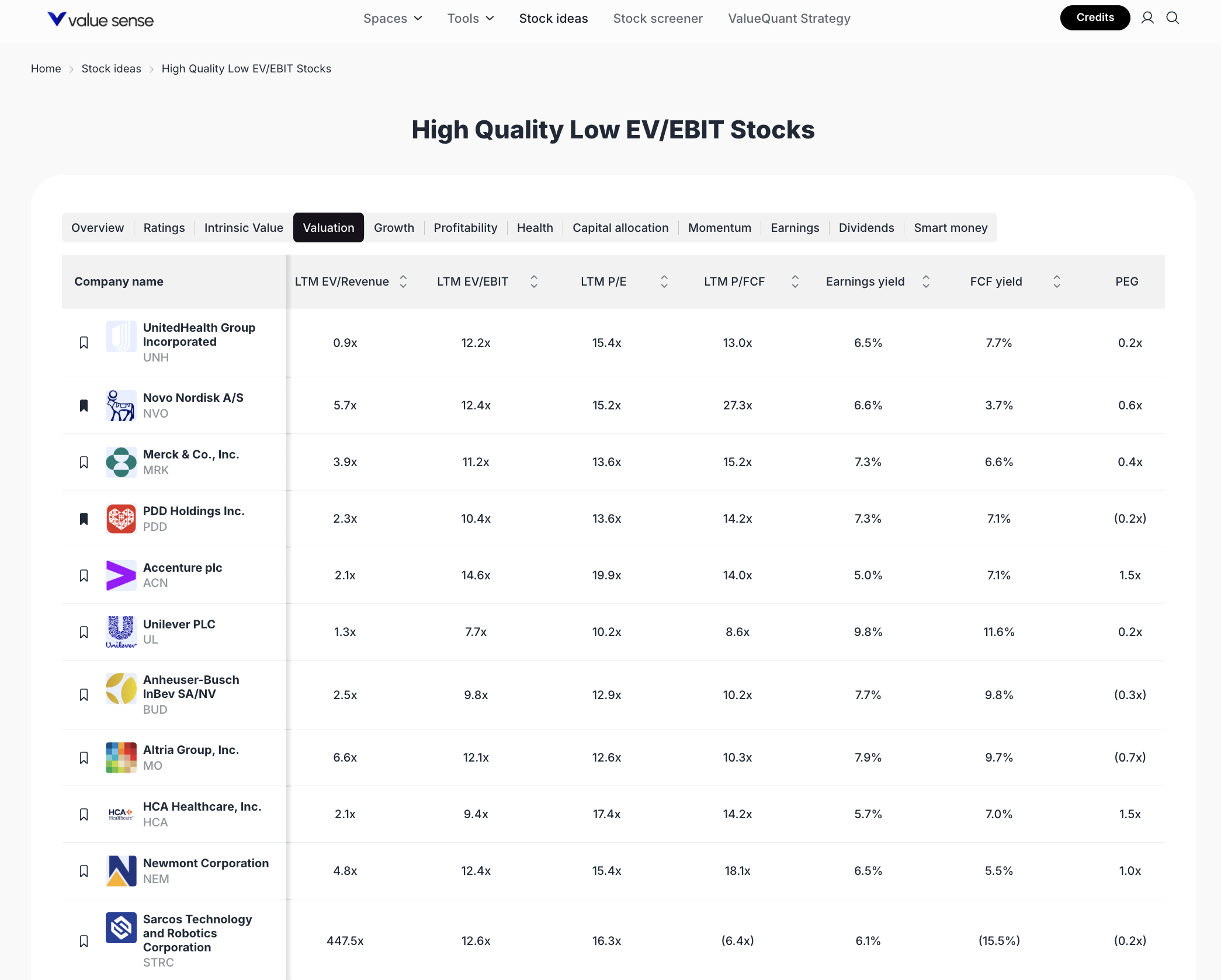

12 Best High Quality Low EV/EBIT Stocks - October-November 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

The current market environment is marked by heightened volatility and sector rotation, making valuation discipline essential for long-term investors. Our selection methodology focuses on stocks with low EV/EBIT multiples, strong free cash flow yields, and robust earnings yields—key indicators of undervaluation and operational efficiency. We prioritize companies from diverse sectors, balancing growth potential with risk management. Each stock is screened using ValueSense’s proprietary intrinsic value models, ensuring a data-driven approach to identifying the best opportunities for 2025.

