52-Week High Stocks: Market Quality Leaders for Autumn 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

In Autumn 2025, the market’s attention is fixed on stocks trading near their 52-week highs. These companies embody strong fundamentals, operational resilience, and persistent investor faith—in spite of higher rates, inflation, and global uncertainty. Below is a profile of large-cap sector leaders trading near their cyclical peaks along with analysis of their intrinsic value, historical returns, growth, and cash flow characteristics.

What Sets 52-Week High Stocks Apart?

Stocks at their 52-week highs are typically marked by:

- Proven business models with steady or accelerating profits.

- High-quality ratings from industry analysts and quant systems.

- Defensive or growth-driven sector positions.

- Consistent free cash flow and margin strength.

- Often, “premium” valuations—yet motivation for further upside, especially when earnings surprise or secular themes take hold.

Autumn 2025: Large-Cap Quality at a Glance

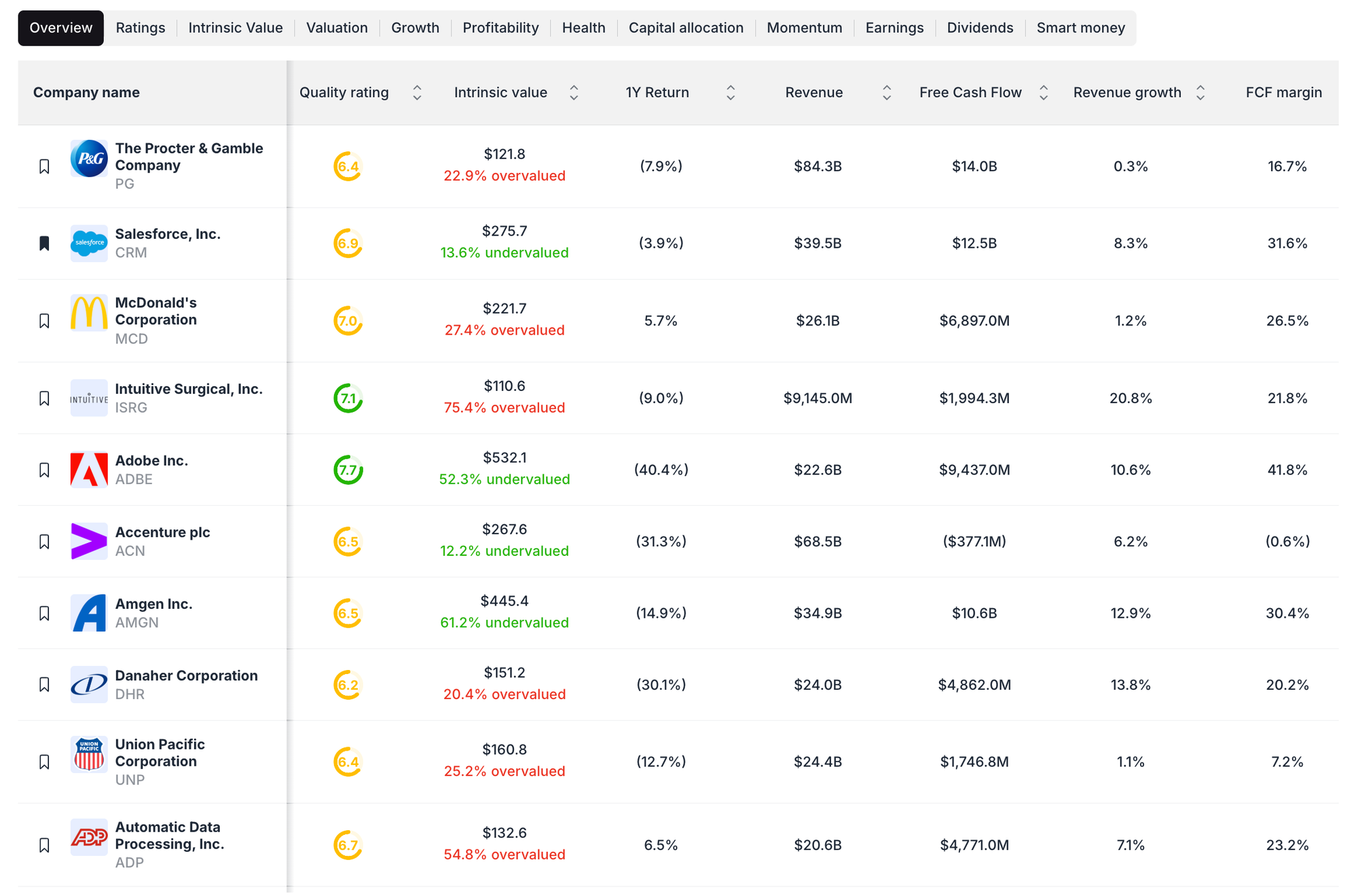

| Name | Quality Rating | Intrinsic Value | Over-/Undervalue | 1Y Return | Revenue | Free Cash Flow | Revenue Growth | FCF Margin |

|---|---|---|---|---|---|---|---|---|

| Procter & Gamble (PG) | 6.4 | $121.8 | 22.9% overvalued | -7.9% | $84.3B | $14.0B | 0.3% | 16.7% |

| Salesforce (CRM) | 6.9 | $275.7 | 13.6% undervalued | -3.9% | $39.5B | $12.5B | 8.3% | 31.6% |

| McDonald's (MCD) | 7.0 | $221.7 | 27.4% overvalued | 5.7% | $26.1B | $6.9B | 1.2% | 26.5% |

| Intuitive Surgical (ISRG) | 7.1 | $110.6 | 75.4% overvalued | -9.0% | $9.1B | $2.0B | 20.8% | 21.8% |

