100-Baggers: Stocks That Return 100-to-1 and How to Find Them by Christopher Mayer

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

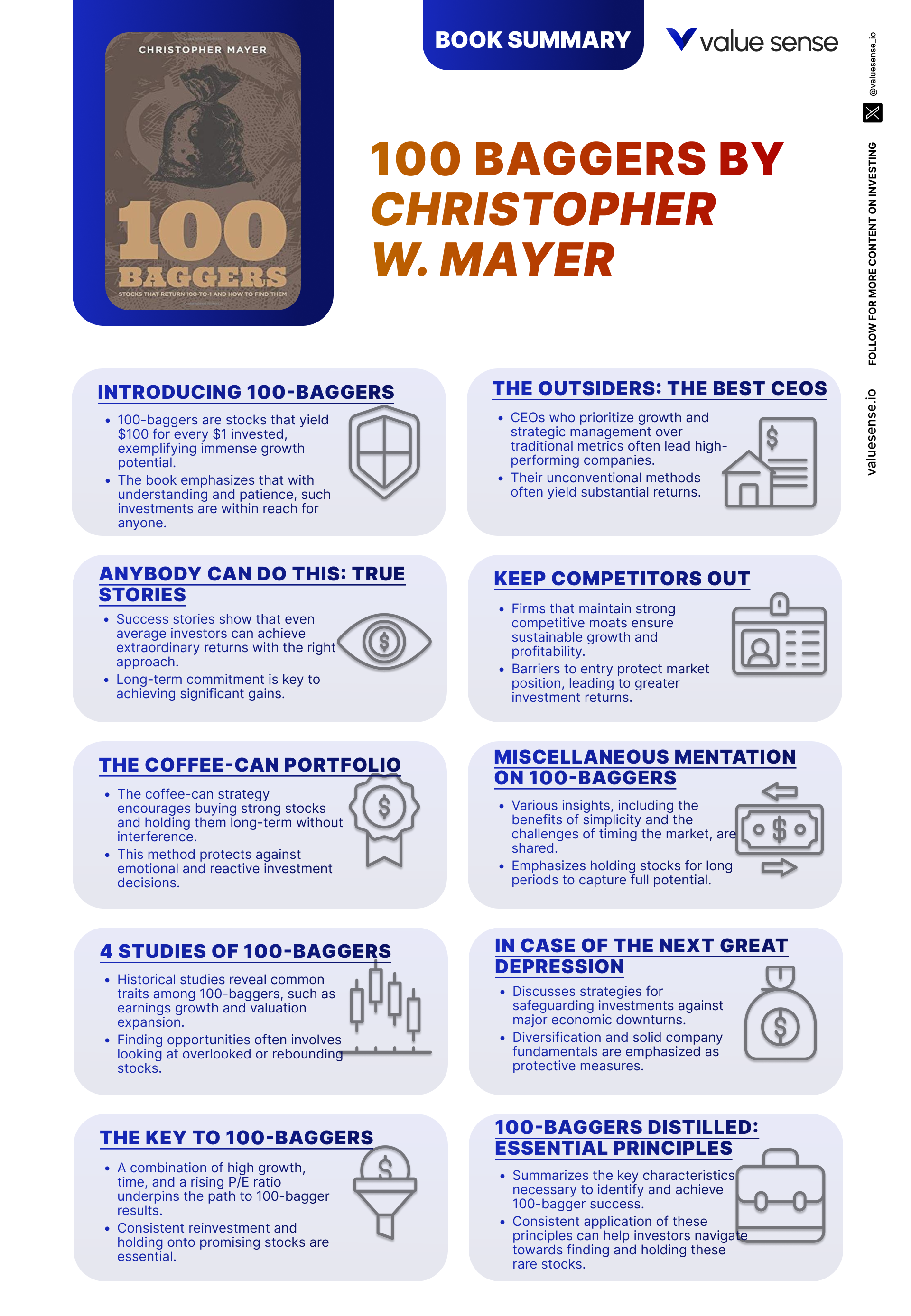

Christopher Mayer’s “100-Baggers: Stocks That Return 100-to-1 and How to Find Them” is a modern classic in the world of value investing, offering a rare and in-depth analysis of one of the most coveted outcomes in investing: turning a $1 investment into $100. Mayer, a seasoned financial journalist, portfolio manager, and publisher of the Mayer Special Situations newsletter, brings a wealth of practical experience and a passion for uncovering market-beating stocks. His background includes years of hands-on research, stock picking, and writing for investors, which infuses the book with both rigor and accessibility. Mayer’s credentials are further bolstered by his role as a managing partner at Woodlock House Family Capital, where he applies the very principles he champions in this book.

Published in 2015, “100-Baggers” arrived at a time when investors were still digesting the lessons of the 2008 financial crisis and looking for new frameworks to achieve outsized returns in a low-yield environment. The book draws inspiration from Thomas Phelps’s 1972 classic “100 to 1 in the Stock Market” but updates the research with decades of new data and a contemporary lens. Mayer’s historical context is invaluable: he not only revisits Phelps’s original case studies but also analyzes the last 50 years of stock market history to identify fresh examples of 100-baggers, offering a longer and richer perspective on what it takes to achieve these rare results.

The main theme of the book is deceptively simple: extraordinary returns are possible for ordinary investors, provided they adopt the right mindset, seek the right qualities in companies, and — most critically — hold their winners for long periods. Mayer’s purpose is to demystify the process of finding 100-baggers, showing that it is not the exclusive domain of Wall Street legends but within reach for patient, disciplined individuals. He explores the characteristics, management qualities, and market conditions that have historically produced 100-baggers, providing readers with actionable insights and a roadmap for their own investing journeys.

“100-Baggers” is considered essential reading for serious investors because it bridges the gap between inspirational stories and practical application. Unlike many investing books that focus solely on value or growth, Mayer synthesizes both approaches, emphasizing the importance of growth, management quality, and valuation discipline. The book stands out for its detailed case studies, statistical rigor, and Mayer’s candid reflections on his own investing experiences. It is especially recommended for long-term investors, value investors seeking higher returns, and anyone interested in compounding wealth over decades rather than quarters.

