Bill Miller - Miller Value Partners Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

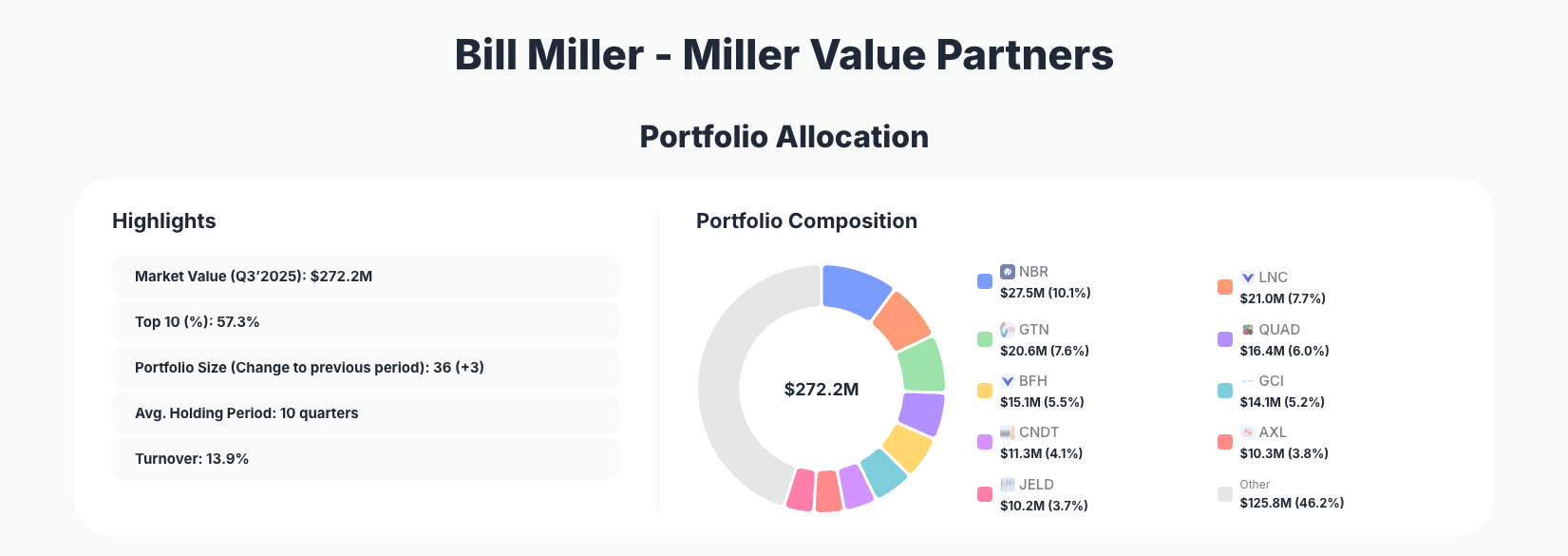

Bill Miller, legendary value investor and founder of Miller Value Partners, showcases his signature contrarian style in the latest 13F filing. His $272.2M portfolio for Q3 2025 features active tinkering with high-conviction bets on beaten-down industrials, media, and financials, adding three new positions amid a portfolio expansion to 36 holdings.

Portfolio Overview: Value Hunter's Calculated Concentration

Portfolio Highlights (Q3 2025): - Market Value: $272.2M - Top 10 Holdings: 57.3% - Portfolio Size: 36 +3 - Average Holding Period: 10 quarters - Turnover: 13.9%

Miller Value Partners maintains a disciplined approach to concentration, with over half the portfolio locked into its top 10 positions, underscoring Bill Miller's philosophy of backing a few deeply researched ideas rather than spreading bets thin. The 57.3% allocation to leaders like energy services and media reflects confidence in turnaround stories overlooked by the broader market. At 36 positions including three fresh additions, the portfolio balances core convictions with opportunistic moves, as seen in the modest 13.9% turnover rate.

This structure aligns with Miller's track record of patient value investing, where an average holding period of 10 quarters signals commitment to intrinsic value realization over short-term noise. The $272.2M portfolio expanded slightly, suggesting dry powder for further deployments in undervalued sectors amid market volatility. Investors tracking these shifts via 13F filings can glean insights into Miller's read on economic cycles.

Top Holdings: Aggressive Adds in Cyclicals and Turnarounds

The portfolio's pulse beats strongest in recent changes, starting with Nabors Industries Ltd. (NBR) at 10.1% after an Add 7.85%, signaling bullishness on oilfield services amid energy sector rotations. Lincoln National Corporation (LNC) holds 7.7% despite a Reduce 8.57%, while Gray Television, Inc. (GTN) at 7.6% saw a Reduce 2.46% trim. Quad/Graphics, Inc. (QUAD) remains key at 6.0% with a Reduce 3.21%, and Bread Financial Holdings, Inc. (BFH) dropped sharply by 17.53% to 5.5%.

