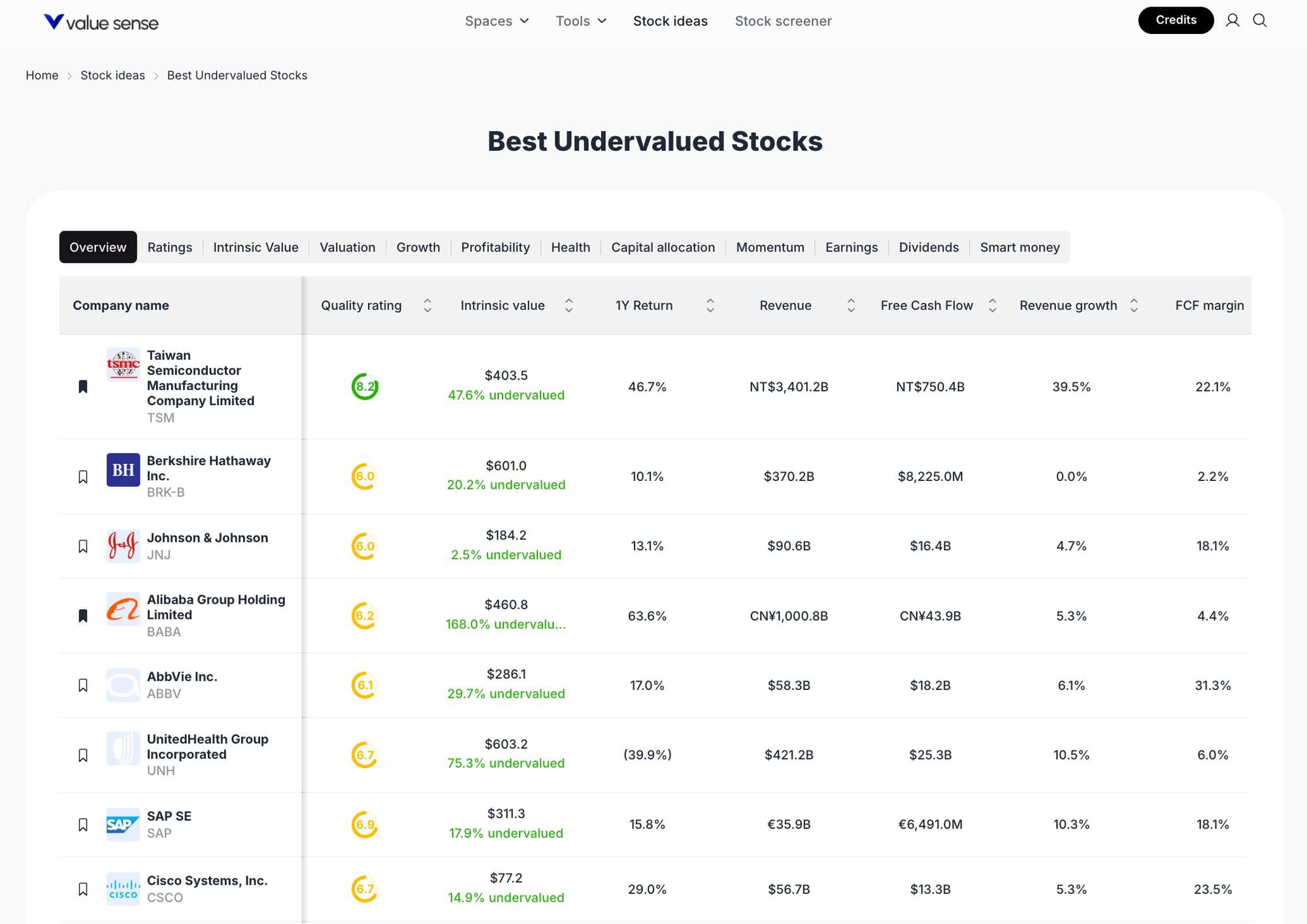

7 Best Undervalued Stock Picks for October 2025: Watchlist & Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

The current market landscape is marked by sector rotation and heightened focus on intrinsic value, making the identification of undervalued stocks crucial for portfolio resilience. Our selection methodology leverages ValueSense’s proprietary quality ratings, intrinsic value calculations, and key financial metrics. Stocks featured here are chosen based on their undervaluation percentage, quality score, sector representation, and growth or cash flow potential, ensuring a diversified and opportunity-rich watchlist.

