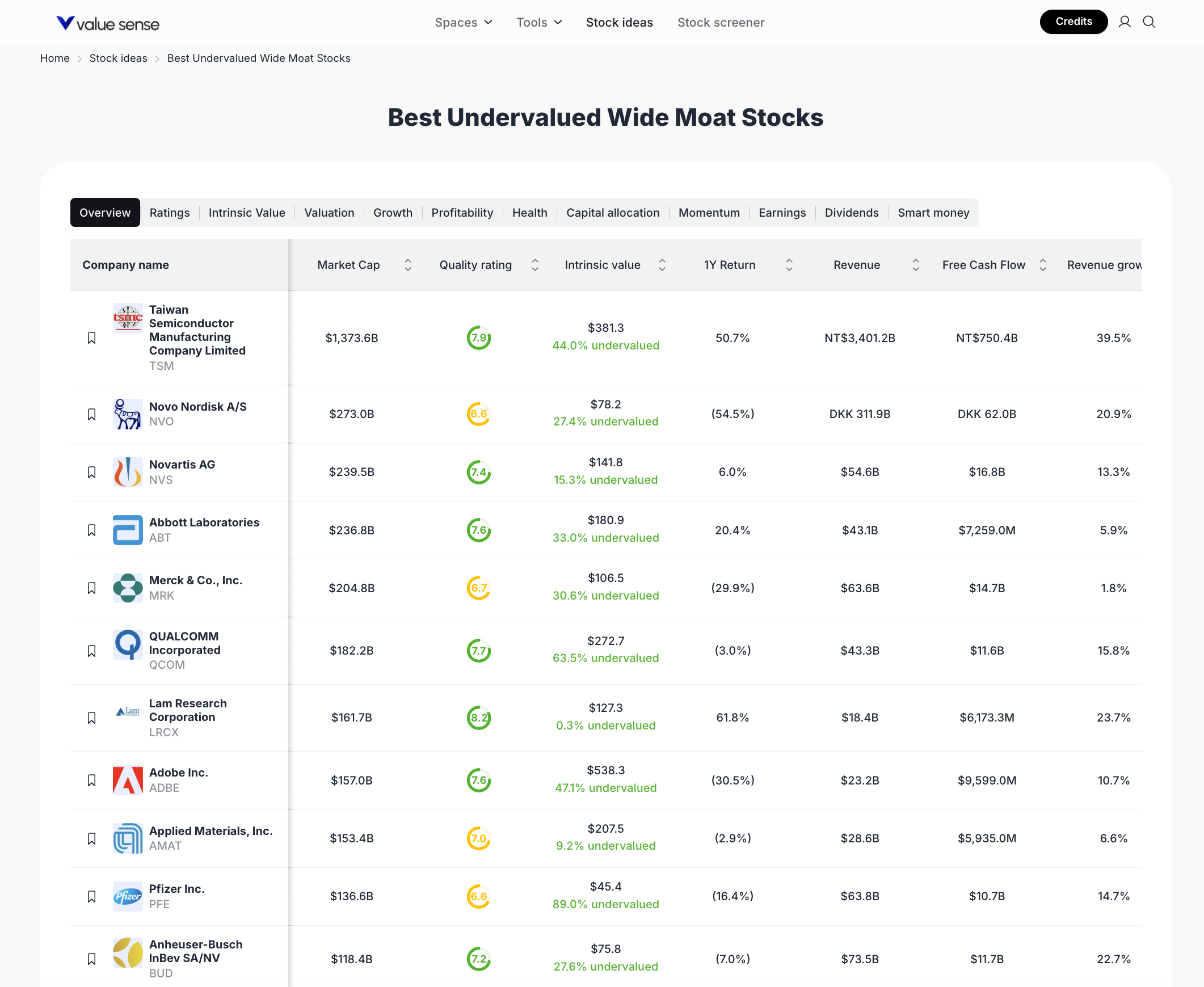

11 Best Stock Picks for 2025: Wide Moat Leaders to Watch

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

The 2025 market landscape is shaped by persistent volatility, sector rotation, and a renewed focus on intrinsic value. Our selection methodology prioritizes companies with wide economic moats, robust free cash flow, and strong quality ratings. Each stock is screened for undervaluation relative to its intrinsic value, with additional emphasis on revenue growth, sector leadership, and resilience to macroeconomic headwinds. This approach ensures a diversified watchlist of stocks with both defensive and growth characteristics.

