11 Best DRIP Stocks for 2025: High Cash Flow Payout Leaders - Value Sense Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Power of DRIP Investing for Long-Term Wealth

Dividend Reinvestment Plans (DRIPs) represent one of the most powerful wealth-building strategies available to long-term investors. By automatically reinvesting dividends to purchase additional shares, investors harness the compound growth potential that transforms modest initial investments into substantial wealth over decades.

Our analysis focuses on companies with cash flow payout ratios exceeding 40%, indicating substantial commitment to returning cash to shareholders while maintaining the financial capacity to sustain and grow their dividend payments. These companies demonstrate the financial strength and shareholder-friendly policies essential for successful DRIP investing strategies.

DRIP Stock Selection Criteria:

- Cash flow payout ratio above 40% demonstrating strong shareholder commitment

- Consistent dividend payment history with growth potential

- Strong balance sheets supporting sustainable dividend policies

- Quality business models generating predictable cash flows for long-term wealth building

Top 11 DRIP Stocks for 2025 - Ranked by Cash Flow Payout Ratio

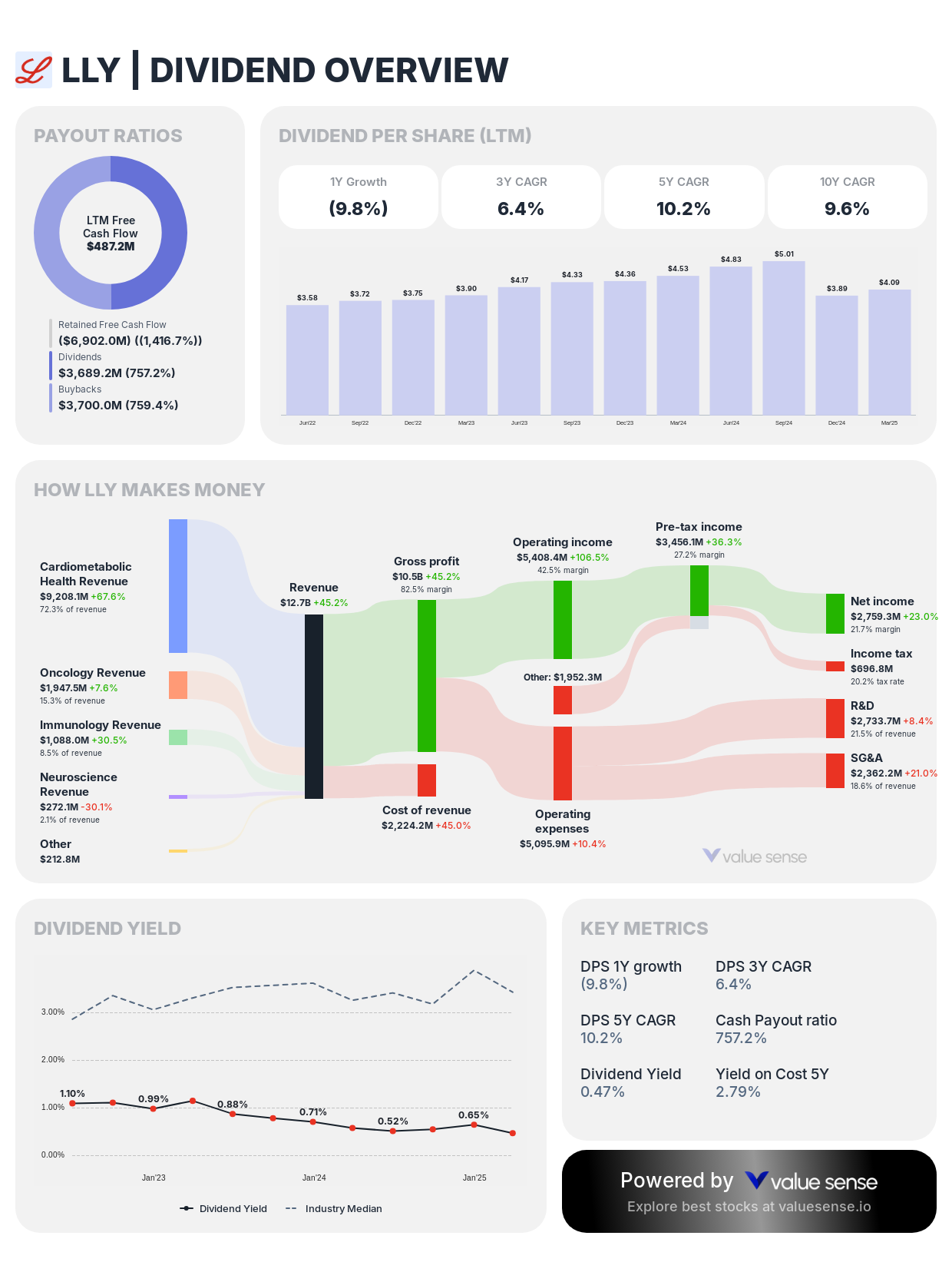

1. Eli Lilly and Company (LLY) - 757.2% Cash Flow Payout Ratio ⚠️

Sector: Pharmaceuticals | Market Cap: $736.4B | Dividend Yield: 0.5%

- Cash Flow Payout Ratio: 757.2%

- Dividend Payout Ratio: 33.2%

- DPS Growth 1Y: (9.8%)

- DPS Growth 3Y: 6.4%

- DPS Growth 10Y: 9.6%

Investment Thesis: Eli Lilly's extraordinary 757.2% cash flow payout ratio represents an extreme outlier requiring careful analysis. This exceptionally high ratio likely reflects temporary circumstances such as large R&D investments, legal settlements, or one-time cash outflows rather than sustainable dividend policy. Despite this anomaly, Lilly's strong pharmaceutical pipeline and breakthrough treatments in diabetes and obesity support long-term dividend growth potential.

DRIP Considerations: While the current cash flow payout ratio appears unsustainable, Lilly's 9.6% ten-year dividend growth rate and strong pharmaceutical franchise suggest underlying business strength. DRIP investors should monitor future quarters to ensure this high ratio represents temporary rather than structural challenges to dividend sustainability.

Growth Catalysts:

- Leading position in diabetes and obesity treatments with expanding market opportunities