What makes “100-Baggers” unique is its combination of exhaustive historical research, practical frameworks, and timeless wisdom. Mayer doesn’t just recount past successes; he distills their lessons into clear principles and strategies that can be adapted to today’s markets. The book’s enduring value lies in its encouragement to think big, act patiently, and focus on the few investments that can truly transform a portfolio. For readers seeking a blend of inspiration, actionable advice, and a deep dive into the anatomy of extraordinary returns, “100-Baggers” is a must-read and a reference to return to throughout one’s investing career.

Key Themes and Concepts

“100-Baggers” weaves together several core themes that recur throughout its pages, each contributing a vital piece to the puzzle of extraordinary investment returns. Rather than offering a single formula, Mayer explores the interplay of patience, growth, management quality, and market discipline. The book’s thematic approach is both practical and philosophical, challenging investors to rethink their assumptions about what it takes to achieve life-changing wealth in the stock market.

Central to Mayer’s argument is the idea that 100-bagger stocks are not accidents or mere products of luck. Instead, they are the result of a unique combination of company characteristics, investor behavior, and market opportunities. The book is structured to help readers identify these characteristics, understand why they matter, and — most importantly — develop the discipline to act on them over long periods. Mayer’s themes are supported by historical data, case studies, and real-world examples, making each lesson actionable for investors at any experience level.

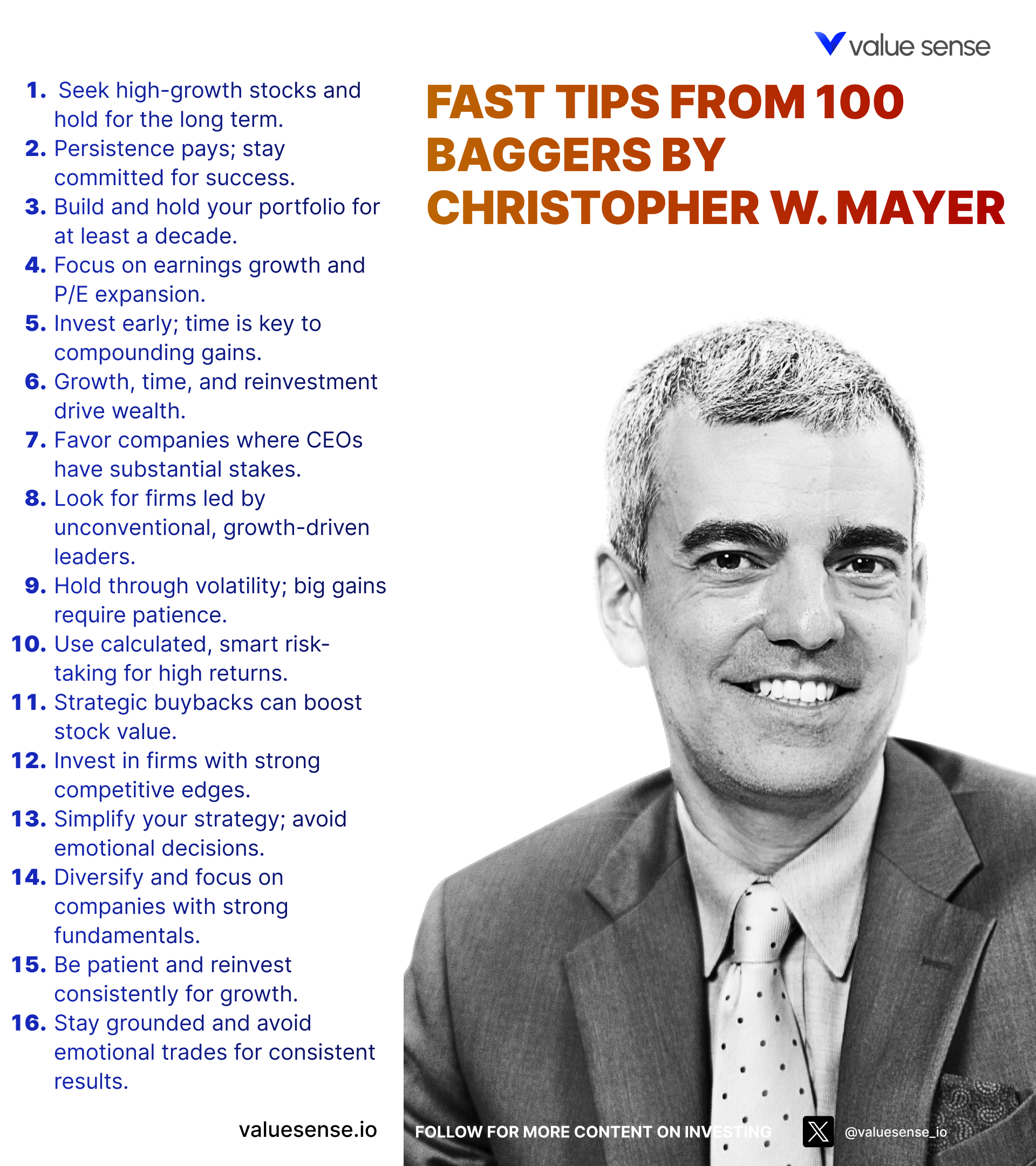

- Long-Term Holding: One of the book’s most persistent themes is the power of holding investments for decades, not just years. Mayer demonstrates, through the coffee-can portfolio concept and numerous case studies, that the most significant returns accrue to those who resist the temptation to sell early. He cites examples like Warren Buffett’s Coca-Cola investment and Peter Lynch’s 10-baggers, showing that the vast majority of a stock’s gains occur after long periods of apparent stagnation. The practical application is clear: investors must cultivate patience and resist the urge to trade frequently, focusing instead on businesses with the potential for long-term compounding.

- Growth and Market Conditions: Mayer emphasizes that rapid and sustained growth in sales, earnings, and free cash flow is a prerequisite for 100-bagger status. He analyzes historical data to show that all 100-baggers share a common trait: they were able to grow at high rates for many years, often in expanding markets or emerging industries. The book details how market conditions — such as low starting valuations and favorable industry trends — amplify the compounding effect, and why investors must seek companies with long runways for growth. Mayer’s analysis underscores the importance of identifying scalable business models and secular trends early.

