Benjamin Allen - Parnassus Investments, Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

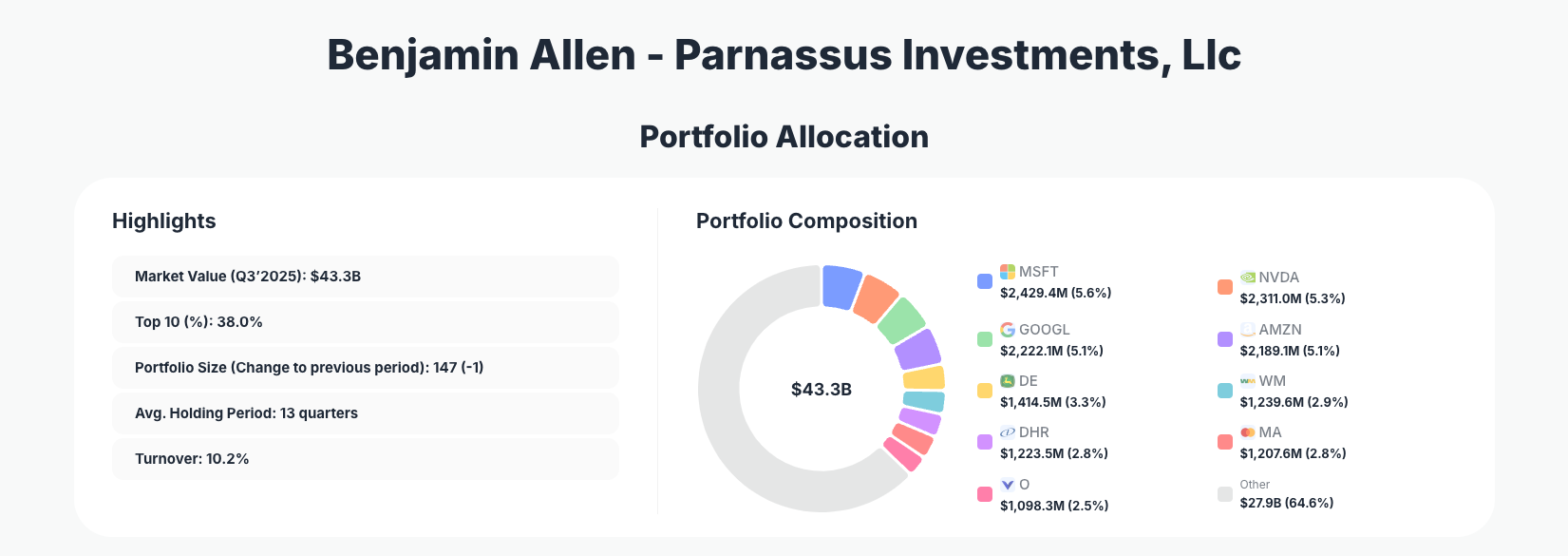

Benjamin Allen - Parnassus Investments, Llc leans into risk management this quarter, trimming several mega‑cap winners while keeping a firmly growth‑at‑a‑reasonable‑price profile. The firm’s Q3’2025 portfolio totals $43.3B in U.S. equities across 147 positions, with broad but still purposeful diversification, and notable reductions in leading tech and quality compounders.

Explore all Parnassus Investments 13F holdings on ValueSense

The Big Picture: Quality-Focused, Broadly Diversified

Portfolio Highlights (Q3 2025): - Market Value: $43.3B

- Top 10 Holdings: 38.0% of portfolio

- Portfolio Size: 147 -1 positions

- Average Holding Period: 13 quarters

- Turnover: 10.2%

At first glance, the Parnassus portfolio looks far more diversified than the ultra‑concentrated styles of some hedge funds, with the top 10 at 38.0% spread over 147 names. Yet an average holding period of 13 quarters and modest 10.2% turnover point to a fundamentally long‑term, buy‑and‑hold discipline rather than high‑frequency trading around positions. This is classic Parnassus: patient capital, but not afraid to rebalance when valuations or risk/reward change.

The Q3’2025 13F shows a consistent tilt toward large‑cap, high‑quality compounders, especially in technology and business services, balanced by steady cash‑flow generators in industrials, real assets, and financial infrastructure. Across the $43.3B portfolio, there is a clear bias toward resilient earnings, wide moats, and recurring revenue models rather than speculative growth.

A key theme this quarter is position trimming rather than wholesale rotation. The firm reduced stakes across several winners—particularly in technology—without exiting them, signaling valuation discipline while keeping exposure to secular growth. For investors tracking the Parnassus Investments portfolio, this quarter is more about risk calibration than a change in core philosophy.

Top Holdings Overview: Tech Leaders and Durable Compounders

The Q3’2025 filing highlights a cluster of high‑conviction positions where Parnassus is dialing back size but maintaining belief.

The portfolio is anchored by Microsoft Corporation at 5.6% of assets, even after a Reduce 10.55% action that brought the position to 4,690,425 shares valued at $2,429.4M. NVIDIA Corporation remains another core winner at 5.3%, with 12,386,339 shares worth $2,311.0M following a Reduce 14.04% move—one of the larger trims this quarter, reflecting both substantial gains and rising concentration risk in AI‑related names.

