Amazon Stock Analysis: E-commerce Giant's Undervalued AWS Division in 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

When discussing Amazon undervalued 2025 prospects, most investors fixate on the company's massive e-commerce empire. However, the real story lies buried within Amazon Web Services (AWS), a cloud computing juggernaut that continues generating extraordinary returns while trading at what many consider attractive valuations relative to its growth potential.

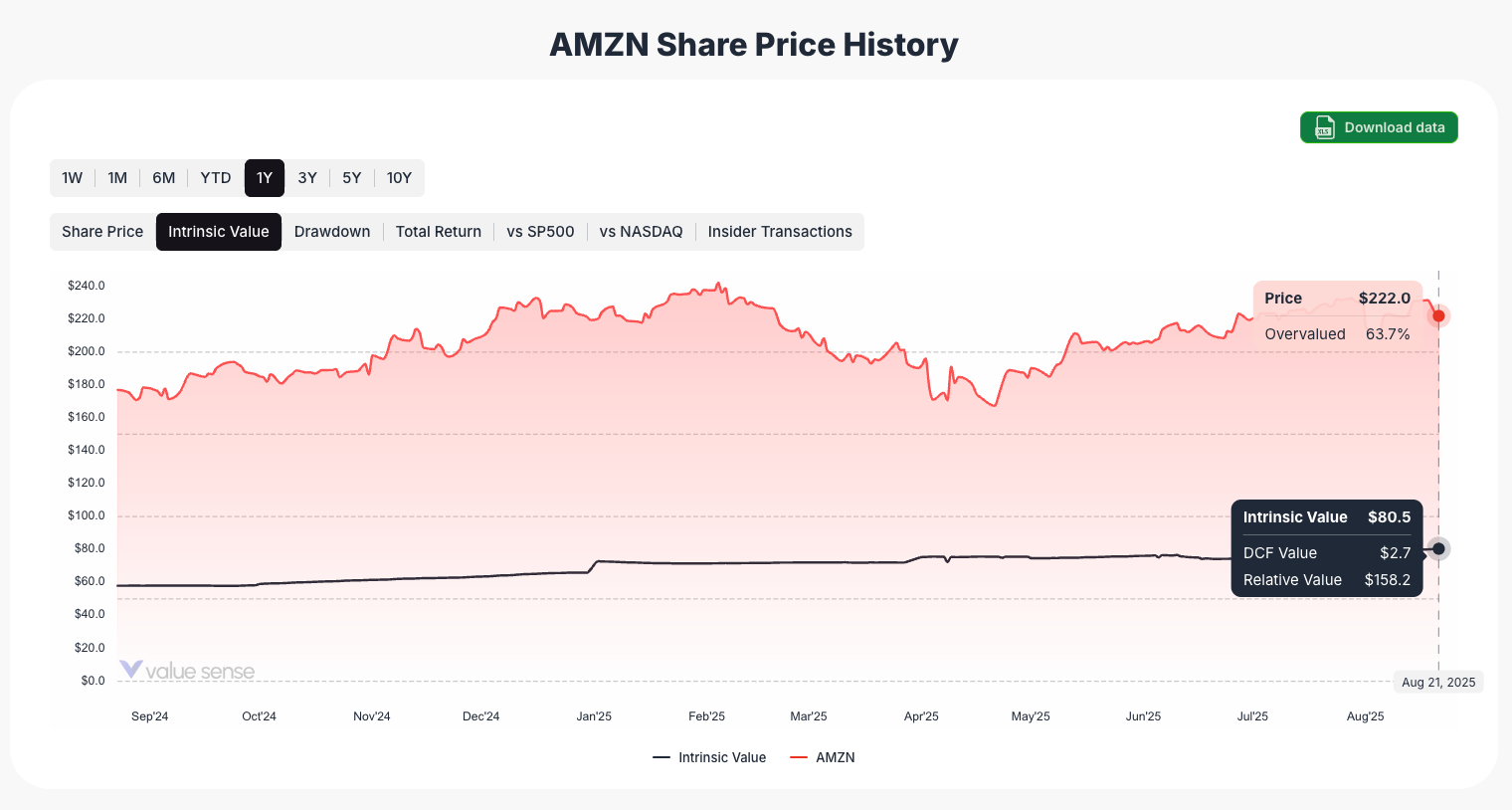

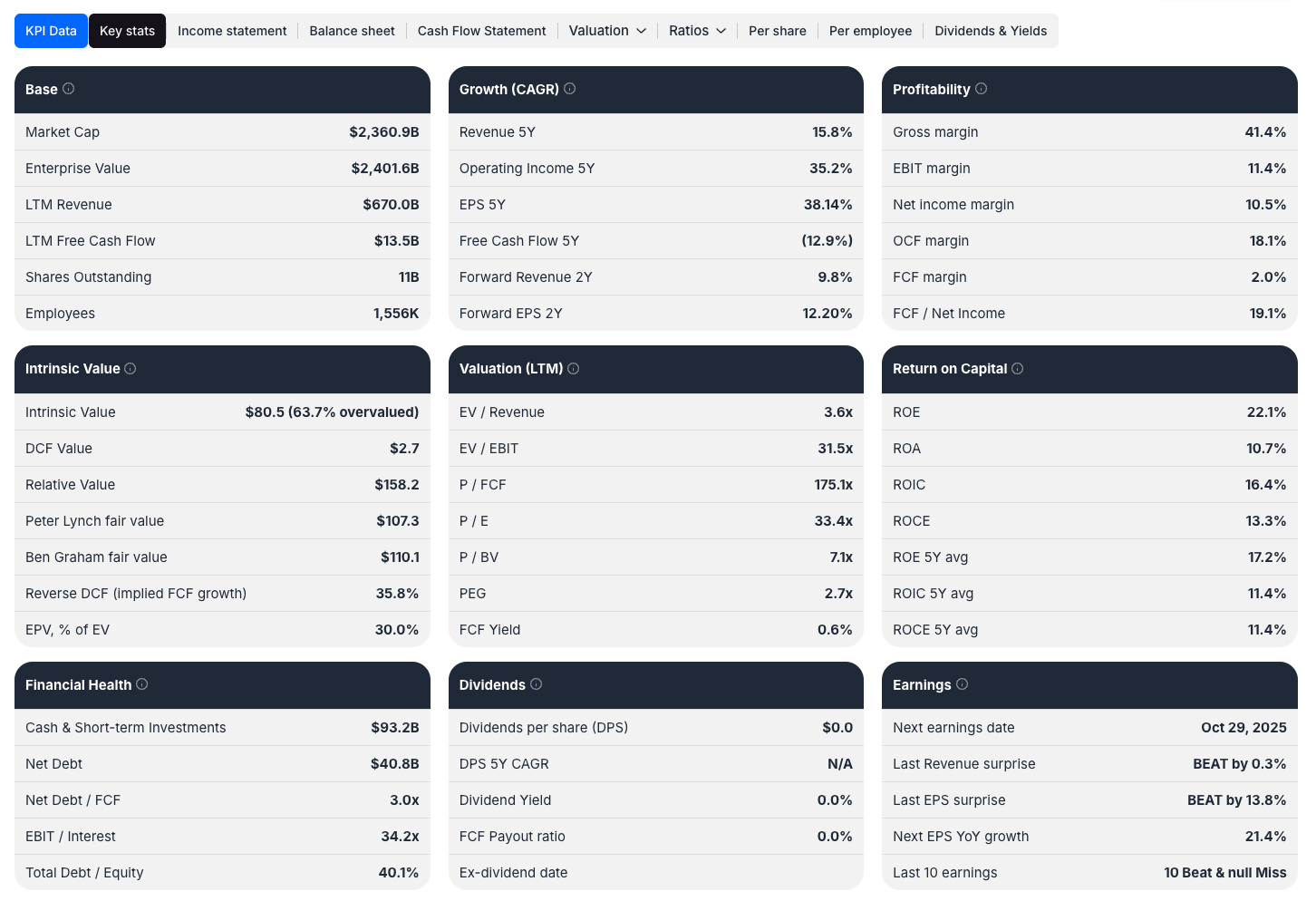

Amazon's recent financial performance presents a fascinating paradox for value investors. While ValueSense's intrinsic value analysis suggests the stock trades 63.7% overvalued at current levels, a deeper examination of AWS fundamentals reveals compelling reasons why this premium might be justified - or even conservative.

