Adam Wyden - Adw Capital Management, Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

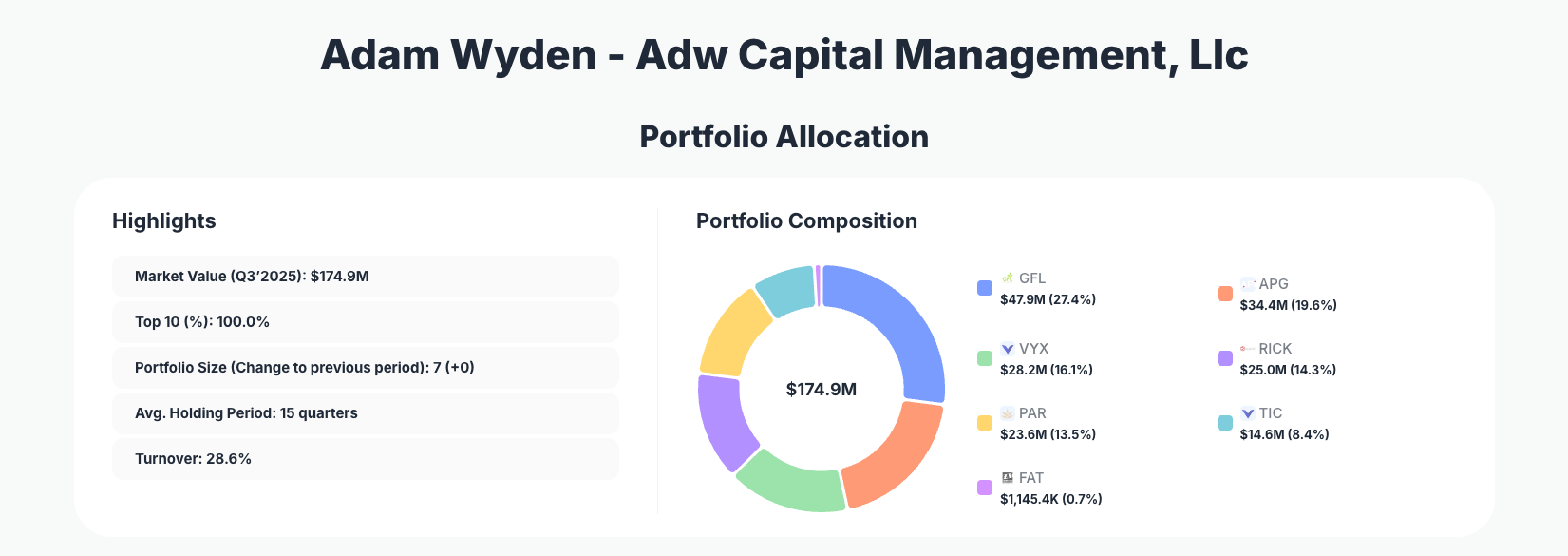

Adam Wyden of ADW Capital Management continues to execute a disciplined, concentrated strategy in small-cap special situations. His $174.9M portfolio for Q3 2025 showcases significant portfolio adjustments, including a fresh "Buy" in VYX and sharp reductions across multiple positions, signaling active management amid market volatility.

Portfolio Overview: Extreme Concentration with Tactical Precision

Portfolio Highlights (Q3 2025): - Market Value: $174.9M - Top 10 Holdings: 100.0% - Portfolio Size: 7 +0 - Average Holding Period: 15 quarters - Turnover: 28.6%

ADW Capital's Q3 2025 portfolio exemplifies ultra-concentrated investing, with the top 10 holdings—essentially the entire portfolio—comprising 100% of assets under management. This approach underscores Wyden's high-conviction style, where conviction in a handful of positions drives performance rather than broad diversification. The stable portfolio size of 7 positions (+0 changes in count) paired with a 28.6% turnover rate indicates selective activity: meaningful trims in underperformers or overweights, but no net expansion.

The 15-quarter average holding period reveals a patient, long-term orientation, contrasting with the quarter's active adjustments. This balance suggests Wyden maintains core bets while pruning to optimize capital allocation. With 100% concentration, risk is amplified, but historical data from the ADW Capital tracker shows this strategy targets undervalued small-caps with turnaround potential, often in overlooked sectors like environmental services and tech-enabled operations.

Such focus demands deep research, aligning perfectly with ValueSense's intrinsic value tools for spotting similar opportunities. Investors following this playbook prioritize businesses with durable moats, even if it means enduring volatility from outsized positions.

Top Holdings Breakdown: Reductions Dominate Amid Selective Adds

The portfolio's changes highlight Wyden's hands-on approach, starting with reductions in key names from the holdingswithchanges data. APi Group Corporation (APG) sits at 19.6% after a Reduce 6.27% trim, maintaining a substantial stake in this infrastructure services provider. A bold new entry, NCR Voyix Corporation (VYX), commands 16.1% via a full "Buy," signaling fresh conviction in retail and hospitality tech post its corporate split.

