12 Best Momentum Stock Picks for November 2025: In-Depth Analysis & Watchlist

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

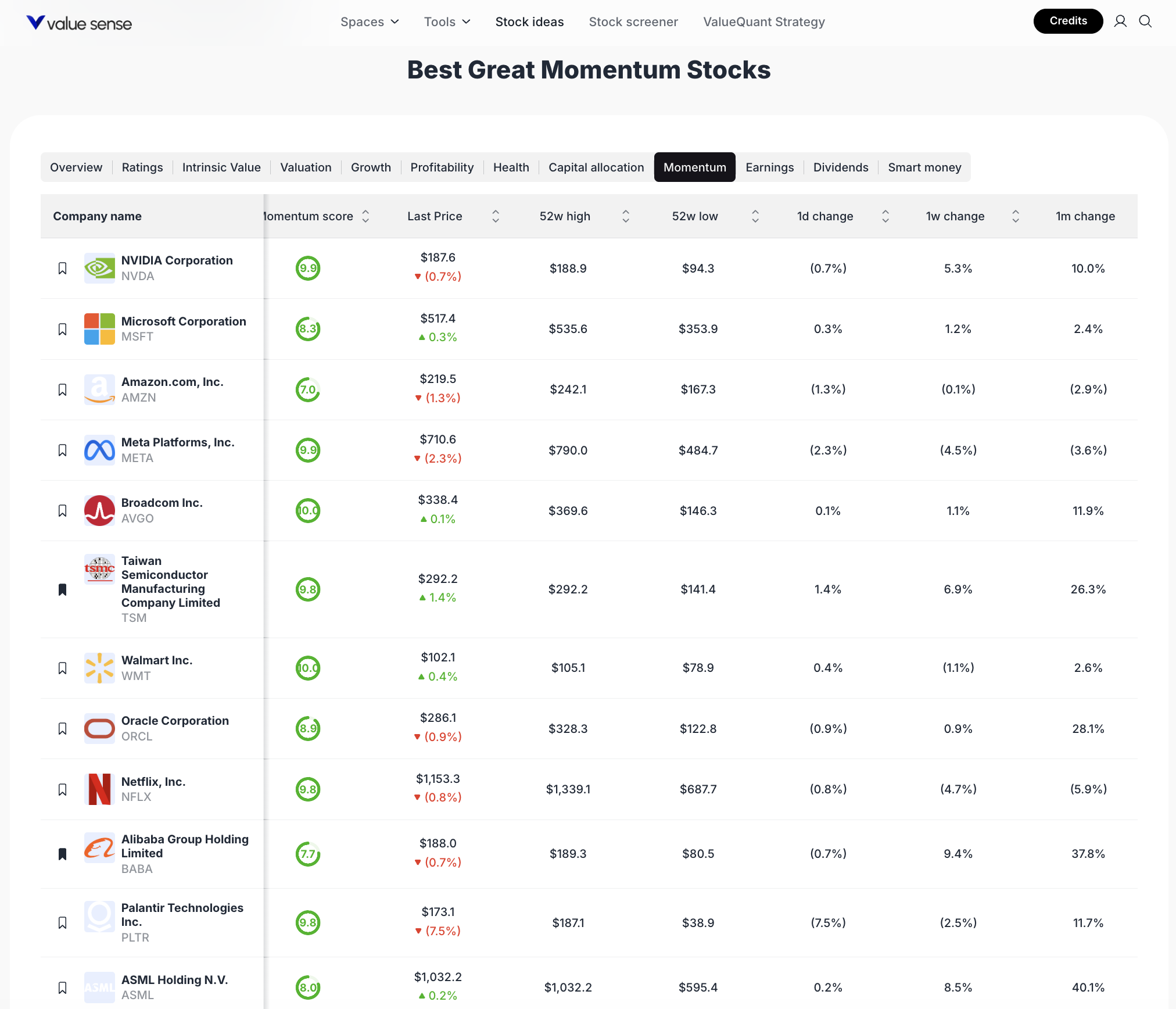

Market Overview & Selection Criteria

Momentum investing focuses on stocks exhibiting strong upward price trends, often outperforming the broader market over short to medium timeframes. For this watchlist, we selected stocks with high ValueSense momentum scores, robust recent price action, and sectoral diversity. Key metrics such as 1-month and 1-week price changes, 52-week highs/lows, and ValueSense proprietary ratings were used to identify leading candidates for November 2025.

