10 Best Stock Picks for October 2025: High-Quality & Undervalued Opportunities

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

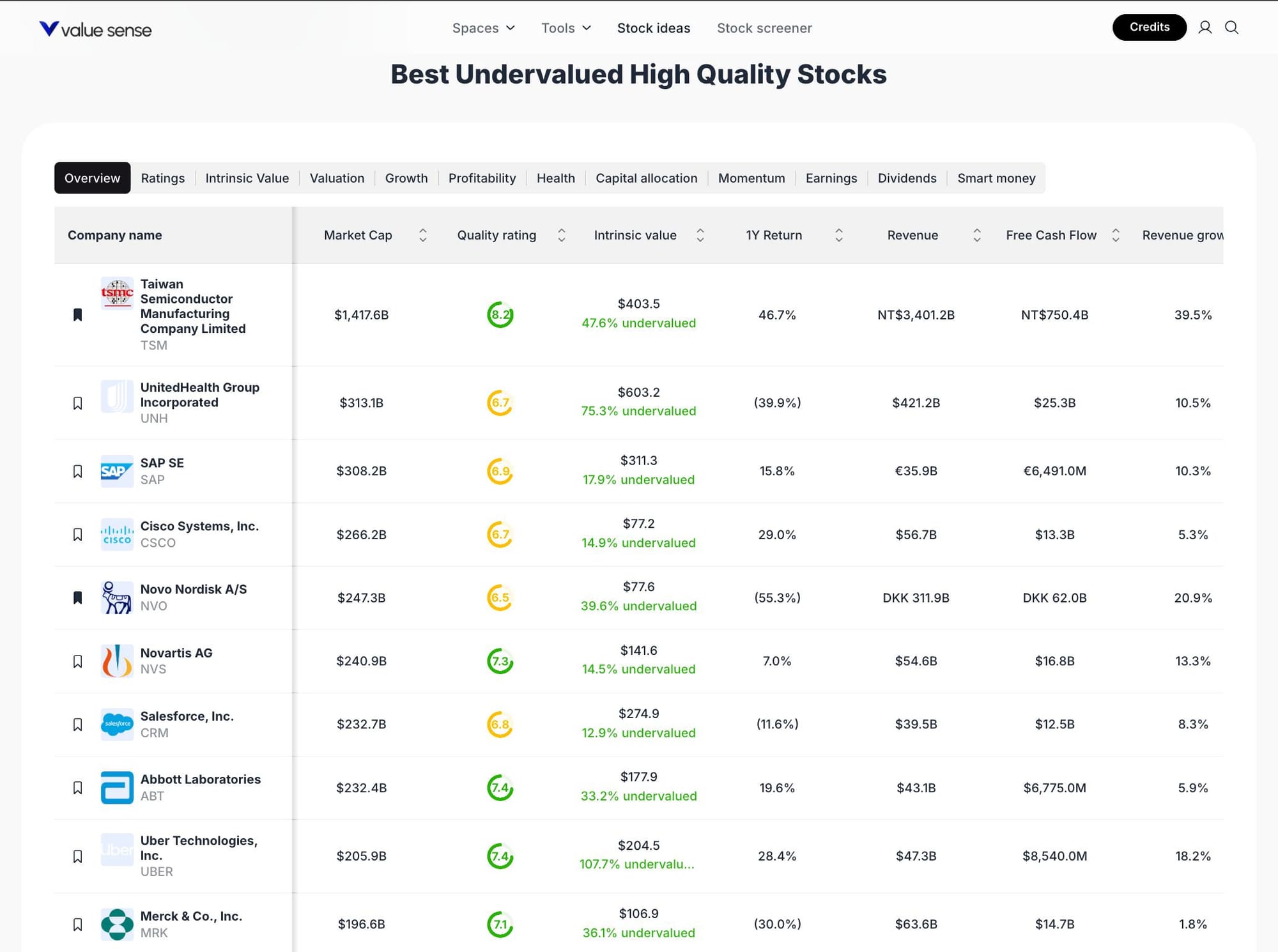

The current market landscape in 2025 is characterized by sector rotation, persistent macroeconomic uncertainty, and a renewed focus on fundamental value. Our selection methodology leverages ValueSense’s proprietary quality ratings, intrinsic value calculations, and growth metrics to identify stocks that are both undervalued and demonstrate high business quality. Each stock is screened for strong free cash flow, robust revenue growth, and a favorable quality rating, ensuring a diversified watchlist across technology, healthcare, and consumer sectors.

