Bill & Melinda Gates Foundation Trust Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

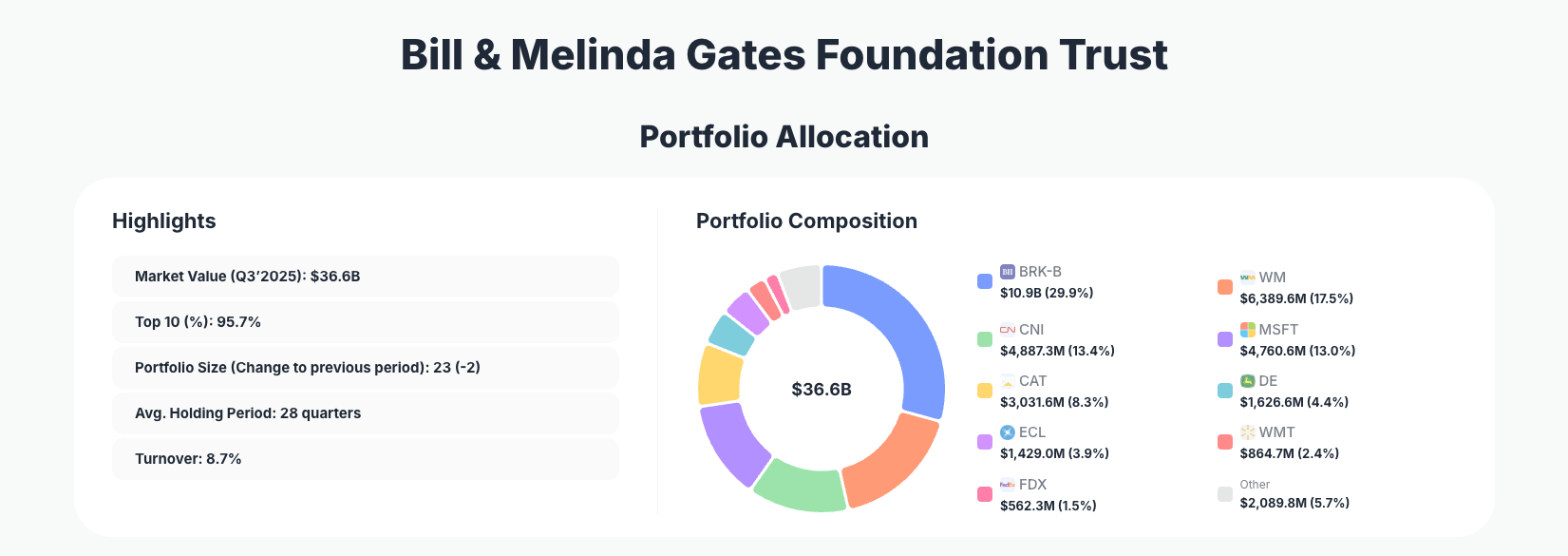

Bill & Melinda Gates Foundation Trust continued its disciplined, high-conviction approach in its Q3’2025 13F filing, executing broad trims across several of its largest positions. The Trust’s $36.6B portfolio remains dominated by durable, cash-generative franchises such as Berkshire Hathaway Inc. (BRK-B), Waste Management, Inc. (WM), Canadian National Railway Company (CNI), and long-time anchor Microsoft Corporation (MSFT), but Q3 shows meaningful reductions even in these core holdings as the Trust manages risk, liquidity, and long-term allocation needs.

The Big Picture: Concentrated Quality with Careful Trimming

Portfolio Highlights (Q3’2025): - Market Value: $36.6B

- Top 10 Holdings: 95.7%

- Portfolio Size: 23 -2

- Average Holding Period: 28 quarters

- Turnover: 8.7%

The Gates Foundation Trust’s latest 13F confirms that this is an ultra-concentrated portfolio: just 23 positions hold $36.6B in assets, and the top 10 names represent 95.7% of total equity exposure. This level of focus in the Gates Foundation portfolio underlines a philosophy built around a small set of dominant, moat-heavy businesses rather than broad diversification.

Despite that concentration, turnover remains modest at 8.7%, with an average holding period of 28 quarters—roughly seven years—emphasizing a long-term, low-churn approach. Yet within that long horizon, Q3’2025 shows a clear pattern: methodical reductions in multiple core holdings. The Trust trimmed stakes in anchors such as Berkshire Hathaway (BRK-B), Waste Management (WM), Canadian National Railway (CNI), Microsoft (MSFT), and Caterpillar (CAT), suggesting profit-taking, risk-balancing, or funding needs rather than a wholesale shift in investment philosophy.

With portfolio size down to 23 holdings (from 25) and no major new buys disclosed in the top positions, the Q3’2025 Gates Foundation portfolio looks like a refinement phase: consolidate around the same set of high-quality franchises, but trim edges where exposure has grown large or valuations are less compelling.

