Best 10 Value Stocks: High-Quality Companies With Strong Profitability [2025 Guide]

![Best 10 Value Stocks: High-Quality Companies With Strong Profitability [2025 Guide]](/content/images/size/w1200/2025/02/2025---stocks.png)

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Many investors assume that finding quality stocks at reasonable prices is a thing of the past in today's market. That's why they often overlook exceptional businesses hiding in plain sight.

But here's what most people don't realize:

Some companies consistently deliver superior returns on invested capital (ROIC) while trading at attractive valuations relative to their intrinsic value. These hidden gems often combine strong competitive advantages with excellent capital allocation.

If you're searching for undervalued stocks, high-quality businesses, or companies with sustainable competitive advantages that also maintain high profitability metrics, this analysis will be invaluable.

Here are 10 high-quality stocks with proven profitability that demonstrate you don't have to choose between value and excellence.

10 Undervalued Compounders With Quality and Profitability Ratings Above 7

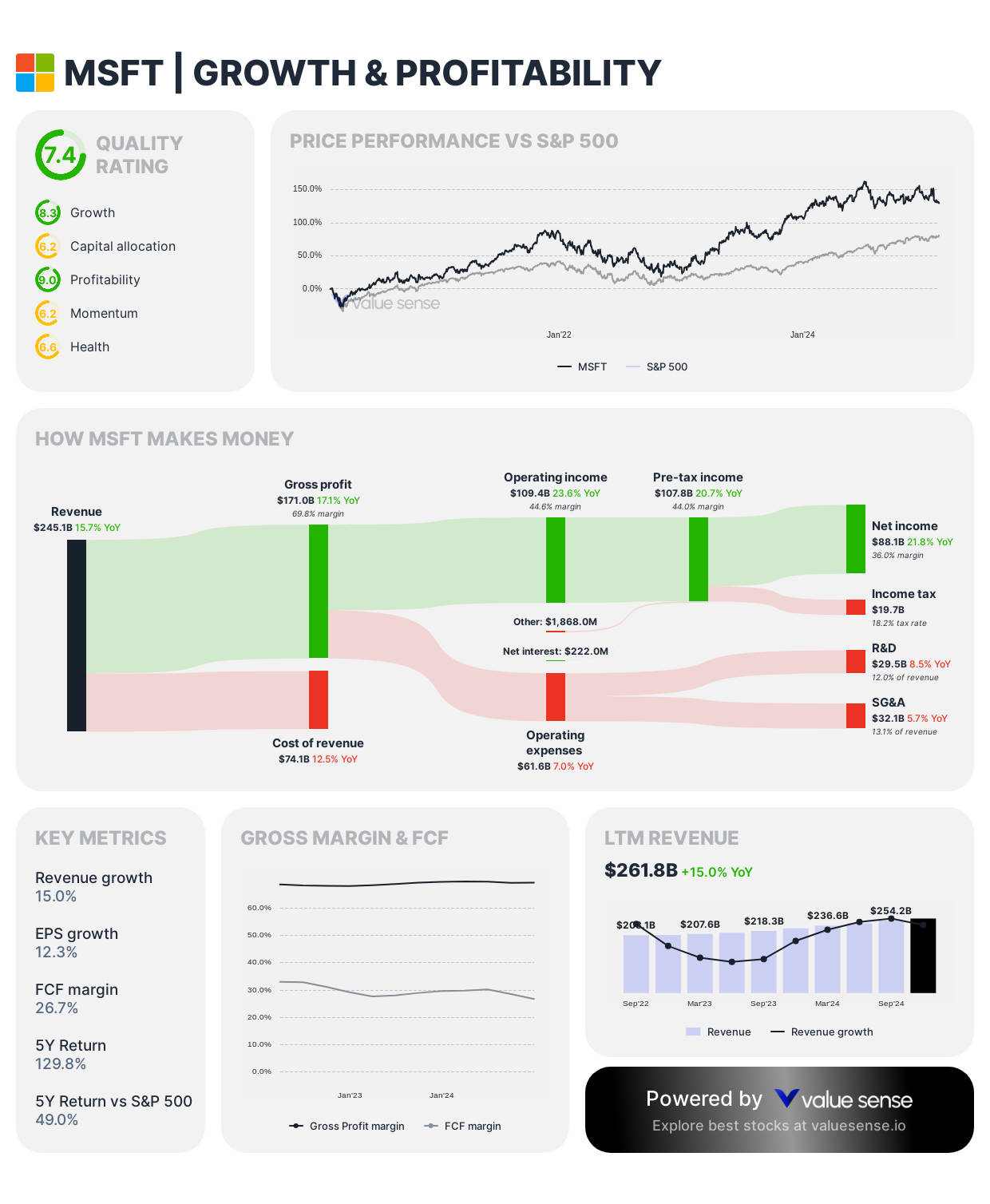

1. Microsoft Corporation ($MSFT)

- Undervalued: 1.7%

- Quality Score: 7.4 / 10

- Profitability: 9.0 / 10

- The tech giant continues to dominate enterprise software while expanding its AI capabilities

