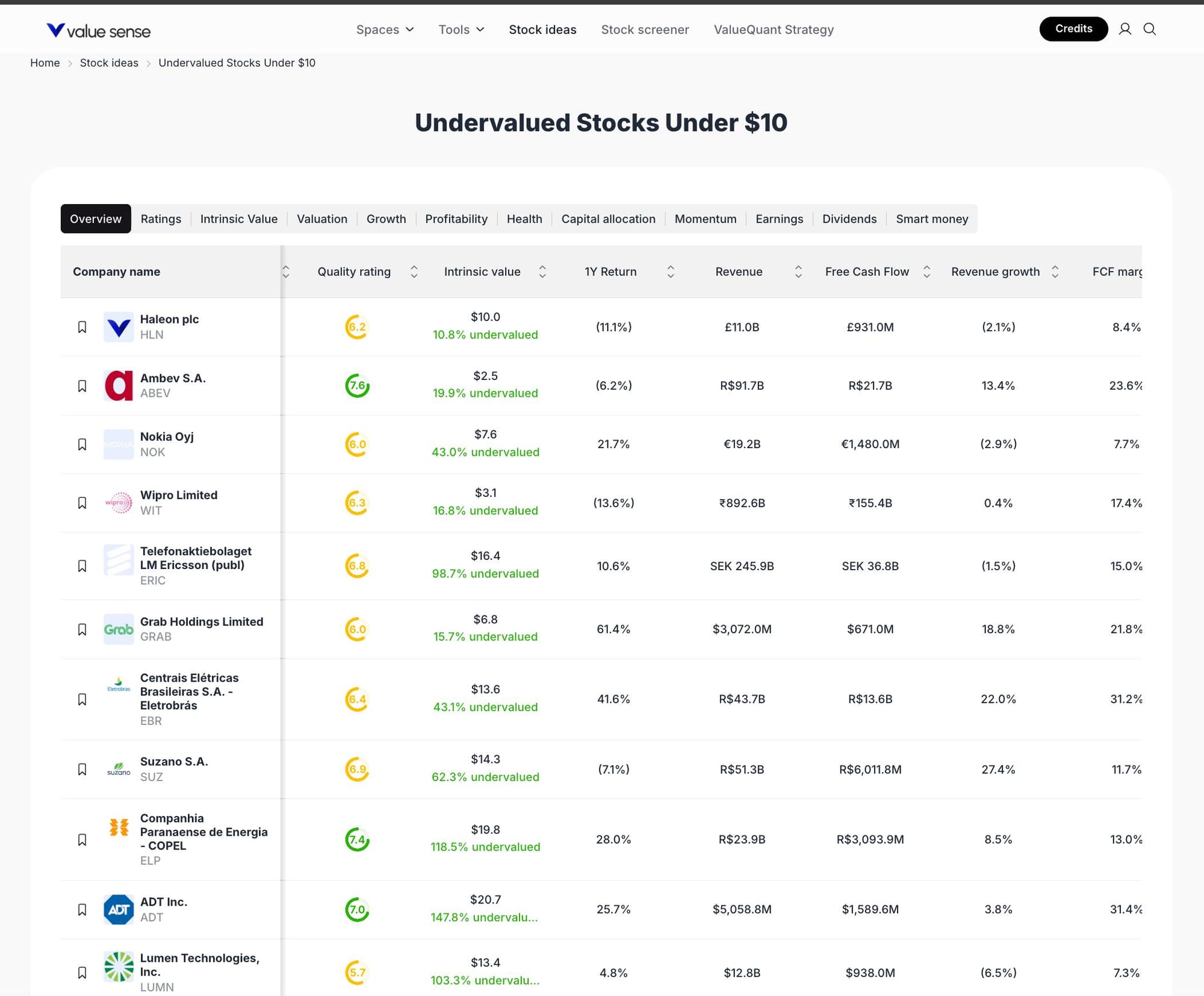

10 Best Stock Picks Under $10 for November 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

In 2025, market volatility and global macroeconomic shifts have created opportunities in undervalued equities, especially among stocks trading under $10. Our selection methodology leverages ValueSense’s proprietary intrinsic value models, focusing on quality ratings, undervaluation percentages, and robust financial health. We prioritize companies with strong free cash flow, positive revenue growth, and sectoral diversification to build a resilient watchlist.

