Bill Ackman - Pershing Square Capital Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

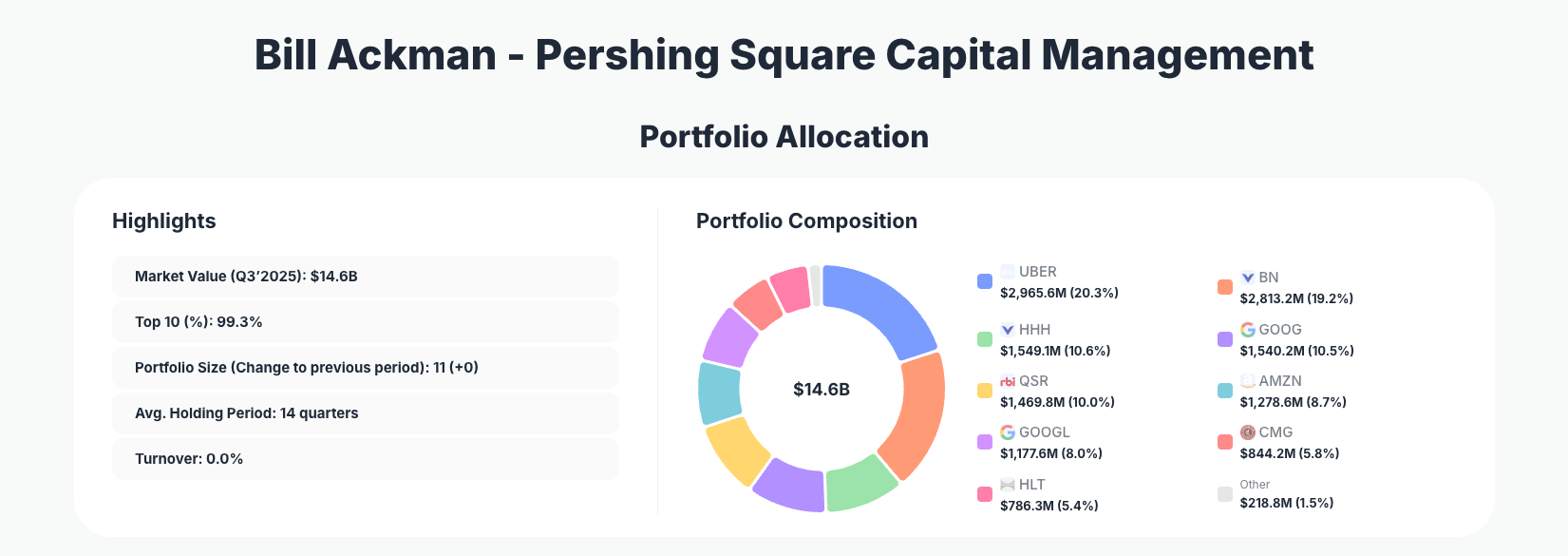

Bill Ackman, the activist investing maestro behind Pershing Square Capital Management, showcases his disciplined approach in the latest 13F filing. His $14.6B Q3 2025 portfolio maintains extreme concentration across 11 positions, with modest trims signaling profit-taking amid market highs rather than a shift in core conviction.

Portfolio Overview: The Power of Persistent Concentration

Portfolio Highlights (Q3’2025): - Market Value: $14.6B - Top 10 Holdings: 99.3% - Portfolio Size: 11 +0 - Average Holding Period: 14 quarters - Turnover: 0.0%

Pershing Square's portfolio exemplifies Ackman's signature strategy: ultra-concentrated bets on a handful of high-quality businesses with durable competitive advantages. With 99.3% of the $14.6B portfolio locked into just 10 holdings, the fund demonstrates unwavering confidence in its selections, avoiding the diversification trap that dilutes returns for many managers. The zero turnover rate underscores a long-term orientation, where positions are held for years—averaging 14 quarters—allowing winners to compound without unnecessary trading friction.

This structure minimizes risk through deep research rather than spreading bets thin. Ackman's activist roots shine through in selections like consumer and tech leaders capable of transformation, but the Q3 filing shows restraint with only minor adjustments. Tracking this via ValueSense reveals how such focus has driven outsized returns historically, rewarding patience in volatile markets. The stable portfolio size at 11 positions (+0 changes) signals no major new initiatives or exits, reinforcing stability in an uncertain economic backdrop.

Top Holdings: Strategic Trims in Tech and Consumer Powerhouses

The Pershing Square portfolio leads with Uber Technologies, Inc. (UBER) at 20.3% $2,965.6M, trimmed by a modest 0.10%—a tweak likely capturing gains in the ride-sharing giant's profitability turnaround. Close behind is Brookfield Corporation (BN) at 19.2% $2,813.2M, reduced 0.34%, maintaining exposure to the asset management's global real estate and infrastructure empire. Restaurant Brands International Inc. (QSR) holds 10.0% $1,469.8M after a 0.37% cut, reflecting steady faith in its Burger King and Tim Hortons franchise model.

Notable among changes is Alphabet Inc. (GOOGL) at 8.0% $1,177.6M, significantly reduced by 9.68%, suggesting profit realization in the search and AI leader amid valuation concerns. Complementing these, steady anchors include Howard Hughes Holdings Inc. (HHH) at 10.6% $1,549.1M with no change, betting on master-planned community development. Alphabet Inc. (GOOG) stays at 10.5% $1,540.2M, no change, balancing the class split.

