ValueSense features - AI-Powered Earnings Overview

The AI-Powered Earnings Overview leverages advanced artificial intelligence and natural language processing to transform raw earnings call transcripts into actionable insights. This feature automatically analyzes, summarizes, and visualizes earnings data to provide investors with comprehensive, AI-driven understanding of company performance and strategic direction.

Core AI Capabilities

1. AI-Powered Earnings Analysis and Summarization

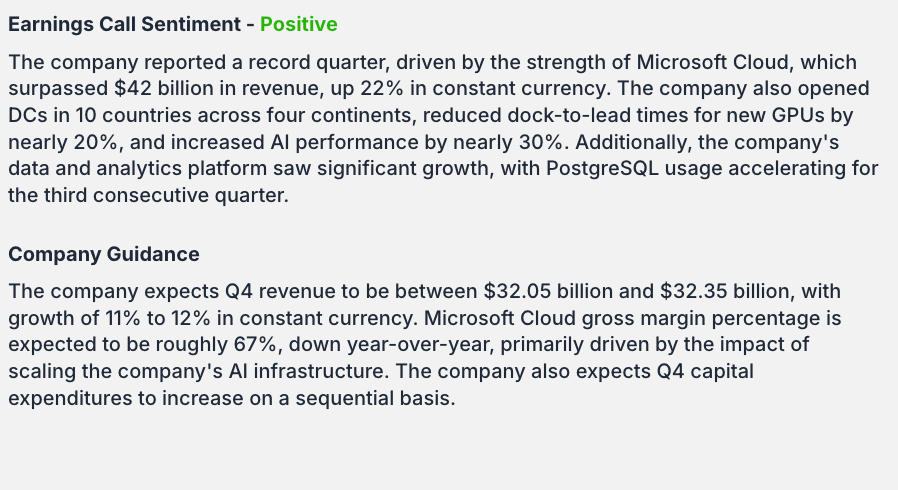

Latest Earnings Call Summary

- Automated Content Generation: AI processes entire earnings call transcripts to create concise, readable summaries

- Structured Analysis: Organizes information into logical sections including:

- Earnings Call Sentiment classification (e.g., "Positive")

- Company Guidance extraction and summary

- Key performance metrics identification

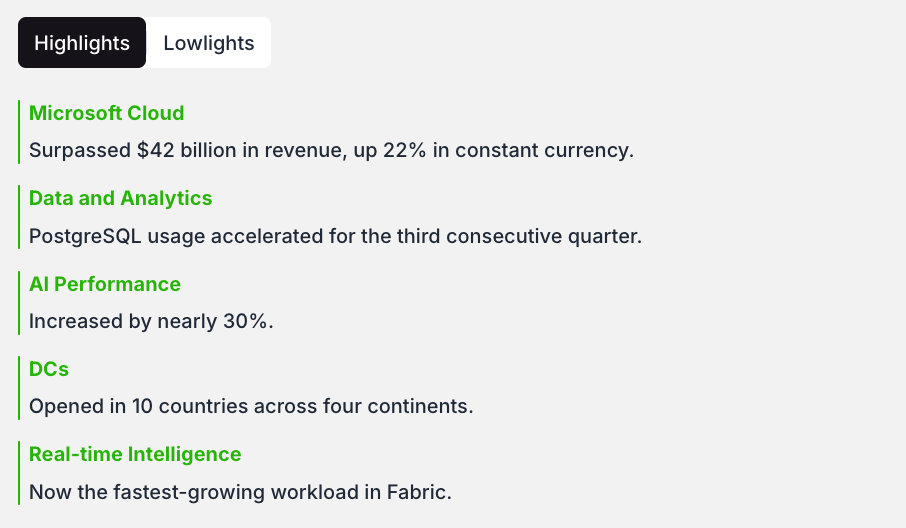

Highlights & Lowlights Extraction

- Intelligent Information Extraction: AI automatically identifies and lists the most significant positive takeaways from earnings calls

- Key Achievement Recognition: Surfaces important metrics such as "Microsoft Cloud Surpassed $42 billion in revenue"

- Automated Prioritization: Ranks insights by importance and relevance

2. Advanced Natural Language Processing

Comprehensive Transcript Analysis

The AI system processes unstructured earnings call data to:

- Generate Text Summaries: Create comprehensive summaries of management discussions

