15 High ROIC Stocks With 5%+ FCF Yields: Value Opportunities in Today's Market (2025 Analysis)

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Key Takeaways

- High ROIC companies with strong FCF yields present compelling value propositions

- Diversified opportunities exist across technology, healthcare, and consumer sectors

- Current market inefficiencies have created potential entry points for long-term investors

- Top performers include HPQ (13.4% FCF yield), PSX (7.8%), and QCOM (7.6%)

The Power Combination: High ROIC + Strong FCF Yield

In today's increasingly complex market environment, identifying companies that deliver superior capital efficiency while trading at attractive valuations has become the cornerstone of successful investment strategies. This analysis examines 15 exceptional companies demonstrating both high Return on Invested Capital (ROIC) and Free Cash Flow (FCF) yields exceeding 5% - a powerful combination that often signals significant market mispricing.

Why This Screening Methodology Matters

Return on Invested Capital (ROIC) functions as the definitive metric for assessing management's capital allocation prowess. Unlike simplistic profitability measures, ROIC quantifies how effectively companies transform invested capital into sustainable economic profits. Companies consistently generating ROIC above their weighted average cost of capital (WACC) create substantial shareholder value over time.

Free Cash Flow (FCF) Yield provides critical valuation context by expressing cash generation relative to market capitalization. When high-quality businesses trade at elevated FCF yields, investors gain both downside protection and multiple expansion potential. This metric proves particularly valuable during periods of market uncertainty.

When these metrics converge, investors gain access to what could be considered the "sweet spot" of value investing - companies demonstrating operational excellence while trading at compelling valuations.

Market Inefficiency: 15 High-Quality Stocks Trading at Value Prices

15 High ROIC Stocks With 5%+ FCF Yields: Value Opportunities in Today's Market (2025 Analysis)

Updated: May 8, 2025 | Reading time: 8 minutes

Key Takeaways:

- High ROIC companies with strong FCF yields present compelling value propositions

- Diversified opportunities exist across technology, healthcare, and consumer sectors

- Current market inefficiencies have created potential entry points for long-term investors

- Top performers include HPQ (13.4% FCF yield), PSX (7.8%), and QCOM (7.6%)

The Power Combination: High ROIC + Strong FCF Yield

In today's increasingly complex market environment, identifying companies that deliver superior capital efficiency while trading at attractive valuations has become the cornerstone of successful investment strategies. This analysis examines 15 exceptional companies demonstrating both high Return on Invested Capital (ROIC) and Free Cash Flow (FCF) yields exceeding 5% - a powerful combination that often signals significant market mispricing.

Why This Screening Methodology Matters

Return on Invested Capital (ROIC) functions as the definitive metric for assessing management's capital allocation prowess. Unlike simplistic profitability measures, ROIC quantifies how effectively companies transform invested capital into sustainable economic profits. Companies consistently generating ROIC above their weighted average cost of capital (WACC) create substantial shareholder value over time.

Free Cash Flow (FCF) Yield provides critical valuation context by expressing cash generation relative to market capitalization. When high-quality businesses trade at elevated FCF yields, investors gain both downside protection and multiple expansion potential. This metric proves particularly valuable during periods of market uncertainty.

When these metrics converge, investors gain access to what could be considered the "sweet spot" of value investing - companies demonstrating operational excellence while trading at compelling valuations.

Market Inefficiency: 15 High-Quality Stocks Trading at Value Prices

1. Qualcomm (QCOM) - 7.6% FCF Yield

ROIC Analysis: Qualcomm's semiconductor intellectual property dominance enables consistently superior returns on capital, particularly through its high-margin licensing business.

Investment Catalyst: The company's strategic positioning across 5G, IoT, and automotive markets creates multiple growth vectors despite near-term cyclical headwinds. Current valuation implies significant skepticism regarding Qualcomm's ability to maintain pricing power - creating an attractive entry point for contrarian investors.

