The Evolution of Buffett’s Investing Philosophy

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

How Warren Buffett Evolved His Investing Approach: Lessons for Modern Investors

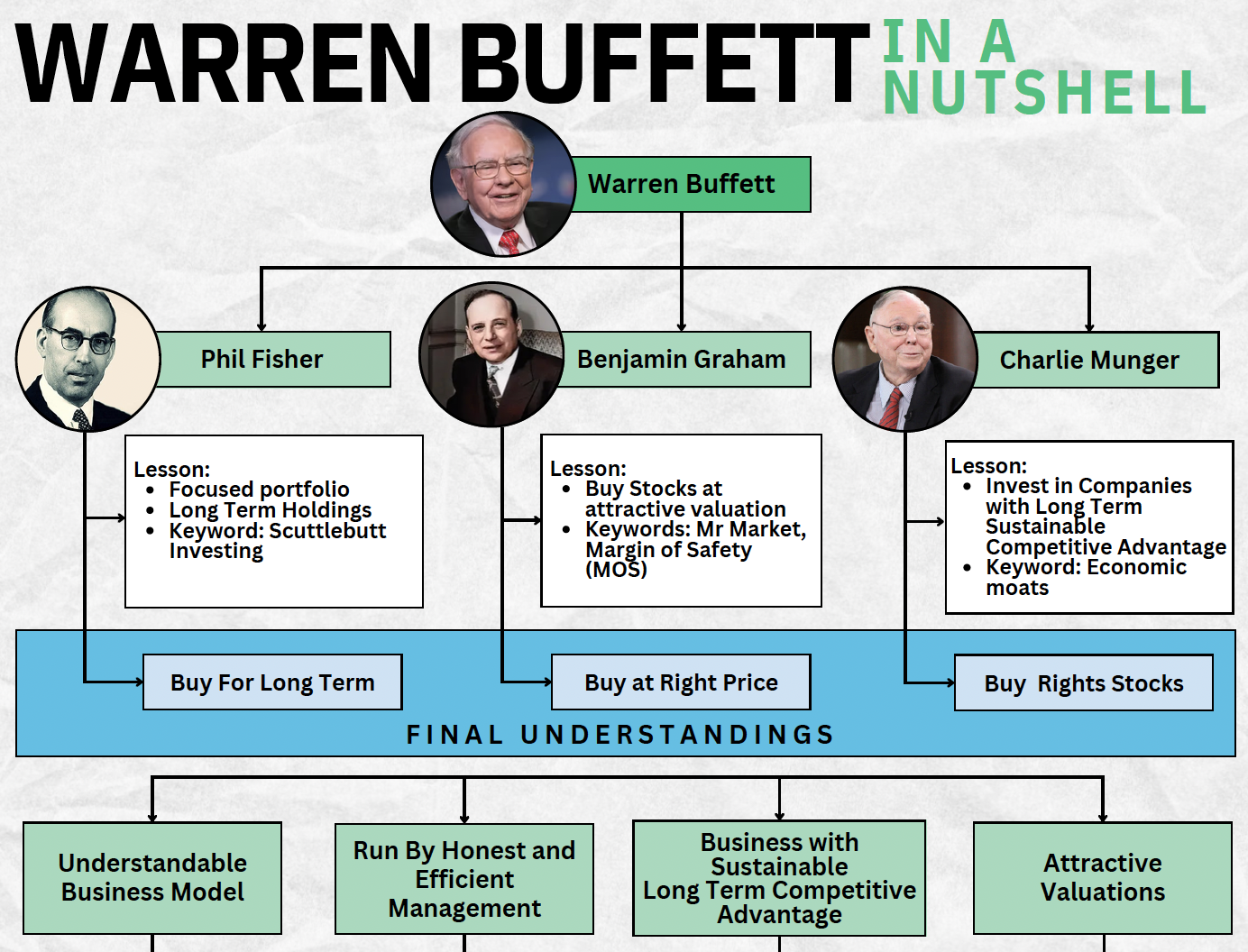

Warren Buffett didn’t become the greatest investor of our time by sticking to one rigid investing system. He evolved as everything evolves, it's simply the law of nature and business world. Over the decades Buffett refined his approach by learning from three key investors: Ben Graham, Phil Fisher, and Charlie Munger. His journey is proof that even the most successful investors must adapt in order to thrive.