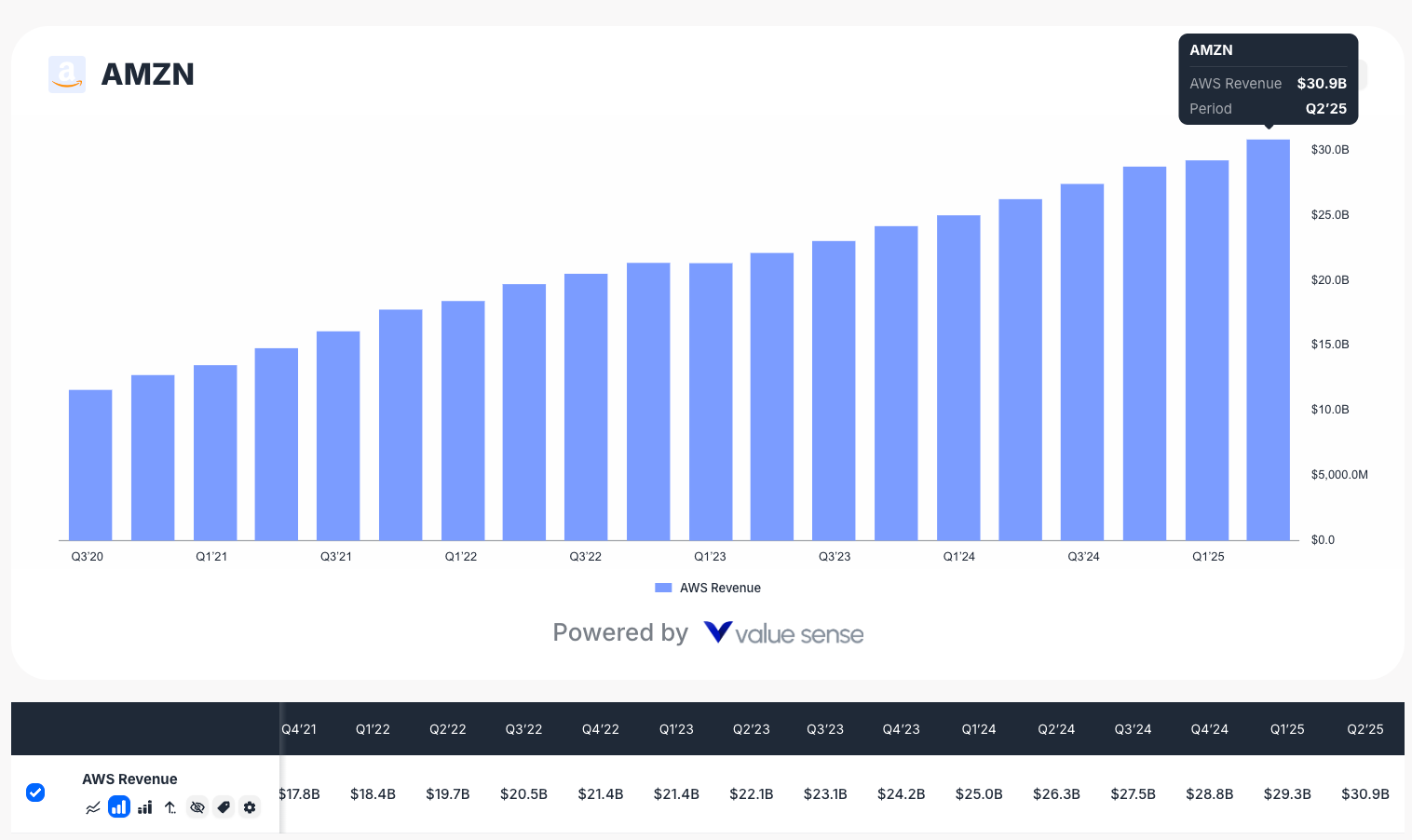

Amazon Web Services delivered $30.9 billion in quarterly revenue for Q2 2025, representing impressive 17.5% year-over-year growth. This performance becomes even more remarkable when considering AWS now represents 18.4% of Amazon's total revenue, up from historical lows during the pandemic period.

The AWS division's trajectory tells a compelling story of market dominance and pricing power. Despite facing fierce competition from Microsoft Azure and Google Cloud Platform, Amazon maintains its leadership position through superior infrastructure, comprehensive service offerings, and deep enterprise relationships built over decades.

What makes AWS particularly attractive for value investors is its predictable, subscription-based revenue model. Unlike Amazon's retail operations, which face margin pressure and cyclical