Featured Stock Analysis

Stock #1: NVIDIA Corporation (NVDA)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $187.6 |

| 52w High | $188.9 |

| 52w Low | $94.3 |

| 1d Change | -0.7% |

| 1w Change | +5.3% |

| 1m Change | +10.0% |

| ValueSense Score | 9.9 |

Investment Thesis:

NVIDIA continues to dominate the AI and GPU markets, driving exceptional momentum as evidenced by its near 52-week high and a strong 10% gain over the past month. The company’s leadership in data center and gaming segments, coupled with robust demand for AI hardware, positions it as a key beneficiary of secular technology trends. Its high ValueSense momentum score reflects both investor confidence and operational outperformance.

Key Catalysts:

- Ongoing AI adoption across industries

- Expansion in data center and cloud infrastructure

- New GPU product launches and ecosystem growth

Risk Factors:

- High valuation relative to historical averages

- Competitive pressures from AMD and Intel

- Cyclical demand in gaming and crypto markets

Stock #2: Microsoft Corporation (MSFT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $517.4 |

| 52w High | $535.6 |

| 52w Low | $353.9 |

| 1d Change | +0.3% |

| 1w Change | +1.2% |

| 1m Change | +2.4% |

| ValueSense Score | 8.3 |

Investment Thesis:

Microsoft’s diversified business model, spanning cloud, productivity software, and AI, underpins its steady momentum. The company’s Azure cloud platform continues to capture market share, while integration of AI features into Office and Windows products drives incremental growth. Its consistent price appreciation and strong ValueSense score highlight its resilience and growth prospects.

Key Catalysts:

- Cloud adoption and enterprise digital transformation

- AI integration across product suite

- Expanding subscription revenues

Risk Factors:

- Regulatory scrutiny in the US and EU

- Slower PC market growth

- Currency headwinds impacting international sales

Stock #3: Amazon.com, Inc. (AMZN)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $219.5 |

| 52w High | $242.1 |

| 52w Low | $167.3 |

| 1d Change | -1.3% |

| 1w Change | -0.1% |

| 1m Change | -2.9% |

| ValueSense Score | 7.0 |

Investment Thesis:

Amazon remains a global e-commerce and cloud leader, though recent momentum has moderated. AWS continues to be a profit engine, while retail and advertising segments provide diversification. Despite a slight pullback, the company’s innovation and scale support its long-term growth trajectory.

Key Catalysts:

- AWS expansion and new cloud services

- Growth in digital advertising

- Logistics and fulfillment network optimization

Risk Factors:

- Margin pressure in retail operations

- Regulatory and antitrust risks

- Slower consumer spending

Stock #4: Meta Platforms, Inc. (META)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $710.6 |

| 52w High | $790.0 |

| 52w Low | $484.7 |

| 1d Change | -2.3% |

| 1w Change | -4.5% |

| 1m Change | -3.6% |

| ValueSense Score | 8.0 |

Investment Thesis:

Meta Platforms is leveraging its social media dominance and investments in AI to drive engagement and monetization. Despite recent volatility, the company’s focus on the metaverse and digital advertising innovation positions it for future growth. Its ValueSense score reflects strong, though currently cooling, momentum.

Key Catalysts:

- AI-driven ad targeting and content recommendations

- Expansion of metaverse initiatives

- Growth in WhatsApp and Instagram monetization

Risk Factors:

- Regulatory and privacy challenges

- High R&D spending on metaverse

- Competition from TikTok and other platforms

Stock #5: Broadcom Inc. (AVGO)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $338.4 |

| 52w High | $369.6 |

| 52w Low | $146.3 |

| 1d Change | +0.1% |

| 1w Change | +1.1% |

| 1m Change | +11.9% |

| ValueSense Score | 9.0 |

Investment Thesis:

Broadcom’s momentum is driven by its leadership in semiconductor solutions for networking, broadband, and wireless. The company’s diversified product portfolio and recent software acquisitions have enhanced its growth profile. Its strong 1-month price performance and high ValueSense score underscore robust investor sentiment.

