AltaRock Partners Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

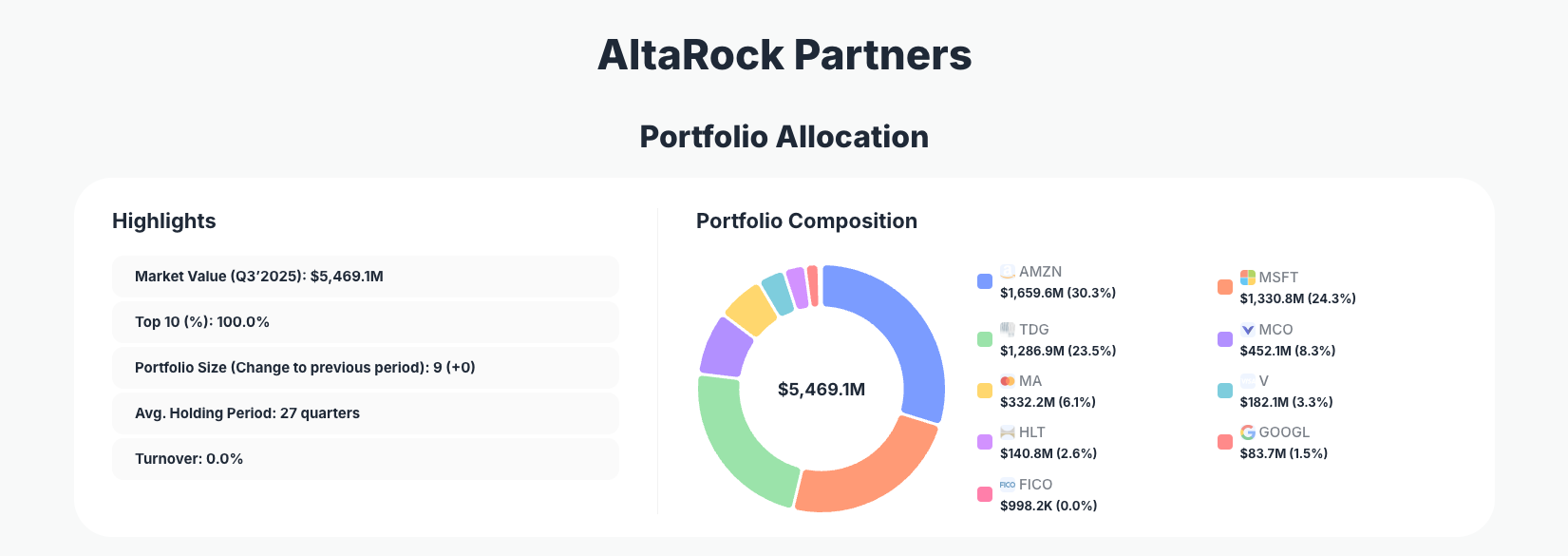

AltaRock Partners continues to showcase a highly concentrated, long-term quality investing style. Their Q3’2025 portfolio holds just nine positions with $5,469.1M in market value, yet it is dominated by a handful of elite compounders. The headline move this quarter is a sizeable increase in Amazon.com, Inc., while the rest of the book saw only marginal trims—underscoring AltaRock’s patience, discipline, and strong conviction in a select group of scalable, moat-heavy businesses.

View the full AltaRock Partners portfolio on ValueSense

Portfolio Overview: A Masterclass in Concentrated Compounding

Portfolio Highlights (Q3’2025): - Market Value: $5,469.1M

- Top 10 Holdings: 100.0%

- Portfolio Size: 9 +0

- Average Holding Period: 27 quarters

- Turnover: 0.0%

AltaRock Partners runs an extraordinarily concentrated portfolio: all capital is effectively in the top 10 positions, even though they own just nine stocks. This type of structure, visible on their dedicated AltaRock Partners portfolio page, reflects a belief that true outperformance comes from backing a small number of exceptional businesses rather than diversifying widely.

