Bryan Lawrence - Oakcliff Capital Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

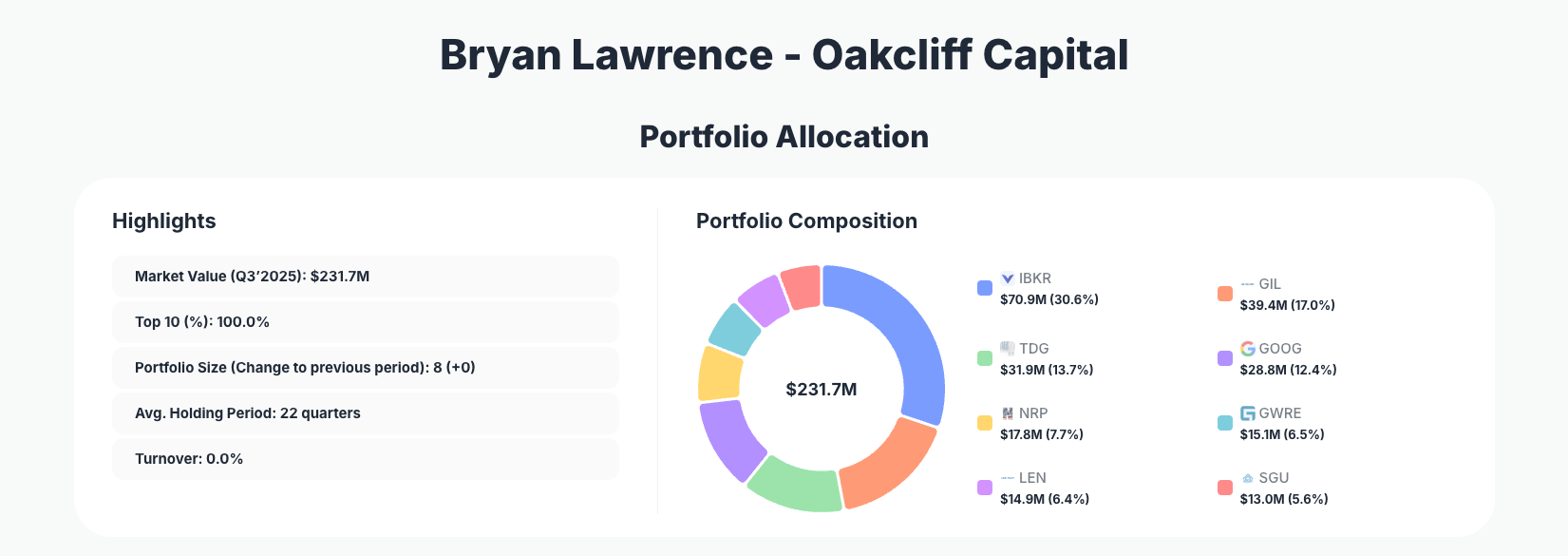

Bryan Lawrence of Oakcliff Capital Partners maintains his signature discipline in concentrated, long-term investing through the firm's Q3 2025 portfolio, valued at $231.7M across just 8 positions. With zero turnover and selective additions to high-conviction names like TDG and NRP, Lawrence signals confidence in his core holdings while fine-tuning exposure to aerospace and energy sectors amid market volatility.

Portfolio Overview: The Power of Extreme Concentration and Patience

Portfolio Highlights (Q3 2025): - Market Value: $231.7M - Top 10 Holdings: 100.0% - Portfolio Size: 8 +0 - Average Holding Period: 22 quarters - Turnover: 0.0%

Oakcliff Capital's $231.7M portfolio exemplifies ultra-concentrated investing, with the top 10 holdings—essentially the entire portfolio—comprising 100% of assets under management. This structure underscores Bryan Lawrence's high-conviction approach, where every position must earn its place through deep fundamental analysis and long-term potential. The unchanged portfolio size of 8 positions, coupled with a remarkable average holding period of 22 quarters (over 5 years), reflects a buy-and-hold philosophy that prioritizes quality businesses over short-term market noise.

Zero turnover in Q3 2025 further highlights Lawrence's patience, as he made only targeted adjustments rather than wholesale shifts. This stability in the Oakcliff Capital portfolio suggests a manager who avoids reactive trading, focusing instead on compounding returns from durable competitive advantages. For investors tracking superinvestors via 13F filings, this low activity level is a beacon of discipline in an era of high-frequency noise.

The portfolio's full allocation to just 8 names also minimizes diversification risk while maximizing impact from winners. With no new positions added and the portfolio size stable at 8 +0, Lawrence appears fully invested, deploying capital only into opportunities that align with his thesis on resilient, cash-generative companies.

Top Holdings: Brokerage Powerhouses, Apparel Leaders, and Strategic Sector Bets

Bryan Lawrence directed notable changes to two key positions in the Q3 2025 filings. He boosted TransDigm Group Incorporated (TDG) by Add 13.51%, lifting it to 13.7% of the portfolio with $31.9M invested, signaling growing conviction in aerospace aftermarket dominance. Similarly, Natural Resource Partners L.P. (NRP) saw an Add 9.83%, now at 7.7% $17.8M, reflecting opportunistic exposure to energy royalties amid commodity cycles.

The portfolio's anchor remains Interactive Brokers Group, Inc. (IBKR) at a commanding 30.6% $70.9M with No change, underscoring unwavering faith in its brokerage platform's scalability and low-cost model. Gildan Activewear Inc. (GIL) holds steady at 17.0% ($39.4M, No change), a testament to its efficient manufacturing and brand resilience in apparel. Alphabet Inc. (GOOG) maintains 12.4% ($28.8M, No change), providing big-tech growth ballast.

