Alta Fox Capital Management, Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

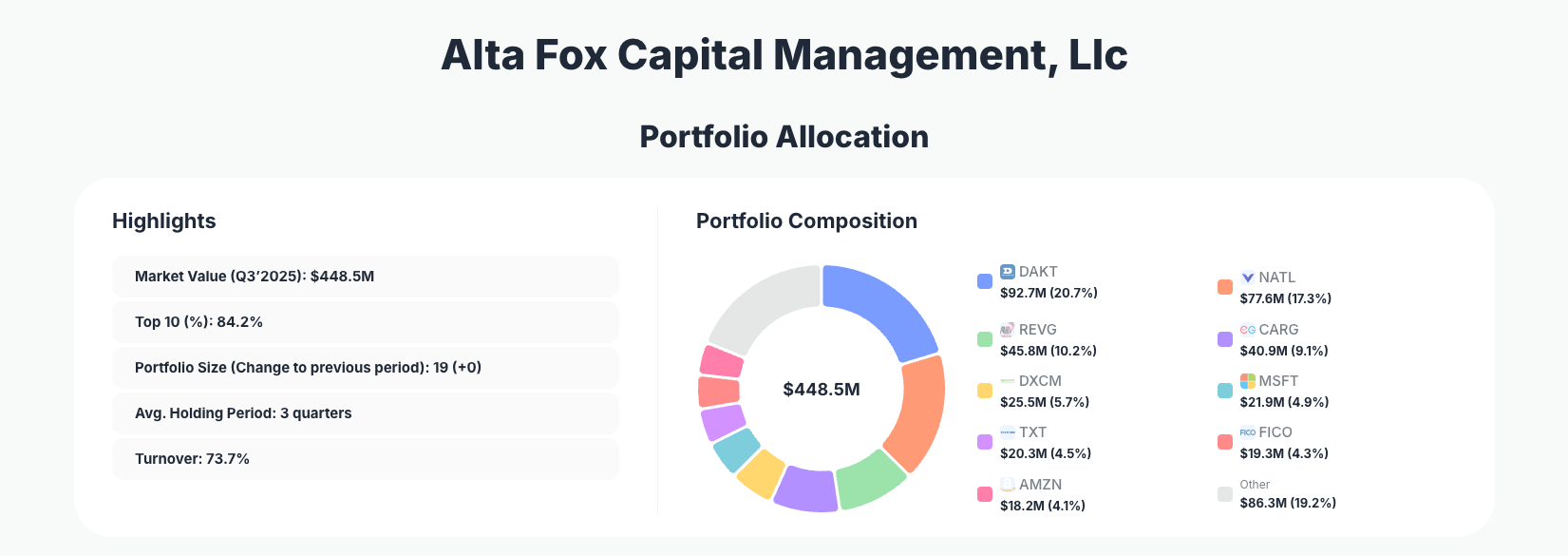

Alta Fox Capital Management, Llc continues to execute its trademark high-conviction, small- and mid-cap strategy with an increasingly targeted mix of niche industrials, specialized software, and select large-cap compounders. Their Q3’2025 portfolio showcases $448.5M in U.S. equity holdings spread across just 19 positions, with outsized exposure to core ideas like Daktronics, Inc., NCR Atleos Corporation, and a growing slate of high-growth names in healthcare, fintech, and digital advertising.

Portfolio Overview: Concentrated Conviction with Active Positioning

Portfolio Highlights (Q3 2025): - Market Value: $448.5M

- Top 10 Holdings: 84.2%

- Portfolio Size: 19 +0

- Average Holding Period: 3 quarters

- Turnover: 73.7%

Alta Fox’s Q3’2025 portfolio is highly concentrated, with the top 10 positions controlling 84.2% of capital despite holding 19 names overall. This structure underscores a barbell between a few dominant core positions and a long tail of smaller, more tactical ideas, consistent with a hedge-fund-style “best ideas only” approach rather than broad diversification.

The average holding period of 3 quarters paired with 73.7% turnover highlights a willingness to actively resize positions as theses evolve, while still giving ideas months—not days—to play out. This balance suggests Alta Fox is neither a hyper-active trader nor a pure buy-and-hold fund; instead, the firm appears to engage in opportunistic rebalancing and thesis refinement across its portfolio as prices and fundamentals shift.

With nearly all capital concentrated in the top 10, risk management is clearly executed through deep conviction and careful sizing, not through owning dozens of small, low-impact positions. Investors following Alta Fox via the ValueSense superinvestor page will recognize a consistent focus on niche competitive advantages, recurring revenues, and underappreciated growth levers.

Top Holdings Snapshot: Smid-Cap Specialists with Select Large-Cap Anchors

The Q3’2025 filing reveals 10–15 key positions that define Alta Fox’s current stance, with special emphasis on names showing meaningful changes this quarter.

