Al Gore - Generation Investment Management Llp Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

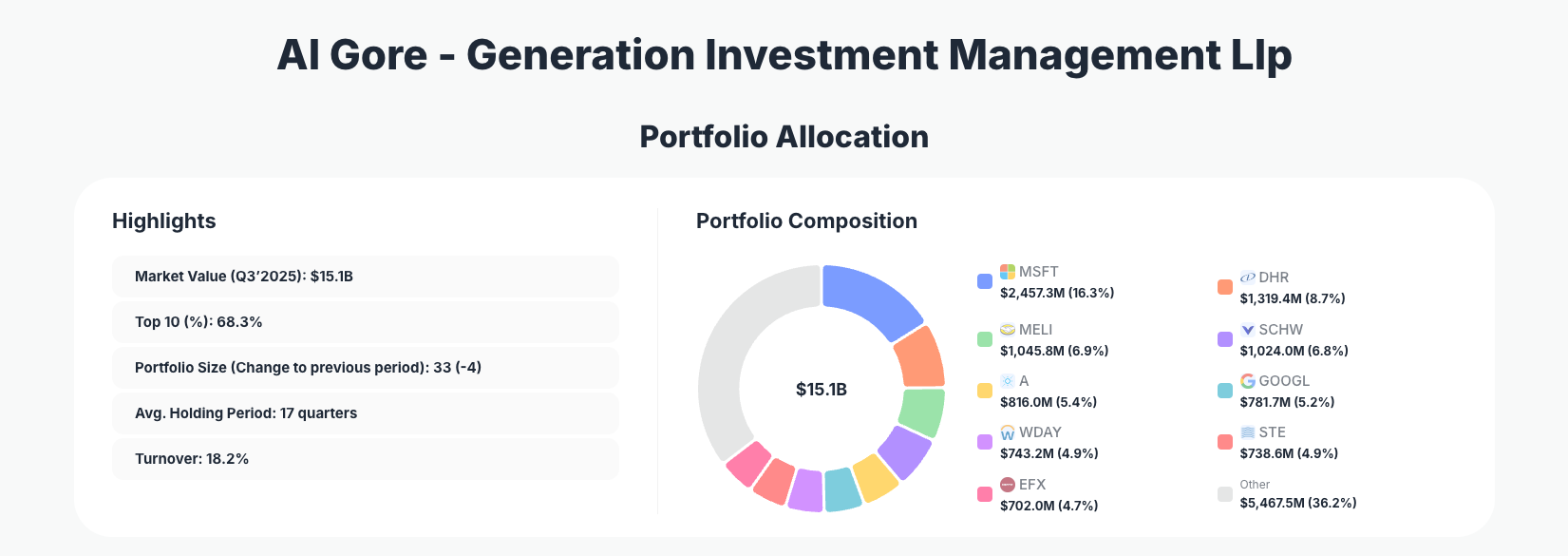

Al Gore - Generation Investment Management Llp continues to apply a disciplined, sustainability-focused approach to public equities. Their Q3’2025 portfolio shows a $15.1B collection of high-quality, cash-generative compounders, with notable trims in mega-cap tech and financials offset by bold additions in life sciences tools, cloud software, and data infrastructure leaders.

Explore Al Gore – Generation Investment portfolio details on ValueSense

The Big Picture: Concentrated, Long-Term Sustainable Winners

Portfolio Highlights (Q3’2025):

- Market Value: $15.1B

- Top 10 Holdings: 68.3%

- Portfolio Size: 33 -4

- Average Holding Period: 17 quarters

- Turnover: 18.2%

Generation’s Q3’2025 portfolio remains highly concentrated, with nearly seven-tenths of assets in the top 10 names and only 33 positions overall. This structure underscores a philosophy of owning a curated list of scalable, mission-critical businesses rather than broad diversification for its own sake. Moderate turnover of 18.2% aligns with an average holding period of 17 quarters, highlighting a genuine long-term orientation rather than rapid trading.