Further tweaks include Gannett Co., Inc. (GCI) boosted to 5.2% via Add 3.62%, and standout aggression in Conduent Incorporated (CNDT) with a massive Add 46.30% to 4.1%. American Axle & Manufacturing Holdings, Inc. (AXL) rose 19.25% to 3.8%, JELD-WEN Holding, Inc. (JELD) gained 10.37% at 3.7%, and Jackson Financial Inc. (JXN) faced a hefty Reduce 24.94% to 3.5%. These moves highlight Miller's willingness to double down on media and industrials while pruning financials showing weakness.

What the Portfolio Reveals

Bill Miller's Q3 adjustments paint a picture of opportunistic value hunting in cyclical sectors battered by economic headwinds:

- Cyclical Revival Bets: Heavy adds in energy (NBR), manufacturing (AXL, JELD), and business services (CNDT) suggest anticipation of industrial recovery and cost-cutting tailwinds.

- Media and Financial Trims: Reductions in publishers (GTN, QUAD, GCI) and insurers/financials (LNC, BFH, JXN) indicate profit-taking amid advertising softness and rate pressures.

- Risk Management: 13.9% turnover and three net new positions show disciplined rebalancing, favoring U.S.-centric small/mid-caps with turnaround potential over high-flyers.

- Quality Cyclicals: Preference for companies with operational leverage, like drilling (NBR) and auto parts (AXL), positions for economic rebound without chasing growth premiums.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Nabors Industries Ltd. | $27.5M | 10.1% | Add 7.85% |

| Lincoln National Corporation | $21.0M | 7.7% | Reduce 8.57% |

| Gray Television, Inc. | $20.6M | 7.6% | Reduce 2.46% |

| Quad/Graphics, Inc. | $16.4M | 6.0% | Reduce 3.21% |

| Bread Financial Holdings, Inc. | $15.1M | 5.5% | Reduce 17.53% |

| Gannett Co., Inc. | $14.1M | 5.2% | Add 3.62% |

| Conduent Incorporated | $11.3M | 4.1% | Add 46.30% |

| American Axle & Manufacturing Holdings, Inc. | $10.3M | 3.8% | Add 19.25% |

| JELD-WEN Holding, Inc. | $10.2M | 3.7% | Add 10.37% |

This table underscores Miller Value Partners' concentrated firepower, with the top 10 commanding 57.3% of the $272.2M portfolio—a hallmark of high-conviction investing. No single position dominates excessively, allowing flexibility, yet leaders like Nabors (NBR) at 10.1% reflect deep research into energy services recovery. The mix of adds (five positions) and reduces (four) demonstrates active management, trimming laggards like BFH -17.53% to fuel aggressive builds in CNDT +46.30%.

Such concentration amplifies upside in winners but demands precise timing, aligning with Miller's history of beating benchmarks through bold, asymmetric bets on misunderstood assets.

Investment Lessons from Bill Miller's Value Approach

- Embrace Contrarian Adds: Miller's outsized increases in CNDT +46% and AXL +19% teach loading up on depressed cyclicals when fundamentals inflect.

- Trim Without Abandoning: Modest reduces in media like GTN show profit-taking preserves capital for better setups while retaining exposure.

- Long Holding Periods Pay Off: 10-quarter average tenure emphasizes patience, letting compounders like core holdings unfold.

- Turnover as a Tool: 13.9% rate balances conviction with adaptability, avoiding inertia in changing markets.

- Focus on Small-Cap Value: Targeting overlooked names in industrials and services exploits inefficiencies big funds ignore.

Looking Ahead: What Comes Next?

With portfolio size up to 36 +3 and turnover at 13.9%, Miller Value Partners likely holds cash for opportunistic strikes in energy and manufacturing rebounds. Recent adds in NBR and AXL position well for industrial capex cycles, while trims in financials hedge rate risks. In a softening economy, expect further concentration in turnaround media and services if valuations compress, setting up asymmetric returns as markets normalize.

FAQ about Bill Miller Portfolio

Q: What are the biggest changes in Bill Miller's Q3 2025 13F filing?

A: Key moves include massive Add 46.30% to Conduent (CNDT) at 4.1%, Add 19.25% to AXL, and sharp Reduce 24.94% in JXN, alongside trims in financials like BFH -17.53%.

Q: Why does Bill Miller concentrate over 57% in top 10 holdings?

A: Miller's strategy leverages deep research for high-conviction bets on undervalued cyclicals, amplifying returns from a few winners while the broader 36 holdings provide diversification—classic value investing discipline.

Q: What sectors dominate Miller Value Partners' portfolio?

A: Energy services (NBR), media/publishing (GTN, GCI), financials (LNC), and industrials (AXL, JELD) lead, betting on turnarounds in beaten-down areas.

Q: How can I track Bill Miller's portfolio like a pro?

A: Follow quarterly 13F filings on the SEC site (with 45-day lag) or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/miller-value for real-time visualizations, change alerts, and historical analysis.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!