- Robust pharmaceutical pipeline with multiple potential blockbuster drugs

- Strategic acquisitions enhancing therapeutic portfolio and market reach

- International expansion opportunities in emerging healthcare markets

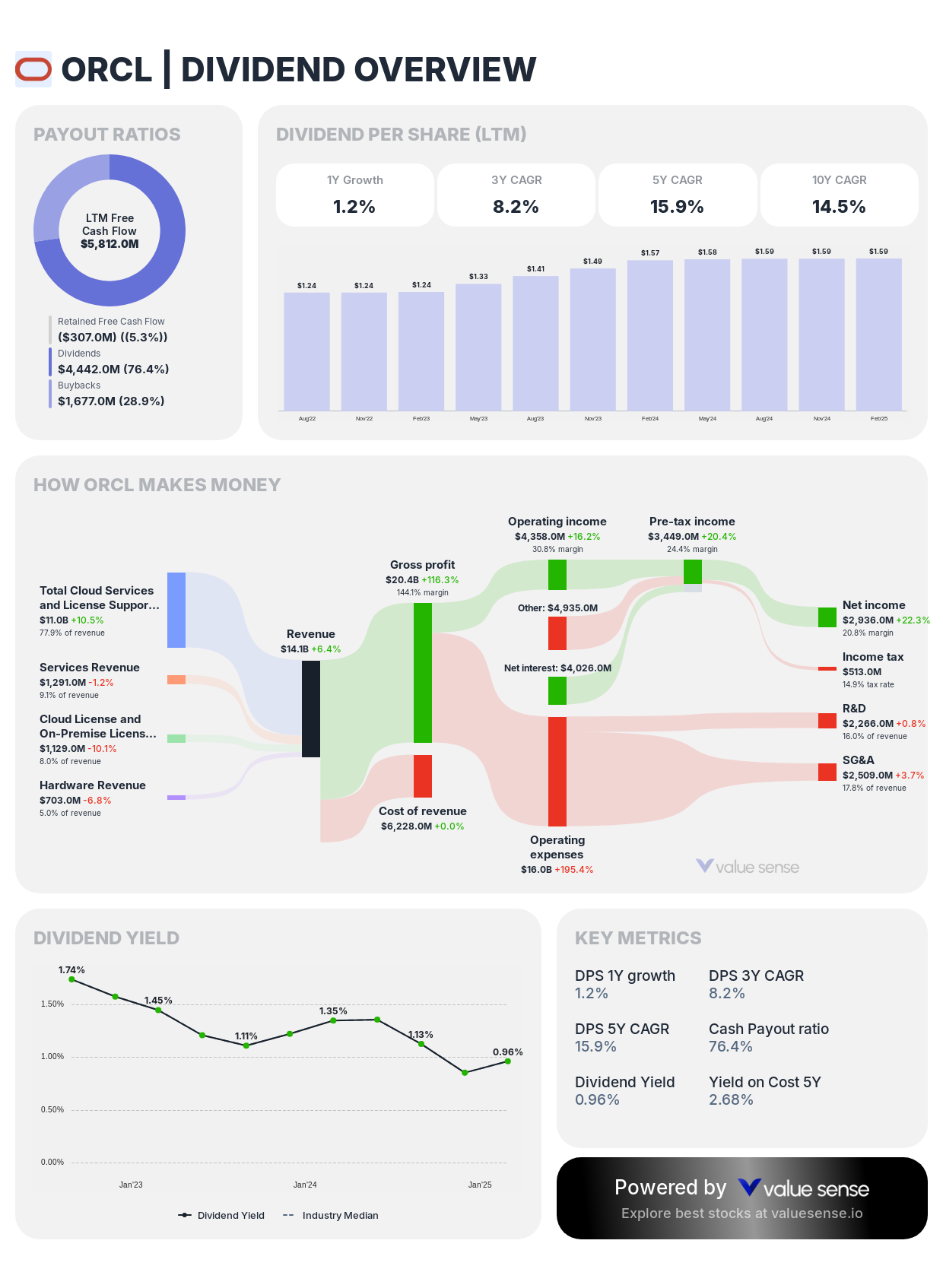

2. Oracle Corporation (ORCL) - 76.4% Cash Flow Payout Ratio

Sector: Enterprise Software | Market Cap: $619.5B | Dividend Yield: 0.7%

- Cash Flow Payout Ratio: 76.4%

- Dividend Payout Ratio: 36.5%

- DPS Growth 1Y: 1.2%

- DPS Growth 3Y: 8.2%

- DPS Growth 10Y: 14.5%

Investment Thesis: Oracle demonstrates strong commitment to shareholder returns with a 76.4% cash flow payout ratio, reflecting confidence in its enterprise software and cloud infrastructure business model. The company's impressive 14.5% ten-year dividend growth rate and mission-critical software create sustainable competitive advantages supporting long-term DRIP success.

DRIP Advantages: Oracle's high cash flow payout ratio and consistent dividend growth make it attractive for DRIP investors seeking technology exposure with income generation. The company's database dominance and cloud transformation provide predictable cash flows supporting dividend sustainability and growth.

Growth Catalysts:

- Database market leadership with high switching costs and recurring revenue

- Cloud infrastructure expansion competing with major technology platforms

- Artificial intelligence integration enhancing product capabilities and market positioning

- Strategic acquisitions expanding addressable markets and customer relationships

3. Novo Nordisk A/S (NVO) - 68.0% Cash Flow Payout Ratio

Sector: Pharmaceuticals | Market Cap: $354.4B | Dividend Yield: 2.2%

- Cash Flow Payout Ratio: 68.0%

- Dividend Payout Ratio: 48.6%

- DPS Growth 1Y: 21.3%

- DPS Growth 3Y: 30.8%

- DPS Growth 10Y: 18.1%

Investment Thesis: Novo Nordisk demonstrates exceptional dividend growth with 21.3% one-year and 30.8% three-year dividend per share growth, supported by its leadership in diabetes care and emerging obesity treatments. The company's 68.0% cash flow payout ratio reflects strong commitment to shareholder returns while funding continued R&D investments.

DRIP Advantages: The company's accelerating dividend growth and dominant position in rapidly expanding therapeutic markets make it highly attractive for DRIP investors. Novo Nordisk's specialized focus and global market leadership provide sustainable competitive advantages supporting long-term dividend expansion.

Growth Catalysts:

- Leadership in diabetes care with expanding global patient populations

- Breakthrough obesity treatments addressing massive addressable markets

- Continuous innovation in drug delivery systems and treatment effectiveness

- International market expansion with direct sales and partnership strategies

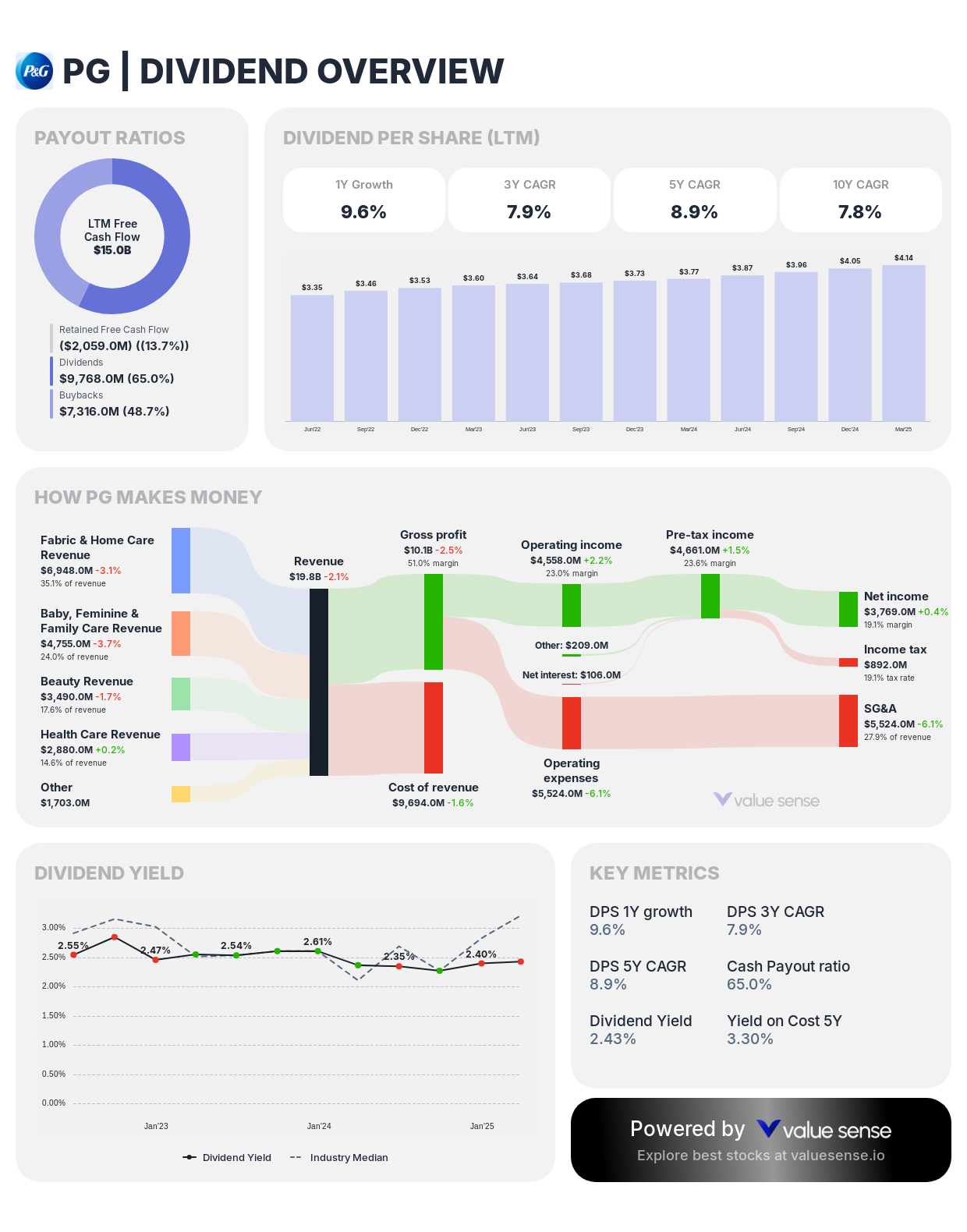

4. The Procter & Gamble Company (PG) - 65.0% Cash Flow Payout Ratio

Sector: Consumer Staples | Market Cap: $376.2B | Dividend Yield: 2.6%

- Cash Flow Payout Ratio: 65.0%

- Dividend Payout Ratio: 62.7%

- DPS Growth 1Y: 9.6%

- DPS Growth 3Y: 7.9%

- DPS Growth 10Y: 7.8%

Investment Thesis: Procter & Gamble represents dividend investing excellence with 68 consecutive years of dividend increases as a Dividend King. The company's 65.0% cash flow payout ratio and 2.6% yield provide attractive current income, while its portfolio of leading consumer brands supports sustainable dividend growth through various economic cycles.

DRIP Advantages: P&G's Dividend King status and consistent cash generation make it ideal for DRIP investing. The company's defensive consumer staples business model provides stability, while premium brand positioning supports pricing power and dividend growth sustainability over decades.

Growth Catalysts:

- Premium brand portfolio with strong consumer loyalty and pricing power

- International expansion opportunities in emerging markets

- Innovation pipeline enhancing product differentiation and market share

- Operational efficiency improvements and cost optimization initiatives

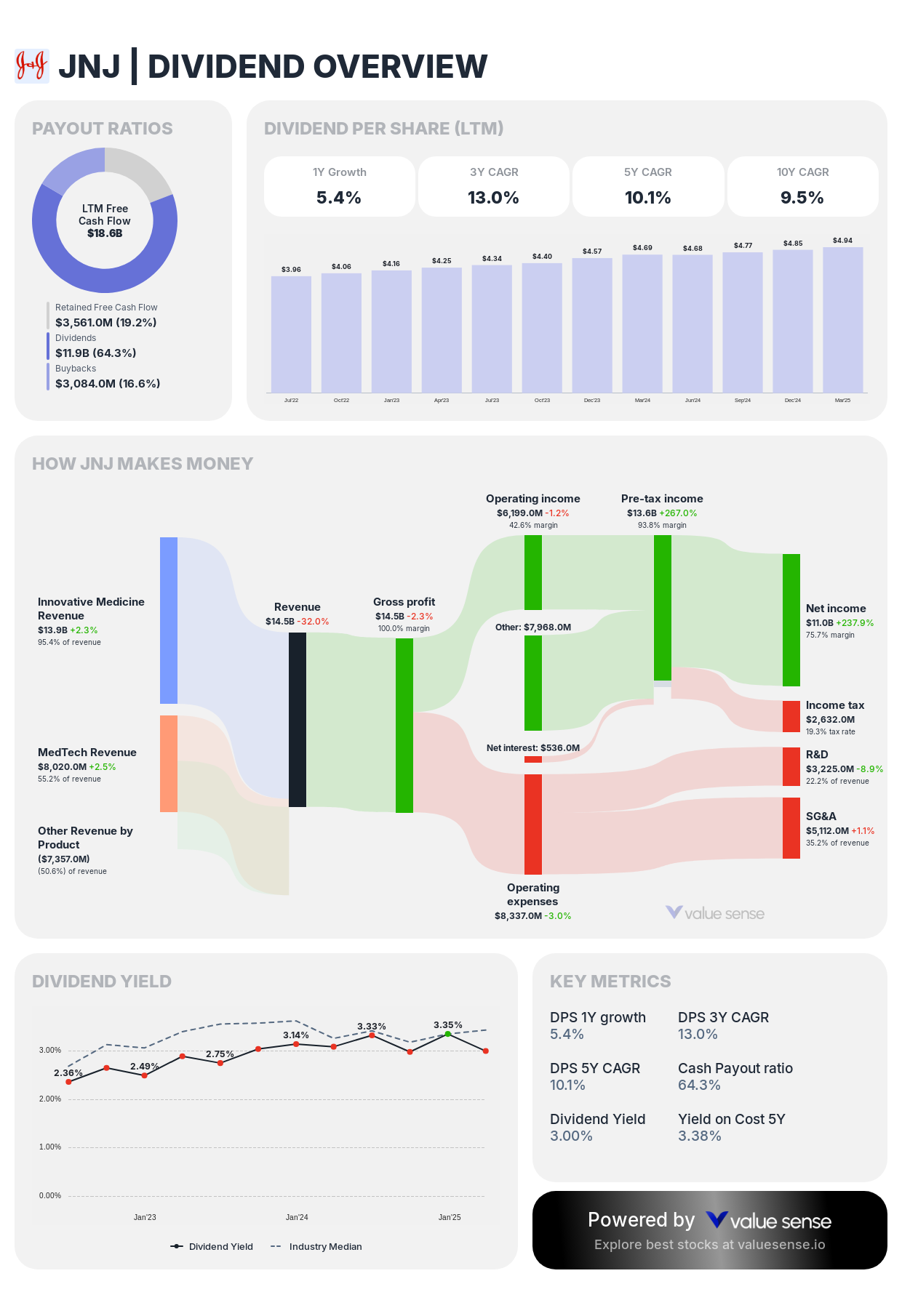

5. Johnson & Johnson (JNJ) - 64.3% Cash Flow Payout Ratio

Sector: Healthcare | Market Cap: $377.9B | Dividend Yield: 3.2%

- Cash Flow Payout Ratio: 64.3%

- Dividend Payout Ratio: 54.8%

- DPS Growth 1Y: 5.4%

- DPS Growth 3Y: 13.0%

- DPS Growth 10Y: 9.5%

Investment Thesis: Johnson & Johnson maintains its status as a Dividend Aristocrat with 62 consecutive years of dividend increases, offering a compelling 3.2% yield supported by diversified healthcare operations. The company's 64.3% cash flow payout ratio demonstrates strong commitment to shareholder returns while maintaining investment capacity for pharmaceutical innovation.