In this article we’ll explore how Buffett’s philosophy evolved, how you can replicate his approach to build your own "investable universe" and why adaptability is the ultimate edge in investing.

The Evolution of Buffett’s Investing Philosophy

1. Ben Graham: The Foundation of Value Investing

Warren Buffett’s career began under the mentorship of Benjamin Graham, often called the father of value investing. Graham’s approach was simple and worked at the time when financial data was not widely available to everyone: buy stocks trading below their intrinsic value, often referred to as "cigar butts" - companies so undervalued that even one last puff could yield significant returns. It usually meant buying stocks valued less than the book value of assets.

Buffett’s early years mirrored Graham’s philosophy.

He focused on:

- Finding bargains: Stocks trading far below their book value;

- The Margin of Safety: Protecting investment decision by ensuring a wide gap between a stock’s price and its intrinsic value;

- Detachment from emotion: Viewing stocks as part ownership of businesses, not pieces of paper.

We summarized key learnings from Ben Graham's legendary book "The Intelligent Investor". This is still Warren Buffett's most favourite book about investing.

Early Buffett was an activist investor to the point that he could teach Bill Ackman or Carl Icahn a few lessons. Buying up stock in the company, getting the board seat and then selling the company by parts ensuring that total payout is much higher than the price he paid.

One of Buffett’s earliest successes was buying shares in a struggling textile company, Berkshire Hathaway, for less than its tangible assets. It was a classic Graham move: undervalued, unloved and deeply discounted. However, Buffett soon realized the flaws of this strategy. Even though the stock was cheap, the business lacked long-term viability.

At the end of the day Ben Graham was not a messiah. He looked for undervalued stocks, but was happy to sell them once they make 50% return. That was the assumption Warren Buffett wanted to challenge.

2. Phil Fisher: The Art of Finding Great Business

Buffett’s approach shifted when he encountered Phil Fisher’s book, Common Stocks and Uncommon Profits. Fisher’s teachings showed the importance of investing in great companies with strong growth potential, even if they weren’t trading at bargain prices.

Key lessons from Fisher:

- Scuttlebutt method: Gathering insights about a company by talking to its suppliers, customers and competitors.

- Focus on quality: Look for companies with excellent management, innovative products and long-term growth prospects.

- Hold for the long term: Fisher believed in owning businesses for decades, not months.

You can find more lessons from his book below:

Inspired by Fisher, Buffett began searching for high-quality businesses. This shift was evident in his investment in See’s Candies, a company with strong branding and pricing power. For Buffett this was a turning point, he started valuing quality over pure cheapness.

3. Charlie Munger: The Power of Moats and Rationality

The final evolution of Buffett’s strategy came with the influence of his business partner and best friend, Charlie Munger. Munger encouraged Buffett to prioritize businesses with long-term sustainable competitive advantages or so called "economic moats."

Key lessons from Munger:

- Invest in exceptional businesses: Companies with high returns on invested capital (ROIC) and durable competitive advantages.

- Avoid diversification for its own sake: Own fewer, higher-quality businesses.

- Think rationally: Don’t let tradition or dogma dictate decisions.