- Role of Management: The quality and alignment of management is a recurring theme, with Mayer arguing that owner-operators — CEOs and founders with significant personal stakes in the company — are disproportionately represented among 100-baggers. He provides case studies of companies like Berkshire Hathaway and Monster Beverage, where management’s vision, discipline, and capital allocation decisions were crucial to long-term success. Mayer encourages investors to look for leaders who think like owners, have “skin in the game,” and demonstrate a track record of prudent decision-making.

- Investment Strategies: Mayer explores a range of strategies that contribute to outsized returns, including the use of stock buybacks, reinvestment of profits, and maintaining a competitive moat. He discusses how strategic share repurchases can accelerate per-share growth and enhance compounding, provided they are done at attractive valuations. The book also examines the importance of business model durability, low capital intensity, and the ability to fend off competition through brand, scale, or technology.

- Historical Analysis: A key strength of “100-Baggers” is its rigorous historical research. Mayer analyzes hundreds of stocks that achieved 100-bagger status, distilling their common features and cautionary tales. He draws from both Phelps’s original studies and his own updates, using data from the last 50 years to identify patterns in industry, timing, and company size. This historical perspective grounds the book’s advice in real-world outcomes, helping investors avoid survivorship bias and false patterns.

- Essential Investment Principles: The book concludes by synthesizing its lessons into a set of guiding principles for investors. Mayer stresses the importance of buying right (at reasonable valuations), holding on (through volatility and market cycles), and focusing on businesses with both high growth potential and strong management. He distills these principles into actionable checklists and mental models, ensuring that readers can translate theory into practice.

- Psychology and Discipline: While not always explicit, Mayer’s discussion of investor psychology is woven throughout the book. He warns against common behavioral pitfalls — such as impatience, overconfidence, and the tendency to sell winners too early. By highlighting the emotional challenges of holding onto big winners through inevitable drawdowns, Mayer provides strategies for developing the discipline required to realize 100-bagger outcomes.

Book Structure: Major Sections

Part 1: Introduction to 100-Baggers

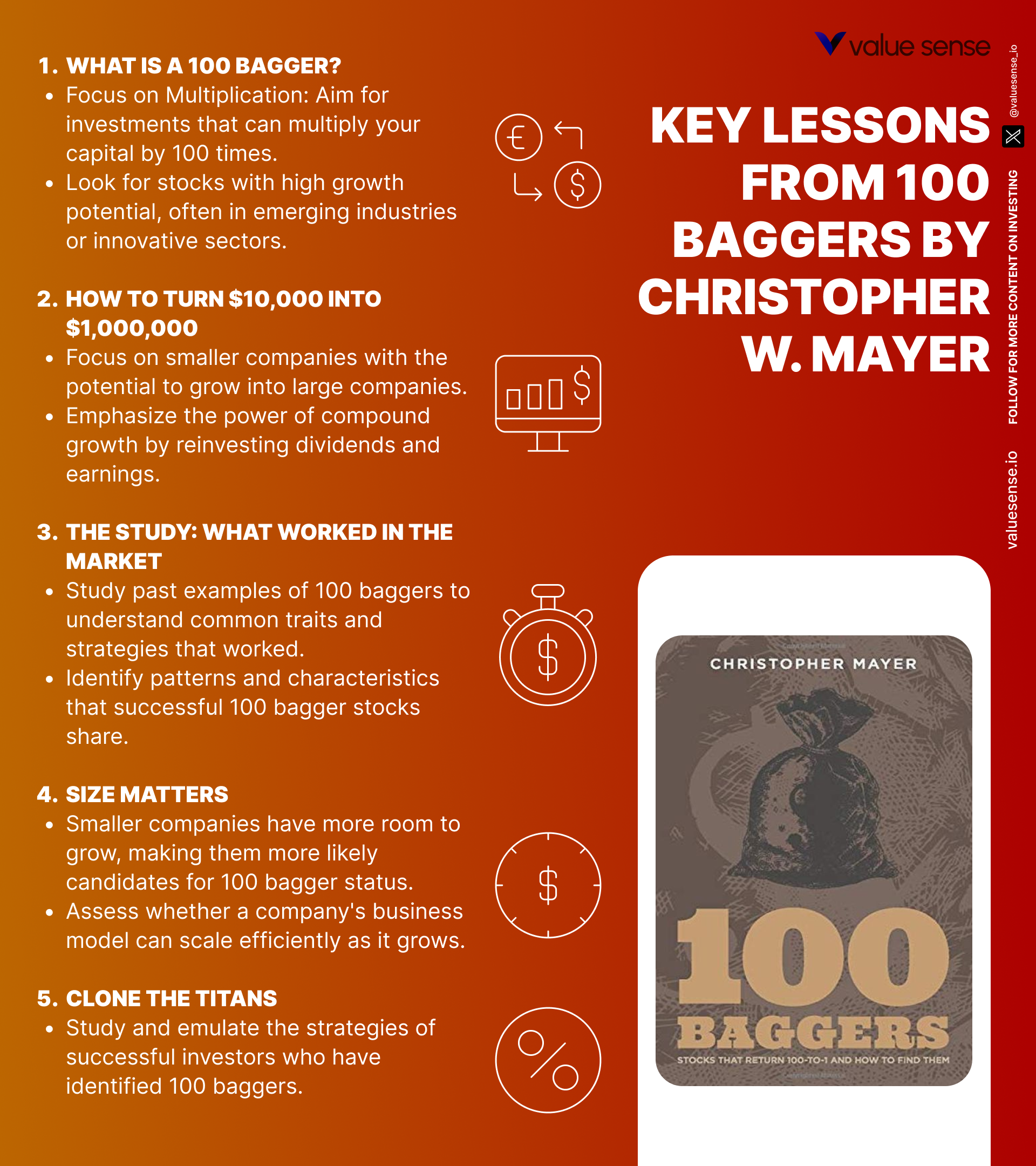

The opening section of “100-Baggers” (Chapters 1–3) lays the conceptual groundwork, introducing the reader to the idea of 100-baggers, sharing inspiring stories of ordinary investors, and presenting the coffee-can portfolio strategy. Mayer begins by defining what a 100-bagger is: a stock that returns 100 times the original investment. He sets the stage with anecdotes of investors who achieved these results, emphasizing that such outcomes are not mere anomalies. The section culminates in the introduction of the coffee-can portfolio, a metaphor for buy-and-hold investing that encourages investors to “forget” their best ideas for a decade or more.