DRIP Advantages: J&J's Dividend Aristocrat status and diversified healthcare portfolio provide exceptional stability for DRIP investors. The company's pharmaceutical pipeline and medical device innovations support continued dividend growth despite recent challenges in some business segments.

Growth Catalysts:

- Pharmaceutical pipeline focused on high-growth therapeutic areas including oncology

- Medical device innovation in surgical and interventional solutions

- Emerging market expansion across healthcare segments

- Strategic divestitures focusing resources on core pharmaceutical strengths

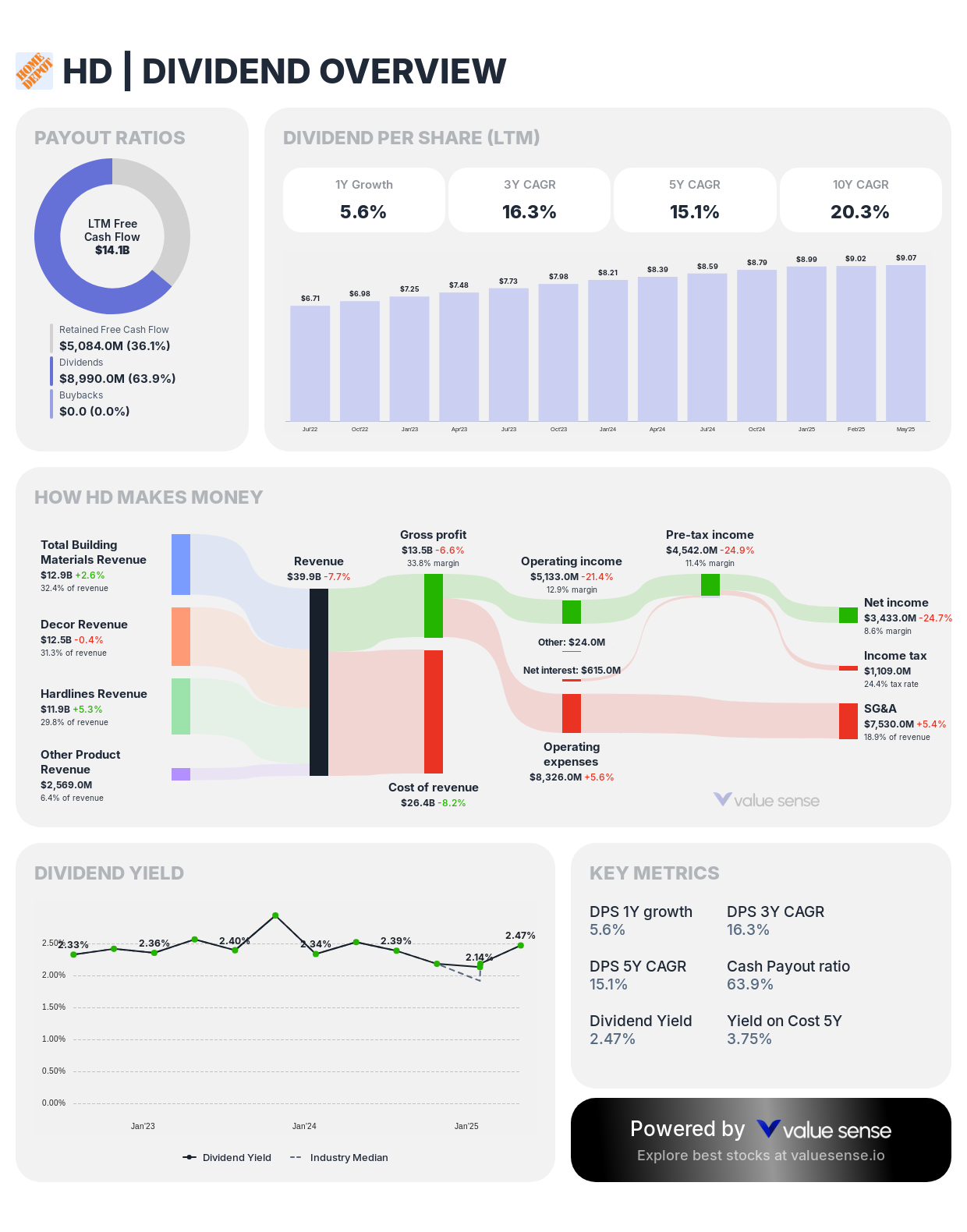

6. The Home Depot, Inc. (HD) - 63.9% Cash Flow Payout Ratio

Sector: Home Improvement Retail | Market Cap: $351.8B | Dividend Yield: 2.6%

- Cash Flow Payout Ratio: 63.9%

- Dividend Payout Ratio: 68.8%

- DPS Growth 1Y: 5.6%

- DPS Growth 3Y: 16.3%

- DPS Growth 10Y: 20.3%

Investment Thesis: Home Depot combines an attractive 2.6% dividend yield with exceptional long-term dividend growth averaging 20.3% annually over the past decade. The company's 63.9% cash flow payout ratio demonstrates strong commitment to shareholder returns while maintaining financial flexibility for growth investments and market expansion.

DRIP Advantages: Home Depot's consistent dividend growth and substantial cash generation make it an excellent DRIP candidate. The company's dominant market position and defensive characteristics provide stability, while its growth initiatives offer dividend expansion potential for long-term wealth building.

Growth Catalysts:

- Market-leading position in home improvement with scale advantages

- Digital transformation enhancing customer experience and operational efficiency

