5 Best Telecom Infrastructure Stock Picks for 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

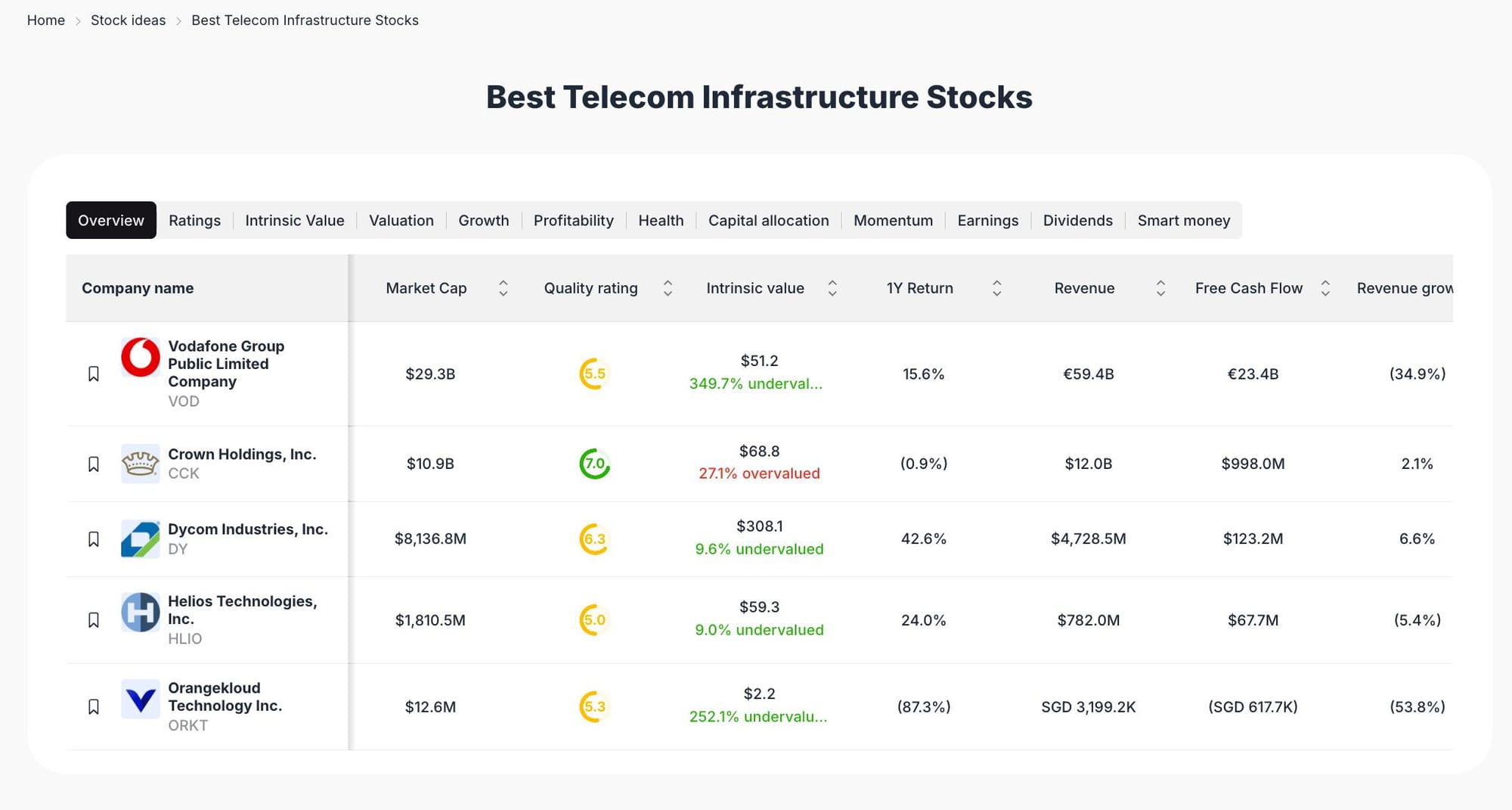

Market Overview & Selection Criteria

The telecom infrastructure sector is evolving rapidly, driven by global connectivity demands, 5G rollouts, and digital transformation. Our selection methodology focuses on companies with strong intrinsic value, robust free cash flow, and favorable quality ratings. We extract and analyze key financial metrics, growth rates, and ValueSense ratings to identify stocks with compelling risk-reward profiles for 2025.