Featured Stock Analysis

Stock #1: Taiwan Semiconductor Manufacturing Company Limited (TSMC)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $1,373.6B |

| Quality Rating | 7.9 |

| Intrinsic Value | $381.3 (44.0% undervalued) |

| 1Y Return | 50.7% |

| Revenue | NT$3,401.2B |

| Free Cash Flow | NT$750.4B |

| Revenue Growth | 39.5% |

Investment Thesis

TSMC stands as the world's leading independent semiconductor foundry, commanding a dominant position in advanced chip manufacturing. Its wide moat is underpinned by technological leadership, scale, and high switching costs for global clients. The company’s robust free cash flow and double-digit revenue growth highlight its operational excellence and ability to capitalize on secular trends in AI, 5G, and high-performance computing.

Despite a strong 50.7% one-year return, TSMC remains 44% undervalued relative to its intrinsic value, indicating significant upside potential. The company’s scale and innovation pipeline position it to benefit from ongoing digital transformation and global chip demand.

Key Catalysts

- Continued global chip shortages and rising demand for advanced nodes

- Expansion into new markets (AI, automotive, IoT)

- Strategic partnerships with leading tech firms

Risk Factors

- Geopolitical tensions impacting supply chain and operations

- Cyclical downturns in semiconductor demand

- High capital expenditure requirements

Stock #2: Novo Nordisk A/S (NVO)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $273.0B |

| Quality Rating | 6.6 |

| Intrinsic Value | $78.2 (27.4% undervalued) |

| 1Y Return | -54.5% |

| Revenue | DKK 311.9B |

| Free Cash Flow | DKK 62.0B |

| Revenue Growth | 20.9% |

Investment Thesis

Novo Nordisk is a global leader in diabetes care and obesity treatments, with a strong moat built on proprietary drug portfolios and a dominant market share. Despite a sharp one-year decline (-54.5%), the company’s fundamentals remain resilient, supported by robust free cash flow and healthy revenue growth.

Trading at a 27.4% discount to intrinsic value, Novo Nordisk offers a compelling opportunity for investors seeking exposure to long-term healthcare trends, particularly in chronic disease management and innovative therapies.

Key Catalysts

- Expanding GLP-1 drug franchise for diabetes and obesity

- Pipeline advancements in metabolic and rare diseases

- Global demographic trends driving demand

Risk Factors

- Patent expirations and biosimilar competition

- Regulatory and pricing pressures in key markets

- Currency fluctuations impacting international revenues

Stock #3: Novartis AG (NVS)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $239.5B |

| Quality Rating | 7.4 |

| Intrinsic Value | $141.8 (15.3% undervalued) |

| 1Y Return | 6.0% |

| Revenue | $54.6B |

| Free Cash Flow | $16.8B |

| Revenue Growth | 13.3% |

Investment Thesis

Novartis is a diversified pharmaceutical giant with a broad portfolio spanning innovative medicines and generics. Its wide moat is reinforced by a strong R&D engine and global scale. The company’s steady revenue growth and solid free cash flow support ongoing investment in breakthrough therapies.

Currently 15.3% undervalued, Novartis offers a blend of defensive characteristics and growth optionality, making it attractive for investors seeking stability and innovation in healthcare.

Key Catalysts

- Launch of new blockbuster drugs

- Expansion in emerging markets

- Strategic divestitures and portfolio optimization

Risk Factors

- Regulatory hurdles for new drug approvals

- Pricing pressures in developed markets

- Patent cliffs impacting legacy products

Stock #4: Abbott Laboratories (ABT)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $236.8B |

| Quality Rating | 7.6 |

| Intrinsic Value | $180.9 (33.0% undervalued) |

| 1Y Return | 20.4% |

| Revenue | $43.1B |

| Free Cash Flow | $7,259.0M |

| Revenue Growth | 5.9% |

Investment Thesis

Abbott Laboratories is a global leader in medical devices, diagnostics, and nutrition. Its wide moat is anchored by a diversified product portfolio and strong brand recognition. The company’s consistent free cash flow and above-market quality rating highlight operational strength.

With shares 33% undervalued, Abbott is well-positioned to benefit from aging populations, rising healthcare spending, and innovation in diagnostics and medical technology.

Key Catalysts

- Growth in diabetes care and diagnostics

- Expansion in emerging markets

- Product innovation and new launches

Risk Factors

- Regulatory risks in medical device approvals

- Currency headwinds

- Competitive pressures in core segments

Stock #5: Merck & Co., Inc. (MRK)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $204.8B |

| Quality Rating | 6.7 |

| Intrinsic Value | $106.5 (30.6% undervalued) |

| 1Y Return | -29.9% |

| Revenue | $63.6B |

| Free Cash Flow | $14.7B |

| Revenue Growth | 1.8% |

Investment Thesis

Merck is a pharmaceutical powerhouse with a focus on oncology, vaccines, and animal health. Its wide moat is driven by blockbuster drugs and a robust R&D pipeline. Despite a challenging year (-29.9% return), Merck’s fundamentals remain solid, with significant undervaluation and strong free cash flow.

