The Bloomberg Terminal alternative: free stock analysis website

Value Sense is the only stock research website entirely built for quick undervalued stock searches. It's also the only analysis tool that will save investors 100+ hours with actionable insights for smarter Investing.

“I got 90% of the real time data I need against Blomberg with much less time spent. Even market data, intrinsic value and price prediction! And subscription is much cheaper”

Guy Mccoy - independent financial consultant

Fundamental analysis

Value Sense helps you understand all companies' financial data, and provides essential tools.

- Historical Financial Analysis - historical financial statements prove useful across the investment chain. Like a company report card, investment decisions hinge on critical pieces of information showcased in historical statements.

- Financial ratios - get access to the most important financial ratios

- Dividends analysis - understand how often is a dividend paid, get dividend yields, and find stocks with growing dividends.

- Comparison analysis - stock competitors, stock price compare, stocks comparison charts, all in one tool for stock comparison.

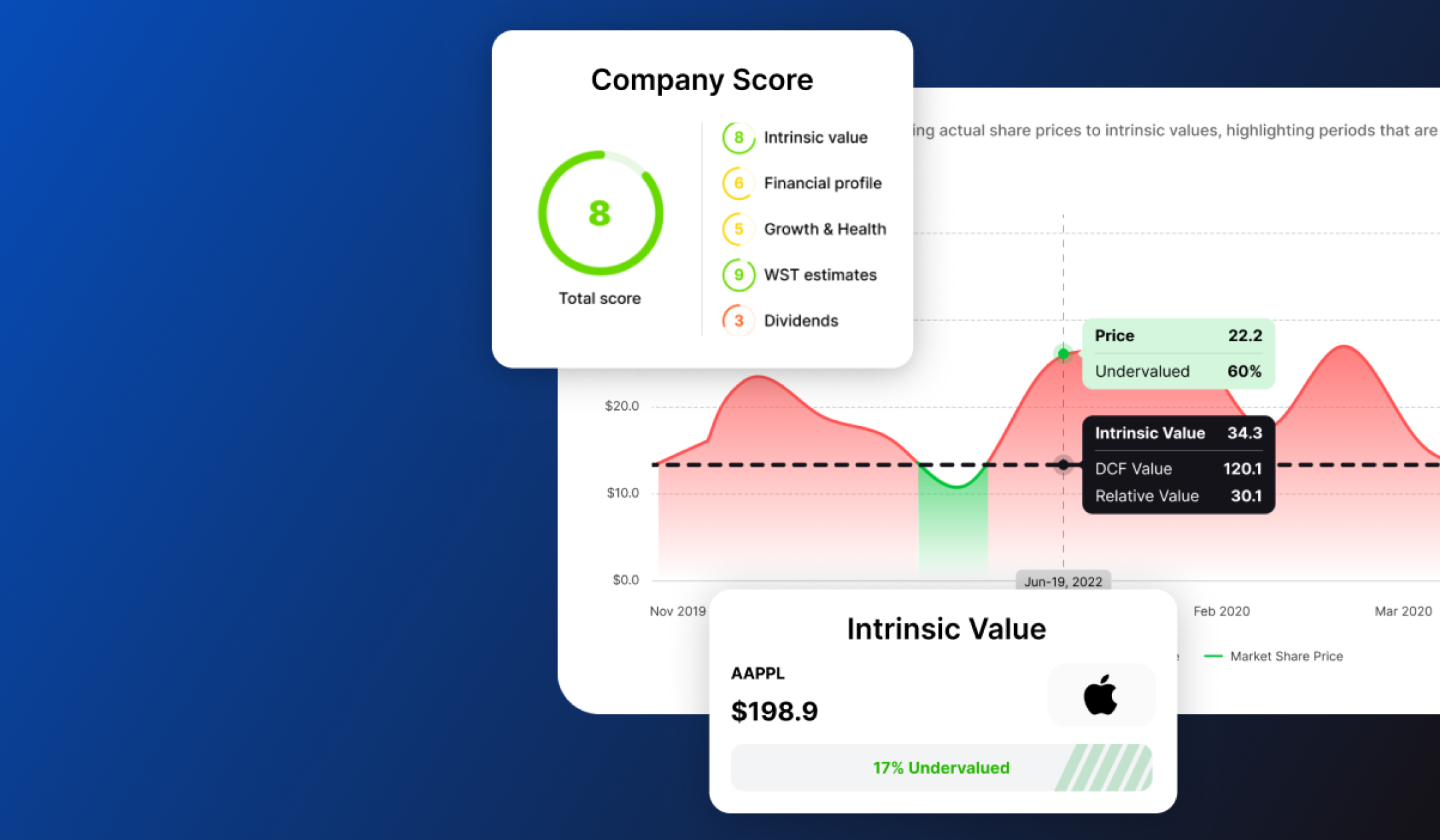

Intrinsic value (aka fair value)

Discover under/overvalued companies with our historical intrinsic value tool.

