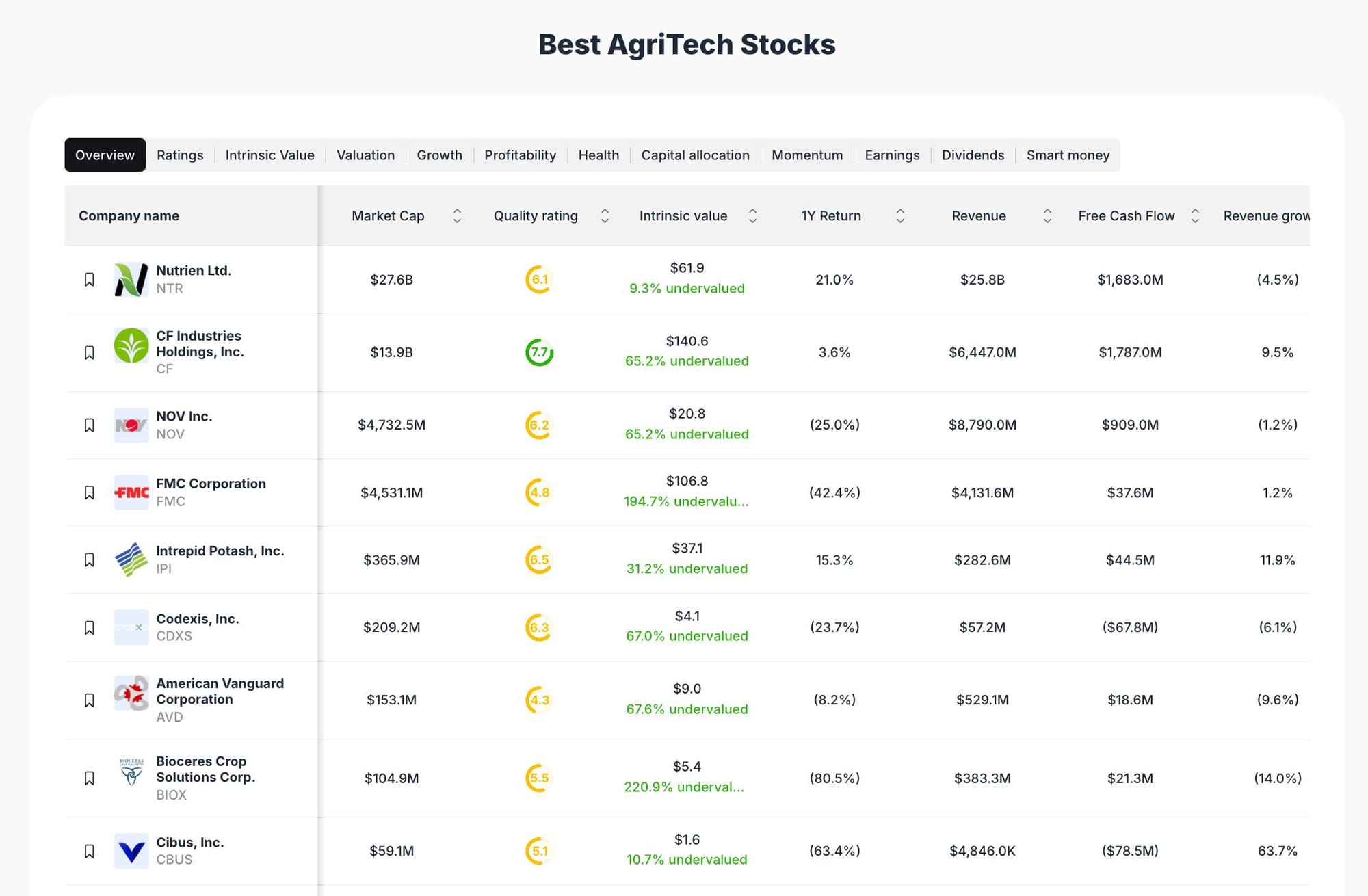

9 Best AgriTech Stock Picks for 2025: ValueSense Watchlist & Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

The AgriTech sector is rapidly evolving, driven by the global need for sustainable food production, efficiency, and technological innovation. Our 2025 AgriTech stock picks are selected based on a combination of intrinsic value, quality rating, revenue growth, and free cash flow. ValueSense’s methodology emphasizes stocks that are undervalued relative to their intrinsic worth, with a focus on companies demonstrating operational resilience, innovation, and sector leadership. Each stock is evaluated using proprietary ratings and financial metrics to ensure a balanced, data-driven watchlist.

