5 high ROIC stocks for Oct 2024

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Almost every investor has a common goal: to maximize their returns. For individual investors, this often means seeking the best returns on stocks, while companies aim to maximize returns on their invested capital, commonly known as Return on Invested Capital (ROIC).

To help identify stocks that offer strong performance across multiple measures of return, we applied several targeted criteria:

- High ROIC: Companies with an average three-year fiscal ROIC exceeding 20%, highlighting strong reinvestment potential.

- Competitive Economic Moat Ratings: Only companies with a Value Sense Economic Moat Rating of "wide" or "narrow" were considered.

- Undervalued Pricing: Stocks currently trading at least 20% below Value Sense's intrinsic value estimate.

The following five stocks meet all these criteria. While past performance doesn’t guarantee future returns, these companies stand out with competitive economic moats and attractive valuations, making them promising contenders for the next decade.

5 high ROIC stocks for Oct 2024

Here’s the new list of Value Sense’s top high ROIC picks to buy for the 4th quarter of 2024.

Here are essential metrics and insights on each stock, as of Oct. 26, 2024, according to our analysts.

VeriSign

- Price/Intrinsic Value: 0.82

- Value Sense Moat Rating: 7/10

- Trailing 10-Year Annualized Return: 17.79%

- Average Fiscal Three-Year ROIC: 48.95%

VeriSign holds a dominant position in the domain name registry market, with over 160 million .com and .net domain names registered as of mid-2024. These agreements effectively position Verisign as a near-monopoly in key domain services. The company’s ability to renew contracts without competition, thanks to its proven reliability and technical expertise, enhances long-term stability.

Verisign’s contracts with ICANN allow it to raise .com and .net domain prices within set limits, supporting steady revenue growth. Value Sense expects Verisign to fully utilize these pricing opportunities to offset weaker registration demand, especially from regions like China.

NetEase

- Value Sense Moat Rating: 9/10

- Trailing 10-Year Annualized Return: 18.26%

- Average Fiscal Three-Year ROIC: 30.20%

Diversified Game portfolios as well as diverse revenue streams such as Youdao and cloud music.

Great Capital Allocation strategies: Growing Dividends & Share buybacks

Attractive valuation multiples and Intrinsic value display that the company is conservatively undervalued by at least 17%.

Good management team performing successful acquisitions such as Quantic Dreams along with the management of big cash positions (20% of MC) to make future acquisitions more effective. Strong Balance Sheet.

A general buy consensus among analysts which one of them is a rating upgrade and another is a buy initiation.

Yum! Brands

- Price/Intrinsic Value: 0.88

- Value Sense Moat Rating: 7/10

- Trailing 10-Year Annualized Return: 14.05%

- Average Fiscal Three-Year ROIC: 40.81%

YUM! Brands, owner of KFC, Taco Bell, and Pizza Hut, faces the challenge of leveraging its iconic brands amidst intense competition and quality control issues. The article examines how YUM! navigates these complexities to maintain its global dominance.

Revenue Growth Strategies: The analysis delves into YUM!'s efforts to differentiate its brands, emphasizing quality control, technological innovation, and global expansion. It highlights Pizza Hut's struggle against Domino's and KFC's growth in Asia as key factors influencing revenue dynamics.

Cost Management: YUM!'s strategic approach to cost management focuses on operational efficiencies through technological advancements like in-store kiosks and Recommended Ordering systems. The shift towards a predominantly franchised model aims to reduce direct operational costs.

NVR

- Price/Intrinsic Value: 1.07

- Value Sense Moat Rating: 7/10

- Trailing 10-Year Annualized Return: 22.75%

- Average Fiscal Three-Year ROIC: 58.16%

- constantly doing buybacks

- relatively small salaries for management

- cash-only bonuses for management (no stock options)

