Bruce Berkowitz - Fairholme Capital Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

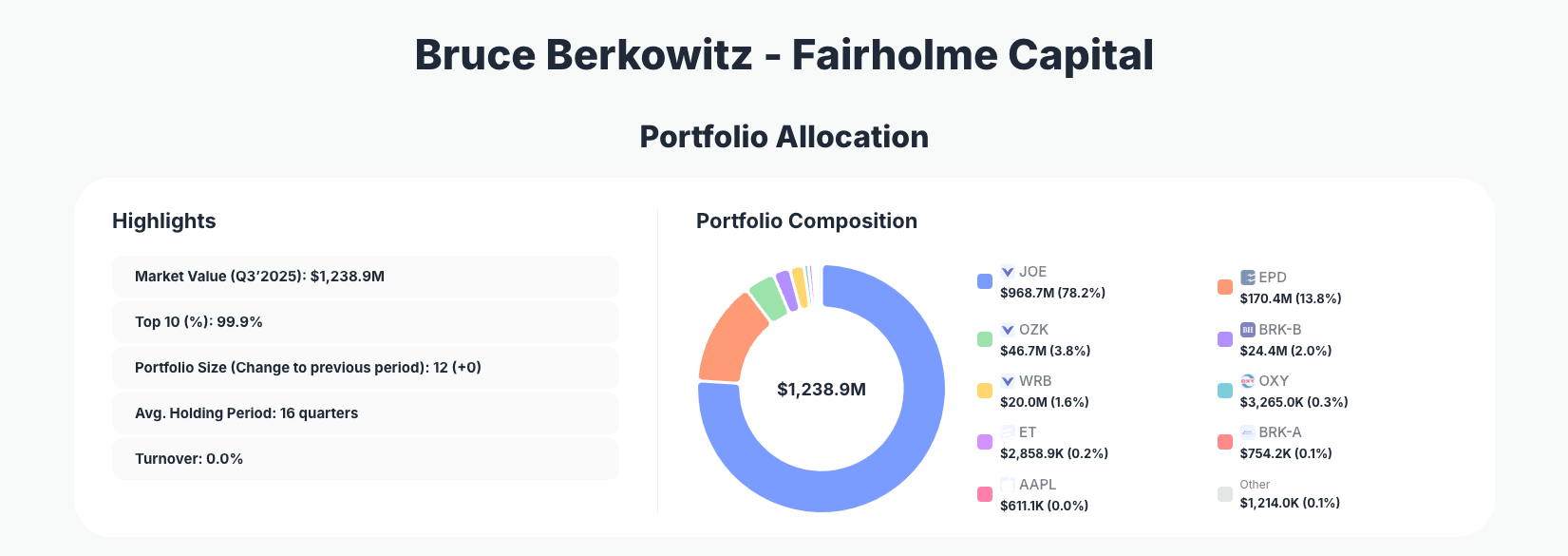

Bruce Berkowitz, the legendary value investor behind Fairholme Capital, exemplifies patient, high-conviction investing through his latest 13F filing. His $1.24B Q3 2025 portfolio showcases extreme concentration with 99.9% of assets in just 10 holdings, including measured reductions in core positions that signal disciplined profit-taking amid market highs.

Portfolio Overview: Extreme Concentration Defines Fairholme's Edge

Portfolio Highlights (Q3 2025): - Market Value: $1,238.9M - Top 10 Holdings: 99.9% - Portfolio Size: 12 +0 - Average Holding Period: 16 quarters - Turnover: 0.0%

Bruce Berkowitz's approach at Fairholme Capital remains a textbook case of ultra-concentrated value investing, where nearly the entire portfolio hinges on a handful of deeply researched ideas. With top 10 holdings commanding 99.9% of the $1.24 billion portfolio and zero turnover, this filing underscores unwavering conviction in long-term holdings rather than chasing short-term trends. The average holding period of 16 quarters—over four years—highlights a buy-and-hold philosophy that prioritizes business quality over market noise.

This structure minimizes diversification risks while amplifying returns from high-confidence bets, a hallmark of Berkowitz's strategy since founding Fairholme in 1997. The static portfolio size of 12 positions (+0 changes in count) reflects stability, allowing focus on monitoring existing stakes amid volatile markets. Investors tracking the Fairholme portfolio via 13F filings will note how this concentration has historically delivered outsized results during value recoveries.

Such extreme focus demands thorough due diligence, as Berkowitz himself emphasizes understanding businesses inside out before committing capital. With turnover at 0.0%, the Q3 2025 portfolio signals no rush to redeploy amid elevated valuations, positioning Fairholme for patient opportunism.

Top Holdings: St. Joe Dominates Amid Targeted Reductions

The Fairholme portfolio is overwhelmingly anchored by The St. Joe Company (JOE) at 78.2% $968.7M, though Berkowitz trimmed this massive position by 3.10%, potentially locking in gains after years of appreciation. Bank OZK (OZK) follows at 3.8% $46.7M with a minor Reduce 0.12%, while Berkshire Hathaway Inc. (BRK-B) at 2.0% $24.4M saw a Reduce 0.33%, suggesting fine-tuning of satellite positions around the core bet.

Complementing these changes, stable anchors include Enterprise Products Partners L.P. (EPD) at 13.8% $170.4M with No change, providing midstream energy stability and distributions. WR Berkley Corp (ticker not specified) holds steady at 1.6% $20.0M with No change, alongside Occidental Petroleum Corporation (OXY) at 0.3% ($3.3M, No change) for energy exposure. Energy Transfer LP (ET) remains at 0.2% ($2.9M, No change), while Berkshire Hathaway Inc. (BRK-A) at 0.1% ($754K, No change) and Apple Inc. (AAPL) at 0.0% ($611K, No change) round out the highly concentrated lineup.