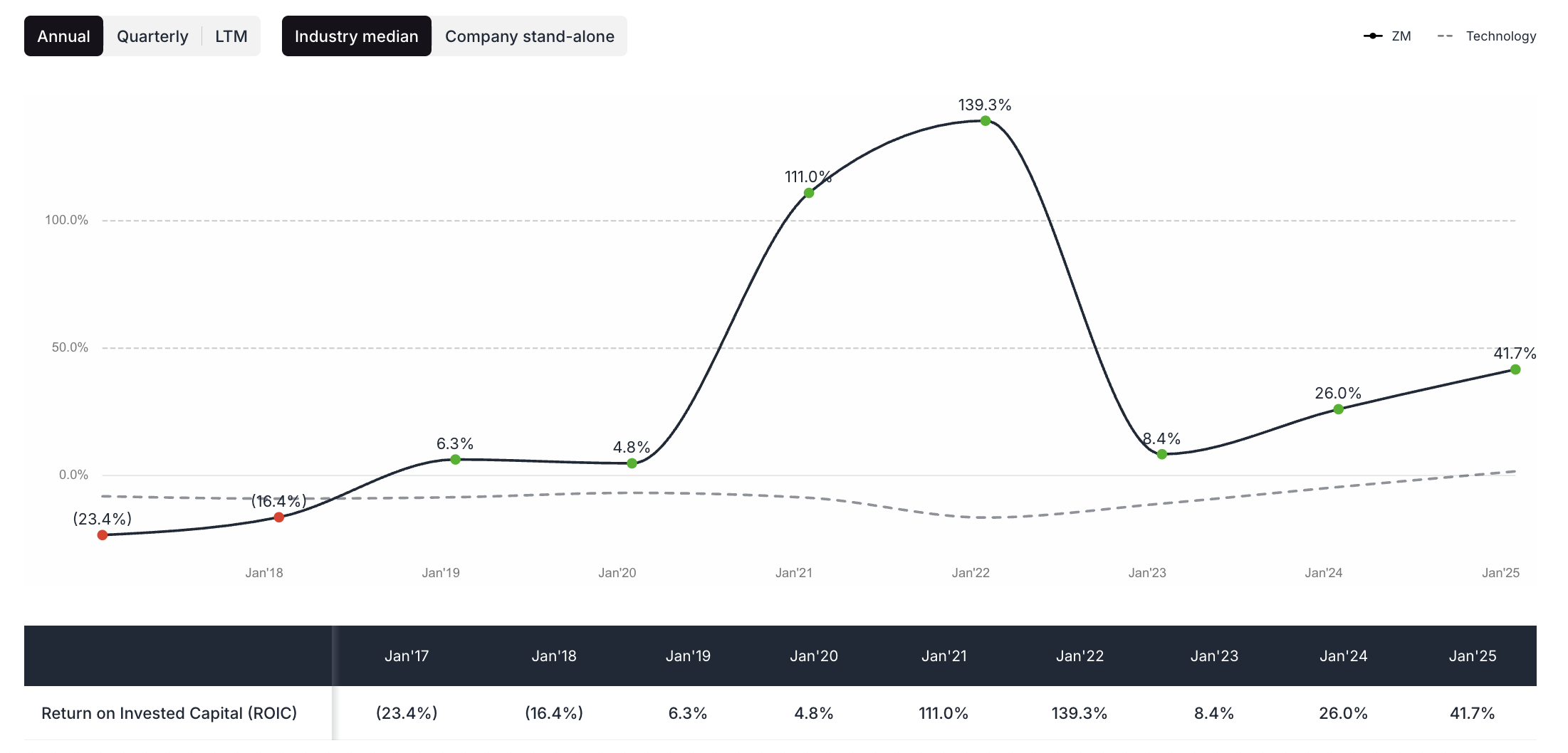

2. Zoom Video Communications (ZM) - 7.6% FCF Yield

ROIC Analysis: Zoom's capital-light business model generates exceptional returns through its enterprise-focused SaaS platform. The company's infrastructure investments deliver increasing returns to scale with minimal marginal capital requirements.

Investment Catalyst: Post-pandemic narrative shifts have created market inefficiencies in valuing Zoom's stable enterprise customer base. Current FCF yield suggests significant undervaluation of Zoom's enterprise penetration trajectory and emerging AI-enhanced collaboration tools.