Key concepts from these chapters include the rarity yet attainability of 100-baggers, the critical role of time in compounding, and the dangers of excessive trading. Mayer uses vivid examples, such as the story of Grace Groner, who turned a $180 investment in Abbott Laboratories into $7 million, to illustrate the power of patience. He also introduces the coffee-can portfolio, originally coined by Robert Kirby, as a practical method for avoiding the pitfalls of overactive management. The section is rich with data showing how even modest annual returns, when left to compound, can lead to extraordinary outcomes over multi-decade periods.

For investors, this section provides a mindset shift: instead of seeking quick wins, the focus should be on identifying a handful of high-quality businesses and holding them through cycles. Mayer’s advice is to resist the urge to “do something” in response to market noise and instead trust the compounding process. The coffee-can approach is particularly relevant for investors who struggle with emotional decision-making or market timing, offering a low-maintenance path to wealth accumulation.

In today’s fast-paced, information-saturated environment, the lessons of this section are more important than ever. The proliferation of trading apps and real-time data can tempt investors into frequent, costly decisions. Mayer’s advocacy for long-term holding is a timely antidote, reminding readers that the greatest fortunes are built not by constant activity but by unwavering patience and conviction.

Part 2: Characteristics and Studies of 100-Baggers

The second section (Chapters 4–6) delves into the defining characteristics of 100-baggers, presents historical studies, and identifies the key factors that enable such remarkable returns. Mayer meticulously analyzes decades of market data, updating and expanding upon Thomas Phelps’s original research. He identifies patterns among hundreds of 100-bagger stocks, highlighting the industries, company sizes, and growth rates most commonly associated with these outcomes.

Central concepts include the necessity of sustained high growth (often 20%+ annualized), the importance of starting with small or mid-cap companies, and the role of market conditions in amplifying returns. Mayer presents detailed case studies, such as Apple, Monster Beverage, and Berkshire Hathaway, to illustrate how these factors play out in real life. He also discusses the impact of valuation, showing that starting with a low price-to-earnings (P/E) ratio increases the odds of outsized gains. The section is filled with tables and charts that break down the statistical likelihood of achieving 100-bagger status across different eras and sectors.

For investors, the takeaway is clear: to find the next 100-bagger, one must look for businesses with long growth runways, robust competitive advantages, and the ability to reinvest profits at high rates of return. Mayer advises screening for companies with high returns on capital, scalable business models, and prudent capital allocation. The historical perspective also helps investors avoid chasing fads, as many 100-baggers emerged from overlooked or out-of-favor industries.

In the context of today’s market, this section’s lessons are highly relevant. The explosion of technology and healthcare innovation has created fertile ground for new 100-baggers, but the principles of durable growth and reasonable valuation remain unchanged. Mayer’s data-driven approach provides a roadmap for navigating both bull and bear markets, helping investors focus on what truly matters over the long run.

Part 3: The Role of Management and Strategy

Chapters 7–9 shift the focus to the human element: the impact of management decisions, the significance of owner-operators, and the strategic choices that drive long-term success. Mayer argues that behind every 100-bagger is a visionary leader — often a founder or CEO with significant personal ownership — who steers the company through good times and bad. This section explores the alignment of interests between management and shareholders, as well as the strategic moves that separate enduring winners from temporary high-flyers.

Key concepts include the “skin in the game” principle, where executives with large personal stakes are more likely to make shareholder-friendly decisions. Mayer provides in-depth case studies, such as Tom and Judy Love of Love’s Travel Stops and John Malone of Liberty Media, to illustrate how owner-operators drive innovation, cost discipline, and smart capital allocation. The section also examines the importance of adaptability, humility, and a long-term vision in management teams. Mayer’s research shows that companies led by owner-operators consistently outperform those run by hired managers with little personal investment.

Investors are encouraged to scrutinize management ownership, track records, and strategic decision-making processes. Mayer suggests reviewing insider filings, proxy statements, and shareholder letters for evidence of alignment and competence. He also warns against companies with excessive executive compensation or frequent management turnover, as these are red flags for misaligned incentives.

Today, the role of management is more scrutinized than ever, with activist investors and proxy battles making headlines. Mayer’s emphasis on owner-operators remains timeless, as companies like Amazon, Tesla, and Shopify demonstrate the outsized impact that visionary leadership can have on shareholder returns. The section’s lessons are essential for investors seeking to identify not just great businesses, but great stewards of capital.

Part 4: Investment Techniques and Market Considerations

The fourth section (Chapters 10–12) explores the tactical side of achieving 100-bagger returns, including investment techniques, the impact of stock buybacks, and strategies for maintaining a competitive edge. Mayer dissects the mechanics of compounding, showing how reinvestment, share repurchases, and operational efficiency can turbocharge returns. He also discusses the importance of defending a company’s moat against competitors, technological disruption, and changing consumer preferences.

Key concepts include the mathematics of buybacks — how reducing the share count increases earnings per share (EPS) and accelerates compounding — and the critical role of capital allocation. Mayer provides examples of companies that used buybacks to great effect, such as AutoZone and IBM, but also warns of the dangers of buybacks at inflated prices. The section covers strategies for identifying companies with sustainable competitive advantages, such as network effects, brand loyalty, and regulatory barriers.

For investors, the actionable takeaway is to seek out companies that generate excess cash, allocate it wisely, and have a proven track record of value-enhancing buybacks or reinvestment. Mayer encourages a focus on free cash flow yield, return on invested capital (ROIC), and the sustainability of competitive advantages. He also suggests monitoring industry dynamics to anticipate potential threats to a company’s moat.

In the modern market, where buybacks have become a central feature of corporate finance, Mayer’s nuanced analysis is invaluable. The proliferation of technology-driven disruptors means that moats are often narrower and more vulnerable, making it essential for investors to continuously assess the durability of a company’s edge. The section’s blend of quantitative and qualitative analysis equips readers with the tools to navigate this evolving landscape.

Part 5: Principles and Future Considerations

The final section (Chapters 13–15) synthesizes the book’s lessons into a set of essential principles and looks ahead to future market challenges. Mayer distills the key attributes of 100-baggers into concise guidelines, emphasizing the importance of buying right, holding through volatility, and focusing on businesses with high growth potential and strong management. He also addresses the inevitability of economic downturns, technological shifts, and changing investor sentiment, offering strategies for staying the course.