Featured Stock Analysis

Stock #1: Haleon plc (HLN)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $10.0 |

| Intrinsic Value | 10.8% undervalued |

| 1Y Return | (11.1%) |

| Revenue | £11.0B |

| Free Cash Flow | £931.0M |

| Revenue Growth | (2.1%) |

| FCF Margin | 8.4% |

| Quality Rating | 6.2 |

Investment Thesis:

Haleon plc, a leading consumer health company, offers a compelling value proposition with its shares trading at a 10.8% discount to intrinsic value. Despite a negative 1-year return, the company maintains solid free cash flow and a stable quality rating, indicating operational resilience. The large revenue base underscores its established market presence, while the current undervaluation provides a margin of safety for long-term investors.

Haleon’s focus on essential health products supports defensive characteristics, making it less susceptible to economic downturns. The company’s ability to generate consistent cash flow, even amid modest revenue contraction, highlights prudent management and operational efficiency.

Key Catalysts:

- Defensive sector exposure (consumer health)

- Strong free cash flow generation

- Potential for margin improvement through cost optimization

Risk Factors:

- Recent negative revenue growth

- Market sentiment reflected in 1Y underperformance

- Currency fluctuations impacting reported results

Stock #2: Ambev S.A. (ABEV)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $2.5 |

| Intrinsic Value | 19.9% undervalued |

| 1Y Return | (6.2%) |

| Revenue | R$91.7B |

| Free Cash Flow | R$21.7B |

| Revenue Growth | 13.4% |

| FCF Margin | 23.6% |

| Quality Rating | 7.9 |

Investment Thesis:

Ambev S.A., a dominant player in the beverage sector, is trading at a 19.9% discount to intrinsic value. The company boasts robust revenue growth and an impressive free cash flow margin, reflecting operational efficiency and strong market demand. With a high quality rating and a low share price, Ambev presents an attractive entry point for value-focused investors.

The company’s scale in Latin America and diversified product portfolio support its growth trajectory. Ambev’s ability to convert revenue into cash flow at a high rate positions it well for reinvestment and shareholder returns.

Key Catalysts:

- Double-digit revenue growth

- High free cash flow margin

- Strong market position in Latin America

Risk Factors:

- Exposure to currency risk (Brazilian Real)

- Competitive beverage market

- Recent negative 1Y return

Stock #3: Nokia Oyj (NOK)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $3.76 |

| Intrinsic Value | 43.0% undervalued |

| 1Y Return | 21.7% |

| Revenue | €19.2B |

| Free Cash Flow | €1,480.0M |

| Revenue Growth | (2.9%) |

| FCF Margin | 7.7% |

| Quality Rating | 6.0 |

Investment Thesis:

Nokia Oyj, a global telecommunications leader, stands out with a 43% discount to intrinsic value and a positive 1-year return. The company’s strong free cash flow and significant revenue base highlight its operational scale and financial flexibility. Despite modest revenue contraction, Nokia’s turnaround efforts and exposure to 5G infrastructure provide a compelling growth narrative.

The stock’s substantial undervaluation and recent positive performance suggest renewed investor confidence, potentially driven by strategic initiatives and new technology deployments.

Key Catalysts:

- 5G infrastructure rollout

- Strong free cash flow generation

- Positive 1Y return momentum

Risk Factors:

- Revenue contraction in recent periods

- Competitive telecom equipment market

- Currency and geopolitical risks

Stock #4: Wipro Limited (WIT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $3.1 |

| Intrinsic Value | 16.8% undervalued |

| 1Y Return | (13.6%) |

| Revenue | ₹892.6B |

| Free Cash Flow | ₹155.4B |

| Revenue Growth | 0.4% |

| FCF Margin | 17.4% |

| Quality Rating | 6.3 |

Investment Thesis:

Wipro Limited, a major IT services provider, is trading at a 16.8% discount to intrinsic value. The company’s stable revenue and healthy free cash flow margin reflect its resilience in a competitive sector. Wipro’s diversified client base and focus on digital transformation services support long-term growth prospects.

Despite a negative 1-year return, Wipro’s operational efficiency and consistent cash generation provide a foundation for recovery and future expansion.

Key Catalysts:

- Digital transformation demand

- Strong free cash flow margin

- Diversified global client base

Risk Factors:

- Intense competition in IT services

- Modest revenue growth

- Currency volatility

Stock #5: Telefonaktiebolaget LM Ericsson (ERIC)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $16.4 |

| Intrinsic Value | 98.7% undervalued |

| 1Y Return | 10.6% |

| Revenue | SEK 245.9B |

| Free Cash Flow | SEK 36.8B |

| Revenue Growth | (1.5%) |

| FCF Margin | 15.0% |

| Quality Rating | 6.6 |

Investment Thesis:

Ericsson, a global telecom equipment giant, is significantly undervalued at nearly 99% below intrinsic value. The company’s positive 1-year return and strong free cash flow margin underscore its financial strength. Ericsson’s leadership in 5G technology and global network deployments position it for continued growth.