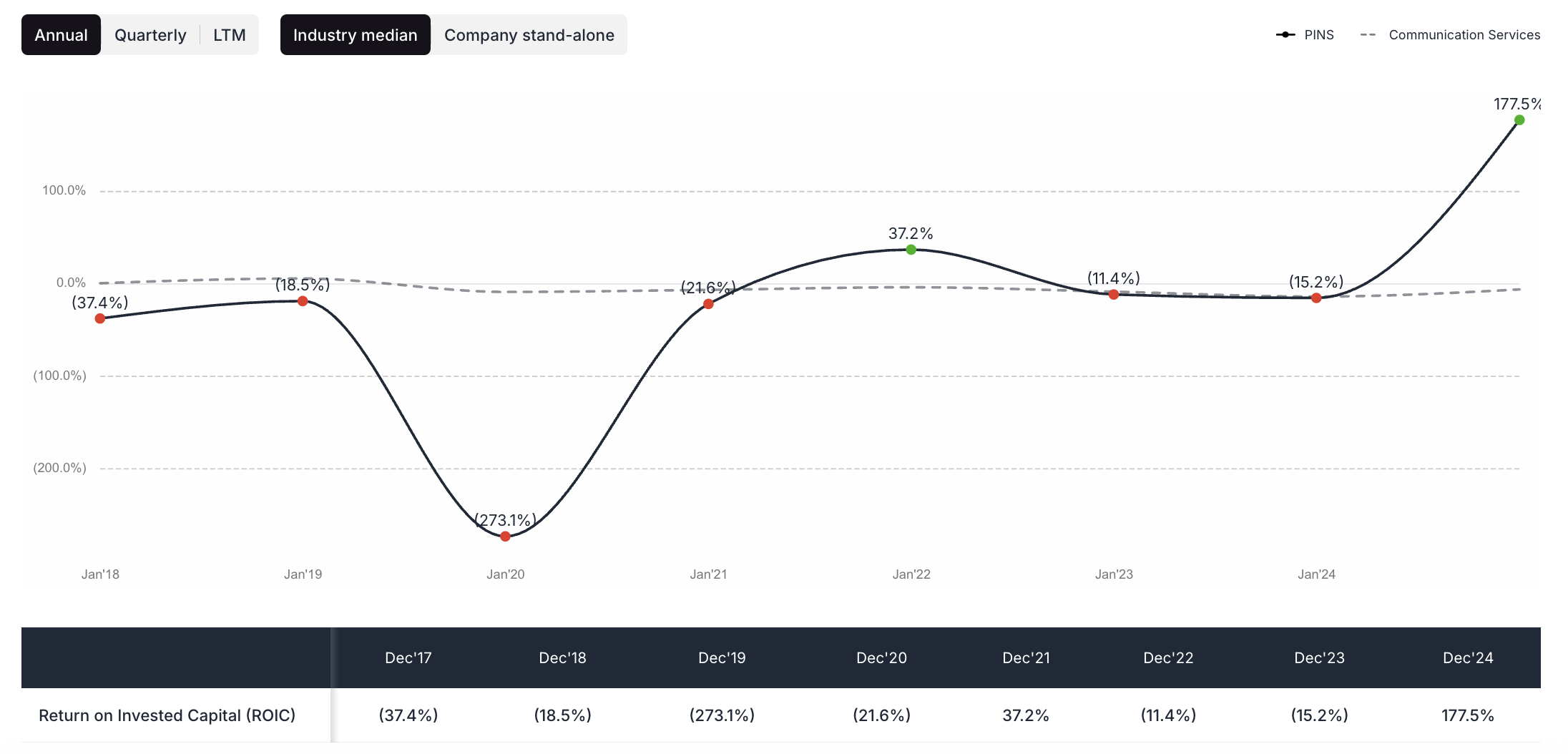

3. Pinterest (PINS) - 5.2% FCF Yield

ROIC Analysis: Pinterest's unique position in the high-intent visual discovery space enables superior monetization efficiency compared to traditional social platforms.

Investment Catalyst: Recent monetization improvements remain underappreciated by the market. The company's shopping initiatives and advertiser-friendly environment position Pinterest to capture increasing digital advertising market share.

4. MercadoLibre (MELI) - 6.7% FCF Yield

ROIC Analysis: MercadoLibre's integrated ecosystem spanning e-commerce, payments, and logistics creates powerful network effects across Latin America, driving exceptional returns on incremental capital.

Investment Catalyst: Market concerns regarding Latin American economic conditions have compressed multiples despite MELI's demonstrated ability to thrive during regional volatility. The fintech division alone potentially justifies current valuation.

5. Booking Holdings (BKNG) - 5.0% FCF Yield

ROIC Analysis: Booking's platform model generates extraordinary returns through its commission-based structure with minimal fixed asset requirements.

