AMD Undervalued: Chip Wars Value Play Against Intel in 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

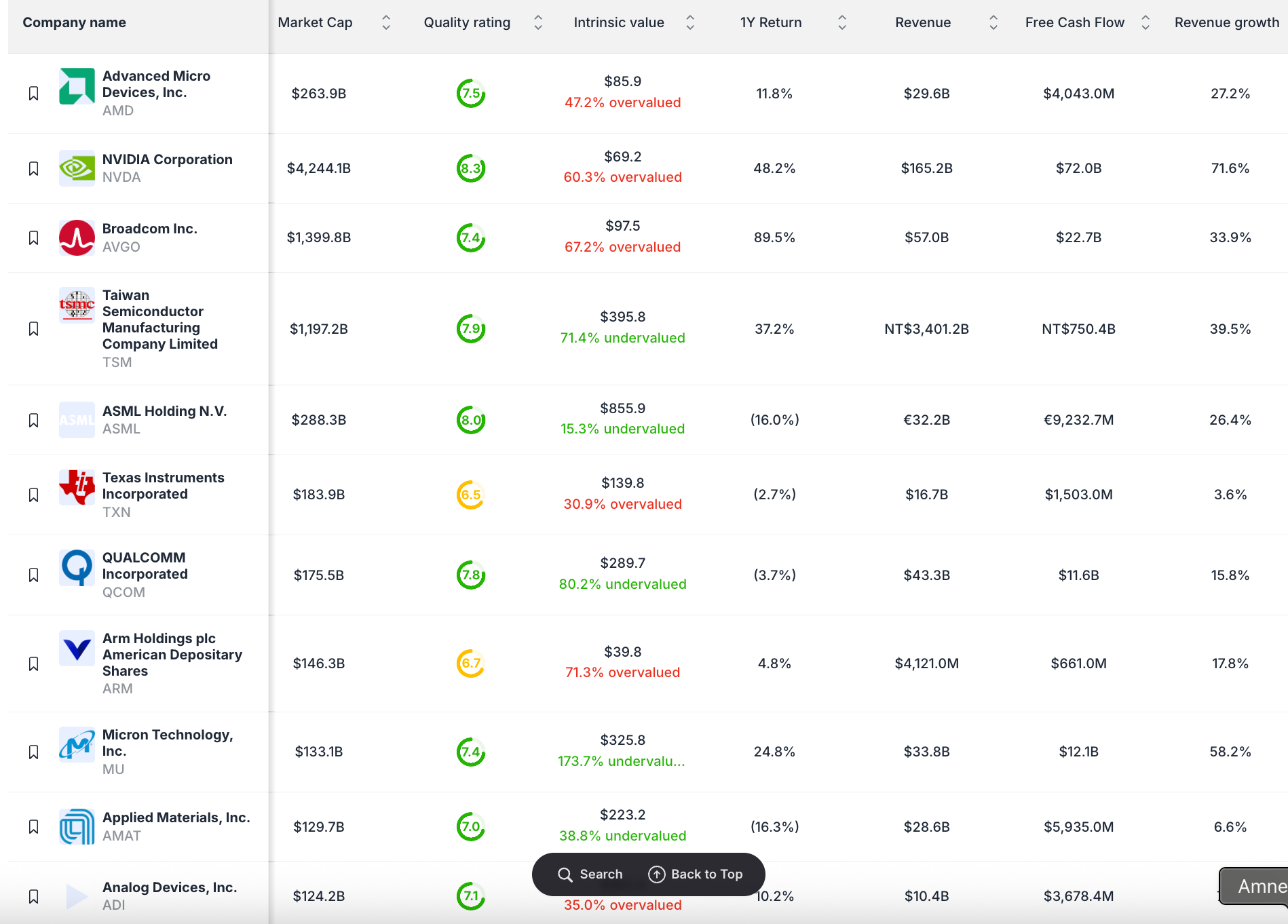

The semiconductor industry presents one of the most compelling value opportunities we've seen in years, and AMD stands at the center of this investment thesis. While the market remains fixated on AI hype and growth at any price, our analysis reveals AMD trading at attractive valuations that don't reflect its competitive positioning against Intel or its long-term market share gains.