Featured Stock Analysis

Stock #1: UnitedHealth Group Incorporated (UNH)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 0.9x |

| LTM EV/EBIT | 12.2x |

| LTM P/E | 15.4x |

| LTM P/FCF | 13.0x |

| Earnings Yield | 6.5% |

| FCF Yield | 7.7% |

| PEG | 0.2x |

Investment Thesis:

UnitedHealth Group is a global leader in healthcare, offering insurance and health services through a diversified business model. Its low EV/EBIT (12.2x) and attractive P/E (15.4x) reflect a compelling valuation for a blue-chip operator. The company’s strong free cash flow yield (7.7%) and earnings yield (6.5%) highlight its ability to generate consistent returns, even in uncertain macro environments. UnitedHealth’s scale, integrated offerings, and data-driven approach position it well to benefit from ongoing healthcare digitization and demographic trends.

Key Catalysts:

- Expansion of value-based care and digital health solutions

- Aging population driving demand for healthcare services

- Strong balance sheet enabling strategic acquisitions

u Risk Factors:

- Regulatory changes in U.S. healthcare policy

- Margin pressures from rising medical costs

- Competitive threats from new entrants and tech disruptors

Stock #2: Novo Nordisk A/S (NVO)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 5.7x |

| LTM EV/EBIT | 12.4x |

| LTM P/E | 15.2x |

| LTM P/FCF | 27.3x |

| Earnings Yield | 6.6% |

| FCF Yield | 3.7% |

| PEG | 0.6x |

Investment Thesis:

Novo Nordisk is a global pharmaceutical leader, especially in diabetes and obesity care. The stock’s low EV/EBIT (12.4x) and solid earnings yield (6.6%) suggest undervaluation relative to its growth prospects. While the P/FCF is elevated (27.3x), this is offset by robust revenue growth and a PEG ratio of 0.6x, indicating strong earnings growth relative to price. Novo Nordisk’s innovation pipeline and global reach underpin its long-term value proposition.

Key Catalysts:

- Blockbuster drugs in diabetes and obesity segments

- Expansion into emerging markets

- Ongoing R&D driving new product launches

Risk Factors:

- Patent expirations and generic competition

- Pricing pressures in key markets

- Regulatory risks in pharmaceuticals

Stock #3: Merck & Co., Inc. (MRK)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 3.9x |

| LTM EV/EBIT | 11.2x |

| LTM P/E | 13.6x |

| LTM P/FCF | 15.2x |

| Earnings Yield | 7.3% |

| FCF Yield | 6.6% |

| PEG | 0.4x |

Investment Thesis:

Merck is a diversified pharmaceutical giant with a strong oncology and vaccines portfolio. Its low EV/EBIT (11.2x) and P/E (13.6x) signal attractive valuation, while high earnings (7.3%) and FCF yields (6.6%) underscore its cash generation strength. The company’s robust pipeline and global footprint provide resilience and upside potential, especially as demand for innovative therapies grows.

Key Catalysts:

- Keytruda and other blockbuster drugs driving revenue

- Expansion in emerging markets

- Strategic M&A to bolster pipeline

Risk Factors:

- Patent cliffs and biosimilar competition

- Regulatory hurdles for new drugs

- Currency and geopolitical risks

Stock #4: PDD Holdings Inc. (PDD)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 2.3x |

| LTM EV/EBIT | 10.4x |

| LTM P/E | 13.6x |

| LTM P/FCF | 14.2x |

| Earnings Yield | 7.3% |

| FCF Yield | 7.1% |

| PEG | (0.2x) |

Investment Thesis:

PDD Holdings is a leading Chinese e-commerce platform, known for its rapid growth and innovative business model. With a low EV/EBIT (10.4x) and P/E (13.6x), the stock is attractively valued relative to its growth trajectory. Strong earnings and FCF yields (7.3% and 7.1%) reflect robust profitability. PDD’s focus on value-driven consumers and technology-driven efficiency supports its competitive edge in a dynamic market.

Key Catalysts:

- Expansion into new international markets

- Growth in active user base and merchant ecosystem

- Investment in logistics and supply chain technology

Risk Factors:

- Regulatory scrutiny in China

- Intense competition from domestic and global players

- Currency and geopolitical risks

Stock #5: Accenture plc (ACN)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 2.1x |

| LTM EV/EBIT | 14.6x |

| LTM P/E | 19.9x |

| LTM P/FCF | 14.0x |

| Earnings Yield | 5.0% |

| FCF Yield | 7.1% |

| PEG | 1.5x |

Investment Thesis:

Accenture is a global leader in consulting and IT services, serving clients across industries. While its EV/EBIT (14.6x) and P/E (19.9x) are higher than some peers, strong FCF yield (7.1%) and a diversified revenue base support its premium valuation. Accenture’s expertise in digital transformation, cloud, and AI positions it as a key enabler of enterprise modernization.