- Calculate Sentiment Scores: Derive quantitative "Total Sentiment Score" from qualitative language

- Identify Strategic Topics: Categorize discussion points into strategic focus areas

Intelligent Content Classification

- Automatic Categorization: Processes conversations to identify key themes

- Strategic Topic Identification: Recognizes and tags discussion segments with relevant categories like:

- "Azure Growth"

- "AI and Ethics"

- "Capital Expenditures"

- "Activision Acquisition"

3. AI-Driven Sentiment Analysis Engine

Quantitative Sentiment Scoring

- Total Sentiment Score: Converts qualitative management tone into numerical values

- Qualitative Ratings: Provides immediate sentiment classifications (Positive, Negative, Neutral)

- Temporal Analysis: Tracks sentiment changes across quarters

Sentiment Visualization

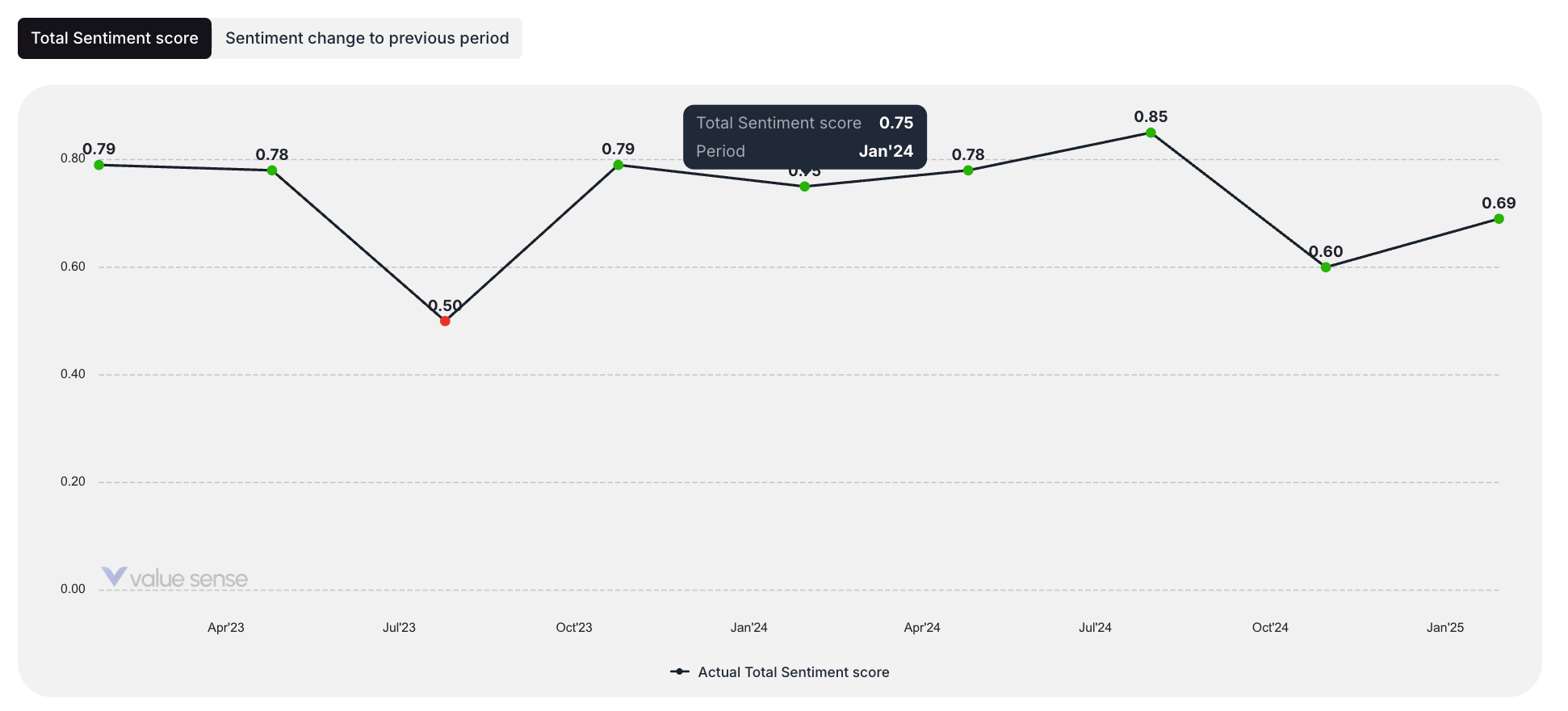

- Earnings Sentiment Score Chart: Line graph displaying AI-generated sentiment trends over time