The narrative around AMD has shifted dramatically over the past five years - from underdog challenger to legitimate competitor, now worth nearly twice Intel's market capitalization. But this transformation has created a unique opportunity: a company with Intel-beating fundamentals available at valuations that still reflect its former underdog status.

The AMD Transformation: From Underdog to Market Leader

AMD's journey from near-bankruptcy to semiconductor powerhouse represents one of the most remarkable corporate turnarounds in tech history. The company that once struggled to compete with Intel's dominance now commands premium pricing in both CPU and GPU markets while maintaining superior growth trajectories.

Market Position Evolution:

- 2019: AMD market cap ~$30B, Intel ~$240B

- 2025: AMD market cap ~$205B, Intel ~$100B

- Market Share: Steady gains in both server and desktop CPU segments

- Technology Leadership: 7nm and 5nm process advantages over Intel's manufacturing delays

This transformation hasn't happened overnight, but the market's valuation methodology hasn't fully caught up to AMD's new competitive reality.

Why AMD Represents Compelling Value in 2025

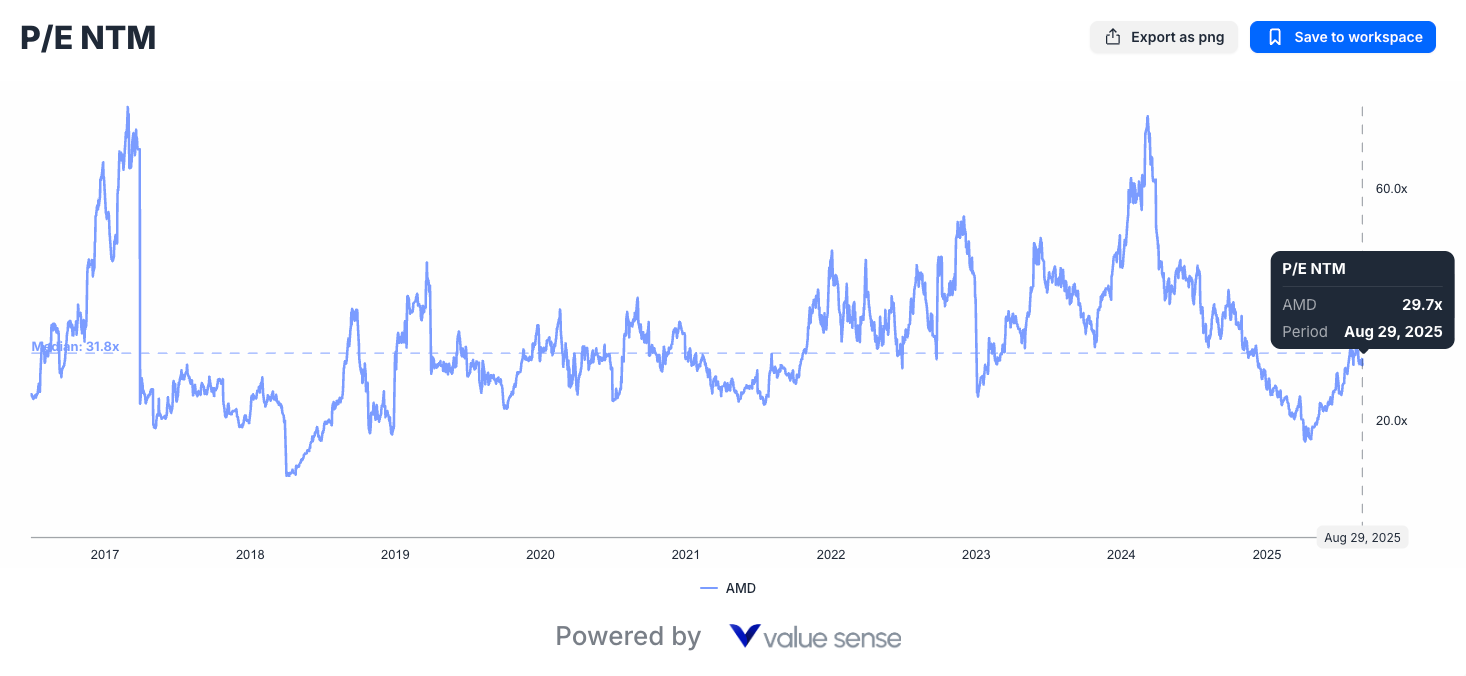

1. Trading Below Historical Growth Multiples

Despite years of consistent execution and market share gains, AMD continues trading at valuations that seem disconnected from its operational performance. The company's P/E ratio remains below its 15-year average even as it delivers superior growth rates compared to traditional semiconductor peers.