Key Catalysts:

- Growing demand for digital and cloud services

- Expansion into emerging markets and new verticals

- Strategic acquisitions to enhance capabilities

Risk Factors:

- Economic slowdowns impacting client budgets

- Talent retention and wage inflation

- Currency fluctuations

Stock #6: Unilever PLC (UL)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 1.3x |

| LTM EV/EBIT | 7.7x |

| LTM P/E | 10.2x |

| LTM P/FCF | 8.6x |

| Earnings Yield | 9.8% |

| FCF Yield | 11.6% |

| PEG | 0.2x |

Investment Thesis:

Unilever is a global consumer goods powerhouse with a broad portfolio of trusted brands. Its low EV/EBIT (7.7x) and P/E (10.2x) make it one of the most attractively valued stocks in the sector. Exceptional earnings (9.8%) and FCF yields (11.6%) highlight its cash generation and dividend potential. Unilever’s scale, brand strength, and emerging market exposure provide resilience and growth opportunities.

Key Catalysts:

- Innovation in health and wellness products

- Expansion in emerging markets

- Cost optimization initiatives

Risk Factors:

- Commodity price volatility

- Currency headwinds

- Shifting consumer preferences

Stock #7: Anheuser-Busch InBev SA/NV (BUD)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 2.5x |

| LTM EV/EBIT | 9.8x |

| LTM P/E | 12.9x |

| LTM P/FCF | 10.2x |

| Earnings Yield | 7.7% |

| FCF Yield | 9.8% |

| PEG | (0.3x) |

Investment Thesis:

Anheuser-Busch InBev is a global brewing leader with a diverse brand portfolio. Its low EV/EBIT (9.8x) and P/E (12.9x) suggest undervaluation, while strong earnings (7.7%) and FCF yields (9.8%) support its dividend and debt reduction strategies. The company’s global scale and premiumization initiatives drive long-term value.

Key Catalysts:

- Premiumization of beer portfolio

- Expansion in emerging markets

- Debt reduction and margin improvement

Risk Factors:

- Shifting consumer preferences toward alternatives

- Currency and commodity price risks

- Regulatory challenges

Stock #8: Altria Group, Inc. (MO)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 6.6x |

| LTM EV/EBIT | 12.1x |

| LTM P/E | 12.6x |

| LTM P/FCF | 10.3x |

| Earnings Yield | 7.9% |

| FCF Yield | 9.7% |

| PEG | (0.7x) |

Investment Thesis:

Altria Group is a leading tobacco company with a focus on transitioning to reduced-risk products. Its low EV/EBIT (12.1x) and P/E (12.6x) reflect a discounted valuation, while high earnings (7.9%) and FCF yields (9.7%) support a robust dividend. Altria’s strategic investments in non-combustible products and cannabis offer long-term growth optionality.

Key Catalysts:

- Growth in reduced-risk and alternative products

- Strong cash flow supporting dividends and buybacks

- Strategic investments in cannabis and vaping

Risk Factors:

- Regulatory and litigation risks

- Declining cigarette volumes

- Shifting consumer preferences

Stock #9: HCA Healthcare, Inc. (HCA)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 2.1x |

| LTM EV/EBIT | 10.9x |

| LTM P/E | 17.4x |

| LTM P/FCF | 14.2x |

| Earnings Yield | 5.7% |

| FCF Yield | 7.0% |

| PEG | 1.5x |

Investment Thesis:

HCA Healthcare is a leading U.S. hospital operator with a strong regional presence. Its low EV/EBIT (10.9x) and solid FCF yield (7.0%) support ongoing investment and shareholder returns. HCA’s scale, operational efficiency, and focus on high-growth markets underpin its long-term growth outlook.

Key Catalysts:

- Expansion in high-growth U.S. regions

- Investments in technology and patient care

- Strong balance sheet enabling M&A

Risk Factors:

- Regulatory and reimbursement risks

- Labor shortages and wage inflation

- Competition from non-traditional healthcare providers

Stock #10: Newmont Corporation (NEM)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 4.8x |

| LTM EV/EBIT | 12.4x |

| LTM P/E | 15.4x |

| LTM P/FCF | 18.1x |

| Earnings Yield | 6.5% |

| FCF Yield | 5.5% |

| PEG | 1.0x |

Investment Thesis:

Newmont is the world’s largest gold producer, offering investors exposure to precious metals and inflation hedging. Its EV/EBIT (12.4x) and P/E (15.4x) are reasonable given its scale and asset quality. Newmont’s strong balance sheet and disciplined capital allocation support sustainable dividends and growth.