headwinds, AWS generates consistent cash flows with exceptional profitability margins that traditional e-commerce simply cannot match.

Revenue Diversification: Beyond E-commerce Dependence

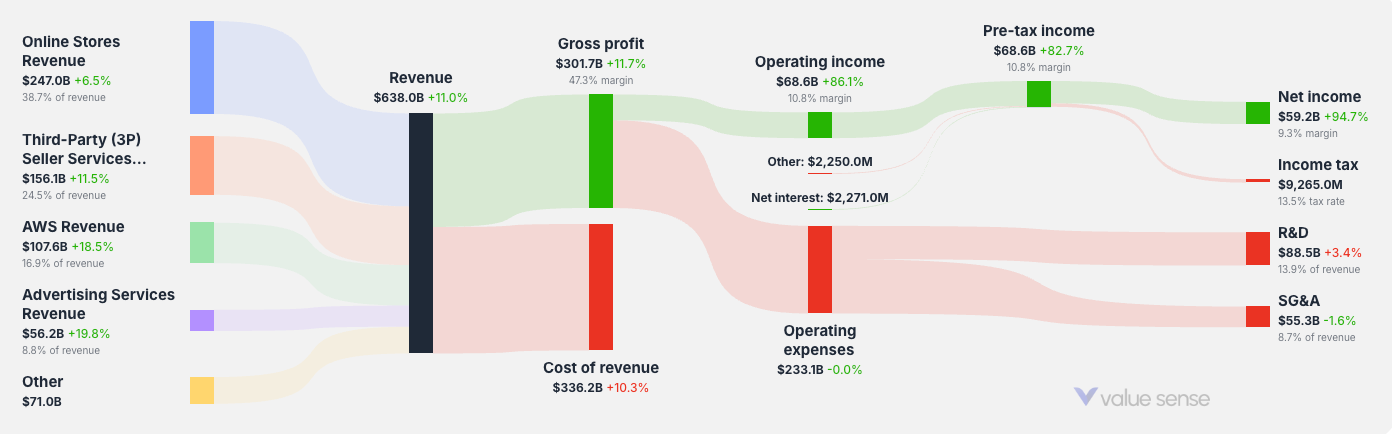

Amazon's revenue diversification strategy has evolved dramatically over the past decade. Online stores revenue reached $247.0 billion in 2024, while third-party seller services contributed $156.1 billion. However, the most significant development involves AWS's growing contribution to overall profitability.

Physical stores revenue stabilized at $21.2 billion, reflecting Amazon's strategic focus on high-value retail locations rather than aggressive expansion. Advertising services revenue surged to $56.2 billion, demonstrating Amazon's ability to monetize its massive customer base through targeted marketing solutions.