Further trims include RCI Hospitality Holdings (RICK) at 14.3% (Reduce 6.68%), a nightlife and hospitality play, and a dramatic Reduce 77.01% in PAR Technology (PAR) now at 13.5%, suggesting profit-taking or reassessment in restaurant tech. ACUREN CORP (_) was cut by 57.92% to 8.4%, rounding out the active changes.

Complementing these, stable anchors persist: GFL Environmental (GFL) holds steady at 27.4% with "No change," as the top position in waste management. Smaller unchanged names like FAT Brands (FAT) at 0.7% provide tail-end exposure to franchising. This mix—five changes, mostly reductions—frees capital while introducing VYX as a high-conviction pivot, blending continuity with opportunism across services, tech, and industrials.

What the Portfolio Reveals About Wyden's Strategy

ADW Capital's moves paint a picture of opportunistic value hunting in niche, turnaround scenarios: - Quality small-caps with operational leverage: Holdings like GFL and APG emphasize essential services with consolidation potential, favoring recurring revenue over cyclical growth. - Sector diversity in underfollowed areas: Exposure spans environmental (GFL), tech (PAR, VYX), hospitality (RICK), and industrials, avoiding mega-cap overcrowding. - Aggressive position management: Heavy reductions (e.g., 77% in PAR) show risk control, trimming winners or stalled bets to fund new ideas like VYX. - Long-term patience with tactical flexibility: 15-quarter holds contrast 28.6% turnover, indicating core conviction tempered by market signals.

This reveals a risk-managed activist bent, targeting mispriced assets where Wyden's research edge shines.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| GFL Environmental Inc. | $47.9M | 27.4% | No change |

| APi Group Corporation | $34.4M | 19.6% | Reduce 6.27% |

| NCR Voyix Corporation | $28.2M | 16.1% | Buy |

| RCI Hospitality Holdings, Inc. | $25.0M | 14.3% | Reduce 6.68% |

| PAR Technology Corporation | $23.6M | 13.5% | Reduce 77.01% |

| ACUREN CORP | $14.6M | 8.4% | Reduce 57.92% |

| FAT Brands Inc. | $1,145.4K | 0.7% | No change |

The table underscores ADW Capital's extreme concentration, with the top position GFL Environmental alone at 27.4% and the top five exceeding 90%. This setup amplifies returns from winners but heightens volatility, as seen in the massive 77% trim in PAR—likely locking in gains or cutting losses. The new VYX buy at 16.1% injects fresh momentum, while trims across APG, RICK, and others rebalance toward higher-conviction names. Overall, 100% in seven holdings demands ironclad thesis validation, aligning with Wyden's track record in small-cap turnarounds.

Investment Lessons from Adam Wyden's ADW Capital Approach

- Concentrate ruthlessly in your circle of competence: 100% top-10 allocation shows betting big only on deeply understood niches like waste and hospitality tech.

- Trim aggressively to stay nimble: Reductions like 77% in PAR demonstrate reallocating from maturing positions to emerging opportunities such as VYX.

- Patience pays in special situations: 15-quarter average holds reward waiting for catalysts in undervalued small-caps.

- Balance stability with bold entries: "No change" in anchors like GFL provides ballast for tactical "Buy" moves.

- Turnover as a discipline tool: 28.6% rate keeps the portfolio fresh without chasing noise.

Looking Ahead: What Comes Next?

With trims generating liquidity from positions like PAR and ACUREN CORP, Wyden has dry powder for new small-cap opportunities. The VYX initiation hints at interest in fintech-hospitality hybrids amid economic uncertainty. Stable portfolio size suggests no rush to expand, but watch for deployments in industrials or services if valuations dip. Current positioning—anchored by GFL—sets up for resilience in a volatile 2026, leveraging long holds for compounding while changes adapt to macro shifts.

FAQ about Adam Wyden's ADW Capital Portfolio

Q: What are the most significant changes in Adam Wyden's Q3 2025 13F filing?

A: Key moves include a new "Buy" in NCR Voyix (VYX) at 16.1%, sharp reductions like 77.01% in PAR Technology (PAR) and 57.92% in ACUREN CORP, plus moderate trims in APG and RICK. These reflect profit-taking and reallocation.

Q: Why does ADW Capital maintain such extreme portfolio concentration?

A: With 100% in top 10 (just 7 holdings), Wyden targets high-conviction small-cap turnarounds where deep research yields asymmetric returns, accepting volatility for outsized upside in niches like environmental services and tech.

Q: What sectors does Adam Wyden favor in this portfolio?

A: Exposure tilts to industrials/services (GFL, APG), tech (VYX, PAR), and hospitality (RICK), focusing on undervalued operators with operational leverage.

Q: How can I track and follow Adam Wyden's ADW Capital portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/adw-capital for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!