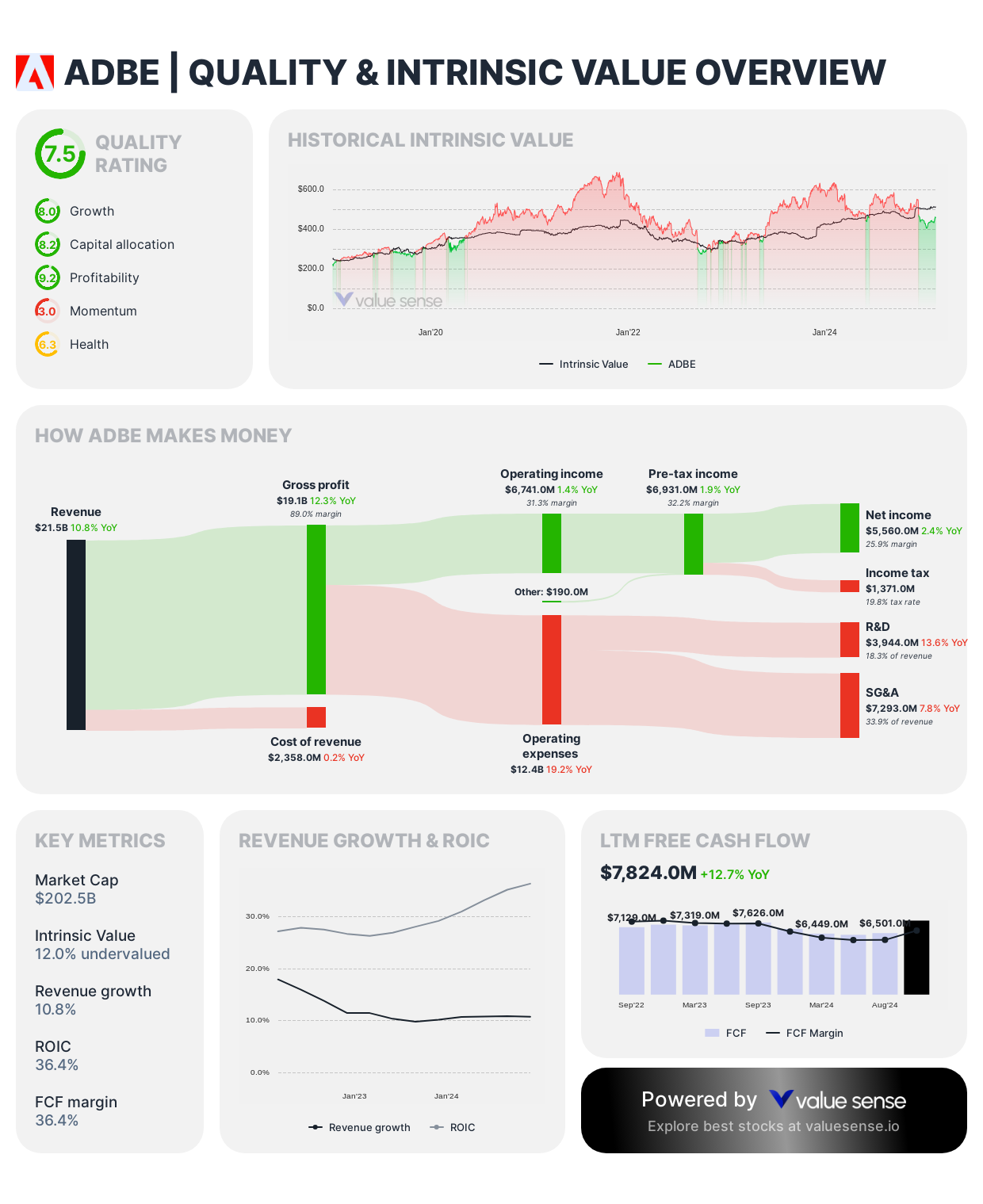

2. Adobe Inc. ($ADBE)

- Undervalued: 17.7%

- Quality Score: 7.5 / 10

- Profitability: 9.2 / 10

- Creative software leader with strong recurring revenue and high switching costs