Subscription services revenue, primarily driven by Amazon Prime memberships, generated $44.4 billion annually. This recurring revenue stream provides predictable cash flows while enhancing customer loyalty across Amazon's entire ecosystem of products and services.

Amazon Segments & KPIs - https://valuesense.io/ticker/amzn/financials

Financial Health: Strong Fundamentals Despite Valuation Concerns

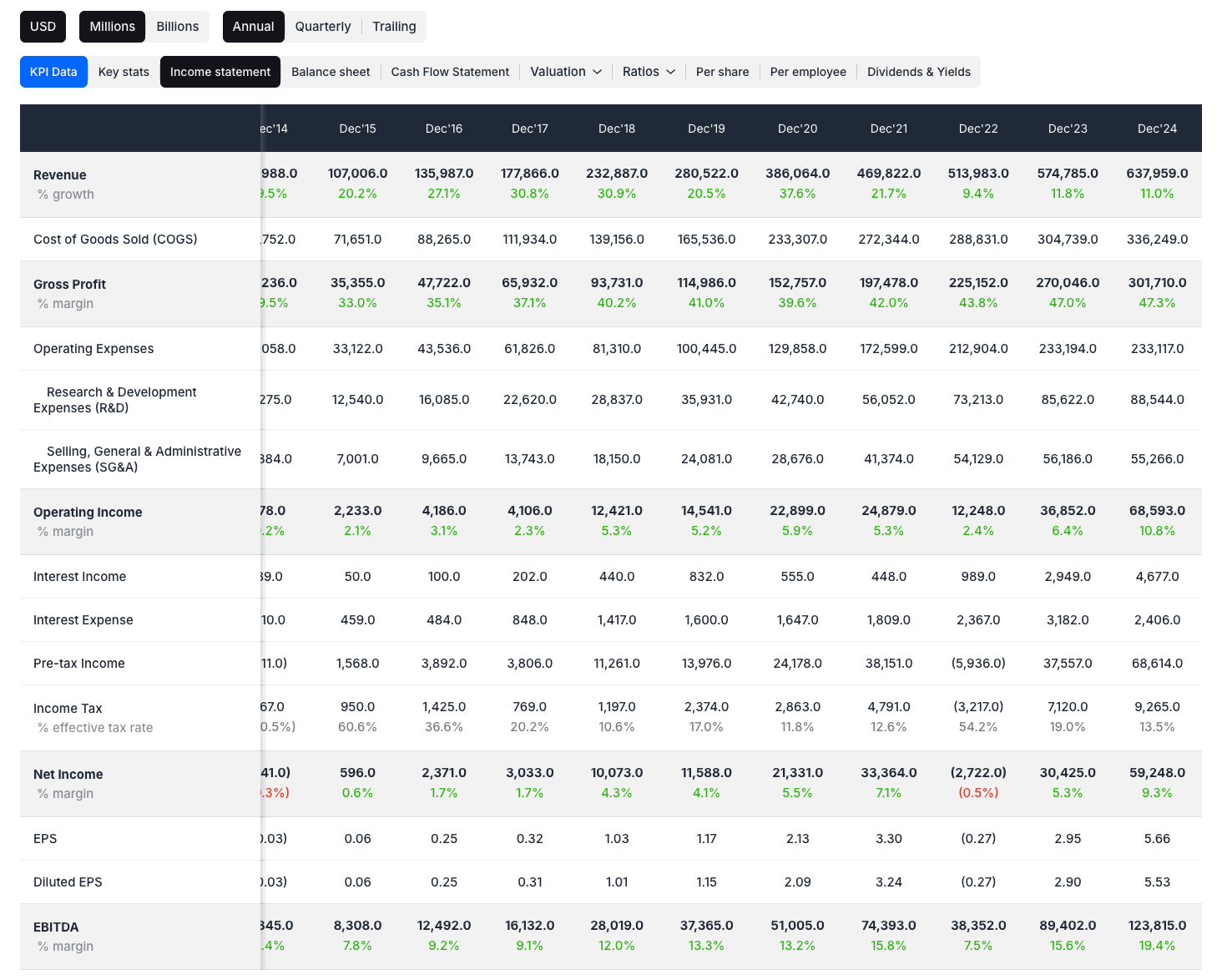

Amazon's financial metrics reveal a company in robust health despite current valuation concerns. Revenue growth maintained impressive 13.3% year-over-year expansion in the most recent quarter, reaching $167.7 billion. This growth rate appears sustainable given Amazon's diversified revenue streams and expanding market opportunities.

Gross profit margins improved to 36.3%, reflecting Amazon's ongoing operational efficiency initiatives and favorable product mix shifts toward higher-margin services. Operating income surged to $19.2 billion, demonstrating management's ability to balance growth investments with profitability improvements.

The company's EBITDA margin expanded to 12.7%, while maintaining substantial investments in research and development totaling $27.2 billion annually. This R&D spending, representing approximately 4.1% of revenue, positions Amazon favorably for future innovation cycles across cloud computing, artificial intelligence, and logistics automation.

AMZN Undervalued Analysis: Intrinsic Value Deep Dive

ValueSense's comprehensive valuation analysis presents mixed signals for Amazon's current investment attractiveness. The intrinsic value calculation of $80.5 per share suggests the stock trades 63.7% overvalued at current market prices, raising significant concerns for value-oriented investors.

However, alternative valuation methodologies tell different stories. The DCF value of $2.7 per share appears unrealistically low, likely reflecting conservative assumptions about Amazon's long-term cash flow generation capabilities. More realistic models might incorporate AWS's recurring revenue characteristics and Amazon's platform economics more accurately.