Key Catalysts:

- Rising gold prices amid macro uncertainty

- Expansion of low-cost mining operations

- Portfolio optimization and cost control

Risk Factors:

- Commodity price volatility

- Operational and geopolitical risks

- Environmental and regulatory challenges

Stock #11: Sarcos Technology and Robotics Corporation (STRC)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 447.5x |

| LTM EV/EBIT | 12.6x |

| LTM P/E | 16.3x |

| LTM P/FCF | (6.4x) |

| Earnings Yield | 6.1% |

| FCF Yield | (15.5%) |

| PEG | (0.2x) |

Investment Thesis:

Sarcos Technology is a robotics innovator focused on industrial automation. While its EV/Revenue is extremely high (447.5x), the EV/EBIT (12.6x) and P/E (16.3x) suggest the market is pricing in future growth. Negative FCF yield (-15.5%) and P/FCF reflect early-stage investment, but the company’s technology leadership and market potential are significant.

Key Catalysts:

- Commercialization of next-gen robotics

- Strategic partnerships with industrial leaders

- Expansion into new automation markets

Risk Factors:

- High cash burn and negative free cash flow

- Execution risk in scaling production

- Competitive pressures from larger tech firms

Stock #12: Bristol-Myers Squibb Company (BMY)

Quick Stats Table:

| Metric | Value |

|---|---|

| LTM EV/Revenue | 2.7x |

| LTM EV/EBIT | 13.2x |

| LTM P/E | 18.3x |

| LTM P/FCF | 6.3x |

| Earnings Yield | 5.5% |

| FCF Yield | 15.8% |

| PEG | (0.1x) |

Investment Thesis:

Bristol-Myers Squibb is a global biopharma leader with a strong pipeline and established brands. Its EV/EBIT (13.2x) and P/E (18.3x) are reasonable for the sector, while a very strong FCF yield (15.8%) supports capital returns. The company’s focus on oncology, immunology, and cardiovascular drugs provides growth and diversification.

Key Catalysts:

- New drug launches and pipeline progress

- Expansion in global markets

- Strategic M&A to enhance portfolio

Risk Factors:

- Patent expirations and generic competition

- Regulatory and pricing pressures

- Integration risks from acquisitions

Portfolio Diversification Insights

This stock collection spans healthcare, technology, consumer goods, industrials, and commodities, providing sector diversification and risk mitigation. Healthcare and pharmaceuticals offer defensive growth, while technology and robotics add innovation exposure. Consumer staples and commodities balance cyclical risks, creating a resilient portfolio foundation.

Market Timing & Entry Strategies

Investors may consider dollar-cost averaging to manage volatility, especially in sectors facing near-term headwinds. Monitoring sector rotation and macroeconomic signals can help optimize entry points. ValueSense’s intrinsic value tools can assist in identifying attractive buy zones for each stock.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 1-Month Market Movers: Best Undervalued High-Quality Stocks

📖 7 Best Undervalued Stock Picks for October 2025

📖 12 Best Stock Picks for Profitable Growth

📖 12 Best Momentum Stock Picks for November 2025

📖 13 Best Wide Moat Stock Picks for 2025

FAQ for Low EV/EBIT Stocks

Q1: How were these stocks selected?

A1: Stocks were chosen based on low EV/EBIT multiples, strong free cash flow and earnings yields, and sector diversification using ValueSense’s proprietary screening models.

Q2: What's the best stock from this list?

A2: Each stock offers unique strengths; investors should align choices with their sector preferences and risk tolerance. Unilever and Merck stand out for value and yield.

Q3: Should I buy all these stocks or diversify?

A3: Diversification across sectors can reduce risk. This collection is designed to provide balanced exposure rather than concentrated bets.

Q4: What are the biggest risks with these picks?

A4: Key risks include regulatory changes, sector-specific headwinds, currency fluctuations, and company execution challenges.

Q5: When is the best time to invest in these stocks?

A5: Market timing is challenging; consider gradual entry strategies and use ValueSense’s intrinsic value tools to identify favorable entry points.

Summary & Investment Outlook

This 2025 stock watchlist highlights 12 undervalued companies with strong operational metrics and sector diversity. By focusing on low EV/EBIT multiples and robust yields, investors can build a resilient portfolio positioned for long-term growth. For deeper analysis and real-time updates, explore ValueSense’s research platform.