Inside the value investing tools hub you'll find:

- Intrinsic value calculator

- DCF value calculator

- Relative value

- and 6+ more tools for value investors

Stock screener

Value Sense stock screener features 4000+ financial metrics users can filter to find stocks based on custom criteria and build custom analysis formulas. Our screener returns a group of stocks that match one or more selected criteria (called filters).

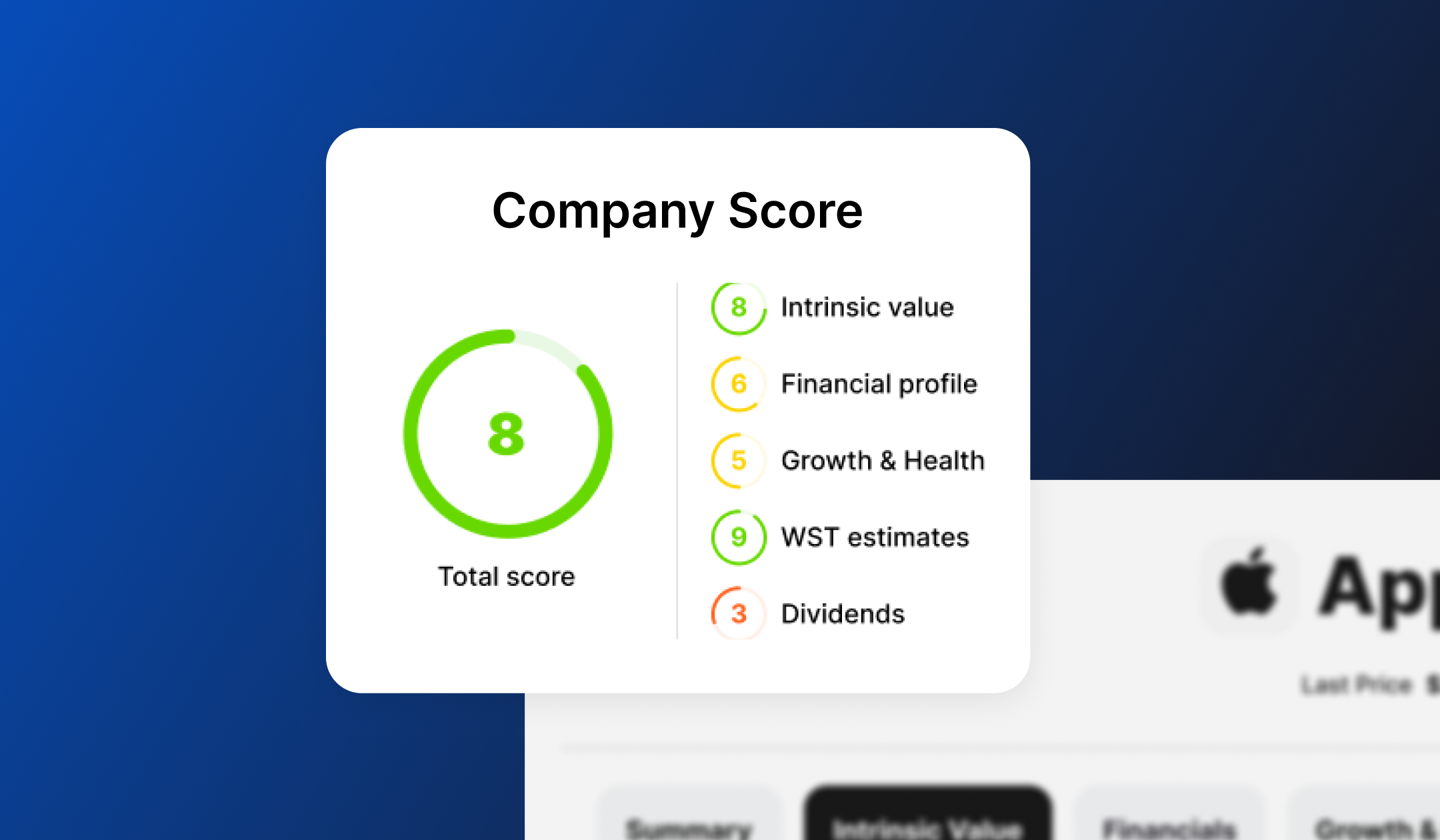

Company quality smart scoring

Understand a company’s quality instantly with Value Sense scoring.

Get an instant overview of any company with Value Sense score analysis. Access information through a user-friendly interface with smart highlights.