The relative value metric of $158.2 provides a middle-ground perspective, suggesting Amazon trades at reasonable levels compared to similar growth companies. Ben Graham's fair value calculation of $110.1 offers another data point for conservative investors seeking margin of safety principles.

AWS Hidden Value: The Cloud Computing Goldmine

Amazon's cloud computing division represents perhaps the most underappreciated asset in the technology sector. AWS maintains approximately 32% global market share in cloud infrastructure services, generating operating margins significantly higher than Amazon's consolidated business.

The division's competitive advantages include:

Network Effects: AWS's extensive global infrastructure creates switching costs for enterprise customers, leading to high customer retention rates and predictable revenue streams.

Innovation Leadership: Amazon consistently introduces new cloud services ahead of competitors, maintaining technological superiority across multiple computing categories.

Enterprise Relationships: Long-term contracts with Fortune 500 companies provide revenue visibility extending several years into the future, reducing cyclical business risks.

Scalability Economics: AWS's infrastructure investments benefit from enormous economies of scale, allowing Amazon to offer competitive pricing while maintaining superior profitability margins.

Investment Risks and Regulatory Challenges

Despite AWS strengths, Amazon faces several headwinds that warrant careful consideration. Regulatory scrutiny continues intensifying across multiple jurisdictions, potentially limiting Amazon's ability to expand through acquisitions or engage in certain competitive practices.

Competition in cloud computing accelerates as Microsoft and Google invest billions in infrastructure and artificial intelligence capabilities. While Amazon maintains market leadership, competitive pressures could compress margins or slow market share expansion over time.

Economic sensitivity remains a concern for Amazon's retail operations. Consumer spending slowdowns directly impact e-commerce revenue, while enterprise IT budget cuts could affect AWS growth rates during economic downturns.