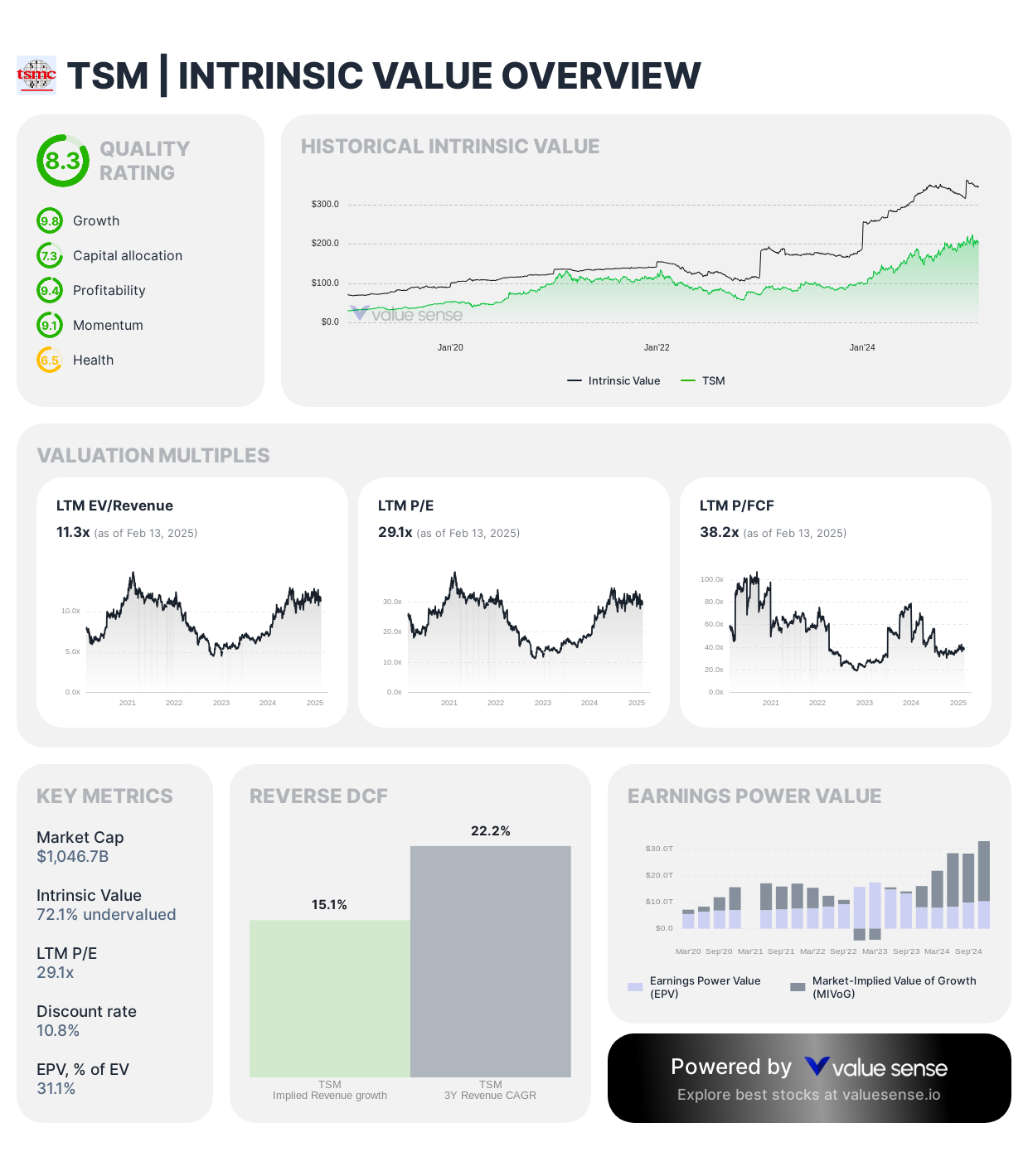

3. Taiwan Semiconductor ($TSM)

- Undervalued: 62.4%

- Quality Score: 8.2 / 10

- Profitability: 9.2 / 10

- World's largest semiconductor foundry with unmatched manufacturing capabilities