Featured Stock Analysis

Stock #1: Nutrien Ltd. (NTR)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $27.6B |

| Quality Rating | 6.1 |

| Intrinsic Value | $61.9 (9.3% undervalued) |

| 1Y Return | 21.0% |

| Revenue | $25.8B |

| Free Cash Flow | $1,683.0M |

| Revenue Growth | -4.5% |

Investment Thesis:

Nutrien Ltd. stands as a global leader in crop inputs and services, leveraging its scale to deliver consistent free cash flow and maintain a strong market presence. Despite a recent decline in revenue growth (-4.5%), Nutrien’s robust cash generation ($1.68B FCF) and a 9.3% undervaluation to intrinsic value highlight its appeal for value-focused investors. The company’s diversified operations across fertilizers and agricultural solutions provide resilience against commodity price volatility.

Nutrien’s 21% one-year return demonstrates its ability to outperform peers even in challenging market conditions. The company’s focus on operational efficiency and capital allocation supports long-term shareholder value, while its scale ensures competitive advantages in procurement and distribution.

Key Catalysts:

- Global demand for crop nutrients and sustainable agriculture

- Expansion of digital agriculture platforms

- Strategic acquisitions and operational efficiencies

Risk Factors:

- Exposure to commodity price fluctuations

- Negative revenue growth trend

- Regulatory and environmental compliance costs

Stock #2: CF Industries Holdings, Inc. (CF)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $13.9B |

| Quality Rating | 7.7 |

| Intrinsic Value | $140.6 (65.2% undervalued) |

| 1Y Return | 3.6% |

| Revenue | $6,447.0M |

| Free Cash Flow | $1,787.0M |

| Revenue Growth | 9.5% |

Investment Thesis:

CF Industries is a leading nitrogen fertilizer producer, recognized for its high quality rating (7.7) and significant undervaluation (65.2% below intrinsic value). The company’s strong free cash flow ($1.79B) and positive revenue growth (9.5%) underscore its financial health and operational efficiency. CF’s focus on cost leadership and technological innovation in fertilizer production positions it well for continued growth as global food demand rises.

The modest 1-year return (3.6%) reflects sector volatility but does not detract from the company’s long-term fundamentals. CF’s ability to generate substantial cash and maintain a disciplined capital structure supports ongoing investment in capacity and sustainability initiatives.

Key Catalysts:

- Rising global food production needs

- Technological advancements in fertilizer efficiency

- Expansion into new markets

Risk Factors:

- Cyclical demand tied to agriculture commodity prices

- Environmental regulations impacting production

- Potential for input cost inflation

Stock #3: NOV Inc. (NOV)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $4,732.5M |

| Quality Rating | 6.2 |

| Intrinsic Value | $20.8 (65.2% undervalued) |

| 1Y Return | -25.0% |

| Revenue | $8,790.0M |

| Free Cash Flow | $909.0M |

| Revenue Growth | -1.2% |

Investment Thesis:

NOV Inc. is a diversified industrial company with a significant presence in AgriTech equipment and solutions. Despite a challenging year (-25% return, -1.2% revenue growth), NOV’s substantial undervaluation (65.2%) and solid free cash flow ($909M) suggest a potential turnaround opportunity. The company’s broad product portfolio and global reach provide exposure to multiple end markets, including agriculture, energy, and infrastructure.

NOV’s moderate quality rating (6.2) reflects operational challenges but also highlights its resilience and capacity for recovery. The company’s focus on innovation and cost management could drive improved performance as sector conditions stabilize.

Key Catalysts:

- Recovery in global industrial and agricultural demand

- New product launches and technology upgrades

- Strategic cost-cutting initiatives

Risk Factors:

- Recent negative returns and revenue contraction

- Exposure to cyclical end markets

- Execution risk in turnaround strategy

Stock #4: FMC Corporation (FMC)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $4,531.1M |

| Quality Rating | 4.8 |

| Intrinsic Value | $106.8 (194.7% undervalued) |

| 1Y Return | -42.4% |

| Revenue | $4,131.6M |

| Free Cash Flow | $37.6M |

| Revenue Growth | 1.2% |

Investment Thesis:

FMC Corporation specializes in crop protection and agricultural solutions. The company is trading at a deep discount to intrinsic value (194.7% undervalued), making it a notable value play despite recent underperformance (-42.4% 1Y return). FMC’s modest revenue growth (1.2%) and low free cash flow ($37.6M) highlight operational headwinds, but its established market position and innovation pipeline offer long-term potential.