Top Holdings Analysis: Blue-Chip Compounding Machines

The Q3’2025 filing highlights a series of trims across virtually all of the Trust’s largest public positions. The portfolio is led by Berkshire Hathaway Inc. (BRK-B), which sits at 29.9% of the portfolio with $10.9B invested after a “Reduce 9.78%” move—still the dominant position by value and a core pillar of the strategy.

Next is Waste Management, Inc. (WM) at 17.5% of the portfolio and $6,389.6M in value, where the Trust executed a “Reduce 10.24%” action, modestly dialing back one of its signature bets on steady, recession-resilient cash flows.

Transportation and infrastructure remain central through Canadian National Railway Company (CNI), now 13.4% of assets at $4,887.3M following a “Reduce 5.47%” move, and Caterpillar Inc. (CAT), an 8.3% position at $3,031.6M that was trimmed by “Reduce 13.60%”.

One of the most notable changes is in long-time anchor Microsoft Corporation (MSFT), which still accounts for 13.0% of the portfolio at $4,760.6M but saw a very significant “Reduce 64.91%” in share count. Even after that sizable trim, Microsoft remains a top-four holding, illustrating how dominant the position once was and how central it remains to the Trust’s long-term compounding thesis.

Further down the list, the Trust maintained stable stakes in industrial and specialty-chemical leaders. Deere & Company (DE) represents 4.4% of the portfolio with $1,626.6M in value and “No change” in Q3’2025, while Ecolab Inc. (ECL) stands at 3.9% and $1,429.0M, also marked as “No change”—signaling durable conviction in these industrial compounders despite market volatility.

Consumer-facing and logistics names saw more measured trims. Walmart Inc. (WMT) sits at 2.4% of the portfolio with $864.7M after a “Reduce 7.70%” move, while FedEx Corporation (FDX) accounts for 1.5% and $562.3M and was “Reduce 5.92%” in Q3’2025.

Outside the top 10, the Trust continued to fine-tune smaller positions. In waste services, Waste Connections, Inc. (WCN) is a 1.0% allocation at $358.5M, trimmed by “Reduce 5.12%”, indicating consistent but measured exposure to the broader waste-management theme. Food and staples names were also lightly pared: The Kraft Heinz Company (KHC) holds 0.2% of assets at $64.4M with a “Reduce 5.72%” action, while Hormel Foods Corporation (HRL) sits at 0.1% and $51.6M after a “Reduce 5.01%” trim.

Altogether, these 10–15 names showcase the Trust’s hallmark mix of defensive, cash-rich, large-cap leaders—from industrials and railroads to software, waste services, consumer staples, and logistics—with Q3’2025 characterized by consistent reductions rather than aggressive buying.

What the Portfolio Reveals About Current Strategy

Several themes stand out from the Q3’2025 positioning of the Gates Foundation portfolio:

- Quality over growth hype

The emphasis remains firmly on businesses with entrenched competitive advantages and predictable cash flows: conglomerates like BRK-B, industrial moats like CNI, CAT, and DE, as well as service businesses such as WM, WCN, and ECL. Even after a 64.91% reduction, MSFT remains a top holding, underlining its perceived long-term quality. - Sector tilt: industrials, infrastructure, and essential services

Rail, machinery, waste management, logistics, and retail staples dominate. The portfolio leans toward critical infrastructure and non-discretionary services—businesses likely to remain relevant across economic cycles and macro regimes. - Geographic and currency exposure skewed to North America

While names like CNI add Canadian exposure, most holdings are U.S.-listed, large-cap companies. That concentration simplifies risk oversight and aligns with the mandate of a U.S.-focused 13F portfolio. - Dividend and cash-return orientation

Many holdings—Berkshire aside—return substantial cash via dividends and buybacks. For a philanthropic vehicle balancing long-term growth with funding needs, such cash-generation profiles help match portfolio design with grant obligations. - Risk management through trims, not turnover

With 28-quarter average holding periods and only 8.7% turnover, Q3’2025 activity looks like incremental risk management—sizing down large winners (MSFT, WM, BRK-B) rather than pivoting to new themes.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Berkshire Hathaway Inc. (BRK-B) | $10.9B | 29.9% | Reduce 9.78% |

| Waste Management, Inc. (WM) | $6,389.6M | 17.5% | Reduce 10.24% |

| Canadian National Railway Company (CNI) | $4,887.3M | 13.4% | Reduce 5.47% |

| Microsoft Corporation (MSFT) | $4,760.6M | 13.0% | Reduce 64.91% |

| Caterpillar Inc. (CAT) | $3,031.6M | 8.3% | Reduce 13.60% |

| Deere & Company (DE) | $1,626.6M | 4.4% | No change |

| Ecolab Inc. (ECL) | $1,429.0M | 3.9% | No change |

| Walmart Inc. (WMT) | $864.7M | 2.4% | Reduce 7.70% |

| FedEx Corporation (FDX) | $562.3M | 1.5% | Reduce 5.92% |

These top positions alone account for 95.7% of the portfolio’s value, highlighting an extreme concentration in a handful of large, liquid, blue-chip names. The fact that every top-5 position was reduced in Q3—especially the dramatic “Reduce 64.91%” in Microsoft—suggests position-sizing discipline rather than waning confidence in the underlying businesses.