Key Catalysts:

- 5G infrastructure rollouts

- Data center and networking demand

- Strategic M&A activity

Risk Factors:

- Semiconductor supply chain risks

- Customer concentration

- Integration risks from acquisitions

Stock #6: Taiwan Semiconductor Manufacturing Company Limited (TSM)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $292.2 |

| 52w High | $292.2 |

| 52w Low | $141.4 |

| 1d Change | +1.4% |

| 1w Change | +6.9% |

| 1m Change | +26.3% |

| ValueSense Score | 9.9 |

Investment Thesis:

TSMC is the world’s leading semiconductor foundry, powering global technology supply chains. The stock’s momentum is exceptional, with a 26.3% gain over the past month and a new 52-week high. Its technological leadership in advanced process nodes and strong demand from AI and automotive sectors drive its ValueSense rating.

Key Catalysts:

- Advanced chip manufacturing (3nm, 5nm)

- AI, automotive, and IoT demand

- Capacity expansion and global diversification

Risk Factors:

- Geopolitical tensions (Taiwan/China)

- Customer concentration (Apple, NVIDIA)

- Capital intensity of new fabs

Stock #7: Walmart Inc. (WMT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $102.1 |

| 52w High | $105.1 |

| 52w Low | $78.9 |

| 1d Change | +0.4% |

| 1w Change | -1.1% |

| 1m Change | +2.6% |

| ValueSense Score | 8.0 |

Investment Thesis:

Walmart’s momentum is supported by its scale, omnichannel strategy, and resilience in consumer staples. The company’s ability to navigate inflationary pressures and expand its e-commerce footprint has driven steady price appreciation and a solid ValueSense score.

Key Catalysts:

- E-commerce and digital transformation

- Expansion of grocery and delivery services

- Cost optimization initiatives

Risk Factors:

- Margin pressure from discounting

- Competitive threats from Amazon and Target

- Labor cost inflation

Stock #8: Oracle Corporation (ORCL)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $286.1 |

| 52w High | $328.3 |

| 52w Low | $122.8 |

| 1d Change | -0.9% |

| 1w Change | +0.9% |

| 1m Change | +28.1% |

| ValueSense Score | 8.9 |

Investment Thesis:

Oracle’s momentum is fueled by its transition to cloud services and strong performance in enterprise software. The stock’s 28.1% monthly gain highlights investor enthusiasm for its cloud infrastructure and AI-driven database offerings.

Key Catalysts:

- Cloud infrastructure growth

- AI and automation in enterprise software

- Strategic partnerships and acquisitions

Risk Factors:

- Intense competition from AWS, Azure, Google Cloud

- Legacy software business headwinds

- Execution risks in cloud migration

Stock #9: Netflix, Inc. (NFLX)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $1,153.3 |

| 52w High | $1,339.1 |

| 52w Low | $687.7 |

| 1d Change | -0.8% |

| 1w Change | -4.7% |

| 1m Change | -5.9% |

| ValueSense Score | 8.0 |

Investment Thesis:

Netflix remains the global leader in streaming, with a vast content library and international expansion. While recent momentum has softened, its ValueSense score and long-term growth prospects remain robust, supported by original content and new monetization strategies.

Key Catalysts:

- International subscriber growth

- Ad-supported tier rollouts

- Content production and licensing deals

Risk Factors:

- Rising content costs

- Competition from Disney+, Amazon Prime, others

- Churn and market saturation

Stock #10: Alibaba Group Holding Limited (BABA)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $188.0 |

| 52w High | $189.3 |

| 52w Low | $80.5 |

| 1d Change | -0.7% |

| 1w Change | +9.4% |

| 1m Change | +37.8% |

| ValueSense Score | 7.7 |

Investment Thesis:

Alibaba’s momentum has surged, with a 37.8% gain in the past month. The company benefits from e-commerce dominance in China, cloud computing growth, and a rebound in consumer sentiment. Its ValueSense score reflects renewed investor optimism.