The quarter’s activity shows targeted rebalancing, not a wholesale strategy shift. Generation reduced exposure to some of its largest, more mature tech and platform holdings while aggressively adding to select life sciences tools, data, and enterprise software positions. Within the same concentrated framework, the firm is subtly tilting the portfolio toward areas where structural growth, pricing power, and sustainability tailwinds remain strongest.

At the same time, the reduction in total positions by four names indicates a continued push toward focus and conviction. The portfolio is being refined toward the firm’s highest-conviction ideas, with incremental capital allocated to scalable platforms that benefit from secular trends like cloud computing, data analytics, digital finance, and healthcare innovation.

Top Holdings Overview: Cloud, Data, and Life Sciences in Focus

The core of Generation’s Q3’2025 positioning lies in a blend of software, data, fintech, and healthcare tools, with nuanced shifts in sizing that reveal their current risk-reward views.

The largest disclosed position with a change is Microsoft Corporation at 16.3% of the portfolio, where Generation chose to “Reduce 5.84%”. With $2,457.3M invested across 4,744,228 shares, this trim looks like risk management and profit-taking in a dominant compounder rather than a change in thesis. Microsoft’s scale in cloud, productivity, and AI likely keeps it central to the strategy, but position size is being reined in at the margin.

In contrast, Danaher Corporation saw a substantial “Add 34.01%” and now stands at 8.7% of the portfolio ($1,319.4M, 6,654,666 shares). This aggressive addition underscores Generation’s conviction in Danaher’s recurring-revenue laboratory tools and diagnostics franchise—critical infrastructure for global healthcare and life sciences research.

Latin American e-commerce and fintech leader MercadoLibre, Inc. remains a key growth pillar at 6.9% ($1,045.8M, 447,488 shares), though the stake was “Reduce 2.76%”. The modest trim suggests careful risk calibration after strong performance, while maintaining a sizable allocation to a business that still enjoys substantial runway in digital payments and marketplace penetration.

Financial services exposure is headlined by The Charles Schwab Corporation at 6.8% of the portfolio ($1,024.0M, 10,726,323 shares), where Generation executed a notable “Reduce 22.75%”. This is one of the most meaningful cuts in the quarter, hinting at either valuation discipline after a rebound or a more cautious view on interest-rate sensitivity and brokerage economics within the financials sleeve.

Healthcare and diagnostics are reinforced through Agilent Technologies, Inc., a 5.4% position worth $816.0M (6,357,953 shares), where Generation chose to “Add 10.08%”. This incremental build suggests increased confidence in Agilent’s role as a picks-and-shovels provider to biotech, pharma, and applied markets—another recurring-revenue, mission-critical tools franchise.

On the software and internet side, Alphabet Inc. remains a core pillar at 5.2% of the portfolio ($781.7M, 3,215,729 shares), even after a “Reduce 12.78%” move. The trim echoes the pattern seen in Microsoft—paring back mega-cap exposure while still sustaining large, long-term positions in dominant digital platforms.

One of the most striking moves is in Workday, Inc., where Generation executed an “Add 50.40%”, lifting the stake to 4.9% of the portfolio ($743.2M, 3,087,395 shares). This bold increase signals strong conviction in Workday’s cloud-native HR and financial management applications as critical SaaS infrastructure for large enterprises.

Defensive healthcare and industrial sterilization exposure continues through STERIS plc, a 4.9% holding worth $738.6M (2,984,939 shares), though Generation opted to “Reduce 5.86%”. The modest trim likely reflects portfolio balancing rather than a strategic exit from the name.

Data and analytics remain a key theme via Equifax Inc., a 4.7% position totaling $702.0M (2,736,467 shares), where the firm chose to “Add 6.35%”. This incremental addition highlights Generation’s ongoing interest in information services and credit data assets that benefit from digitalization and regulatory-driven information needs.