Valuation Disconnect Indicators:

- Trading at significant discount to growth potential

- P/E ratios below historical norms despite improved fundamentals

- EPS growth expectations of $3.80-$3.91 for 2025, $5.55-$5.89 for 2026

- DCF analysis from multiple sources suggesting $185-$223 fair value range

2. Competitive Positioning vs Intel

The AMD vs Intel value comparison reveals stark differences in both operational execution and market recognition:

AMD Advantages:

- Technology Leadership: Advanced manufacturing processes providing performance and efficiency gains

- Market Share Growth: Consistent CPU market share expansion in both consumer and enterprise segments

- AI Positioning: Strong GPU capabilities positioning for AI acceleration demand

- Execution Track Record: Consistent delivery on product roadmaps and financial guidance

Intel Challenges:

- Manufacturing Delays: Repeated setbacks in advanced process technology

- Market Share Losses: Steady erosion in core CPU markets

- Foundry Struggles: Difficulties competing with TSMC in contract manufacturing

- Legacy Costs: Higher overhead structure from decades of market dominance

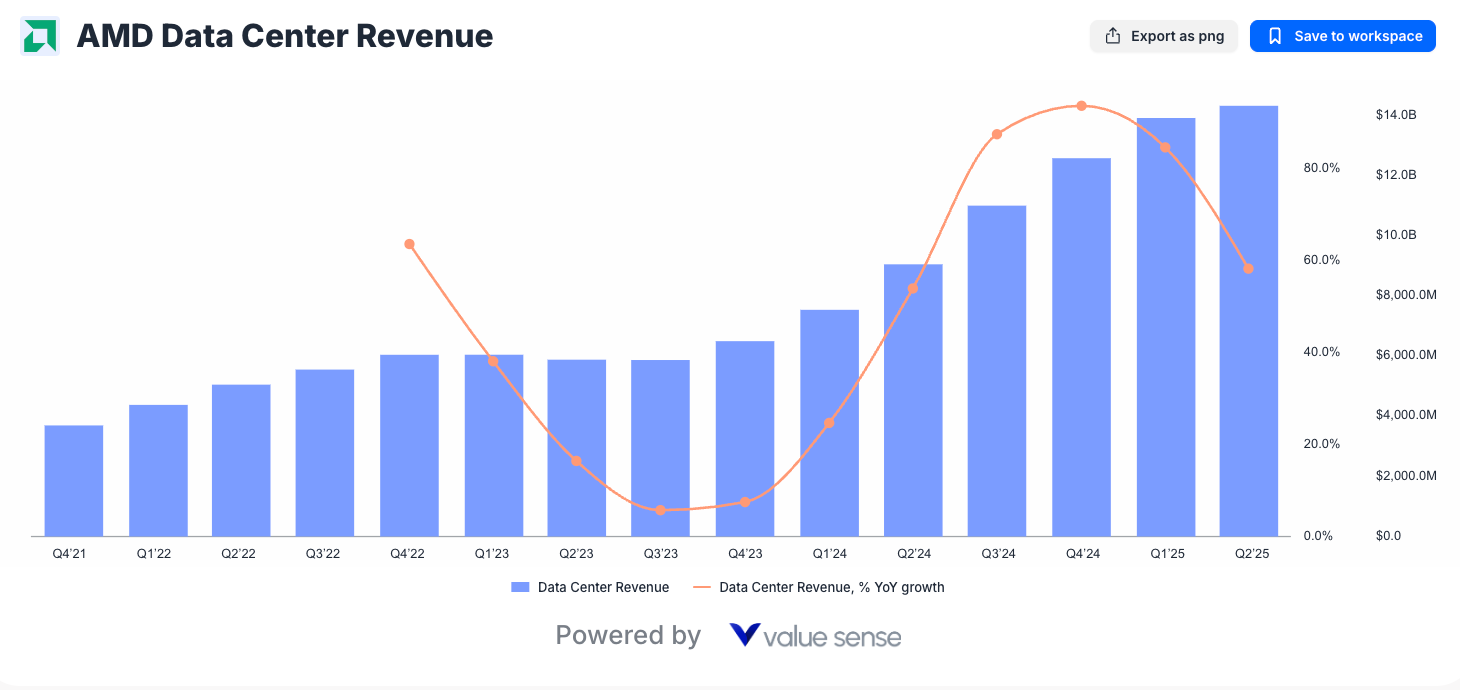

3. AI Market Positioning Misunderstood

While NVIDIA dominates AI headlines, AMD's positioning in the AI acceleration market remains underappreciated by investors. The company's GPU portfolio offers credible alternatives for AI workloads at more attractive price points, creating significant market expansion opportunities.