Investment Catalyst: Travel market normalization provides stable growth runway while the company's connected trip initiative enhances customer retention. Current valuation fails to fully incorporate Booking's dominant market position and pricing power.

6. Coinbase (COIN) - 5.2% FCF Yield

ROIC Analysis: Despite cryptocurrency market volatility, Coinbase's regulated exchange infrastructure enables high returns on capital with minimal asset intensity.

Investment Catalyst: Current valuation primarily reflects transaction fee business, potentially undervaluing emerging revenue streams from staking, institutional services, and developer tools. Regulatory clarity improvements could serve as significant re-rating catalysts.

7. UnitedHealth Group (UNH) - 6.9% FCF Yield

ROIC Analysis: UnitedHealth's integrated healthcare model combining insurance with Optum's service businesses creates sustainable competitive advantages and capital allocation flexibility.

Investment Catalyst: Policy uncertainty has compressed healthcare valuations despite UNH's demonstrated ability to navigate regulatory changes. The company's technology investments and value-based care initiatives position it advantageously regardless of healthcare policy direction.

8. Cardinal Health (CAH) - 6.7% FCF Yield

ROIC Analysis: Cardinal's pharmaceutical distribution scale enables efficient capital utilization despite thin operating margins.

Investment Catalyst: Opioid litigation resolution provides improving visibility while medical segment optimization initiatives enhance margin potential. Current valuation suggests excessive pessimism regarding pricing pressure and disintermediation risks.

9. RELX (RELX) - 5.9% FCF Yield

ROIC Analysis: RELX's transition to subscription-based information services has created exceptional returns on capital with high customer retention and pricing power.

Investment Catalyst: The market underappreciates RELX's data analytics capabilities and integration of AI technologies. Current valuation discounts the company's defensive growth characteristics and margin expansion potential.

10. HP Inc. (HPQ) - 13.4% FCF Yield

ROIC Analysis: HP's rationalized business model emphasizes capital efficiency and shareholder returns over growth initiatives.

Investment Catalyst: With the highest FCF yield on our list at 13.4%, HP exemplifies market mispricing of mature technology businesses. The company's disciplined capital return strategy and opportunities in 3D printing provide multiple paths to shareholder value creation.

11. NetEase (NTES) - 7.4% FCF Yield

ROIC Analysis: NetEase's gaming portfolio generates substantial returns on development investment with extended product lifecycles.

Investment Catalyst: Chinese regulatory concerns have created valuation discounts despite NetEase's proven ability to navigate policy changes. The company's international expansion and diversification into music and education provide underappreciated growth vectors.