Alphabet Inc. stands at 5.1% of the portfolio after Parnassus chose to Reduce 7.62%, holding 9,140,511 shares worth $2,222.1M. Similarly, e‑commerce and cloud giant Amazon.com, Inc. sits at 5.1% with 9,970,124 shares valued at $2,189.1M, also trimmed via a Reduce 3.66% action. Taken together, these four mega‑caps still represent a significant slice of the Parnassus book, but the incremental reductions suggest profit‑taking and a desire not to let any single growth theme dominate risk.

Outside of big tech, Parnassus continues to favor durable, cash‑generating real‑economy businesses. Deere & Company accounts for 3.3% of the fund, with 3,093,334 shares worth $1,414.5M after a modest Reduce 1.16%. This indicates continued conviction in long‑term agricultural and construction equipment demand, while respecting cyclical risks. In essential services, Waste Management, Inc. holds 2.9%, with 5,613,315 shares valued at $1,239.6M after a Reduce 1.74% move—again a fine‑tuning rather than a strategic reversal.

Healthcare and life‑science tools exposure remains visible through Danaher Corporation, now 2.8% of the portfolio. Parnassus owns 6,171,104 shares worth $1,223.5M, trimmed via a Reduce 2.32% action in Q3. In payments, Mastercard Incorporated also stands at 2.8%, with 2,123,059 shares valued at $1,207.6M following a slight Reduce 0.73%, showing continued belief in the secular shift to digital payments with a careful eye on valuation.

Real assets and income generation appear through Realty Income Corporation, a well‑known REIT representing 2.5% of the portfolio. Parnassus holds 18,066,603 shares worth $1,098.3M and Reduce 1.74% this quarter—consistent with modest de‑risking in interest‑rate‑sensitive areas while keeping a sizeable stake in a steady dividend payer. Rounding out the key moves, Intercontinental Exchange, Inc. stands at 2.5% with 6,496,975 shares valued at $1,094.6M after a Reduce 2.00% adjustment, maintaining exposure to critical financial market infrastructure.

Across these 10 principal names, the pattern is remarkably consistent: broad‑based trimming of winners, not aggressive rotation into new ideas. For investors studying Benjamin Allen – Parnassus Investments stocks, Q3’2025 is a textbook example of long‑term quality investing paired with disciplined position sizing.

What the Portfolio Reveals About Current Strategy

The Q3’2025 13F for the Parnassus portfolio underscores several strategic themes:

- Quality first, growth second

The largest positions—Microsoft, NVIDIA, Alphabet, Amazon, Deere, Waste Management, Danaher, Mastercard, Realty Income, Intercontinental Exchange—are all established, cash‑generative franchises with defensible moats. Even in high‑growth segments like AI and cloud, the firm is emphasizing profitability and durability over speculative names. - Risk control via trims, not exits

Almost every major disclosed change is a “Reduce” rather than “Sell” or “Buy.” That tells us Parnassus is not abandoning its core ideas; it is managing exposure after a strong run‑up in many of these stocks. The use of relatively modest reductions (often in the 1–3% range, with a few larger cuts like NVIDIA’s 14.04% and Microsoft’s 10.55%) reflects a measured, data‑driven risk framework. - Sector balance with a tilt to technology and services

While tech and information services dominate the upper ranks, the presence of industrials (DE), waste services (WM), healthcare tools (DHR), property REITs (O), and market infrastructure (ICE) shows deliberate sector diversification. The firm is clearly not an all‑in technology fund, but it does lean into secular digitalization and data‑driven business models. - Defensive characteristics and income

Names like Waste Management, Realty Income, and Intercontinental Exchange bring a combination of predictable cash flows, high switching costs, and in some cases dividends. Combined with the long average holding period, this supports a strategy geared toward compounding and downside resilience rather than rapid factor rotation.

For investors, the message is clear: Parnassus is staying the course on high‑quality, wide‑moat names while shaving risk at the margin after strong performance.

Portfolio Concentration Analysis

Using the disclosed top positions from the 13F:

Note: The JSON data begins with rank 2; the absolute #1 holding is not included here but is part of the fund’s full top‑10, which sums to 38.0% of assets.

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Microsoft Corporation (MSFT) | $2,429.4M | 5.6% | Reduce 10.55% |

| NVIDIA Corporation (NVDA) | $2,311.0M | 5.3% | Reduce 14.04% |

| Alphabet Inc. (GOOGL) | $2,222.1M | 5.1% | Reduce 7.62% |

| Amazon.com, Inc. (AMZN) | $2,189.1M | 5.1% | Reduce 3.66% |

| Deere & Company (DE) | $1,414.5M | 3.3% | Reduce 1.16% |

| Waste Management, Inc. (WM) | $1,239.6M | 2.9% | Reduce 1.74% |

| Danaher Corporation (DHR) | $1,223.5M | 2.8% | Reduce 2.32% |

| Mastercard Incorporated (MA) | $1,207.6M | 2.8% | Reduce 0.73% |

| Realty Income Corporation (O) | $1,098.3M | 2.5% | Reduce 1.74% |

Concentration in the top four positions alone totals over 21% of the portfolio, all in mega‑cap platforms at the center of cloud, AI, digital advertising, and e‑commerce. This level of focus shows that when Parnassus has conviction, it is willing to size positions meaningfully—but the consistent “Reduce” actions show that position size is actively managed as markets move.