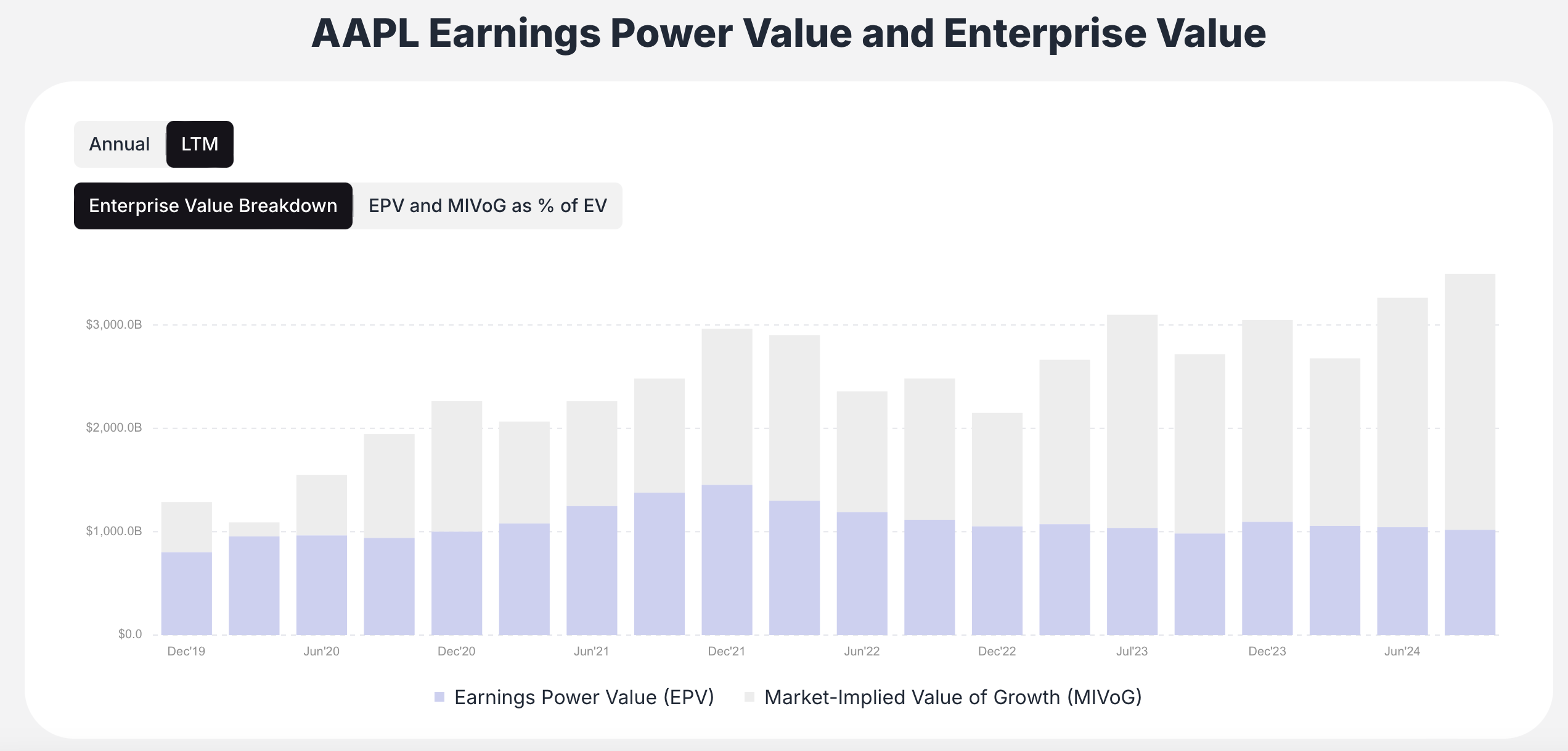

One of Buffett’s most iconic investments, Apple, highlights Munger’s influence and his strive to evolve as an investor. Historically Buffett avoided technology stocks because he felt they were outside his circle of competence. However, guided by Munger’s philosophy of focusing on durable businesses, Buffett recognized Apple’s unparalleled ecosystem and customer loyalty as an economic moat. It’s has been one of Berkshire Hathaway’s most successful investments.