Despite slight revenue contraction, the company’s scale and technological edge provide a competitive moat. The high undervaluation offers a substantial margin of safety for investors seeking exposure to telecom infrastructure.

Key Catalysts:

- 5G network expansion

- Strong free cash flow

- Global telecom partnerships

Risk Factors:

- Revenue contraction

- Regulatory and geopolitical risks

- Competitive pressures

Stock #6: Grab Holdings Limited (GRAB)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $6.8 |

| Intrinsic Value | 15.7% undervalued |

| 1Y Return | 61.4% |

| Revenue | $3,072.0M |

| Free Cash Flow | $671.0M |

| Revenue Growth | 18.8% |

| FCF Margin | 21.8% |

| Quality Rating | 6.5 |

Investment Thesis:

Grab Holdings Limited, a leading Southeast Asian super-app, is trading at a 15.7% discount to intrinsic value. The company’s explosive 61.4% 1-year return and double-digit revenue growth highlight its rapid expansion and market dominance. Grab’s strong free cash flow margin reflects operational leverage and scalability.

The company’s diversified platform, spanning mobility, delivery, and financial services, supports sustained growth and cross-selling opportunities.

Key Catalysts:

- Rapid revenue growth

- Market leadership in Southeast Asia

- Platform diversification

Risk Factors:

- Competitive regional landscape

- Regulatory uncertainties

- Execution risk in scaling new services

Stock #7: Centrais Elétricas Brasileiras S.A. - Eletrobras (EBR)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $13.6 |

| Intrinsic Value | 43.1% undervalued |

| 1Y Return | 41.6% |

| Revenue | R$43.7B |

| Free Cash Flow | R$13.6B |

| Revenue Growth | 22.0% |

| FCF Margin | 31.2% |

| Quality Rating | 6.4 |

Investment Thesis:

Eletrobras, Brazil’s largest electricity utility, is trading at a 43.1% discount to intrinsic value. The company’s strong 1-year return and robust revenue and free cash flow growth reflect operational improvements and favorable market conditions. Eletrobras’s high free cash flow margin supports reinvestment and potential shareholder distributions.

The company’s scale and strategic importance in Brazil’s energy sector provide stability and growth potential.

Key Catalysts:

- Strong revenue and FCF growth

- Market leadership in Brazil

- Sectoral tailwinds from energy transition

Risk Factors:

- Regulatory and political risks

- Currency exposure

- Capital-intensive operations

Stock #8: Suzano S.A. (SUZ)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $14.3 |

| Intrinsic Value | 62.3% undervalued |

| 1Y Return | (7.1%) |

| Revenue | R$51.3B |

| Free Cash Flow | R$6,011.8M |

| Revenue Growth | 27.4% |

| FCF Margin | 11.7% |

| Quality Rating | 6.4 |

Investment Thesis:

Suzano S.A., a global pulp and paper leader, is trading at a 62.3% discount to intrinsic value. The company’s strong revenue growth and substantial free cash flow generation highlight its competitive advantage and operational scale. Suzano’s exposure to global commodity cycles provides both risk and opportunity.

Despite a negative 1-year return, the company’s high undervaluation and sector leadership position it as a potential turnaround candidate.

Key Catalysts:

- Global demand for pulp and paper

- Strong revenue growth

- Operational scale

Risk Factors:

- Commodity price volatility

- Currency risk

- Environmental regulations

Stock #9: Companhia Paranaense de Energia - COPEL (ELP)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $19.8 |

| Intrinsic Value | 118.5% undervalued |

| 1Y Return | 28.0% |

| Revenue | R$23.9B |

| Free Cash Flow | R$3,093.9M |

| Revenue Growth | 8.5% |

| FCF Margin | 13.0% |

| Quality Rating | 7.4 |

Investment Thesis:

COPEL, a major Brazilian utility, is trading at a remarkable 118.5% discount to intrinsic value. The company’s positive 1-year return and healthy revenue and free cash flow growth highlight its operational strength. COPEL’s high quality rating and sectoral stability make it a defensive addition to any diversified portfolio.

The company’s focus on energy infrastructure and regulated markets supports predictable cash flows and long-term value creation.

