12 Best Robotics Stock Picks for 2025: In-Depth Analysis & Watchlist

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

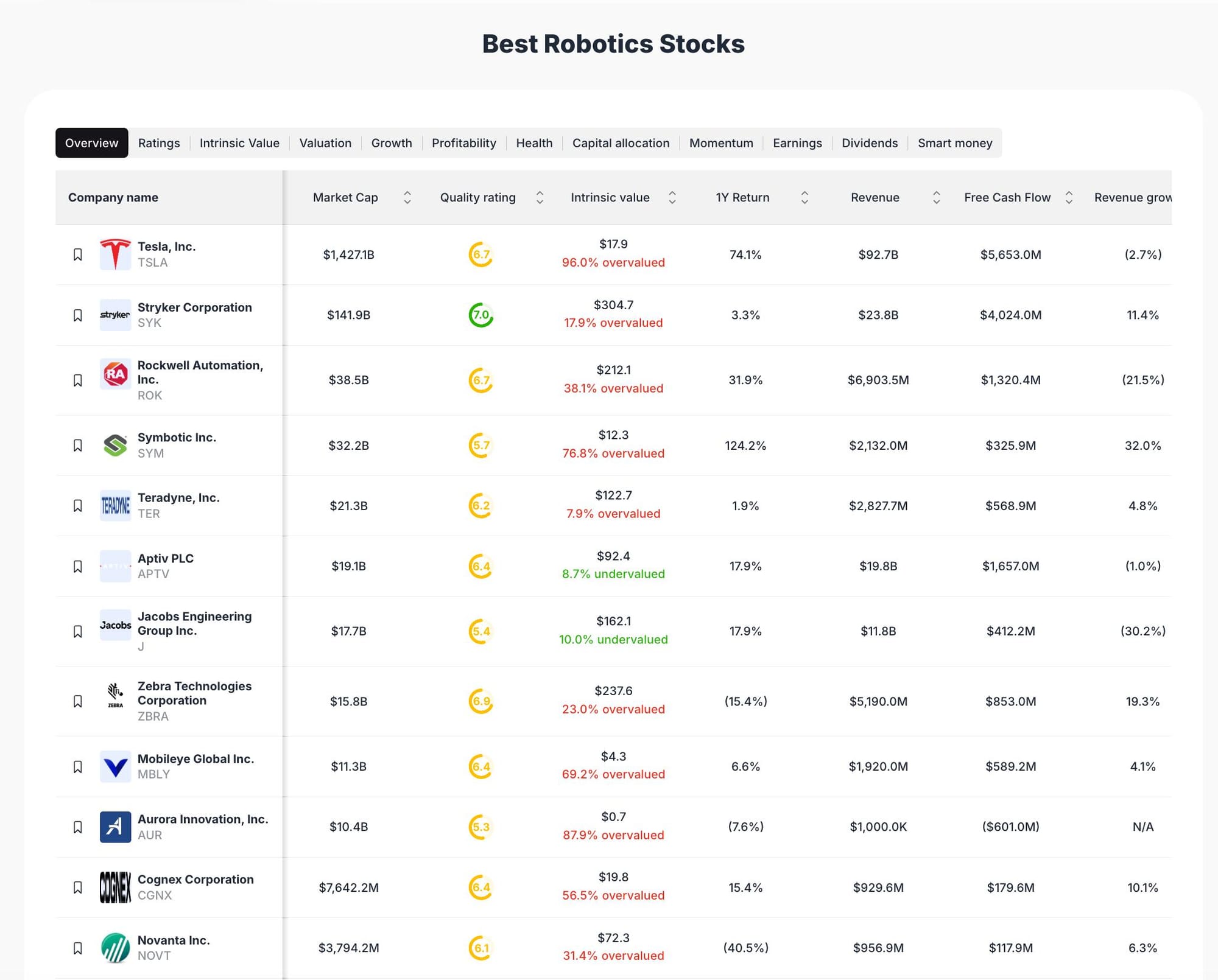

The robotics sector is experiencing rapid growth, driven by automation trends across manufacturing, healthcare, and logistics. Our selection methodology focuses on companies with robust market capitalization, strong free cash flow, and notable revenue growth or resilience. Each stock is evaluated using ValueSense’s proprietary quality and intrinsic value ratings, ensuring a balanced watchlist of both established leaders and emerging innovators.

