Bill Ackman's Portfolio Analysis Q2 2025: The $13.7B Pershing Square Playbook

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

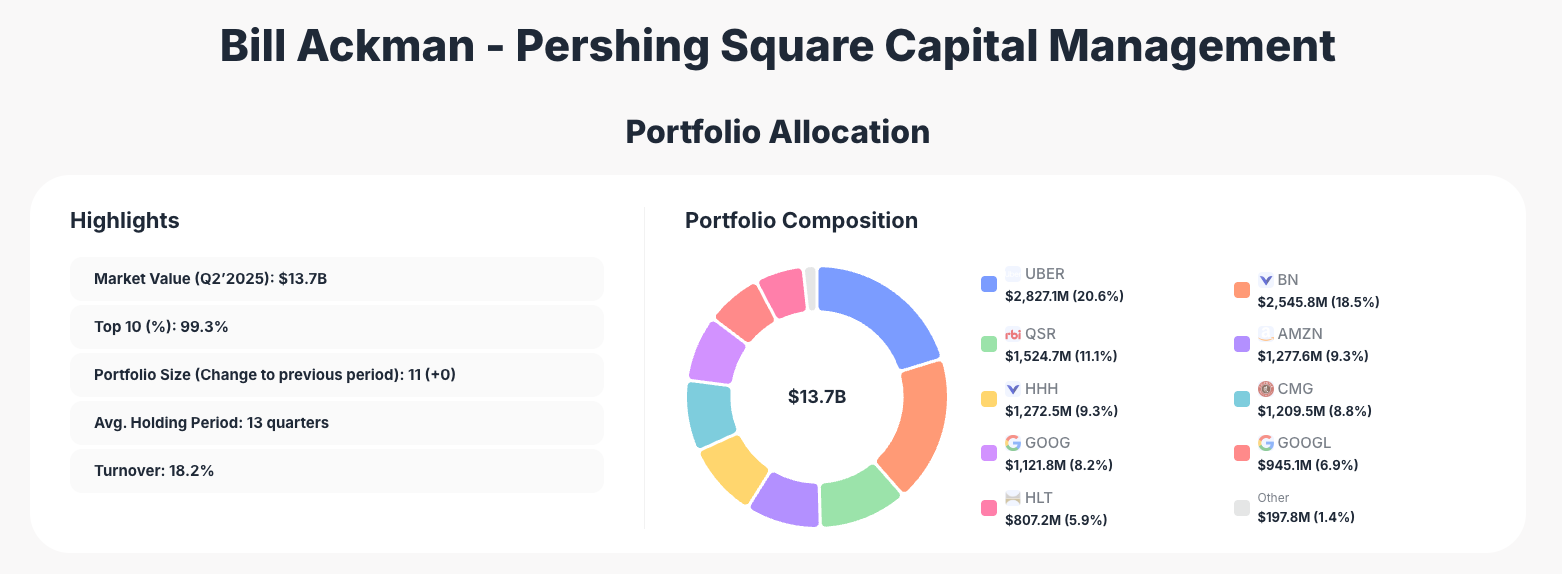

Bill Ackman, founder and CEO of Pershing Square Capital Management, continues to demonstrate why he's considered one of Wall Street's most influential activist investors. His Q2 2025 portfolio reveals a masterclass in concentrated investing, with $13.7 billion deployed across just 11 carefully selected positions that reflect his signature high-conviction approach.

Unlike traditional diversified funds, Ackman's strategy centers on deep research, significant stakes, and the patience to hold positions for years rather than quarters. His latest moves, particularly a massive new Amazon position, signal a strategic pivot toward technology giants positioned to benefit from the AI revolution.

Portfolio Overview: Ultra-Concentrated Excellence

Pershing Square's Q2 2025 portfolio showcases Ackman's unwavering commitment to concentrated investing:

- Total Portfolio Value: $13.7 billion

- Number of Positions: 11 (unchanged from previous quarter)

- Top 10 Holdings: 99.3% of total portfolio

- Average Holding Period: 13 quarters (over 3 years)

- Portfolio Turnover: 18.2% (indicating low trading activity)

This extreme concentration reflects Ackman's philosophy: "It's far better to own a significant stake in the fate of a company you believe in than to diversify for the sake of diversification."