AI Market Catalysts:

- Enterprise Adoption: Growing demand for cost-effective AI acceleration beyond NVIDIA solutions

- Cloud Partnerships: Major cloud providers seeking supplier diversification

- Software Ecosystem: Continued investment in ROCm and AI software stack development

- Price Competition: Ability to offer performance-competitive solutions at lower price points

Financial Metrics Supporting Undervaluation

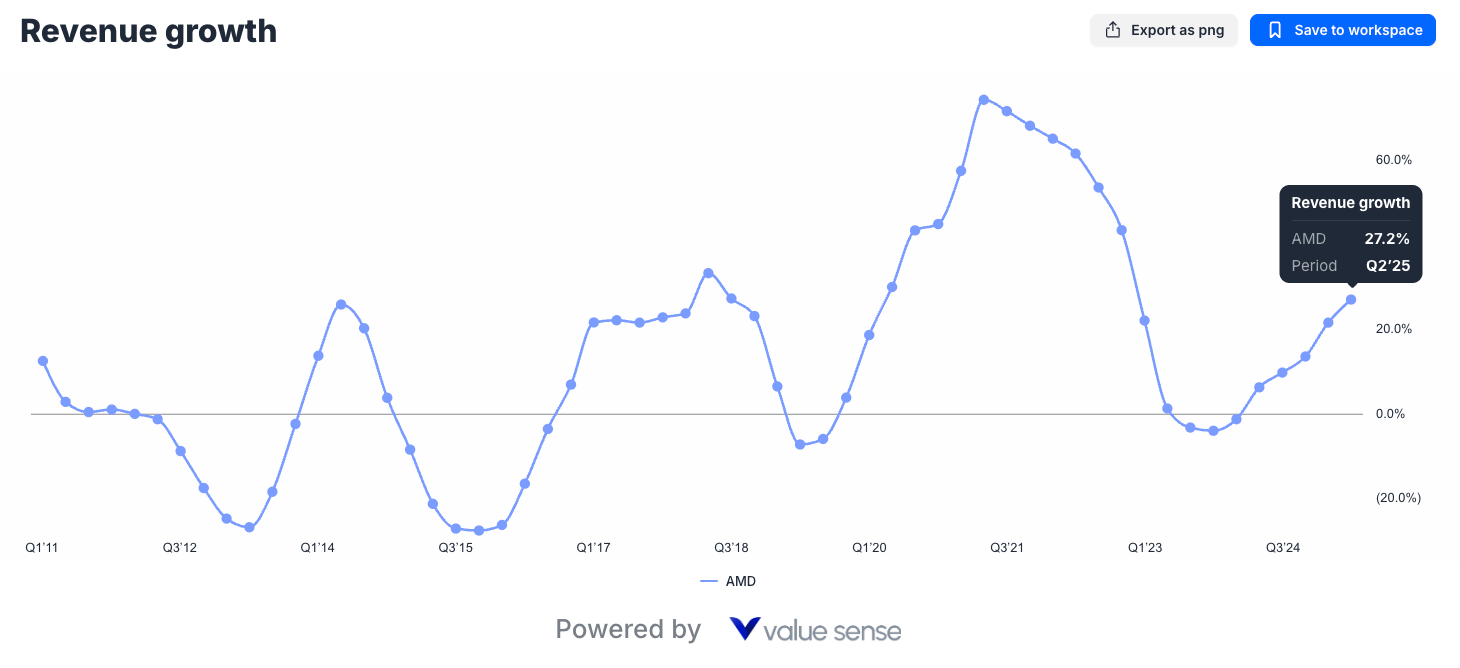

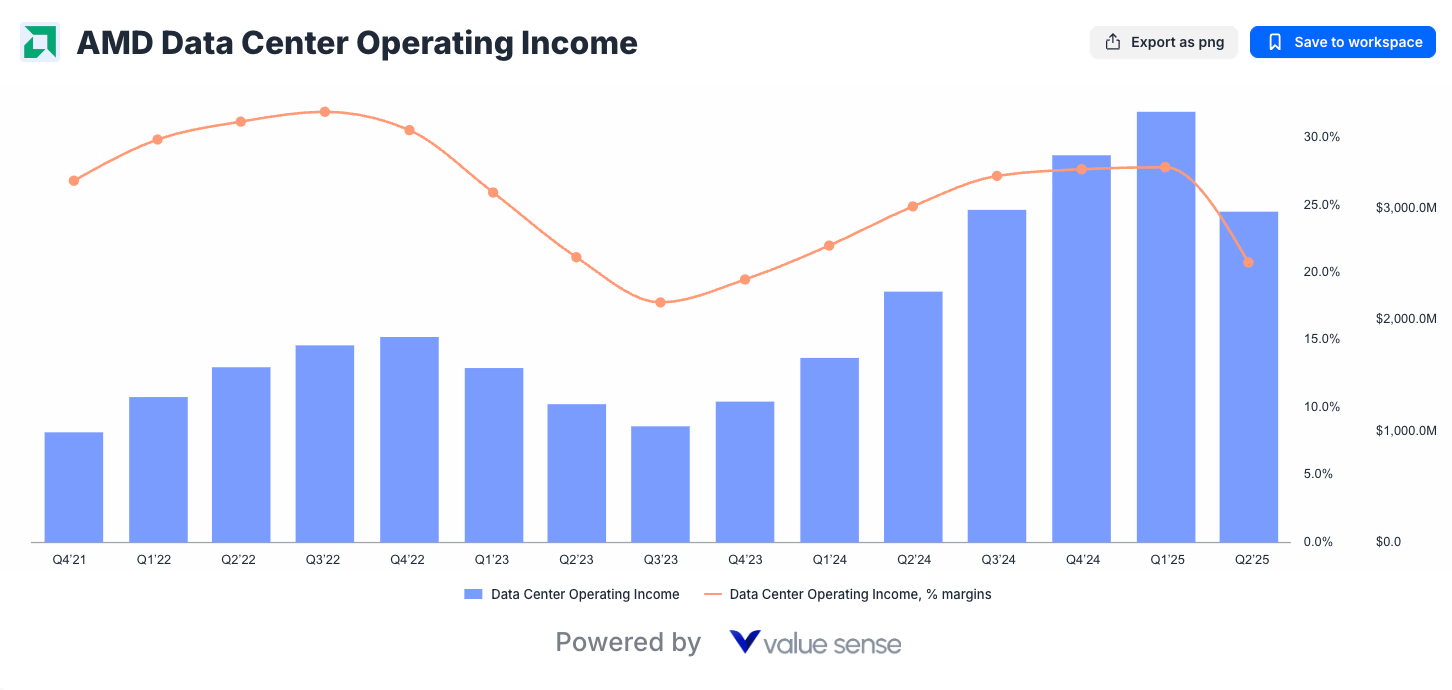

Revenue Growth and Market Expansion

AMD's revenue trajectory demonstrates consistent execution in expanding markets:

Growth Indicators:

- Strong revenue growth across CPU and GPU segments

- Data center revenue expansion driven by EPYC processor adoption

- Gaming segment resilience despite cyclical challenges

- Embedded and semi-custom business providing diversification

Margin Expansion Potential

Unlike Intel's margin compression from competitive pressures, AMD benefits from operating leverage as it scales:

Margin Drivers:

- Premium Pricing: Technology leadership enabling premium product positioning

- Volume Scale: Increased production volumes improving manufacturing economics

- Mix Improvement: Higher-margin server and professional graphics products growing share

