10 stocks with good P/E ratio

What is the price to earnings ratio?

The Price-to-Earnings (P/E) ratio is a fundamental financial metric used to evaluate a company's stock valuation. It represents the relationship between a company's stock price and its earnings per share (EPS)

How to calculate P/E ratio?

The P/E ratio is calculated using the following formula:

P/E Ratio = Current Market Price of a Share / Earnings per Share (EPS)

For example, if a company's stock is trading at $100 per share and its EPS is $4, the P/E ratio would be 25 (100 / 4)

Here’s the new list of Value Sense’s top low P/E picks to buy for the third quarter of 2024 with average industry.

1. Toyota (TM)

Price to Earnings LTM: 7.1x

Industry median LTM: 11.1x

2. TotalEnergies (TTE)

Price to Earnings LTM: 7.6x

Industry median LTM: 12.6x

3. Unilever (UV)

Price to Earnings LTM: 9.7x

Industry median LTM: 22.8x

4. British American Tobacco (BTI)

Price to Earnings LTM: (2.9x)

Industry median LTM: 20.9x

5. Coca-Cola Europacific Partners (CCEP)

Price to Earnings LTM: 9.9x

Industry median LTM: 23.7x

6. Devon Energy (DVN)

Price to Earnings LTM: 7.6x

Industry median LTM: 10.3x

7. Cenovus Energy (CVE)

Price to Earnings LTM: 9.4x

Industry median LTM: 12.6x

8. Valero Energy (VLO)

Price to Earnings LTM: 7.8x

Industry median LTM: 9.1x

9. VEON (VEON)

Price to Earnings LTM: 3.3x

Industry median LTM: 15.1x

10. APA Corporation (APA)

Price to Earnings LTM: 3.4x

Industry median LTM: 10.3x

How to Apply P/E in Investing Research

This may

P/E ratios are most useful when compared across similar companies within the same industry or sector. What's considered a "good" P/E ratio can vary significantly between different types of businesses, so always evaluate a company's P/E in the context of its peers.

Industry Benchmarks

Different industries tend to have different average P/E ratios:

- The average P/E ratio for the S&P 500 is typically around 15-25.

- Some sectors, like utilities, may have lower average P/E ratios (e.g., around 10).

- High-growth industries like technology often have higher P/E ratios.

Interpreting P/E Values

- Lower P/E: This may indicate an undervalued stock or a value investment opportunity.

Higher P/E: This could suggest an overvalued stock or reflect high growth expectations.

Consider Growth Potential

The PEG (Price/Earnings to Growth) ratio can provide additional context by factoring in expected earnings growth. A PEG ratio below 1 is often considered attractive, as it may indicate the stock is undervalued relative to its growth prospects.

Use Multiple Metrics

While P/E is valuable, it shouldn't be used in isolation. Combine it with other financial metrics and qualitative factors for a comprehensive analysis

Time Frames

Consider both trailing P/E (based on past earnings) and forward P/E (based on projected future earnings) to get a more complete picture

Market Conditions

Be aware that overall market conditions can influence P/E ratios across the board. During bull markets, average P/E ratios tend to be higher.

By applying these principles, investors can use P/E ratios as an effective tool in their stock valuation and selection process. Remember that while P/E is a useful metric, it's just one piece of the puzzle in comprehensive investment research.

Value Sense helps you understand all companies' financial data, and provides essential tools.

- Historical Financial Analysis - Discover key financial statements, including income statements, balance sheets, and cash flow statements.

- Financial ratios - get access to the most important financial ratios

- Dividends analysis - understand how often a dividend is paid, get dividend yields, and find stocks with growing dividends.

- Comparison analysis - stock competitors, stock price compare, stocks comparison charts, all in one tool for stock comparison.