- Professional contractor business expansion with higher-margin services

- Supply chain optimization and inventory management improvements

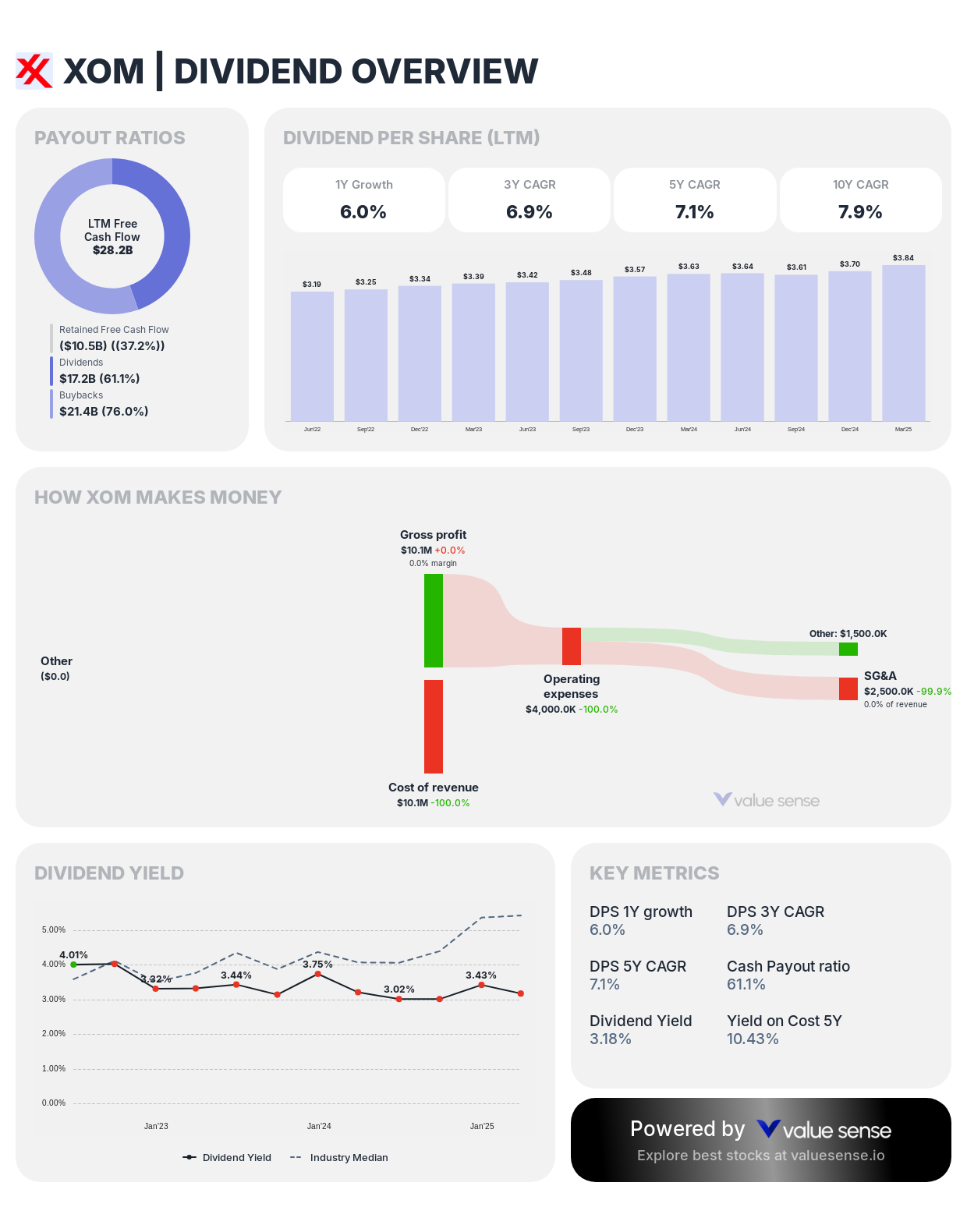

7. Exxon Mobil Corporation (XOM) - 61.1% Cash Flow Payout Ratio

Sector: Energy | Market Cap: $500.3B | Dividend Yield: 3.4%

- Cash Flow Payout Ratio: 61.1%

- Dividend Payout Ratio: 51.4%

- DPS Growth 1Y: 6.0%

- DPS Growth 3Y: 6.9%

- DPS Growth 10Y: 7.9%

Investment Thesis: Exxon Mobil offers an attractive 3.4% dividend yield supported by a 61.1% cash flow payout ratio, demonstrating the company's commitment to shareholder returns through commodity cycles. The integrated energy giant's scale advantages and disciplined capital allocation approach support dividend sustainability and modest growth potential.

DRIP Advantages: Exxon's substantial dividend yield and consistent payout policy make it attractive for income-focused DRIP investors. The company's integrated business model and strong balance sheet provide stability through energy market volatility while generating substantial cash flows for dividend payments.

Growth Catalysts:

- Integrated business model providing operational stability across energy value chain

- Low-cost production assets and operational efficiency improvements

- Strategic investments in carbon capture and lower-emission technologies

- Disciplined capital allocation prioritizing shareholder returns and debt reduction

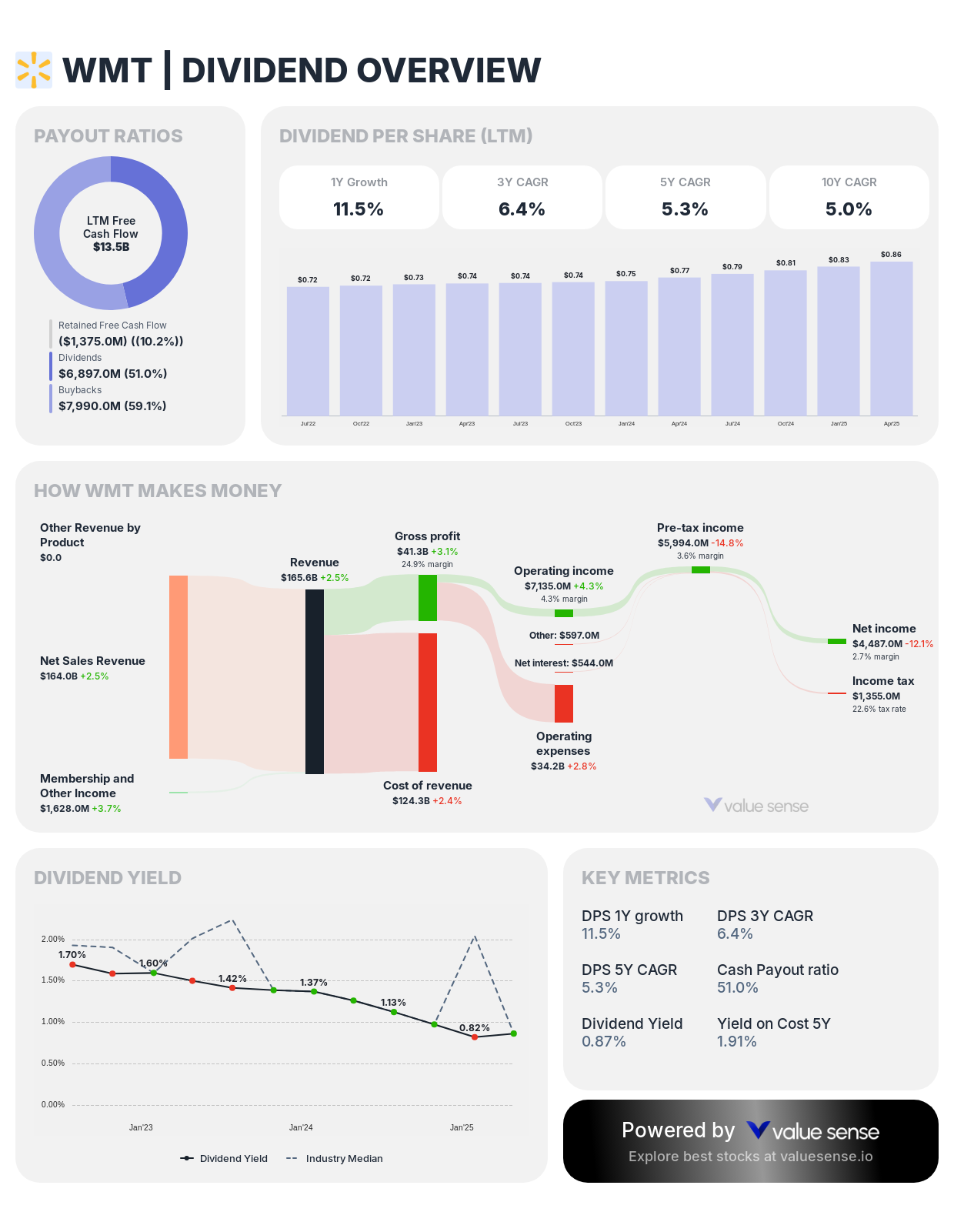

8. Walmart Inc. (WMT) - 51.0% Cash Flow Payout Ratio

Sector: Retail | Market Cap: $756.6B | Dividend Yield: 0.9%

- Cash Flow Payout Ratio: 51.0%

- Dividend Payout Ratio: 35.0%

- DPS Growth 1Y: 11.5%

- DPS Growth 3Y: 6.4%

- DPS Growth 10Y: 5.0%

Investment Thesis: Walmart demonstrates accelerating dividend growth with 11.5% one-year dividend per share growth, supported by its 51.0% cash flow payout ratio and dominant retail operations. The company's defensive characteristics and consistent cash generation provide stability, while e-commerce growth and operational improvements support dividend expansion.

