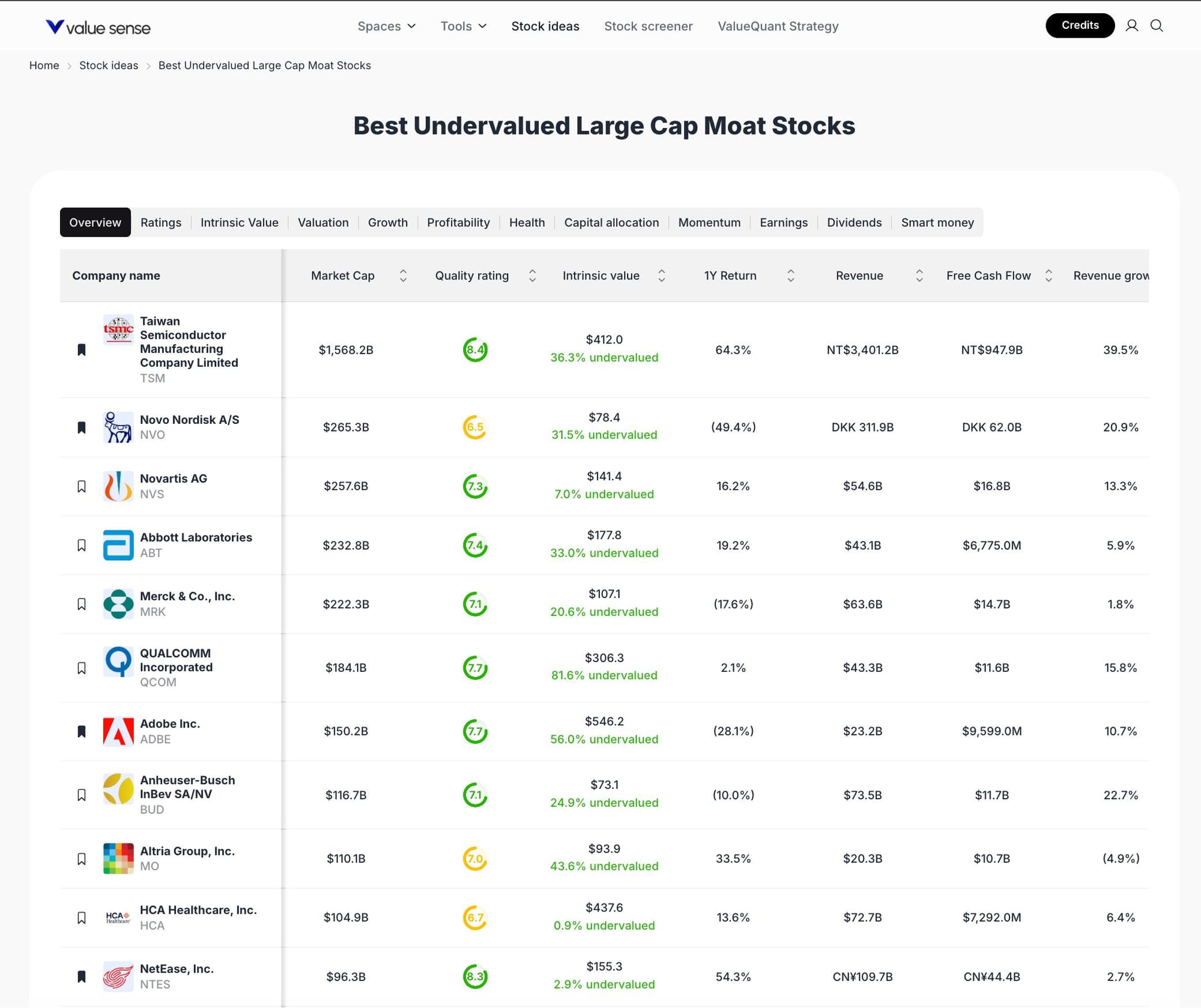

11 Best Undervalued Large Cap Moat Stocks for 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

The current market landscape in 2025 is marked by volatility and sector rotation, with investors seeking resilient, undervalued companies that demonstrate strong fundamentals and sustainable growth. Our selection methodology leverages ValueSense’s intrinsic value models, focusing on large-cap stocks with economic moats, robust free cash flow, and attractive valuation discounts. Each stock is chosen based on a combination of undervaluation percentage, quality rating, sector leadership, and recent financial performance as extracted from the ValueSense platform.