Featured Stock Analysis

Stock #1: Vodafone Group Public Limited Company (VOD)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $29.3B |

| Quality Rating | 5.5 |

| Intrinsic Value | $51.2 (349.7% undervalued) |

| 1Y Return | 15.6% |

| Revenue | €59.4B |

| Free Cash Flow | €23.4B |

| Revenue Growth | (34.9%) |

Investment Thesis:

Vodafone stands out as a major global telecom player with a significant market cap and robust free cash flow. The ValueSense platform highlights an intrinsic value of $51.2, indicating the stock is 349.7% undervalued relative to its current market price. Despite a challenging revenue growth rate of -34.9%, Vodafone’s strong cash generation and scale position it well to weather sector volatility and capitalize on future telecom infrastructure upgrades.

The company’s moderate quality rating (5.5) suggests operational stability, while a positive 1-year return of 15.6% demonstrates recent market momentum. Vodafone’s extensive infrastructure footprint and ongoing investments in next-generation networks could unlock further value as global data consumption rises.

Key Catalysts:

- Expansion of 5G and fiber networks across Europe and emerging markets

- Monetization of infrastructure assets and strategic partnerships

- Strong free cash flow supporting potential shareholder returns

Risk Factors:

- Negative revenue growth trend

- Regulatory pressures and competitive pricing in core markets

- Currency fluctuations impacting euro-denominated revenues

Stock #2: Crown Holdings, Inc. (CCK)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $10.9B |

| Quality Rating | 7.0 |

| Intrinsic Value | $68.8 (27.1% overvalued) |

| 1Y Return | (0.9%) |

| Revenue | $12.0B |

| Free Cash Flow | $998.0M |

| Revenue Growth | 2.1% |

Investment Thesis:

Crown Holdings is a diversified industrial company with exposure to telecom infrastructure through its packaging and container solutions. With a quality rating of 7.0, it ranks highest among this collection for operational excellence and financial health. However, the current market price exceeds its intrinsic value by 27.1%, suggesting limited immediate upside from a value perspective.

Despite a slightly negative 1-year return, Crown’s steady revenue growth and nearly $1B in free cash flow underscore its resilience. The company’s focus on innovation and efficiency in its core business lines may provide incremental growth opportunities, especially as demand for reliable packaging solutions in telecom and technology sectors increases.

Key Catalysts:

- Expansion into high-growth packaging markets supporting telecom supply chains

- Operational efficiency initiatives driving margin improvements

- Strong balance sheet enabling strategic investments

Risk Factors:

- Overvaluation risk based on intrinsic value analysis

- Exposure to cyclical industrial demand

- Modest revenue growth outlook

Stock #3: Dycom Industries, Inc. (DY)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $8,136.8M |

| Quality Rating | 6.3 |

| Intrinsic Value | $308.1 (9.6% undervalued) |

| 1Y Return | 42.6% |

| Revenue | $4,728.5M |

| Free Cash Flow | $123.2M |

| Revenue Growth | 6.6% |

Investment Thesis:

Dycom Industries is a leading provider of specialty contracting services for telecom infrastructure, including fiber optic network deployment. The stock is 9.6% undervalued based on ValueSense’s intrinsic value model, and its 42.6% 1-year return highlights strong recent performance. Dycom’s quality rating of 6.3 reflects solid execution and a healthy balance sheet.

With 6.6% revenue growth and positive free cash flow, Dycom is well-positioned to benefit from ongoing investments in broadband expansion and 5G infrastructure. The company’s expertise in large-scale network projects and established client relationships with major telecom operators provide a competitive edge.

Key Catalysts:

- Increased government and private sector investment in broadband infrastructure

- Rising demand for fiber optic and 5G network buildouts

- Strong project pipeline and recurring revenue streams

Risk Factors:

- Project-based revenue can be cyclical and lumpy

- Labor and supply chain constraints impacting margins

- Competitive bidding environment

Stock #4: Helios Technologies, Inc. (HLIO)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $1,810.5M |

| Quality Rating | 5.0 |

| Intrinsic Value | $59.3 (9.0% undervalued) |

| 1Y Return | 24.0% |

| Revenue | $782.0M |

| Free Cash Flow | $67.7M |

| Revenue Growth | (5.4%) |

Investment Thesis:

Helios Technologies specializes in engineered motion control and electronic solutions, supporting telecom infrastructure modernization. The stock is 9.0% undervalued and has delivered a 24% return over the past year, despite a modest quality rating of 5.0. Helios’s focus on innovation and integration of advanced technologies positions it to capture growth in telecom and industrial automation.