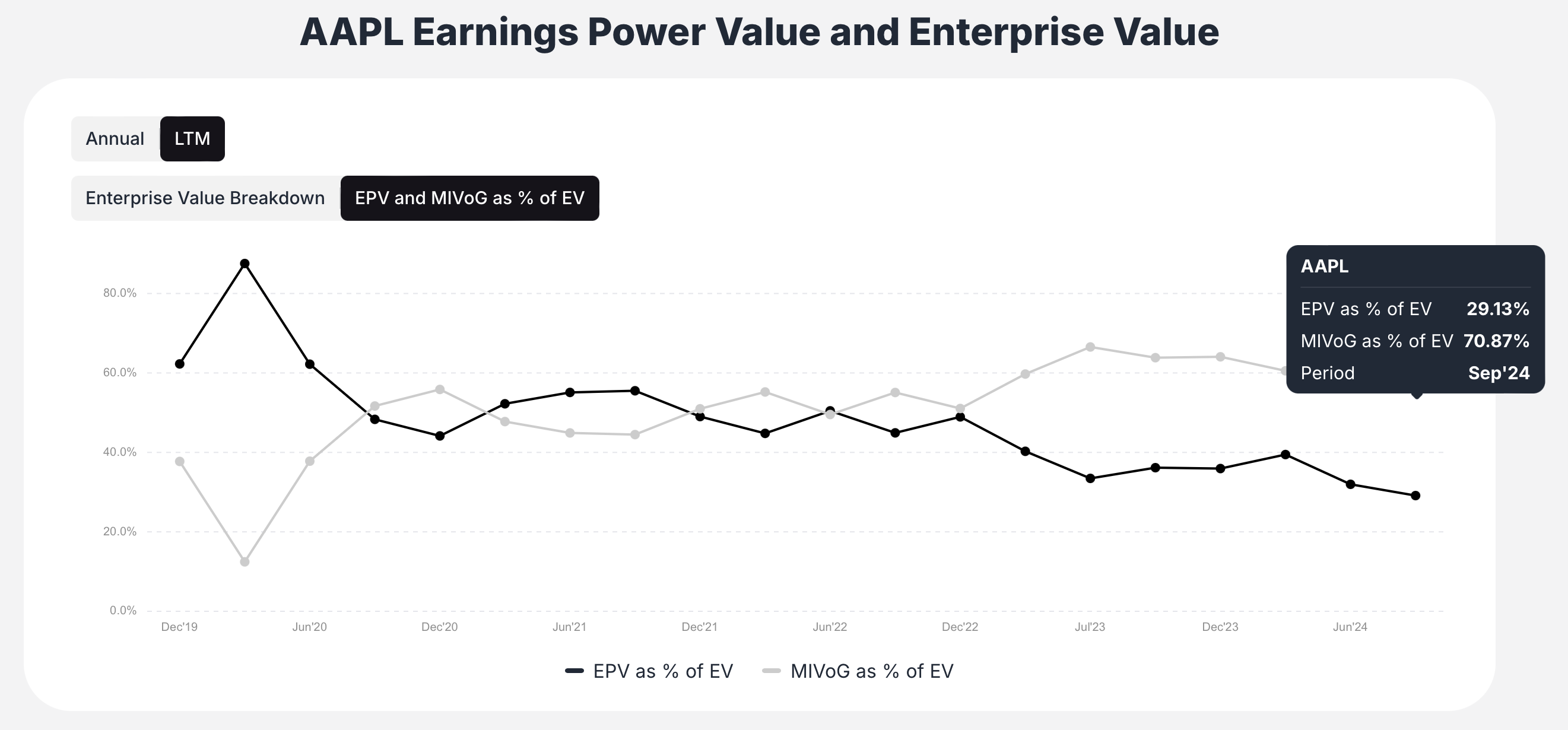

Apple was also a great assymetric investment that Buffett made. Back in 2016-2017 when he started piling on Apple, right now its Earnings Power Value is about 30%, which means that broad market completely overlooked Apple's potential growth and didn't imply much of a growth into the price. Unlike the current situation when Apple's growth is very limited but 70% of the current price is attributed to future growth.

You can try these Intrinsic value tools here: https://valuesense.io/intrinsic-value-tools

Key Takeaways from Buffett’s Journey:

- Adaptability is essential: Buffett didn’t stick to Graham’s dogma; he evolved by integrating Fisher and Munger’s principles of investing;

- Quality over quantity: Buffett’s focus shifted to sustainable businesses by transitioning from "cigar butts" to wonderful companies at fair prices;

- Rational decision-making wins: Buffett’s ability to challenge his assumptions (like investing in Apple) highlights the importance of staying open-minded to new opportunities on the market.

Build Your Own Investable Universe Like Buffett

Warren Buffett’s success as well as overall success in investing lies in saying "No" most of the time. It means narrowing down a vast universe of companies into a focused, high-quality portfolio.

It sounds very hard and almost impossible to ordinary investors but the beauty is that technology development and information entropy allow us to enjoy the knowledge and tools of top investors.

Information about public markets is broadly available. Yet, ordinary investors have no time, resources or tools to process it.

That's why we built Value Sense to help smart investors make smart investment decisions with stock ratings, intrinsic value tools, best stock screener, charts and 30Y of financial data.