Key concepts include the “essence of 100-baggers” — a checklist of traits such as high returns on capital, owner-operator management, long growth runways, and reasonable valuations. Mayer discusses the psychological challenges of holding big winners through drawdowns and market corrections, stressing the need for discipline and conviction. The section also explores the impact of macroeconomic trends, regulatory changes, and global competition on the prospects for future 100-baggers.

For investors, this section serves as both a summary and a call to action. Mayer encourages readers to create their own checklists, document their investment theses, and regularly review their holdings for alignment with 100-bagger principles. He also advocates for humility and continuous learning, recognizing that markets are dynamic and past success does not guarantee future results.

In an era of rapid technological change and global uncertainty, the principles outlined in this section are more relevant than ever. Mayer’s emphasis on adaptability, resilience, and a long-term perspective provides a framework for navigating both opportunities and risks. The section’s forward-looking approach ensures that readers are not just armed with historical lessons, but prepared to apply them in the markets of tomorrow.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: Introducing 100-Baggers

Chapter 1 is foundational, establishing the core concept of a 100-bagger and setting the tone for the entire book. Mayer explains that a 100-bagger is a stock that multiplies an investor’s initial stake by 100, transforming modest investments into generational wealth. He articulates the significance of such returns, not just as a mathematical curiosity but as a realistic goal for disciplined, long-term investors. The chapter also introduces the author’s motivation, drawing inspiration from Thomas Phelps’s 1972 work and the desire to update and expand upon those ideas for a modern audience. This chapter is critically important because it reframes the conversation around what is possible in stock investing, challenging readers to think beyond incremental gains.

Mayer supports his argument with compelling stories and data. He recounts the tale of Grace Groner, who turned a $180 investment in Abbott Laboratories into over $7 million simply by holding her shares for decades. He also references Warren Buffett’s investments in companies like Coca-Cola, which delivered hundreds-fold returns over time. Mayer uses these examples to emphasize that 100-baggers are not unicorns reserved for the lucky or the elite; rather, they are the product of patience, discipline, and a willingness to think long-term. He provides statistics showing that dozens of stocks have achieved 100-bagger status over the past century, underscoring the attainability of this goal.

For investors, the lesson is to expand their horizons and focus on the power of compounding. Mayer encourages readers to set ambitious yet realistic goals, seek out businesses with the potential for exponential growth, and resist the temptation to settle for quick wins. He suggests that investors should regularly ask themselves whether their holdings have the characteristics necessary to become 100-baggers and to structure their portfolios accordingly. Concrete steps include screening for companies with high returns on capital, scalable business models, and visionary management.

Historically, the concept of the 100-bagger has been validated by numerous investors, from Peter Lynch to Philip Fisher. In today’s market, where short-termism and instant gratification dominate, Mayer’s message is a timely reminder of the transformative power of patience. The chapter’s examples resonate with modern readers, illustrating that extraordinary returns are possible for anyone willing to commit to the long game.

Chapter 3: The Coffee-Can Portfolio

Chapter 3 introduces the coffee-can portfolio, a simple yet powerful strategy that forms the backbone of Mayer’s approach to long-term investing. The concept, originally coined by Robert Kirby, involves selecting a portfolio of high-conviction stocks and then “forgetting” about them for a decade or more, much like placing valuables in a coffee can for safekeeping. This chapter is vital because it addresses one of the biggest obstacles to 100-bagger success: the human tendency to overtrade and second-guess investment decisions.

Mayer illustrates the coffee-can approach with anecdotes and empirical evidence. He recounts how Kirby discovered that his client’s portfolio, left untouched for years, dramatically outperformed his own actively managed accounts. Mayer supports the strategy with data showing that most of the market’s biggest winners experienced significant drawdowns — often 50% or more — on their way to 100-bagger status. He also cites studies demonstrating that frequent trading reduces returns due to transaction costs, taxes, and behavioral errors. The chapter includes quotes from investment legends like Warren Buffett, who famously said, “Our favorite holding period is forever.”

The actionable lesson for investors is to design portfolios that minimize the temptation to tinker. Mayer suggests creating a coffee-can portfolio by selecting a handful of high-quality stocks with the potential for long-term growth, documenting the investment thesis for each, and committing to hold them for at least 10 years. He recommends periodic but infrequent reviews, focusing on fundamental changes rather than price movements. The strategy is especially useful for investors who struggle with emotional decision-making or market timing.

In the era of zero-commission trading and real-time portfolio tracking, the coffee-can portfolio is more relevant than ever. Mayer’s advice helps investors avoid the traps of short-term thinking and performance chasing, promoting a disciplined, hands-off approach that maximizes the odds of capturing 100-bagger returns. The chapter’s blend of historical anecdotes and practical guidance makes it a cornerstone of the book’s philosophy.

Chapter 4: 4 Studies of 100-Baggers

Chapter 4 provides a rigorous analysis of historical 100-baggers, drawing on four major studies to identify the common traits and patterns that underpin these extraordinary outcomes. Mayer’s deep dive into the data is crucial because it moves the discussion from theory to evidence, demonstrating that 100-baggers are not just outliers but the result of identifiable factors. The chapter is important for investors seeking to move beyond anecdotes and develop a systematic approach to finding the next generation of super-stocks.

Mayer reviews studies by Thomas Phelps, William O’Neil, and his own research, each of which analyzed hundreds of stocks that achieved 100-bagger status. He finds consistent themes: high and sustained growth rates, low starting valuations, and significant insider ownership. Mayer presents tables and charts showing the distribution of 100-baggers across industries and time periods, revealing that they are not confined to a single sector or era. He also discusses the average holding periods required to achieve 100-bagger returns, often 20–30 years, and the volatility endured along the way.

For investors, the takeaway is to focus on companies with the potential for consistent, high growth and to be prepared for long holding periods. Mayer advises screening for businesses with high returns on equity, robust free cash flow, and scalable models. He also suggests paying attention to insider buying and management alignment. The chapter encourages investors to create watchlists of potential 100-baggers and monitor them for signs of sustained growth and competitive strength.

Historically, the lessons of this chapter have been borne out by subsequent market cycles. Many of the companies identified in these studies — such as Walmart, Home Depot, and Starbucks — have continued to outperform by sticking to the principles outlined by Mayer. In the current market, where new industries like cloud computing and biotechnology are emerging, the chapter’s data-driven approach provides a blueprint for identifying tomorrow’s 100-baggers.