Featured Stock Analysis

Stock #1: Taiwan Semiconductor Manufacturing Company Limited (TSM)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $403.5 |

| Quality Rating | 8.2 |

| Intrinsic Value | 47.6% undervalued |

| 1Y Return | 46.7% |

| Revenue | NT$3,401.2B |

| Free Cash Flow | NT$750.4B |

| Revenue Growth | 39.5% |

| FCF Margin | 22.1% |

Investment Thesis:

Taiwan Semiconductor Manufacturing Company Limited (TSMC) stands out as a global leader in semiconductor manufacturing, benefiting from robust demand in advanced chip technologies. With a high quality rating of 8.2 and trading at a 47.6% discount to intrinsic value, TSMC offers a compelling blend of growth and value. The company’s impressive 1-year return of 46.7% and revenue growth of 39.5% highlight its operational momentum and market leadership.

TSMC’s strong free cash flow and healthy margin profile (22.1% FCF margin) reinforce its financial resilience. The company’s scale and technological edge position it to capitalize on secular trends in AI, 5G, and automotive electronics, supporting sustained long-term growth.

Key Catalysts:

- Expansion in AI and high-performance computing demand

- Leadership in advanced process nodes (3nm, 2nm)

- Strategic partnerships with global tech giants

- Ongoing capacity expansion and capex investments

Risk Factors:

- Geopolitical tensions in the Taiwan Strait

- Cyclical semiconductor industry dynamics

- High capital expenditure requirements

Stock #2: Berkshire Hathaway Inc. (BRK-B)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $601.0 |

| Quality Rating | 6.0 |

| Intrinsic Value | 20.2% undervalued |

| 1Y Return | 10.1% |

| Revenue | $370.2B |

| Free Cash Flow | $8,225.0M |

| Revenue Growth | 0.0% |

| FCF Margin | 2.2% |

Investment Thesis:

Berkshire Hathaway Inc. remains a cornerstone for value-focused investors, offering diversified exposure across insurance, utilities, manufacturing, and equity holdings. With a 20.2% undervaluation and a solid quality rating, Berkshire’s fortress balance sheet and disciplined capital allocation underpin its appeal. The company’s $370.2B in revenue and consistent free cash flow generation reflect its operational scale and stability.

Despite modest revenue growth, Berkshire’s portfolio approach and prudent management by Warren Buffett and team continue to deliver steady returns and downside protection, making it a reliable anchor in any diversified portfolio.

Key Catalysts:

- Strategic acquisitions and share buybacks

- Resilient insurance and reinsurance operations

- Equity portfolio performance (notably Apple, Coca-Cola)

Risk Factors:

- Succession planning and leadership transition

- Exposure to macroeconomic cycles

- Slower growth in core businesses

Stock #3: Johnson & Johnson (JNJ)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $184.2 |

| Quality Rating | 6.0 |

| Intrinsic Value | 2.5% undervalued |

| 1Y Return | 13.1% |

| Revenue | $90.6B |

| Free Cash Flow | $16.4B |

| Revenue Growth | 4.7% |

| FCF Margin | 18.1% |

Investment Thesis:

Johnson & Johnson, a global healthcare leader, combines pharmaceutical innovation with consumer health and medical devices. With a modest 2.5% undervaluation and a quality rating of 6.0, JNJ offers stability and consistent cash flow. The company’s $16.4B in free cash flow and 18.1% margin highlight its operational efficiency and ability to fund R&D and shareholder returns.

JNJ’s diversified business model and strong pipeline support resilience against sector volatility. Its steady revenue growth and robust balance sheet make it a core holding for defensive and income-oriented investors.

Key Catalysts:

- New drug launches and pipeline advancements

- Expansion in medical devices and global markets

- Strong dividend track record

Risk Factors:

- Litigation and regulatory risks

- Patent expirations and generic competition

- Currency headwinds in international markets

Stock #4: Alibaba Group Holding Limited (BABA)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $460.8 |

| Quality Rating | 6.2 |

| Intrinsic Value | 168.0% undervalued |

| 1Y Return | 63.6% |

| Revenue | CNY1,000.8B |

| Free Cash Flow | CNY43.9B |

| Revenue Growth | 5.3% |

| FCF Margin | 4.4% |

Investment Thesis:

Alibaba Group stands out as one of the most undervalued large-cap technology stocks, trading at a 168% discount to intrinsic value. With a quality rating of 6.2 and a strong 1-year return of 63.6%, Alibaba’s core e-commerce, cloud, and digital media businesses continue to drive growth. The company’s massive revenue base and positive free cash flow reinforce its financial strength.