Key Catalysts:

- E-commerce recovery post-regulation

- Cloud and fintech expansion

- International growth initiatives

Risk Factors:

- Regulatory uncertainty in China

- Geopolitical tensions (US-China)

- Competitive landscape in Asia

Stock #11: Palantir Technologies Inc. (PLTR)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $17.31 |

| 52w High | $18.71 |

| 52w Low | $3.89 |

| 1d Change | -7.5% |

| 1w Change | -2.5% |

| 1m Change | +11.7% |

| ValueSense Score | 9.0 |

Investment Thesis:

Palantir’s momentum is driven by its leadership in big data analytics and government contracts. Despite recent volatility, the stock’s 11.7% monthly gain and high ValueSense score highlight its potential as AI and data-driven decision-making become more critical.

Key Catalysts:

- Expansion of commercial client base

- AI and machine learning platform growth

- New government contracts

Risk Factors:

- High valuation and volatility

- Customer concentration

- Uncertainty in commercial adoption

Stock #12: ASML Holding N.V. (ASML)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $1,032.2 |

| 52w High | $1,032.2 |

| 52w Low | $595.4 |

| 1d Change | +0.2% |

| 1w Change | +8.5% |

| 1m Change | +40.1% |

| ValueSense Score | 9.0 |

Investment Thesis:

ASML is a critical supplier of advanced lithography equipment for semiconductor manufacturing. Its 40.1% monthly gain and new 52-week high underscore its importance in the global chip supply chain. The company’s technological moat and strong ValueSense score make it a standout in the sector.

Key Catalysts:

- EUV lithography demand

- Semiconductor industry capex cycle

- Expansion into new markets

Risk Factors:

- Supply chain constraints

- Customer concentration (TSMC, Samsung, Intel)

- Export restrictions and geopolitical risks

Portfolio Diversification Insights

This collection spans technology, retail, semiconductors, and cloud computing, offering exposure to both US and international markets. The portfolio is weighted toward technology and semiconductor leaders, balancing high-growth disruptors (PLTR, NVDA) with established blue chips (MSFT, WMT). Sector allocation supports diversification, while momentum scores highlight both stability and upside potential.

Market Timing & Entry Strategies

Momentum stocks often perform best during bullish market phases, but can be volatile during corrections. Consider phased entry strategies, such as dollar-cost averaging, and monitor technical indicators for optimal timing. Watch for earnings reports, sector rotations, and macroeconomic shifts that may impact short-term price trends.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 1-Month Market Movers: Best Undervalued High-Quality Stocks

📖 7 Best Undervalued Stock Picks for October 2025

📖 George Soros - Soros Fund Management LLC Q2 2025 Portfolio

📖 10 Best Stock Picks for 2025: E-commerce Watchlist & Analysis

📖 13 Best Wide Moat Stock Picks for 2025

FAQ for 12 Best Momentum Stock Picks

Q1: How were these stocks selected?

Stocks were chosen based on ValueSense momentum scores, recent price performance, and sector diversity, using proprietary screening and fundamental analysis.

Q2: What's the best stock from this list?

The "best" stock depends on individual investment goals, but TSMC, NVIDIA, and ASML currently show the highest momentum and ValueSense ratings.

Q3: Should I buy all these stocks or diversify?

Diversification across sectors and geographies can help manage risk; this watchlist is designed to offer a balanced mix of growth and stability.

Q4: What are the biggest risks with these picks?

Key risks include valuation concerns, sector-specific headwinds, regulatory changes, and market volatility inherent to momentum strategies.

Q5: When is the best time to invest in these stocks?

Optimal timing often aligns with positive earnings, strong technical trends, and favorable market conditions. Consider gradual entry and ongoing monitoring.

Summary & Investment Outlook

This ValueSense watchlist highlights 12 of the best momentum stocks for 2025, spanning technology, retail, and global markets. Each stock is supported by robust data and individual analysis, offering educational insights for investors seeking growth opportunities. For deeper research and real-time updates, visit ValueSense.