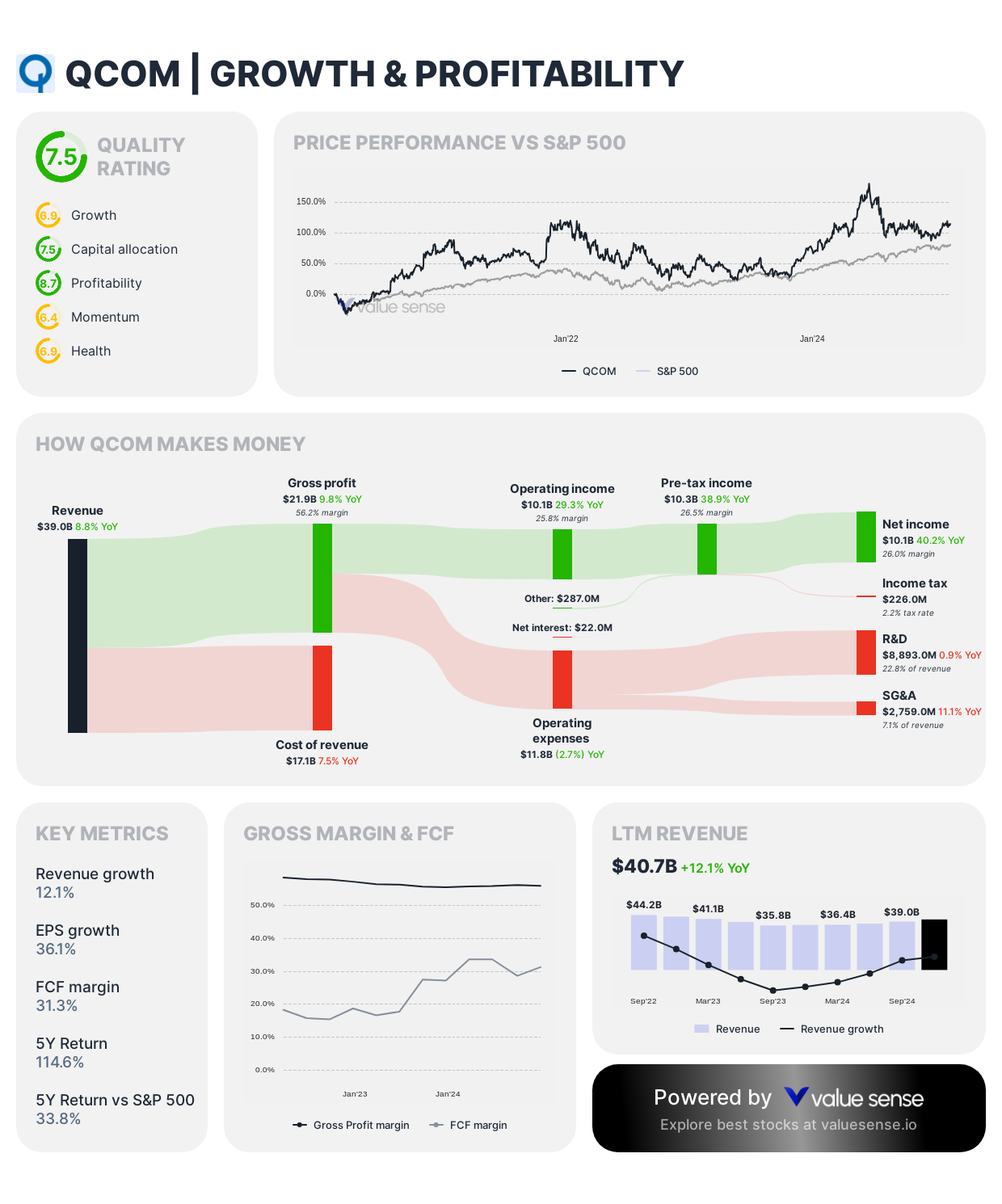

4. QUALCOMM ($QCOM)

- Undervalued: 76.8%

- Quality Score: 7.5 / 10

- Profitability: 8.7 / 10

- Mobile chip leader well-positioned for 5G and IoT growth

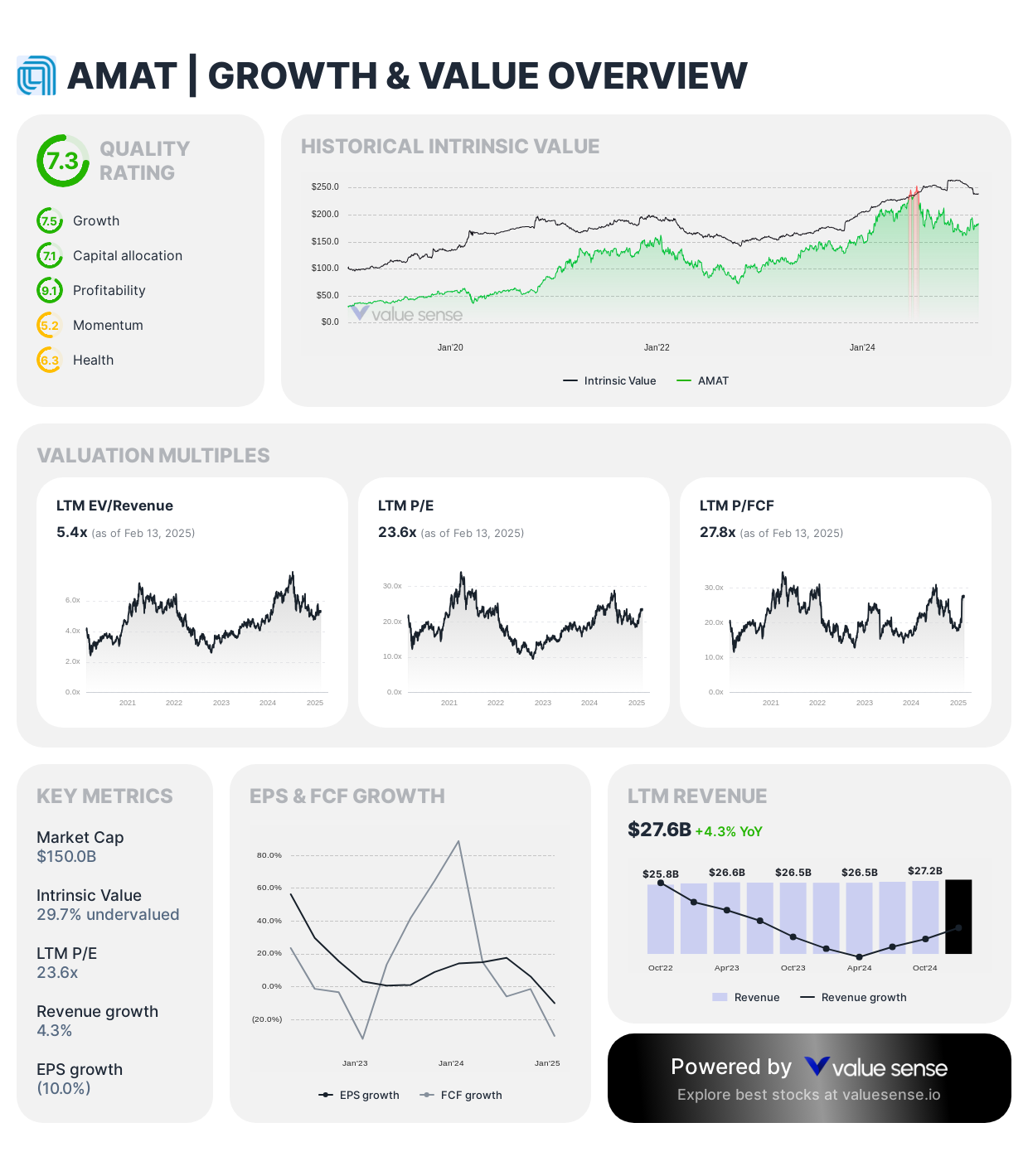

5. Applied Materials ($AMAT)

- Undervalued: 31.3%

- Quality Score: 7.3 / 10

- Profitability: 9.1 / 10

- Essential semiconductor equipment supplier benefiting from chip demand

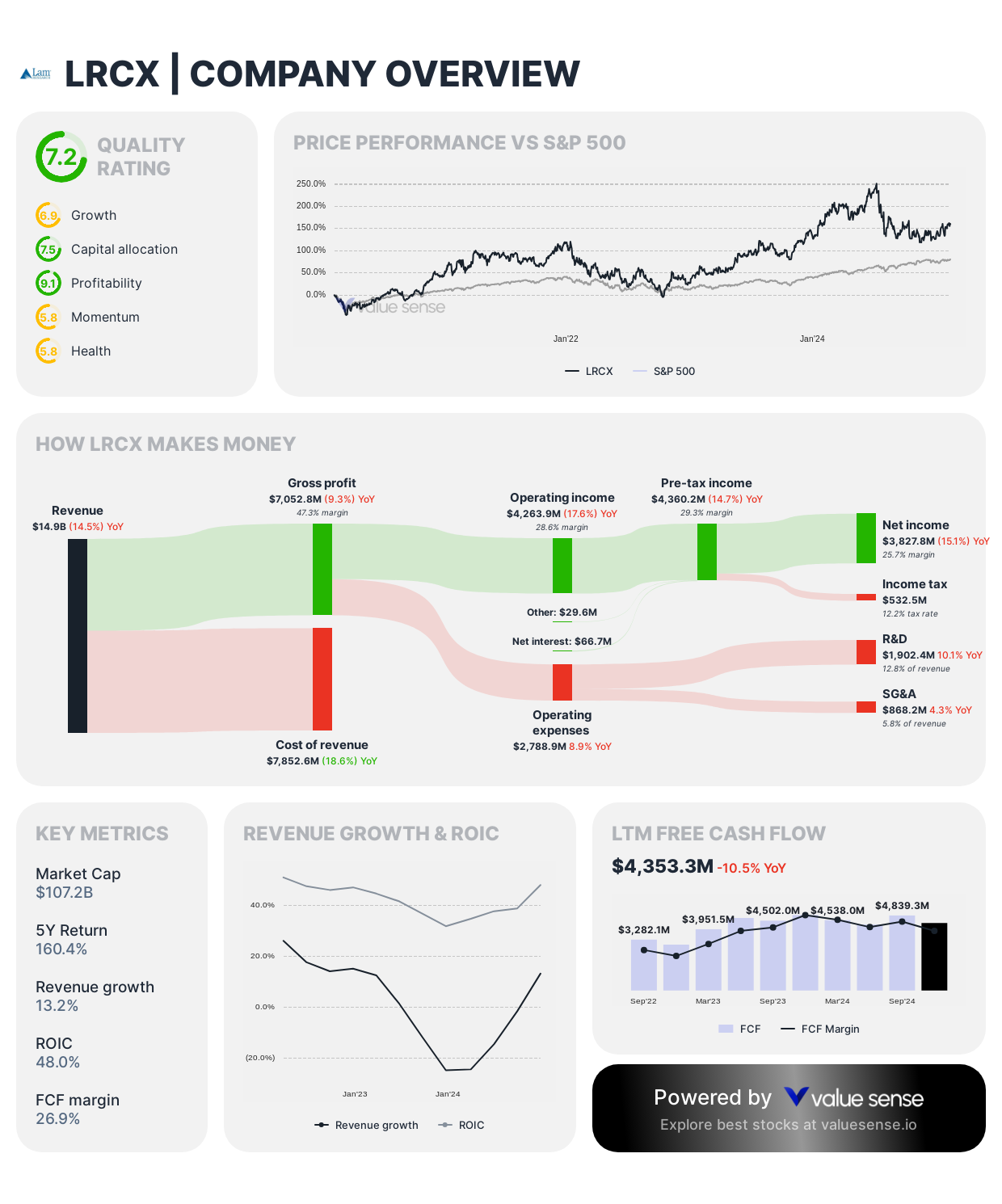

6. Lam Research ($LRCX)

- Undervalued: 30.7%

- Quality Score: 7.2 / 10

- Profitability: 9.1 / 10

- Critical semiconductor equipment manufacturer with high barriers to entry

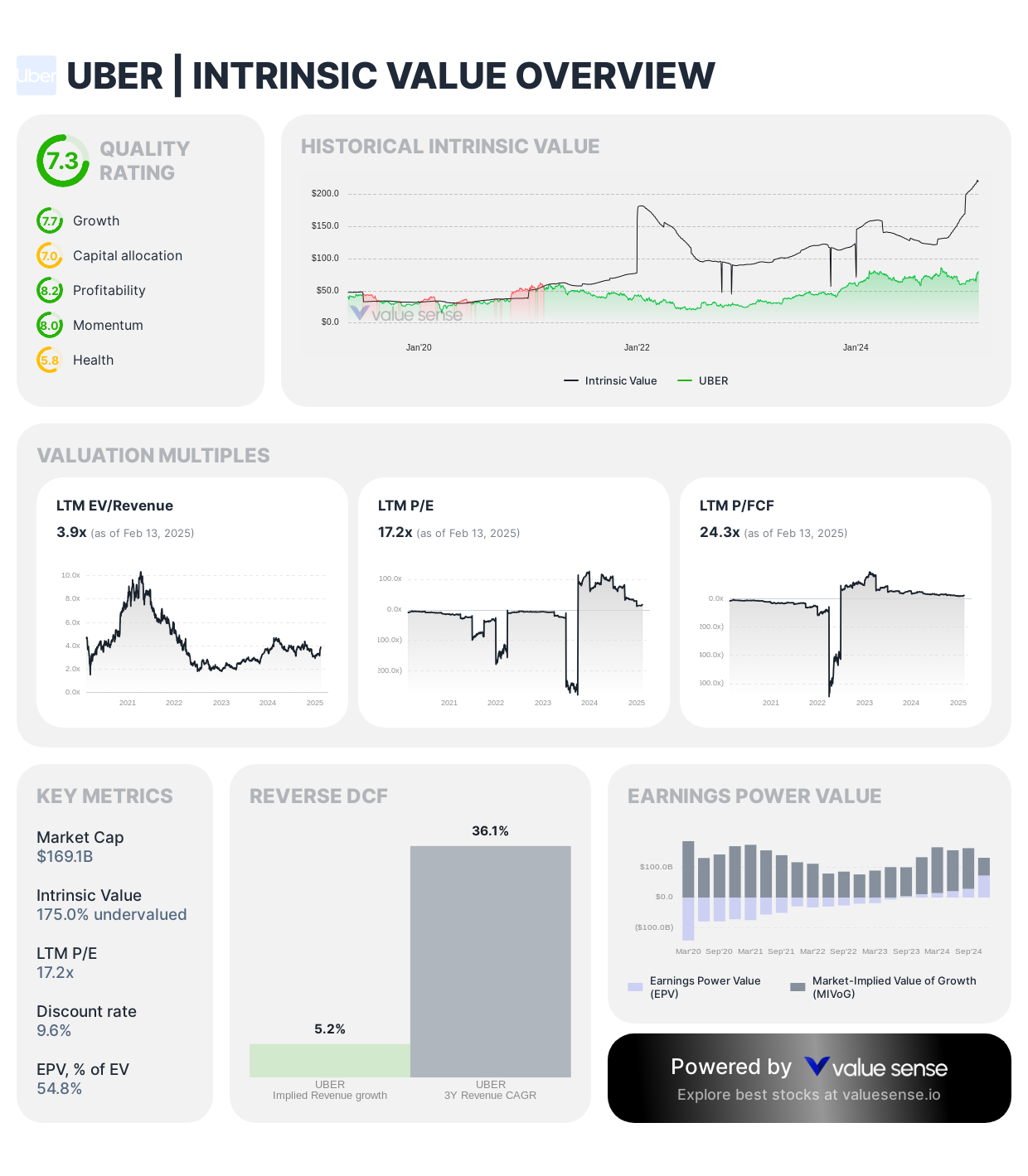

7. Uber Technologies ($UBER)

- Undervalued: 177.9%

- Quality Score: 7.3 / 10

- Profitability: 8.2 / 10

- Mobility platform achieving profitability with strong network effects

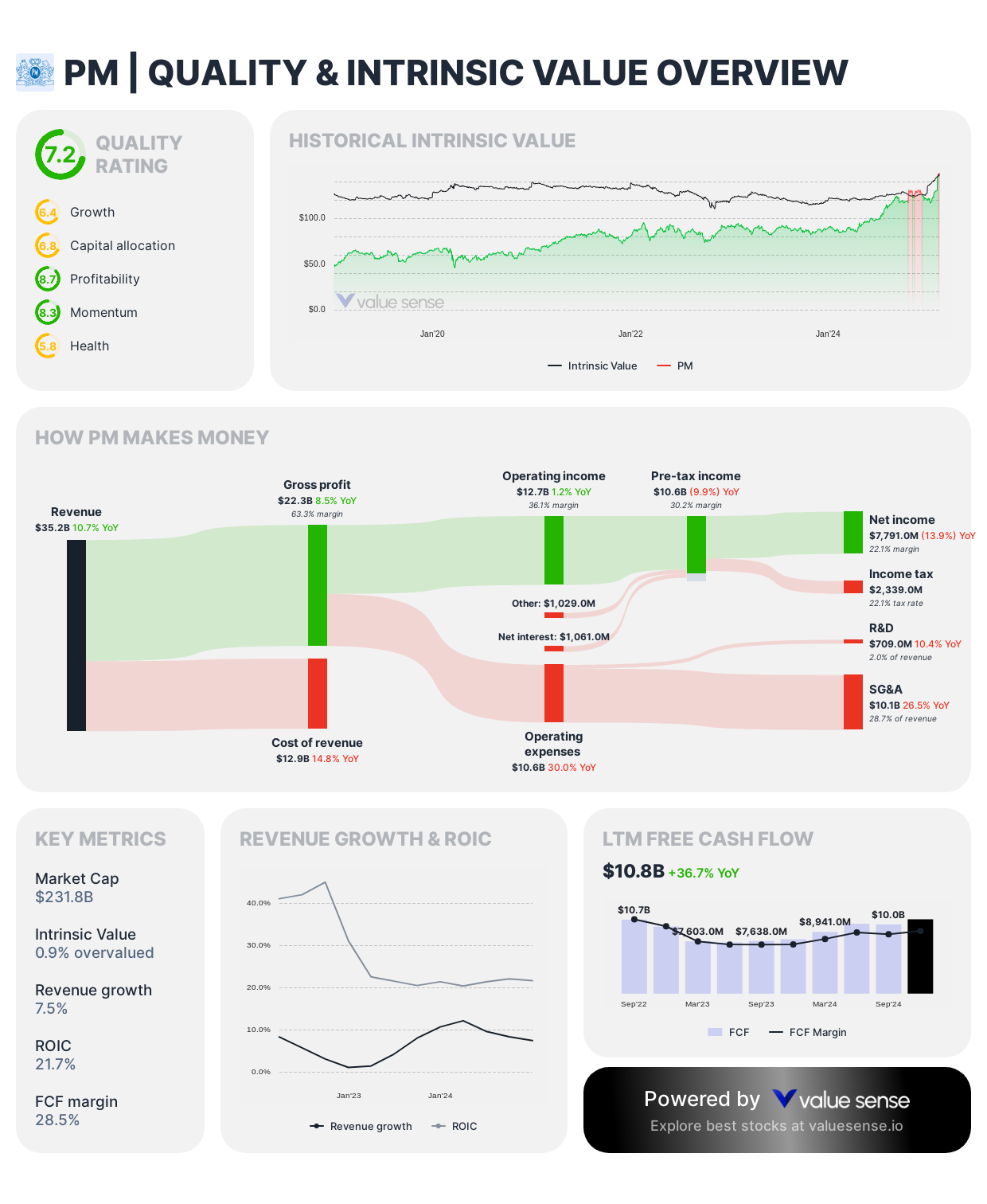

8. Philip Morris International ($PM)

- Undervalued: 15.7%

