12 Best Stock Picks with High ROIC for 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

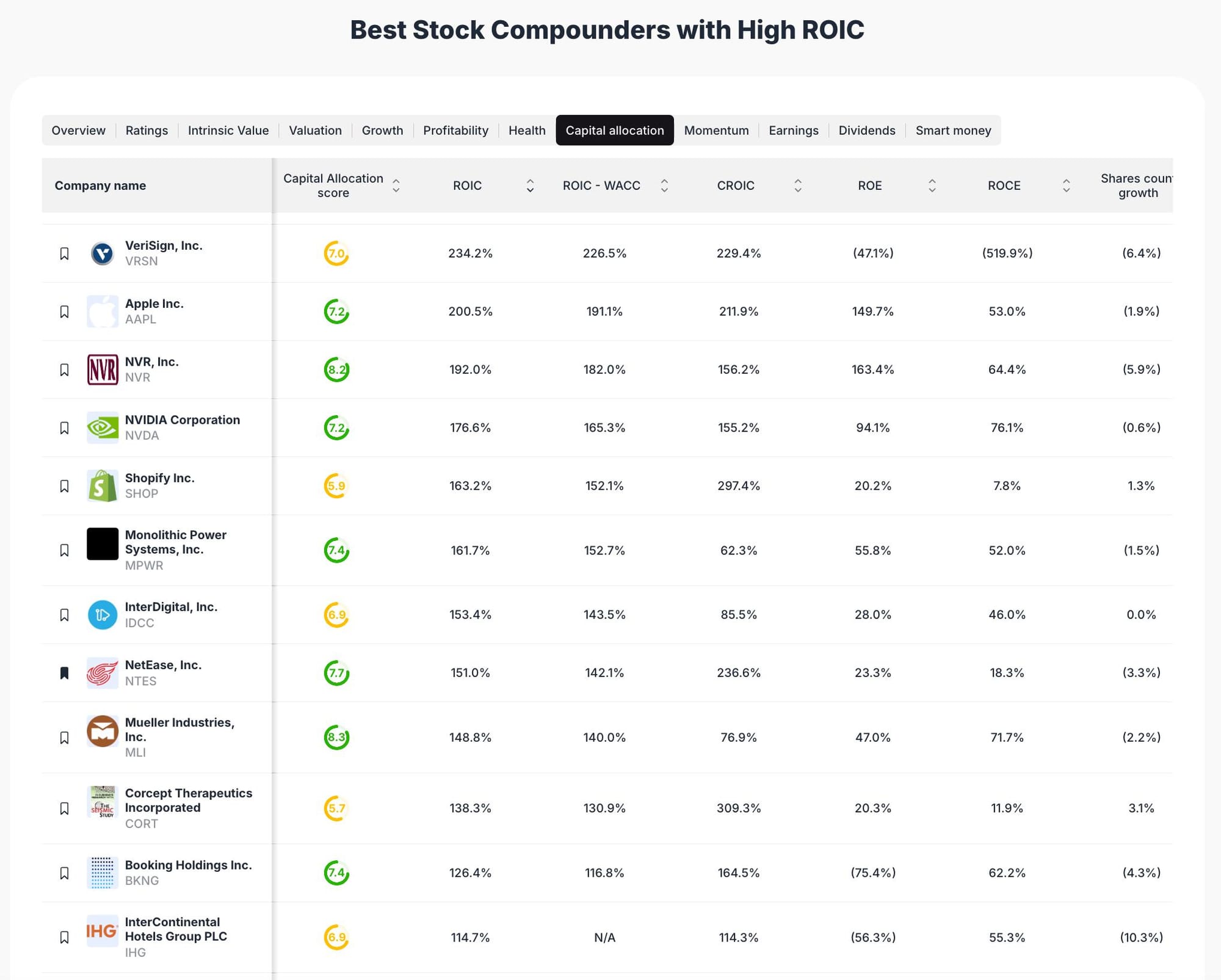

Market Overview & Selection Criteria

The current market environment rewards companies with robust capital allocation and high returns on invested capital (ROIC). Our selection methodology prioritizes stocks with consistently high ROIC, strong capital allocation scores, and resilient business models. We extract and analyze key financial metrics, sector trends, and ValueSense ratings to identify compounders—companies that can sustainably grow shareholder value through disciplined reinvestment and operational excellence.

