmaceuticals, biotechnology, medical devices, and health insurance, offering exposure to multiple healthcare sub-sectors. The portfolio includes both undervalued and overvalued stocks, balancing growth potential with defensive characteristics. Diversification across market caps and business models helps mitigate sector-specific risks and enhances overall stability.

Market Timing & Entry Strategies

Given the mix of overvalued and undervalued stocks, investors may consider staggered entry points and focus on accumulating positions in undervalued names. Monitoring sector trends, earnings releases, and regulatory developments can help refine timing. Dollar-cost averaging and sector rotation strategies may also be effective for managing volatility.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 12 Best Dividend Growth Stocks to Buy Now

📖 12 Best Stock Picks with High ROIC for 2025

📖 10 Best Stock Picks for 2025: High Quality, Low Price/FCF Stocks

📖 10 Best Low P/E Stock Picks for 2025

📖 10 Best Undervalued Stocks for 2025

FAQ for High Quality Healthcare Stocks

Q1: How were these stocks selected?

A1: Stocks were chosen based on ValueSense’s intrinsic value analysis, quality ratings, and sector leadership, focusing on undervalued opportunities and strong fundamentals.

Q2: What's the best stock from this list?

A2: The “best” stock depends on individual criteria, but UnitedHealth Group (UNH) and Amgen (AMGN) stand out for their significant undervaluation and strong fundamentals.

Q3: Should I buy all these stocks or diversify?

A3: Diversification across these healthcare stocks can reduce risk and provide exposure to various growth drivers within the sector.

Q4: What are the biggest risks with these picks?

A4: Key risks include overvaluation, sector volatility, regulatory changes, and competitive pressures within healthcare.

Q5: When is the best time to invest in these stocks?

A5: Entry timing should consider valuation, sector trends, and individual risk tolerance. Accumulating undervalued stocks during market pullbacks may enhance long-term returns.

Summary & Investment Outlook

This ValueSense watchlist highlights 10 high-quality healthcare stocks with a blend of undervalued opportunities and sector leaders. By leveraging intrinsic value analysis and quality metrics, investors can build a diversified portfolio positioned for both growth and resilience. For more in-depth research and real-time analysis, visit ValueSense.