Featured Stock Analysis

Stock #1: Taiwan Semiconductor Manufacturing Company Limited (TSMC)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $1,417.6B |

| Quality Rating | 8.2 |

| Intrinsic Value | $403.5 (47.6% undervalued) |

| 1Y Return | 46.7% |

| Revenue | NT$3,401.2B |

| Free Cash Flow | NT$750.4B |

| Revenue Growth | 39.5% |

Investment Thesis

Taiwan Semiconductor Manufacturing Company Limited (TSMC) stands as the world’s premier semiconductor foundry, supplying advanced chips to leading technology firms globally. With a market cap exceeding $1.4 trillion and a stellar quality rating of 8.2, TSMC is recognized for its technological leadership and operational excellence. The stock is currently trading at a 47.6% discount to its intrinsic value, according to ValueSense, making it one of the most compelling large-cap opportunities in the sector.

TSMC’s robust free cash flow and exceptional revenue growth of 39.5% underscore its ability to reinvest in next-generation manufacturing processes. The company’s 1-year return of 46.7% reflects strong market confidence, yet its valuation remains attractive relative to its growth prospects.

Key Catalysts

- Ongoing global demand for advanced chips (AI, automotive, IoT)

- Expansion into next-gen process nodes (3nm, 2nm)

- Strategic partnerships with leading tech giants

- Geopolitical incentives for semiconductor supply chain localization

Risk Factors

- Geopolitical tensions in East Asia

- Cyclical downturns in semiconductor demand

- High capital expenditure requirements

Stock #2: UnitedHealth Group Incorporated (UNH)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $313.1B |

| Quality Rating | 6.7 |

| Intrinsic Value | $603.2 (75.3% undervalued) |

| 1Y Return | -39.9% |

| Revenue | $421.2B |

| Free Cash Flow | $25.3B |

| Revenue Growth | 10.5% |

Investment Thesis

UnitedHealth Group (UNH) is a diversified healthcare giant, integrating insurance, pharmacy, and care delivery. Despite a challenging year with a -39.9% return, ValueSense identifies UNH as 75.3% undervalued relative to its intrinsic value, signaling a potential rebound opportunity for long-term investors. The company’s $421.2 billion in revenue and solid free cash flow position it as a resilient player in the healthcare sector.

The quality rating of 6.7 reflects operational stability, while consistent revenue growth (10.5%) highlights its ability to adapt to evolving healthcare needs. UNH’s scale and integrated model provide a competitive moat, even in volatile market conditions.

Key Catalysts

- Expansion of value-based care and digital health services

- Aging population driving increased healthcare demand

- Strategic acquisitions and vertical integration

Risk Factors

- Regulatory changes in U.S. healthcare policy

- Margin pressures from reimbursement shifts

- Litigation and compliance risks

Stock #3: SAP SE (SAP)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $308.2B |

| Quality Rating | 6.9 |

| Intrinsic Value | $311.3 (17.9% undervalued) |

| 1Y Return | 15.8% |

| Revenue | €35.9B |

| Free Cash Flow | €6,491.0M |

| Revenue Growth | 10.3% |

Investment Thesis

SAP SE is a global leader in enterprise software, enabling digital transformation for businesses worldwide. With a market cap of $308.2 billion and a quality rating of 6.9, SAP combines scale with innovation. The stock is currently 17.9% undervalued based on ValueSense’s intrinsic value model, offering moderate upside potential.

SAP’s free cash flow and steady revenue growth (10.3%) support ongoing investments in cloud and AI-driven solutions. The company’s 1-year return of 15.8% demonstrates resilience amid shifting IT spending patterns.

Key Catalysts

- Accelerated adoption of cloud-based ERP and analytics

- Expansion into AI and machine learning applications

- Strong customer retention and recurring revenue streams

Risk Factors

- Intense competition from cloud-native vendors

- Currency fluctuations impacting European revenues

- Execution risk in large-scale digital transformation projects

Stock #4: Cisco Systems, Inc. (CSCO)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $266.2B |

| Quality Rating | 6.7 |

| Intrinsic Value | $77.2 (14.9% undervalued) |

| 1Y Return | 29.0% |

| Revenue | $56.7B |

| Free Cash Flow | $13.3B |

| Revenue Growth | 5.3% |

Investment Thesis

Cisco Systems (CSCO) remains a foundational player in networking and cybersecurity. With a market cap of $266.2 billion and a quality rating of 6.7, Cisco’s broad product portfolio and recurring service revenues provide stability. The stock is 14.9% undervalued per ValueSense, offering a margin of safety for investors seeking exposure to digital infrastructure.