Featured Stock Analysis

Stock #1: Taiwan Semiconductor Manufacturing Company Limited (TSM)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $1,568.2B |

| Quality Rating | 6.4 |

| Intrinsic Value | $412.0 |

| Undervaluation | 36.3% undervalued |

| 1Y Return | 64.3% |

| Revenue | NT$3,401.2B |

| Free Cash Flow | NT$947.9B |

| Revenue Growth | 39.5% |

Investment Thesis:

Taiwan Semiconductor Manufacturing Company (TSMC) stands out as a global leader in semiconductor manufacturing, benefiting from a robust economic moat and technological leadership. With a 36.3% undervaluation to intrinsic value and a 64.3% 1-year return, TSMC’s scale and innovation pipeline position it at the heart of global electronics supply chains. The company’s strong free cash flow and double-digit revenue growth underscore its operational excellence and capacity to reinvest for future growth.

TSMC’s dominant market share in advanced chip fabrication, coupled with high barriers to entry, ensures pricing power and long-term customer relationships. The company’s ongoing investments in next-generation process nodes and capacity expansion further reinforce its competitive edge.

Key Catalysts:

- Continued global demand for advanced semiconductors (AI, 5G, automotive)

- Expansion into new fabrication technologies

- Strategic partnerships with leading technology firms

- Resilient supply chain management

Risk Factors:

- Geopolitical tensions affecting Taiwan

- Cyclical downturns in semiconductor demand

- High capital expenditure requirements

Stock #2: Novo Nordisk A/S (NVO)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $265.3B |

| Quality Rating | 6.5 |

| Intrinsic Value | $78.4 |

| Undervaluation | 31.5% undervalued |

| 1Y Return | (49.4%) |

| Revenue | DKK 311.9B |

| Free Cash Flow | DKK 62.0B |

| Revenue Growth | 20.9% |

Investment Thesis:

Novo Nordisk is a global healthcare leader specializing in diabetes care and chronic disease management. With a 31.5% undervaluation and strong revenue growth of 20.9%, the company’s innovative drug portfolio and expanding global footprint drive its long-term prospects. Despite a recent negative 1-year return, Novo Nordisk’s commitment to R&D and pipeline expansion positions it for future recovery and growth.

The company’s focus on high-demand therapeutic areas, particularly diabetes and obesity, ensures resilient demand and pricing power. Its robust free cash flow supports ongoing innovation and shareholder returns.

Key Catalysts:

- Launch of new diabetes and obesity treatments

- Expansion in emerging markets

- Advancements in biologics and next-generation therapies

Risk Factors:

- Patent expirations and generic competition

- Regulatory and pricing pressures in key markets

- Currency fluctuations impacting international revenue

Stock #3: Novartis AG (NVS)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $257.6B |

| Quality Rating | 7.3 |

| Intrinsic Value | $141.4 |

| Undervaluation | 7.0% undervalued |

| 1Y Return | 16.2% |

| Revenue | $54.6B |

| Free Cash Flow | $16.8B |

| Revenue Growth | 13.3% |

Investment Thesis:

Novartis is a diversified pharmaceutical giant with a strong track record in drug innovation and global market reach. The stock is currently 7.0% undervalued and delivered a 16.2% 1-year return, reflecting solid operational performance and a healthy pipeline. Novartis’s focus on high-growth therapeutic areas and strategic capital allocation underpin its long-term value proposition.

The company’s robust free cash flow and consistent revenue growth support ongoing investments in R&D and shareholder returns. Novartis’s diversified portfolio reduces reliance on any single product or market, enhancing stability.

Key Catalysts:

- New drug approvals and pipeline progress

- Expansion in oncology and specialty medicines

- Strategic acquisitions and partnerships

Risk Factors:

- Regulatory hurdles and drug pricing reforms

- Patent cliffs for key products

- Competition from biosimilars and generics

Stock #4: Abbott Laboratories (ABT)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $232.8B |

| Quality Rating | 7.1 |

| Intrinsic Value | $177.8 |

| Undervaluation | 33.0% undervalued |

| 1Y Return | 19.2% |

| Revenue | $43.1B |

| Free Cash Flow | $6,775.0M |

| Revenue Growth | 5.9% |

Investment Thesis:

Abbott Laboratories is a global healthcare leader with a diversified portfolio spanning diagnostics, medical devices, nutrition, and branded generic medicines. With a 33.0% undervaluation and a 19.2% 1-year return, Abbott’s innovation-driven growth and strong free cash flow generation support its long-term outlook.

Abbott’s leadership in diagnostics and medical devices, coupled with its global reach, provides resilience against sector-specific headwinds. The company’s ongoing investments in R&D and product launches drive sustainable growth.

