5 Best Stock Picks for October 2025: Top Undervalued Stocks to Watch

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

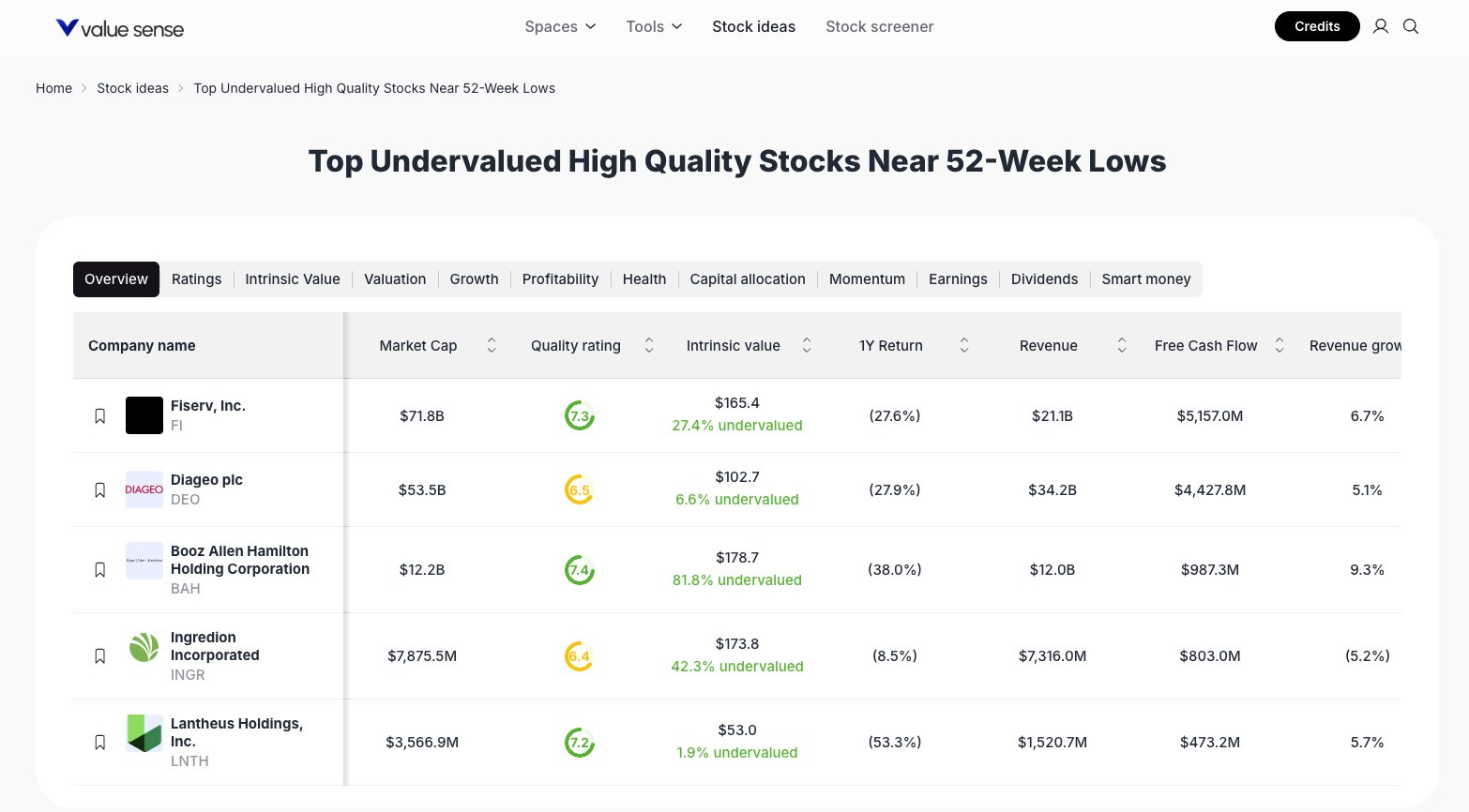

The current market environment is characterized by heightened volatility and a renewed focus on value-driven investing. Our selection methodology emphasizes intrinsic value, quality ratings, and recent price performance relative to 52-week lows. Each stock is screened for undervaluation using proprietary ValueSense metrics, including quality scores, revenue growth, and free cash flow. This approach ensures a diversified watchlist of high-quality companies with strong fundamentals and attractive upside potential.