- Quality Score: 7.2 / 10

- Profitability: 8.7 / 10

- Global tobacco giant transitioning to reduced-risk products

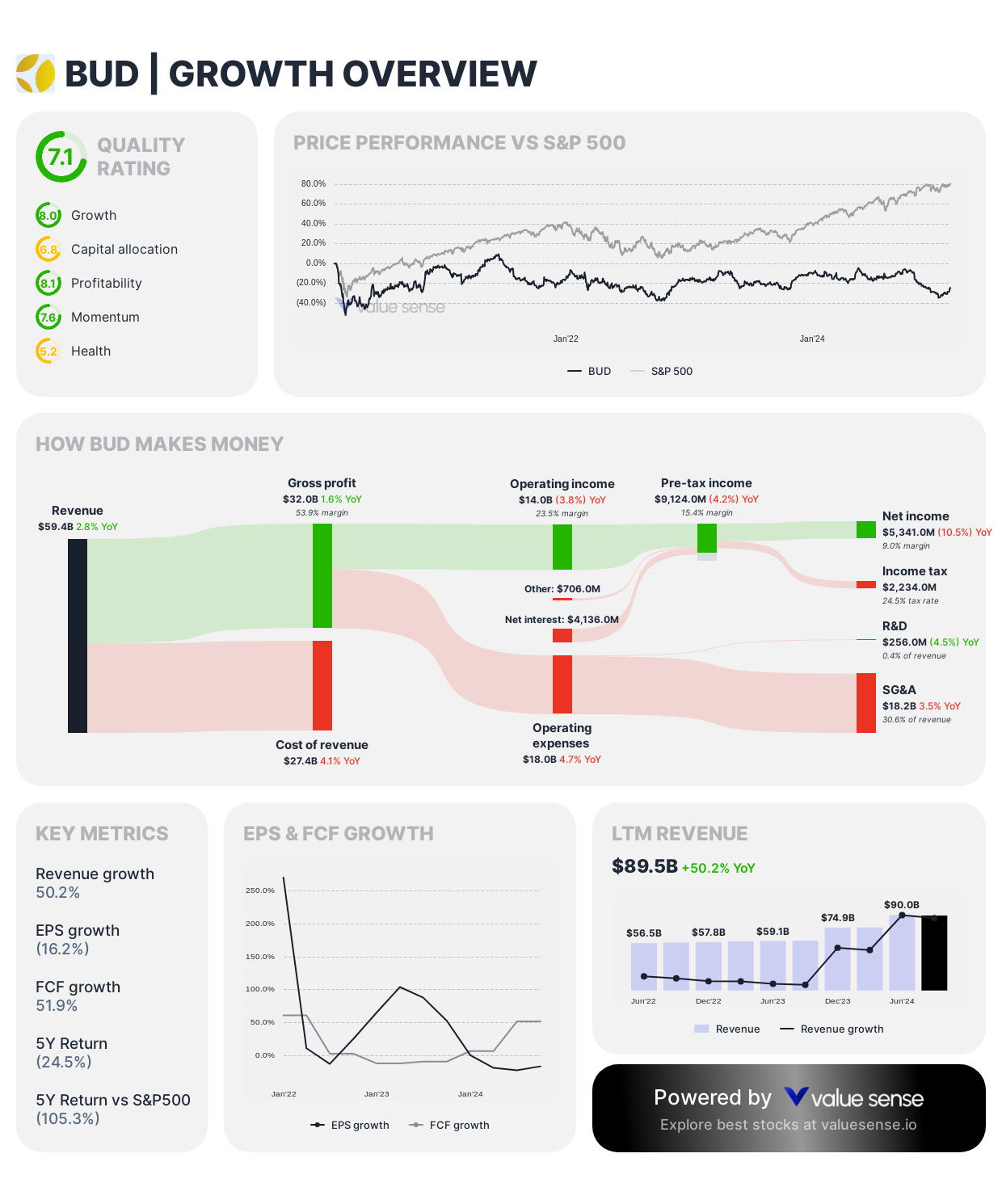

9. Anheuser-Busch InBev ($BUD)

- Undervalued: 4.9%

- Quality Score: 7.1 / 10

- Profitability: 8.1 / 10

- Global beverage leader with a strong brand portfolio and distribution

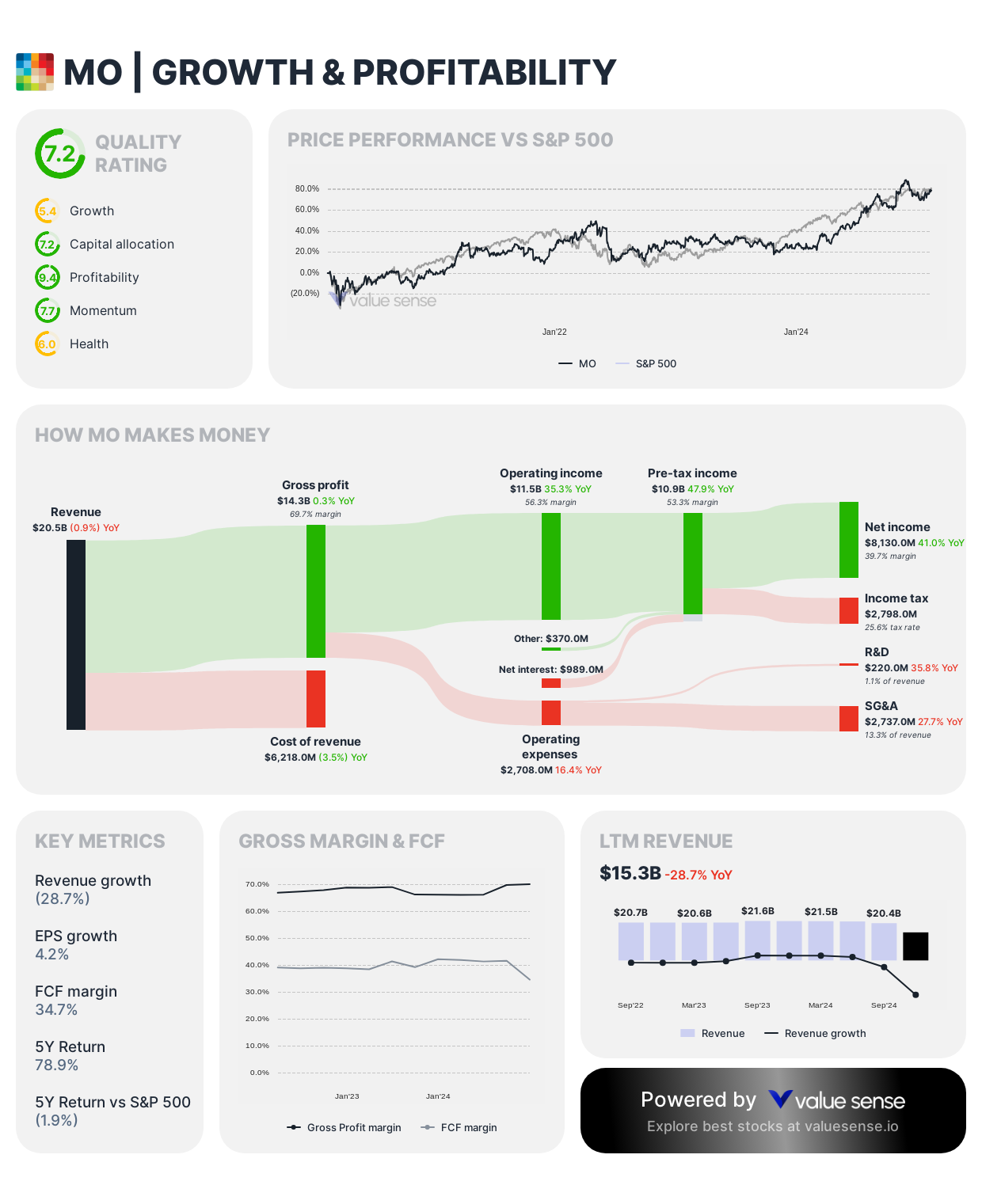

10. Altria Group ($MO)

- Undervalued: 56.0%

- Quality Score: 7.2 / 10

- Profitability: 9.4 / 10

- Tobacco giant with pricing power and transition to smoke-free products

Screening Criteria: What Makes These Stocks Stand Out?

To identify truly exceptional companies, each stock had to meet these stringent quality and value metrics:

✅ Undervalued Based on Intrinsic Value (Ensures margin of safety and upside potential)

✅ Quality Rating > 7.0 / 10.0 (Indicates sustainable competitive advantages and strong business model)