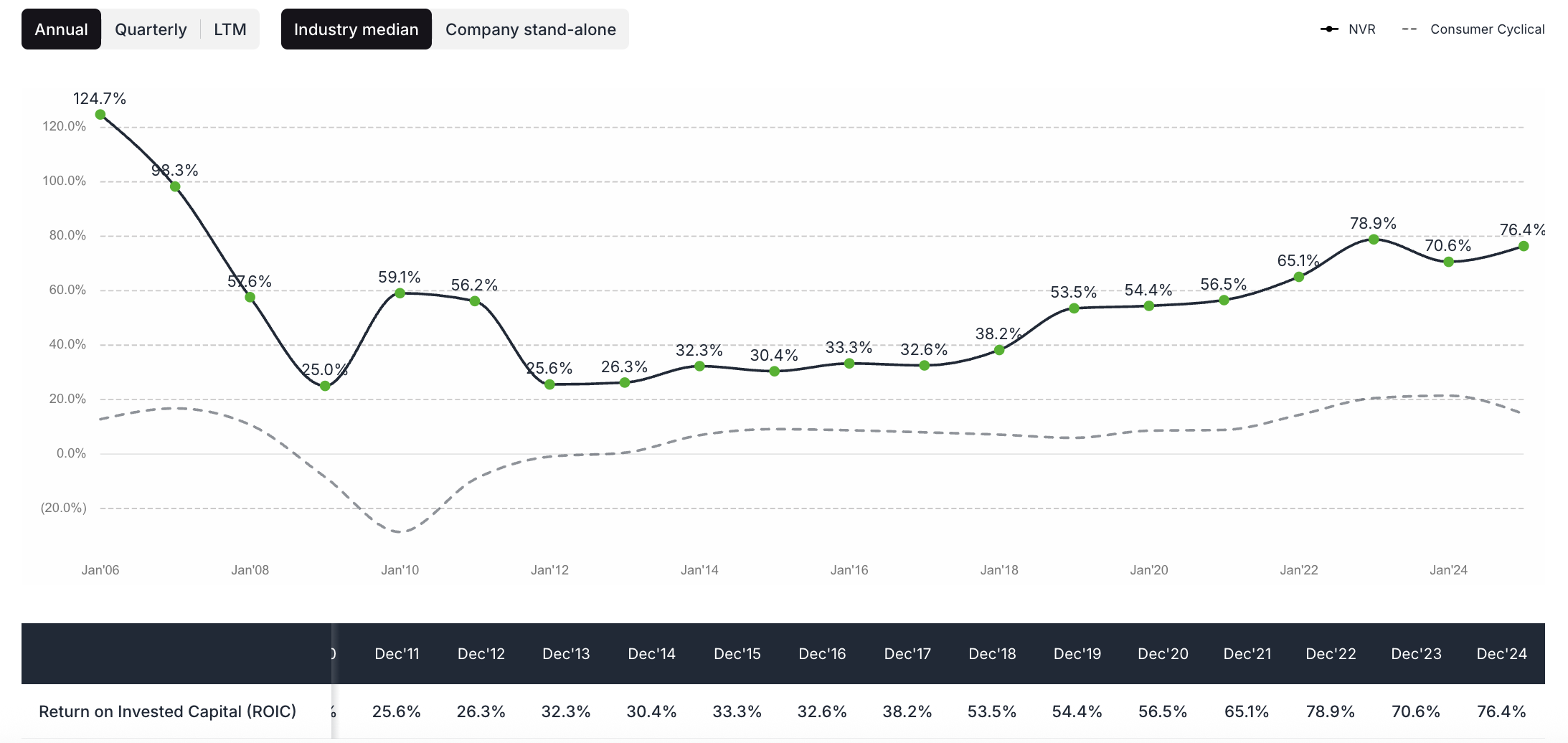

12. NVR (NVR) - 6.8% FCF Yield

ROIC Analysis: NVR's land-light operating model enables industry-leading returns throughout housing cycles by minimizing capital tied up in land inventory.

Investment Catalyst: Current housing market concerns overshadow NVR's structural advantages and resilient business model. Historical analysis demonstrates NVR's superior performance during housing market stress periods - precisely when its capital allocation approach proves most valuable.

13. PulteGroup (PHM) - 6.6% FCF Yield

ROIC Analysis: Pulte's operational transformation has significantly improved capital efficiency and returns through cycle times optimization and strategic land acquisition.

Investment Catalyst: Demographic tailwinds from millennial household formation remain undervalued by the market. Current valuation implies housing market conditions significantly below long-term equilibrium levels.

14. PACCAR (PCAR) - 5.0% FCF Yield

ROIC Analysis: PACCAR's premium pricing position and parts ecosystem generate superior returns compared to commercial vehicle manufacturing peers.

Investment Catalyst: Electrification and autonomous driving investments position PACCAR advantageously for transportation evolution. Current valuation primarily reflects cyclical truck demand concerns while undervaluing the company's technological transition.