Featured Stock Analysis

Stock #1: Tesla, Inc. (TSLA)

| Metric | Value |

|---|---|

| Current Price | Not shown |

| Market Cap | $1,427.1B |

| Quality Rating | 6.7 |

| Intrinsic Value | $17.9 (96.0% overvalued) |

| 1Y Return | 74.1% |

| Revenue | $92.7B |

| Free Cash Flow | $5,653.0M |

| Revenue Growth | (2.7%) |

| Sector | Robotics/Automotive |

Investment Thesis:

Tesla remains the dominant force in robotics-driven automotive innovation, leveraging advanced automation in manufacturing and AI-powered vehicle platforms. Despite being significantly overvalued relative to its intrinsic value, Tesla’s strong brand, technological leadership, and substantial free cash flow underpin its continued relevance in the robotics sector. The company’s 74.1% one-year return highlights robust investor confidence, even as revenue growth has slightly contracted.

Tesla’s scale and integration of robotics in production processes position it as a bellwether for automation trends. However, the current valuation suggests much of its future growth is already priced in, warranting careful monitoring of operational execution and margin sustainability.

Key Catalysts:

- Expansion of autonomous driving and robotics in manufacturing

- Continued global EV adoption

- Potential new product launches and AI integration

Risk Factors:

- 96% overvaluation relative to intrinsic value

- Negative revenue growth (-2.7%)

- Competitive pressures and regulatory risks

Stock #2: Stryker Corporation (SYK)

| Metric | Value |

|---|---|

| Market Cap | $141.9B |

| Quality Rating | 7.0 |

| Intrinsic Value | $304.7 (17.9% overvalued) |

| 1Y Return | 3.3% |

| Revenue | $23.8B |

| Free Cash Flow | $4,024.0M |

| Revenue Growth | 11.4% |

| Sector | Healthcare Robotics |

Investment Thesis:

Stryker is a leader in medical robotics, specializing in surgical and healthcare automation solutions. With a high quality rating and strong free cash flow, Stryker demonstrates operational excellence and consistent revenue growth. Although currently trading 17.9% above its intrinsic value, the company’s innovation pipeline and expanding addressable market in healthcare robotics support its long-term outlook.

Stryker’s stable 3.3% one-year return reflects market caution amid valuation concerns, but its double-digit revenue growth and sector leadership provide a solid foundation for future expansion.

Key Catalysts:

- Growth in robotic-assisted surgery adoption

- Expansion into new healthcare markets

- Strong R&D and product innovation

Risk Factors:

- 17.9% overvaluation

- Slower share price appreciation relative to peers

- Regulatory and reimbursement uncertainties

Stock #3: Rockwell Automation, Inc. (ROK)

| Metric | Value |

|---|---|

| Market Cap | $38.5B |

| Quality Rating | 6.7 |

| Intrinsic Value | $212.1 (38.1% overvalued) |

| 1Y Return | 31.9% |

| Revenue | $6,903.5M |

| Free Cash Flow | $1,320.4M |

| Revenue Growth | (21.5%) |

| Sector | Industrial Automation |

Investment Thesis:

Rockwell Automation is a cornerstone of industrial robotics, providing automation solutions for manufacturing and process industries. The company’s 31.9% one-year return signals strong market performance, but a 38.1% overvaluation and significant revenue contraction (-21.5%) highlight near-term challenges. Rockwell’s robust free cash flow and established customer base offer resilience, but investors should monitor for signs of recovery in revenue trends.