These positions blend real estate development via St. Joe, regional banking through OZK, conglomerate wisdom in Berkshire, and energy infrastructure in EPD, ET, and OXY. The subtle reductions in JOE, OZK, and BRK-B—totaling under 4% across changes—indicate tactical rebalancing without abandoning conviction, keeping the portfolio laser-focused on resilient, cash-generating assets.

What the Portfolio Reveals About Berkowitz's Strategy

Fairholme's Q3 2025 filing reveals a strategy rooted in quality over speculation, with heavy emphasis on businesses boasting durable competitive moats like land banks (JOE), energy pipelines (EPD, ET), and proven conglomerates (BRK).

- Sector Focus: Dominated by real estate (78% via JOE), energy midstream (14%+), and financials/insurance (OZK, WR Berkley, BRK), reflecting bets on inflation-hedged assets and steady cash flows amid economic uncertainty.

- Geographic Concentration: Primarily U.S.-centric, with St. Joe's Florida land holdings offering regional growth potential tied to housing and development cycles.

- Dividend Strategy: Positions like EPD and ET prioritize yield and distributions, supporting income in a low-turnover portfolio.

- Risk Management: Extreme concentration (99.9% top 10) paired with long holding periods mitigates volatility through deep conviction, while minor trims manage valuation risks without disrupting the core thesis.

This approach signals caution on overvalued markets, favoring "fortress" balance sheets that thrive in any environment.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| The St. Joe Company (JOE) | $968.7M | 78.2% | Reduce 3.10% |

| Enterprise Products Partners L.P. (EPD) | $170.4M | 13.8% | No change |

| Bank OZK (OZK) | $46.7M | 3.8% | Reduce 0.12% |

| Berkshire Hathaway Inc. (BRK-B) | $24.4M | 2.0% | Reduce 0.33% |

| WR BERKLEY CORP (_) | $20.0M | 1.6% | No change |

| Occidental Petroleum Corporation (OXY) | $3,265.0K | 0.3% | No change |

| Energy Transfer LP (ET) | $2,858.9K | 0.2% | No change |

| Berkshire Hathaway Inc. (BRK-A) | $754.2K | 0.1% | No change |

| Apple Inc. (AAPL) | $611.1K | 0.0% | No change |

This table illustrates Fairholme's hallmark extreme concentration, with St. Joe (JOE) alone comprising 78.2%—a bet on real estate development that amplifies upside but demands ironclad thesis validation. The next tier, led by EPD at 13.8%, adds diversification into energy infrastructure, yet the top four holdings control over 97%, underscoring Berkowitz's willingness to swing big on understood opportunities.

Minor reductions in JOE, OZK, and BRK.B reflect prudent risk management, trimming winners without selling out, while "No change" across smaller energy and quality names preserves dry powder implicitly. This setup positions the portfolio for asymmetric returns if core holdings execute, though it heightens sensitivity to St. Joe's performance.

Investment Lessons from Bruce Berkowitz's Fairholme Approach

Bruce Berkowitz's playbook offers timeless principles for value investors:

- Concentrate relentlessly when conviction is sky-high: 99.9% in top 10 shows that diversification is for those lacking edge—focus capital where you have deep insights, like St. Joe's land bank.

- Patience trumps trading: 16-quarter average hold and 0% turnover prove holding quality businesses through cycles beats frequent adjustments.

- Trim winners strategically: Subtle reductions (e.g., 3.10% in JOE) manage risk and valuation without abandoning theses.

- Favor moat-heavy cash machines: Energy midstream (EPD, ET) and banks (OZK) prioritize predictable flows over growth hype.

- Study the masters: Nod to Berkshire (BRK-A/B) holdings reflects learning from Buffett-style compounding.

Looking Ahead: What Comes Next?

With turnover at 0% and portfolio size unchanged at 12, Fairholme appears fully invested, implying limited cash for immediate deployment but readiness to act on dislocations. St. Joe's dominance sets up for housing/tourism tailwinds in Florida, while energy holdings like EPD and OXY position for commodity volatility and inflation.

Berkowitz may eye further trims if valuations stretch, targeting undervalued real estate, regional banks, or energy amid 2026 uncertainties. Current positioning—moaty assets with yields—fortifies against recessions, with potential to add if markets correct, aligning with ValueSense's focus on intrinsic value opportunities.

FAQ about Bruce Berkowitz Fairholme Capital Portfolio

Q: What are the most significant changes in Fairholme's Q3 2025 13F filing?

A: Berkowitz reduced St. Joe (JOE) by 3.10%, Bank OZK (OZK) by 0.12%, and BRK-B by 0.33%, with all else unchanged—signaling profit-taking on core holdings without major overhauls.

Q: Why is Fairholme's portfolio so heavily concentrated?

A: Extreme concentration (99.9% top 10, 78% in JOE) stems from Berkowitz's high-conviction value strategy, betting big on deeply understood businesses to maximize long-term returns over broad diversification.

Q: What sectors dominate Fairholme's holdings?

A: Real estate (JOE), energy midstream (EPD, ET, OXY), banking (OZK), and quality conglomerates (BRK-B), favoring inflation-resistant cash generators.

Q: How can I track and follow Bruce Berkowitz's Fairholme Capital portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/fairholme for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!