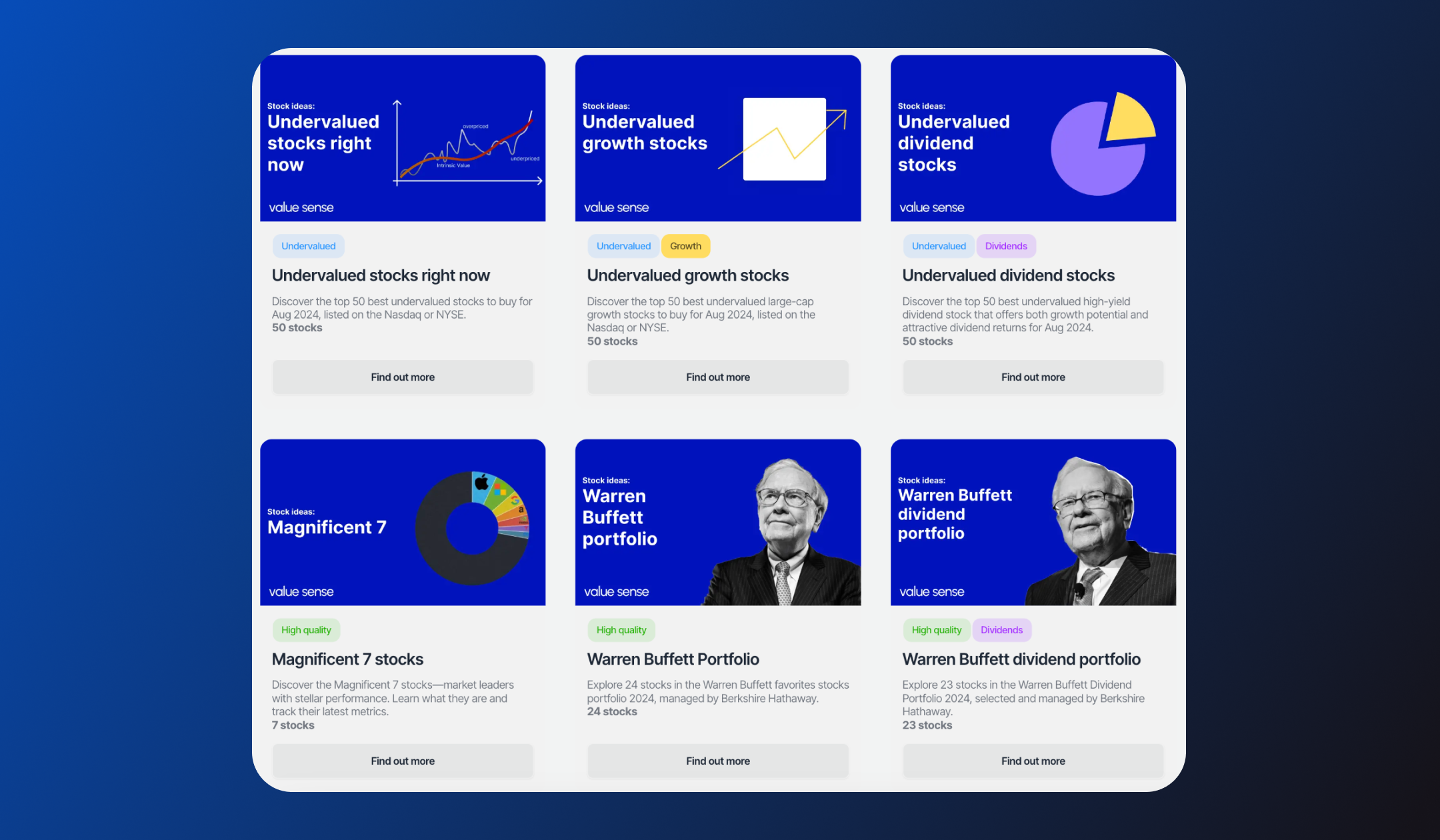

Undervalued stock ideas

For those seeking market opportunities, our analytics team has compiled over 10 exclusive lists of undervalued and high-quality stocks:

Earning reports

Value Sense provides a quick summary of a company’s quarterly results, highlighting the variances between reported earnings and Wall Street analysts' forecasts.

Here’s how Earnings Report can transform your investment strategy:

- Overview of Recent Earnings: Quickly check recent earnings and upcoming estimates to understand a company’s performance for the quarter.

- Historical Actuals vs. Estimates: See at a glance how a company’s results compare to analyst estimates historically, with a summary of key metrics over time.

- Overview of Financial Statements: Access the income statement, balance sheet, and cash flow statement all in one place.

- Benchmarking with peer companies: Growth and margins, valuation multiples.

Buy what you actually need in stock analysis

Value Sense might not have all the functionalities of Bloomberg, but it helps you to make smart investment decisions and stay ahead of the market.

Ready to start?

Join 3,500+ value investors worldwide