The company’s focus on digital transformation and smart manufacturing positions it well for long-term growth as industries increasingly adopt automation.

Key Catalysts:

- Increased demand for industrial automation

- Digital transformation initiatives

- Expansion into emerging markets

Risk Factors:

- 38.1% overvaluation

- Sharp revenue decline (-21.5%)

- Cyclical exposure to manufacturing downturns

Stock #4: Symbotic Inc. (SYM)

| Metric | Value |

|---|---|

| Market Cap | $32.2B |

| Quality Rating | 5.7 |

| Intrinsic Value | $12.3 (76.8% overvalued) |

| 1Y Return | 124.2% |

| Revenue | $2,132.0M |

| Free Cash Flow | $325.9M |

| Revenue Growth | 32.0% |

| Sector | Warehouse Automation |

Investment Thesis:

Symbotic is a high-growth player in warehouse robotics, delivering automation solutions for logistics and supply chain optimization. The company’s 124.2% one-year return and 32% revenue growth underscore its rapid ascent. However, the stock is trading at a 76.8% premium to intrinsic value, reflecting high expectations for continued expansion.

Symbotic’s scalable platform and partnerships with major retailers drive its growth, but the relatively low quality rating suggests operational risks remain.

Key Catalysts:

- E-commerce and logistics automation boom

- Strategic partnerships with large retailers

- Expansion of product offerings

Risk Factors:

- 76.8% overvaluation

- Execution risk in scaling operations

- Competitive pressures in warehouse automation

Stock #5: Teradyne, Inc. (TER)

| Metric | Value |

|---|---|

| Market Cap | $21.3B |

| Quality Rating | 6.2 |

| Intrinsic Value | $122.7 (7.9% overvalued) |

| 1Y Return | 1.9% |

| Revenue | $2,827.7M |

| Free Cash Flow | $568.9M |

| Revenue Growth | 4.8% |

| Sector | Test Automation |

Investment Thesis:

Teradyne is a leader in test automation and robotics, serving semiconductor and electronics manufacturers. The company’s near-fair valuation (7.9% overvalued) and steady revenue growth make it a stable component of a robotics-focused portfolio. While the one-year return is modest, Teradyne’s strong free cash flow and established market position provide a solid foundation for future growth.

Key Catalysts:

- Growth in semiconductor testing demand

- Expansion into collaborative robotics

- Technological innovation in automation

Risk Factors:

- Modest share price performance

- Cyclical exposure to semiconductor industry

- Competitive landscape

Stock #6: Aptiv PLC (APTV)

| Metric | Value |

|---|---|

| Market Cap | $19.1B |

| Quality Rating | 6.4 |

| Intrinsic Value | $92.4 (8.7% undervalued) |

| 1Y Return | 17.9% |

| Revenue | $19.8B |

| Free Cash Flow | $1,657.0M |

| Revenue Growth | (1.0%) |

| Sector | Automotive Technology |

Investment Thesis:

Aptiv stands out as one of the few undervalued stocks in this collection, trading 8.7% below intrinsic value. The company’s focus on automotive robotics and smart vehicle technology supports its long-term growth prospects. Despite a slight revenue contraction, Aptiv’s strong free cash flow and positive one-year return highlight its resilience.

Key Catalysts:

- Growth in autonomous and connected vehicles

- Expansion into electric vehicle components

- Strategic partnerships with automakers

Risk Factors:

- Revenue contraction

- Automotive sector cyclicality

- Technology adoption risks

Stock #7: Jacobs Engineering Group Inc. (J)

| Metric | Value |

|---|---|

| Market Cap | $17.7B |

| Quality Rating | 6.4 |

| Intrinsic Value | $162.1 (10.0% undervalued) |

| 1Y Return | 17.9% |

| Revenue | $11.8B |

| Free Cash Flow | $412.2M |

| Revenue Growth | (30.2%) |

| Sector | Engineering/Automation |

Investment Thesis:

Jacobs Engineering is another undervalued pick, trading 10% below intrinsic value. The company’s expertise in engineering and automation solutions supports its long-term outlook, though a sharp revenue decline (-30.2%) warrants caution. Jacobs’ positive one-year return and solid free cash flow reflect operational strength in a challenging environment.