Cisco’s free cash flow and positive 1-year return of 29% reflect operational efficiency and market relevance, even as revenue growth moderates.

Key Catalysts

- Growth in cloud networking and cybersecurity demand

- Expansion of subscription-based software offerings

- 5G and edge computing infrastructure upgrades

Risk Factors

- Slower enterprise IT spending cycles

- Competitive pressures from emerging tech firms

- Supply chain disruptions

Stock #5: Novo Nordisk A/S (NVO)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $247.3B |

| Quality Rating | 6.5 |

| Intrinsic Value | $77.6 (39.6% undervalued) |

| 1Y Return | -55.3% |

| Revenue | DKK 311.9B |

| Free Cash Flow | DKK 62.0B |

| Revenue Growth | 20.9% |

Investment Thesis

Novo Nordisk (NVO) is a global leader in diabetes and obesity care. Despite a -55.3% 1-year return, ValueSense rates NVO as 39.6% undervalued, highlighting a potential turnaround opportunity. The company’s quality rating of 6.5 and strong revenue growth of 20.9% underscore its innovation pipeline and market leadership.

Novo Nordisk’s robust free cash flow and expanding product portfolio position it for long-term growth, particularly as global health trends drive demand for metabolic therapies.

Key Catalysts

- Launch of next-generation diabetes and obesity drugs

- Expansion into emerging markets

- Strategic R&D investments

Risk Factors

- Patent expirations and biosimilar competition

- Regulatory hurdles for new drug approvals

- Currency risk due to international operations

Stock #6: Novartis AG (NVS)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $240.9B |

| Quality Rating | 7.3 |

| Intrinsic Value | $141.6 (14.5% undervalued) |

| 1Y Return | 7.0% |

| Revenue | $54.6B |

| Free Cash Flow | $16.8B |

| Revenue Growth | 13.3% |

Investment Thesis

Novartis AG (NVS) is a diversified pharmaceutical leader with a market cap of $240.9 billion and a strong quality rating of 7.3. The stock is 14.5% undervalued according to ValueSense, offering steady upside potential. Novartis’s revenue growth of 13.3% and healthy free cash flow support ongoing innovation and shareholder returns.

The company’s broad therapeutic portfolio and global reach provide resilience against sector volatility.

Key Catalysts

- Pipeline of innovative therapies and biosimilars

- Expansion in oncology and immunology

- Strategic M&A activity

Risk Factors

- Patent cliffs and generic competition

- Regulatory and pricing pressures

- R&D execution risk

Stock #7: Salesforce, Inc. (CRM)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $232.7B |

| Quality Rating | 6.8 |

| Intrinsic Value | $274.9 (12.9% undervalued) |

| 1Y Return | -11.6% |

| Revenue | $39.5B |

| Free Cash Flow | $12.5B |

| Revenue Growth | 8.3% |

Investment Thesis

Salesforce (CRM) is the global leader in customer relationship management (CRM) software. With a market cap of $232.7 billion and a quality rating of 6.8, Salesforce combines innovation with scale. The stock is 12.9% undervalued per ValueSense, offering moderate upside for investors seeking exposure to enterprise SaaS.

Salesforce’s free cash flow and consistent revenue growth (8.3%) support its ongoing investments in AI and platform expansion.

Key Catalysts

- Growth in enterprise digital transformation

- Expansion of AI-driven CRM solutions

- Strategic acquisitions to broaden platform capabilities

Risk Factors

- Intense competition in SaaS and cloud markets

- Integration risk from acquisitions

- Macroeconomic sensitivity of enterprise IT budgets

Stock #8: Abbott Laboratories (ABT)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $232.4B |

| Quality Rating | 7.4 |

| Intrinsic Value | $177.9 (33.2% undervalued) |

| 1Y Return | 19.6% |

| Revenue | $43.1B |

| Free Cash Flow | $6,775.0M |

| Revenue Growth | 5.9% |

Investment Thesis

Abbott Laboratories (ABT) is a diversified healthcare company with strengths in diagnostics, medical devices, and nutrition. With a market cap of $232.4 billion and a quality rating of 7.4, Abbott is well-positioned for stable growth. The stock is 33.2% undervalued according to ValueSense, making it attractive for defensive portfolios.

Abbott’s free cash flow and positive 1-year return of 19.6% reflect operational efficiency and resilience in a dynamic healthcare environment.

