Adobe Stock Analysis: Undervalued Creative Software Monopoly

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

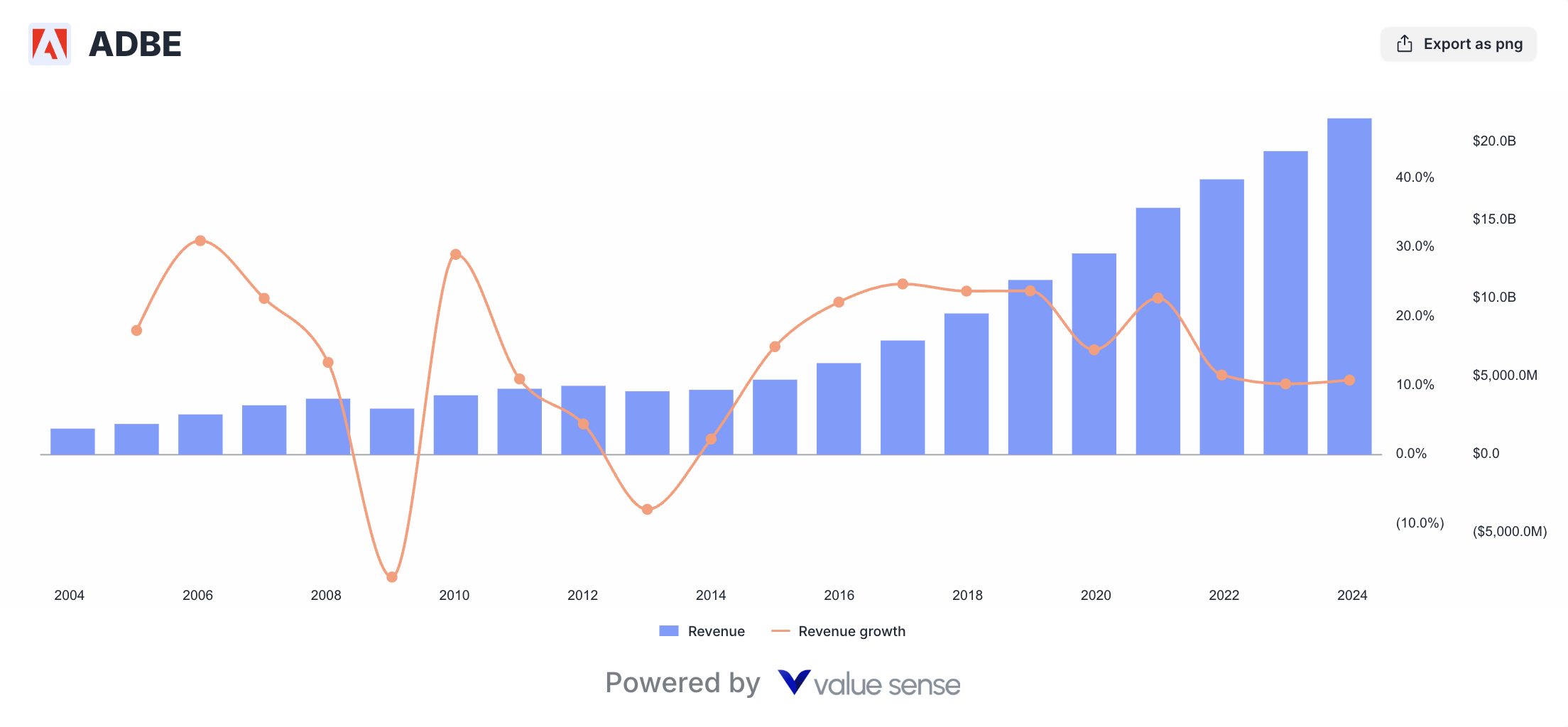

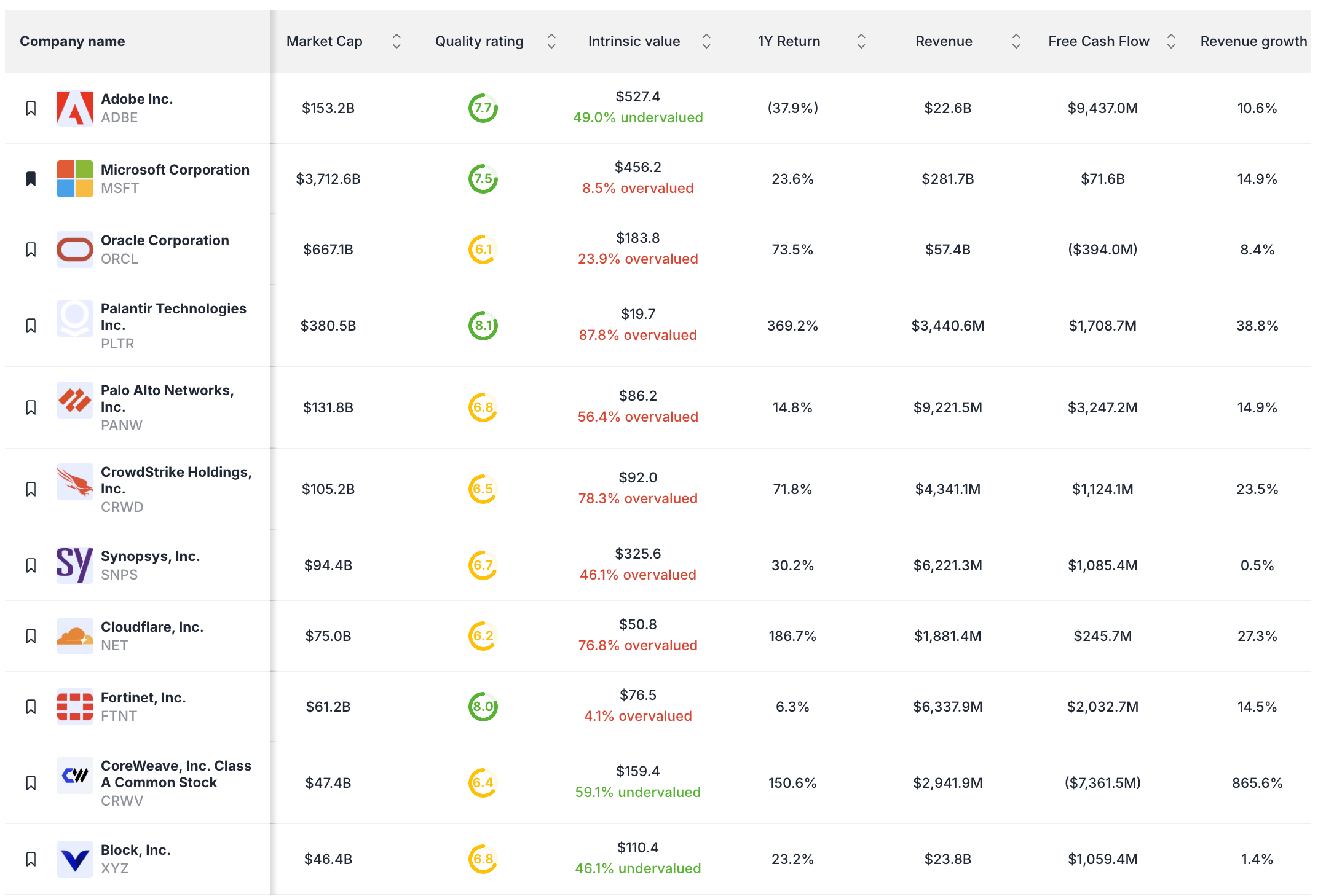

Adobe Inc. (NASDAQ: ADBE) powers the global digital content economy, offering essential tools for professionals and enterprises in design, publishing, marketing, and video. Despite intensifying competition and wider tech volatility, millions of users—and trillions in creative output—run on its Creative Cloud suite. In 2025, Adobe stock trades at a sharp discount compared to its pandemic-era highs, with the company’s profits and recurring revenue showing resilience and suggesting ADBE is an undervalued opportunity for long-term investors.