Chapter 5: The 100-Baggers of the Last 50 Years

Chapter 5 offers a comprehensive review of the top-performing 100-baggers from the last five decades, providing invaluable context for investors seeking to understand what drives extraordinary returns. Mayer meticulously catalogs dozens of companies that achieved 100-bagger status, analyzing their industry backgrounds, business models, and growth trajectories. This chapter is critically important because it demonstrates the diversity of paths to 100-bagger outcomes and highlights the importance of both growth and market conditions.

Mayer presents detailed case studies of companies like Monster Beverage, Apple, and Berkshire Hathaway, each of which followed a unique path to 100-bagger status. He uses data to show that these companies often started as small or mid-cap firms, operated in expanding industries, and benefited from secular trends such as the rise of technology or changing consumer preferences. Mayer also examines the role of valuation, noting that many 100-baggers were initially undervalued or overlooked by the market. The chapter includes charts tracking the share price progressions of these companies, illustrating the power of compounding over decades.

For investors, the lesson is to cast a wide net and remain open to opportunities across sectors and market caps. Mayer advises looking for companies with strong growth potential, scalable business models, and the ability to reinvest profits at high rates of return. He also encourages investors to be patient, as many 100-baggers experienced long periods of underperformance before their breakthroughs. The chapter’s examples reinforce the importance of holding on through volatility and market skepticism.

In the modern context, Mayer’s analysis is particularly relevant as new industries — such as renewable energy, artificial intelligence, and biotechnology — create fertile ground for future 100-baggers. The chapter’s historical perspective helps investors avoid recency bias and recognize that today’s overlooked companies may be tomorrow’s market leaders. Mayer’s case studies provide a roadmap for identifying and nurturing the next generation of super-stocks.

Chapter 6: The Key to 100-Baggers

Chapter 6 distills the critical factors necessary for achieving 100-bagger returns, synthesizing the lessons from earlier chapters into a clear framework. Mayer identifies high and sustained growth, exceptional management, and favorable market conditions as the essential ingredients for extraordinary outcomes. This chapter is crucial because it moves from descriptive analysis to prescriptive advice, giving investors a checklist for evaluating potential 100-baggers.

Mayer uses both historical data and contemporary examples to illustrate his points. He shows that all 100-baggers share a common DNA: the ability to grow earnings and free cash flow at 20%+ annualized rates for decades, often under the stewardship of visionary leaders. Mayer cites companies like Fastenal and Amgen, which combined innovation, operational excellence, and prudent capital allocation to achieve outsized returns. He also discusses the importance of starting with a reasonable valuation, as high starting multiples can limit future compounding.

For investors, the actionable steps are to focus on identifying businesses with high returns on invested capital, durable competitive advantages, and strong reinvestment opportunities. Mayer suggests using quantitative screens to filter for these traits, followed by qualitative analysis of management quality and industry dynamics. He also recommends patience and conviction, as the path to 100-bagger status is rarely smooth or linear.

The chapter’s framework is timeless, applicable to both traditional industries and emerging sectors. In today’s market, where innovation cycles are accelerating, Mayer’s emphasis on growth, management, and valuation provides a robust foundation for long-term investing. The chapter’s blend of data, case studies, and actionable advice makes it a must-read for anyone seeking to identify the next generation of super-compounders.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 7: Owner-Operators: Skin in the Game

Chapter 7 highlights the importance of owner-operators — founders and CEOs with significant personal stakes in their companies — as a driving force behind many 100-baggers. Mayer argues that when management’s interests are aligned with those of shareholders, the odds of long-term success increase dramatically. This chapter is important because it shifts the focus from business metrics to human factors, emphasizing the role of leadership in compounding wealth.

Mayer provides compelling case studies, including Tom and Judy Love of Love’s Travel Stops and John Malone of Liberty Media, to illustrate how owner-operators make disciplined, long-term decisions that benefit shareholders. He cites data showing that companies with high insider ownership consistently outperform peers, as management is incentivized to maximize long-term value rather than short-term performance. Mayer also discusses the pitfalls of companies run by hired managers with little personal investment, highlighting the risks of misaligned incentives and agency problems.

For investors, the lesson is to prioritize companies where management has “skin in the game.” Mayer recommends reviewing insider filings, proxy statements, and shareholder communications to assess ownership levels and alignment. He also suggests looking for evidence of prudent capital allocation, such as share buybacks, dividend policies, and reinvestment decisions. The chapter provides a checklist for evaluating management quality, including tenure, track record, and communication transparency.

In the current era of activist investors and executive compensation controversies, Mayer’s emphasis on owner-operators is highly relevant. Companies like Amazon, Tesla, and Shopify demonstrate the outsized impact that visionary, aligned leadership can have on shareholder returns. The chapter’s insights help investors navigate the complex interplay of management, incentives, and long-term value creation.

Chapter 9: Secrets of an 18,000-Bagger

Chapter 9 provides a deep dive into one of the most extraordinary success stories in investing: a stock that returned 18,000 times the original investment. Mayer analyzes the factors that enabled this exceptional outcome, offering valuable lessons for investors seeking to identify the next generation of super-compounders. The chapter is important because it illustrates the power of compounding and the unique combination of traits required for truly outsized returns.

Mayer details the story of Monster Beverage, which transformed from a small, niche company into a global powerhouse. He examines the company’s relentless focus on innovation, brand building, and operational efficiency, as well as the pivotal role of management in navigating competitive threats and market shifts. Mayer uses data to show how Monster’s sustained high growth, reinvestment of profits, and disciplined capital allocation created a virtuous cycle of compounding. The chapter also highlights the volatility and skepticism the company faced along the way, emphasizing the importance of conviction and patience.

For investors, the actionable takeaway is to look for companies with similar characteristics: strong brands, scalable business models, and management teams with a track record of innovation and discipline. Mayer advises monitoring key performance indicators such as revenue growth, profit margins, and return on invested capital. He also suggests being prepared for volatility and maintaining conviction in the face of market skepticism, as the path to extraordinary returns is rarely smooth.

