Andrew Brenton - Turtle Creek Asset Management Inc. Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Andrew Brenton - Turtle Creek Asset Management Inc. continues to pursue an aggressively selective, business-first investing style. Their Q3’2025 portfolio shows a $3.3B collection of mid‑cap compounders, with especially large reallocations into names like WillScot Holdings Corporation and Cogent Communications Holdings, Inc. while trimming cyclicals such as Brunswick Corporation and capital‑intensive industrials including Ingersoll Rand Inc..

Portfolio Overview: Turtle Creek’s Quietly Concentrated Compounding Machine

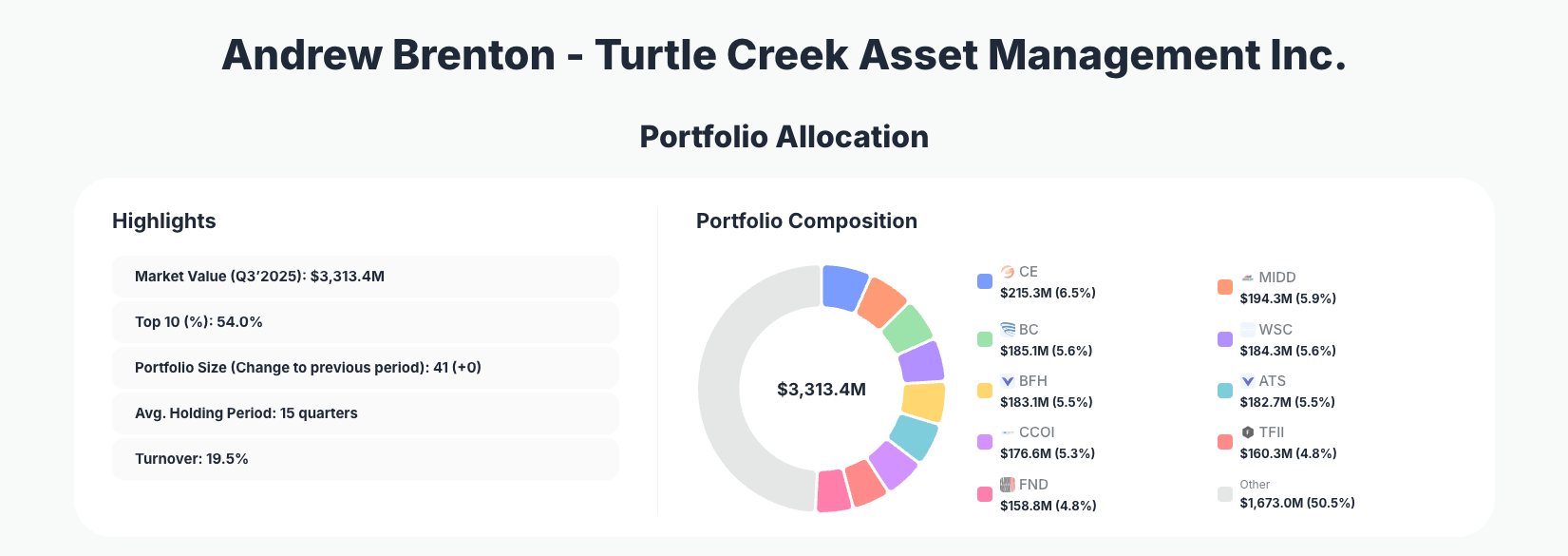

Portfolio Highlights (Q3 2025): - Market Value: $3,313.4M

- Top 10 Holdings: 54.0%

- Portfolio Size: 41 +0 positions

- Average Holding Period: 15 quarters

- Turnover: 19.5%

The latest Turtle Creek portfolio combines meaningful concentration with deliberate diversification. With 54.0% of capital in the top 10 positions across 41 names, Brenton balances high‑conviction bets in core compounders with a long tail of smaller positions that can be scaled over time as theses play out.

A 15‑quarter average holding period underscores Turtle Creek’s identity as a long‑term owner rather than a trader, even as the fund maintains a moderate 19.5% turnover to refine sizing and recycle capital into better risk‑reward opportunities. This quarter’s changes inside the Q3’2025 portfolio highlight that philosophy: aggressively adding to winners where the upside remains compelling, while trimming or partially harvesting where valuations and business cyclicality warrant caution.

Overall, the Turtle Creek Asset Management portfolio remains a focused bet on durable, cash‑generative businesses, especially in industrials, business services, specialty chemicals, and communications infrastructure—sectors where operational excellence and competitive moats can drive outsized compounding over many years.

Top Holdings Snapshot: Industrial Compounders, Niche Leaders, and Aggressive Adds

The Q3’2025 filing reveals 10–11 core names where Turtle Creek is actively reshaping exposure through sizable percentage adds and reductions.

