10 Best Stock Picks for 2025: High-Quality Low PEG Growth Stocks to Buy Now

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

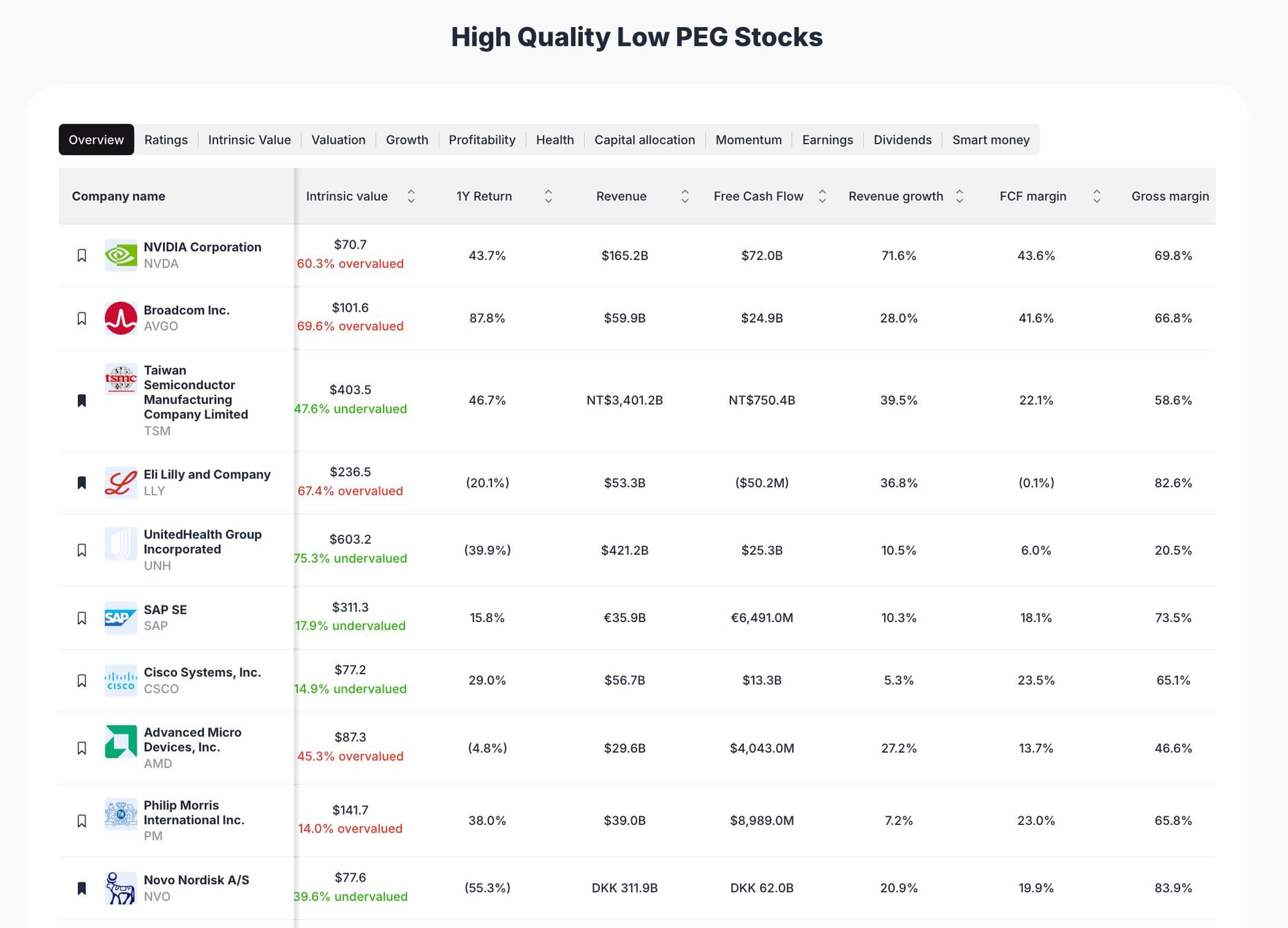

The current market environment presents unique opportunities for savvy investors seeking high-quality growth stocks with low PEG ratios. Our comprehensive analysis focuses on companies demonstrating exceptional financial strength, robust free cash flow generation, and sustainable competitive advantages in 2025's evolving market landscape.