In the context of today’s market, Monster Beverage’s story is a powerful reminder that the next 100- or 1,000-bagger may currently be hiding in plain sight. Mayer’s analysis provides a blueprint for identifying and nurturing these opportunities, encouraging investors to think big, act patiently, and focus on the long-term drivers of value creation.

Chapter 11: Stock Buybacks: Accelerate Returns

Chapter 11 explores the mechanics and impact of stock buybacks, demonstrating how they can accelerate shareholder returns and contribute to 100-bagger outcomes. Mayer explains that buybacks, when executed at attractive valuations, reduce the share count and increase earnings per share, amplifying the compounding effect. This chapter is important because it provides a nuanced understanding of a common but often misunderstood capital allocation tool.

Mayer presents data showing that many 100-baggers used buybacks strategically to enhance per-share growth. He cites examples like AutoZone, which consistently repurchased shares at low valuations, driving substantial increases in EPS and shareholder value. Mayer also warns of the dangers of buybacks at inflated prices, highlighting cases where poorly timed repurchases destroyed value. The chapter includes quotes from Warren Buffett and other investment legends on the importance of disciplined capital allocation.

For investors, the lesson is to seek out companies with a history of value-enhancing buybacks and to scrutinize the timing and rationale behind repurchase programs. Mayer recommends analyzing free cash flow yield, return on invested capital, and management’s track record of capital allocation. He also suggests monitoring insider buying and ownership levels as indicators of alignment and confidence in the company’s prospects.

In the modern market, where buybacks have become a central feature of corporate finance, Mayer’s analysis is especially relevant. The chapter’s insights help investors distinguish between companies that use buybacks to create long-term value and those that use them to mask operational weaknesses or boost short-term metrics. Mayer’s framework equips investors to evaluate buyback programs critically and incorporate them into their search for future 100-baggers.

Chapter 15: 100-Baggers Distilled: Essential Principles

Chapter 15 serves as the book’s capstone, distilling the lessons of “100-Baggers” into a concise set of guiding principles for investors. Mayer synthesizes the characteristics, strategies, and mindsets that underpin extraordinary returns, providing a practical checklist for those seeking to replicate these outcomes. This chapter is critically important because it translates the book’s research and case studies into actionable advice that can be applied across market cycles and industries.

Mayer summarizes the key principles of 100-bagger investing: focus on high-growth companies with durable competitive advantages, prioritize owner-operator management, buy at reasonable valuations, and hold for the long term. He provides a checklist of traits to look for, including high returns on capital, scalable business models, and a history of prudent capital allocation. Mayer also emphasizes the importance of patience, discipline, and the willingness to endure volatility and skepticism from the market. The chapter includes quotes from investment legends and practical frameworks for evaluating potential 100-baggers.

For investors, the actionable steps are to create a personal checklist based on Mayer’s principles, screen for companies that meet these criteria, and commit to holding through market cycles. Mayer encourages regular review of investment theses, ongoing monitoring of company fundamentals, and continuous learning from both successes and failures. The chapter’s frameworks can be adapted to different investment styles and market environments, making them universally applicable.

In today’s rapidly changing market, Mayer’s distilled principles provide a timeless foundation for long-term success. The chapter’s emphasis on adaptability, humility, and continuous improvement ensures that investors are equipped to navigate both opportunities and challenges. Mayer’s synthesis of research, case studies, and practical advice makes Chapter 15 an essential reference for anyone committed to the pursuit of extraordinary returns.

Practical Investment Strategies

- Build a Coffee-Can Portfolio: Begin by identifying 10–15 high-quality, growth-oriented stocks with strong fundamentals, owner-operator management, and reasonable valuations. Document your investment thesis for each holding, then commit to a minimum holding period of 10 years. Avoid the temptation to tinker or trade based on short-term news. Set a calendar reminder to review the portfolio only once per year, focusing on significant business changes rather than price fluctuations. This strategy leverages the power of compounding and minimizes behavioral errors.

- Screen for High Growth and High Returns on Capital: Use quantitative tools to filter for companies with a consistent track record of 15–20%+ annualized growth in sales, earnings, and free cash flow. Prioritize businesses with high returns on invested capital (ROIC) and strong reinvestment opportunities. Evaluate industry growth rates and secular trends to ensure a long runway for expansion. Tools like ValueSense’s AI-powered screener can automate much of this process, allowing you to focus on qualitative analysis.

- Focus on Owner-Operators and Insider Alignment: Analyze insider filings and proxy statements to identify companies where management owns a significant percentage of shares. Look for evidence of prudent capital allocation, such as value-enhancing buybacks, dividend policies, and conservative debt levels. Companies with aligned leadership are more likely to make long-term decisions that benefit shareholders. Incorporate management interviews, shareholder letters, and track records into your due diligence process.

- Monitor and Evaluate Stock Buyback Programs: Track companies’ share repurchase activity, focusing on those that buy back stock at attractive valuations and with excess free cash flow. Evaluate the impact of buybacks on earnings per share and long-term compounding. Avoid companies that finance buybacks with excessive debt or use them to mask operational weaknesses. Use metrics like buyback yield and insider buying as additional filters when screening for potential 100-baggers.

- Seek Out Durable Competitive Advantages: Assess each company’s moat by analyzing their brand strength, network effects, regulatory barriers, and switching costs. Use Porter’s Five Forces or similar frameworks to evaluate competitive positioning. Focus on businesses with low capital intensity, high customer retention, and the ability to fend off disruptors. Regularly review industry trends and potential threats to ensure the moat remains intact over time.

- Embrace Volatility and Hold Through Drawdowns: Prepare mentally for significant price volatility and drawdowns, which are inevitable on the path to 100-bagger returns. Develop a checklist of reasons to hold or sell, based on business fundamentals rather than market sentiment. Use historical examples of 100-baggers that endured 50%+ drawdowns as a reminder to stay the course. Consider journaling your investment decisions to reinforce discipline and reduce emotional reactions.

- Balance Portfolio Concentration with Diversification: While 100-bagger investing often requires concentrated bets on high-conviction ideas, maintain some diversification to reduce company-specific risk. Limit any single position to no more than 10–15% of your portfolio, and ensure exposure to multiple industries and secular trends. Rebalance only in response to major business changes, not short-term price movements. This approach optimizes risk-adjusted returns while preserving the potential for outsized gains.