The largest disclosed mover is Celanese Corporation, now a 6.5% position after an Add 20.99% move to 5,115,365 shares and $215.3M in value. As a specialty chemicals leader, Celanese fits Turtle Creek’s preference for cash‑rich industrial businesses with pricing power and strong competitive positions.

Close behind is The Middleby Corporation at 5.9% of the portfolio and $194.3M, where Turtle Creek Added 4.21% to reach 1,461,810 shares. Middleby’s focus on commercial and residential kitchen equipment provides exposure to a steady replacement cycle and margin expansion via operational efficiencies.

Cyclical sensitivity is being carefully managed through a substantial Reduce 18.14% in Brunswick Corporation, still a hefty 5.6% allocation at $185.1M across 2,926,223 shares. The reduction suggests a measured approach to consumer‑driven marine and recreational products as macro conditions evolve.

One of the boldest moves this quarter is in WillScot Holdings Corporation, a modular space and storage solutions provider. Turtle Creek Added 71.69%, lifting the stake to 8,730,347 shares worth $184.3M, or 5.6% of capital. Such a large percentage increase signals very high conviction in the company’s unit economics, consolidation potential, and cash flow trajectory.

In financial services, Bread Financial Holdings, Inc. remains a central position at 5.5% of the portfolio and $183.1M, even after a Reduce 8.65% to 3,283,546 shares. Trimming here likely reflects risk management in a credit‑sensitive business after a strong run or amid changing consumer credit dynamics.

Automation and industrial technology exposure continues through ATS Corporation, a 5.5% position at $182.7M. Turtle Creek Reduced 8.14% to 6,973,010 shares, which may indicate partial profit‑taking or a recalibration of risk as valuation multiples expand.

One of the more eye‑catching moves is in communications infrastructure: Cogent Communications Holdings, Inc. saw a Add 64.86% increase, bringing the stake to 4,603,933 shares valued at $176.6M, or 5.3% of the portfolio. This aggressive scaling suggests confidence in Cogent’s recurring revenue model, bandwidth demand tailwinds, and shareholder‑friendly capital allocation.

Transportation and logistics remain important but are being modestly dialed back. TFI International Inc. is a 4.8% position at $160.3M, with shares trimmed Reduce 5.66% to 1,820,727, likely managing exposure to freight cycles while retaining long‑term conviction.

Consumer‑facing exposure includes Floor & Decor Holdings, Inc., still a 4.8% allocation at $158.8M after a Reduce 4.55% adjustment to 2,155,011 shares. Here the fund stays meaningfully invested in the specialty retail story while moderating risk in a housing‑linked name.

Rounding out the list of active changes is Ingersoll Rand Inc., now a 4.5% position at $148.6M after a Reduce 1.93% to 1,798,850 shares. The modest trim indicates continued conviction in the mission‑critical industrial equipment and service model, with only fine‑tuning of position size.

Together, these 10–11 holdings define the core of Turtle Creek’s Q3’2025 positioning: capital‑light or asset‑light industrials, niche business services, infrastructure‑like communications, and selected financials, all sized assertively and adjusted with meaningful percentage changes rather than incremental tweaks.

What the Portfolio Reveals About Turtle Creek’s Current Strategy

Several themes emerge from the Q3’2025 13F:

- Concentrated conviction in mid‑cap compounders

With 54.0% of capital in the top 10 and individual positions in the 4.5–6.5% range, Turtle Creek backs its best ideas aggressively while still spreading risk across 41 names. - Industrial and business‑service bias

Names like Celanese, Middleby, ATS, Ingersoll Rand, and WillScot highlight a deep focus on businesses that combine engineering know‑how, recurring or repeat‑purchase demand, and operating leverage. - Selective risk management rather than wholesale exits

Most moves are partial trims—“Reduce” actions in Brunswick, Bread Financial, ATS, TFI International, Floor & Decor, and Ingersoll Rand—rather than binary sells, consistent with a long‑term compounding mindset. - Opportunistic scaling into high‑conviction winners

The massive Add 71.69% in WillScot and Add 64.86% in Cogent Communications indicate a willingness to double down when price dislocations or improving fundamentals open an attractive entry point. - Stable core, active sizing

Portfolio size remained unchanged at 41 positions +0, while turnover of 19.5% shows that Q3 changes came almost entirely from resizing existing holdings instead of entering or exiting many new names. Turtle Creek appears to be refining the same opportunity set rather than constantly cycling through ideas.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Celanese Corporation | $215.3M | 6.5% | Add 20.99% |

| The Middleby Corporation | $194.3M | 5.9% | Add 4.21% |

| Brunswick Corporation | $185.1M | 5.6% | Reduce 18.14% |

| WillScot Holdings Corporation | $184.3M | 5.6% | Add 71.69% |

| Bread Financial Holdings, Inc. | $183.1M | 5.5% | Reduce 8.65% |

| ATS Corporation | $182.7M | 5.5% | Reduce 8.14% |

| Cogent Communications Holdings, Inc. | $176.6M | 5.3% | Add 64.86% |

| TFI International Inc. | $160.3M | 4.8% | Reduce 5.66% |

| Floor & Decor Holdings, Inc. | $158.8M | 4.8% | Reduce 4.55% |

The top of the book is tightly packed, with the largest disclosed positions ranging from 4.8% to 6.5% of total assets. No single stock dominates, but each top‑10 name represents a meaningful driver of returns. This structure reduces idiosyncratic risk from any one company while keeping the portfolio sharply differentiated from broad indices.