Despite regulatory headwinds, Alibaba’s dominant market position and innovation in cloud computing and digital finance provide significant upside potential as China’s economy stabilizes.

Key Catalysts:

- Recovery in Chinese consumer spending

- Cloud business expansion and profitability

- Regulatory clarity and business restructuring

Risk Factors:

- Ongoing regulatory scrutiny in China

- Geopolitical tensions and delisting risks

- Competitive pressures in e-commerce and cloud

Stock #5: AbbVie Inc. (ABBV)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $286.1 |

| Quality Rating | 6.1 |

| Intrinsic Value | 29.7% undervalued |

| 1Y Return | 17.0% |

| Revenue | $58.3B |

| Free Cash Flow | $18.2B |

| Revenue Growth | 6.1% |

| FCF Margin | 31.3% |

Investment Thesis:

AbbVie Inc. is a leading biopharmaceutical company with a strong focus on immunology and oncology. Trading at a 29.7% discount to intrinsic value and boasting a high free cash flow margin of 31.3%, AbbVie’s financial health is robust. The company’s 17% 1-year return and consistent revenue growth reflect its successful product portfolio and pipeline.

AbbVie’s blockbuster drugs and expanding R&D investments position it for continued growth, while its dividend and cash flow generation support shareholder value.

Key Catalysts:

- New drug approvals and pipeline progress

- Expansion in immunology and oncology markets

- Strong dividend and capital return policy

Risk Factors:

- Patent cliffs and biosimilar competition

- Regulatory and pricing pressures

- Dependence on key products (e.g., Humira)

Stock #6: UnitedHealth Group Incorporated (UNH)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $603.2 |

| Quality Rating | 6.7 |

| Intrinsic Value | 75.3% undervalued |

| 1Y Return | -39.9% |

| Revenue | $421.2B |

| Free Cash Flow | $25.3B |

| Revenue Growth | 10.5% |

| FCF Margin | 6.0% |

Investment Thesis:

UnitedHealth Group is a dominant force in managed healthcare and insurance, with a 75.3% undervaluation and a quality rating of 6.7. Despite a recent negative 1-year return, the company’s $421.2B revenue and $25.3B free cash flow demonstrate scale and operational strength. UnitedHealth’s diversified business model and technology-driven care delivery support long-term growth.

The company’s resilience in a changing healthcare landscape and focus on innovation position it for recovery and renewed growth.

Key Catalysts:

- Expansion of Optum health services

- Growth in Medicare Advantage and Medicaid

- Technology integration in healthcare delivery

Risk Factors:

- Regulatory changes in U.S. healthcare policy

- Margin pressures from rising costs

- Competitive dynamics in insurance markets

Stock #7: SAP SE (SAP)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $311.3 |

| Quality Rating | 6.9 |

| Intrinsic Value | 17.9% undervalued |

| 1Y Return | 15.8% |

| Revenue | €35.9B |

| Free Cash Flow | €6,491.0M |

| Revenue Growth | 10.3% |

| FCF Margin | 18.1% |

Investment Thesis:

SAP SE is a global leader in enterprise software, offering mission-critical solutions for digital transformation. With a 17.9% undervaluation and a quality rating of 6.9, SAP’s strong free cash flow and double-digit revenue growth highlight its operational excellence. The company’s cloud transition and innovation in AI and analytics are driving new growth avenues.

SAP’s global customer base and recurring revenue streams provide stability, while its investments in cloud and AI position it for future expansion.

Key Catalysts:

- Cloud migration and SaaS adoption

- Expansion in AI-driven enterprise solutions

- Strategic partnerships and acquisitions

Risk Factors:

- Intense competition in enterprise software

- Currency fluctuations impacting earnings

- Execution risks in cloud transformation

Stock #8: Cisco Systems, Inc. (CSCO)

Quick Stats Table:

| Metric | Value |

|---|---|

| Current Price | $77.2 |

| Quality Rating | 6.7 |

| Intrinsic Value | 14.9% undervalued |

| 1Y Return | 29.0% |

| Revenue | $56.7B |

| Free Cash Flow | $13.3B |

| Revenue Growth | 5.3% |

| FCF Margin | 23.5% |

Investment Thesis:

Cisco Systems is a leading provider of networking hardware and software, with a 14.9% undervaluation and a quality rating of 6.7. The company’s 29% 1-year return and robust free cash flow margin of 23.5% underscore its financial strength. Cisco’s focus on recurring software revenue and security solutions supports growth and margin expansion.