Key Catalysts:

- Expansion of diagnostic and medical device offerings

- Growth in emerging markets

- New product launches and regulatory approvals

Risk Factors:

- Regulatory and reimbursement challenges

- Currency and macroeconomic headwinds

- Competitive pressures in core segments

Stock #5: Merck & Co., Inc. (MRK)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $222.3B |

| Quality Rating | 7.1 |

| Intrinsic Value | $107.1 |

| Undervaluation | 20.6% undervalued |

| 1Y Return | (17.6%) |

| Revenue | $63.6B |

| Free Cash Flow | $14.7B |

| Revenue Growth | 1.8% |

Investment Thesis:

Merck & Co. is a leading pharmaceutical company with a focus on oncology, vaccines, and animal health. The stock is 20.6% undervalued despite a negative 1-year return, reflecting temporary headwinds. Merck’s strong pipeline and established product portfolio provide a foundation for future growth.

The company’s robust free cash flow and ongoing investments in R&D support its innovation strategy. Merck’s global presence and diversified revenue streams enhance its resilience.

Key Catalysts:

- Pipeline advancements in oncology and vaccines

- Expansion in animal health segment

- Strategic collaborations and licensing deals

Risk Factors:

- Patent expirations and generic competition

- Regulatory and pricing pressures

- Slower revenue growth in mature markets

Stock #6: QUALCOMM Incorporated (QCOM)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $184.1B |

| Quality Rating | 7.7 |

| Intrinsic Value | $306.3 |

| Undervaluation | 81.6% undervalued |

| 1Y Return | 2.1% |

| Revenue | $34.1B |

| Free Cash Flow | $11.6B |

| Revenue Growth | 15.8% |

Investment Thesis:

QUALCOMM is a global leader in wireless technology and semiconductor solutions, with a commanding position in 5G and mobile communications. The stock is 81.6% undervalued according to ValueSense, offering significant upside potential. QUALCOMM’s innovation in chipsets and licensing business model drive strong free cash flow and revenue growth.

The company’s leadership in 5G technology and expansion into automotive and IoT markets provide new growth avenues. QUALCOMM’s high quality rating reflects its strong intellectual property portfolio and market positioning.

Key Catalysts:

- 5G adoption and device proliferation

- Expansion into automotive and IoT segments

- Licensing revenue growth

Risk Factors:

- Patent litigation and regulatory scrutiny

- Cyclical demand in mobile devices

- Competitive pressures from global chipmakers

Stock #7: Adobe Inc. (ADBE)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $150.2B |

| Quality Rating | 7.6 |

| Intrinsic Value | $546.2 |

| Undervaluation | 56.0% undervalued |

| 1Y Return | (28.1%) |

| Revenue | $23.2B |

| Free Cash Flow | $9,599.0M |

| Revenue Growth | 10.7% |

Investment Thesis:

Adobe is a global software leader, best known for its creative and digital media solutions. With a 56.0% undervaluation and a high quality rating, Adobe’s recurring revenue model and innovation in digital content creation underpin its long-term growth. Despite a negative 1-year return, the company’s strong free cash flow and double-digit revenue growth highlight its resilience.

Adobe’s expansion into cloud-based solutions and AI-driven features enhances its competitive positioning. The company’s global customer base and brand strength support continued growth.

Key Catalysts:

- Growth in digital media and cloud services

- Expansion of AI-powered creative tools

- New product launches and ecosystem integration

Risk Factors:

- Competitive pressures in software markets

- Shifts in technology trends and customer preferences

- Currency and macroeconomic headwinds

Stock #8: Anheuser-Busch InBev SA/NV (BUD)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $116.7B |

| Quality Rating | 6.7 |

| Intrinsic Value | $73.1 |

| Undervaluation | 24.9% undervalued |

| 1Y Return | (10.0%) |

| Revenue | $73.5B |

| Free Cash Flow | $11.7B |

| Revenue Growth | 22.7% |

Investment Thesis:

Anheuser-Busch InBev is a global beverage leader with a diversified portfolio of iconic brands. The stock is 24.9% undervalued and offers exposure to defensive consumer staples with strong cash generation. Despite a negative 1-year return, BUD’s revenue growth and scale support its long-term value.

The company’s global distribution network and brand strength provide resilience against market volatility. Ongoing cost optimization and expansion in emerging markets are key drivers.

Key Catalysts:

- Growth in emerging markets

- New product launches and premiumization

- Cost optimization initiatives

Risk Factors:

- Shifts in consumer preferences

- Regulatory and tax pressures

- Currency volatility in international markets

Stock #9: Altria Group, Inc. (MO)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $110.1B |

| Quality Rating | 7.0 |

| Intrinsic Value | $93.9 |

| Undervaluation | 43.6% undervalued |

| 1Y Return | 33.5% |

| Revenue | $20.3B |

| Free Cash Flow | $10.7B |

| Revenue Growth | (4.9%) |

Investment Thesis:

Altria Group is a leading tobacco company with a focus on cash generation and shareholder returns. The stock is 43.6% undervalued and delivered a 33.5% 1-year return, reflecting strong performance despite declining revenue. Altria’s high dividend yield and cost discipline support its value proposition.