Valuation Metrics Comparison Table

| Metric | Value | Assessment | Industry Average |

|---|---|---|---|

| Market Cap | $2,360.9B | Premium | $180.5B |

| Enterprise Value | $2,401.6B | High | $195.2B |

| Revenue (LTM) | $670.0B | Strong | $45.8B |

| P/E Ratio | 33.4x | Elevated | 24.2x |

| EV/Revenue | 3.6x | Reasonable | 4.1x |

| EV/EBITDA | 31.5x | Premium | 18.7x |

| ROE | 22.1% | Excellent | 15.3% |

| ROA | 10.7% | Strong | 7.8% |

| Net Debt/FCF | 3.0x | Manageable | 2.1x |

| FCF Yield | 0.6% | Low | 4.2% |

Growth Catalysts and Future Opportunities

Amazon's growth trajectory benefits from several emerging catalysts that traditional valuation models might underestimate. Artificial intelligence integration across AWS services creates new revenue opportunities while enhancing existing service value propositions.

International expansion remains largely untapped, particularly in emerging markets where e-commerce adoption accelerates rapidly. Amazon's logistics expertise and technology infrastructure provide competitive advantages in these developing regions.

Advertising revenue growth continues exceeding expectations as Amazon leverages its customer data and shopping intent signals. This high-margin business segment could materially impact overall profitability as it scales toward maturity.

Investment Verdict: Selective Optimism Warranted

Current Amazon undervalued analysis reveals a nuanced investment opportunity requiring careful portfolio positioning. While aggregate valuation metrics suggest overvaluation, AWS's exceptional fundamentals and growth prospects justify selective optimism for long-term investors.

The key lies in recognizing Amazon as primarily a cloud computing company with substantial e-commerce operations, rather than the inverse perspective many investors maintain. This framing adjustment significantly alters risk-return expectations and appropriate valuation multiples.

For value investors, Amazon might not qualify as a traditional bargain purchase. However, growth investors seeking exposure to cloud computing leadership and platform economics might find current levels attractive relative to long-term earning power potential.

Position sizing becomes crucial given valuation uncertainty. Conservative investors might prefer smaller positions until intrinsic value calculations align more favorably with market prices, while growth-oriented portfolios could justify standard weightings based on AWS fundamentals alone.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Rule of 40 Stocks August 2025: Best Growth-Efficiency Plays

📖 Rule of 40 Explained: The Ultimate SaaS Stock Analysis Guide

📖 Microsoft vs Google: Which Tech Giant Is More Undervalued in 2025?

FAQ about Amazon (AMZN) stock

Q: Is Amazon stock undervalued in 2025 despite high valuation metrics?

A: Amazon presents a complex valuation scenario. While ValueSense analysis suggests 63.7% overvaluation based on intrinsic value calculations, the AWS division's exceptional growth and profitability characteristics may justify premium pricing. The stock appears fairly valued for investors focused on cloud computing leadership rather than traditional e-commerce metrics.

Q: How much of Amazon's value comes from AWS versus retail operations?

A: AWS generated $30.9 billion in Q2 2025 revenue representing 18.4% of total revenue, but likely contributes 60-70% of operating profits due to superior margins. The cloud division's recurring revenue model and scalability economics make it Amazon's most valuable asset from an investment perspective.

Q: What are the main risks facing Amazon's AWS division?

A: Primary risks include intensifying competition from Microsoft Azure and Google Cloud, potential margin compression from pricing wars, regulatory scrutiny around market dominance, and economic slowdowns affecting enterprise IT spending. However, AWS's network effects and switching costs provide defensive characteristics against these challenges.

Q: How does Amazon's P/E ratio of 33.4x compare to other tech giants?

A: Amazon's P/E ratio appears elevated compared to mature tech companies but reasonable for its growth profile. When adjusted for AWS's recurring revenue characteristics and Amazon's platform economics, the multiple reflects market recognition of sustainable competitive advantages and long-term earning power expansion.

Q: Should value investors consider Amazon at current levels?

A: Traditional value investors might find Amazon challenging due to high valuation multiples and limited margin of safety. However, investors adopting growth-at-reasonable-price approaches might appreciate AWS fundamentals and Amazon's platform economics. The key involves recognizing Amazon as a cloud computing leader rather than primarily an e-commerce retailer.