Featured Stock Analysis

Stock #1: Fiserv, Inc. (FI)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $71.8B |

| Quality Rating | 7.3 |

| Intrinsic Value | $165.4 (27.4% undervalued) |

| 1Y Return | (27.6%) |

| Revenue | $21.1B |

| Free Cash Flow | $5,157.0M |

| Revenue Growth | 6.7% |

Investment Thesis

Fiserv, Inc. stands out as a leading provider in the financial technology sector, offering payment and financial services to businesses worldwide. With a market cap of $71.8B and a quality rating of 7.3, Fiserv demonstrates robust operational scale and resilience. The stock is currently trading at a significant discount to its intrinsic value of $165.4, representing a 27.4% undervaluation. Despite a negative one-year return of (27.6%), Fiserv’s fundamentals remain strong, highlighted by $21.1B in revenue and $5.16B in free cash flow.

The company’s 6.7% revenue growth signals ongoing expansion, supported by its diversified client base and recurring revenue streams. Fiserv’s ability to generate substantial free cash flow provides flexibility for reinvestment and shareholder returns, positioning it well for a market rebound.

Key Catalysts

- Continued digital transformation in financial services

- Expansion of payment processing solutions

- Strategic acquisitions and partnerships

Risk Factors

- Exposure to macroeconomic slowdowns impacting transaction volumes

- Competitive pressures from fintech disruptors

- Regulatory changes in the payments industry

Stock #2: Diageo plc (DEO)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $53.5B |

| Quality Rating | 6.5 |

| Intrinsic Value | $102.7 (6.6% undervalued) |

| 1Y Return | (27.9%) |

| Revenue | $34.2B |

| Free Cash Flow | $4,427.8M |

| Revenue Growth | 5.1% |

Investment Thesis

Diageo plc, a global leader in beverage alcohol, commands a market cap of $53.5B and maintains a quality rating of 6.5. The stock is trading 6.6% below its intrinsic value of $102.7, suggesting moderate undervaluation. Despite a challenging year with a (27.9%) return, Diageo’s $34.2B in revenue and $4.43B in free cash flow underscore its financial strength and operational efficiency.

The company’s 5.1% revenue growth reflects steady demand for its premium brands across international markets. Diageo’s global footprint and diversified product portfolio provide resilience against regional economic fluctuations, while ongoing innovation in product offerings supports long-term growth.

Key Catalysts

- Expansion in emerging markets

- Premiumization trends in spirits and beverages

- Cost optimization initiatives

Risk Factors

- Currency fluctuations impacting international revenues

- Regulatory risks in the alcohol industry

- Shifts in consumer preferences

Stock #3: Booz Allen Hamilton Holding Corporation (BAH)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $12.2B |

| Quality Rating | 7.4 |

| Intrinsic Value | $178.7 (81.8% undervalued) |

| 1Y Return | (38.0%) |

| Revenue | $12.0B |

| Free Cash Flow | $987.3M |

| Revenue Growth | 9.3% |

Investment Thesis

Booz Allen Hamilton, a premier management and technology consulting firm, boasts a market cap of $12.2B and the highest quality rating of 7.4 among the featured stocks. The stock is deeply undervalued, trading 81.8% below its intrinsic value of $178.7. Despite a (38.0%) one-year return, Booz Allen’s $12.0B in revenue and $987.3M in free cash flow highlight its strong financial position.

With 9.3% revenue growth, Booz Allen is capitalizing on increased demand for digital transformation and cybersecurity services across government and commercial sectors. The company’s expertise in mission-critical consulting and technology solutions positions it as a key beneficiary of rising IT spending.

Key Catalysts

- Growing demand for cybersecurity and analytics

- Expansion of government contracts

- Investments in digital transformation

Risk Factors

- Dependence on government spending cycles

- Intense competition in consulting and IT services

- Talent retention challenges

Stock #4: Ingredion Incorporated (INGR)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $7,875.5M |

| Quality Rating | 6.4 |

| Intrinsic Value | $173.8 (42.3% undervalued) |

| 1Y Return | (8.5%) |

| Revenue | $7,316.0M |

| Free Cash Flow | $803.0M |

| Revenue Growth | (5.2%) |

Investment Thesis

Ingredion Incorporated, a global ingredient solutions provider, has a market cap of $7.88B and a quality rating of 6.4. The stock is trading at a 42.3% discount to its intrinsic value of $173.8. While the one-year return is only (8.5%), Ingredion’s $7.32B in revenue and $803M in free cash flow reflect solid operational performance.