Top Holdings Analysis: Tech Titans and Proven Winners

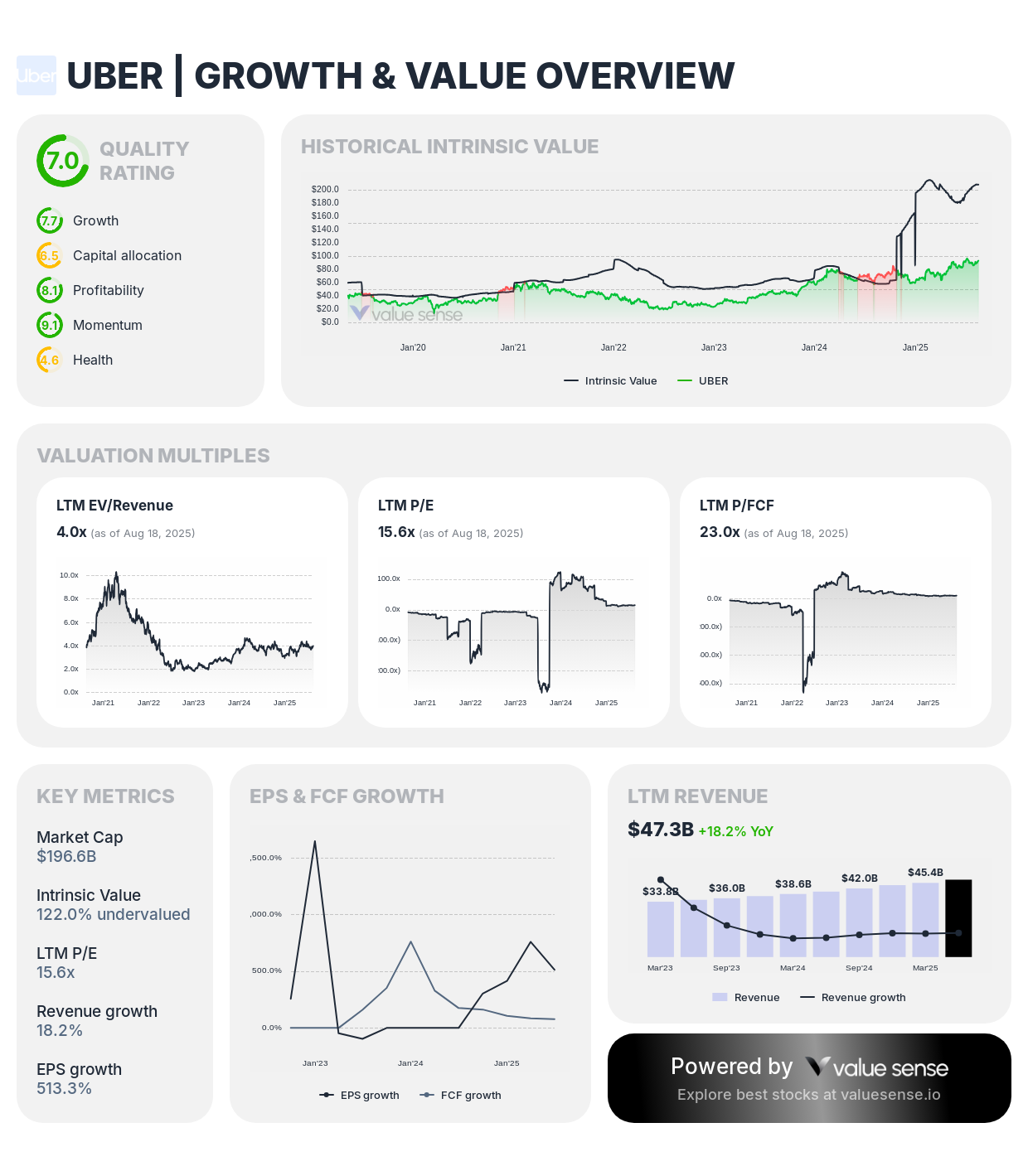

1. Uber Technologies (UBER) - 20.6% ($2.83B)

The crown jewel of Ackman's portfolio, Uber maintains its position as the largest holding with no changes during Q2. This massive $2.83 billion stake represents Ackman's conviction in the ride-sharing leader's long-term potential.