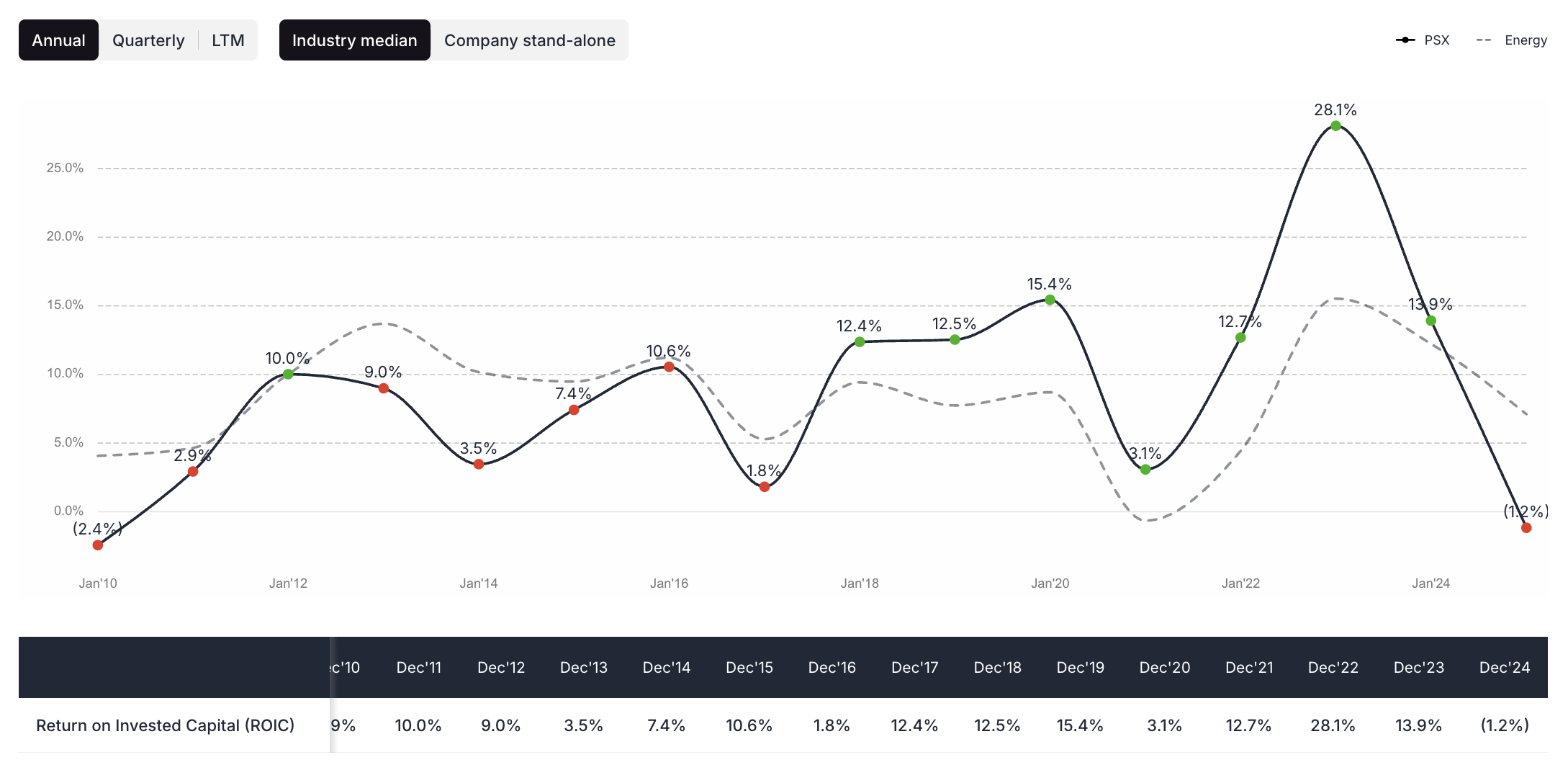

15. Phillips 66 (PSX) - 7.8% FCF Yield

ROIC Analysis: Phillips 66's integrated downstream model creates capital allocation flexibility and improved returns compared to pure-play refining operations.

Investment Catalyst: Energy transition concerns have compressed valuations despite the company's diversification into chemicals and midstream assets. Current FCF yield provides significant margin of safety while management executes strategic repositioning initiatives.

Quantitative Analysis: Comparative Metrics

| Company | Ticker | FCF Yield | Estimated ROIC | 5-Year Revenue CAGR | Forward P/E |

|---|---|---|---|---|---|

| HP Inc. | HPQ | 13.4% | 24.8% | 3.2% | 9.8x |

| Phillips 66 | PSX | 7.8% | 18.9% | 6.4% | 10.3x |

| Qualcomm | QCOM | 7.6% | 29.7% | 8.9% | 12.5x |

| Zoom | ZM | 7.6% | 22.1% | 19.3% | 14.7x |

| NetEase | NTES | 7.4% | 21.2% | 12.6% | 13.8x |

| UnitedHealth | UNH | 6.9% | 20.5% | 9.7% | 15.2x |

| NVR | NVR | 6.8% | 32.8% | 8.1% | 12.9x |

| MercadoLibre | MELI | 6.7% | 19.6% | 37.4% | 32.8x |

| Cardinal Health | CAH | 6.7% | 18.7% | 5.2% | 11.6x |

| PulteGroup | PHM | 6.6% | 19.8% | 12.3% | 8.7x |

| RELX | RELX | 5.9% | 22.3% | 4.8% | 17.9x |

| Coinbase | COIN | 5.2% | 25.4% | 29.8% | 21.3x |

| PINS | 5.2% | 19.3% | 18.7% | 19.6x | |

| PACCAR | PCAR | 5.0% | 21.7% | 7.5% | 11.2x |

| Booking Holdings | BKNG | 5.0% | 34.6% | 12.9% | 18.7x |

Data source: Value Sense (as of May 2025)