- Sentiment Change Analysis: Highlights significant shifts in sentiment from previous periods

- Color-Coded Indicators: Visual representation of sentiment direction and intensity

4. Automated Insights Generation

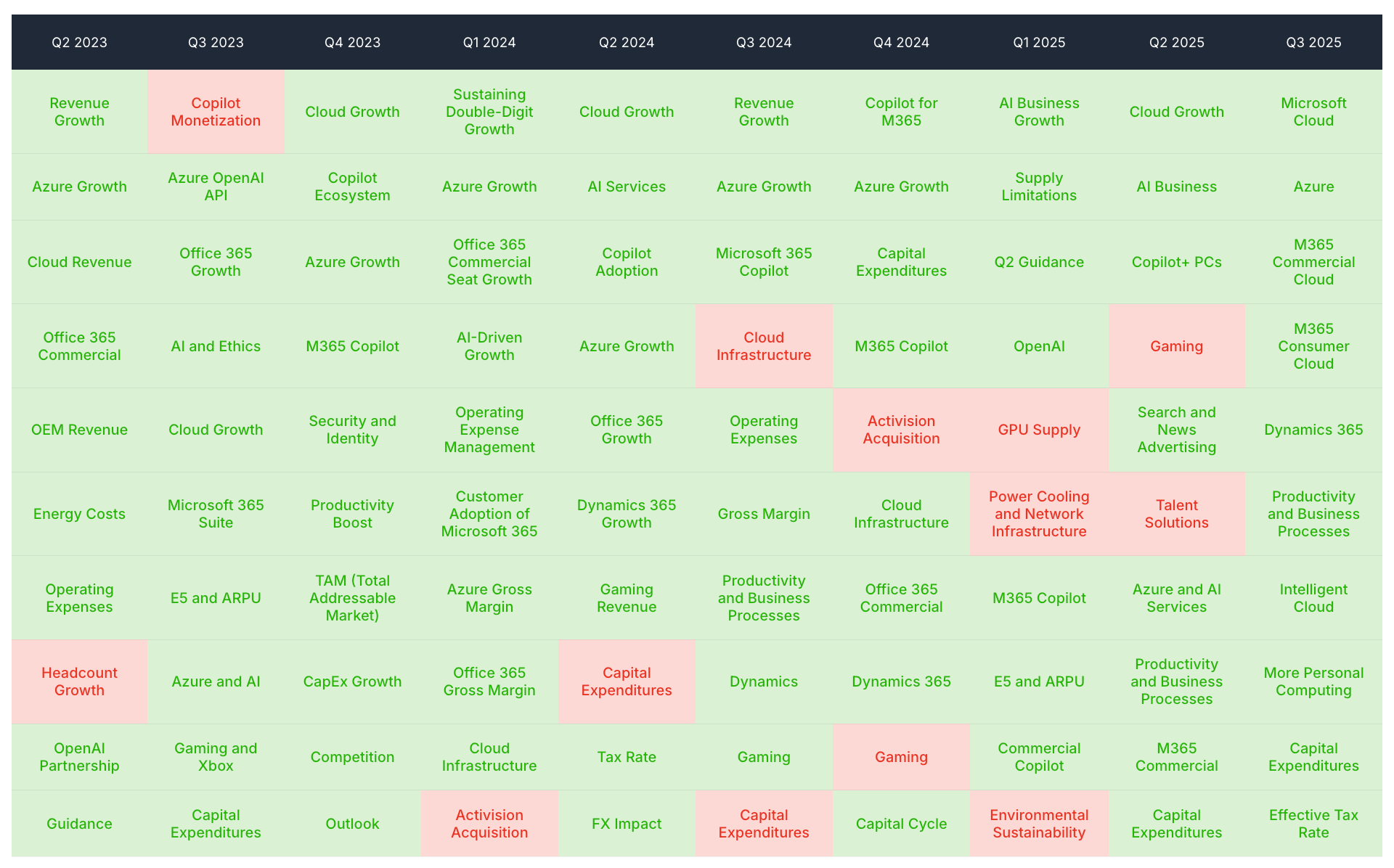

Top Focus Area Heatmap

- AI-Powered Strategic Analysis: Explicitly AI-driven feature as indicated by tooltip: "This heatmap is AI-powered, highlighting the strategic topics from earnings calls each quarter"