The portfolio is led by smid-cap industrial and tech-adjacent names, starting with Daktronics, Inc. at 20.7% of the portfolio. Alta Fox reduced 10.91% of this position, but at $92.7M in value it clearly remains a flagship holding, signaling ongoing conviction despite partial profit-taking or risk trimming.

Close behind, NCR Atleos Corporation commands 17.3% of capital after Alta Fox elected to Add 30.47% this quarter, raising its stake to 1,974,153 shares worth $77.6M. This sizable add suggests growing confidence in Atleos’ standalone value proposition and potential re-rating.

REV Group, Inc. sits at 10.2% of the portfolio with $45.8M invested, even after a dramatic Reduce 49.72% move. This near-halving of the position still leaves REV as a top-5 holding, likely reflecting both risk management and profit realization rather than a full thesis reversal.

On the growth and digital side, Alta Fox established or expanded several meaningful mid-sized positions: - CarGurus, Inc. is now 9.1% of the portfolio following a Buy to 1,098,700 shares and $40.9M in value, signaling a strong view on the company’s marketplace economics and margin potential. - DexCom, Inc., a leading diabetes technology name, represents 5.7% of assets after Alta Fox chose to Add 52.92%, bringing its stake to 379,100 shares worth $25.5M. - Textron Inc. accounts for 4.5% of the portfolio; a fresh Buy of 240,800 shares brings the position to $20.3M, indicating interest in aerospace and defense/industrial exposure. - Fair Isaac Corporation, a data and analytics powerhouse, now holds 4.3% at $19.3M after a Buy to 12,900 shares—small in share count but meaningful in dollars.

Alta Fox also maintains select large-cap compounders as strategic anchors: - Microsoft Corporation sits at 4.9% $21.9M, with No change this quarter, suggesting a stable, long-term high-quality core holding. - Amazon.com, Inc. represents 4.1% of the portfolio $18.2M, also with No change, anchoring the portfolio with diversified exposure to cloud, e-commerce, and advertising.

Further down the list but still strategically relevant: - SharkNinja, Inc. is a 3.4% position after a Buy to 149,000 shares valued at $15.4M, highlighting Alta Fox’s interest in branded consumer products with innovation-driven growth. - DoubleVerify Holdings, Inc. stands at 3.3% following a dramatic Add 233.49% to 1,231,900 shares worth $14.8M—one of the most aggressive conviction signals in the filing. - BrightSpring Health Services, Inc. Common Stock rounds out this key group at 3.0% with $13.6M after a fresh Buy of 460,525 shares, indicating an appetite for healthcare services exposure.

Together, these 10–15 names show a deliberate blend of special situations, recurring-revenue platforms, and blue-chip tech, all tightly sized to reflect Alta Fox’s risk/reward views.

What the Portfolio Reveals About Alta Fox’s Current Strategy

Alta Fox’s Q3’2025 positioning offers several clear strategic themes:

- High-Conviction Concentration in Smid-Caps

The bulk of capital is deployed in companies like Daktronics, NCR Atleos, and REV Group, where Alta Fox likely believes the market misprices niche advantages, turnaround potential, or under-the-radar growth. - Selective Growth and Quality Overlay

Moves into and within DexCom, Fair Isaac, DoubleVerify, and established giants like Microsoft and Amazon show an emphasis on recurring revenue, data moats, and scalable software-like economics. - Sector Breadth with Thematic Cohesion

While the names span industrials, software, healthcare devices, ad-tech, and consumer products, many share attributes such as mission-critical products, high switching costs, or entrenched customer relationships, rather than chasing cyclical or commodity-driven stories. - Active but Focused Risk Management

Aggressive adds (e.g., Add 233.49% in DoubleVerify and Add 52.92% in DexCom) sit alongside large reductions (e.g., Reduce 49.72% in REV Group), suggesting Alta Fox is quick to press winners, scale into conviction, and trim when risk/reward changes, all within a relatively concentrated portfolio.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Daktronics, Inc. (DAKT) | $92.7M | 20.7% | Reduce 10.91% |

| NCR Atleos Corporation (NATL) | $77.6M | 17.3% | Add 30.47% |

| REV Group, Inc. (REVG) | $45.8M | 10.2% | Reduce 49.72% |

| CarGurus, Inc. (CARG) | $40.9M | 9.1% | Buy |

| DexCom, Inc. (DXCM) | $25.5M | 5.7% | Add 52.92% |

| Microsoft Corporation (MSFT) | $21.9M | 4.9% | No change |

| Textron Inc. (TXT) | $20.3M | 4.5% | Buy |

| Fair Isaac Corporation (FICO) | $19.3M | 4.3% | Buy |

| Amazon.com, Inc. (AMZN) | $18.2M | 4.1% | No change |

This table underscores just how top-heavy Alta Fox’s structure is: the top three positions alone account for roughly half the portfolio’s value, and the top nine names represent 84.2% of total assets. A single idea like Daktronics at 20.7% has the potential to materially drive or drag overall returns.