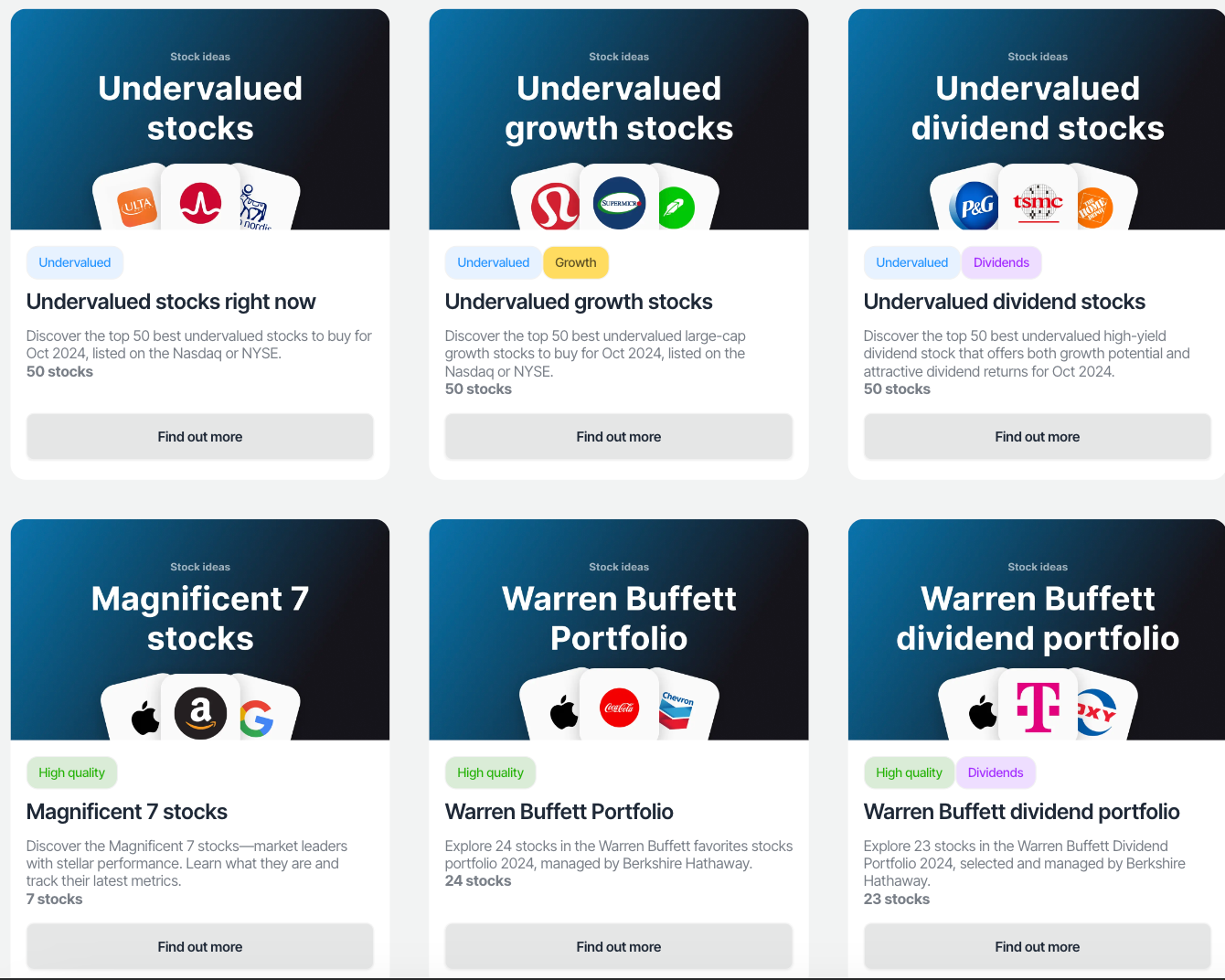

For those seeking market opportunities, our analytics team has compiled over 10 exclusive lists of undervalued and high-quality stocks:

Ready to start?

Join 3,500+ value investors worldwide