The stock’s 30.6% discount to intrinsic value offers a margin of safety for investors seeking exposure to healthcare innovation and defensive growth.

Key Catalysts

- Expansion of oncology portfolio (e.g., Keytruda)

- New vaccine approvals

- Strategic partnerships and acquisitions

Risk Factors

- Patent expirations and biosimilar threats

- Regulatory and litigation risks

- Slower revenue growth in mature markets

Stock #6: QUALCOMM Incorporated (QCOM)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $182.2B |

| Quality Rating | 7.7 |

| Intrinsic Value | $272.7 (63.5% undervalued) |

| 1Y Return | -3.0% |

| Revenue | $43.3B |

| Free Cash Flow | $11.6B |

| Revenue Growth | 15.8% |

Investment Thesis

QUALCOMM is a global leader in wireless technology and semiconductors, with a wide moat built on intellectual property and industry standards. The company’s strong quality rating and substantial undervaluation (63.5%) make it a standout in the tech sector.

QUALCOMM’s innovation in 5G, IoT, and automotive chips positions it for long-term growth, while its robust free cash flow supports ongoing R&D and shareholder returns.

Key Catalysts

- 5G adoption and device proliferation

- Expansion into automotive and IoT markets

- Licensing revenue growth

Risk Factors

- Patent litigation and regulatory scrutiny

- Cyclical demand in consumer electronics

- Competitive pressures from global peers

Stock #7: Lam Research Corporation (LRCX)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $161.7B |

| Quality Rating | 6.2 |

| Intrinsic Value | $127.3 (3.0% undervalued) |

| 1Y Return | 61.8% |

| Revenue | $18.4B |

| Free Cash Flow | $6,173.3M |

| Revenue Growth | 23.7% |

Investment Thesis

Lam Research is a leading supplier of wafer fabrication equipment to the semiconductor industry. Its wide moat is anchored by technological leadership and deep customer relationships. The company’s impressive 61.8% one-year return and strong revenue growth reflect robust demand for advanced manufacturing solutions.

While only 3% undervalued, Lam Research’s high free cash flow and sector tailwinds make it a compelling addition for investors seeking exposure to semiconductor capital equipment.

Key Catalysts

- Growth in advanced semiconductor manufacturing

- Expansion in memory and logic markets

- Strategic partnerships with leading chipmakers

Risk Factors

- Cyclical nature of semiconductor industry

- High R&D and capital expenditure requirements

- Customer concentration risk

Stock #8: Adobe Inc. (ADBE)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $157.0B |

| Quality Rating | 7.6 |

| Intrinsic Value | $538.3 (47.1% undervalued) |

| 1Y Return | -30.5% |

| Revenue | $23.2B |

| Free Cash Flow | $9,599.0M |

| Revenue Growth | 10.7% |

Investment Thesis

Adobe is a global software leader with a wide moat built on creative and digital media dominance. The company’s high quality rating and substantial undervaluation (47.1%) suggest significant upside potential.

Despite a challenging year, Adobe’s recurring revenue model, innovation in AI-powered tools, and strong free cash flow support its long-term growth trajectory.

Key Catalysts

- Expansion of Creative Cloud and Document Cloud

- Integration of AI and machine learning features

- Growth in digital marketing solutions

Risk Factors

- Competitive pressures from emerging software providers

- Subscription model churn risk

- Macroeconomic sensitivity in enterprise spending

Stock #9: Applied Materials, Inc. (AMAT)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $153.4B |

| Quality Rating | 7.0 |

| Intrinsic Value | $207.5 (9.2% undervalued) |

| 1Y Return | -2.9% |

| Revenue | $28.6B |

| Free Cash Flow | $5,935.0M |

| Revenue Growth | 6.6% |

Investment Thesis

Applied Materials is a leading supplier of equipment, services, and software for semiconductor manufacturing. Its wide moat is driven by technology leadership and deep integration with global chipmakers. The company’s steady free cash flow and modest undervaluation (9.2%) offer a balanced risk-reward profile.

Applied Materials is well-positioned to benefit from secular growth in semiconductors, driven by AI, cloud, and automotive demand.