Monopoly-Like Position in Creative Software

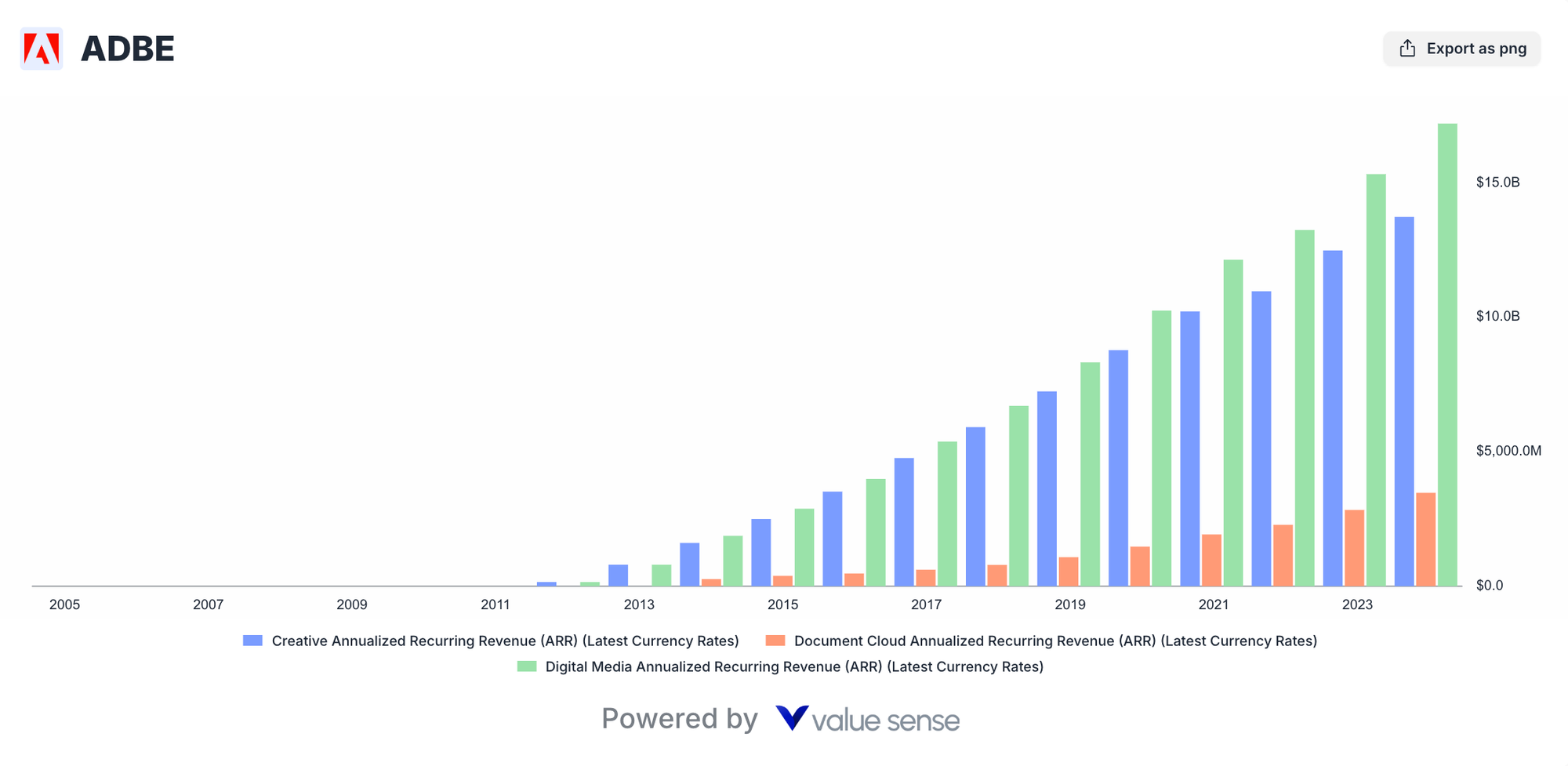

Adobe dominates digital creativity, with >90% share in image, video, and publishing software for professionals. Brands like Photoshop, Illustrator, Premiere Pro, and Acrobat are industry standards, driving sticky, subscription-based revenues and sky-high gross margins.

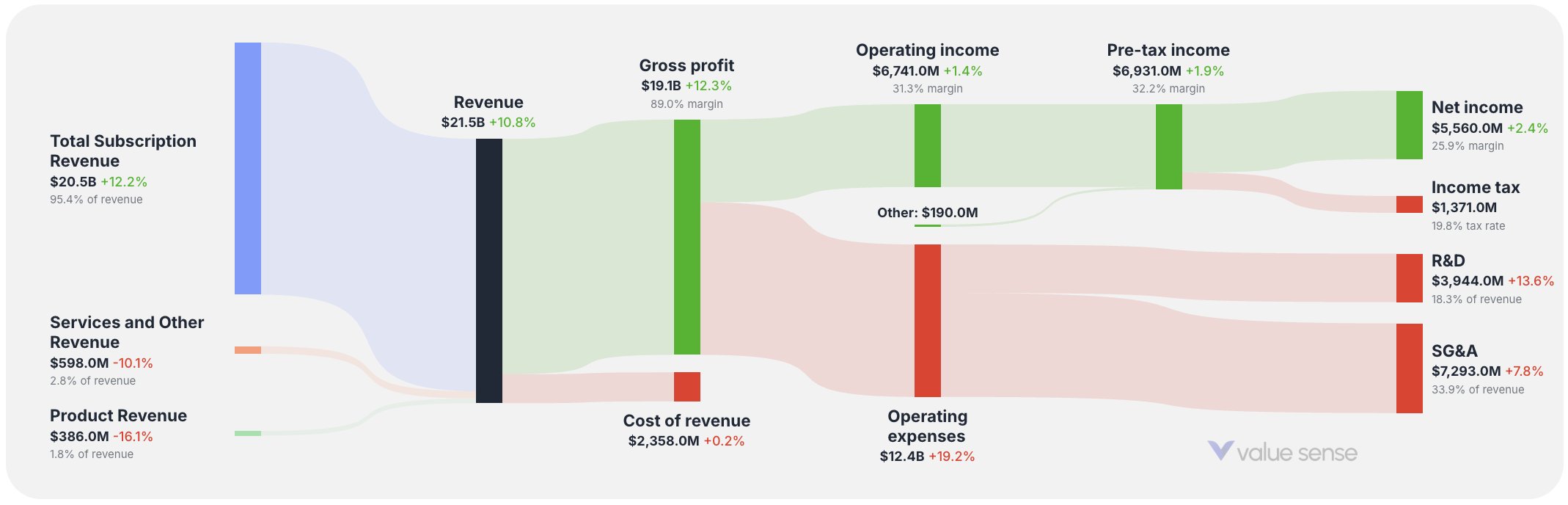

Key facts (2025):