- Visual Intelligence: Uses color-coding (green for positive, red for negative) based on AI sentiment analysis

- Strategic Pattern Recognition: Identifies and visualizes evolution of corporate strategic priorities over time

Intelligent Data Extraction

- Structured Information Extraction: Processes unstructured transcripts to extract:

- Specific strategic topics for heatmap visualization

- Key positive factual statements for highlights section

- Guidance and forward-looking statements

5. AI-Enhanced Pattern Recognition

Earnings Sentiment & Price Performance Analysis

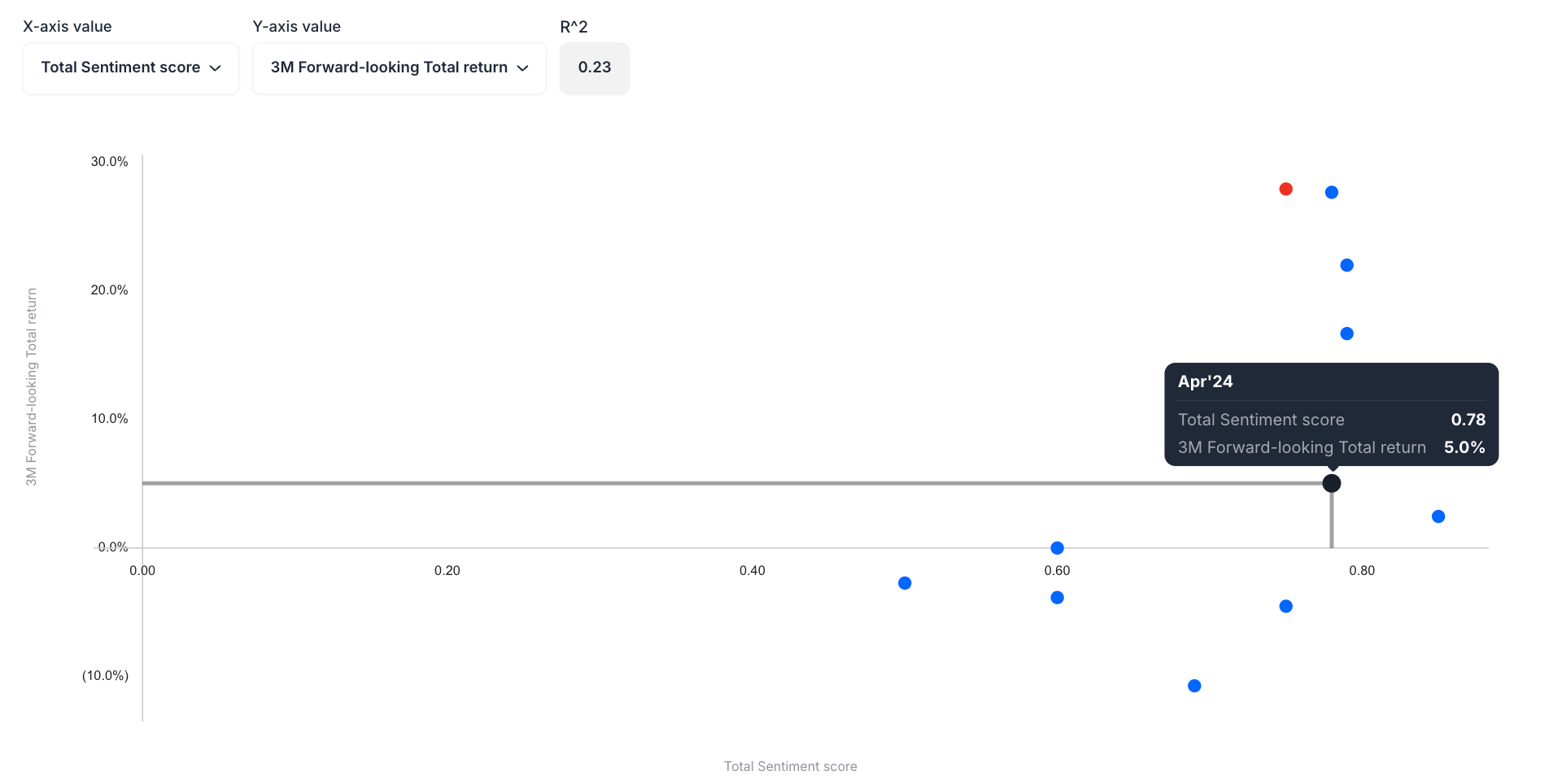

- Correlation Intelligence: Plots AI-generated "Total Sentiment Score" against "3M Forward-looking Total return"