Despite a (5.2%) decline in revenue growth, the company’s focus on specialty ingredients and cost management supports margin stability. Ingredion’s diversified customer base across food, beverage, and industrial sectors provides resilience in varying economic conditions.

Key Catalysts

- Growth in specialty and plant-based ingredients

- Operational efficiency initiatives

- Expansion into emerging markets

Risk Factors

- Volatility in agricultural commodity prices

- Shifts in consumer dietary trends

- Global supply chain disruptions

Stock #5: Lantheus Holdings, Inc. (LNTH)

Quick Stats Table

| Metric | Value |

|---|---|

| Market Cap | $3,566.9M |

| Quality Rating | 7.2 |

| Intrinsic Value | $53.0 (1.9% undervalued) |

| 1Y Return | (53.3%) |

| Revenue | $1,520.7M |

| Free Cash Flow | $473.2M |

| Revenue Growth | 5.7% |

Investment Thesis

Lantheus Holdings, Inc., a leader in medical imaging and diagnostics, features a market cap of $3.57B and a quality rating of 7.2. The stock is trading close to its intrinsic value, with only 1.9% undervaluation. Despite a sharp (53.3%) one-year return, Lantheus maintains $1.52B in revenue and $473.2M in free cash flow.

The company’s 5.7% revenue growth is driven by innovation in diagnostic imaging and radiopharmaceuticals. Lantheus’s strong cash flow and commitment to R&D position it to benefit from advances in healthcare technology and increased demand for diagnostic solutions.

Key Catalysts

- New product launches in imaging diagnostics

- Expansion into international healthcare markets

- Strategic partnerships with healthcare providers

Risk Factors

- Regulatory hurdles in medical device approval

- Pricing pressures in healthcare reimbursement

- Competition from larger medical technology firms

Portfolio Diversification Insights

This collection spans financial technology, consumer goods, consulting, industrial ingredients, and healthcare, offering broad sector exposure. The mix of large-cap and mid-cap stocks helps reduce concentration risk, while the inclusion of both growth and value-oriented companies supports balanced portfolio construction. Notably, the portfolio features both defensive (healthcare, consumer staples) and cyclical (technology, industrials) components, enhancing resilience across market cycles.

Market Timing & Entry Strategies

Given the proximity of these stocks to their 52-week lows and their undervaluation metrics, dollar-cost averaging or phased entry strategies may help mitigate timing risk. Monitoring sector-specific catalysts—such as regulatory changes, earnings releases, or macroeconomic shifts—can further inform entry points. Investors may consider aligning purchases with periods of market volatility to capitalize on price dislocations.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Quality Industrials Stocks to Buy Now

📖 5 Best Telecom Infrastructure Stock Picks for 2025

📖 10 Best DefenseTech Stock Picks for 2025

📖 10 Best Stock Picks for 2025: E-commerce Watchlist & Analysis

📖 10 Best Stock Picks for Healthcare 2025

FAQ for 52-week low stocks

Q1: How were these stocks selected?

A1: These stocks were chosen based on ValueSense’s proprietary screening for undervaluation, quality ratings, and recent price performance relative to 52-week lows, ensuring a focus on high-quality, fundamentally strong companies.

Q2: What's the best stock from this list?

A2: Each stock offers unique strengths, but Booz Allen Hamilton (BAH) stands out for its high quality rating and significant undervaluation, making it a compelling candidate for further analysis.

Q3: Should I buy all these stocks or diversify?

A3: Diversification across sectors and market caps, as represented in this collection, can help manage risk and enhance portfolio stability. Individual allocations should align with personal investment goals and risk tolerance.

Q4: What are the biggest risks with these picks?

A4: Key risks include sector-specific headwinds, macroeconomic volatility, regulatory changes, and company-specific challenges such as competition or revenue declines. Each stock’s risk profile is detailed in its analysis section.

Q5: When is the best time to invest in these stocks?

A5: Timing strategies such as dollar-cost averaging or entering positions during market pullbacks can help manage volatility. Monitoring company and sector catalysts may also provide advantageous entry points.

Summary & Investment Outlook

This ValueSense watchlist highlights five high-quality, undervalued stocks across diverse sectors, each with strong fundamentals and unique growth drivers. By leveraging intrinsic value analysis and quality ratings, investors can identify opportunities for potential outperformance. For more in-depth research and real-time updates, visit ValueSense.