Key Catalysts:

- Infrastructure automation projects

- Expansion into digital engineering

- Government and private sector contracts

Risk Factors:

- Significant revenue contraction

- Project-based revenue volatility

- Sector competition

Stock #8: Zebra Technologies Corporation (ZBRA)

| Metric | Value |

|---|---|

| Market Cap | $15.8B |

| Quality Rating | 6.9 |

| Intrinsic Value | $237.6 (23.0% overvalued) |

| 1Y Return | (15.4%) |

| Revenue | $5,190.0M |

| Free Cash Flow | $853.0M |

| Revenue Growth | 19.3% |

| Sector | Automation/IoT |

Investment Thesis:

Zebra Technologies specializes in automation and IoT solutions for logistics and manufacturing. Despite a 15.4% decline in share price over the past year, the company’s 19.3% revenue growth and strong free cash flow highlight its operational momentum. Trading at a 23% premium to intrinsic value, Zebra’s valuation reflects optimism about its growth trajectory.

Key Catalysts:

- Expansion of IoT and automation in logistics

- New product launches

- Strategic acquisitions

Risk Factors:

- 23% overvaluation

- Recent share price underperformance

- Competitive pressures

Stock #9: Mobileye Global Inc. (MBLY)

| Metric | Value |

|---|---|

| Market Cap | $11.3B |

| Quality Rating | 6.4 |

| Intrinsic Value | $4.3 (69.2% overvalued) |

| 1Y Return | 6.6% |

| Revenue | $1,920.0M |

| Free Cash Flow | $589.2M |

| Revenue Growth | 4.1% |

| Sector | Automotive AI/Robotics |

Investment Thesis:

Mobileye is a leader in automotive AI and robotics, focusing on advanced driver-assistance systems. The company’s moderate revenue growth and positive one-year return are offset by a 69.2% overvaluation. Mobileye’s strong free cash flow and technological edge support its long-term potential, but valuation risks remain.

Key Catalysts:

- Growth in autonomous vehicle adoption

- Expansion of OEM partnerships

- Technological innovation

Risk Factors:

- 69.2% overvaluation

- Competitive landscape

- Regulatory hurdles

Stock #10: Aurora Innovation, Inc. (AUR)

| Metric | Value |

|---|---|

| Market Cap | $10.4B |

| Quality Rating | 6.3 |

| Intrinsic Value | $0.7 (87.9% overvalued) |

| 1Y Return | (7.6%) |

| Revenue | $1,000.0K |

| Free Cash Flow | ($601.0M) |

| Revenue Growth | N/A |

| Sector | Autonomous Vehicles |

Investment Thesis:

Aurora Innovation is an emerging player in autonomous vehicle technology. Despite a high overvaluation and negative free cash flow, the company’s focus on next-generation robotics and AI positions it for potential long-term growth. However, the lack of revenue growth and recent share price decline highlight significant execution risks.

Key Catalysts:

- Advancements in autonomous driving technology

- Strategic partnerships

- Expansion of pilot programs

Risk Factors:

- 87.9% overvaluation

- Negative free cash flow

- Early-stage operational risks

Stock #11: Cognex Corporation (CGNX)

| Metric | Value |

|---|---|

| Market Cap | $7,642.2M |

| Quality Rating | 6.4 |

| Intrinsic Value | $19.8 (56.5% overvalued) |

| 1Y Return | 15.4% |

| Revenue | $929.6M |

| Free Cash Flow | $179.6M |

| Revenue Growth | 10.1% |

| Sector | Machine Vision |

Investment Thesis:

Cognex is a leader in machine vision systems for industrial automation. The company’s 15.4% one-year return and 10.1% revenue growth reflect solid demand for its solutions. However, the stock is trading at a 56.5% premium to intrinsic value, suggesting high expectations for continued growth.