Key Investment Screening Criteria:

- Low PEG ratios (Price/Earnings to Growth)

- Strong free cash flow generation

- Revenue growth exceeding industry averages

- Market leadership positions

- ValueSense intrinsic value analysis

Top 10 Stock Picks for 2025: Complete Analysis

Stock #1: NVIDIA Corporation (NVDA) - AI Revolution Leader

Quick Financial Overview:

| Key Metric | Value | Performance Indicator |

|---|---|---|

| PEG Ratio | 0.62 | Strong fundamentals |

| Intrinsic Value | $70.7 | Strong fundamentals |

| 1-Year Return | 43.7% | Exceptional growth |

| Revenue | $165.2B | Market leader |

| Free Cash Flow | $72.0B | Cash generation machine |

| Revenue Growth | 71.6% | Explosive expansion |

| FCF Margin | 43.6% | Industry-leading efficiency |

| Gross Margin | 69.8% | Premium pricing power |

| ValueSense Rating | 60.3% overvalued | Valuation concern |

Investment Thesis

NVIDIA (NVDA) remains the undisputed leader in AI infrastructure and semiconductor innovation. The company's 71.6% revenue growth and industry-leading 69.8% gross margins demonstrate exceptional operational excellence and pricing power in the rapidly expanding artificial intelligence market. With a PEG ratio of 0.62, NVDA shows attractive growth relative to earnings.

Key Growth Catalysts 2025

- AI data center expansion driving unprecedented demand

- GPU technology leadership in machine learning applications

- Strategic cloud partnerships with major hyperscalers

- Automotive AI solutions penetrating autonomous vehicle market

Risk Assessment

- Significant overvaluation at current price levels

- Cyclical semiconductor demand patterns

- Intensifying competition from emerging AI chip manufacturers

Stock #2: Broadcom Inc. (AVGO) - Diversified Tech Powerhouse

Financial Performance Snapshot:

| Metric | Value | Analysis |

|---|---|---|

| PEG Ratio | 1.60 | Reasonable growth valuation |

| Intrinsic Value | $101.6 | Solid foundation |

| 1-Year Return | 87.8% | Outstanding performance |

| Revenue | $59.9B | Diversified revenue streams |

| Free Cash Flow | $24.9B | Strong cash generation |

| Revenue Growth | 28.0% | Consistent expansion |

| FCF Margin | 41.6% | Efficient operations |

| ValueSense Rating | 69.6% overvalued | Premium valuation |

Investment Case

Broadcom's (AVGO) diversified semiconductor and software portfolio positions it as a cash-generating powerhouse with exposure to multiple high-growth technology sectors. The company's 41.6% FCF margin demonstrates exceptional operational efficiency, while its PEG ratio of 1.60 suggests reasonable growth valuation.

2025 Growth Drivers

- Cloud infrastructure expansion driving networking demand

- Strategic acquisitions enhancing software capabilities

- Consistent dividend growth supporting income investors

Stock #3: Taiwan Semiconductor (TSM) - Global Foundry Leader

Key Performance Metrics:

| Financial Indicator | Value | Market Position |

|---|---|---|

| PEG Ratio | 1.02 | Attractive growth multiple |

| Intrinsic Value | $403.5 | Significant upside |

| 1-Year Return | 46.7% | Strong momentum |

| Revenue | NT$3,401.2B | Global market leader |

| Free Cash Flow | NT$750.4B | Exceptional cash flow |

| Revenue Growth | 39.5% | Robust expansion |

| ValueSense Rating | 47.6% undervalued | Value opportunity |

Why TSM Stands Out

Taiwan Semiconductor (TSM) represents the world's most advanced pure-play foundry, controlling critical global chip supply chains. With 47.6% undervaluation according to ValueSense analysis and a PEG ratio of 1.02, TSM offers a rare combination of growth and value.

Strategic Advantages 2025

- Advanced process node leadership (3nm, 5nm technology)

- Rising AI and automotive demand driving capacity utilization

- Strategic partnerships with leading fabless chip designers

- Geographic diversification with new US facilities

Stock #4: Eli Lilly and Company (LLY) - Pharmaceutical Innovation Leader

Healthcare Investment Metrics:

| Health Metric | Performance | Industry Comparison |

|---|---|---|

| PEG Ratio | 0.74 | Attractive growth valuation |

| Intrinsic Value | $236.5 | Premium valuation |

| 1-Year Return | (20.1%) | Recent decline |

| Revenue | $53.3B | Healthcare leader |

| Free Cash Flow | ($50.2M) | Temporary negative |

| Revenue Growth | 36.8% | Strong expansion |

| Gross Margin | 82.6% | Pharma excellence |

| ValueSense Rating | 67.4% overvalued | Premium pricing |

Pharmaceutical Investment Thesis

Eli Lilly's (LLY) breakthrough drug portfolio in diabetes and obesity treatment positions the company at the forefront of major healthcare trends. Despite recent share price volatility, the PEG ratio of 0.74 suggests attractive growth potential relative to earnings growth.