The mix of “Add” and “Reduce” actions inside the top 10 reinforces that Turtle Creek treats position size as a dynamic expression of both conviction and risk. Heavier adds in Celanese, WillScot, and Cogent contrast with sizable trims in Brunswick, Bread Financial, and ATS, suggesting an active re‑rating of risk‑reward within a relatively stable roster of holdings.

Investment Lessons from Andrew Brenton’s Turtle Creek Approach

Several practical lessons emerge from studying the Q3’2025 Turtle Creek portfolio:

- Concentrate when you know the businesses well

Running 54.0% of capital through 10 names—yet still avoiding a single oversized bet—illustrates how to be meaningfully concentrated without becoming reckless. - Use holding period as a competitive edge

A 15‑quarter average holding period reflects a willingness to let operational execution compound over multiple business cycles, instead of trading around short‑term noise. - Treat position sizing as an ongoing decision

Large percentage adds in WillScot and Cogent, offset by trims in more cyclical or credit‑sensitive names, show that risk and conviction are constantly re‑evaluated, not set‑and‑forget. - Favor cash‑flow‑rich, competitively advantaged businesses

Many top holdings share traits: durable demand, pricing power, recurring or repeat revenue, and strong free cash flow—qualities that help sustain compounding even in choppier macro environments. - Adjust exposure, not necessarily the thesis

“Reduce” actions in several names highlight that you can remain fundamentally positive on a company while still taking risk off the table as valuation, leverage, or cycle dynamics shift.

Looking Ahead: What Comes Next for Turtle Creek?

Given an unchanged 41‑position count and 19.5% turnover, Turtle Creek appears poised to continue refining its existing roster of ideas rather than dramatically expanding into new sectors or styles. The elevated adds to WillScot, Celanese, and Cogent suggest these names could remain key performance drivers in upcoming quarters.

If economic conditions soften, we may see further risk management via trims in the more cyclical and credit‑sensitive names, paired with incremental adds to infrastructure‑like businesses and industrial technology platforms that can grow through cycles. Conversely, any market dislocations in high‑quality mid‑caps could offer Turtle Creek fresh entry points or opportunities to scale existing positions further.

For investors following the Turtle Creek portfolio, the pattern to watch is not just which stocks appear or disappear, but how Brenton adjusts the sizing of core names in response to changing fundamentals and valuations.

FAQ about Andrew Brenton – Turtle Creek Asset Management Portfolio

Q: What were the most significant portfolio changes in Turtle Creek’s Q3’2025 filing?

The most notable moves were large adds to WillScot Holdings Corporation (Add 71.69%), Cogent Communications Holdings, Inc. (Add 64.86%), and Celanese Corporation (Add 20.99%), alongside significant trims in Brunswick Corporation (Reduce 18.14%), Bread Financial Holdings, Inc. (Reduce 8.65%), and ATS Corporation (Reduce 8.14%).

Q: How concentrated is Andrew Brenton’s Turtle Creek portfolio?

Turtle Creek runs 41 positions, with the top 10 holdings accounting for 54.0% of the $3,313.4M portfolio. Individual top positions generally fall in the 4.5–6.5% range, reflecting high conviction without extreme single‑stock risk.

Q: How active is Turtle Creek in managing its holdings?

Despite a long average holding period of 15 quarters, turnover in Q3’2025 was 19.5%. This indicates that while Brenton tends to hold businesses for years, he actively recalibrates position sizes—adding to high‑conviction opportunities and trimming where risk or valuation has increased.

Q: Which sectors and business models does Turtle Creek favor?

The top holdings skew toward industrials, business services, specialty chemicals, and communications infrastructure, with names like The Middleby Corporation, ATS Corporation, Ingersoll Rand Inc., Celanese, and Cogent. These businesses generally feature strong competitive positions, recurring or repeat revenue, and robust free cash flow generation.

Q: How can I track Andrew Brenton’s Turtle Creek holdings and future changes?

You can follow the Turtle Creek Asset Management portfolio via quarterly 13F filings, which are filed up to 45 days after each quarter‑end, meaning there is an inherent reporting lag. ValueSense aggregates these filings, providing visualizations, change tracking, and historical data so you can monitor how the portfolio evolves over time.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!