The “No change” stance in mid-sized, high-quality holdings like Deere and Ecolab indicates that once allocations are in a comfortable range, the Trust is willing to simply let the thesis play out over many years. Meanwhile, the gradual trims in Walmart and FedEx keep consumer and logistics exposure meaningful but controlled.

Investment Lessons from the Gates Foundation Trust

The Q3’2025 positioning of the Gates Foundation portfolio offers several practical takeaways for individual investors:

- Concentrate in what you truly understand

The Trust holds only 23 stocks, yet commits nearly 30% to Berkshire and double-digit weights to WM, CNI, and MSFT. High conviction is expressed through meaningful position sizes, not token holdings. - Holding periods matter more than short-term timing

An average holding period of 28 quarters shows that the Trust is willing to own businesses across cycles, adjusting size periodically instead of trading frequently. - Quality businesses can remain core even after trims

A ~65% cut in Microsoft still leaves it at 13% of assets. Trimming winners to manage risk does not mean abandoning them; it means rebalancing while the thesis is intact. - Position sizing is a risk-management tool

Repeated “Reduce” actions in BRK-B, WM, CAT, and others show that the Trust actively uses sizing to keep any one risk under control. - Defensive sectors can compound strongly over time

Railroads, waste management, industrial equipment, and consumer staples might not be flashy, but the Gates Foundation Trust demonstrates that steady, essential businesses can be powerful long-term engines of capital growth.

Looking Ahead: What Comes Next?

Given the broad-based trimming across major holdings in Q3’2025, the next few quarters of 13F data for the Gates Foundation portfolio will be important to watch:

- Dry powder and flexibility

While the 13F does not reveal cash balances, systematic reductions in core holdings often signal preparation for future opportunities, grant funding needs, or tax planning. Investors should watch for whether future filings show new positions or increased stakes in smaller holdings. - Potential new themes or reinforcements

If valuations in key sectors compress, the Trust could redeploy proceeds back into existing favorites—such as adding to DE or ECL—or into new high-quality franchises not yet visible in the current top-10. - Resilience through cycles

The current mix of infrastructure, industrials, and staples positions the portfolio to withstand a range of macro scenarios, from inflationary spikes to slower growth. Future changes are likely to be evolutionary, not revolutionary, unless a major dislocation creates unusually attractive prices. - Implications for individual investors

For retail investors, tracking the Trust’s ongoing trims and additions through each 13F cycle helps reveal where one of the world’s most sophisticated philanthropic organizations sees risk, opportunity, or fully valued positions.

To explore every holding and change in greater detail, you can review the full Gates Foundation portfolio on ValueSense, including historical allocations and trends.

FAQ about the Gates Foundation Portfolio

Q: What were the most notable changes in the Gates Foundation Trust’s Q3’2025 portfolio?

The most striking change was the “Reduce 64.91%” trim in Microsoft (MSFT), which remains a 13.0% position despite the large reduction. Other significant moves include “Reduce 9.78%” in Berkshire (BRK-B), “Reduce 10.24%” in Waste Management (WM), and “Reduce 13.60%” in Caterpillar (CAT), as well as trims across smaller positions like WCN, KHC, and HRL.

Q: How concentrated is the Gates Foundation Trust’s equity portfolio?

Highly concentrated. As of Q3’2025, there are 23 positions, and the top 10 holdings make up 95.7% of the $36.6B portfolio. Names like BRK-B, WM, CNI, MSFT, and CAT dominate total exposure.

Q: What does the Q3’2025 strategy say about how the Trust manages risk?

Risk is managed primarily through position sizing and gradual trims rather than constant trading. With an 8.7% turnover rate and multiple “Reduce” actions in large positions, the Trust demonstrates that it prefers to scale back winners and maintain long-term holdings instead of exiting entirely.

Q: Which sectors or themes are most important in the current portfolio?

Key themes include industrial infrastructure and transportation (CNI, CAT, DE, FDX), waste and environmental services (WM, WCN, ECL), technology via MSFT, and consumer staples through WMT, KHC, and HRL.

Q: How can I track or follow the Gates Foundation Trust’s portfolio?

You can follow the Trust’s holdings via quarterly 13F filings, which U.S. institutional managers must submit within 45 days of each quarter-end. Because of this 45-day reporting lag, reported positions may differ from real-time holdings. For easier tracking, visualization, and historical analysis of all these moves, use the dedicated Gates Foundation page on ValueSense.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!