Key Catalysts

- Breakthrough drug launches in diabetes and oncology

- Expansion into new therapeutic areas

- Strong R&D investment pipeline

Stock #5: UnitedHealth Group (UNH) - Healthcare Value Play

Healthcare Sector Analysis:

| Value Metric | UNH Performance | Market Opportunity |

|---|---|---|

| PEG Ratio | 1.44 | Reasonable healthcare multiple |

| Intrinsic Value | $603.2 | Strong foundation |

| 1-Year Return | (39.9%) | Value opportunity |

| Revenue | $421.2B | Healthcare giant |

| Free Cash Flow | $25.3B | Solid generation |

| FCF Margin | 6.0% | Steady performance |

| ValueSense Rating | 75.3% undervalued | Exceptional value |

Value Investment Opportunity

UnitedHealth's (UNH) 75.3% undervaluation presents significant upside potential for value-focused investors seeking exposure to the defensive healthcare sector. The PEG ratio of 1.44 aligns with healthcare industry standards.

Growth Catalysts

- Expansion in managed care and health services

- Integration of technology in healthcare delivery

- Growth in Medicare Advantage enrollment

Stock #6: SAP SE (SAP) - Enterprise Software Leader

Enterprise Technology Metrics:

| Software Metric | SAP Value | Digital Transformation |

|---|---|---|

| PEG Ratio | 1.13 | Reasonable software multiple |

| Intrinsic Value | $311.3 | Solid valuation |

| 1-Year Return | 15.8% | Steady growth |

| Revenue | €35.9B | Enterprise leader |

| Free Cash Flow | €6,491.0M | Strong generation |

| Revenue Growth | 10.3% | Cloud transition |

| FCF Margin | 18.1% | Efficient operations |

| Gross Margin | 73.5% | Software efficiency |

| ValueSense Rating | 17.9% undervalued | Value opportunity |

Investment Case

SAP SE (SAP) is a global leader in enterprise software, with strong recurring revenue and high margins. The company's 17.9% undervaluation and PEG ratio of 1.13 make it attractive for investors seeking exposure to digital transformation trends.

Key Catalysts

- Cloud migration and SaaS adoption

- Expansion in AI-driven enterprise solutions

- Strong customer retention and upsell opportunities

Stock #7: Cisco Systems, Inc. (CSCO) - Networking Infrastructure

Infrastructure Investment Data:

| Network Metric | CSCO Performance | 5G/Cloud Exposure |

|---|---|---|

| PEG Ratio | 2.66 | Premium infrastructure multiple |

| Intrinsic Value | $77.2 | Solid foundation |

| 1-Year Return | 29.0% | Strong performance |

| Revenue | $56.7B | Networking leader |

| Free Cash Flow | $13.3B | Reliable generation |

| Revenue Growth | 5.3% | Modest expansion |

| FCF Margin | 23.5% | Reliable cash flow |

| ValueSense Rating | 14.9% undervalued | Infrastructure play |

Investment Thesis

Cisco Systems (CSCO) remains a foundational player in networking and cybersecurity, offering stable cash flows and a 14.9% undervaluation. While the PEG ratio of 2.66 reflects modest growth expectations, CSCO's high margins and consistent capital returns make it a reliable component for income and value portfolios.

Stock #8: Advanced Micro Devices, Inc. (AMD) - Semiconductor Growth

Chip Sector Analysis:

| AMD Metric | Value | Competitive Position |

|---|---|---|

| PEG Ratio | 0.50 | Attractive growth multiple |

| Intrinsic Value | $87.3 | Growth potential |

| 1-Year Return | (4.8%) | Recent weakness |

| Revenue | $29.6B | Market share gains |

| Free Cash Flow | $4,043.0M | Solid generation |

| Revenue Growth | 27.2% | Market share gains |

| FCF Margin | 13.7% | Improving efficiency |

| ValueSense Rating | 45.3% overvalued | Premium valuation |

Investment Case

AMD (AMD) continues to gain market share in CPUs and GPUs, supported by strong revenue growth and improving free cash flow. The PEG ratio of 0.50 suggests attractive growth potential relative to earnings, despite a 45.3% overvaluation according to ValueSense.

Stock #9: Philip Morris International Inc. (PM) - Consumer Staples

Consumer Investment Metrics:

| Consumer Metric | PM Performance | Stability Factor |

|---|---|---|

| PEG Ratio | 1.85 | Consumer staples multiple |

| Intrinsic Value | $141.7 | Stable foundation |

| 1-Year Return | 38.0% | Strong performance |

| Revenue | $39.0B | Global presence |

| Free Cash Flow | $8,989.0M | Cash generation |

| Revenue Growth | 7.2% | Steady expansion |

| FCF Margin | 23.0% | Cash generation |

| ValueSense Rating | 14.0% overvalued | Modest premium |

Investment Thesis

Philip Morris International (PM) is a global leader in tobacco and reduced-risk products, delivering steady returns and high margins. The PEG ratio of 1.85 reflects the company's steady growth profile, while strong free cash flow supports income investors.