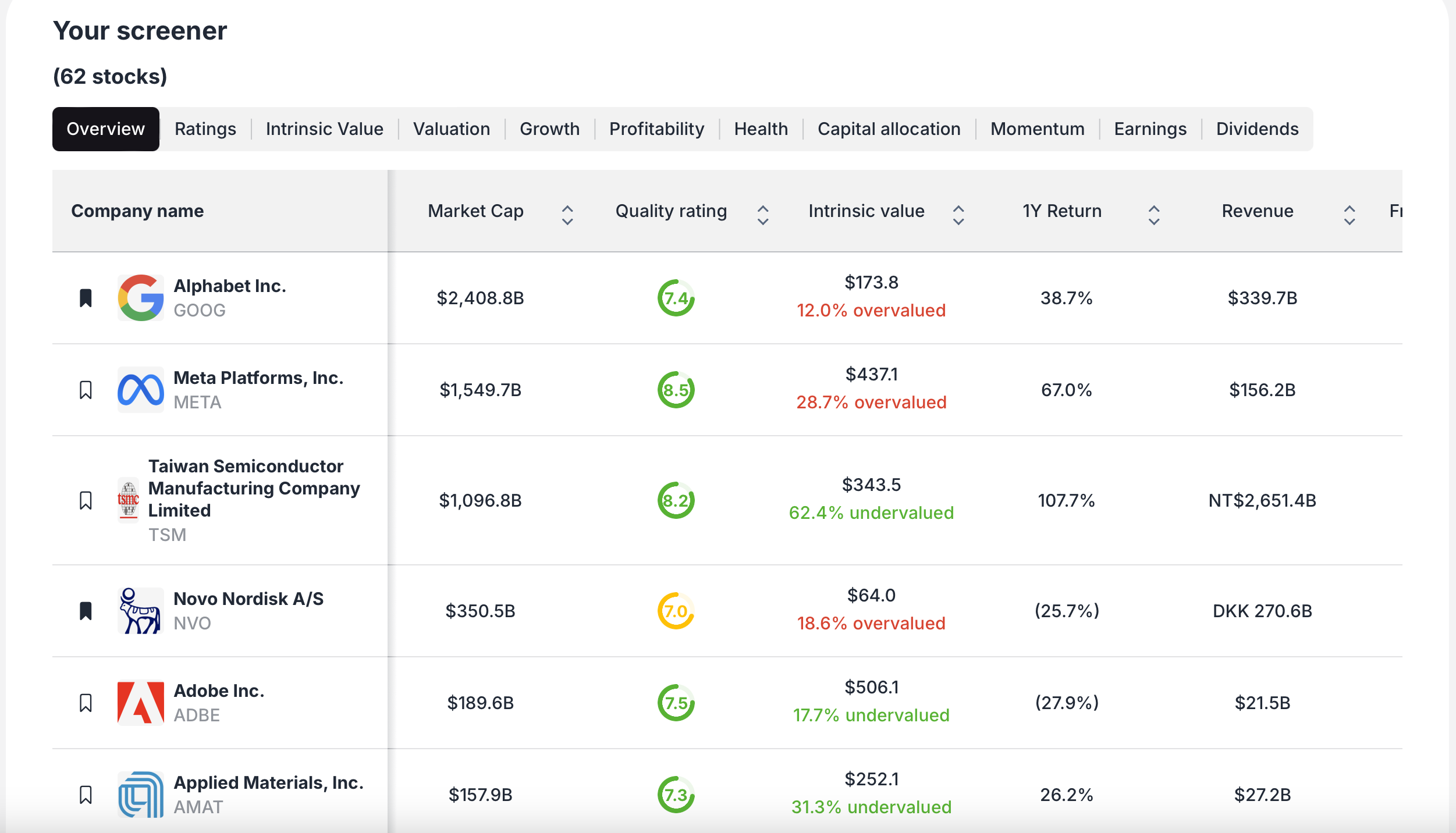

Here’s the example how you can apply Warren Buffet's principles with Value Sense stock screener:

Criteria for Your Investable Universe

- Company Quality:

Great rating (≥6) based on metrics like Growth, Health, Profitability, Capital Allocation and Momentum - Intrinsic Value:

Stocks trading at a fair value or ideally undervalued (between -30% to 200% of intrinsic value). - High Moat:

Gross margin > 40%

ROIC - WACC > 15% (yes, you can actually screen for value creation here)

FCF margin > 15% - Financial Health:

Net debt < 0 to ensure a strong balance sheet

And just like that we narrowed down our Potential Investable Universe to 62 stocks with some of them on a screen below:

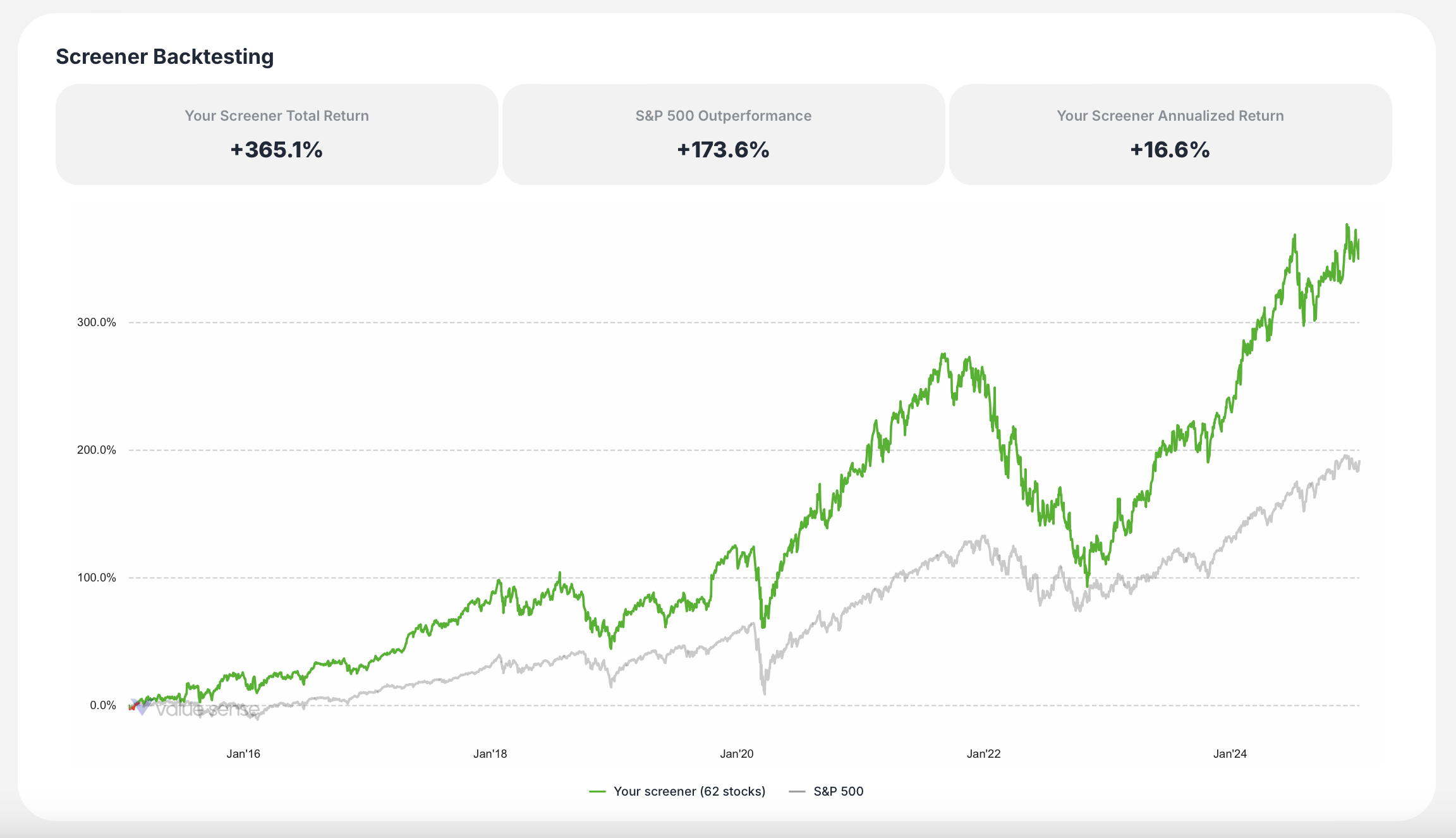

You can also backtest the resulting Investable Universe to ensure that the criteria you used yielded you best results:

This is the magic of a Value Sense stock screener.

You can further narrow down the list by going into the details of each business and their business models.

Final Thoughts: Evolve or Fall Behind

Buffett’s evolution as an investor teaches us a crucial lesson.

Rigidity in your approach can lead to missed opportunities.

That's why as an investor you need to:

- Challenge your assumptions

- Learn from others

- Adapt to new environments

And you can achieve long-term success just like Buffett.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Stocks With Great Health Ratings and 15%+ Returns Over 5 Years

📖 High ROIC Stocks with Exceptional Quality and Momentum

📖 11 Low-Debt Stocks With High FCF Conversion and Revenue Growth