At the same time, the variety in the “Recent Change” column shows dynamic capital allocation. Large Add and Reduce tags across several of the top positions indicate that Alta Fox adjusts exposure aggressively as valuation, fundamentals, or alternative opportunities shift, rather than letting weights drift passively.

Investment Lessons from Alta Fox’s High-Conviction Approach

Retail investors studying the Alta Fox Capital Management, Llc playbook can extract several practical principles:

- Concentrate When You Truly Understand the Business

Positions above 10–20% in names like Daktronics and NCR Atleos imply deep due diligence and conviction. Concentration magnifies outcomes—so it only makes sense when your understanding and thesis strength are equally concentrated. - Let Winners Run, but Trim When Risk/Reward Changes

The Reduce 49.72% move in REV Group alongside its continued 10.2% weight shows that scaling back does not always mean giving up. Trimming can lock in gains and rebalance risk while keeping exposure to a still-attractive story. - Use Adds to Signal Growing Conviction

Massive percentage increases in names like DoubleVerify (Add 233.49%) and DexCom (Add 52.92%) illustrate how Alta Fox leans in when the thesis strengthens or when prices become more attractive relative to intrinsic value. - Blend Niche Smid-Caps with Durable Large-Cap Compounding Machines

Holding blue chips like Microsoft and Amazon at mid-single-digit weights can stabilize a portfolio otherwise driven by more volatile, under-the-radar ideas. - Turnover Should Reflect Thesis Evolution, Not Impulse

With a 3-quarter average holding period and 73.7% turnover, Alta Fox shows that being active does not mean day trading—it means reviewing, updating, and acting as new information emerges.

Looking Ahead: What Comes Next for Alta Fox’s Portfolio?

Based on the current Q3’2025 positioning, several forward-looking inferences stand out:

- Room to Further Scale High-Conviction Growth Names

Positions like DexCom, DoubleVerify, and Fair Isaac could still grow as a share of the portfolio if their execution remains strong and valuations remain compelling. - Potential Recycling Out of Trimmed Industrials into Digital & Data Plays

Significant reductions in REV Group and modest trimming in Daktronics may indicate gradual rotation toward higher-growth or higher-ROIC platforms in software, data analytics, and healthcare technology. - Balanced Exposure Across Cycles

Industrial and defense names like Textron sit alongside secular growers like Amazon and Microsoft, which can help the portfolio navigate a range of macro environments. - Ongoing Opportunity in Underfollowed Smid-Caps

Smaller but meaningful stakes in companies such as SharkNinja and BrightSpring Health Services suggest Alta Fox will likely continue to mine less crowded areas of the market where deep research can produce an edge.

To stay on top of Alta Fox’s next moves, you can monitor updates to their 13F-reported portfolio on ValueSense, which tracks quarter-over-quarter changes and position histories.

FAQ about Alta Fox Capital Management, Llc Portfolio

Q: What were the biggest changes in Alta Fox’s portfolio this quarter?

The most notable changes include Add 30.47% in NCR Atleos, Add 52.92% in DexCom, Add 233.49% in DoubleVerify, and a Reduce 49.72% in REV Group, alongside a Reduce 10.91% in Daktronics.

Q: How concentrated is Alta Fox’s portfolio?

Alta Fox runs a highly concentrated book, with the top 10 positions representing 84.2% of total portfolio value across 19 holdings. Names like Daktronics and NCR Atleos alone account for more than a third of assets.

Q: What role do large-cap stocks like Microsoft and Amazon play in this strategy?

Positions in Microsoft 4.9% and Amazon 4.1%, both with No change this quarter, act as high-quality anchors that provide stability, cash flow resilience, and exposure to secular technology trends within an otherwise smid-cap-heavy portfolio.

Q: How does the 13F reporting lag affect following Alta Fox’s moves?

13F filings are reported up to 45 days after quarter-end, meaning that Alta Fox’s actual positions may have changed by the time data becomes public. Investors should treat the Q3’2025 snapshot as a historical view, not a real-time trade log, and use tools like ValueSense’s Alta Fox page to track trends rather than mimic every move.

Q: How can I track Alta Fox’s positions and changes over time?

You can follow Alta Fox Capital Management, Llc via their dedicated page on ValueSense at Alta Fox’s portfolio, which compiles quarterly 13F filings, highlights top holdings, and visualizes adds, reductions, buys, and sells over time.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!