Investment Thesis:

- Global expansion opportunities in emerging markets

- Diversification beyond rides into delivery, freight, and autonomous vehicles

- Network effects creating sustainable competitive advantages

- Path to improved profitability as market matures

2. Brookfield Corporation (BN) - 18.5% ($2.55B)

The second-largest position saw a modest 0.38% increase, reflecting Ackman's continued confidence in the Canadian asset management giant. Brookfield's diversified alternative asset platform provides stable cash flows and inflation protection.

Strategic Value:

- Exposure to real estate, infrastructure, and renewable energy

- Strong dividend yield with consistent growth

- Professional management team with proven track record

- Hedge against inflation through real asset exposure

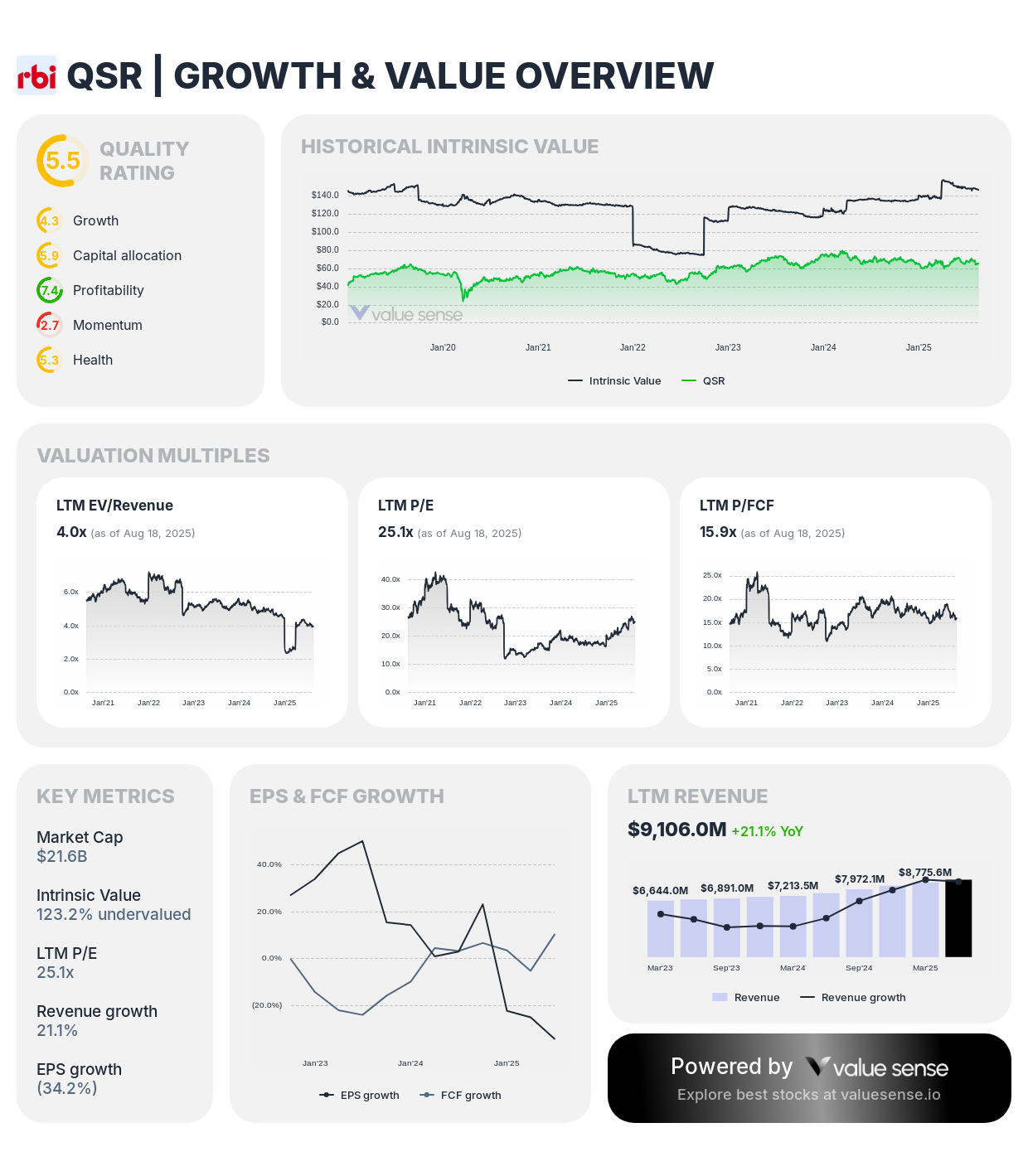

3. Restaurant Brands International (QSR) - 11.1% ($1.52B)

Unchanged position in the parent company of Tim Hortons, Burger King, and Popeyes. This holding represents Ackman's belief in strong franchise business models and global brand expansion.