DRIP Advantages: Walmart's essential retail services and improving dividend growth make it attractive for DRIP investors seeking defensive exposure with modest income generation. The company's scale advantages and operational efficiency provide sustainable competitive advantages for long-term wealth building.

Growth Catalysts:

- E-commerce expansion competing effectively with online retail leaders

- Supply chain optimization and automation improving operational efficiency

- International market opportunities and format innovation

- Technology investments enhancing customer experience and operational capabilities

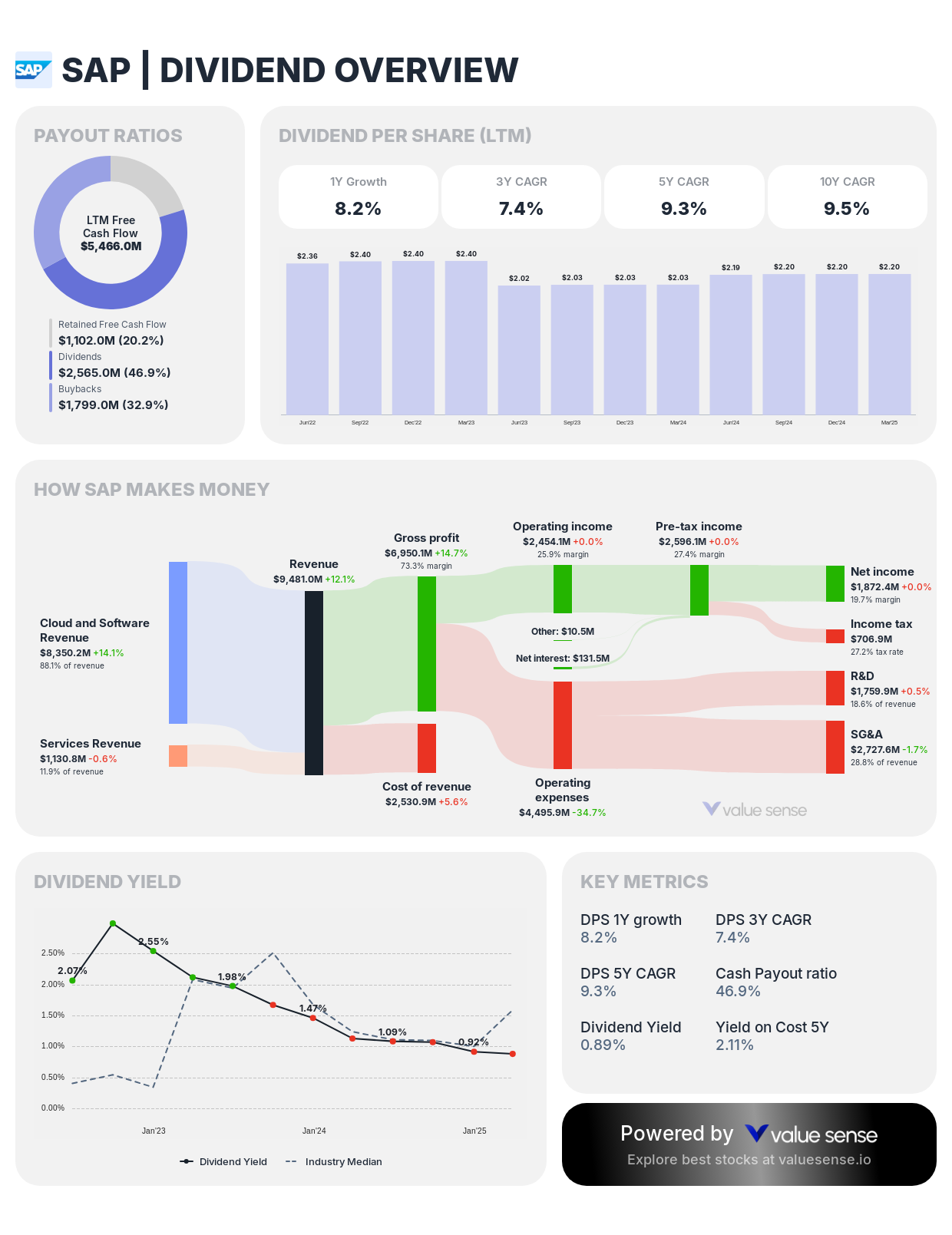

9. SAP SE (SAP) - 46.9% Cash Flow Payout Ratio

Sector: Enterprise Software | Market Cap: $342.4B | Dividend Yield: 0.9%

- Cash Flow Payout Ratio: 46.9%

- Dividend Payout Ratio: 44.8%

- DPS Growth 1Y: 8.2%

- DPS Growth 3Y: 7.4%

- DPS Growth 10Y: 9.5%

Investment Thesis: SAP provides consistent dividend growth with 9.5% ten-year compound annual growth rate supported by its leadership in enterprise resource planning software. The company's 46.9% cash flow payout ratio demonstrates balanced approach to shareholder returns while funding cloud transformation initiatives.

DRIP Advantages: SAP's mission-critical enterprise software and consistent dividend growth make it suitable for DRIP investors seeking technology exposure with moderate income generation. The company's customer relationships and switching costs provide predictable cash flows supporting dividend sustainability.

Growth Catalysts:

- Enterprise resource planning software leadership with high customer retention

- Cloud transformation expanding addressable markets and recurring revenue

- Artificial intelligence integration enhancing product capabilities and customer value