Key Catalysts

- Growth in advanced chip manufacturing

- Expansion into new materials and processes

- Strategic customer partnerships

Risk Factors

- Cyclical demand in semiconductor industry

- High R&D and capital intensity

- Global supply chain disruptions

Stock #10: Pfizer Inc. (PFE)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $136.6B |

| Quality Rating | 6.8 |

| Intrinsic Value | $45.4 (89.0% undervalued) |

| 1Y Return | -16.4% |

| Revenue | $63.8B |

| Free Cash Flow | $10.7B |

| Revenue Growth | 14.7% |

Investment Thesis

Pfizer is a global pharmaceutical leader with a wide moat built on a diverse drug portfolio and strong R&D capabilities. The company’s 89% undervaluation signals deep value, especially given its solid free cash flow and double-digit revenue growth.

Pfizer’s ongoing innovation and expansion into new therapeutic areas support its long-term growth outlook, despite recent share price weakness.

Key Catalysts

- Launch of new vaccines and therapeutics

- Expansion in emerging markets

- Strategic acquisitions and partnerships

Risk Factors

- Patent expirations and generic competition

- Regulatory and litigation risks

- Revenue volatility post-pandemic

Stock #11: Anheuser-Busch InBev SA/NV (BUD)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $118.4B |

| Quality Rating | 6.8 |

| Intrinsic Value | $75.8 (27.6% undervalued) |

| 1Y Return | -7.0% |

| Revenue | $73.5B |

| Free Cash Flow | $11.7B |

| Revenue Growth | 22.7% |

Investment Thesis

Anheuser-Busch InBev is a global beverage giant with a wide moat built on iconic brands and global distribution. The company’s strong free cash flow and double-digit revenue growth highlight its resilience and pricing power.

Trading at a 27.6% discount to intrinsic value, BUD offers exposure to consumer staples with a growth kicker from emerging markets and premiumization trends.

Key Catalysts

- Expansion in emerging markets

- Premiumization of product portfolio

- Cost optimization initiatives

Risk Factors

- Currency and commodity price volatility

- Regulatory and tax risks in key markets

- Shifts in consumer preferences

Portfolio Diversification Insights

This watchlist spans technology, healthcare, and consumer staples, offering a blend of growth and defensive sectors. The inclusion of semiconductor leaders (TSMC, QUALCOMM, Lam Research, Applied Materials), pharmaceutical giants (Novo Nordisk, Novartis, Merck, Pfizer, Abbott), and a global beverage powerhouse (Anheuser-Busch InBev) ensures sectoral balance and mitigates single-industry risk. The portfolio’s diversity enhances resilience to market cycles and macroeconomic shocks.

Market Timing & Entry Strategies

Entry timing should consider sector-specific cycles and macroeconomic trends. For technology and semiconductor stocks, monitoring industry demand and supply chain dynamics is crucial. Healthcare stocks may offer defensive entry points during market volatility. Staggered entry and dollar-cost averaging can help manage risk and optimize long-term returns.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best Cannabis Stock Picks for 2025

📖 Fortress Balance Sheets: The Best Low-Debt Companies

📖 10 Best B2B SaaS Stock Picks for 2025

📖 9 Best AgriTech Stock Picks for 2025

📖 10 Best Undervalued Stocks for 2025

FAQ for Undervalued Wide Moat Stocks

Q1: How were these stocks selected?

These stocks were chosen based on wide economic moats, undervaluation relative to intrinsic value, strong quality ratings, and robust free cash flow, as identified by ValueSense’s proprietary screening.

Q2: What's the best stock from this list?

Each stock offers unique strengths; TSMC and QUALCOMM stand out for technology growth, while Pfizer and Abbott provide healthcare stability. The best pick depends on individual investment goals and sector preferences.

Q3: Should I buy all these stocks or diversify?

Diversification across these stocks and sectors can help manage risk and capture multiple growth drivers. Allocation should align with your risk tolerance and investment horizon.

Q4: What are the biggest risks with these picks?

Key risks include sector-specific headwinds, regulatory changes, patent expirations, and macroeconomic volatility. Each stock’s risk profile is detailed in its analysis section.

Q5: When is the best time to invest in these stocks?

Optimal timing depends on market conditions, sector cycles, and individual stock valuations. Dollar-cost averaging and monitoring for pullbacks can enhance entry strategies.

Summary & Investment Outlook

This ValueSense watchlist highlights 11 best stock picks for 2025, each offering a combination of wide economic moats, undervaluation, and sector leadership. By focusing on intrinsic value and quality, these stocks provide a foundation for building a resilient, growth-oriented portfolio. For more in-depth analysis and personalized research tools, visit ValueSense.