Featured Stock Analysis

Stock #1: VeriSign, Inc. (VRSN)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 7.0 |

| ROIC | 234.2% |

| ROIC - WACC | 226.5% |

| CROIC | 229.4% |

| ROE | -47.1% |

| ROCE | -519.9% |

| Shares Count Growth | -6.4% |

Investment Thesis:

VeriSign, Inc. stands out as a top compounder with an exceptional ROIC of 234.2%, indicating highly efficient capital deployment. The company’s negative ROE and ROCE figures are a function of its unique capital structure and aggressive share repurchases, as reflected in a -6.4% shares count growth. VeriSign’s business model, centered on domain name registry services, provides stable cash flows and pricing power, supporting its ability to return capital to shareholders.

Key Catalysts:

- Dominant position in internet infrastructure and domain registry

- Consistent free cash flow generation

- Aggressive share buybacks enhancing per-share value

Risk Factors:

- Regulatory risks in domain management

- Limited growth in core domain registration market

- High dependency on internet infrastructure trends

Stock #2: Apple Inc. (AAPL)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 7.2 |

| ROIC | 200.5% |

| ROIC - WACC | 191.1% |

| CROIC | 211.9% |

| ROE | 149.7% |

| ROCE | 53.0% |

| Shares Count Growth | -1.9% |

Investment Thesis:

Apple Inc. continues to deliver industry-leading returns, with a ROIC of 200.5% and a robust capital allocation score. The company’s focus on innovation, ecosystem lock-in, and premium branding drives high profitability and customer loyalty. Apple’s negative shares count growth reflects ongoing buybacks, further boosting shareholder value.

Key Catalysts:

- Strong product pipeline and services growth

- Expanding recurring revenue from services

- Global brand strength and pricing power

Risk Factors:

- Supply chain disruptions

- Regulatory scrutiny in key markets

- Dependence on flagship product cycles

Stock #3: NVR, Inc. (NVR)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 6.3 |

| ROIC | 192.0% |

| ROIC - WACC | 182.0% |

| CROIC | 156.2% |

| ROE | 163.4% |

| ROCE | 64.4% |

| Shares Count Growth | -5.9% |

Investment Thesis:

NVR, Inc. is a leading homebuilder with a disciplined approach to capital allocation, reflected in its high ROIC and steady share repurchases. The company’s asset-light business model and focus on high-return projects enable it to outperform peers in both up and down cycles.

Key Catalysts:

- Strong housing demand in core markets

- Prudent land acquisition strategy

- Consistent share buybacks

Risk Factors:

- Exposure to housing market cycles

- Rising interest rates impacting affordability

- Regional economic fluctuations

Stock #4: NVIDIA Corporation (NVDA)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 7.2 |

| ROIC | 176.6% |

| ROIC - WACC | 165.3% |

| CROIC | 155.2% |

| ROE | 94.1% |

| ROCE | 76.1% |

| Shares Count Growth | -0.6% |

Investment Thesis:

NVIDIA Corporation is a technology leader in graphics processing and AI, with a stellar ROIC and strong capital allocation discipline. The company’s innovation-driven growth and expanding addressable markets in AI, data centers, and automotive position it as a long-term compounder.