- Pattern Recognition: Enables identification of potential correlations between earnings sentiment and stock performance

- Statistical Analysis: Includes R² values for relationship strength assessment

Strategic Focus Evolution

- Trend Analysis: AI tracks how strategic topics evolve across quarters

- Priority Shift Detection: Identifies growing focus areas (e.g., increasing emphasis on "AI Services")

- Strategic Pattern Mapping: Visualizes corporate strategy evolution over time

6. Machine Learning-Powered Financial Analysis

Sentiment Analysis Algorithms

- Advanced NLP Models: Trained machine learning models analyze complex language patterns

- Contextual Understanding: Processes financial terminology and industry-specific language

- Tone Recognition: Identifies subtle sentiment indicators in executive communications

Correlation Analysis

- Statistical ML Applications: Uses machine learning for finding relationships between sentiment and performance data

- Predictive Indicators: Provides data that can inform predictive analysis models

- Performance Correlation: Identifies patterns between qualitative sentiment and quantitative returns

7. Intelligent Visualization Enhancements

AI-Powered Visual Analytics

- Smart Color Coding: Automatically applies color schemes based on sentiment analysis

- Dynamic Heatmaps: Real-time visualization updates based on AI processing

- Intuitive Data Representation: Transforms complex analysis into easily digestible visual formats

Automated Chart Generation

- Sentiment Trend Visualization: Automatically generates charts showing sentiment evolution

- Performance Correlation Plots: Creates scatter plots correlating AI insights with market performance

- Strategic Focus Mapping: Generates heatmaps showing strategic priority evolution

8. Smart Categorization and Tagging

Automated Topic Classification

- Financial Theme Recognition: AI identifies and categorizes financial discussion topics

- Strategic Priority Tagging: Automatically tags segments with relevant business themes

- Contextual Categorization: Understands business context to properly classify discussions

Intelligent Content Organization

- Structured Data Creation: Transforms unstructured call transcripts into organized insights

- Hierarchical Information Processing: Prioritizes and structures information by relevance

- Automated Content Filtering: Surfaces most important insights while filtering noise

Key AI Differentiators

Qualitative-Quantitative Integration

- Unique Value Proposition: Converts qualitative management communications into quantitative metrics

- Comprehensive Analysis: Combines AI-driven insights with traditional financial metrics

- Actionable Intelligence: Provides both numerical scores and contextual understanding

Real-Time Processing

- Automated Updates: AI processes new earnings calls automatically

- Immediate Insights: Generates summaries and analysis shortly after earnings releases

- Continuous Learning: Models improve with each processed earnings call

Financial Context Awareness

- Industry-Specific Intelligence: AI trained on financial terminology and context

- Business Strategy Recognition: Understands corporate strategy discussions

- Market-Relevant Analysis: Focuses on investment-relevant insights

Best Practices for AI Feature Usage

Maximizing AI Insights

- Review AI Summaries First: Start with automated summaries for quick understanding

- Analyze Sentiment Trends: Use sentiment scoring to identify management confidence patterns

- Track Strategic Evolution: Monitor heatmap changes to understand strategic shifts

- Correlate with Performance: Use sentiment-performance analysis for investment insights

Interpreting AI Analysis

- Understand Sentiment Context: Consider AI sentiment alongside traditional metrics

- Validate AI Insights: Cross-reference AI-generated insights with source material

- Monitor Sentiment Changes: Pay attention to significant quarter-over-quarter sentiment shifts

- Strategic Pattern Recognition: Use AI-identified patterns to inform investment decisions

This AI-powered Earnings Overview represents a significant advancement in financial analysis, combining cutting-edge artificial intelligence with deep financial expertise to provide investors with unprecedented insights into company performance and strategic direction.