- International expansion opportunities in emerging enterprise software markets

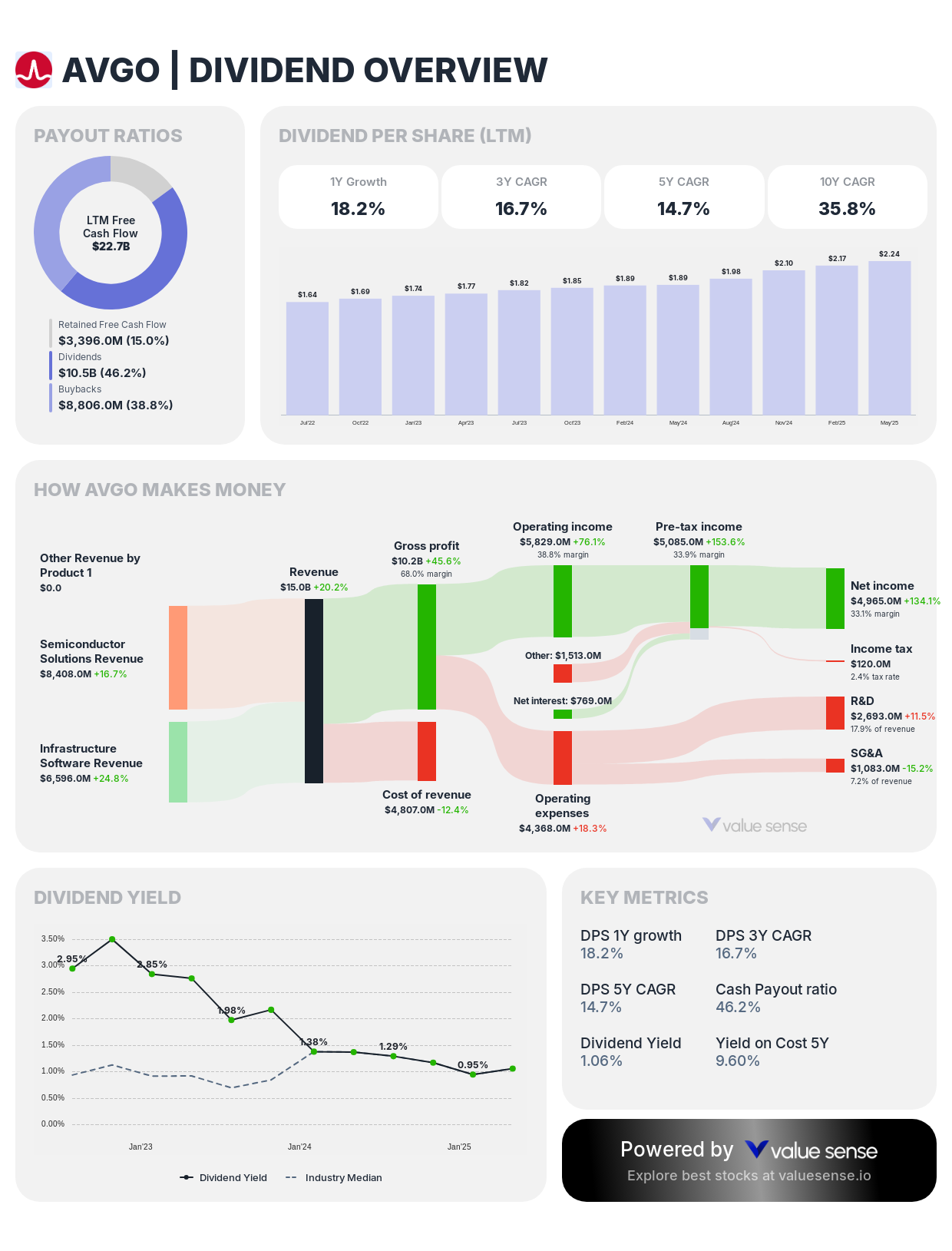

10. Broadcom Inc. (AVGO) - 46.2% Cash Flow Payout Ratio

Sector: Semiconductors | Market Cap: $1,170.6B | Dividend Yield: 0.9%

- Cash Flow Payout Ratio: 46.2%

- Dividend Payout Ratio: 78.6%

- DPS Growth 1Y: 18.2%

- DPS Growth 3Y: 16.7%

- DPS Growth 10Y: 35.8%

Investment Thesis: Broadcom delivers exceptional dividend growth with 35.8% ten-year compound annual growth rate and 18.2% recent one-year growth. The company's 46.2% cash flow payout ratio reflects disciplined capital allocation while funding strategic acquisitions and maintaining substantial shareholder returns.

DRIP Advantages: Broadcom's exceptional dividend growth history and strong cash generation make it highly attractive for DRIP investors seeking technology exposure with significant income growth potential. The company's acquisition strategy and market leadership support continued dividend expansion over time.

Growth Catalysts:

- Diversified semiconductor portfolio serving essential technology applications

- Strategic acquisitions expanding addressable markets and customer relationships

- Artificial intelligence and data center infrastructure growth driving demand

- Software business expansion through infrastructure technology acquisitions

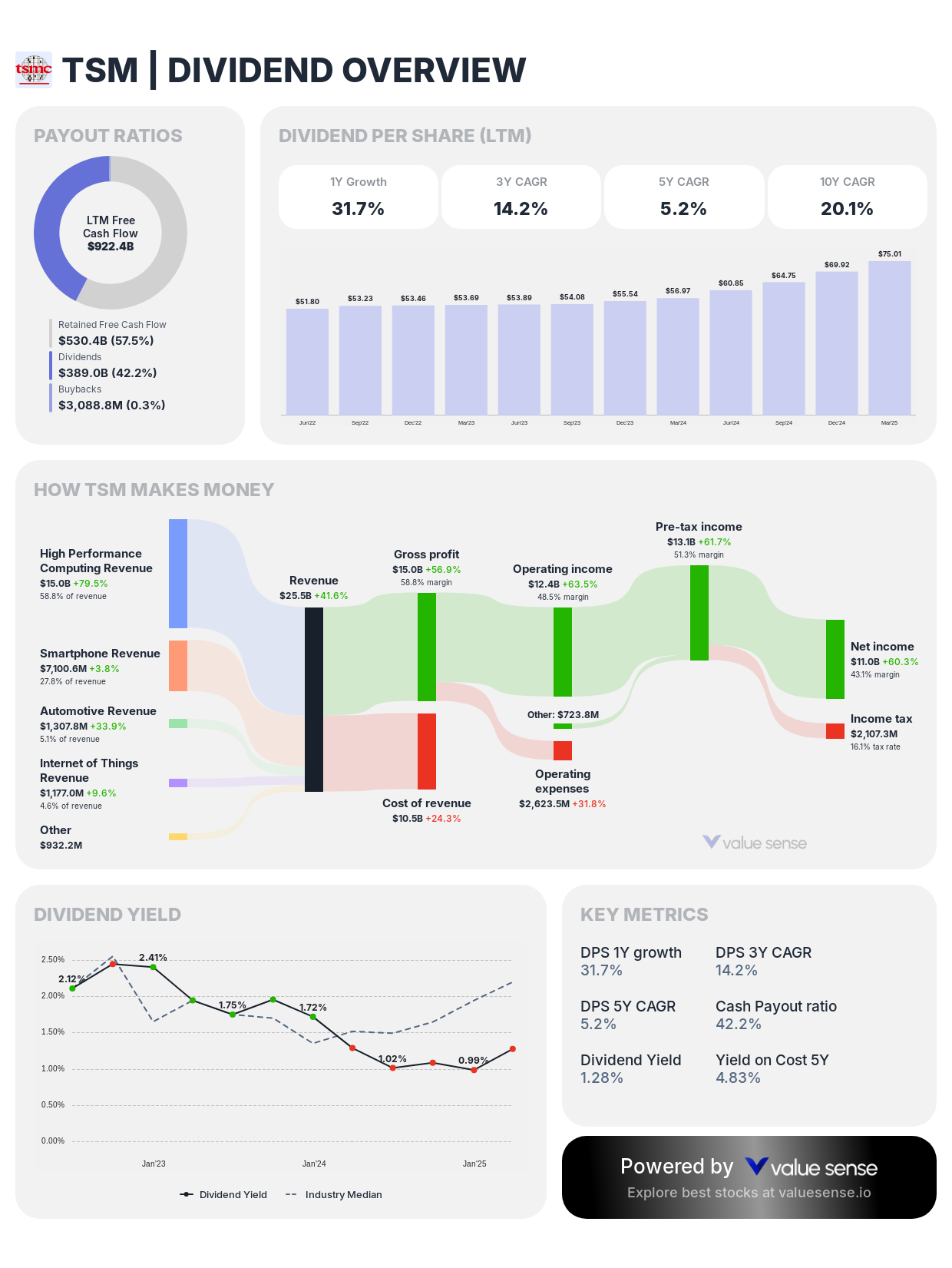

11. Taiwan Semiconductor Manufacturing Company (TSM) - 42.2% Cash Flow Payout Ratio

Sector: Semiconductors | Market Cap: $1,094.9B | Dividend Yield: 1.2%

- Cash Flow Payout Ratio: 42.2%

- Dividend Payout Ratio: 29.7%

- DPS Growth 1Y: 31.7%

- DPS Growth 3Y: 14.2%

- DPS Growth 10Y: 20.1%

Investment Thesis: TSMC demonstrates strong dividend growth with 31.7% one-year and 20.1% ten-year compound annual growth rates, supported by its dominant position in semiconductor manufacturing. The company's 42.2% cash flow payout ratio reflects conservative dividend policy while funding massive capital expenditures for capacity expansion.