Key Catalysts

- Innovation in diagnostics and medical devices

- Expansion in emerging markets

- Strong brand portfolio in consumer health

Risk Factors

- Regulatory and reimbursement challenges

- Product recall risks

- Currency headwinds

Stock #9: Uber Technologies, Inc. (UBER)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $205.9B |

| Quality Rating | 7.4 |

| Intrinsic Value | $204.5 (107.7% undervalued) |

| 1Y Return | 28.4% |

| Revenue | $47.3B |

| Free Cash Flow | $8,540.0M |

| Revenue Growth | 18.2% |

Investment Thesis

Uber Technologies (UBER) is a global leader in mobility and logistics. With a market cap of $205.9 billion and a quality rating of 7.4, Uber is recognized for its disruptive business model and growth trajectory. ValueSense rates UBER as 107.7% undervalued, indicating significant upside potential.

Uber’s free cash flow and strong revenue growth of 18.2% highlight its ability to scale across ride-hailing, delivery, and logistics. The company’s 1-year return of 28.4% reflects improving profitability and market sentiment.

Key Catalysts

- Expansion of delivery and logistics services

- Growth in international markets

- Path to sustained profitability

Risk Factors

- Regulatory and labor challenges

- Competitive pressures in mobility and delivery

- Macroeconomic sensitivity

Stock #10: Merck & Co., Inc. (MRK)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $196.6B |

| Quality Rating | 7.1 |

| Intrinsic Value | $106.9 (36.1% undervalued) |

| 1Y Return | -30.0% |

| Revenue | $63.6B |

| Free Cash Flow | $14.7B |

| Revenue Growth | 1.8% |

Investment Thesis

Merck & Co. (MRK) is a global pharmaceutical leader with a market cap of $196.6 billion and a quality rating of 7.1. The stock is 36.1% undervalued per ValueSense, offering a margin of safety for healthcare-focused investors. Merck’s free cash flow and broad therapeutic portfolio provide stability, even as revenue growth moderates.

The company’s -30% 1-year return may present a contrarian opportunity for those seeking value in the sector.

Key Catalysts

- Pipeline of oncology and vaccine products

- Expansion in emerging markets

- Strategic partnerships and licensing deals

Risk Factors

- Patent expirations and generic competition

- Regulatory and pricing pressures

- R&D execution risk

Portfolio Diversification Insights

This watchlist spans technology, healthcare, and consumer sectors, providing a balanced allocation across growth and defensive industries. Technology names like TSMC, SAP, and Cisco offer exposure to digital transformation, while healthcare giants such as UnitedHealth, Novo Nordisk, Novartis, Abbott, and Merck provide stability and innovation. Uber adds a disruptive consumer platform, enhancing overall diversification and risk-adjusted return potential.

Market Timing & Entry Strategies

Entry strategies should consider valuation gaps (as highlighted by ValueSense’s intrinsic value metrics), sector rotation trends, and individual stock momentum. Staggered entry, dollar-cost averaging, and monitoring for technical breakouts can help manage risk and optimize timing. Investors may also watch for earnings releases and macroeconomic events that could impact sector sentiment.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Quality Large Cap Stock Picks for 2025

📖 5 Best Telecom Infrastructure Stock Picks for 2025

📖 12 Best Robotics Stock Picks for 2025: In-Depth Analysis & Watchlist

📖 10 Best Stock Picks for 2025: E-commerce Watchlist & Analysis

📖 5 Best Stock Picks for October 2025: Top Undervalued Stocks

FAQ for Quality Undervalued Stocks - October 2025

Q1: How were these stocks selected?

A1: Stocks were chosen based on ValueSense’s proprietary quality ratings, intrinsic value discounts, and strong financial metrics, ensuring a blend of undervaluation and business quality.

Q2: What's the best stock from this list?

A2: The “best” stock depends on individual investment goals, but TSMC and Uber stand out for their high undervaluation and quality ratings, according to ValueSense’s analysis.

Q3: Should I buy all these stocks or diversify?

A3: Diversification is key; this watchlist is designed to provide exposure across sectors, reducing risk and enhancing potential returns.

Q4: What are the biggest risks with these picks?

A4: Risks include sector-specific challenges (regulation, competition), macroeconomic volatility, and company-specific execution risks, as outlined in each stock’s analysis.

Q5: When is the best time to invest in these stocks?

A5: Optimal timing depends on valuation, market trends, and individual risk tolerance. Monitoring intrinsic value gaps and sector momentum can help inform entry points.

Summary & Investment Outlook

This ValueSense watchlist highlights 10 high-quality, undervalued stocks across major sectors, each with unique growth drivers and risk profiles. By leveraging ValueSense’s data-driven analysis, investors can identify opportunities for portfolio enhancement and long-term value creation. For more in-depth research and real-time updates, visit ValueSense.