Key Catalysts:

- AI and machine learning adoption

- Data center and cloud infrastructure growth

- Expansion into automotive and edge computing

Risk Factors:

- Competitive pressures in semiconductors

- Cyclical demand for consumer electronics

- Regulatory and geopolitical risks

Stock #5: Shopify Inc. (SHOP)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 5.9 |

| ROIC | 163.2% |

| ROIC - WACC | 152.1% |

| CROIC | 297.4% |

| ROE | 20.2% |

| ROCE | 7.8% |

| Shares Count Growth | 1.3% |

Investment Thesis:

Shopify Inc. empowers e-commerce businesses with scalable solutions, reflected in its high ROIC and exceptional CROIC. The company’s platform approach and recurring revenue streams drive robust growth, while its capital allocation score suggests room for improvement in efficiency.

Key Catalysts:

- E-commerce adoption and digital transformation

- Expansion into new merchant services

- International growth opportunities

Risk Factors:

- Intense competition from larger platforms

- Margin pressures from scaling operations

- Sensitivity to small business trends

Stock #6: Monolithic Power Systems, Inc. (MPWR)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 7.4 |

| ROIC | 161.7% |

| ROIC - WACC | 152.7% |

| CROIC | 62.3% |

| ROE | 55.8% |

| ROCE | 52.0% |

| Shares Count Growth | -1.5% |

Investment Thesis:

Monolithic Power Systems, Inc. is a high-quality semiconductor company with a strong capital allocation score and high ROIC. Its focus on power solutions for diverse end markets supports steady growth and profitability.

Key Catalysts:

- Growth in power management solutions

- Expansion into automotive and industrial sectors

- Technological innovation in chip design

Risk Factors:

- Cyclical semiconductor demand

- Supply chain disruptions

- Competitive pricing pressures

Stock #7: InterDigital, Inc. (IDCC)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 6.9 |

| ROIC | 153.4% |

| ROIC - WACC | 143.5% |

| CROIC | 85.5% |

| ROE | 28.0% |

| ROCE | 46.0% |

| Shares Count Growth | 0.0% |

Investment Thesis:

InterDigital, Inc. specializes in wireless and video technologies, boasting a high ROIC and stable capital allocation. The company’s licensing model and intellectual property portfolio provide recurring revenue and margin stability.

Key Catalysts:

- Growth in 5G and wireless standards

- Expansion of licensing agreements

- Strong patent portfolio

Risk Factors:

- Patent litigation risks

- Technology obsolescence

- Customer concentration

Stock #8: NetEase, Inc. (NTES)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 7.7 |

| ROIC | 151.0% |

| ROIC - WACC | 142.1% |

| CROIC | 236.6% |

| ROE | 23.3% |

| ROCE | 18.3% |

| Shares Count Growth | -3.3% |

Investment Thesis:

NetEase, Inc. is a leading Chinese internet technology company with a high capital allocation score and impressive CROIC. Its diversified portfolio in gaming, education, and e-commerce supports resilient growth.

Key Catalysts:

- Expansion in online gaming and digital content

- Growth in education technology

- International market penetration

Risk Factors:

- Regulatory risks in China

- Competition from domestic and global peers

- Currency and geopolitical volatility

Stock #9: Mueller Industries, Inc. (MLI)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 6.3 |

| ROIC | 148.8% |

| ROIC - WACC | 140.0% |

| CROIC | 76.9% |

| ROE | 47.0% |

| ROCE | 71.7% |

| Shares Count Growth | -2.2% |

Investment Thesis:

Mueller Industries, Inc. is a diversified manufacturer with strong capital allocation and high ROIC. Its focus on operational efficiency and disciplined capital deployment supports long-term value creation.

Key Catalysts:

- Infrastructure spending and construction growth

- Product innovation in industrial materials

- Strategic acquisitions

Risk Factors:

- Commodity price volatility

- Cyclical demand in construction

- Supply chain constraints

Stock #10: Corcept Therapeutics Incorporated (CORT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 5.7 |

| ROIC | 138.3% |

| ROIC - WACC | 130.9% |

| CROIC | 309.3% |

| ROE | 20.3% |

| ROCE | 11.9% |

| Shares Count Growth | 3.1% |

Investment Thesis:

Corcept Therapeutics Incorporated is a biopharmaceutical company with a standout CROIC, reflecting efficient cash generation from operations. The company’s capital allocation score suggests a focus on reinvestment in R&D and pipeline expansion.