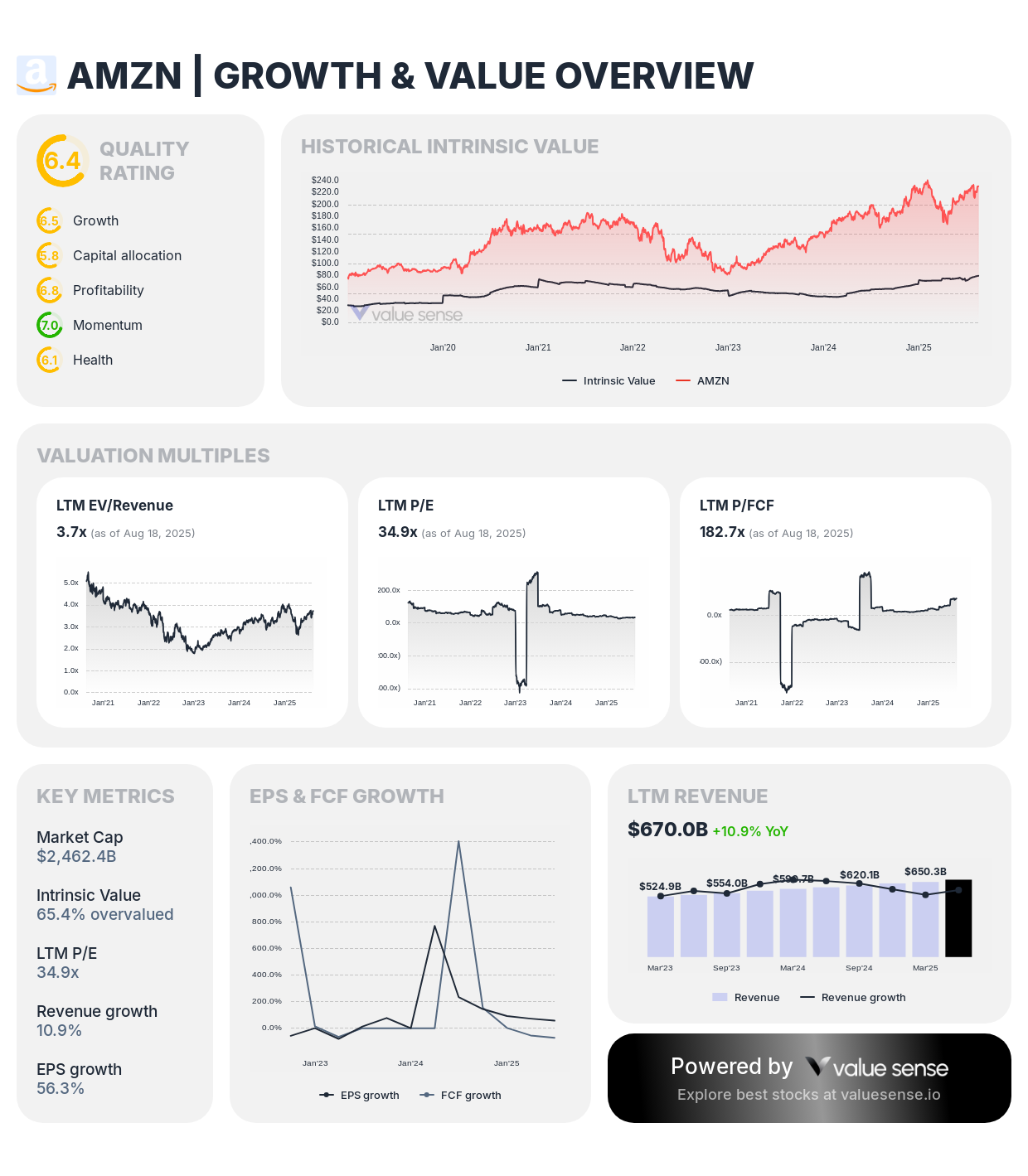

4. Amazon.com (AMZN) - 9.3% ($1.28B) - NEW POSITION

The quarter's most significant move, Ackman initiated a massive $1.28 billion position in Amazon, acquiring 5.82 million shares. This represents a major strategic shift toward technology and AI-leveraged businesses.

Why Amazon Now:

- Cloud computing dominance through AWS

- AI integration across all business segments

- E-commerce leadership with expanding margins

5. Howard Hughes Holdings (HHH) - 9.3% ($1.27B)

No changes to this real estate development position, reflecting Ackman's long-term view on urban land development and master-planned communities.