| Adobe (ADBE) | 7.7 | $532.1 | 52.3% undervalued | -40.4% | $22.6B | $9.4B | 10.6% | 41.8% |

| Accenture (ACN) | 6.5 | $267.6 | 12.2% undervalued | -31.3% | $68.5B | ($377M) | 6.2% | -0.6% |

| Amgen (AMGN) | 6.5 | $445.4 | 61.2% undervalued | -14.9% | $34.9B | $10.6B | 12.9% | 30.4% |

| Danaher (DHR) | 6.2 | $151.2 | 20.4% overvalued | -30.1% | $24.0B | $4.9B | 13.8% | 20.2% |

| Union Pacific (UNP) | 6.4 | $160.8 | 25.2% overvalued | -12.7% | $24.4B | $1.7B | 1.1% | 7.2% |

| Automatic Data Processing (ADP) | 6.7 | $132.6 | 54.8% overvalued | 6.5% | $20.6B | $4.8B | 7.1% | 23.2% |

Individual Company Commentary – Autumn 2025

Procter & Gamble (PG):

PG is a sector-defensive favorite but trades 22.9% above estimated intrinsic value. The stock's -7.9% 1Y return reflects margin contraction after pandemic-era highs. Revenue and profit growth are muted (0.3%), but its FCF margin (16.7%) offers continued payout reliability.

Salesforce (CRM):

CRM shows a rare hybrid of growth and value, trading below fair value (13.6% undervalued) after a soft tech sector year. Its powerful 31.6% FCF margin and solid 8.3% revenue growth hint at robust recovery potential—despite the -3.9% 1Y return.

McDonald's (MCD):

MCD remains a consumer staple for portfolios, with strong FCF generation (26.5%), slight revenue growth, and a 5.7% return for the year. But shares are now pricey (27.4% overvalued), as investors rush to safety and global brand strength.

Intuitive Surgical (ISRG):

ISRG enjoys premium multiples—now vastly overvalued (75.4%)—as the leader in surgical robotics. At 20.8% annual growth and a 21.8% FCF margin, ISRG is a technology healthcare standout, but at elevated risk for valuation correction after its -9% return.

Adobe (ADBE):

ADBE is deeply undervalued (52.3%) after market pressures. Despite a -40% 1Y drawdown, the company posts double-digit growth and a 41.8% FCF margin, making it a prime candidate for long-term accumulation and a strong bounce if sentiment shifts.

Accenture (ACN):

ACN’s big drop (-31.3%) has pushed shares into value territory (12.2% undervalued). Cash flow turned negative briefly due to tough cycles, but the firm remains a consulting leader with relatively stable revenue growth (6.2%).

Amgen (AMGN):

AMGN’s healthcare moat is strong, now at a 61.2% discount to intrinsic value with 30.4% FCF margin and 12.9% sales growth. A solid pick for “dividend growth and defense” within the sector, despite modest near-term underperformance.

Danaher (DHR):

DHR is another defensive name, overvalued (20.4%) as investors pile into diagnostic and life science stability. Returns are down (-30%) but core business grows at a steady clip, with a healthy FCF margin over 20%.

Union Pacific (UNP):

UNP exhibits the “expensive defensive” dynamic: valuation is 25% above fair value—despite basically flat growth (1.1%) and single-digit FCF margins. Investors are paying up for rail stability, but risk medium-term mean reversion.

Automatic Data Processing (ADP):

ADP trades substantially above value (54.8% overvalued) with a 6.5% return and reliable global employer services. With 7.1% revenue growth and 23.2% FCF margin, ADP remains a reliable, but currently expensive, option for steady dividend growth.

Market Perspective

Stocks at their 52-week highs in Autumn 2025 are often defensive plays, richly valued, and selected for consistency in an uncertain global environment. Deep fundamental research is essential—many are very expensive, while some, like Adobe and Amgen, offer clear long-term upside due to their valuation gaps and strong margins.

Summary

The Autumn 2025 market highlights a handful of large-cap stocks trading at or near their 52-week highs. These companies—including Procter & Gamble, Salesforce, McDonald’s, Adobe, Amgen, and more—feature strong free cash flow, resilient business models, and sector leadership. However, many also show signs of elevated valuations, prompting investors to balance defensive stability with careful fundamental analysis. While some stocks like Adobe and Amgen present clear undervaluation opportunities, others trade at steep premiums due to their track records of consistency and investor confidence.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Undervalued Retirement Portfolio Stocks for October 2025

📖 Fortress Balance Sheets: The Best Low-Debt Companies

📖 High ROIC Stocks in September 2025: The Best Quality Compounders

📖 Adobe Stock Analysis: Undervalued Creative Software Monopoly

📖 Pfizer Undervalued Post-COVID

FAQ

Q: What does it mean when a stock is at a 52-week high?

A: It means the company’s share price is trading at or near its highest point in the last year—a sign of recent momentum or investor optimism.

Q: Are all 52-week high stocks good investments?

A: Not always. Many defensive and essential sector leaders can get expensive due to their reputation for stability. Always compare intrinsic value, cash flow margins, growth trends, and analyst estimates before buying.

Q: Which stocks in Autumn 2025 are most attractively valued?

A: Among the profiled names, Adobe and Amgen stand out as deeply undervalued despite recent underperformance, offering potential for long-term gains.

Q: Should I be concerned about overvalued defensive stocks?

A: Defensive stocks can help anchor portfolios in volatile times, but elevated valuations may limit future returns. Trim or rebalance when the premium grows too large versus fair value.

Q: What caution should momentum investors heed in the current cycle?

A: Chasing 52-week highs in richly-valued names requires discipline; look for sustained margin growth and avoid those with flagging sales or unsustainable price increases.