Rounding out the main changes list, Trimble Inc. stands at 4.5% of the portfolio ($682.4M, 8,358,112 shares) after a “Reduce 7.33%”. The cut indicates measured de-risking or rotation within industrial technology and geospatial software, while still preserving a significant allocation to this niche automation and infrastructure tech play.

Collectively, these 10 names alone represent the core of Generation’s active decisions this quarter, spanning mega-cap software, life sciences tools, e-commerce, brokerage, enterprise SaaS, healthcare services, and data infrastructure.

What the Portfolio Reveals About Generation’s Current Strategy

Generation’s Q3’2025 13F snapshot reveals several clear strategic themes:

- Long-term compounders, not short-term trades

With an average holding period of 17 quarters and only 18.2% turnover, the firm is clearly focused on multi-year theses. Adjustments in Microsoft, Alphabet, and MercadoLibre look like calibration, not directional flips. - Quality and resilience over speculative growth

The largest actions are in durable franchises with strong moats: Danaher, Agilent, Equifax, and Workday. These companies sit at the intersection of secular growth and recurring, high-margin business models. - Selective de-risking in financials and mega-cap tech

Significant reductions in Charles Schwab, plus trims in Microsoft and Alphabet, suggest a desire to limit downside in more cyclical or already fully-valued areas while maintaining substantial exposure. - Persistent emphasis on data and infrastructure

The increased stakes in Danaher, Agilent, and Equifax, combined with continuing commitments to Trimble and MercadoLibre, underscore a belief in infrastructure-like, data-heavy business models that benefit from digital transformation. - Risk management via position sizing, not broad diversification

Generation is not adding dozens of new names; instead, it is resizing existing positions to reflect updated risk-reward. This is visible in the strong add to Workday and the sharp cut in Schwab.

Portfolio Concentration Analysis

Using the disclosed top holdings, the concentration profile is as follows:

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Microsoft Corporation (MSFT) | $2,457.3M | 16.3% | Reduce 5.84% |

| Danaher Corporation (DHR) | $1,319.4M | 8.7% | Add 34.01% |

| MercadoLibre, Inc. (MELI) | $1,045.8M | 6.9% | Reduce 2.76% |

| The Charles Schwab Corporation (SCHW) | $1,024.0M | 6.8% | Reduce 22.75% |

| Agilent Technologies, Inc. (A) | $816.0M | 5.4% | Add 10.08% |

| Alphabet Inc. (GOOGL) | $781.7M | 5.2% | Reduce 12.78% |

| Workday, Inc. (WDAY) | $743.2M | 4.9% | Add 50.40% |

| STERIS plc (STE) | $738.6M | 4.9% | Reduce 5.86% |

| Equifax Inc. (EFX) | $702.0M | 4.7% | Add 6.35% |

Even with incomplete disclosure of rank 1, these top positions alone account for a large share of the $15.1B portfolio, consistent with the reported 68.3% weight in the top 10. Single-name exposure reaches as high as 16.3% in Microsoft, illustrating just how concentrated Generation is willing to be when conviction is strong.

The table also highlights how position changes are most active in the very names that dominate overall exposure. Large adds in Danaher and Workday, along with substantial reductions in Schwab and notable trims in Alphabet, show that risk is managed primarily through proactive sizing of top holdings rather than a long tail of small positions. For investors studying this 13F, the message is clear: what Generation believes most strongly in, it owns in size—and actively manages.