Key Catalysts:

- Defensive utility sector exposure

- Strong FCF generation

- Infrastructure investment tailwinds

Risk Factors:

- Regulatory changes

- Currency fluctuations

- Capital expenditure requirements

Stock #10: ADT Inc. (ADT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $6.7 |

| Intrinsic Value | 147.8% undervalued |

| 1Y Return | 25.7% |

| Revenue | $5,058.8M |

| Free Cash Flow | $1,589.6M |

| Revenue Growth | 3.8% |

| FCF Margin | 31.4% |

| Quality Rating | 6.7 |

Investment Thesis:

ADT Inc., a leader in home security solutions, is trading at a substantial 147.8% discount to intrinsic value. The company’s strong 1-year return, positive revenue growth, and exceptional free cash flow margin highlight its operational efficiency and market demand. ADT’s recurring revenue model and sectoral tailwinds from increased security awareness support its growth outlook.

The company’s high undervaluation and robust cash generation make it an attractive candidate for value-focused portfolios.

Key Catalysts:

- Recurring revenue from security services

- High free cash flow margin

- Sectoral growth in home automation

Risk Factors:

- Debt levels

- Competitive pressures

- Technology disruption

Stock #11: Lumen Technologies, Inc. (LUMN)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $1.4 |

| Intrinsic Value | 103.3% undervalued |

| 1Y Return | 4.8% |

| Revenue | $12.8B |

| Free Cash Flow | $938.0M |

| Revenue Growth | (6.5%) |

| FCF Margin | 7.3% |

| Quality Rating | 7.1 |

Investment Thesis:

Lumen Technologies, a major telecommunications provider, is trading at a 103.3% discount to intrinsic value. The company’s positive 1-year return and solid free cash flow generation highlight its operational resilience. Despite revenue contraction, Lumen’s focus on network modernization and digital infrastructure supports its turnaround potential.

The company’s high undervaluation and sectoral importance make it a speculative but potentially rewarding addition to a diversified watchlist.

Key Catalysts:

- Network modernization initiatives

- Positive 1Y return

- Free cash flow generation

Risk Factors:

- Revenue contraction

- High debt levels

- Competitive telecom landscape

Portfolio Diversification Insights

This watchlist spans multiple sectors, including consumer health, beverages, telecommunications, IT services, utilities, and industrials. The inclusion of both defensive (utilities, consumer health) and growth-oriented (technology, emerging markets) stocks provides sectoral balance. Exposure to Latin America, Europe, and Asia enhances geographic diversification, reducing portfolio-specific risks.

Market Timing & Entry Strategies

Given the current market volatility, consider phased entry strategies such as dollar-cost averaging to mitigate timing risk. Monitor sector-specific catalysts (e.g., 5G rollouts, energy transition, digital transformation) and macroeconomic indicators before initiating positions. Use ValueSense’s intrinsic value tools to identify optimal entry points based on updated valuations.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best Nuclear Energy Stock Picks for 2026

📖 Best Dividend Growth Stocks: 13 Quality Companies

📖 11 Best Undervalued Large Cap Moat Stocks for 2025

📖 12 Best Momentum Stock Picks for November 2025

📖 10 Best Price Dislocation Value Stocks: Stock Watchlist & Analysis

FAQ about Best Stock Picks Under $10

Q1: How were these stocks selected?

All stocks were selected using ValueSense’s proprietary intrinsic value models, focusing on undervaluation, quality ratings, and financial health as shown in the platform’s data.

Q2: What's the best stock from this list?

The “best” stock depends on individual investment goals, but ADT Inc. and COPEL stand out for their high undervaluation and strong free cash flow margins.

Q3: Should I buy all these stocks or diversify?

Diversification across sectors and geographies, as represented in this watchlist, can help manage risk and capture multiple growth opportunities.

Q4: What are the biggest risks with these picks?

Key risks include sector-specific challenges, currency fluctuations, regulatory changes, and company-specific operational risks as detailed in each analysis.

Q5: When is the best time to invest in these stocks?

Consider entering positions when stocks trade at a significant discount to intrinsic value and after reviewing sectoral and macroeconomic trends.

Summary & Investment Outlook

This ValueSense watchlist highlights 10 of the best stock picks under $10 for 2025, each selected for its undervaluation, financial strength, and sectoral relevance. By leveraging ValueSense’s research tools, investors can make informed decisions and build a diversified portfolio tailored to current market conditions. For more in-depth analysis and real-time updates, visit ValueSense.