- Market cap: $150B

- Free cash flow: $9.4B+ annually

- Gross margin: 89%

- Operating margin: ~39%

- Return on equity: 56%

- Over 35% of Photoshop subscribers now use generative AI features

Adobe’s moat is reinforced by high switching costs, global reach, and integration into enterprise marketing, publishing, and creative content workflows.

Why Adobe Is Undervalued

After running up to nearly $590, Adobe stock trades at ~$355 in 2025—down ~40% from highs and pricing in recession, competition, and AI disruption concerns. Yet valuation metrics signal compelling value vs. history and peers:

- Trailing P/E: 22.7x (close to 5-year lows)

- Forward P/E: 15.5x (lowest since 2016)

- PEG ratio: 1.18 (suggests undervaluation relative to growth)

- Price/Sales: 6.9x (down sharply from 12.8x last year)

- Analyst target price: $410–$480; upside 15–37% vs. current price

Recent dips reflect fear of competition (Google Gemini, Figma, Canva) and AI’s impact. However, Adobe’s position in creative, document, and marketing software remains dominant, with AI integration raising switching costs and expanding use cases.

Earnings, Growth, and AI Strategy

Q2 2025 highlights:

- Revenue: $5.87B (+11% YoY)

- EPS guidance raised: $20.50–$20.70 (+12% YoY)

- ARR up 12% YoY; 67% of performance obligations recognized within a year

Adobe leads in embedding generative AI—Firefly, Acrobat AI Assistant, and GenStudio show strong user uptake. New features boost customer stickiness and create fresh monetization streams. AI is expected to deliver ~$250M recurring revenue by late 2025, with rapid adoption fueling growth.

Competitive Landscape: Figma, Canva, Google

- Figma and Canva capture younger, SMB-focused market but lack deep enterprise roots

- Google Gemini introduces new image/video editing but trails Adobe’s depth and workflow integration

- Microsoft competes in cloud, productivity, and workflow, but not creative-first domains

Adobe’s moat comes from integration, platform robustness, and the creative/institutional lock-in only a mature suite can provide.

Risks and Headwinds

- Tech cycles, slower enterprise SaaS spending could pressure near-term growth

- Competitive pressure may require heavier R&D and marketing investments

- Subscription fatigue and viral consumer apps could erode low-end market share

Yet, Adobe’s execution, deepening enterprise ties, and secular shift to digital creative workflows support durable growth and cash flow, regardless of short-term hype cycles.

Analyst Verdict and Long-Term Outlook

- Most analysts rate Adobe “Buy”; consensus target $410–$480

- Valuation models see 28–37% upside (fair value ~$450)

- Growth and margins remain best-in-class among mature software leaders

In sum, Adobe’s undervaluation in 2025 reflects macro fears, not business fundamentals. The company’s creative software monopoly, rapid AI adoption in its suite, and robust recurring cash flow make ADBE an outstanding value investment for long-term holders.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Visa Stock Analysis: Undervalued Digital Payments Growth Story

📖 Procter & Gamble Undervalued: Consumer Staples Dividend Champion

📖 Which Gold Mining Stocks Are Undervalued in September 2025

FAQ

Q: Why is Adobe considered undervalued now?

A: Adobe trades at discount multiples due to tech volatility, but its cash flow, margins, and growth are well above peers and its own history, making it attractive on intrinsic value.

Q: How is Adobe using AI?

A: Features like Firefly, Acrobat AI Assistant, and GenStudio are driving subscriber growth and recurring AI revenue, deepening user engagement and platform stickiness.

Q: What growth rates can investors expect?

A: Consensus sees 11–12% annual revenue growth, with EPS and cash flow compounding from high-margin cloud subscriptions.

Q: What risks are most relevant?

A: Competition, tech cycles, and evolving user needs, but Adobe’s integrated platform and moat mitigate long-term risks.

Final Verdict

Adobe’s creative software monopoly, unmatched margins, and AI-driven growth make it a compelling undervalued buy for value investors in 2025. As the digital economy expands, Adobe’s recurring revenues and market leadership promise resilient returns for long-term shareholders.