The quality rating (4.8) signals caution, but the significant undervaluation could attract contrarian investors seeking turnaround opportunities. FMC’s focus on R&D and new product development may drive future growth as agricultural markets recover.

Key Catalysts:

- Launch of new crop protection products

- Expansion into emerging markets

- Strategic cost optimization

Risk Factors:

- Recent sharp share price decline

- Low free cash flow and profitability pressures

- Regulatory and environmental risks

Stock #5: Intrepid Potash, Inc. (IPI)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $365.9M |

| Quality Rating | 6.5 |

| Intrinsic Value | $37.1 (31.2% undervalued) |

| 1Y Return | 15.3% |

| Revenue | $282.6M |

| Free Cash Flow | $44.5M |

| Revenue Growth | 11.9% |

Investment Thesis:

Intrepid Potash is a key supplier of potash and specialty fertilizers, benefiting from strong revenue growth (11.9%) and a healthy free cash flow position ($44.5M). The stock is trading 31.2% below intrinsic value, with a solid quality rating (6.5), making it an attractive candidate for growth-oriented investors seeking exposure to essential agricultural inputs.

IPI’s 15.3% one-year return reflects positive market sentiment and operational momentum. The company’s focus on cost control and product diversification supports its ability to navigate commodity cycles and capitalize on rising demand for sustainable fertilizers.

Key Catalysts:

- Increasing demand for potash in sustainable agriculture

- Expansion of specialty fertilizer offerings

- Operational efficiency improvements

Risk Factors:

- Sensitivity to commodity price swings

- Competitive pressures in fertilizer markets

- Environmental and regulatory compliance

Stock #6: Codexis, Inc. (CDXS)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $209.2M |

| Quality Rating | 6.3 |

| Intrinsic Value | $4.1 (67.0% undervalued) |

| 1Y Return | -23.7% |

| Revenue | $57.2M |

| Free Cash Flow | -$67.8M |

| Revenue Growth | -6.1% |

Investment Thesis:

Codexis operates at the intersection of biotechnology and AgriTech, developing innovative enzyme solutions for food and agriculture. The stock is deeply undervalued (67.0%) with a moderate quality rating (6.3), but recent performance has been challenged by negative returns and revenue contraction. The company’s negative free cash flow (-$67.8M) and declining revenue (-6.1%) highlight the risks associated with early-stage innovation.

Despite these challenges, Codexis’s technology platform and intellectual property portfolio position it for long-term growth if commercialization efforts succeed. The company’s focus on strategic partnerships and new applications could unlock future value.

Key Catalysts:

- Commercialization of enzyme technologies

- Strategic collaborations and licensing deals

- Expansion into new AgriTech markets

Risk Factors:

- Ongoing cash burn and negative free cash flow

- Execution risk in scaling operations

- Competitive pressures from larger biotech firms

Stock #7: American Vanguard Corporation (AVD)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $153.1M |

| Quality Rating | 4.3 |

| Intrinsic Value | $9.0 (67.6% undervalued) |

| 1Y Return | -8.2% |

| Revenue | $529.1M |

| Free Cash Flow | $18.6M |

| Revenue Growth | -9.6% |

Investment Thesis:

American Vanguard is a diversified provider of crop protection and management solutions. The stock is trading at a significant discount to intrinsic value (67.6% undervalued), but recent performance has been weak, with negative returns and declining revenue. The company’s low quality rating (4.3) and modest free cash flow ($18.6M) suggest operational challenges, but its established market presence and product portfolio offer a foundation for recovery.

AVD’s focus on innovation and regulatory compliance may support future growth, particularly as demand for sustainable crop protection rises.

Key Catalysts:

- New product launches in crop protection

- Expansion into international markets

- Regulatory approvals for innovative solutions

Risk Factors:

- Revenue contraction and profitability pressures

- Regulatory and environmental risks

- Competitive market dynamics

Stock #8: Bioceres Crop Solutions Corp. (BIOX)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $104.9M |

| Quality Rating | 5.5 |

| Intrinsic Value | $5.4 (220.9% undervalued) |

| 1Y Return | -80.5% |

| Revenue | $383.3M |

| Free Cash Flow | $21.3M |

| Revenue Growth | -14.0% |

Investment Thesis:

Bioceres Crop Solutions is a biotechnology company focused on sustainable agriculture and crop productivity. The stock is trading at a dramatic discount to intrinsic value (220.9% undervalued), but recent performance has been extremely weak (-80.5% 1Y return, -14% revenue growth). Despite these challenges, Bioceres’s innovation pipeline and focus on sustainable solutions position it for potential recovery if market conditions improve.