The statistics reinforce this approach. With an average holding period of 27 quarters and turnover at 0.0% in Q3’2025, AltaRock is clearly not trading around headlines. Instead, the firm holds its winners through cycles, letting compounding in businesses like Microsoft, TransDigm Group, and Moody's do the heavy lifting.

From a strategic lens, the AltaRock portfolio is tilted toward global platform and infrastructure leaders—cloud, digital payments, aerospace components, and data/analytics. These businesses tend to have wide moats, recurring revenue, pricing power, and strong free cash flow. The only truly large move this quarter was the substantial “Add 20.43%” in Amazon, which signals AltaRock’s deepening conviction in the company’s long-term earnings and cash flow trajectory.

Top Holdings: Dominance of Tech, Payments, and Structural Monopolies

The Q3’2025 AltaRock Partners portfolio is anchored by a tight cluster of dominant franchises, with three positions alone making up nearly 80% of assets.

At the top of the book, Amazon.com, Inc. (AMZN) now represents 30.3% of the portfolio, after AltaRock executed an “Add 20.43%” this quarter. That kind of incremental sizing in an already major position highlights strong conviction in Amazon’s multi-engine model—combining e-commerce, AWS cloud infrastructure, and advertising—as a core long-term compounder.

Right behind Amazon sits Microsoft Corporation (MSFT) at 24.3% of the portfolio, where AltaRock made only a “Reduce 0.36%” adjustment. This tiny trim looks more like fine-tuning than a thesis change, consistent with viewing Microsoft as a durable, cloud-and-productivity powerhouse that remains central to the firm’s equity exposure.

TransDigm Group Incorporated (TDG) is the third major pillar at 23.5%, again with a marginal “Reduce 0.36%” move. TransDigm’s niche, high-margin aerospace components and pricing power make it a classic AltaRock-style holding: structurally advantaged, cash generative, and relatively insulated from commodity dynamics.

Further down, Moody's Corporation (MCO) accounts for 8.3% of the portfolio with a slight “Reduce 0.37%” this quarter. Moody’s, as a leader in credit ratings and financial analytics, offers a mix of recurring revenue and data-driven moats that fits well with AltaRock’s preference for mission-critical services.

The payments duopoly features prominently too. Mastercard Incorporated (MA) sits at 6.1% of the portfolio after a “Reduce 0.37%” action, while Visa Inc. (V) represents 3.3% following a “Reduce 0.35%”. These incremental trims look like risk-balancing decisions rather than fundamental shifts, as both companies continue to benefit from the global migration from cash to digital payments.

In the travel and hospitality space, Hilton Worldwide Holdings Inc. (HLT) holds 2.6% of the book with a minimal “Reduce 0.36%” move. Hilton gives AltaRock exposure to asset-light, fee-based hotel franchising and management—another recurring revenue model with brand and scale advantages.

One of the most notable changes in Q3 is AltaRock’s aggressive repositioning in Alphabet Inc. (GOOGL). Although still a holding at 1.5% of the portfolio, it was subject to a dramatic “Reduce 67.06%” action. This suggests a deliberate decision to reallocate capital—likely toward higher-conviction ideas like Amazon—while still maintaining some participation in Alphabet’s advertising and cloud franchises.

Rounding out the list is Fair Isaac Corporation (FICO), a niche but strategically telling holding at 0.0% of reported portfolio weight (due to rounding) with $998.2K in value and a “Reduce 0.45%” note. Even at a modest size, AltaRock’s continuing interest in FICO aligns with its broader affinity for data monopolies and embedded financial infrastructure.

Overall, the combination of these 9 positions—each adjusted mostly at the margin except for Amazon and Alphabet—shows a portfolio that is evolving at the edges while keeping its core thesis intact.