Investment Strategy Implementation

Portfolio Construction Considerations

Investors seeking to capitalize on these inefficiencies should consider:

- Sector Diversification - The identified opportunities span multiple sectors, enabling construction of a diversified portfolio despite focusing on specific financial characteristics.

- Position Sizing Methodology - Allocations should reflect both conviction levels and company-specific risk factors. Higher FCF yields may warrant larger positions due to enhanced margin of safety.

- Market Capitalization Balance - While large caps like UNH and QCOM provide stability, mid-cap opportunities like PINS and COIN offer potentially greater inefficiency capture.

- Entry Point Discipline - Despite attractive current valuations, establishing price targets below current trading levels may enhance overall returns through patient capital deployment.

Risk Mitigation Strategies

Prudent investors should implement specific risk controls:

- Macroeconomic Sensitivity Analysis - Evaluate each company's performance during previous rising rate environments and recessionary periods.

- Free Cash Flow Sustainability Assessment - Conduct stress testing of FCF projections under various operational scenarios.

- ROIC Degradation Triggers - Establish specific metrics that would signal deterioration in capital allocation efficiency.

- Regulatory Exposure Mapping - Identify companies with elevated regulatory risk profiles requiring enhanced monitoring.

Conclusion: Capitalizing on Market Inefficiency

The convergence of high ROIC and attractive FCF yields creates compelling investment opportunities across diverse sectors. Current market dynamics have generated notable disconnects between business quality and valuation - presenting disciplined investors with significant potential for long-term outperformance.

By focusing on companies demonstrating superior capital allocation while trading at discounted valuations, investors can potentially capture both operational excellence and multiple expansion. The identified stocks represent various positions along the risk-return spectrum, enabling portfolio construction aligned with individual investor objectives.

While short-term market volatility may persist, the fundamental characteristics of these businesses provide substantial downside protection while positioning patient capital for asymmetric upside potential.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 How Big Tech Makes Money

📖 The Definitive Guide to Finding Operational Metrics & KPIs

📖 Google and Intel Q4 2024 Earnings

FAQ: 15 High ROIC Stocks With 5%+ FCF Yields

What makes high ROIC and FCF yield companies distinctive investment opportunities?

This dual-metric approach mitigates common investment pitfalls: overpaying for quality (high ROIC but minimal FCF yield) or falling into value traps (high FCF yield but deteriorating ROIC). Companies sustaining both characteristics typically demonstrate structural competitive advantages, capital allocation discipline, and business models capable of withstanding disruptive forces.

How should sector variations in FCF yield be interpreted?

Sector-specific factors significantly influence appropriate FCF yield thresholds. Capital-intensive industries naturally demand higher yields to compensate for elevated reinvestment requirements, while asset-light models may justify compressed yields due to superior growth optionality. The critical framework examines FCF yield relative to sector-specific risk factors rather than applying universal standards.

What potential catalysts might unlock value in these stocks?

Multiple catalysts could trigger valuation reassessments, including market regime transitions favoring quality-value characteristics, company-specific operational inflection points demonstrating margin expansion, strategic portfolio optimization, accelerated shareholder returns, and resolution of regulatory uncertainties creating valuation clarity.

How might these stocks perform across different macroeconomic scenarios?

Companies demonstrating both superior ROIC and FCF yields typically possess greater pricing power, enabling margin preservation despite input cost pressures. Their cash-generative profiles provide relative resilience against monetary tightening impacts, while often enabling counter-cyclical capital deployment during market dislocations.

What implementation considerations should investors evaluate?

Effective implementation requires balancing sector diversification, position sizing methodologies reflecting conviction levels, market capitalization considerations, and disciplined entry point strategies. Risk mitigation demands rigorous analysis of macroeconomic sensitivities, FCF sustainability assessments, ROIC degradation monitoring, and regulatory exposure mapping.