Key Catalysts:

- Advancements in drug development pipeline

- Expansion of approved indications

- Strategic partnerships

Risk Factors:

- Clinical trial and regulatory risks

- Patent expiration and competition

- R&D execution challenges

Stock #11: Booking Holdings Inc. (BKNG)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 7.4 |

| ROIC | 126.4% |

| ROIC - WACC | 116.8% |

| CROIC | 164.5% |

| ROE | -75.4% |

| ROCE | 62.2% |

| Shares Count Growth | -4.3% |

Investment Thesis:

Booking Holdings Inc. is a global leader in online travel, with a high ROIC and strong CROIC. The company’s negative ROE is influenced by capital structure choices, but its operational efficiency and global reach drive long-term compounding.

Key Catalysts:

- Recovery in global travel demand

- Expansion into new travel services

- Technology-driven booking platforms

Risk Factors:

- Sensitivity to travel industry cycles

- Competitive pressures from new entrants

- Currency and geopolitical risks

Stock #12: InterContinental Hotels Group PLC (IHG)

Quick Stats Table:

| Metric | Value |

|---|---|

| Capital Allocation Score | 6.1 |

| ROIC | 114.7% |

| ROIC - WACC | N/A |

| CROIC | 114.3% |

| ROE | -56.3% |

| ROCE | 55.3% |

| Shares Count Growth | -10.3% |

Investment Thesis:

InterContinental Hotels Group PLC is a major player in the hospitality sector, with a strong ROIC and CROIC. The company’s negative ROE reflects capital structure adjustments, while its global brand portfolio supports resilience and recovery potential.

Key Catalysts:

- Global travel and tourism recovery

- Expansion of hotel brands and franchises

- Asset-light business model

Risk Factors:

- Economic downturns impacting travel

- Competition from alternative accommodations

- Currency and geopolitical risks

Portfolio Diversification Insights

This collection spans technology, healthcare, consumer, industrials, and hospitality, providing sector diversification and exposure to both growth and defensive themes. The mix of U.S. and international companies further reduces geographic concentration risk. High ROIC and disciplined capital allocation are common threads, supporting a balanced approach to compounding returns.

Market Timing & Entry Strategies

Consider monitoring valuation multiples and sector trends for optimal entry points. Staggered entry or dollar-cost averaging can help manage volatility. Pay attention to earnings releases, macroeconomic data, and sector rotation signals for timing adjustments.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 12 Best Dividend Growth Stocks to Buy Now

📖 Fortress Balance Sheets: The Best Low-Debt Companies

📖 10 Best Stock Picks for 2025: High Quality, Low Price/FCF Stocks

📖 9 Best AgriTech Stock Picks for 2025

📖 10 Best Undervalued Stocks for 2025

FAQ for Stock Compounders with High ROIC

Q1: How were these stocks selected?

These stocks were chosen based on high ROIC, strong capital allocation scores, and robust business models as identified by ValueSense’s proprietary analysis.

Q2: What's the best stock from this list?

Each stock offers unique strengths; Apple, NVIDIA, and VeriSign stand out for their consistent capital returns and sector leadership.

Q3: Should I buy all these stocks or diversify?

Diversification across sectors and business models can help manage risk; this list is designed to provide a balanced watchlist for further research.

Q4: What are the biggest risks with these picks?

Risks include sector-specific headwinds, regulatory changes, market cycles, and company-specific execution challenges.

Q5: When is the best time to invest in these stocks?

Optimal timing depends on market conditions, valuation, and individual risk tolerance; consider phased entry and ongoing monitoring.

Summary & Investment Outlook

This ValueSense watchlist highlights 12 high-ROIC compounders across diverse sectors, each with strong capital allocation and growth potential. Use this analysis as an educational resource to inform your own research and portfolio construction. For deeper insights and real-time updates, visit ValueSense.