What the Portfolio Reveals About AltaRock’s Current Strategy

AltaRock Partners’ Q3’2025 13F filing provides several clear strategic signals:

- Relentless focus on quality over quantity

With only nine holdings and the entire portfolio captured in the top 10, AltaRock is making an explicit bet that a handful of structurally advantaged companies will outperform broad indices over long periods. - Tech and infrastructure at the core

The portfolio leans heavily into cloud, software, digital payments, and aerospace infrastructure via names like Microsoft, Amazon, TransDigm, Mastercard, and Visa. These are secular beneficiaries of digitization, global travel recovery, and the ongoing shift to electronic payments. - Geographic and currency exposure via global champions

Although the underlying companies are U.S.-listed, many have global revenue footprints—Amazon and Microsoft in cloud and SaaS, TransDigm in aerospace, Moody’s in ratings, and Hilton in international travel—giving the portfolio diversified geographic earnings exposure without overcomplicating the stock list. - Dividend-light, compounding-heavy orientation

Several holdings do pay dividends, but AltaRock’s profile skews more toward reinvestment and buyback stories than income plays. The emphasis is on companies that can reinvest cash at high incremental returns or repurchase shares to drive per-share growth. - Risk managed through understanding, not diversification

Rather than owning dozens of names, AltaRock manages risk by knowing a few businesses exceptionally well and holding them over many years. The tiny trims in most positions and the 0.0% turnover confirm that the firm prefers thesis refinement to wholesale rotation.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Amazon.com, Inc. (AMZN) | $1,659.6M | 30.3% | Add 20.43% |

| Microsoft Corporation (MSFT) | $1,330.8M | 24.3% | Reduce 0.36% |

| TransDigm Group Incorporated (TDG) | $1,286.9M | 23.5% | Reduce 0.36% |

| Moody's Corporation (MCO) | $452.1M | 8.3% | Reduce 0.37% |

| Mastercard Incorporated (MA) | $332.2M | 6.1% | Reduce 0.37% |

| Visa Inc. (V) | $182.1M | 3.3% | Reduce 0.35% |

| Hilton Worldwide Holdings Inc. (HLT) | $140.8M | 2.6% | Reduce 0.36% |

| Alphabet Inc. (GOOGL) | $83.7M | 1.5% | Reduce 67.06% |

| Fair Isaac Corporation (FICO) | $998.2K | 0.0% | Reduce 0.45% |

This table illustrates just how top-heavy AltaRock’s structure is. The top three names—AMZN, MSFT, and TDG—jointly control nearly 80% of reported equity assets. That level of focus is far beyond traditional asset management norms and is more akin to a high-conviction, “owner-operator” style portfolio.

The smaller positions—particularly GOOGL, HLT, V, and FICO—look like satellite holdings that complement the core compounding engines. The sizable reduction in Alphabet, juxtaposed with the large add in Amazon, suggests a deliberate concentration in AltaRock’s highest-conviction digital platform, while still keeping some optionality in other mega-cap tech ecosystems.

Analyze AltaRock’s full position history on ValueSense

Investment Lessons from AltaRock Partners’ Approach

AltaRock Partners’ Q3’2025 portfolio offers several actionable lessons for individual investors:

- Concentrate when you truly understand the businesses

Running nine positions with nearly 80% in three names only works if you deeply understand the economics, risks, and long-term outlook for each company. For most investors, this level of concentration is aggressive—but the principle of fewer, better still applies. - Let holding periods do the heavy lifting

An average holding period of 27 quarters implies more than six years in typical positions. AltaRock’s 0.0% turnover this quarter reinforces that time in the market can be more powerful than timing the market, especially when backed by durable franchises. - Favor structural advantages and recurring revenue

Names like TDG, MCO, MA, V, and FICO share traits: high switching costs, embedded products, network effects, and steady cash flows. AltaRock’s playbook suggests prioritizing economic moats and pricing power over optically cheap valuations alone. - Size positions to match conviction—not noise

The quarter’s main move was a 20.43% add to Amazon and a 67.06% reduction in Alphabet, while most other names were adjusted by less than 0.5%. This shows that when AltaRock’s conviction changes materially, it acts decisively in size, rather than making cosmetic tweaks everywhere. - Use trims and adds to manage risk over time

Light reductions in MSFT, TDG, MCO, MA, V, HLT, and FICO show that AltaRock fine-tunes exposure without abandoning core ideas—an approach retail investors can mirror when rebalancing winners or managing concentration risk.