- Regularly Review and Update Your Investment Thesis: Set a structured schedule (e.g., annually or semi-annually) to review each holding’s business performance, management quality, and industry dynamics. Update your investment thesis as new information emerges, but avoid knee-jerk reactions to short-term volatility. Use a checklist to ensure each company still meets the criteria for potential 100-bagger status. Document lessons learned from both successes and failures to continuously refine your process.

Modern Applications and Relevance

The principles outlined in “100-Baggers” are as relevant today as they were when the book was published, if not more so. In an era of rapid technological change, global competition, and unprecedented access to information, the ability to identify and hold onto extraordinary companies is a rare but powerful advantage. Mayer’s emphasis on long-term holding, owner-operator management, and disciplined capital allocation provides a timeless framework that can be applied across market cycles and industries.

Since the book’s publication, several trends have reinforced its core messages. The rise of zero-commission trading and the proliferation of real-time financial data have made it easier than ever for investors to fall into the trap of overtrading and short-term thinking. Mayer’s advocacy for the coffee-can portfolio is a powerful antidote, encouraging investors to focus on what truly matters: business fundamentals, growth potential, and management quality. The explosion of technology and innovation has also created new opportunities for 100-bagger outcomes, particularly in sectors like software, healthcare, and renewable energy.

At the same time, some aspects of the market have changed. Increased competition, shorter innovation cycles, and the rise of passive investing have made it more challenging to find undiscovered gems. However, Mayer’s focus on durable competitive advantages and high returns on capital remains a reliable filter for separating potential winners from the crowd. The book’s emphasis on owner-operator alignment is especially relevant in an age of frequent management turnover and executive compensation controversies.

Modern examples abound. Companies like Shopify, Tesla, and MercadoLibre have delivered 100-bagger returns for early investors by combining visionary leadership, scalable business models, and relentless innovation. These stories validate Mayer’s principles and demonstrate that extraordinary returns are still possible for those willing to think long-term and act with conviction. The ongoing success of these companies also highlights the importance of monitoring industry trends and adapting to new market realities.

In summary, “100-Baggers” provides a roadmap for navigating both the timeless and evolving aspects of investing. Its lessons are universally applicable, offering guidance for investors seeking to build generational wealth in any market environment. By focusing on growth, management, and discipline, readers can position themselves to capture the next wave of extraordinary returns.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Define Your Investment Universe: Begin by screening for small- and mid-cap companies with high historical growth rates, strong returns on invested capital, and evidence of durable competitive advantages. Use quantitative filters to narrow the universe to 50–100 candidates, then conduct qualitative research to assess management quality and industry dynamics. Allocate 2–4 weeks to this initial research phase, leveraging tools like ValueSense’s stock screener for efficiency.

- Develop a Coffee-Can Portfolio Strategy: Select 10–15 high-conviction stocks from your research list, focusing on those with owner-operator management, scalable business models, and reasonable valuations. Document your investment thesis for each holding, including growth drivers, competitive advantages, and key risks. Commit to a minimum holding period of 10 years, with a scheduled annual review to assess business fundamentals rather than short-term price movements.

- Construct and Allocate Your Portfolio: Allocate capital evenly across your selected holdings, with no single position exceeding 10–15% of the total portfolio. Ensure diversification across industries and secular trends to mitigate company-specific risk. Consider a phased approach to building positions, averaging in over several months to minimize the impact of market volatility. Maintain a cash buffer of 5–10% for opportunistic additions or unforeseen liquidity needs.

- Establish an Ongoing Review and Management Process: Set a structured review schedule — annually or semi-annually — to evaluate each holding’s business performance, management alignment, and industry outlook. Use a checklist to ensure each company still meets the criteria for potential 100-bagger status. Document any changes to your investment thesis and avoid making decisions based on short-term price fluctuations. Rebalance the portfolio only in response to significant business changes, such as management turnover or loss of competitive advantage.

- Commit to Continuous Improvement and Learning: Regularly read shareholder letters, annual reports, and industry research to stay informed about your holdings and the broader market. Attend investor conferences, listen to management calls, and engage with other long-term investors to refine your process. Maintain a journal of investment decisions and outcomes, using both successes and failures as learning opportunities. Consider joining investment communities or leveraging resources like ValueSense’s research library for ongoing education and idea generation.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About 100-Baggers: Stocks That Return 100-to-1 and How to Find Them

1. What is a 100-bagger, and how rare are they?

A 100-bagger is a stock that increases in value by 100 times the original investment, turning $1,000 into $100,000. While rare, Christopher Mayer’s research shows that dozens of stocks have achieved this feat over the past 50 years, often by combining high growth, strong management, and long-term holding. The book demonstrates that 100-baggers are not just historical anomalies but attainable goals for disciplined investors willing to think long-term and act with patience.

2. How does the coffee-can portfolio strategy work?

The coffee-can portfolio involves selecting a group of high-conviction stocks and holding them for at least 10 years without trading or interference. This approach minimizes behavioral errors, reduces transaction costs, and allows the power of compounding to work over decades. The strategy is especially effective for investors who struggle with emotional decision-making or are tempted by short-term market fluctuations.

3. What are the most important qualities to look for in a potential 100-bagger?

Key qualities include high and sustained growth (20%+ annualized), strong returns on capital, owner-operator management with significant insider ownership, and a durable competitive advantage. Mayer also emphasizes the importance of starting with reasonable valuations and the ability to reinvest profits at high rates of return. These traits increase the likelihood of a company achieving extraordinary long-term returns.

4. How should investors handle volatility and large drawdowns on the path to 100-bagger returns?

Investors should expect and embrace significant volatility, as even the best-performing stocks often experience 50%+ drawdowns on their journey to 100-bagger status. Mayer recommends focusing on business fundamentals rather than price movements, maintaining conviction in the investment thesis, and using historical examples as reassurance. Discipline, patience, and a long-term perspective are essential for weathering market turbulence.

5. Can the principles in “100-Baggers” be applied to today’s fast-changing markets?

Absolutely. Mayer’s principles — long-term holding, focus on growth and management quality, and disciplined capital allocation — are timeless and universally applicable. While technology and industry dynamics have evolved, the core drivers of 100-bagger outcomes remain unchanged. Modern examples like Tesla, Shopify, and MercadoLibre illustrate that extraordinary returns are still possible for investors who apply these principles with discipline and conviction.