Stock #10: Novo Nordisk A/S (NVO) - Healthcare Innovation

Pharmaceutical Growth Story:

| Pharma Metric | NVO Value | Healthcare Trends |

|---|---|---|

| PEG Ratio | 0.66 | Attractive pharma multiple |

| Intrinsic Value | $77.6 | Growth potential |

| 1-Year Return | (55.3%) | Significant decline |

| Revenue | DKK 311.9B | Obesity treatment leader |

| Free Cash Flow | DKK 62.0B | Strong generation |

| Revenue Growth | 20.9% | Diabetes/obesity market |

| FCF Margin | 19.9% | Efficient operations |

| Gross Margin | 83.9% | Premium healthcare |

| ValueSense Rating | 39.6% undervalued | Value opportunity |

Investment Thesis

Novo Nordisk (NVO) is a global leader in diabetes and obesity care, with industry-leading gross margins and strong free cash flow. Despite a sharp share price decline, the PEG ratio of 0.66 and 39.6% undervaluation highlight its long-term growth potential in healthcare.

2025 Investment Strategy & Portfolio Construction

Sector Diversification Benefits

This carefully curated portfolio spans multiple high-growth sectors:

- Technology Leadership: NVDA, AVGO, TSM, CSCO, AMD, SAP

- Healthcare Innovation: LLY, UNH, NVO

- Consumer Staples: PM

Low PEG Ratio Opportunities

Best PEG Ratio Values for 2025:

Undervalued Opportunities

Value Entry Points:

Market Timing & Entry Strategies for 2025

Dollar-Cost Averaging Approach

Implement systematic investment strategies to mitigate timing risk, especially for premium-valued growth stocks like NVDA and AVGO.

Value Entry Points

Focus initial investments on undervalued opportunities like TSM, UNH, and NVO for optimal risk-adjusted returns.

Low PEG Strategy

Target stocks with PEG ratios below 1.0 such as AMD, NVDA, NVO, and LLY for superior growth potential.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Quality Large Cap Stock Picks for 2025

📖 10 Best Stock Picks for October 2025: High-Quality & Undervalued

📖 12 Best Robotics Stock Picks for 2025: In-Depth Analysis & Watchlist

📖 10 Best Stock Picks for 2025: E-commerce Watchlist & Analysis

📖 5 Best Stock Picks for October 2025: Top Undervalued Stocks

Frequently Asked Questions - 2025 Stock Picks

Q1: How were these top stocks selected for 2025?

Our selection methodology combines ValueSense intrinsic value analysis, low PEG ratio screening, and fundamental analysis focusing on financial strength, market leadership, and sustainable competitive advantages.

Q2: Which stock offers the best value opportunity?

TSM and UNH stand out for significant undervaluation combined with strong fundamentals, offering attractive risk-adjusted return potential for 2025.

Q3: What makes a good PEG ratio for stock selection?

PEG ratios below 1.0 typically indicate undervalued growth potential. Our list includes several stocks with attractive PEG ratios: AMD (0.50), NVDA (0.62), and NVO (0.66).

Q4: Should I buy all 10 stocks or focus on specific sectors?

Diversification across these complementary sectors reduces portfolio risk, but individual allocation should align with your risk tolerance and investment timeline.

Q5: What are the primary investment risks?

Key risks include valuation premiums for some stocks, sector-specific headwinds, regulatory changes, and macroeconomic uncertainty affecting growth trajectories.

2025 Investment Outlook & Final Recommendations

Summary: Best Low PEG Stocks for 2025

This comprehensive analysis identifies 10 exceptional investment opportunities combining growth potential, financial strength, and attractive valuations across key sectors driving future economic growth.

Key Investment Themes for 2025:

- Artificial Intelligence Revolution led by NVDA and TSM

- Healthcare Innovation through LLY, UNH, and NVO

- Digital Transformation via SAP and CSCO

- Global Technology Leadership across AVGO and AMD

Portfolio Construction Strategy

Balance growth and value by combining low PEG ratio stocks like AMD, NVDA, and NVO with undervalued opportunities such as TSM, UNH, and SAP.

Next Steps for Investors

Conduct additional due diligence using ValueSense tools for real-time analysis, intrinsic value updates, and portfolio optimization recommendations. Visit individual ticker pages for detailed fundamental analysis and updated PEG ratios.