Looking Ahead: What Comes Next for AltaRock’s Portfolio?

Based on the current Q3’2025 positioning, several forward-looking themes stand out:

- Further concentration in dominant platforms

The sizable add to AMZN suggests AltaRock may continue emphasizing platforms where operating leverage, AI integration, and cloud scale can drive multi-year earnings expansion. If Amazon’s fundamentals continue to strengthen, it could remain the portfolio’s flagship position. - Selective rotation within mega-cap tech

The sharp reduction in GOOGL indicates AltaRock is willing to rotate among large-cap tech when relative risk/reward shifts. Future quarters may show whether this was a one-off reallocation or the start of a longer-term pivot in digital advertising and cloud exposure. - Enduring faith in payments and data moats

Modest trims in MA, V, MCO, and FICO look more like position-sizing decisions after strong runs than thesis changes. Expect AltaRock to remain anchored in these financial infrastructure names, which benefit from secular growth and entrenched competitive positions. - Resilience through cycle-tested businesses

With macro uncertainties, higher-for-longer rates, and geopolitical risks, AltaRock’s preference for cash-generative, high-ROIC companies should provide resilience. While short-term volatility is possible, the underlying holdings are generally less cyclical than average and benefit from long-duration demand drivers. - Dry powder via low turnover, not high cash

The 13F doesn’t detail cash levels, but the 0.0% turnover implies AltaRock is not aggressively reshuffling. If market volatility increases, expect the firm to opportunistically lean into existing high-conviction names rather than expand the stock list dramatically.

Investors following AltaRock can use ValueSense to monitor whether future quarters bring additional concentration into Amazon and TransDigm, or if the firm begins building new positions in adjacent moaty sectors.

Track AltaRock’s future 13F moves on ValueSense

FAQ about AltaRock Partners’ Portfolio

Q: What were the biggest changes in AltaRock Partners’ Q3’2025 portfolio?

The standout move was a “Add 20.43%” increase in Amazon (AMZN), which now sits at 30.3% of the portfolio. AltaRock also executed a “Reduce 67.06%” in Alphabet (GOOGL), significantly shrinking its allocation while maintaining smaller trims (around 0.3–0.4%) across other core holdings.

Q: How concentrated is the AltaRock Partners portfolio?

Extremely. The Q3’2025 13F shows nine holdings and 100.0% of capital in the top 10 positions. The top three names—AMZN, MSFT, and TDG—make up nearly 80% of the reported equity portfolio, reflecting a high-conviction strategy focused on a small set of compounders.

Q: What is AltaRock’s typical holding period and turnover?

AltaRock’s average holding period is 27 quarters, and reported turnover in Q3’2025 is 0.0%. This indicates a long-term, buy-and-hold orientation where the firm holds onto core names for years, making only incremental changes over time rather than frequent trading.

Q: Which sectors or themes does AltaRock prioritize?

AltaRock emphasizes technology platforms, financial infrastructure, and mission-critical services. Key themes include cloud and software (MSFT, AMZN), aerospace components (TDG), credit ratings and data (MCO, FICO), digital payments (MA, V), and asset-light hospitality (HLT).

Q: How can I track AltaRock Partners’ portfolio over time?

You can follow AltaRock’s holdings via quarterly 13F filings, which U.S. institutional investment managers must submit to the SEC typically within 45 days after quarter-end. Because of this 45-day reporting lag, positions may have changed by the time the filing is public. Platforms like ValueSense aggregate these filings, visualize changes, and provide historical context—visit the dedicated AltaRock Partners portfolio page to monitor updates.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!