Rounding out the core are unchanged stalwarts like Guidewire Software, Inc. (GWRE) at 6.5% $15.1M, a software play on insurance digitization; Lennar Corporation (LEN) at 6.4% $14.9M, betting on housing recovery; and Star Group, L.P. (SGU) at 5.6% $13.0M, a niche energy distributor. These positions, combined with the recent adds, paint a picture of selective conviction across financial services, industrials, tech, consumer goods, and resources—totaling all 8 holdings in a tightly woven tapestry.

What the Portfolio Reveals

Oakcliff Capital's Q3 moves reveal a strategy blending stability with opportunistic refinement: - Quality compounding focus: Massive weights in IBKR and GIL prioritize businesses with strong moats, high returns on capital, and operational leverage. - Sector diversification within concentration: Exposure spans brokerage/tech (IBKR, GOOG, GWRE), industrials/aerospace (TDG), apparel (GIL), homebuilding (LEN), energy (NRP, SGU)—avoiding over-reliance on any one area. - Value in cyclical upswings: Adds to TDG and NRP suggest bets on aerospace recovery and energy royalties, balancing growth with income. - Risk management via sizing: No position exceeds 31%, yet top holdings drive performance, with long holds mitigating volatility. - Low-turnover discipline: 0.0% turnover and 22-quarter average tenure emphasize patience over speculation.

This thematic mix positions Oakcliff for resilience in uncertain markets, favoring adaptable leaders over fleeting trends.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Interactive Brokers Group, Inc. (IBKR) | $70.9M | 30.6% | No change |

| Gildan Activewear Inc. (GIL) | $39.4M | 17.0% | No change |

| TransDigm Group Incorporated (TDG) | $31.9M | 13.7% | Add 13.51% |

| Alphabet Inc. (GOOG) | $28.8M | 12.4% | No change |

| Natural Resource Partners L.P. (NRP) | $17.8M | 7.7% | Add 9.83% |

| Guidewire Software, Inc. (GWRE) | $15.1M | 6.5% | No change |

| Lennar Corporation (LEN) | $14.9M | 6.4% | No change |

| Star Group, L.P. (SGU) | $13.0M | 5.6% | No change |

This table illustrates Oakcliff Capital's extreme concentration, with 100% of the $231.7M portfolio in just 8 holdings and the top two alone commanding nearly half 47.6%. The stability of "No change" across six positions reinforces Bryan Lawrence's long-term orientation, while the adds to TDG and NRP—13.51% and 9.83% respectively—show willingness to scale winners without disrupting the core.

Such focus amplifies returns from conviction bets like IBKR's dominance but demands precise selection; the even spread post-top holdings (all under 14%) aids risk control. For followers, this structure highlights how concentration, paired with 22-quarter holds, can outperform broad indexing when grounded in superior business analysis.

Investment Lessons from Bryan Lawrence's Oakcliff Capital Approach

Bryan Lawrence's Q3 2025 portfolio demonstrates timeless principles tailored to his patient, concentrated style: - Concentrate heavily but selectively: 100% in 8 positions shows that understanding a few businesses deeply trumps superficial diversification. - Long holding periods build wealth: 22 quarters average tenure proves patience with quality compounds superior to frequent trading. - Fine-tune winners incrementally: Adds to TDG 13.51% and NRP 9.83% illustrate scaling proven theses without overhauling. - Balance growth, cyclicals, and income: Mix of GOOG growth, TDG industrials, and NRP/SGU yields creates resilient returns. - Zero turnover in conviction portfolios: 0.0% activity teaches ignoring noise, focusing on fundamentals over market swings.

These lessons empower retail investors to emulate Oakcliff's edge through discipline and research.

Looking Ahead: What Comes Next?

With a fully invested 8-position portfolio and zero turnover, Oakcliff Capital appears poised for organic growth from existing holdings like IBKR and TDG, which benefit from brokerage expansion and aerospace tailwinds. No explicit cash position is reported, suggesting Bryan Lawrence sees current valuations aligning with his criteria, but the stable size +0 leaves room for opportunistic deploys if dislocations arise in tech, energy, or housing.

Potential new investments could target undervalued industrials or resources, given recent adds to NRP and TDG amid volatile commodities and defense spending. In a 2026 market facing rate uncertainty and election cycles, Oakcliff's low-turnover setup insulates against whipsaws, positioning it to capitalize on cyclicals like LEN if housing rebounds. Track updates via 13F filings on ValueSense for signals on shifts.

FAQ about Bryan Lawrence Oakcliff Capital Portfolio

Q: What are the most significant changes in Oakcliff Capital's Q3 2025 13F filing?

A: Bryan Lawrence added 13.51% to TransDigm Group (TDG) (now 13.7%) and 9.83% to Natural Resource Partners (NRP) (now 7.7%), while core holdings like IBKR saw no change—reflecting targeted conviction boosts.

Q: Why does Oakcliff Capital maintain such extreme portfolio concentration?

A: With 100% in top 10 (all 8 holdings) and 30.6% in IBKR alone, Lawrence prioritizes deep research on high-moat businesses, accepting volatility for outsized returns from compounding winners over diversified mediocrity.

Q: What sectors does Bryan Lawrence favor in this portfolio?

A: Financial services/brokerage (IBKR), apparel (GIL), aerospace (TDG), tech (GOOG, GWRE), energy (NRP, SGU), and homebuilding (LEN)—a balanced yet concentrated bet on resilient cyclicals and growth.

Q: How can I track and follow Bryan Lawrence's Oakcliff Capital portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/oakcliff-capital for real-time analysis, historical changes, and visualizations. Note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!