DRIP Advantages: TSMC's leadership position and exceptional dividend growth make it attractive for DRIP investors seeking exposure to semiconductor industry growth. The company's technological advantages and essential role in global technology supply chains support sustainable dividend expansion.

Growth Catalysts:

- Global semiconductor foundry leadership with advanced process technology

- Artificial intelligence and high-performance computing driving premium demand

- Capacity expansion supporting customer growth and market share gains

- Strategic partnerships with leading technology companies ensuring demand visibility

DRIP Investment Strategy for Maximum Wealth Building

Prioritize Sustainable Cash Flow Payout Ratios: Focus on companies with cash flow payout ratios between 40-70% for optimal balance between current income and dividend sustainability. Companies like Oracle (76.4%) and Novo Nordisk (68.0%) demonstrate strong commitment to shareholder returns while maintaining financial flexibility for growth investments.

Balance Current Yield with Growth Potential: While high current yields provide immediate income, prioritize companies with sustainable dividend growth potential. Home Depot (20.3% 10-year growth) and Broadcom (35.8% 10-year growth) demonstrate exceptional dividend expansion capabilities that compound wealth over time through DRIP reinvestment.

Diversification Across Sectors: Spread DRIP investments across healthcare, technology, consumer staples, and energy sectors to reduce concentration risk while capturing different economic cycle benefits. This approach provides stability during sector-specific challenges while maintaining exposure to various growth drivers.

Monitor Payout Ratio Sustainability: Regularly assess whether high payout ratios reflect sustainable business characteristics or temporary circumstances. Eli Lilly's exceptional 757.2% ratio requires investigation to determine if it represents sustainable policy or temporary anomaly affecting dividend security.

Our DRIP Stock Selection Methodology

Cash Flow Analysis (50% Weight):

- Cash flow payout ratio above 40% ensuring dividends are well-covered by operational cash flows

- Consistency of cash generation across business cycles and economic conditions

- Free cash flow growth supporting future dividend increases

Dividend Growth Assessment (30% Weight):

- Historical dividend per share growth across 1-year, 3-year, and 10-year periods

- Dividend payment consistency and management commitment to shareholder returns

- Sustainable growth rates supported by underlying business fundamentals

Business Quality Evaluation (20% Weight):

- Market leadership positions and competitive advantages

- Financial strength and balance sheet quality

- Predictable revenue streams and defensive business characteristics supporting long-term dividend sustainability

Key Takeaways for DRIP Investors

✅ Exceptional Commitment: Oracle (76.4%) and Novo Nordisk (68.0%) demonstrate strong cash flow payout ratios with growth potential

✅ Dividend Growth Leaders: Broadcom (35.8% 10Y growth) and TSMC (20.1% 10Y growth) offer exceptional expansion for compounding

✅ Balanced Opportunities: Home Depot and P&G combine attractive yields with sustainable growth potential

✅ Sector Diversification: Opportunities span healthcare, technology, consumer goods, and energy sectors

✅ Caution Required: Eli Lilly's 757.2% payout ratio requires careful monitoring for sustainability concerns

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best High Free Cash Flow Stocks

📖 10 Best Undervalued Dividend Stocks

📖 9 Best Small-Cap Growth Stocks

FAQ About DRIP Investing

What makes cash flow payout ratios more important than dividend payout ratios for DRIP investing?

Cash flow payout ratios provide a more accurate picture of dividend sustainability because they measure actual cash available for shareholder returns after covering operational and capital expenditure needs. Companies like Oracle show a 76.4% cash flow payout ratio versus 36.5% dividend payout ratio, reflecting the difference between accounting earnings and actual cash generation. For DRIP investors, cash flow sustainability matters more than reported earnings, as it indicates the company's ability to maintain and grow dividend payments over extended periods.

How do high cash flow payout ratios impact long-term dividend growth potential?

High cash flow payout ratios can indicate strong management confidence in sustainable cash generation, but investors must assess whether these ratios are sustainable long-term. Companies like Novo Nordisk (68.0%) and Home Depot (63.9%) maintain high ratios while funding growth investments, suggesting efficient capital allocation. However, extremely high ratios like Eli Lilly's 757.2% may limit future dividend growth if they represent unsustainable cash outflows rather than normal operations.

Should DRIP investors prioritize current dividend yield or dividend growth rates?

DRIP investors should typically prioritize dividend growth over current yield because reinvestment compounds the benefits of growing dividends over time. Companies like Broadcom (0.9% yield, 35.8% 10-year growth) and TSMC (1.2% yield, 20.1% 10-year growth) demonstrate how modest current yields with strong growth create substantial wealth over decades through automatic reinvestment. However, a balanced approach considering both current income needs and growth potential often provides optimal results.

How important is dividend consistency versus growth for successful DRIP investing?

Dividend consistency provides the foundation for successful DRIP investing, while growth amplifies wealth creation over time. Dividend Kings like Procter & Gamble and Aristocrats like Johnson & Johnson offer exceptional consistency with modest growth, while companies like Novo Nordisk provide higher growth with shorter track records. The ideal DRIP portfolio combines both consistent dividend payers for stability and growing dividend companies for wealth acceleration, balanced according to individual risk tolerance and investment timeline.

What sectors provide the best opportunities for DRIP investing in 2025?

Healthcare and technology sectors offer compelling DRIP opportunities with companies like Eli Lilly, Novo Nordisk, Oracle, and Broadcom demonstrating strong cash flow payout ratios and dividend growth potential. Consumer staples (P&G, Home Depot) provide defensive characteristics with consistent returns, while energy companies (Exxon) offer higher current yields with commodity exposure. Diversification across sectors reduces risk while capturing different economic cycle benefits, with healthcare and technology offering the strongest growth potential for long-term wealth building.

Important DRIP Considerations: Most companies offer direct DRIP programs allowing commission-free dividend reinvestment, though some may charge nominal fees. Investors should verify current DRIP availability and terms directly with companies or brokers. Tax implications of dividend reinvestment should be considered, as dividends remain taxable even when automatically reinvested.

Special Note on Eli Lilly: Eli Lilly's exceptional 757.2% cash flow payout ratio in the LTM period should be investigated further by investors to understand the underlying causes (e.g., one-time cash outflows, large R&D investments, or legal settlements) and confirm long-term dividend sustainability before making investment decisions.