The company’s investments in reduced-risk products and strategic partnerships aim to offset secular declines in traditional tobacco. Altria’s strong free cash flow underpins ongoing shareholder distributions.

Key Catalysts:

- Expansion of reduced-risk and alternative products

- Cost optimization and efficiency gains

- Strategic investments and partnerships

Risk Factors:

- Regulatory and litigation risks

- Declining cigarette volumes

- Shifts in consumer preferences

Stock #10: HCA Healthcare, Inc. (HCA)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $104.9B |

| Quality Rating | 7.2 |

| Intrinsic Value | $437.6 |

| Undervaluation | 0.9% undervalued |

| 1Y Return | 13.6% |

| Revenue | $72.7B |

| Free Cash Flow | $7,292.0M |

| Revenue Growth | 6.4% |

Investment Thesis:

HCA Healthcare is a leading provider of healthcare services in the United States, operating a broad network of hospitals and care facilities. The stock is 0.9% undervalued and posted a 13.6% 1-year return, reflecting steady operational performance. HCA’s scale and efficiency drive consistent revenue and free cash flow growth.

The company’s focus on operational excellence and expansion into new markets supports its long-term outlook. HCA’s diversified service offerings provide resilience against sector-specific risks.

Key Catalysts:

- Expansion of hospital network and outpatient services

- Growth in insured patient volumes

- Efficiency and cost management initiatives

Risk Factors:

- Regulatory and reimbursement changes

- Labor cost pressures

- Regional economic fluctuations

Stock #11: NetEase, Inc. (NTES)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $96.3B |

| Quality Rating | 6.3 |

| Intrinsic Value | $155.3 |

| Undervaluation | 2.9% undervalued |

| 1Y Return | 54.3% |

| Revenue | CN¥109.7B |

| Free Cash Flow | CN¥44.4B |

| Revenue Growth | 2.7% |

Investment Thesis:

NetEase is a leading Chinese technology company specializing in online services and gaming. The stock is 2.9% undervalued and delivered a 54.3% 1-year return, reflecting strong performance in a competitive market. NetEase’s innovation in gaming and digital content drives its growth.

The company’s robust free cash flow and expanding user base support ongoing investments in new content and technology. NetEase’s diversified revenue streams enhance its resilience.

Key Catalysts:

- Launch of new games and digital content

- Expansion into international markets

- Growth in cloud and online education services

Risk Factors:

- Regulatory changes in China’s tech sector

- Intense competition in gaming and digital services

- Currency and macroeconomic risks

Portfolio Diversification Insights

This watchlist spans technology, healthcare, consumer staples, and communications, offering a balanced sector allocation. The inclusion of both defensive (healthcare, consumer staples) and growth-oriented (technology, communications) stocks helps mitigate risk and capture upside across market cycles. The portfolio’s geographic diversity, with exposure to the US, Europe, and Asia, further enhances resilience.

Market Timing & Entry Strategies

Given the varying undervaluation levels and recent returns, staggered entry strategies such as dollar-cost averaging or sector rotation may help manage volatility. Monitoring sector trends and macroeconomic indicators can inform optimal entry points. Investors should consider aligning entries with earnings releases, product launches, or macro catalysts for each stock.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best GARP Stock Picks for 2025

📖 12 Best High Quality Low EV/EBIT Stocks - October-November 2025

📖 12 Best Stock Picks for Profitable Growth

📖 12 Best Momentum Stock Picks for November 2025

📖 11 Best High Quality Stock Picks for November 2025

FAQ about Undervalued Large Cap Moat Stocks

Q1: How were these stocks selected?

Stocks were chosen based on ValueSense’s intrinsic value models, focusing on large-cap companies with strong moats, undervaluation, and robust financials as shown in the platform’s data.

Q2: What's the best stock from this list?

The “best” stock depends on individual investment goals, but TSMC and QUALCOMM stand out for their high undervaluation and sector leadership based on ValueSense metrics.

Q3: Should I buy all these stocks or diversify?

Diversification across sectors and geographies, as represented in this list, can help manage risk and capture growth opportunities.

Q4: What are the biggest risks with these picks?

Key risks include regulatory changes, sector-specific headwinds, macroeconomic volatility, and company-specific challenges such as patent expirations or competition.

Q5: When is the best time to invest in these stocks?

Optimal timing may depend on market conditions, sector trends, and company-specific catalysts. Staggered entries and monitoring for major news or earnings can be effective.

Summary & Investment Outlook

This ValueSense watchlist highlights 10 best stock picks for 2025, each offering unique value and growth potential based on rigorous intrinsic value analysis. The diversified selection balances sector exposure and risk, providing a foundation for further research and portfolio construction. For more in-depth analysis and real-time updates, visit ValueSense.