- R&D Efficiency: Focused product development versus Intel's broader portfolio

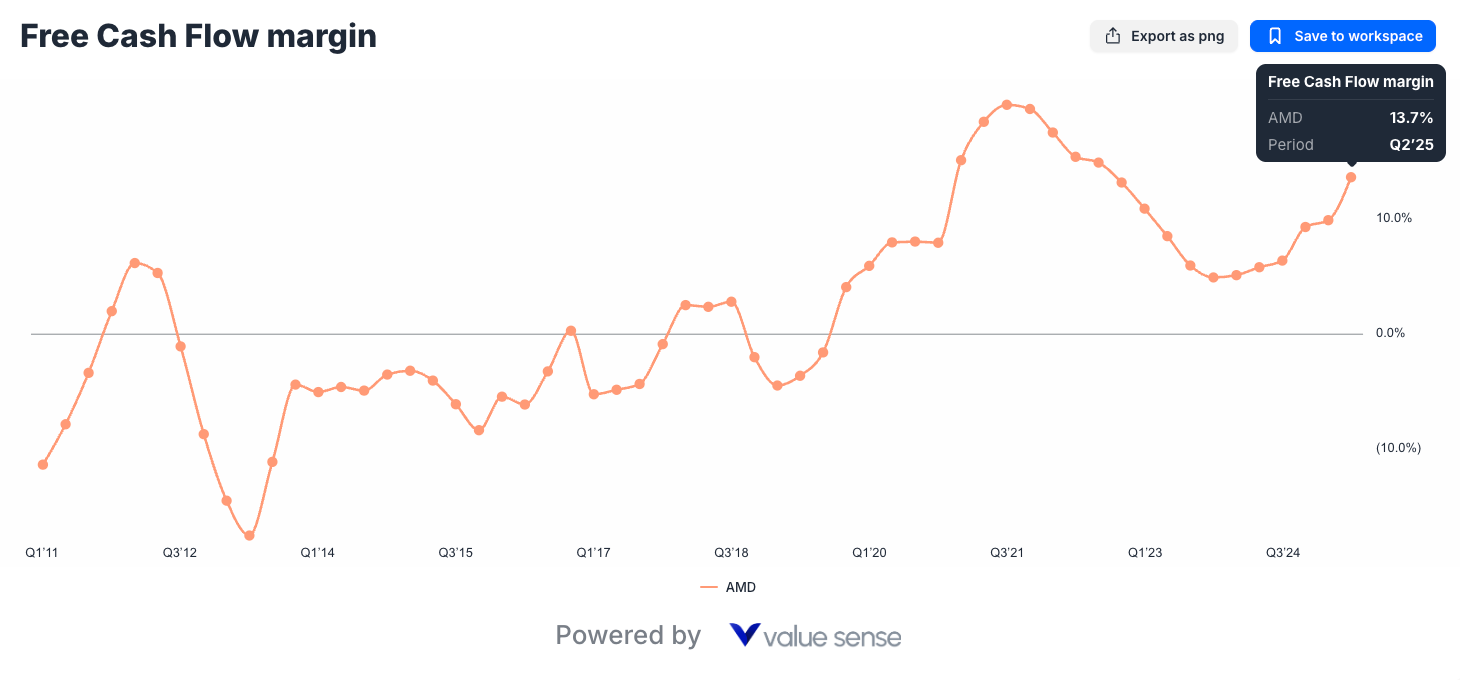

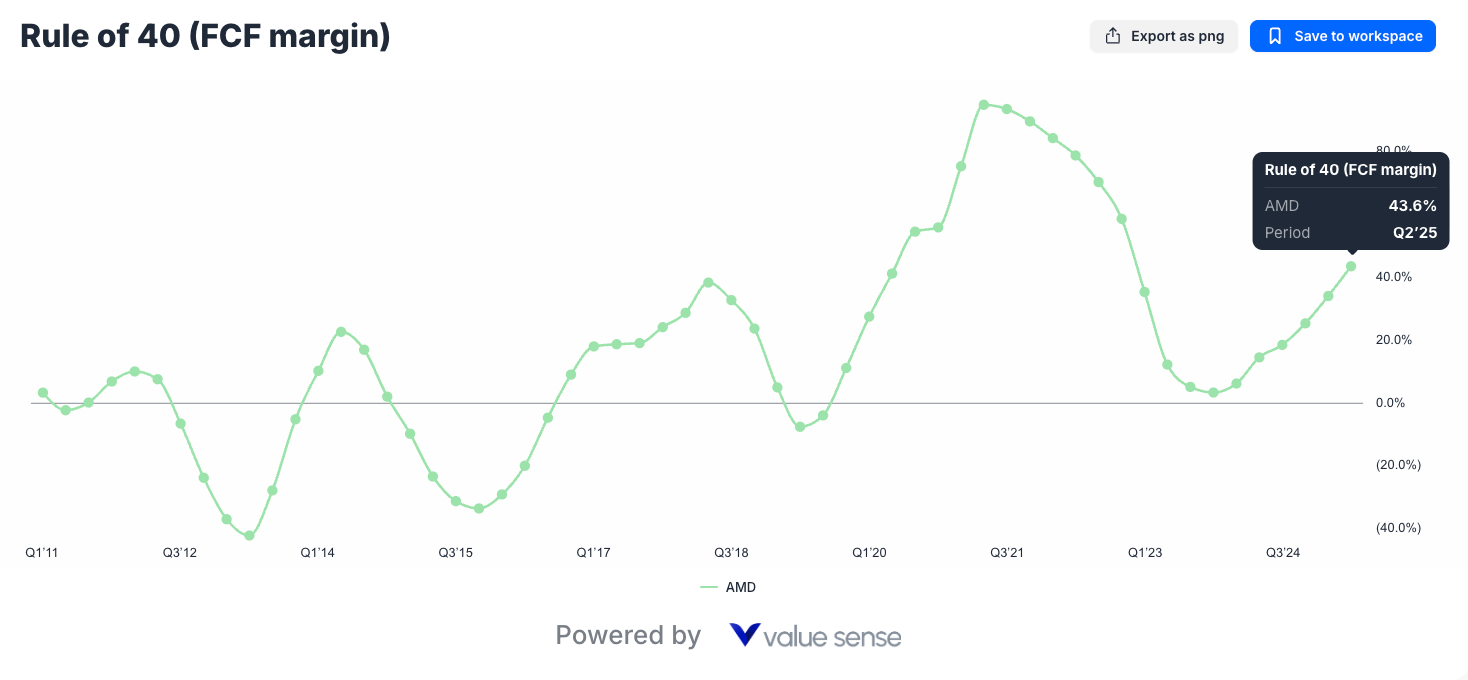

Cash Generation and Capital Allocation

AMD's improving cash generation profile supports both growth investments and shareholder returns:

Cash Flow Strengths:

- Consistent free cash flow generation supporting R&D investments

- Disciplined capital allocation balancing growth and returns

- Strong balance sheet providing financial flexibility

- Debt reduction improving financial metrics

The Intel Comparison: Why AMD Wins on Value

Operational Metrics Favor AMD

Technology Execution:

- AMD: Consistent roadmap delivery with advanced node adoption

- Intel: Repeated delays and manufacturing challenges

Market Positioning:

- AMD: Growing market share across key segments

- Intel: Defensive positioning in legacy markets

Financial Trajectory:

- AMD: Expanding margins and growing cash generation

- Intel: Margin pressure and restructuring costs

Valuation Metrics Support AMD

Growth-Adjusted Valuations:

- AMD trades at lower multiples relative to growth rates

- Intel's apparent "value" reflects operational challenges rather than opportunity

- Forward-looking metrics favor AMD's positioning

Total Return Potential:

- AMD offers superior near-term and long-term return prospects

- Multiple expansion potential as market recognizes competitive advantages

- Dividend sustainability less critical given growth opportunities

Risk Assessment: What Could Go Wrong

Competitive Risks

NVIDIA Competition: Continued dominance in AI acceleration could limit AMD's GPU growth opportunities.

Intel Recovery: Successful execution of Intel's turnaround plan could pressure AMD's market share gains.

New Entrants: ARM-based processors and custom silicon could disrupt traditional CPU markets.

Market Risks

Cyclical Downturn: Semiconductor cycles could pressure near-term financial performance regardless of competitive positioning.

Geopolitical Tensions: China restrictions and trade policies affecting global semiconductor markets.

Customer Concentration: Reliance on key customers for revenue growth creating vulnerability to demand changes.

Execution Risks

Technology Transitions: Continued need to execute on advanced manufacturing and product development.

Capacity Constraints: Dependence on TSMC for manufacturing creating potential bottlenecks.

Talent Retention: Competition for engineering talent in competitive semiconductor market.

The Long-Term AMD Investment Case

Secular Growth Drivers

AI Acceleration: Expanding demand for parallel processing capabilities playing to AMD's GPU strengths.