The mid‑tier holdings—Deere, Waste Management, Danaher, Mastercard, Realty Income, and Intercontinental Exchange just outside this displayed table—cluster in the 2.5–3.3% range. That creates a laddered exposure structure, where no single non‑mega‑cap dominates risk, but each still has enough weight to move the needle. For individual investors studying the Parnassus top holdings, this table illustrates how to blend conviction with diversification.

Investment Lessons from Parnassus’s Quality-First Discipline

Parnassus’s Q3’2025 positioning offers several actionable lessons:

- Concentrate in your best ideas—but not too much

The fund is comfortable with 5%+ positions in names like MSFT, NVDA, GOOGL, and AMZN, yet trims them when they get extended. Retail investors can mirror this by letting winners grow—while having rules for when to rebalance. - Holding periods matter more than short‑term noise

A 13‑quarter average holding period shows that the core edge is time in the market, not market timing. Parnassus lets compounding work, making only 10.2% annualized changes at the margin. - Quality businesses can be bought in cyclical or volatile sectors

Deere, Waste Management, Danaher, Mastercard, and Intercontinental Exchange show that even in industrials, utilities‑like services, healthcare, and financials, Parnassus favors companies with moats, recurring revenues, and pricing power. - Risk management is ongoing, not episodic

The prevalence of small “Reduce” adjustments (1–3%) across many holdings demonstrates a continuous risk‑tuning approach. It is not about calling macro tops; it is about nudging exposure in line with valuations and fundamentals. - Income and defensiveness complement growth

Including Realty Income and similar names provides ballast to a growth‑heavy set of tech leaders. Blending dividends and secular growth can smooth portfolio volatility.

Looking Ahead: What Comes Next for Parnassus?

Based on the Q3 2025 shape of the Parnassus Investments portfolio, several forward‑looking themes emerge:

- Dry powder from trims

While we do not see cash directly in 13F data, the breadth of “Reduce” actions suggests Parnassus may be building room to add if volatility creates better entry points in existing names or new high‑quality opportunities. - Continued focus on digital infrastructure and data‑rich platforms

The heavy weights in MSFT, NVDA, GOOGL, AMZN, MA, and ICE imply that AI, cloud, digital payments, and financial market infrastructure will remain core themes. - Watch for incremental adds in under‑owned defensives

If rates stabilize or fall, names like O or other income‑oriented assets could become more attractive again. Parnassus’s small trims this quarter may simply be volatility management, not a negative structural view. - Opportunistic buying in corrections

Given the long holding periods and measured turnover, sharp sector pullbacks—especially in quality tech and healthcare—are exactly where Parnassus historically prefers to scale into strength at better prices.

For investors following Benjamin Allen – Parnassus stocks, monitoring subsequent 13F filings will clarify whether Q3’s moves were one‑off trims or the start of a larger rotation.

FAQ about the Parnassus Investments Portfolio

Q: Why did Parnassus trim large positions like Microsoft, NVIDIA, and Alphabet in Q3 2025?

A: The Q3’2025 13F shows Reduce actions of 10.55% in MSFT, 14.04% in NVDA, and 7.62% in GOOGL, even though they remain top‑five positions. This pattern suggests disciplined profit‑taking and position size risk management rather than a loss of conviction.

Q: How concentrated is the Parnassus portfolio?

A: While the firm holds 147 positions, the top 10 represent 38.0% of the $43.3B portfolio. Individual high‑conviction names such as MSFT, NVDA, GOOGL, and AMZN each exceed 5%, blending meaningful concentration with wide diversification in the tail.

Q: What is the typical holding period and what does it say about Parnassus’s style?

A: With an average holding period of 13 quarters and turnover of just 10.2%, Parnassus is clearly a long‑term, low‑turnover manager. The firm appears to buy quality businesses with the intent to hold for many years, adjusting weights gradually instead of trading around short‑term moves.

Q: Which sectors or themes stand out in the current top holdings?

A: The Q3 2025 top positions emphasize mega‑cap technology and platforms (MSFT, NVDA, GOOGL, AMZN), alongside industrial and infrastructure leaders (DE, WM, ICE), healthcare tools (DHR), payments (MA), and real estate income (O). The common thread is high‑quality, recurring revenue and strong competitive moats.

Q: How can I track or follow Parnassus’s portfolio moves?

A: You can follow quarterly 13F filings submitted to the SEC, which disclose U.S. equity holdings with a 45‑day reporting lag—meaning positions may have changed after the reporting date. For a more user‑friendly view, use ValueSense’s dedicated page for Parnassus at Parnassus Investments’ portfolio to see top holdings, historical changes, and visual breakdowns across sectors and positions.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!