The roster rounds out with Amazon.com, Inc. (AMZN) at 8.7% ($1,278.6M, no change), leveraging e-commerce and cloud dominance; Chipotle Mexican Grill, Inc. (CMG) at 5.8% ($844.2M, no change) for fast-casual growth; and Hilton Worldwide Holdings Inc. (HLT) at 5.4% ($786.3M, no change), capitalizing on travel recovery. These positions blend tech disruptors, consumer staples, and real assets, with changes prioritizing discipline over impulse.

What the Portfolio Reveals About Ackman's Strategy

Ackman's Q3 moves highlight a refined activist-value hybrid: prioritizing quality compounders with global scale while trimming on strength to manage risk.

- Sector Focus: Heavy tilt toward technology (Uber, Alphabet dual-class, Amazon ~47%) and consumer/discretionary (QSR, CMG, HLT ~21%), with Brookfield and HHH adding real assets (~30%) for inflation hedging.

- Quality Over Speculation: Holdings feature network effects (Uber, Alphabet), brand moats (Chipotle, Hilton), and operational scale (Amazon, Restaurant Brands), avoiding cyclical traps.

- Risk Management: Modest reduces (total turnover 0.0%) show profit-taking without abandoning theses, maintaining geographic diversity via U.S.-centric but globally operating firms.

- Long-Horizon Conviction: 14-quarter average hold signals patience, letting winners run amid short-term noise.

This reveals Ackman's evolution: less aggressive activism, more stewardship of proven winners.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Uber Technologies, Inc. | $2,965.6M | 20.3% | Reduce 0.10% |

| Brookfield Corporation | $2,813.2M | 19.2% | Reduce 0.34% |

| Howard Hughes Holdings Inc. | $1,549.1M | 10.6% | No change |

| Alphabet Inc. | $1,540.2M | 10.5% | No change |

| Restaurant Brands International Inc. | $1,469.8M | 10.0% | Reduce 0.37% |

| Amazon.com, Inc. | $1,278.6M | 8.7% | No change |

| Alphabet Inc. | $1,177.6M | 8.0% | Reduce 9.68% |

| Chipotle Mexican Grill, Inc. | $844.2M | 5.8% | No change |

| Hilton Worldwide Holdings Inc. | $786.3M | 5.4% | No change |

This table underscores Pershing Square's hallmark concentration, with the top two holdings alone commanding nearly 40% and the top 10 covering 99.3% of the portfolio. The minor reduces in UBER, BN, QSR, and especially GOOGL 9.68% indicate tactical rebalancing, harvesting profits from outperformers without disrupting the core structure. Such positioning amplifies returns from conviction picks but demands rigorous thesis validation, as Ackman has demonstrated through years of outperformance.

Investment Lessons from Bill Ackman's Pershing Square Approach

Ackman's Q3 portfolio distills timeless principles for high-conviction investing:

- Extreme Concentration Beats Diversification: 99.3% in 10 names proves that deep understanding of few businesses trumps broad exposure.

- Trim Winners, Don't Sell: Modest reduces like UBER's 0.10% show discipline in position sizing without abandoning quality.

- Long Holding Periods Unlock Compounding: 14 quarters average emphasizes patience over trading.

- Activist Mindset on Operations: Selections like CMG and QSR reflect pushes for efficiency in consumer-facing moats.

- Balance Growth with Resilience: Tech heavies paired with real assets (BN, HHH) hedge volatility.

Looking Ahead: What Comes Next?

With turnover at 0.0% and portfolio size unchanged at 11, Pershing Square appears poised for continuity rather than upheaval. No explicit cash position is detailed, but low activity suggests dry powder for opportunistic activist plays in undervalued sectors like healthcare or energy transitions. Current tech/consumer tilt positions well for AI-driven growth and travel rebound, but trims signal caution on overvalued names amid potential rate cuts or election volatility. Watch for Q4 filings on Pershing Square's page—new bets could emerge in resilient compounders if markets correct.

FAQ about Bill Ackman Portfolio

Q: What are the most significant changes in Ackman's Q3 2025 13F filing?

A: Key moves include a 9.68% reduction in GOOGL (8.0% weight), alongside minor trims in UBER 0.10%, BN 0.34%, and QSR 0.37%, reflecting profit-taking without major overhauls.

Q: Why does Pershing Square maintain such high portfolio concentration?

A: Ackman's strategy bets big on thoroughly vetted ideas, with 99.3% in top 10 holdings to maximize returns from high-conviction theses, backed by activist influence and long-term holds averaging 14 quarters.

Q: What sectors dominate Ackman's holdings?

A: Technology (~47% via UBER, Alphabet, AMZN) leads, followed by consumer/discretionary (~21% in QSR, CMG, HLT) and real assets (~30% in BN, HHH), blending growth with defensive qualities.

Q: How can I track and follow Bill Ackman's Pershing Square portfolio?

A: Monitor quarterly 13F filings via the SEC (with a 45-day lag) or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/pershing-square for real-time analysis, historical changes, and visualizations.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!