Key Catalysts:

- Growth in factory automation

- Expansion into new industries

- Technological innovation

Risk Factors:

- 56.5% overvaluation

- Cyclical demand in manufacturing

- Competitive pressures

Stock #12: Novanta Inc. (NOVT)

| Metric | Value |

|---|---|

| Market Cap | $3,794.2M |

| Quality Rating | 6.4 |

| Intrinsic Value | $72.3 (31.4% overvalued) |

| 1Y Return | (40.5%) |

| Revenue | $956.9M |

| Free Cash Flow | $117.9M |

| Revenue Growth | 6.3% |

| Sector | Precision Automation |

Investment Thesis:

Novanta specializes in precision automation and photonics, serving healthcare and industrial markets. Despite a 40.5% share price decline, the company’s 6.3% revenue growth and positive free cash flow indicate underlying business strength. Trading at a 31.4% premium to intrinsic value, Novanta’s valuation reflects optimism about its niche market leadership.

Key Catalysts:

- Growth in precision automation demand

- Expansion into healthcare applications

- Technological innovation

Risk Factors:

- 31.4% overvaluation

- Recent share price underperformance

- Niche market risks

Portfolio Diversification Insights

This robotics stock collection spans multiple sectors, including automotive, healthcare, industrial automation, and precision technology. The mix of large-cap leaders (Tesla, Stryker), high-growth disruptors (Symbotic, Mobileye), and undervalued opportunities (Aptiv, Jacobs Engineering) provides sector diversification and balances risk across different industry cycles. Exposure to both established and emerging robotics companies enhances the portfolio’s resilience and growth potential.

Market Timing & Entry Strategies

Given the range of valuations, investors may consider staggered entry points, focusing on undervalued or fairly valued stocks for immediate positions and monitoring overvalued names for potential pullbacks. Sector rotation and macroeconomic trends should inform timing, with particular attention to earnings cycles and technological adoption milestones.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Quality Industrials Stocks to Buy Now

📖 5 Best Telecom Infrastructure Stock Picks for 2025

📖 10 Best DefenseTech Stock Picks for 2025

📖 10 Best Stock Picks for 2025: E-commerce Watchlist & Analysis

📖 5 Best Stock Picks for October 2025: Top Undervalued Stocks

FAQ for Robotic Stocks

Q1: How were these stocks selected?

These stocks were chosen based on ValueSense’s proprietary ratings, focusing on market cap, quality, intrinsic value, and sector relevance as shown in the platform’s analytics.

Q2: What's the best stock from this list?

There is no single “best” stock; however, undervalued names like Aptiv (APTV) and Jacobs Engineering (J) stand out for their favorable valuation and sector positioning.

Q3: Should I buy all these stocks or diversify?

Diversification across multiple robotics sectors can help manage risk and capture growth opportunities, as reflected in this watchlist’s balanced sector allocation.

Q4: What are the biggest risks with these picks?

Key risks include overvaluation, sector cyclicality, revenue contraction, and execution challenges, all detailed in each stock’s analysis.

Q5: When is the best time to invest in these stocks?

Optimal timing depends on individual stock valuations, sector trends, and market conditions. Monitoring for pullbacks in overvalued stocks and aligning entries with earnings or product catalysts is recommended for educational purposes.

Summary & Investment Outlook

This ValueSense robotics stock watchlist offers a comprehensive overview of leading and emerging companies across the automation landscape. By combining sector diversification, in-depth analysis, and a focus on intrinsic value, investors can use this educational content to inform their research and portfolio construction. For more insights and detailed analysis, visit ValueSense.