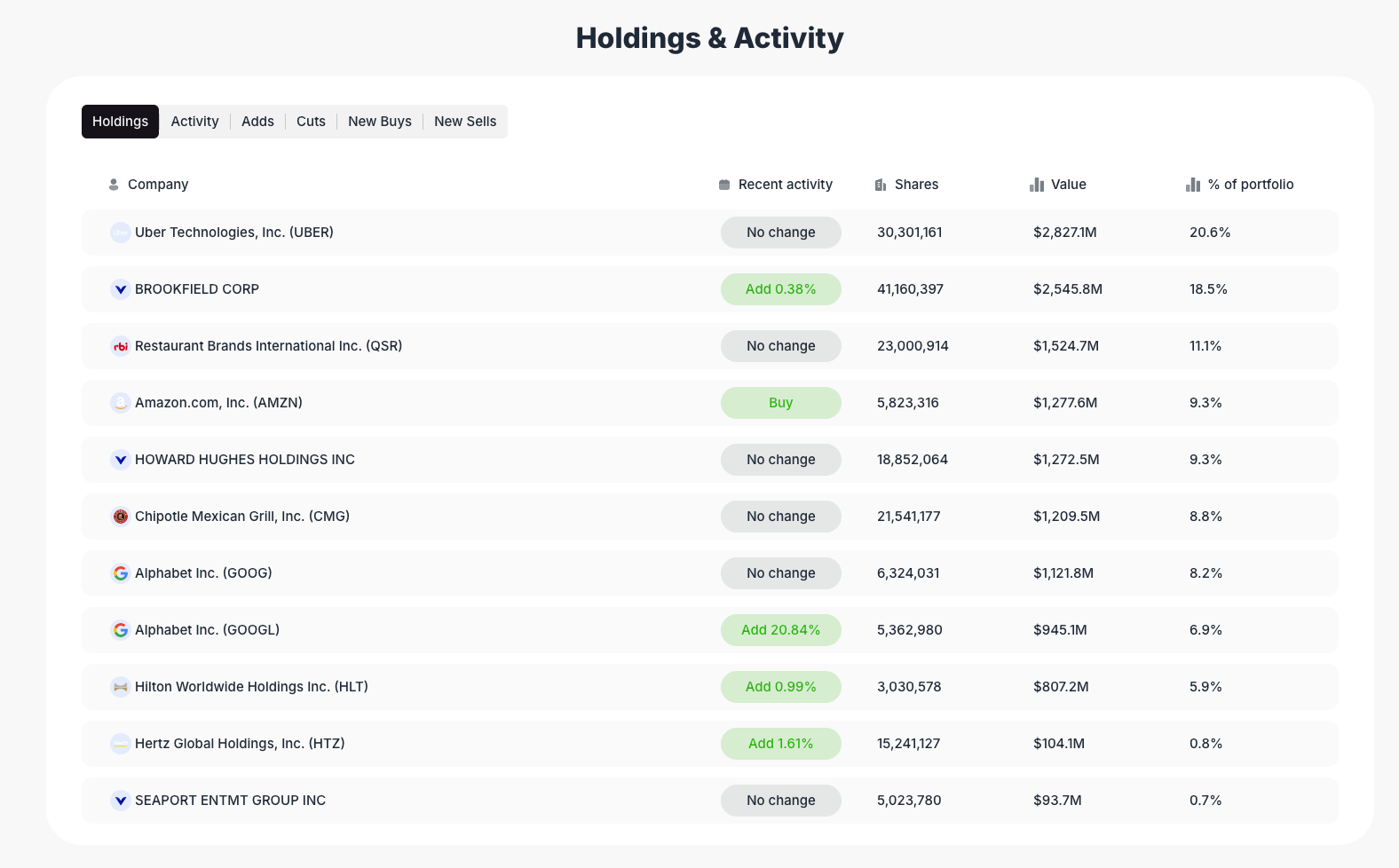

Holdings & Activity - Q2 2025 Detailed Breakdown

| Company | Ticker | Recent Activity | Shares | Value | % of Portfolio |

|---|---|---|---|---|---|

| Uber Technologies Inc. | UBER | No change | 30,301,161 | $2,827.1M | 20.6% |

| Brookfield Corp | BN | Add 0.38% | 41,160,397 | $2,545.8M | 18.5% |

| Restaurant Brands Intl Inc. | QSR | No change | 23,000,914 | $1,524.7M | 11.1% |

| Amazon.com Inc. | AMZN | New Buy | 5,823,316 | $1,277.6M | 9.3% |

| Howard Hughes Holdings Inc | HHH | No change | 18,852,064 | $1,272.5M | 9.3% |

| Chipotle Mexican Grill Inc. | CMG | No change | 2,541,177 | $1,209.5M | 8.8% |

| Alphabet Inc. | GOOGL | Add 20.84% | 5,362,980 | $945.1M | 6.9% |

| Alphabet Inc. | GOOG | No change | 6,324,031 | $1,121.8M | 8.2% |

| Hilton Worldwide Holdings | HLT | Add 0.99% | 3,030,578 | $807.2M | 5.9% |

| Hertz Global Holdings Inc. | HTZ | Add 1.61% | 15,241,127 | $104.1M | 0.8% |

| Seaport Entertainment Group | SPRT | No change | 5,023,780 | $93.7M | 0.7% |

Strategic Moves: The Tech Transformation

Major Technology Pivot

Ackman's Q2 moves signal a significant strategic shift toward technology companies positioned to benefit from artificial intelligence:

Combined Tech Exposure:

- Amazon (AMZN): $1.28B (9.3%)

- Alphabet (GOOGL + GOOG): $2.07B (15.1%)

- Total Tech Allocation: $3.35B (24.4% of portfolio)

This represents over $3.3 billion invested in just two mega-cap technology companies, demonstrating Ackman's conviction in the AI-driven transformation of these businesses.

The Amazon Thesis

Ackman's new Amazon position reflects several strategic considerations:

- AWS Dominance: Cloud computing leadership with AI integration

- E-commerce Evolution: Continued market share gains and margin expansion

- Valuation Opportunity: Stock trading below historical multiples

- Long-term Positioning: Beneficiary of digital transformation trends

Investment Philosophy: The Ackman Method

Core Principles

1. Extreme Concentration

- 11 positions controlling $13.7 billion

- Top 5 holdings represent 70% of portfolio

- Focus on best ideas rather than diversification

2. Long-term Conviction

- Average holding period of 13 quarters

- Low 18.2% turnover rate

- Patience to let thesis develop

3. Activist Approach

- Active engagement with management teams

- Board representation when appropriate

- Catalyst-driven investment selection

4. Quality Bias

- Focus on market-leading companies

- Strong competitive moats

- Experienced management teams

Risk Management Through Concentration

Contrary to conventional wisdom, Ackman argues that concentration reduces risk through:

- Deep Knowledge: Extensive research on each position

- Quality Selection: Only highest-conviction opportunities

- Active Monitoring: Continuous engagement with portfolio companies

- Flexibility: Ability to act quickly when needed

Sector Analysis: Diversified Concentration

Despite limited positions, Ackman achieves sector diversification:

Technology (24.4%)

- Amazon and Alphabet positions

- AI and cloud computing exposure

- Growth-oriented allocation

Transportation/Logistics (20.6%)

- Uber's platform dominance

- Network effect businesses

Asset Management (18.5%)

- Brookfield's alternative assets

- Inflation hedge positioning

Consumer/Restaurants (19.9%)

- QSR and Chipotle franchises

- Brand value and expansion

Real Estate Development (9.3%)

- Howard Hughes urban development

- Long-term value creation

Performance Context: Beating the Market Through Conviction

Pershing Square's track record demonstrates the power of concentrated investing:

Recent Performance Highlights:

- 2025 YTD: +12.7% (as of July 2025)

- Long-term Track Record: Consistent outperformance through cycles

- Risk-Adjusted Returns: Superior Sharpe ratios vs. broad market

The concentrated approach has enabled Ackman to:

- Capitalize on high-conviction opportunities

- Avoid over-diversification that dilutes returns

- Maintain focus during market volatility

- Generate alpha through active engagement

Lessons for Individual Investors

While Ackman's extreme concentration isn't suitable for most retail investors, his approach offers valuable insights:

Applicable Principles:

1. Quality Over Quantity

- Focus on best investment ideas

- Avoid excessive diversification

- Thoroughly research each position

2. Long-term Perspective

- Hold winning positions for years

- Ignore short-term market noise

- Let compound growth work

3. Conviction-Based Sizing

- Size positions based on conviction level

- Larger positions in highest-confidence ideas

- Regular portfolio review and rebalancing

4. Business Understanding

- Invest in companies you understand

- Focus on sustainable competitive advantages

- Consider management quality

Adaptation for Retail Investors:

- Maintain 15-25 positions instead of 11

- Use ETFs for sector exposure rather than individual stocks

- Implement position limits (maximum 5-10% per holding)

- Regular rebalancing to maintain target allocations

Looking Ahead: Strategic Implications

Key Catalysts to Watch:

Technology Positions:

- AI adoption rates across Amazon and Alphabet

- Cloud computing growth trajectories

- Regulatory developments in tech sector

Transportation Evolution:

- Autonomous vehicle progress at Uber

- International expansion success

- Profitability improvements in key markets

Economic Factors:

- Interest rate environment impact on growth stocks

- Consumer spending patterns affecting restaurant chains

- Real estate development cycles for Howard Hughes

Potential Portfolio Evolution:

Given Ackman's strategic thinking, future moves might include:

- Additional technology positions in AI leaders

- Healthcare opportunities following sector rotation

- International expansion through global leaders

- ESG-focused investments aligned with long-term trends

Conclusion: The Power of Concentrated Conviction

Bill Ackman's Q2 2025 portfolio represents a masterclass in concentrated investing, demonstrating how deep research, patient capital, and unwavering conviction can create substantial wealth. His dramatic pivot toward technology through the Amazon position, while maintaining core holdings in proven businesses, showcases the strategic thinking that has made Pershing Square one of the world's most watched hedge funds.

The $13.7 billion portfolio's extreme concentration—99.3% in just 10 holdings—might seem risky to traditional investors, but Ackman's track record suggests that focused, high-conviction investing can deliver superior risk-adjusted returns over time. His approach reminds us that successful investing often requires the courage to be different, backed by rigorous analysis and the patience to let great businesses compound.

For investors seeking to learn from one of the world's most successful activists, Ackman's portfolio offers timeless lessons: invest in what you understand, size positions by conviction, think in years rather than quarters, and never underestimate the power of concentrated excellence in a world that often mistakes diversification for safety.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 YouTube Valuation 2025

📖 Michael Burry's Portfolio Analysis

📖 Data-Driven Value Investing: Why Fundamentals Still Matter