✅ Profitability Rating > 7.0 / 10.0 (Shows superior capital allocation and operational efficiency)

These companies demonstrate superior business fundamentals, combining quality operations with attractive valuations. Their high profitability ratings suggest strong pricing power and efficient cost management, while quality scores above 7.0 indicate durable competitive advantages.

This makes them compelling candidates for high-quality value stocks and undervalued market leaders in 2025.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Stocks With Great Health Ratings and 15%+ Returns Over 5 Years

📖 High ROIC Stocks with Exceptional Quality and Momentum

📖 11 Low-Debt Stocks With High FCF Conversion and Revenue Growth

FAQ - Best 10 Value Stocks: High-Quality Companies With Strong Profitability

Q1: Which Value Stocks Are Most Undervalued in 2025?

Our analysis shows significant undervaluation in tech and semiconductor stocks, with QUALCOMM ($QCOM) being 76.8% undervalued and Taiwan Semiconductor ($TSM) showing a 62.4% discount to intrinsic value. Uber Technologies ($UBER) shows the highest potential upside at 177.9% undervaluation, while maintaining strong quality (7.3/10) and profitability (8.2/10) scores.

Q2: Are Semiconductor Stocks a Good Investment in 2025?

Semiconductor stocks currently offer compelling value opportunities. Industry leaders like TSM, QCOM, AMAT, and LRCX combine high profitability ratings (8.7-9.2/10) with significant undervaluation (30-76%). These companies benefit from long-term trends in AI, 5G, and cloud computing while trading at attractive valuations due to near-term chip cycle concerns.

Q3: What Makes a Stock "High-Quality" in Today's Market?

High-quality stocks typically demonstrate:

- Quality ratings above 7.0/10

- Strong competitive advantages

- Efficient capital allocation

- Sustainable market leadership

- High barriers to entry Companies like Microsoft (7.4/10) and Adobe (7.5/10) exemplify these characteristics through their dominant market positions and robust business models.

Q4: Which Dividend Stocks Have the Best Quality Ratings?

Among dividend-paying stocks, our analysis highlights:

- Philip Morris International ($PM): Quality 7.2/10, Profitability 8.7/10

- Altria Group ($MO): Quality 7.2/10, Profitability 9.4/10

- Anheuser-Busch InBev ($BUD): Quality 7.1/10, Profitability 8.1/10 These consumer staples leaders combine strong dividend yields with high quality metrics.

Q5: How to Find Undervalued Quality Stocks in 2025?

To identify undervalued quality stocks, focus on these key metrics:

- Quality Rating > 7.0/10

- Profitability Rating > 7.0/10

- Significant discount to intrinsic value

- Strong competitive position

- Sustainable business advantages Top examples include Taiwan Semiconductor ($TSM) and QUALCOMM ($QCOM), which meet all these criteria while trading at substantial discounts to their intrinsic values.