Cloud Computing: Continued enterprise cloud adoption driving server processor demand where AMD competes effectively.

Edge Computing: Distributed computing trends requiring efficient processors across diverse applications.

Gaming Evolution: Next-generation gaming driving demand for advanced graphics capabilities.

Competitive Moat Development

Technology Portfolio: Strong patent portfolio and engineering capabilities creating barriers to entry.

Customer Relationships: Deep partnerships with major cloud providers and OEMs providing stability.

Ecosystem Development: Software and development tool improvements increasing switching costs.

Manufacturing Partnerships: Strong relationships with leading foundries ensuring production capacity access.

Market Catalysts for Value Recognition

Near-Term Catalysts (6-12 months)

Quarterly Results: Continued demonstration of market share gains and margin expansion.

Product Launches: New processor generations showcasing technology leadership.

Customer Wins: Major design wins with cloud providers or enterprise customers.

Intel Struggles: Continued competitive pressure on Intel validating AMD's advantages.

Medium-Term Catalysts (1-3 years)

AI Market Growth: Expanding AI workload adoption driving GPU demand.

Data Center Expansion: Enterprise digital transformation creating server processor demand.

Market Share Milestones: Achieving significant milestones in CPU or GPU market share.

Manufacturing Advances: Next-generation process nodes providing continued competitive advantages.

Conclusion: AMD's Undervalued Opportunity in Chip Wars

Our analysis reveals AMD as a compelling undervalued opportunity in the ongoing semiconductor competition. The company's transformation from underdog to legitimate Intel competitor has created sustainable competitive advantages that current valuations don't fully reflect.

The AMD vs Intel comparison shows clear operational superiority for AMD across technology execution, market positioning, and financial trajectory. While Intel trades at apparent "value" multiples, those metrics reflect operational challenges rather than investment opportunities.

AMD's positioning in growing markets like AI acceleration, cloud computing, and advanced gaming creates multiple paths for sustained growth at valuations that remain attractive relative to both historical norms and competitive positioning. The semiconductor undervalued thesis finds its strongest expression in AMD's combination of execution capability, market opportunity, and reasonable entry valuations.

For investors seeking exposure to semiconductor growth trends without paying growth-at-any-price premiums, AMD represents the optimal balance of opportunity and value in today's market environment. The chip wars have produced a clear winner in competitive positioning - now available at prices that don't reflect that victory.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Palantir Rule of 40 Analysis

📖 Undervalued Dividend Aristocrats September 2025

📖 Shopify Undervalued: E-commerce Platform's Recovery Story

FAQ: AMD Undervalued

Q1: What makes AMD undervalued compared to other semiconductor stocks in 2025?

A: AMD trades below its 15-year average P/E ratio despite superior execution versus Intel, with EPS growth expected to reach $5.55-$5.89 by 2026. DCF analysis suggests fair value ranges of $185-$223, significantly above current levels, while the company maintains technology leadership and growing market share.

Q2: How does the AMD vs Intel value comparison favor AMD investors?

A: AMD demonstrates superior technology execution with advanced manufacturing processes, consistent market share gains, and expanding margins, while Intel faces manufacturing delays and market share losses. AMD's operational improvements haven't been fully recognized in valuations, creating asymmetric upside potential.

Q3: What are the key risks to the AMD undervalued investment thesis?

A: Primary risks include potential Intel recovery executing their turnaround plan, NVIDIA's continued AI dominance limiting AMD's GPU opportunities, semiconductor cyclical downturns affecting near-term performance, and geopolitical tensions impacting global chip markets. However, AMD's diversified portfolio and competitive advantages provide downside protection.

Q4: How should investors position for AMD's value recognition?

A: Consider dollar-cost averaging to capture volatility while building positions, focus on long-term holding aligned with technology adoption cycles, and balance AMD overweight with sector diversification. The investment thesis requires patience as operational improvements translate into valuation recognition over 1-3 year timeframes.

Q5: What catalysts could drive AMD's undervaluation to correct in 2025-2026?

A: Key catalysts include quarterly results demonstrating continued market share gains, new product launches showcasing technology leadership, major customer design wins with cloud providers, expanding AI workload adoption driving GPU demand, and continued competitive pressure on Intel validating AMD's operational superiority.