The company’s moderate quality rating (5.5) and positive free cash flow ($21.3M) provide some financial stability, but operational risks remain elevated.

Key Catalysts:

- Commercialization of sustainable crop technologies

- Expansion into new geographies

- Strategic partnerships and licensing

Risk Factors:

- Severe recent share price and revenue declines

- Execution risk in scaling new technologies

- Competitive and regulatory challenges

Stock #9: Cibus, Inc. (CBUS)

Quick Stats Table:

| Metric | Value |

|---|---|

| Market Cap | $59.1M |

| Quality Rating | 5.1 |

| Intrinsic Value | $1.6 (10.7% undervalued) |

| 1Y Return | -63.4% |

| Revenue | $4,846.0K |

| Free Cash Flow | -$78.5M |

| Revenue Growth | 63.7% |

Investment Thesis:

Cibus is an emerging player in agricultural biotechnology, focusing on gene editing and crop improvement. The company’s strong revenue growth (63.7%) stands out, but negative free cash flow (-$78.5M) and a significant share price decline (-63.4%) highlight the risks of early-stage innovation. Cibus’s modest undervaluation (10.7%) and quality rating (5.1) reflect both its potential and its challenges.

The company’s technology platform and focus on high-impact crop traits could drive future growth if commercialization efforts succeed.

Key Catalysts:

- Breakthroughs in gene editing technologies

- Strategic partnerships with major agribusinesses

- Expansion of product pipeline

Risk Factors:

- High cash burn and negative free cash flow

- Execution risk in scaling operations

- Competitive pressures from established biotech firms

Portfolio Diversification Insights

This AgriTech watchlist spans large-cap leaders (Nutrien, CF Industries) and innovative small-caps (Cibus, Codexis), providing exposure to fertilizers, crop protection, and biotechnology. The portfolio balances established revenue generators with high-growth disruptors, offering sector diversification and a range of risk profiles. Investors can achieve broad exposure to the agricultural value chain, from input production to cutting-edge biotech solutions.

Market Timing & Entry Strategies

AgriTech stocks often experience cyclical volatility tied to commodity prices and agricultural demand. Consider dollar-cost averaging to manage entry risk, and monitor sector trends such as global food demand, regulatory changes, and technological adoption. Entry points may be optimized during market pullbacks or following positive earnings and product announcements.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best Cannabis Stock Picks for 2025

📖 Fortress Balance Sheets: The Best Low-Debt Companies

📖 10 Best B2B SaaS Stock Picks for 2025

📖 52-Week High Stocks: Market Quality Leaders for Autumn 2025

📖 10 Best Undervalued Stocks for 2025

FAQ Section

Q1: How were these stocks selected?

A: Stocks were chosen based on ValueSense’s proprietary ratings, intrinsic value analysis, and key financial metrics, focusing on undervalued opportunities and sector leadership.

Q2: What's the best stock from this list?

A: The “best” stock depends on individual investment goals, but CF Industries and Nutrien stand out for their strong quality ratings, free cash flow, and undervaluation.

Q3: Should I buy all these stocks or diversify?

A: Diversification across multiple AgriTech stocks can reduce risk and provide exposure to different growth drivers and innovation trends within the sector.

Q4: What are the biggest risks with these picks?

A: Key risks include commodity price volatility, regulatory changes, operational execution, and market adoption of new technologies.

Q5: When is the best time to invest in these stocks?

A: Market timing is challenging; consider gradual entry strategies and monitor sector catalysts such as earnings releases, regulatory approvals, and macroeconomic trends.

Summary & Investment Outlook

The 2025 AgriTech stock watchlist from ValueSense highlights a diverse mix of established leaders and innovative disruptors, each offering unique value and growth potential. By combining rigorous intrinsic value analysis with sector insights, investors can identify opportunities in a rapidly evolving market. For more in-depth research and real-time updates, visit ValueSense and leverage our tools for smarter investment decisions.