- informative communication about the industry through financial reports

- financial reports do not contain EBITDA, adjusted this, or non-GAAP that

- owned by insiders to a considerable degree

- long track record of successful operations

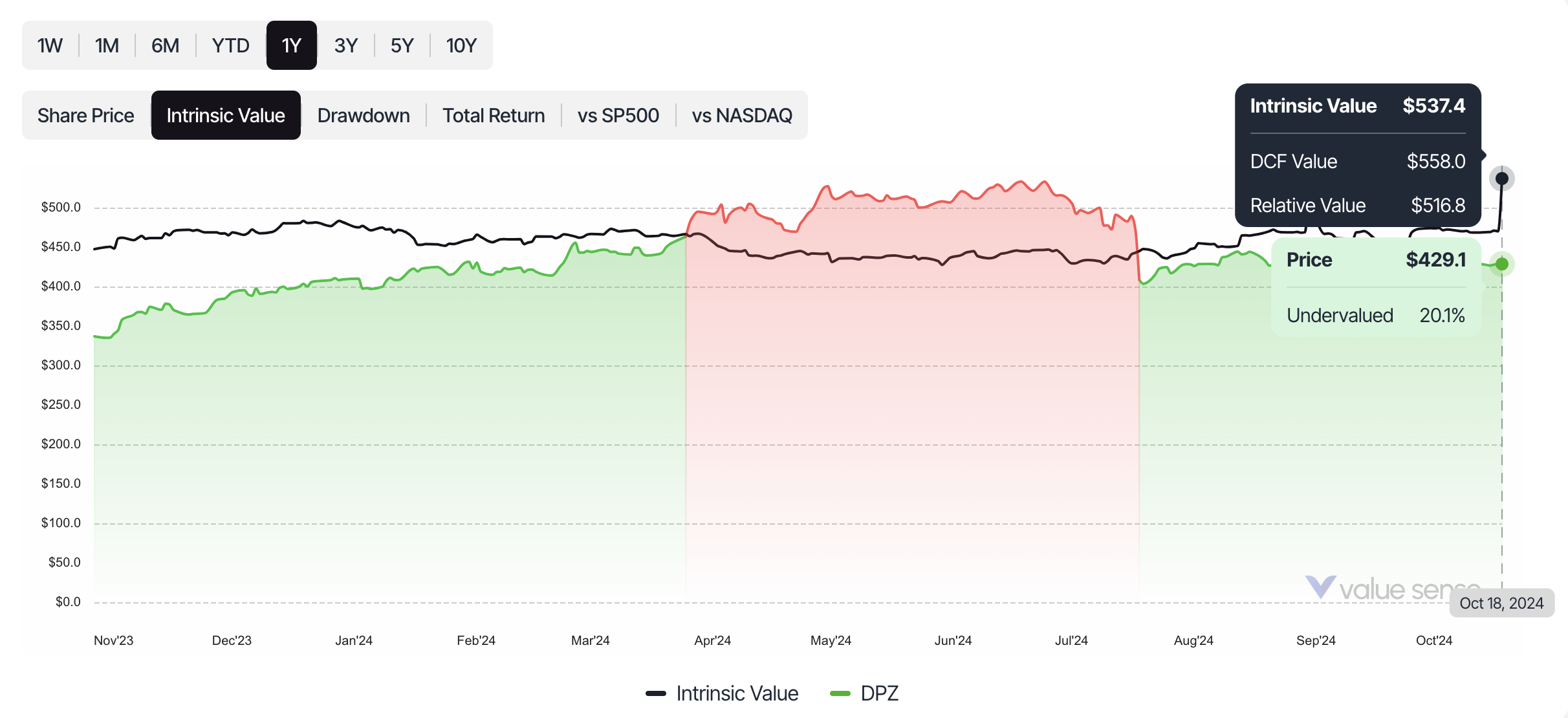

Domino's Pizza

- Price/Intrinsic Value: 0.79

- Value Sense Moat Rating: 8/10

- Trailing 10-Year Annualized Return: 20.54%

- Average Fiscal Three-Year ROIC: 50.79%

The strongest businesses in the world (the card networks, the hyperscalers, and the credit ratings agencies) have built their moat around switching costs and network effects. Domino’s on the other hand has built its moat around process power and aligning its brand with being a low-cost producer.

Domino’s has a built-in flywheel to their business that has allowed them to consistently grow units which have all kinds of impacts. First, Domino’s invests more in the stores which drives higher same-store sales, the higher the same-store sales increases store profitability. As stores become more profitable, the franchisees have more money in their pockets to open more stores in their region which lowers delivery times. Lower delivery times mean happier customers who order more pizza and on and on.

Value Sense helps you understand all companies' financial data, and provides essential tools.

- Historical Financial Analysis - Discover key financial statements, including income statements, balance sheets, and cash flow statements.

- Financial ratios - get access to the most important financial ratios

- Dividends analysis - understand how often a dividend is paid, get dividend yields, and find stocks with growing dividends.

- Comparison analysis - stock competitors, stock price compare, stocks comparison charts, all in one tool for stock comparison.

For those seeking market opportunities, our analytics team has compiled over 10 exclusive lists of undervalued and high-quality stocks:

Ready to start?

Join 3,500+ value investors worldwide