Cisco’s global reach and innovation in cloud networking and cybersecurity make it a key player in digital infrastructure, well-positioned for ongoing digital transformation trends.

Key Catalysts:

- Growth in cloud and security solutions

- Expansion of recurring revenue streams

- Strategic M&A and product innovation

Risk Factors:

- Competitive pressures from new entrants

- Supply chain disruptions

- Shifts in enterprise IT spending

Portfolio Diversification Insights

This watchlist spans technology, healthcare, insurance, and consumer sectors, providing a balanced approach to sector allocation. Technology (TSMC, SAP, Cisco, Alibaba) offers growth and innovation, while healthcare (Johnson & Johnson, AbbVie, UnitedHealth) delivers stability and defensive characteristics. Berkshire Hathaway anchors the portfolio with diversified exposure and risk mitigation. The combination enhances resilience against sector-specific volatility and supports long-term capital appreciation.

Market Timing & Entry Strategies

Entry timing should consider both macroeconomic conditions and individual stock catalysts. Investors may look for technical pullbacks or confirmation of positive news (e.g., earnings beats, regulatory clarity) before initiating positions. Dollar-cost averaging and staggered entry points can help manage volatility and reduce timing risk, especially in uncertain markets.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Quality Large Cap Stock Picks for 2025

📖 10 Best Stock Picks for October 2025: High-Quality & Undervalued

📖 12 Best Robotics Stock Picks for 2025: In-Depth Analysis & Watchlist

📖 10 Best Stock Picks for 2025: E-commerce Watchlist & Analysis

📖 George Soros - Soros Fund Management LLC Q2 2025 Portfolio Analysis

Frequently Asked Questions - 2025 Stock Picks

Q1: How were these top stocks selected for 2025?

Our selection methodology combines ValueSense intrinsic value analysis, low PEG ratio screening, and fundamental analysis focusing on financial strength, market leadership, and sustainable competitive advantages.

Q2: Which stock offers the best value opportunity?

TSM and UNH stand out for significant undervaluation combined with strong fundamentals, offering attractive risk-adjusted return potential for 2025.

Q3: What makes a good PEG ratio for stock selection?

PEG ratios below 1.0 typically indicate undervalued growth potential. Our list includes several stocks with attractive PEG ratios: AMD (0.50), NVDA (0.62), and NVO (0.66).

Q4: Should I buy all 10 stocks or focus on specific sectors?

Diversification across these complementary sectors reduces portfolio risk, but individual allocation should align with your risk tolerance and investment timeline.

Q5: What are the primary investment risks?

Key risks include valuation premiums for some stocks, sector-specific headwinds, regulatory changes, and macroeconomic uncertainty affecting growth trajectories.

FAQ Section

Q1: How were these stocks selected?

Stocks were chosen based on ValueSense’s proprietary quality ratings, intrinsic value discounts, sector representation, and key financial metrics visible in the platform’s analysis.

Q2: What's the best stock from this list?

While each stock offers unique strengths, TSMC stands out for its high quality rating, significant undervaluation, and strong growth profile. However, suitability depends on individual investment goals.

Q3: Should I buy all these stocks or diversify?

Diversification across these stocks can help manage risk and capture opportunities across sectors. Portfolio allocation should reflect your risk tolerance and investment objectives.

Q4: What are the biggest risks with these picks?

Risks include sector-specific headwinds, regulatory changes, geopolitical tensions, and company-specific challenges such as competition or patent expirations.

Q5: When is the best time to invest in these stocks?

Optimal timing depends on market conditions and individual stock catalysts. Consider gradual entry strategies and monitor for key events or technical signals.

Summary & Investment Outlook

This ValueSense watchlist highlights seven of the best stock picks for 2025, each offering a blend of value, quality, and growth potential. By leveraging intrinsic value analysis and sector diversification, investors can build a resilient portfolio positioned for evolving market dynamics. For more in-depth research and personalized analysis, visit ValueSense and explore our full suite of investment tools.