Investment Lessons from Al Gore’s Generation Investment Approach

Several key principles emerge from the Q3’2025 Generation Investment portfolio:

- Concentrate in your highest-conviction ideas

Generation is comfortable with double-digit allocations to core winners like Microsoft and high-single-digit weights in Danaher and MercadoLibre. For individual investors, this highlights that true outperformance often stems from owning a few great businesses in size, not many mediocre ones. - Hold for years, tweak at the margin

An average holding period of 17 quarters indicates multi-year conviction. Changes—such as “Reduce 5.84%” in MSFT or “Add 10.08%” in Agilent—are incremental, reflecting updated valuation and risk views, not wholesale thesis reversals. - Favor recurring-revenue, infrastructure-like models

From Danaher and Agilent in life sciences tools to Equifax and Trimble in data and geospatial solutions, the portfolio showcases a preference for businesses embedded in customer workflows with high switching costs. - Balance growth with risk through sizing, not timing

Generation still owns high-growth names like MercadoLibre and Workday, but adjusts exposure via partial adds and trims rather than all-or-nothing decisions. This provides a useful model for navigating volatility while staying invested in secular trends. - Align with structural and sustainability megatrends

Although the 13F doesn’t label companies as “sustainable,” the holdings lineup—cloud infrastructure, healthcare innovation, financial inclusion, and data transparency—fits with a philosophy of backing businesses that benefit from long-term societal and environmental shifts.

Looking Ahead: What Comes Next for Generation’s Portfolio?

While 13F data is backward-looking and reported with a lag, Q3’2025 positioning offers clues about Generation’s forward stance:

- Room to allocate into corrections

With some de-risking in financials like Schwab and large-cap tech trims in Microsoft and Alphabet, Generation may be building optionality to redeploy into future volatility while still holding core stakes. - Potential continued build in life sciences and enterprise SaaS

The sharp increase in Danaher and Workday, plus the add in Agilent, suggests these areas could see more capital if valuations remain attractive relative to growth prospects. - Ongoing commitment to data and infrastructure

The add in Equifax and continued sizable positions in MercadoLibre and Trimble imply that information, analytics, and platform businesses will likely remain at the heart of the strategy. - Selective pruning of lower-conviction names

With portfolio size already down to 33 positions, any further tightening would probably come from exiting smaller holdings and recycling capital into the strongest ideas already visible at the top of the book.

For investors tracking sustainable growth strategies, watching how Generation sizes and rebalances these themes over coming quarters—through updated 13F filings—will be crucial.

FAQ about Al Gore – Generation Investment Portfolio

Q: What were the most notable changes in Generation’s Q3’2025 portfolio?

The most significant moves included a “Reduce 22.75%” cut in The Charles Schwab Corporation, a “Add 34.01%” increase in Danaher Corporation, and a bold “Add 50.40%” in Workday, Inc.. There were also trims in Microsoft, Alphabet, MercadoLibre, STERIS, and Trimble, alongside smaller adds in Agilent and Equifax.

Q: How concentrated is the Al Gore – Generation Investment portfolio?

The Q3’2025 13F shows a $15.1B portfolio with 68.3% of assets in the top 10 holdings and only 33 positions overall. Single-name allocations reach up to 16.3% in Microsoft, reflecting a high-conviction, focused investing style rather than broad index-like diversification.

Q: What is Generation’s typical holding period and turnover?

Generation’s average holding period is 17 quarters, or more than four years, with 18.2% turnover in Q3’2025. This pattern indicates a long-term, research-driven approach where adjustments are made gradually as fundamentals and valuations evolve.

Q: Which sectors or themes does Generation emphasize?

Based on the top positions and recent changes, Generation emphasizes:

- Cloud and enterprise software: Microsoft, Workday

- Life sciences tools and healthcare: Danaher, Agilent, STERIS

- Data and analytics: Equifax, Trimble

- Digital commerce and fintech: MercadoLibre

- Financial services: Charles Schwab

These align with long-term trends in digitalization, healthcare innovation, financial inclusion, and data-driven decision-making.

Q: How can I track Al Gore – Generation Investment portfolio changes?

You can follow Generation’s holdings through quarterly 13F filings submitted to the SEC, which disclose long equity positions for the quarter. These filings are reported with a 45-day lag, so positions may have changed since the reported date. Platforms like ValueSense aggregate this data, provide historical context, and visualize changes over time—visit the dedicated page at Generation’s portfolio to monitor updates, top holdings, and position changes each quarter.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!