While revenue growth is currently negative, the company’s positive free cash flow and strategic product development may drive long-term value. Helios’s diversified end markets and commitment to R&D support its resilience in a competitive landscape.

Key Catalysts:

- Adoption of advanced motion control in telecom infrastructure

- Expansion into new industrial and telecom applications

- Ongoing product innovation and R&D investment

Risk Factors:

- Negative revenue growth trend

- Exposure to cyclical industrial demand

- Execution risk in new market segments

Stock #5: Orangekloud Technology Inc. (ORKT)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $12.6M |

| Quality Rating | 5.3 |

| Intrinsic Value | $2.2 (252.1% undervalued) |

| 1Y Return | (87.3%) |

| Revenue | SGD 3,199.2K |

| Free Cash Flow | (SGD 617.7K) |

| Revenue Growth | (53.8%) |

Investment Thesis:

Orangekloud Technology is a micro-cap player in the telecom technology space, with a striking 252.1% undervaluation according to ValueSense’s intrinsic value model. However, the company faces significant operational challenges, as reflected in its steep negative 1-year return and revenue contraction of 53.8%. The quality rating of 5.3 suggests average fundamentals, but the deep undervaluation may attract speculative interest.

Orangekloud’s small scale and negative free cash flow highlight the risks, but any turnaround in revenue or operational efficiency could lead to outsized returns. Investors should closely monitor management’s execution and market developments.

Key Catalysts:

- Potential for operational turnaround or strategic partnerships

- Niche technology solutions in telecom infrastructure

- Attractive valuation for high-risk, high-reward profiles

Risk Factors:

- Severe revenue and free cash flow declines

- Micro-cap volatility and liquidity risks

- Execution and funding challenges

Portfolio Diversification Insights

This telecom infrastructure stock collection spans large-cap global operators, mid-cap contractors, and micro-cap technology innovators. The portfolio includes exposure to network operators (Vodafone), industrial suppliers (Crown Holdings, Helios), specialty contractors (Dycom), and emerging tech (Orangekloud). This sector allocation balances stability, growth, and speculative upside, reducing concentration risk and enhancing diversification.

Market Timing & Entry Strategies

Given the sector’s cyclical nature, consider phased entry strategies such as dollar-cost averaging or buying on pullbacks. Monitor sector trends—like 5G rollouts and infrastructure spending—for optimal timing. Evaluate each stock’s valuation relative to intrinsic value and recent price action before initiating positions.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Quality Industrials Stocks to Buy Now

📖 12 Best Stock Picks with High ROIC for 2025

📖 10 Best DefenseTech Stock Picks for 2025

📖 10 Best Low P/E Stock Picks for 2025

📖 10 Best Stock Picks for Healthcare 2025

FAQ for Telecom Infrastructure Stocks

Q1: How were these stocks selected?

These stocks were chosen based on ValueSense’s intrinsic value analysis, quality ratings, and key financial metrics, focusing on undervalued opportunities and sector relevance.

Q2: What's the best stock from this list?

Based on intrinsic value and recent performance, Vodafone (VOD) and Dycom Industries (DY) stand out for their undervaluation and positive returns, but each stock offers unique strengths.

Q3: Should I buy all these stocks or diversify?

Diversification across these telecom infrastructure stocks can help balance risk and capture sector-wide growth, but allocation should reflect individual risk tolerance and investment goals.

Q4: What are the biggest risks with these picks?

Risks include negative revenue trends, overvaluation (Crown Holdings), operational challenges (Orangekloud), and sector-specific headwinds like regulation and competition.

Q5: When is the best time to invest in these stocks?

Optimal timing may coincide with sector pullbacks, major infrastructure announcements, or when stocks trade below intrinsic value. Consider phased entries to manage volatility.

Summary & Investment Outlook

The telecom infrastructure sector offers a blend of stability, growth, and innovation. This ValueSense watchlist highlights undervalued opportunities and sector leaders, each with distinct risk-return profiles. Use this analysis as educational content to inform your research and portfolio construction. For deeper insights and real-time updates, visit ValueSense.